Some crypto companies are fully compliant, fully regulated, and still can't keep their bank accounts. Learn why the financial system is quietly freezing them out.

Keep reading

Why can't a fully compliant, regulated crypto business secure a bank account in 2025?

If you're operating in this space, you already know the answer. You've lived through it. You've submitted the documentation, walked through your AML procedures, and demonstrated your regulatory compliance… only to be rejected. Or worse still, waking up to find your existing account frozen, with no real explanation and no path forward.

This isn't about isolated cases or bad actors being weeded out. It's a pattern of systematic risk aversion that's creating real barriers to growth across the entire sector, and it's throttling one of the most significant financial innovations of our generation.

We're Tap, and we're building the infrastructure that traditional banks refuse to provide.

The Economics Behind the Blockade

Let's examine what's actually driving this exclusion, because it's rarely about the reasons banks cite publicly.

The European Banking Authority has explicitly warned against unwarranted de-risking, noting it causes "severe consequences" and financial exclusion of legitimate customers. Yet the practice continues, driven by two fundamental economic pressures that have nothing to do with your business's actual risk profile.

The compliance cost calculation

Financial crime compliance across EMEA costs organizations approximately $85 billion annually. For traditional banks, the math is simple: serving crypto businesses requires specialized expertise, enhanced monitoring, and ongoing due diligence. As a result, it's cheaper to reject the entire sector than to build the infrastructure needed to serve it properly.

The regulatory capital burden

New EU regulations impose a 1,250% risk weight on unbacked crypto assets such as Bitcoin and Ethereum. This isn't a compliance requirement; it's a capital penalty that makes crypto exposure commercially unviable for traditional institutions, regardless of the actual risk individual clients present.

In the UK, approximately 90% of crypto firm registration applications have been rejected or withdrawn, often citing inadequate AML controls. Whether those assessments are accurate or not, they've created the perfect justification for blanket rejection policies.

The result? Compliant businesses are being treated the same as bad actors; not because of what they've done, but because of the sector they're in.

The Real Cost of Financial Exclusion

Financial exclusion isn’t just an hiccup; it creates tangible operational barriers that ripple through every part of running a crypto business.

Firms that have secured MiCA authorization, built robust compliance programs, and met regulatory requirements can find themselves locked out of basic banking services. Essential fiat on-ramps and off-ramps remain inaccessible, slowing payments, limiting growth, and complicating cash flow management.

Individual cases illustrate the problem vividly as well. Accounts are closed because a business receives a payment from a regulated exchange. Others are dropped with vague references to “commercial decisions,” offering no substantive justification. Founders frequently struggle to separate personal and business finances, as both are considered too risky to serve.

The irony is striking. By refusing service to compliant businesses, traditional banks aren’t mitigating risk; they’re amplifying it. Forced to operate through less regulated channels, these legitimate firms face higher operational and compliance risks, slower transactions, and reduced investor confidence. Over time, this slows innovation, and raises the cost of doing business for firms that are legally and technically sound.

Debanking Beyond Europe: U.S. Crypto Firms Face Their Own Challenges

Limited access to banking services isn’t exclusive to Europe. Leading firms in the U.S. crypto industry have faced numerous challenges regarding the banking blockade. Alex Konanykhin, CEO of Unicoin, described repeated account closures by major banks such as Citi, JPMorgan, and Wells Fargo, noting that access was cut off without explanation. Unicoin’s experience echoes a broader sentiment among crypto executives who argue that traditional financial institutions remain wary of digital asset businesses despite recent policy shifts toward a more pro-innovation stance.

Jesse Powell, co-founder of Kraken, has also spoken out about being dropped by long-time banking partners, calling the practice “financial censorship in disguise.” Caitlin Long, founder of Custodia Bank, recounted how her institution was repeatedly denied services. Gemini founders Tyler Winklevoss and Cameron Winklevoss shared similar frustrations.

These experiences reveal a pattern many in the industry interpret as systemic risk aversion. Even in a market as large and mature as the United States, crypto-focused businesses continue to encounter obstacles in maintaining basic financial infrastructure. The issue became especially acute after the collapse of crypto-friendly banks such as Silvergate, Signature, and Moonstone; institutions that once served as key bridges between fiat and digital assets. Their exit left a gap few traditional players have been willing to fill.

Why Tap Exists

The crypto industry has reached an inflection point. Regulatory frameworks like MiCA are providing clarity. Institutional adoption is accelerating. The technology is proven and tested. But the fundamental infrastructure gap remains: access to business banking that actually works for digital asset businesses.

This is precisely why we built Tap for Business.

We provide business accounts with dedicated EUR and GBP IBANs specifically designed for crypto companies and businesses that interact with digital assets. This isn't a side offering or an experiment, it's our core focus.

Our approach is straightforward

We built our infrastructure for this sector

Rather than retrofitting traditional banking systems to reluctantly accommodate crypto businesses, we designed our compliance, monitoring, and operational frameworks specifically for digital asset flows. This means we can properly assess and serve businesses that others automatically reject.

We price in the actual risk, not the sector

Blanket rejection policies exist because they're cheap and simple. We take a different approach: evaluating each business based on their actual controls, compliance posture, and operational reality. It costs more, but it's the only way to serve this market properly.

We're committed to sector normalization

Every time a legitimate crypto business is forced to operate without proper banking infrastructure, it reinforces outdated stigmas. By providing professional financial services to compliant businesses, we're helping demonstrate what should be obvious: crypto companies can and should be served by the financial system.

It isn't about taking on risks that others won't. It's about properly evaluating risks that others refuse to understand.

Moving Forward

The industry is maturing. Regulatory clarity is emerging. Institutional adoption is accelerating. But you can't put your business on hold while traditional banks slowly catch up to reality.

That's not sustainable in the long run.

As a firm, you shouldn't have to beg for a bank account. You shouldn't have to downplay your crypto operations just to access basic financial services. And you certainly shouldn't have to accept that systematic exclusion with little to no explanation other than “It’s just how things are."

The crypto sector is building the future of finance. Your banking partner should believe in that future too. If you're ready to work with financial infrastructure built for your business, not in spite of it, here we are.

Talk today with one of our experts to understand how we can help your business access the banking infrastructure you need.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

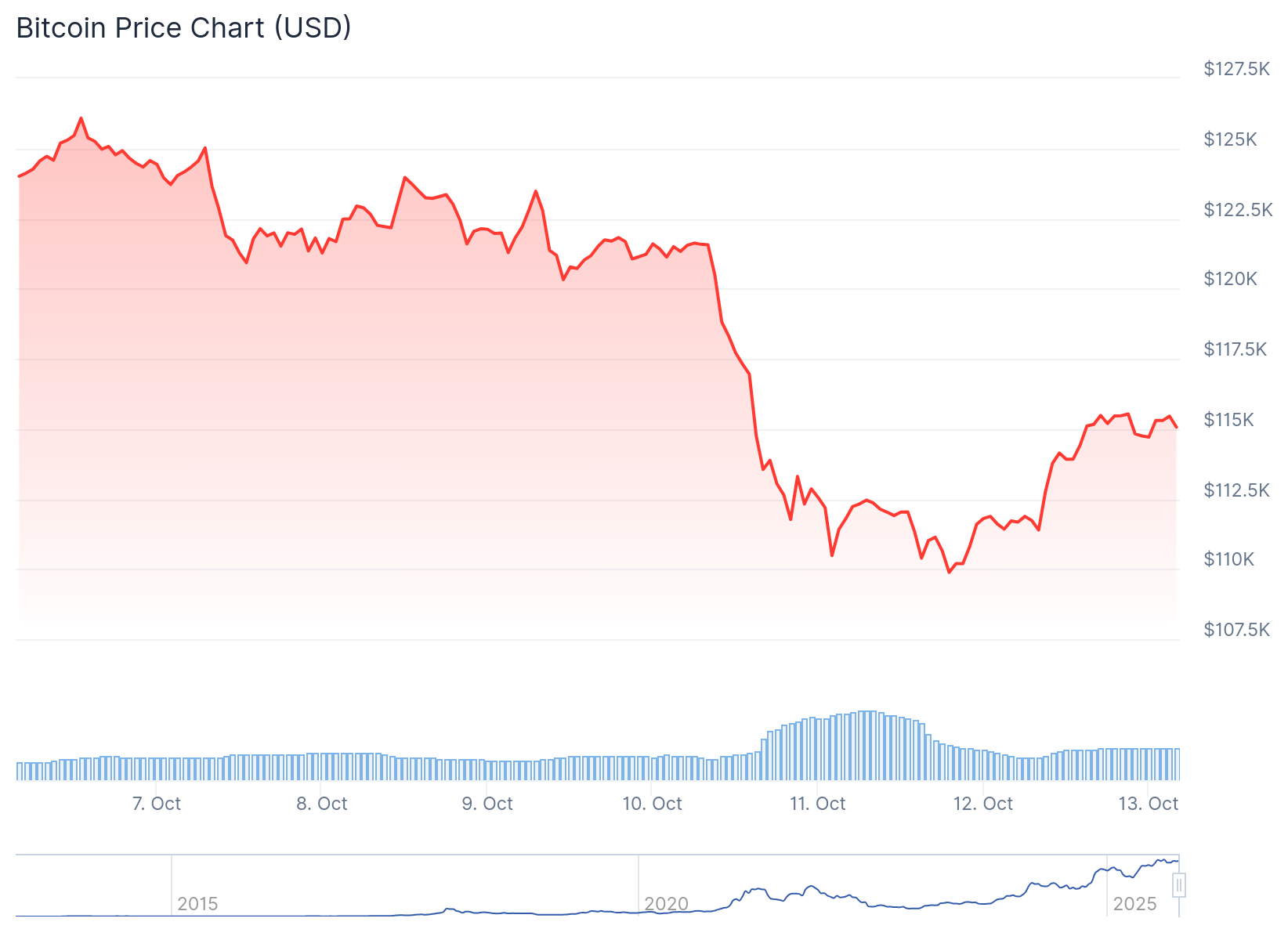

The Crash That Shook It All

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

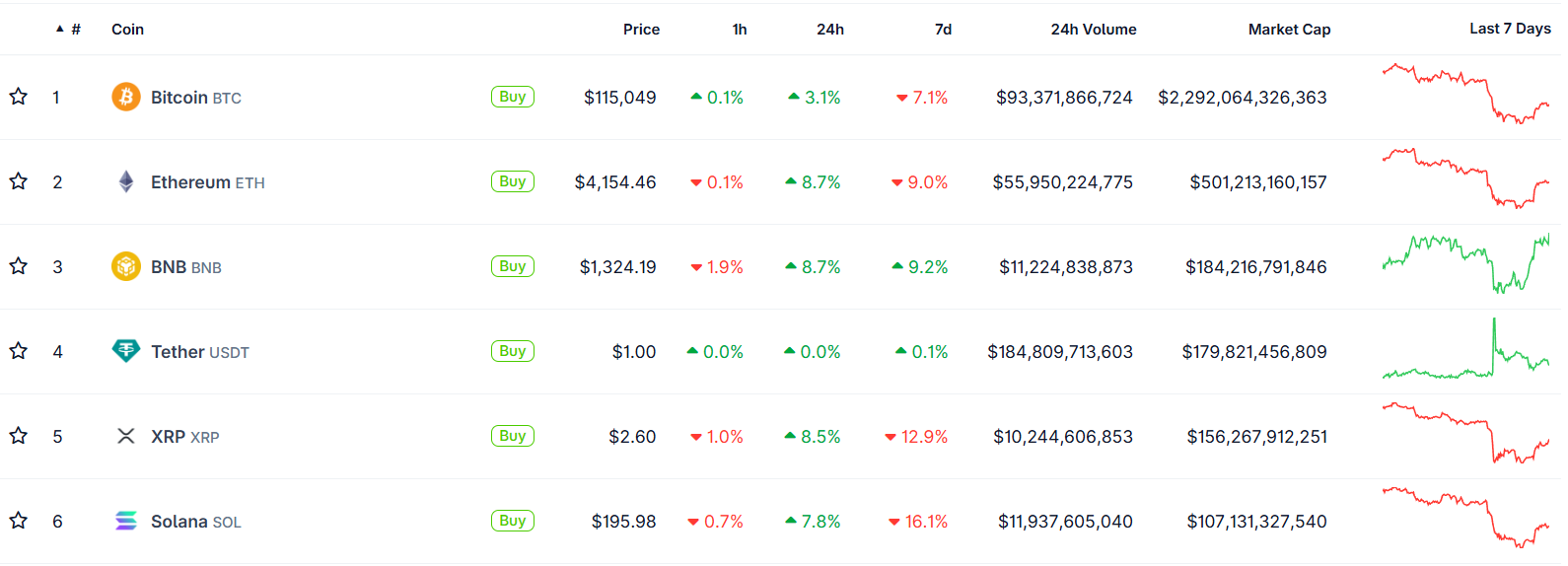

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

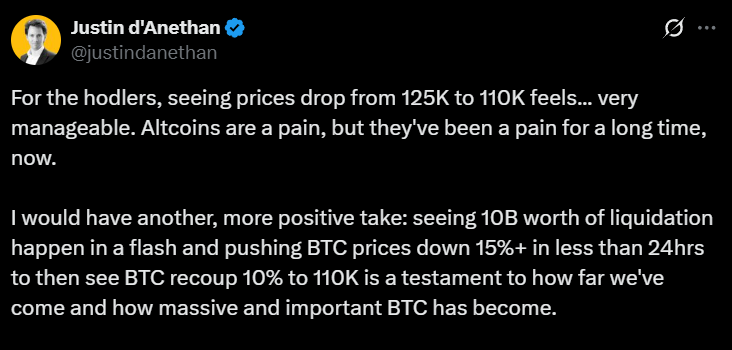

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

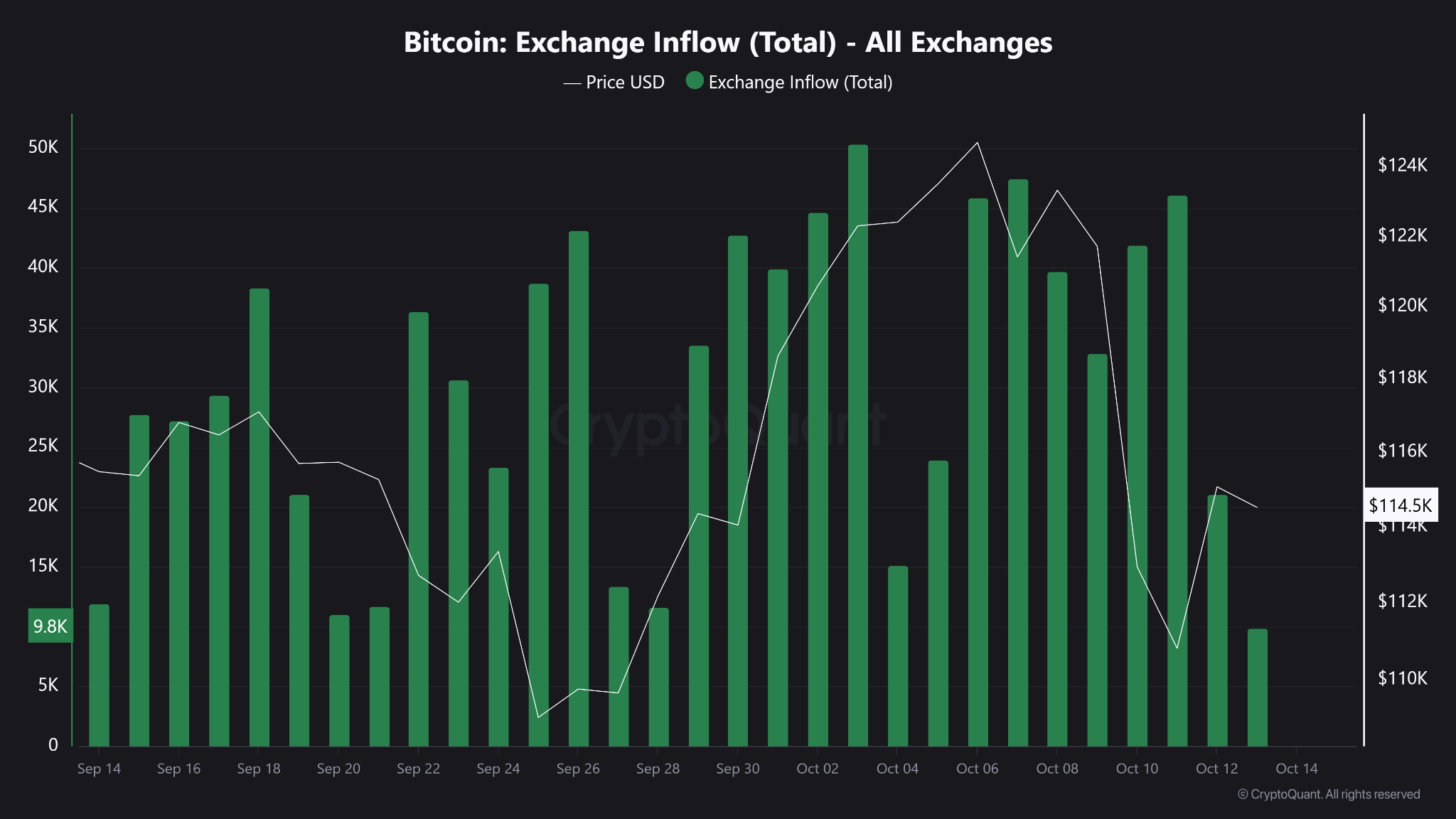

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore why Bitcoin and the crypto market are worth $2.1 trillion and why skepticism still lingers among Americans in this deep dive.

Decoding the disconnect: America's cautious approach to crypto

Bitcoin and the broader crypto market have soared to a staggering $2.1 trillion in value, but why does skepticism still linger among so many Americans?

Despite increasing adoption, digital currencies remain shrouded in doubt, revealing a significant trust gap that continues to challenge the industry. As cryptocurrencies become more woven into everyday financial transactions, closing this trust deficit is essential for ensuring sustained growth and mainstream acceptance.

In this article, we'll dive into the key reasons behind this persistent mistrust, uncover the expanding real-world uses of digital assets, and explore how education and technological advancements can help bridge the confidence gap. Keep in mind, the data presented draws from multiple studies, so some figures and age groupings may vary slightly.

A Look at the Current State of Crypto Trust

To truly understand cryptocurrency adoption and the accompanying trust issues, it’s essential to examine the latest statistics and demographic data. This section breaks down public sentiment toward crypto and provides a snapshot of its user base.

General Public Sentiment

Percentage of Americans Who Own Cryptocurrency

Cryptocurrency adoption has seen slow but steady growth over the years. According to surveys conducted by Pew Research Center in 2021 and 2023, 17% of Americans have invested in, traded, or used cryptocurrency, up slightly from 16% in 2021.

While estimates vary, Security.org places this figure higher, estimating that roughly 40% of the U.S. population - around 93 million adults - own some form of cryptocurrency.

Both studies agree that younger generations are driving much of this growth, with 30% of Americans aged 18-29 reporting they have experience with crypto.

Trust Levels in Cryptocurrency

Despite rising adoption rates, trust in cryptocurrency remains a significant hurdle. Pew Research Center found that 75% of Americans have little or no confidence that cryptocurrency exchanges can safeguard their funds. Similarly, a recent report by Morning Consult shows that 7 in 10 consumers familiar with crypto express low or no trust in it.

This contrasts the 31% who have some or high trust, or the 24% in the Pew study who are “somewhat” to “extremely” confident in cryptocurrencies.

Demographics of Crypto Adopters

- Age Groups

Cryptocurrency adoption trends reveal a distinct generational divide. According to the 2023 Morning Consult survey, Gen Z adults (ages 18-25) lead in crypto ownership at 36%, closely followed by Millennials at 30%.

These younger groups are also more inclined toward future investments, with 39% of Gen Z and 45% of Millennials planning to invest in crypto in the coming years. Over half of both generations view cryptocurrency and blockchain as the future, while a notable percentage (27% of Gen Z and 21% of Millennials) considered opening an account with a crypto exchange in the past year.

When compared to other asset classes, data from Bankrate’s 2021 survey reveals that younger Millennials (ages 25-31) favor real estate and stock market investments, while Baby Boomers have the least interest in cryptocurrency. Older Millennials (32-40) lean toward cash investments, with cryptocurrency’s appeal steadily declining with age.

Interestingly, the report also highlights gender differences, showing that 80% of women familiar with crypto express low confidence, compared to 71% of men, indicating a broader trust gap among female users.

- Income Levels

Contrary to common assumptions, cryptocurrency adoption is not confined to high-income individuals. The same Pew Research Center survey revealed that crypto ownership is relatively evenly spread across income brackets:

- 13% of those earning less than $56,600 annually own crypto.

- 19% of those earning between $56,600 and $169,800 own crypto.

- 22% of those earning over $169,800 own crypto.

This data suggests that while higher earners may be more inclined to own cryptocurrency, the appeal of digital assets spans various income levels.

- Educational Background

Education also plays a role in crypto adoption. A 2022 report by Triple-A found that the majority of crypto owners are “highly educated”:

- 24% of crypto owners have graduated from middle or high school.

- 10% have some vocational or college education.

- 39% are college graduates.

- 27% hold postgraduate degrees.

This shows that while those with some college education or a degree are more likely to own crypto, it is not exclusively a pursuit of the highly educated.

This demographic data paints a picture of cryptocurrency adopters as predominantly younger, spread across a range of income levels, and with diverse educational backgrounds. However, the trust gap between crypto and traditional financial systems remains a significant barrier to wider acceptance of digital assets.

Key Trust Barriers

To bridge the gap between cryptocurrency adoption and trust, it’s crucial to understand the major concerns fueling skepticism. This section explores these concerns and contrasts them with similar risks in traditional financial systems.

The Primary Concerns of Skeptics

Volatility

One of the most significant barriers to cryptocurrency adoption is its notorious volatility, particularly for investors seeking stable, long-term assets. Bitcoin, the most well-known cryptocurrency, symbolizes this risk.

In 2022, Bitcoin’s volatility was stark. Its 30-day volatility reached 64.02% in June, driven by broader economic uncertainty and market downturns, compared to the S&P 500’s much lower volatility of 4.71% during the same period.

Over the course of the year, Bitcoin’s price swung from a peak of $47,835 to a low of $18,490, marking a substantial 61% decline from its highest point in 2022. Factors such as rising interest rates, geopolitical tensions, and major crypto market disruptions, like the TerraUSD collapse and Celsius’ liquidity crisis, played a pivotal role.

This extreme volatility reinforces the perception of cryptocurrencies as high-risk investments.

However, traditional stock markets, while typically more stable than crypto, can also experience sharp fluctuations, especially in times of economic stress. For instance, the CBOE Volatility Index (VIX), which measures expected near-term volatility in the U.S. stock market, dropped by 23% to 28.71 on June 30, 2022, far below the 82.69 peak recorded during the early COVID-19 market turbulence in March 2020. This shows that even stock markets, generally seen as safer, can experience moments of intense volatility, particularly during global crises.

Additionally, when compared to the "Magnificent Seven" (a group of top-performing and influential stocks) Bitcoin’s volatility doesn't stand out as unusual. In fact, over the past two years, Bitcoin has shown less volatility than Netflix (NFLX) stock.

On a 90-day timeframe, NFLX had an average realized volatility of 53%, while Bitcoin’s was slightly lower at 46%. The reality is that among all S&P 500 companies, Bitcoin has demonstrated lower annualized historical volatility than 33 of the 503 constituents.

In October 2023, Bitcoin was actually less volatile than 92 stocks in the S&P 500, based on 90-day realized historical volatility figures, including some large-cap and mega-cap companies.

Security

Security concerns are another major hurdle in building trust with cryptocurrencies. Cryptocurrency exchanges and wallets have been targeted by numerous high-profile hacks and frauds, raising doubts about the safety of digital assets. It comes as no surprise that a study from Morning Consult found that 67% of Americans believe having a secure and trustworthy platform is essential to entering the crypto market.

While security threats in the crypto space are well-documented, traditional banking systems are not immune to fraud either. Federal Trade Commission data reveals that consumer fraud losses in the traditional financial sector hit a record high of $10 billion in 2023, marking a 14% increase from the previous year.

Although traditional banks have more safeguards in place to protect consumers, they remain vulnerable to attacks, showing that security is a universal challenge across both crypto and traditional finance.

Prevention remains key, which in this case equates to using only reliable platforms or hardwallets.

Regulatory Uncertainty

Regulatory ambiguity continues to be a critical barrier for both cryptocurrency investors and businesses. The evolving landscape creates uncertainty about the future of digital assets.

Currently, cryptocurrency is legal in 119 countries and four British Overseas Territories, covering more than half of the world’s nations. Notably, 64.7% of these countries are emerging and developing economies, primarily in Asia and Africa.

However, only 62 of these 119 countries (52.1%) have comprehensive regulations in place. This represents significant growth from 2018, when only 33 jurisdictions had formal regulations, showing a 53.2% increase, but still falls short in creating a sense of “unified safety”.

In the United States, regulatory views remain fragmented. Various agencies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have conflicting perspectives on how to classify and regulate cryptocurrencies. Since 2019, the SEC has filed over 116 crypto-related lawsuits, adding to the regulatory uncertainty faced by the industry.

The Growing Integration Of Digital Assets In Daily Life

As we progress further into the digital age, cryptocurrencies and digital assets are increasingly becoming part of our everyday financial transactions. This shift is driven by two key developments: the rise of crypto payment options and the growing adoption of Central Bank Digital Currencies (CBDCs).

According to a MatrixPort report, global cryptocurrency adoption has now reached 7.51% of the population, underscoring the expanding influence of digital currencies worldwide. By 2025, this rate is expected to surpass 8%, signaling a potential shift from niche usage to mainstream acceptance.

The list of major retailers embracing cryptocurrency as a payment method continues to grow. Some notable companies now accepting crypto include:

- Microsoft: Accepts Bitcoin for Xbox store credits.

- AT&T: The first major U.S. mobile carrier to accept crypto payments.

- Whole Foods: Accepts Bitcoin via the Spedn app.

- Overstock: One of the first major retailers to accept Bitcoin.

- Starbucks: Allows customers to load their Starbucks cards with Bitcoin through the Bakkt app.

A 2022 Deloitte survey revealed that nearly 75% of retailers plan to accept either cryptocurrency or stablecoin payments within the next two years. This trend highlights the growing mainstream acceptance of digital assets as a legitimate payment method.

Crypto-backed debit cards are further bridging the gap between digital assets and everyday transactions. These cards enable users to spend their cryptocurrency at any merchant that accepts traditional debit cards.

According to Factual Market Research, the global crypto card market is projected to reach $9.5 billion by 2030, with a compound annual growth rate (CAGR) of approximately 31.6% from 2021 to 2030. This growth reflects the increasing popularity of crypto-backed debit cards as a way for consumers to integrate their digital assets into daily spending.

The Rise of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) represent digital versions of a country’s fiat currency, issued and regulated by the national monetary authority. In 2024, the global progress of CBDCs has seen a significant uptick, with marked advances in both research and adoption. As of this year:

- 11 countries have fully launched CBDCs, including the Bahamas, Nigeria, Jamaica, and China.

- 44 countries are conducting pilot programs, up from 36, reflecting growing interest in testing the functionality and stability of digital currencies.

- 66 nations are at advanced stages of CBDC development, contributing to a global landscape where 134 countries (accounting for 98% of the world’s economy) are engaged in CBDC projects.

In the United States, the Federal Reserve is exploring the feasibility of a CBDC through Project Hamilton, a collaborative research initiative with MIT. This exploration aligns with broader goals to reduce reliance on cash, enhance financial inclusion, and improve control over national monetary systems amid the rise of digital payments and cryptocurrencies.

The introduction of CBDCs could significantly reshape daily financial transactions in several ways:

- Increased financial inclusion: CBDCs could offer digital payment access to the 1.4 billion adults who remain unbanked, according to World Bank estimates.

- Faster and cheaper transactions: CBDCs could streamline both domestic and cross-border payments, reducing costs and settlement times.

- Enhanced monetary policy: Central banks would gain more direct control over money supply and circulation.

- Improved traceability: CBDCs could help combat financial crimes and reduce tax evasion by providing greater transaction transparency.

However, challenges persist, including concerns about privacy, cybersecurity risks, and the potential disruption of existing banking systems.

As digital assets continue to integrate into everyday life, they hold the potential to transform how we think about and use money. Despite these challenges, trends in both private cryptocurrency adoption and CBDC development point to a future where digital assets play a central role in our financial systems.

Building Trust Through Technology and Education

According to the 2023 Web3 UI/UX Report, nearly 48% of users cite security concerns and asset protection as the primary barriers to crypto adoption. Other challenges include high transaction fees and the steep learning curve needed to fully grasp both the technology and its benefits.

Despite these obstacles, the blockchain sector has made significant strides as it matures, particularly in enhancing security. Hack-related losses in the crypto market dropped from $3.7 billion in 2022 to $1.8 billion in 2023, underscoring the progress in safeguarding digital assets.

The increased adoption of offline hardware wallets and multi-signature wallets, both of which add critical layers of security, reflects this momentum. Advances in smart contract auditing tools and stronger compliance standards are also minimizing risks, creating a safer environment for both users and institutions.

These improvements highlight the industry’s commitment to establishing a more secure foundation for digital transactions and bolstering confidence in blockchain as a reliable financial technology.

In another positive development, in May 2023, the European Council approved the first comprehensive legal framework for the cryptocurrency industry. This legislation sets a new standard for regulatory transparency and oversight, further reinforcing trust.

Financial Literacy Initiatives

The rise of crypto education in the U.S. is playing a pivotal role in increasing public understanding and encouraging adoption. Programs such as Coinbase Earn aim to simplify the onboarding process for new users, directly addressing the complexity and security concerns that often deter people from engaging with crypto.

According to recent data, 43% of respondents feel that insufficient knowledge is a key reason they avoid the sector, highlighting the ongoing need for crypto-related learning.

Additionally, Chainalysis' 2024 Global Crypto Adoption Index noted a significant increase in crypto interest following the launch of spot Bitcoin ETFs in the U.S. earlier in the year. This development enabled investors to trade ETF shares tied to Bitcoin directly on stock exchanges, making it easier to enter the market without needing extensive technical expertise - thus driving a surge in adoption.

These advancements in security and education are gradually fostering greater trust in the cryptocurrency ecosystem. As the sector continues to evolve, these efforts may pave the way for broader adoption and deeper integration of digital assets into daily financial life.

The Future of Digital Asset Adoption

As digital assets continue to evolve and capture mainstream attention, their potential to transform the financial landscape is becoming increasingly evident. From late 2023 through early 2024, global crypto transaction volumes surged, surpassing the peaks of the 2021 bull market (as illustrated below).

Interestingly, much of this growth in adoption was driven by lower-middle income countries, highlighting the global reach of digital assets.

Below, we explore projections for cryptocurrency usage and its potential impact on traditional banking and finance.

Projections for Crypto Usage in the Next 5-10 Years

Several studies and reports offer insights into the expected growth of cryptocurrency over the next decade:

Global Adoption

The global cryptocurrency market revenue is projected to reach approximately $56.7 billion in 2024, with the United States leading the charge, expected to generate around $9.8 billion in revenue. Statista predicts the number of global crypto users will hit 861 million by 2025, marking a significant shift toward mainstream use.

Institutional Adoption

The 2023 Institutional Investor Digital Assets Study found that 65% of the 1,042 institutional investors surveyed plan to buy or invest in digital assets in the future.

As of 2024, digital currency usage among U.S. organisations is expanding, particularly in sectors such as finance, retail, and technology. Hundreds of financial services and fintech firms are now involved in digital assets, whether in payment processing, investments, or blockchain-based applications. This includes major companies utilising cryptocurrencies as stored value and exploring stablecoin use cases to enhance transaction efficiency.

Notably, major U.S. companies are increasingly engaging with blockchain and digital assets, as regulatory clarity improves and security concerns are addressed.

Retail Adoption

At present, about 85% of major retailers generating over $1 billion in annual online sales accept cryptocurrency payments. In contrast, 23% of mid-sized retailers, with online sales between $250 million and $1 billion, currently accept crypto payments. This growing trend points to an expanding role for digital assets in retail, especially among large-scale businesses.

Potential Impact on Traditional Banking and Finance

The rise of digital asset utilisation is poised to reshape traditional banking systems in multiple areas. For starters, the growth of blockchain technology and digitised financial services is driving the decentralised finance (DeFi) market, which is projected to reach $450 billion by 2030, with a compound annual growth rate (CAGR) of 46%.

In Q3 2024 alone, trading on decentralised exchanges surpassed $100 billion, marking the third consecutive month of growth in trading volume. This trend underscores the increasing interest and activity in the decentralised finance space.

As Central Bank Digital Currencies (CBDCs) are likely to be adopted by 80% of central banks by 2030, the role of commercial banks in money distribution could diminish significantly. Meanwhile, blockchain technology and stablecoins are expected to revolutionise cross-border B2B payments, with 20% of these transactions powered by blockchain by 2025. Stablecoin payment volumes are projected to hit $620 billion by 2026.

Furthermore, the investment landscape is set to evolve as asset tokenisation scales, potentially reaching a value of $16 trillion, making crypto a standard component in investment portfolios.

With regulatory clarity expected to improve - more than half of financial institutions anticipate clearer rules within the next three years - crypto integration is likely to become more widespread. These developments emphasise the transformative potential of digital assets across payments, investments, and financial structures globally.

Bridging the trust gap in crypto adoption

The cryptocurrency landscape is experiencing a surge in institutional interest, which could be a pivotal moment for integrating digital assets into traditional finance. Financial giants like BlackRock are at the forefront of this movement, signaling a shift in mainstream perception and adoption of cryptocurrencies.

Historically, the introduction of new investment vehicles around Bitcoin has spurred market growth. As Markus Thielen, founder of 10x Research, highlights, the launch of spot ETFs could bring about a new wave of institutional involvement, potentially driving the next phase of market expansion.

This growing institutional momentum, combined with evolving regulatory frameworks, is reshaping the crypto ecosystem. However, a key question remains: Will these developments be enough to close the trust gap and push cryptocurrencies into mainstream adoption?

As we stand at this crossroads, the future of digital assets hangs in the balance. The coming years will be critical in determining whether cryptocurrencies can overcome persistent skepticism and fully integrate into the global financial system, or if they will remain a niche, yet impactful, financial instrument.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

Unveiling the future of money: Explore the game-changing Central Bank Digital Currencies and their potential impact on finance.

Since the debut of Bitcoin in 2009, central banks have been living in fear of the disruptive technology that is cryptocurrency. Distributed ledger technology has revolutionized the digital world and has continued to challenge the corruption of central bank morals.

Financial institutions can’t beat or control cryptocurrency, so they are joining them in creating digital currencies. Governments have now been embracing digital currencies in the form of CBDCs, otherwise known as central bank digital currencies.

Central bank digital currencies are digital tokens, similar to cryptocurrency, issued by a central bank. They are pegged to the value of that country's fiat currency, acting as a digital currency version of the national currency. CBDCs are created and regulated by a country's central bank and monetary authorities.

A central bank digital currency is generally created for a sense of financial inclusion and to improve the application of monetary and fiscal policy. Central banks adopting currency in digital form presents great benefits for the federal reserve system as well as citizens, but there are some cons lurking behind the central bank digital currency facade.

Types of central bank digital currencies

While the concept of a central bank digital currency is quite easy to understand, there are layers to central bank money in its digital form. Before we take a deep dive into the possibilities presented by the central banks and their digital money, we will break down the different types of central bank digital currencies.

Wholesale CBDCs

Wholesale central bank digital currencies are targeted at financial institutions, whereby reserve balances are held within a central bank. This integration assists the financial system and institutions in improving payment systems and security payment efficiency.

This is much simpler than rolling out a central bank digital currency to the whole country but provides support for large businesses when they want to transfer money. These digital payments would also act as a digital ledger and aid in the avoidance of money laundering.

Retail CBDCs

A retail central bank digital currency refers to government-backed digital assets used between businesses and customers. This type of central bank digital currency is aimed at traditional currency, acting as a digital version of physical currency. These digital assets would allow retail payment systems, direct P2P CBDC transactions, as well as international settlements among businesses. It would be similar to having a bank account, where you could digitally transfer money through commercial banks, except the currency would be in the form of a digital yuan or euro, rather than the federal reserve of currency held by central banks.

Pros and cons of a central bank digital currency (CBDC)

Central banks are looking for ways to keep their money in the country, as opposed to it being spent on buying cryptocurrencies, thus losing it to a global market. As digital currencies become more popular, each central bank must decide whether they want to fight it or profit from the potential. Regardless of adoption, central banks creating their own digital currencies comes with benefits and disadvantages to users that you need to know.

Pros of central bank digital currency (CBDC)

- Cross border payments

- Track money laundering activity

- Secure international monetary fund

- Reduces risk of commercial bank collapse

- Cheaper

- More secure

- Promotes financial inclusion

Cons of central bank digital currency (CDBC)

- Central banks have complete control

- No anonymity of digital currency transfers

- Cybersecurity issues

- Price reliant on fiat currency equivalent

- Physical money may be eliminated

- Ban of distributed ledger technology and cryptocurrency

Central bank digital currency conclusion

Central bank money in an electronic form has been a big debate in the blockchain technology space, with so many countries considering the possibility. The European Central Bank, as well as other central banks, have been considering the possibility of central bank digital currencies as a means of improving the financial system. The Chinese government is in the midst of testing out their e-CNY, which some are calling the digital yuan. They have seen great success so far, but only after completely banning Bitcoin trading.

There is a lot of good that can come from CBDCs, but the benefits are mostly for the federal reserve system and central banks. Bank-account holders and citizens may have their privacy compromised and their investment options limited if the world adopts CBDCs.

It's important to remember that central bank digital currencies are not cryptocurrencies. They do not compete with cryptocurrencies and the benefits of blockchain technology. Their limited use cases can only be applied when reinforced by a financial system authority. Only time will tell if CBDCs will succeed, but right now you can appreciate the advantages brought to you by crypto.

Tap makes entering the Bitcoin world simple. Buy, sell, hold, and trade Bitcoin easily on our secure platform.

Welcome to this week's Crypto Update, your go-to destination for the latest news in the exciting world of cryptocurrencies. Let's dive right into the highlights of the past week in the dynamic crypto market.

Etherscan's AI Tool for Smart Contracts:

Etherscan has launched Code Reader, an advanced tool that utilizes AI to retrieve and interpret source code from specific Ethereum contract addresses. Code Reader leverages OpenAI's powerful language model to generate comprehensive insights into contract source code files. The tool allows users to gain a deeper understanding of contract code, access comprehensive lists of smart contract functions, and explore contract interactions with decentralized applications. To access and utilize Code Reader, users need a valid OpenAI API Key and sufficient OpenAI usage limits. However, researchers caution about the challenges posed by current AI models, including computing power limitations, data synchronization, network optimization, and privacy concerns.

SEC's increased scrutiny on cryptocurrencies sparks debate:

The U.S. Securities and Exchange Commission's (SEC) increased scrutiny has led to a prominent debate concerning the future of XRP and Ethereum. Max Keiser, a well-known Bitcoin advocate, predicts the downfall of XRP and Ethereum due to regulatory overreach. In contrast, John Deaton, representing XRP holders, opposes this view, arguing for a more balanced regulatory approach. The cryptocurrency community is now anxiously awaiting regulatory clarity, as the SEC's actions remain unpredictable.

It's important to note that the regulatory environment is constantly evolving and can have significant impacts on the cryptocurrency market, including Ethereum. Therefore, it is advisable to stay informed about the latest developments.

A Call for Clarity: Federal reserve governor advocates for clearer crypto regulations:

Michelle Bowman, a Federal Reserve Governor, has urged global regulators to establish clearer regulations for emerging banking activities, particularly banking as a service and digital assets. She emphasized the need for a well-defined regulatory framework to address the supervisory void and uncertainties that financial institutions currently face. Bowman's call aligns with the growing demand for enhanced regulation of digital assets. A robust and comprehensive regulatory framework is crucial for ensuring the stability and integrity of the banking sector, mitigating risks, protecting consumers, and fostering innovation.

Turkish lira hit a record low against the US dollar

The Turkish lira hit a historic low, trading at 25.74 per US dollar, following Turkey's central bank decision to raise interest rates by 650 basis points to 15%. While the hike was expected, it fell short of the anticipated 21%, and analysts believe a larger increase was needed to show the government's resolve to fight inflation. The lira's devaluation has been part of a larger trend, prompting citizens to invest in alternative assets like digital currencies and gold. The central bank, now under new leadership, has adopted a more gradual approach to rate adjustments, seeking to stabilize the economy. However, the uncertainty surrounding Turkey's economic future persists.

Biggest Movers on Tap - Last 7 days

LATEST ARTICLE

From Comedy Gold to Digital Ghost Town

Memecoins were once the beating heart of retail-driven speculation in cryptocurrency markets. From Dogecoin's Elon Musk-fueled rallies to the lightning-fast ascent of tokens like Shiba Inu and Pepe, these internet-born digital assets transformed online jokes into substantial market capitalizations, at least for those who managed to time the hype cycles correctly. But moving into late 2025, the atmosphere has shifted dramatically. Prices have experienced significant declines, trading liquidity has diminished considerably, and the frenzied enthusiasm that characterized previous market cycles appears to be a distant memory.

The question facing the cryptocurrency community now is whether memecoins represent a fading trend from the previous bull market, or whether they still retain potential for unexpected resurgence, like many internet phenomena before them.

When Chaos Became Currency: The Memecoin Genesis

The emergence of memecoins remains inseparable from broader internet culture and social media dynamics. Unlike Bitcoin or Ethereum, which originated from detailed technical documentation and comprehensive visions for decentralized finance, memecoins typically began as internet humor, sustained by community engagement, viral content, and grassroots enthusiasm.

Dogecoin, widely recognized as the original memecoin, launched in 2013 as a deliberate parody of cryptocurrency speculation. Despite its humorous origins, it eventually achieved a multi-billion-dollar market capitalization through sustained community support and high-profile endorsements by the likes of Elon Musk. This success established a template that numerous subsequent projects attempted to replicate, often promising rapid returns without substantial underlying fundamentals.

During the market cycles of 2021 and 2024, memecoins transcended their status as mere digital assets to become cultural phenomena. Social media platforms amplified hype cycles exponentially, and retail traders participated en masse, with some small initial positions growing into substantial returns. However, as with most speculative market movements, the inevitable correction followed the euphoric peaks.

The Great Memecoin Correction of 2025

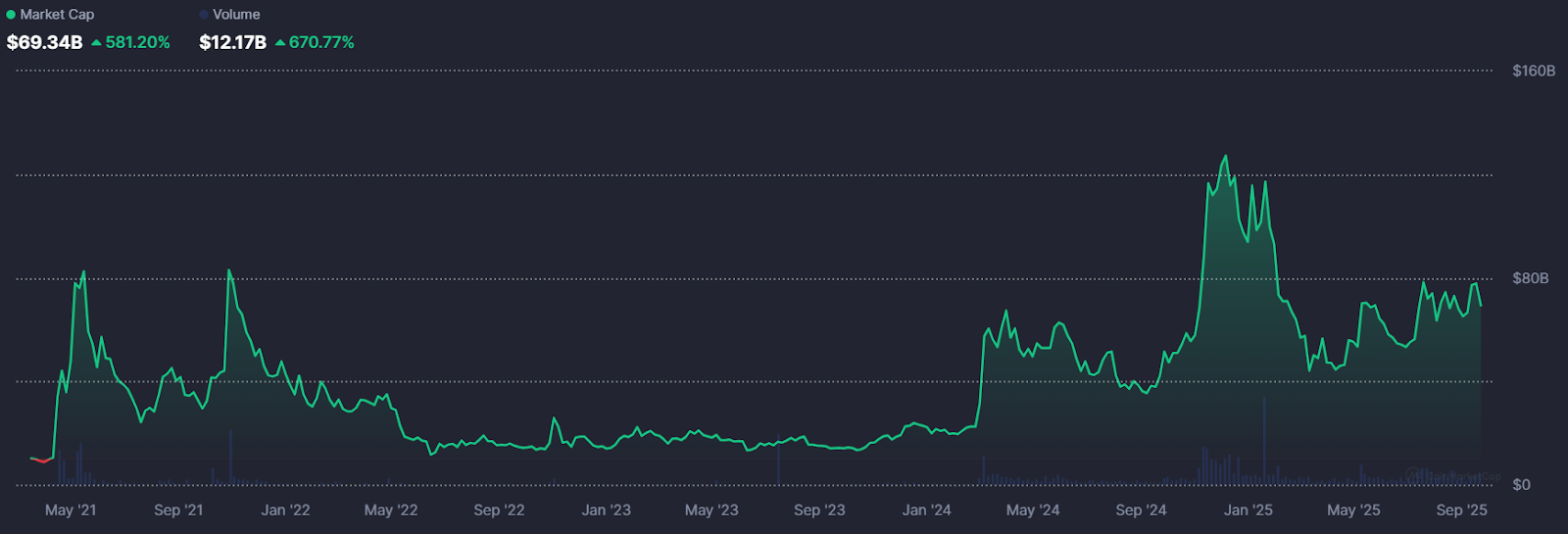

Since the speculative peaks of late 2024, memecoin markets have experienced sustained downward pressure. Market capitalizations that previously reached tens of billions of dollars have retraced by 60-90% across the sector. Data from CoinMarketCap indicates that aggregate memecoin market capitalization has declined from over $120 billion in December 2024 to just under $70 billion as of the time of writing, with many individual tokens experiencing severe liquidity constraints.

This market correction has highlighted the fundamental challenge facing the memecoin sector: without strong technological foundations or clear utility cases, these assets depend almost entirely on viral attention and consistent liquidity inflows. When these supporting factors diminish, price performance typically follows suit.

Many retail participants who entered positions near market peaks now hold assets that may not recover their previous valuations, and the collective market enthusiasm that previously drove exponential price increases has largely dissipated.

It Was Funnier the First Time Around: Why Most Memes Don't Make It

One primary factor contributing to memecoin market instability is what market analysts describe as the flash flood phenomenon. Cryptocurrency hype cycles don't typically develop gradually. They tend to surge rapidly and intensively, overwhelming normal market dynamics. However, this attention often disappears just as quickly, leaving limited lasting impact.

This dynamic creates a predictable pattern that most memecoins follow:

- Viral launch accompanied by community-driven price appreciation

- Explosive price movement that attracts new buyers

- Rapid attention fatigue as focus shifts to newer projects

- Market collapse within weeks or months

Some Memes Never Get Old: What Separates Winners from Losers

What distinguishes long-term survivors like Dogecoin and Shiba Inu, which maintain ongoing recognition, from the thousands of forgotten tokens? Market analysts describe this as the authority gap: the difference between temporary viral attention and sustained market credibility.

Successful memecoins typically manage to establish cultural relevance or practical utility that extends beyond initial market mania. Dogecoin has maintained its position as an internet cultural staple with a dedicated holder base and continued mainstream references. Shiba Inu expanded its ecosystem to include staking mechanisms and decentralized applications, positioning itself closer to legitimate alternative cryptocurrencies.

Without these elements, even the most viral initial launches tend to fade into market obscurity. The underlying meme concept alone appears insufficient for long-term sustainability, projects must develop narratives that communities and market participants can support even after speculative excitement subsides.

Could Lightning Strike Twice?

Despite current market pessimism, not everyone believes memecoins have reached their final conclusion. Market observers like Darkfost suggest that memecoin dominance within the broader alternative cryptocurrency market is approaching levels historically associated with trend reversals.

The memecoin dominance ratio, which compares memecoin market capitalization to other alternative cryptocurrencies, has been trending near technical support levels that previously marked significant turning points. If speculative capital rotates back toward high-risk digital assets, which is a common occurrence during liquidity-driven bull markets, memecoins could potentially experience another explosive growth phase.

The underlying logic remains straightforward: speculative capital typically seeks volatility opportunities, and few digital asset categories provide volatility comparable to memecoins. For market participants willing to accept associated risks, the possibility of disproportionate returns continues to exist.

The Many Pitfalls of Memeland: The Risks Never Go Away

Even assuming a potential market rebound, memecoins remain among the highest-risk positions within cryptocurrency markets. Unlike Bitcoin, which has established scarcity characteristics, or Ethereum, which powers decentralized application ecosystems, most memecoins lack intrinsic utility propositions. Their market value remains almost entirely dependent on narrative and sentiment factors.

This dynamic means that timing becomes critically important. Market participants who enter positions early and exit strategically can potentially achieve remarkable returns. However, hesitation often converts profitable positions into losses, as exponential rallies frequently reverse with minimal advance warning.

For newcomers to this market segment, the implications are clear: memecoins may provide entertainment and occasional opportunities, but they should not constitute foundational portfolio elements. Effective risk management practices, and the willingness to accept complete capital loss, remain essential when stepping into Memeland.

Curtain Call or Just Intermission?

So has the meme coin era truly concluded? The answer isn’t simple. Examining the thousands of failed token projects, the sector certainly resembles a digital graveyard. Most projects were never designed for long-term sustainability, and their decline represents the natural consequence of speculative excess.

Yet historical patterns suggest caution in declaring memecoins permanently finished. Their cyclical nature, driven by internet culture and speculative market dynamics, indicates they often resurface when liquidity conditions and risk appetite shift favorably. Whether through traditional meme-based narratives or emerging AI-enhanced strategies, future market cycles could still produce unexpected developments.

For market participants, the key takeaway remains consistent: memecoins are not traditional financial assets. They represent speculative instruments capable of both extraordinary gains and losses. The underlying joke isn’t over… but anyone who’s still in on the joke should remain prepared for the punchline.

Managing payments across borders remains one of the biggest operational challenges for expanding businesses. While digital transformation has touched nearly every aspect of commerce, international banking is currently lagging behind with separate systems for crypto and traditional currency transactions, creating unnecessary complexity.

Tap solves this problem by offering each business a multi-currency account with a dedicated IBAN that functions as a bridge between these two financial worlds. For businesses handling both crypto and fiat currencies, this means one unified system rather than juggling multiple accounts and conversion processes. This isn't just convenient - it directly impacts your bottom line by reducing transaction fees, speeding up settlements, and simplifying reconciliation.

If you're handling international payments or considering crypto adoption, this could significantly streamline your financial operations. Here's what you need to know.

What is a business IBAN?

An IBAN (International Bank Account Number) serves as your business's financial passport - a standardised identifier recognised across 78+ countries. Unlike traditional account numbers, a Business IBAN follows a structured format that includes country codes, bank identifiers, and your unique account number.

What sets Tap's approach apart is the integration of this established banking standard with crypto functionality. Instead of operating in parallel financial universes, your transactions (whether in euros, dollars, or Bitcoin) flow through a single identifiable channel.

For finance teams, this means the end of reconciliation nightmares. For your customers and partners, it means one consistent payment destination regardless of their preferred currency.

How Business IBANs Work

The mechanics behind modern business transactions

A Business IBAN functions as the digital coordinates for your company's financial location in the global banking ecosystem. When properly implemented, it creates a frictionless path for money to flow into and out of your business regardless of currency type or originating country.

Sending and receiving payments

When receiving payments, your Business IBAN acts as a universal identifier that works across different payment systems. Clients simply enter your IBAN (and sometimes BIC code) into their banking platform, eliminating the confusion of different account number formats across countries.

For outgoing payments, the process works in reverse. You provide the recipient's IBAN, specify the amount, and Tap's platform handles the routing complexities behind the scenes. This standardisation prevents the common errors that lead to payment delays and rejection fees.

What separates Tap's system from conventional banking is the integration layer that works with both crypto and traditional currencies. When a client pays in Bitcoin, for example, you can choose to receive it as cryptocurrency or have it automatically converted to your preferred fiat currency before it reaches your account.

Banking networks demystified

Business IBANs interact with several key payment networks:

SEPA (Single Euro Payments Area): Covering 36 European countries, SEPA processes euro-denominated transfers typically within one business day at low fixed costs. Your Business IBAN automatically routes euro payments through this network without requiring a separate setup.

SWIFT (Society for Worldwide Interbank Financial Telecommunication): The backbone of international banking, SWIFT connects over 11,000 financial institutions worldwide.

Real-world transaction example

Consider a UK-based e-commerce business receiving payment from a German customer:

- The customer initiates a €5,000 payment to the merchant's business IBAN

- The transaction enters the SEPA network and arrives in the merchant's Tap account within hours

- The merchant can either keep the funds in euros or convert to GBP at their preferred timing

- If choosing to convert, Tap executes the exchange at market rates with minimal spread

- The funds become available for business operations, supplier payments, or withdrawal

This same process that once required multiple accounts, banking relationships, and days of processing now happens automatically through a single business IBAN. For businesses managing dozens or hundreds of such transactions monthly, the efficiency gains and cost savings compound significantly.

The ability to handle these complex financial pathways through one unified system represents the core value proposition of modern business IBANs - simplicity on the surface, sophisticated routing underneath.

Cross-border advantages that impact your bottom line

The practical benefits of a business IBAN become immediately apparent in cross-border transactions:

- Reduced rejection rates: correctly formatted IBANs virtually eliminate payment failures due to incorrect account details

- Faster settlement times: direct routing through the SEPA network for European transactions

- Lower transaction costs: fewer intermediaries means fewer fees eating into your margins

- Simplified compliance: clearer transaction trails for more straightforward reporting

Bridging crypto and traditional finance

The crypto market now represents a $2 trillion opportunity that many businesses struggle to tap into due to technical and operational barriers. A business account with Tap eliminates these obstacles by providing:

- Seamless conversion between crypto and fiat currencies

- Consolidated financial reporting across all currency types

- Regulatory compliance built into the platform

- Reduced exposure to crypto volatility through instant conversion options

For businesses cautiously exploring crypto acceptance, this hybrid approach offers a low-risk entry point without requiring major infrastructure changes.

Implementation without disruption

Setting up a business account through Tap requires minimal operational changes:

- Fill in the contact form to initiate a callback

- Complete the business account set-up and verification process

- Receive your unique account with IBAN

- Update payment details with clients and suppliers

- Integrate with your existing accounting systems

The entire process typically takes less than 48 hours, with Tap's team handling the technical heavy lifting.

Is a Tap business account right for your growth strategy?

It's worth considering a business account if your company:

- Operates in multiple countries or currencies

- Needs to reduce payment processing costs

- Wants to accept crypto payments without complexity

- Are looking to streamline financial operations

As payment landscapes continue evolving, businesses that implement flexible, future-proof solutions gain a significant competitive advantage in customer experience and operational efficiency.

Explore how a business IBAN could fit into your financial infrastructure by visiting Tap's business solutions page, from where a dedicated account manager can discuss potential savings based on your specific transaction patterns.

The business world won't wait for outdated payment systems to catch up. The question isn't whether you need more efficient payment solutions - it's how quickly you can implement them.

Let’s make your cross-border payments simple. Schedule a chat with our expert team and explore how Tap can work for your business.

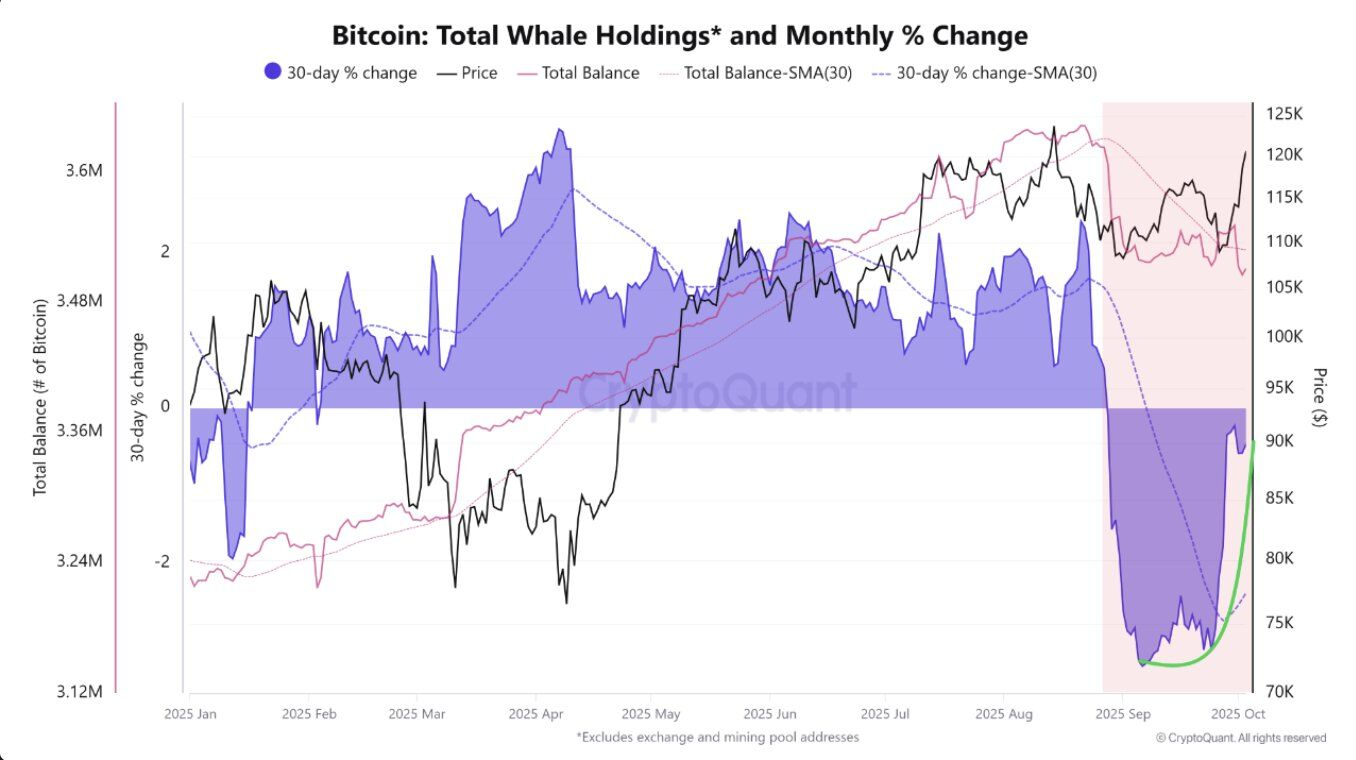

October is off to a strong start. The total market capitalization has once again crossed the $4 trillion threshold, fueled by fresh highs in Bitcoin (BTC) and renewed optimism around altcoins. But beneath the surface, whale wallets (i.e. those holding tens or hundreds of millions in crypto) are making strategic moves that could define market direction this month.

On-chain data paints a picture of accumulation, profit-taking, and rebalancing across top assets. Let’s take a closer look at what these whales are doing, and why their moves matter.

1. Bitcoin (BTC): Holding Strong

Bitcoin remains the market anchor, and its rise above $125,000 has been both a catalyst and a cash-out moment for many whales.

One wallet (3NVeXm) transferred 1,550 BTC (~$193.75 million) to Binance shortly after BTC set a new all-time high, while an address linked to Alameda Research moved another 250 BTC ($30.1 million), likely for liquidation or reallocation.

Despite these outflows, institutional interest has remained exceptionally strong. According to BitcoinTreasuries, corporate holdings continue to climb:

- Metaplanet added 5,268 BTC,

- Marathon Digital accumulated 373 BTC,

- CleanSpark added 308 BTC, and

- MicroStrategy increased by 196 BTC.

In total, the top 100 public companies now collectively hold over 1 million BTC, reinforcing Bitcoin’s role as the primary institutional asset in the digital market.

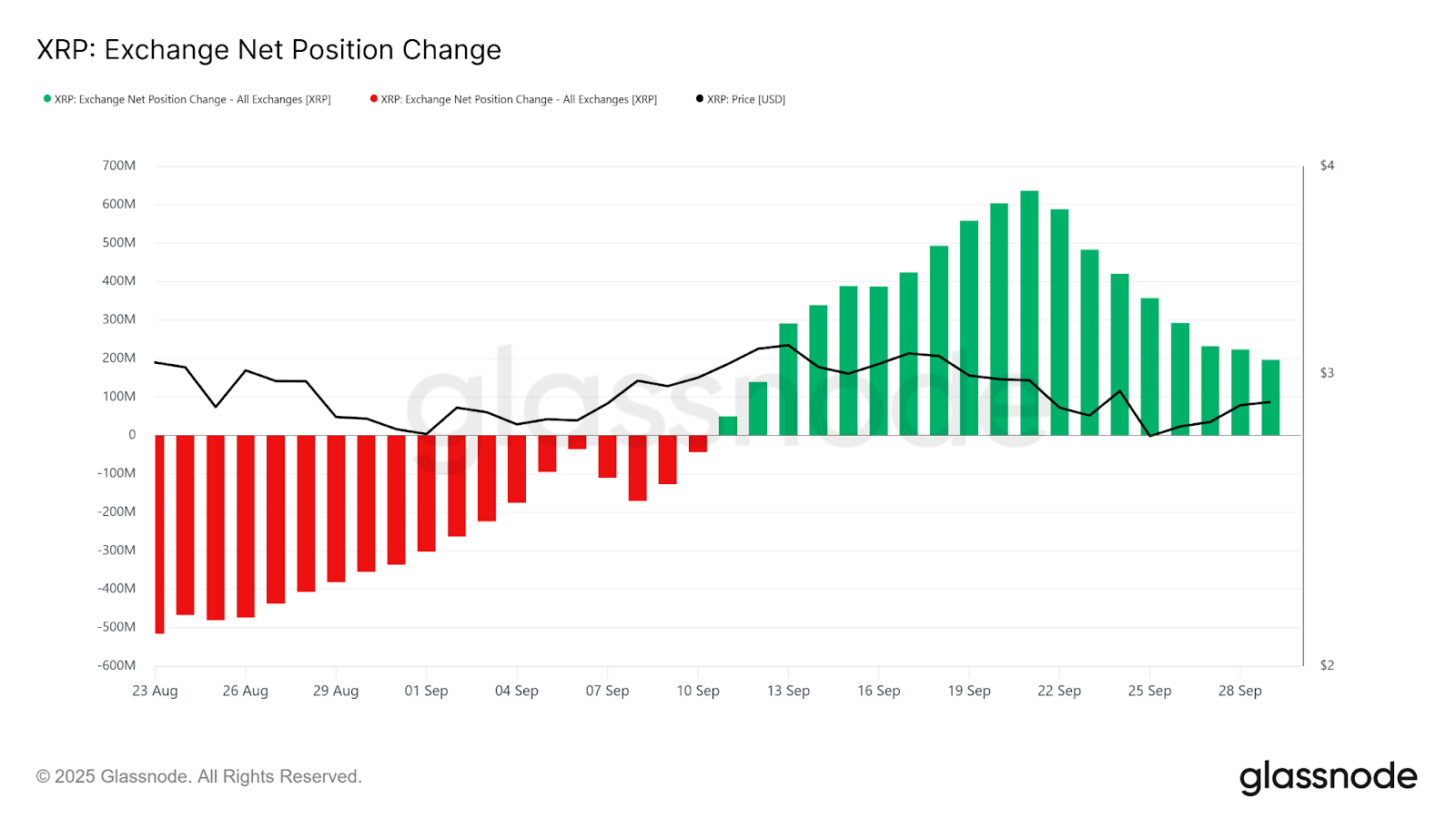

Moreover, whale selling pressure appears to be easing since late September. This sharp decline follows weeks of heavy selling activity, signaling that major holders may be positioning for a reinvigorated accumulation phase.

2. Altcoins: Strategic Bets Across the Board

Beyond the majors, whales seem to be placing their bets across select altcoins, particularly ASTER, ONDO, and Chainlink (LINK).

A single wallet recently accumulated 1.69 million ASTER tokens (~$3.14 million at the time of writing), while a Gnosis Safe Proxy address moved 11.67 million ONDO (~$10.8 million) into exchanges. Of that, 3.89 million ONDO was sent to a Bybit address linked to Arthur Hayes, suggesting that whales could be anticipating volatility or looking to trade around liquidity spikes.

Meanwhile, Arkham Intelligence flagged a whale deposit of 700,000 LINK (~$15.5 million) to Binance. Together, these moves suggest whales are diversifying their positions, betting selectively on tokens with strong ecosystems.

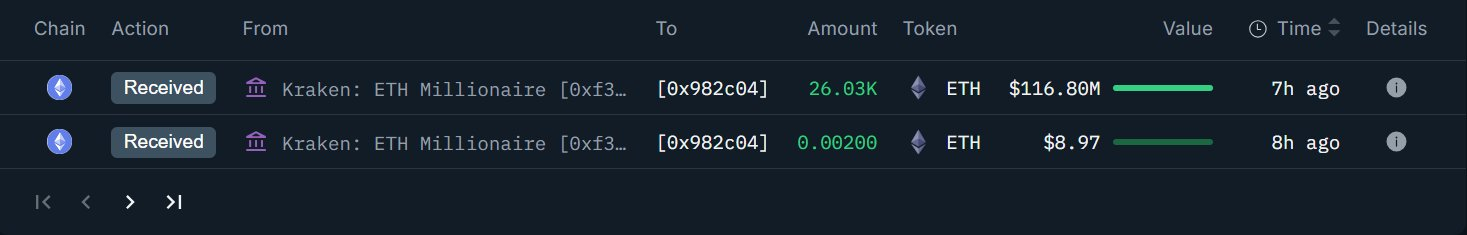

3. Ethereum (ETH): Accumulation Meets Opportunity