Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Money talks, but some currencies whisper so quietly you need a magnifying glass to hear them. In the grand theatre of global finance, not all currencies are created equal, while some strut around like peacocks (looking at you, Kuwaiti Dinar), others shuffle about with the confidence of a wet paper bag.

The Lebanese Pound (LBP) currently holds the unfortunate distinction of being the world's weakest currency in 2025, with an exchange rate so low that one U.S. dollar equals approximately 89,500 Lebanese pounds. To put this in perspective, you'd need a small suitcase to carry the equivalent of $100 in Lebanese pounds, assuming you could find enough physical notes.

Currency weakness isn't just about having a lot of zeros after the decimal point. It reflects a complex web of economic factors, including inflation rates, political stability, monetary policy decisions, and investor confidence. This guide on the world's weakest currencies in 2025, explores the economic stories behind their struggles and what it means for the countries (and the people) who use them.

Top 10 weakest currencies in the world (2025)

Here's the lineup of currencies that make your wallet feel surprisingly heavy when travelling abroad:

| Rank | Currency | Country | Approx. units per USD |

|---|---|---|---|

| 1 | Lebanese Pound (LBP) | Lebanon | 89,500-90,000 LBP |

| 2 | Iranian Rial (IRR) | Iran | 800,000-890,000 IRR |

| 3 | Vietnamese Dong (VND) | Vietnam | 25,960-26,100 VND |

| 4 | Laotian Kip (LAK) | Laos | 21,500-21,600 LAK |

| 5 | Indonesian Rupiah (IDR) | Indonesia | 15,400 IDR |

| 6 | Uzbekistani Som (UZS) | Uzbekistan | 12,700-12,800 UZS |

| 7 | Syrian Pound (SYP) | Syria | 13,000 SYP |

| 8 | Guinean Franc (GNF) | Guinea | 8,600 GNF |

| 9 | Paraguayan Guarani (PYG) | Paraguay | 7,800 PYG |

| 10 | Malagasy Ariary (MGA) | Madagascar | 4,600 MGA |

Exchange rates are approximate and fluctuate daily. Data compiled from multiple financial sources as of July 2025.

What makes a currency weak?

Before we roll our eyes at long strings of zeros, let’s get clear on what actually drives currency weakness.

Exchange rates show how much of one currency you need to buy another, usually measured against the U.S. dollar. But a low exchange rate isn’t automatically a red flag. Just like shoe sizes, bigger numbers aren’t necessarily worse, they’re just different.

The real reasons a currency weakens?

- Persistent inflation that eats away at value

- Short-term monetary policies that undermine long-term confidence

- Trade imbalances and shrinking foreign reserves

- Political instability that rattles investor trust

When investors lose faith, money moves fast, and exchange rates feel the impact. In short, weak currencies aren’t a punchline, they’re a signal of deeper economic tension.

Country spotlights - case studies behind the weakest currencies

Lebanon | A financial collapse without precedent

Lebanon’s currency crisis is a case study in how not to run an economy. As of mid-2025, the Lebanese pound trades at over 89,500 LBP per USD, making it one of the weakest currencies in the world.

The collapse stemmed from a banking sector that functioned like a state-sponsored Ponzi scheme: banks attracted deposits with sky-high interest rates, only to lend most of those funds to a debt-laden government. When confidence evaporated, the system imploded. Add in the 2019 mass protests and the devastating 2020 Beirut port explosion, and the result was economic freefall.

Today, Lebanese citizens navigate a surreal economy where ATMs limit withdrawals to tiny amounts, and many businesses have shifted to unofficial dollar pricing. A shadow economy thrives alongside the official one, proof that when trust in institutions fails, people find their own workarounds.

Iran | Sanctions, inflation, and isolation

The Iranian rial now trades at over 1,000,000 IRR per USD (yes, that's six zeros). Sanctions have cut Iran off from the global financial system, leaving its oil-rich economy unable to fully monetise its most valuable resource.

It's like owning a garage full of Ferraris with no keys to drive them. In response, Iran has attempted to bypass sanctions with crypto experiments and barter agreements, but none have stabilised the currency.

Inflation routinely exceeds 40%, and as a result Iranians have turned to gold, property, and U.S. dollars to preserve what little value they can. In a country known for its resilience, the rial’s collapse remains a stark reminder of the long-term costs of economic isolation.

Vietnam | Weak by design, not disaster

The Vietnamese dong trades at around 26,000 VND per USD, but that doesn’t signal a crisis, it actually reflects deliberate policy. Vietnam maintains a weaker currency to keep exports competitive, a strategy known as competitive devaluation.

This has helped transform Vietnam into a global manufacturing hub, attracting companies looking to diversify away from China. It's like running a permanent sale on your national output - foreign buyers love the prices, and Vietnamese factories stay busy.

The challenge lies in balance. The government works to avoid the inflation traps that have plagued other countries on this list, proving that not all weak currencies come from failure, some are tools of long-term economic strategy.

Laos | Trapped by debt and dependency

The Laotian kip now trades at around 21,800 LAK per USD, weighed down by inflation above 25% and a debt-to-GDP ratio over 125%. Much of that debt is owed to China, tied to major infrastructure projects that haven’t yet paid off economically.

Laos is a landlocked nation with limited industrial capacity and high import dependence, leaving its currency exposed whenever commodity prices shift. With little monetary wiggle room, the kip’s trajectory reflects deeper economic vulnerabilities.

Sierra Leone | A currency redefined, but still fragile

In 2022, Sierra Leone redenominated its currency, removing three zeros from the leone to simplify transactions. But even the new leone remains weak due to decades of disruption: civil war, the Ebola outbreak, COVID-19, and swings in diamond prices.

This is an economy that's faced shock after shock, and recovery is slow. The mining sector, especially diamonds, still dominates, leaving the leone vulnerable to commodity price drops.

Healthcare challenges and limited infrastructure add even more pressure, reducing productivity and increasing fiscal strain. The leone’s weakness tells the story of a country rebuilding piece by piece, with its currency reflecting both the past and the uphill path ahead.

Why some countries choose to keep their currency weak

Believe it or not, some countries actually prefer their currencies to be weaker - and for good economic reasons. It's counterintuitive, like preferring to drive in the slow lane, but the strategy can be remarkably effective.

Export competitiveness represents the primary motivation. A weaker currency makes domestic products cheaper for foreign buyers, essentially providing a permanent discount. German cars might be excellent, but if Vietnamese motorcycles cost 70% less due to currency differences, guess which ones developing countries will buy?

Countries like China famously maintained an artificially weak currency for decades, helping fuel their manufacturing boom. The strategy worked so well that other countries accused them of "currency manipulation" - the economic equivalent of being too good at a game and getting accused of cheating.

However, this approach carries significant risks. Import costs rise dramatically, making everything from oil to smartphones more expensive for domestic consumers

Long-term currency weakness can also trigger capital flight, where wealthy citisens move their money abroad. When your own citisens don't trust your currency, convincing foreigners becomes considerably more challenging.

Does a weak currency mean a weak economy?

We’ve established that a weak currency doesn't automatically signal economic disaster,sometimes it's just a reflection of different economic structures and historical circumstances.

Indonesia and Vietnam serve as the best examples of countries with numerically weak currencies but relatively strong economies. Both nations have achieved consistent growth, reduced poverty, and built increasingly diversified economies despite their currencies requiring calculators to count properly.

The key lies in purchasing power parity - what matters isn't how many zeros follow your currency symbol, but what those zeros can actually buy. A Vietnamese worker earning 10 million dong monthly isn't necessarily poor if that amount provides a comfortable living standard within the Vietnamese economy.

The real measure of economic health involves factors like employment rates, productivity growth, infrastructure development, and living standards. A country with a weak currency but growing wages, improving infrastructure, and expanding opportunities may be economically healthier than a nation with a strong currency but declining industries and rising unemployment.

What are the consequences of a weak currency?

In essence, a weak currency makes daily life more expensive, with rising prices on imports like food, fuel, and electronics. Added into the mix, Inflation erodes savings, and capital flight accelerates as people move their money into more stable currencies.

Over time, foreign currencies may replace the local one in everyday use, limiting government control. Internationally, weak currencies hurt credit ratings and investor confidence, reinforcing instability.

Final thoughts

Currency weakness is more than just numbers, it’s a signal. We’ve learnt above that it can both expose deep economic flaws or reflect deliberate strategies for growth. Lebanon and Iran highlight how instability and isolation can erode value fast, while Vietnam shows how weakness can fuel exports and development.

These disparities then shape the country’s trade, capital flows, and financial stability worldwide, causing a wider ripple effect. In a global economy, no currency moves alone; each affects the rest. And behind every weak currency are real people navigating inflation, opportunity, or uncertainty.

In this article, we're covering what transaction fees are and taking a look at which cryptocurrencies offer the lowest transaction fees in 2025.

While long-term traders are less likely to be affected by transaction fees, short-term traders and people actively using cryptocurrencies continue to be plagued by excessive fee structures.

This ongoing concern has accelerated the adoption of layer 2 solutions, where transactions can be executed more quickly and cost-effectively, as well as the development of new blockchain platforms entirely.

We've also seen increased focus on zero-fee alternatives and innovative consensus mechanisms that eliminate traditional mining costs. Sounds good, right? Let’s get into it.

What are transaction fees?

Transaction fees are fees paid to the miner or validator of the network to execute the transaction. While some networks differ in how they operate, transaction fees are consistent across the board (Proof of Work mechanisms use miners, while Proof of Stake ones use validators).

How transaction fees work on Proof of Work networks

Looking at Bitcoin as an example, when a user sends BTC the transaction is entered into a pool of pending transactions known as a mempool.

The miner will then pick up a batch of transactions and validate them, checking to see whether the original wallet does, in fact, have the funds to send and if the wallet addresses are valid. Once the transaction is executed, the data relevant to the transaction is added to a block, which is chronologically added to the blockchain.

As compensation to the miner for their time and electricity, they earn a small crypto transaction fee from each transaction, as well as a reward for adding the block, known as a miner's reward. This process also ensures the safety and integrity of the network.

When the networks are very busy, the cost of sending a transaction increases. Users can then choose to pay a higher crypto transaction fee in order to prioritise their transaction in the mempool.

How transaction fees work on Proof of Stake networks

Proof of Stake (PoS) networks operate differently from traditional Proof of Work systems like Bitcoin. In PoS networks, validators are chosen to propose and validate blocks based on their stake (the amount of crypto they hold and have locked up) rather than computational power. When you send a transaction on a PoS network, validators collect and validate these transactions in exchange for transaction fees and block rewards.

The key difference is that PoS networks typically consume much less energy since they don't require intensive computational work. This often results in lower transaction fees compared to Proof of Work networks, as validators don't need to cover the same electricity costs. Popular PoS networks include Ethereum (since its transition in 2022), Solana, Cardano, and Polkadot.

Like PoW networks, when networks are very busy, the cost of sending a transaction also typically increases. Users can then also choose to add a higher crypto transaction fee to prioritise their transaction in the mempool.

Transaction fees for smart contracts are mostly much higher, as they are based on how much electricity will be needed to complete the task.

Note: generally speaking, the terms “transaction fee” and “network fee” can be used interchangeably. They both refer to the transaction fee necessary by the network for the transaction to get processed.

Exchange fees refer to something else entirely. Exchange fees are fees charged by the exchange in order to conduct the service. Be sure to check before executing a transaction on an exchange, as you might be required to pay a transaction fee (or network fees) as well as exchange fees.

How to pay less for transaction fees

A transaction fee is imperative to your transaction getting executed on most networks, so it cannot be avoided entirely. However, there are several ways to reduce the amount you need to pay.

Transaction fees increase when networks are busy, so sending your transaction during quieter periods is a great way to reduce costs. Typically, busier periods occur during business hours in major trading regions like the United States and Asia.

Look out for the Lightning Network for Bitcoin, layer-2 scaling solutions for Ethereum (such as Polygon, Arbitrum, and Optimism), and consider cryptocurrencies with inherently low fees or zero-fee architectures. These provide cost-effective solutions to high transaction costs.

Which cryptocurrency has the lowest average transaction fee?

Let’s look at some of the lowest-fee cryptocurrencies and their average transaction costs at the time of writing in 2025.

Nano (NANO) - Near $0 per transaction

Nano stands out as a cryptocurrency with zero transaction fees, making it the most cost-effective option for users seeking to avoid transaction costs entirely. Thanks to its unique block-lattice structure that doesn't rely on miners, Nano provides almost instant transaction speeds while maintaining complete fee elimination. This makes it a common go-to for frequent micro-transactions and real-world payments where every cent counts.

Stellar (XLM) - $0.00001 per transaction

Stellar charges a tiny $0.00001 per transaction, commonly used for cheap international payments. Designed specifically for cross-border transactions and financial inclusion, Stellar's minimal fees and fast settlement times have made it a favourite among payment providers and individuals sending money globally.

XRP - $0.0002 per transaction

Ripple (XRP) charges $0.0002 fees with impressively fast global transfers. Developed by Ripple Labs, XRP remains optimised for fast, affordable cross-border payments, with a continued focus on serving financial institutions and remittance providers.

Its minimal costs and consistent 4-second transaction times have made it a common choice for users and institutions alike.

Solana (SOL) - $0.00025 per transaction

Solana is known for being one of the lowest gas fee cryptos, costing close to $0.00025 per transaction. The network stands out for its lightning-fast transactions, typically wrapping up in about 2.5 seconds.

Thanks to its scalable design, Solana can handle many transactions simultaneously, making it widely adopted by dapps and major blockchain projects. This efficiency has maintained Solana's position as a top-10 crypto by market cap throughout 2025.

Bitcoin Cash (BCH) - $0.01 per transaction

Bitcoin Cash maintains its position with an attractive $0.01 average transaction fee. As a Bitcoin fork, BCH continues to be engineered for faster, more affordable transfers via its larger block sizes.

The consistently low fees on Bitcoin Cash have helped BCH remain in use as a cost-effective blockchain and low-cost market entry option.

Litecoin (LTC) - $0.05 per transaction

Litecoin continues to stand out as one of the cheapest crypto options, maintaining its average cost of around $0.01 - $0.05 per transfer.

As an early pioneer in the space, Litecoin was designed with speedy 2.5-minute transaction times and affordable payments in mind, building upon and refining Bitcoin's underlying technology.

Dogecoin (DOGE) - $0.055 per transaction

Despite its meme origins, DOGE offers practical benefits for crypto users, particularly in terms of transaction costs. The average transaction fee for Dogecoin is approximately $0.055, making it an economical choice for small-scale and frequent transactions.

With fast 1-minute transaction times and continued community support, Dogecoin is often used for micro-transactions like tipping and donations.

Trade smart, trade with Tap

Users can trade all the tokens mentioned above with equally impressive low-cost exchange fees directly on the Tap app. Adding to the cost-effective nature of the platform, it also offers heightened security and added convenience.If you’re looking to trade these tokens, Tap offers low exchange fees with added security and convenience. Learn more in the Tap app.

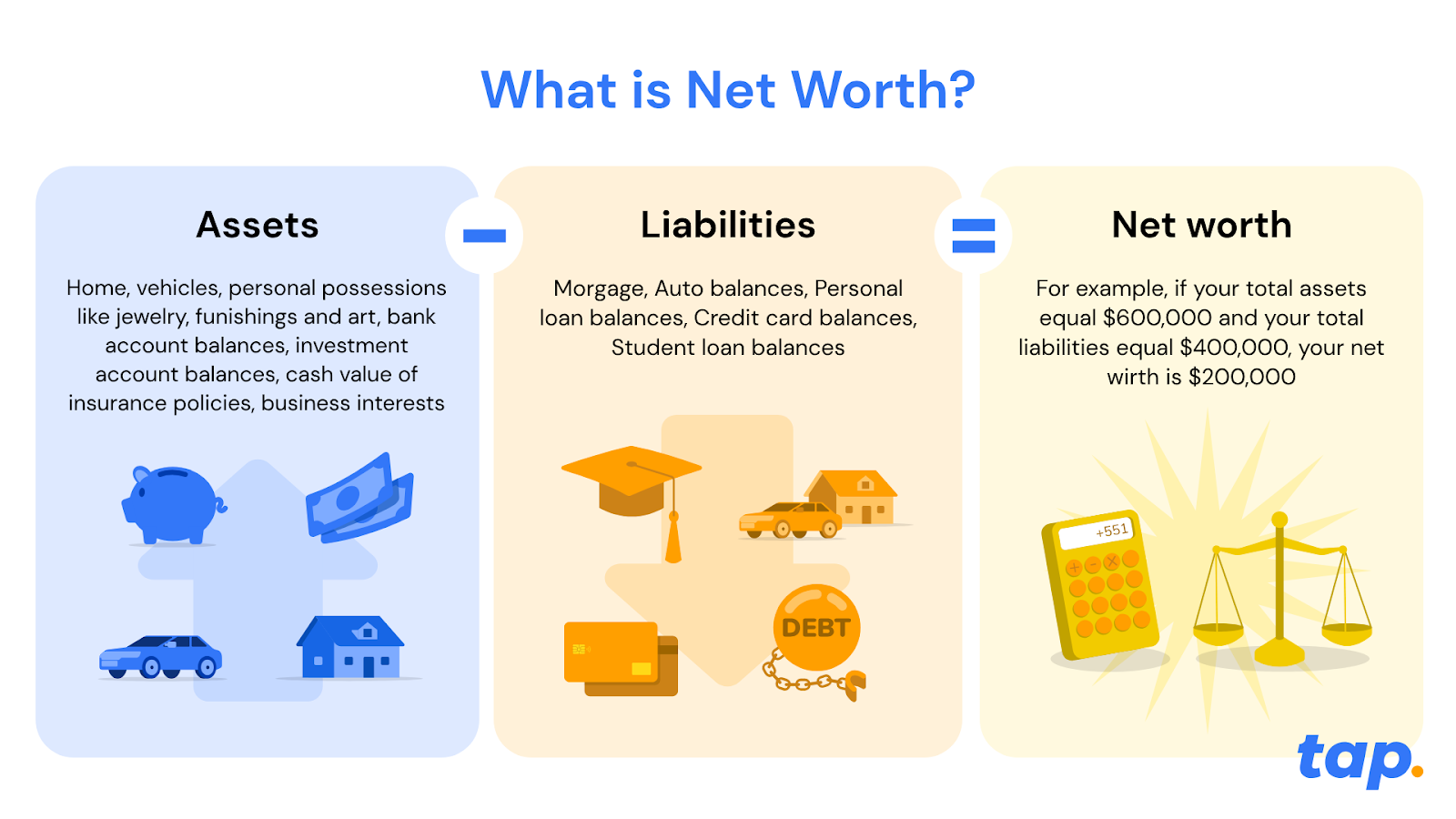

Ever wondered if you're winning or losing the money game? Your net worth holds the answer - and it's easier to calculate than you think.

What is net worth? (and why should you care?)

Think of net worth as your financial report card. It's the ultimate measure of your financial health - not how much you earn, but how much you're actually worth.

Here's the simple truth: net worth = what you own - what you owe

Unlike your salary (which just shows your monthly income), net worth gives you the big picture. It's like comparing a snapshot to a full movie of your financial life.

Why net worth beats income every time

You might earn $100,000 a year, but if you owe $150,000 in debt with only $20,000 in assets, your net worth is actually negative $130,000. Meanwhile, someone earning $50,000 with $200,000 in assets and $50,000 in debt has a net worth of $150,000. Who's really ahead?

The net worth formula

Assets (the good stuff you own)

- Real Estate: Your home, investment properties, land

- Investments: Stocks, bonds, mutual funds, crypto

- Retirement accounts: pension funds

- Cash & savings: Bank accounts, CDs, money market accounts

- Valuable possessions: Cars, jewellery, art, collectables

- Business interests: Ownership stakes, equipment

Liabilities (what's draining your wealth)

- Mortgages: Home loans, investment property loans

- Student loans: Education debt

- Credit cards: Outstanding balances

- Auto loans: Car payments

- Personal loans: Any other borrowed money

- Outstanding bills: Medical debt, taxes owed

How to calculate your net worth (3 simple steps)

Step 1: List your assets

Add up everything valuable you own. Be honest but don't undervalue quality items.

Step 2: Total your liabilities

List every debt, loan, and outstanding balance. Yes, even that store credit card.

Step 3: Do the maths

Assets - liabilities = your net worth

Real-world examples: Meet Sarah and Mark

Sarah's success story

Assets:

- Home: $400,000

- Savings: $50,000

- Investment Portfolio: $150,000

- 401(k): $200,000

- Vehicle: $20,000

- Total Assets: $820,000

Liabilities:

- Mortgage: $200,000

- Student Loan: $30,000

- Total Liabilities: $230,000

Sarah's net worth: $590,000

Sarah's doing great! Her assets significantly outweigh her debts.

Mark's comeback journey

Assets:

- Car: $10,000

- Personal Items: $5,000

- Total Assets: $15,000

Liabilities:

- Student Loans: $50,000

- Credit Cards: $8,000

- Medical Bills: $3,000

- Total Liabilities: $61,000

Mark's net worth: -$46,000

Mark has negative net worth, but this is his starting point, not his destiny.

6 reasons why it’s beneficial to grow your net worth

Financial security

Increasing your net worth provides a foundation of financial security. As your net worth grows, you have a greater buffer against unexpected expenses, job loss, or economic downturns. It offers a safety net to navigate through challenging times and helps you maintain stability in your financial life.

Achieving financial goals

A higher net worth enables you to achieve your financial goals and aspirations. Whether it's buying a home, starting a business, funding education, or retiring comfortably, a growing net worth provides the necessary resources and financial freedom to pursue your dreams.

Building wealth

Net worth is a measure of your wealth accumulation over time. By actively growing your net worth, you increase your overall wealth and improve your financial position. It allows you to build a stronger foundation for yourself and potentially leave a legacy for future generations.

Better financial opportunities

A higher net worth opens doors to better financial opportunities. It improves your borrowing capacity, allowing you to secure favourable loan terms and interest rates when needed. Additionally, a strong net worth can attract investment opportunities and partnerships that can further boost your wealth.

Flexibility and choices

Increasing your net worth provides you with more flexibility and choices in life. It affords you the freedom to make decisions based on what aligns with your long-term goals and values, rather than being constrained by financial limitations. A growing net worth expands your options and empowers you to take calculated risks or make life-changing decisions with confidence.

Peace of mind

Knowing that your net worth is growing can bring peace of mind. It reduces financial stress and anxiety, allowing you to focus on other aspects of your life. A positive net worth provides a sense of control over your financial well-being and offers peace of mind that you are on the right track towards a secure financial future.

Tips for increasing your net worth

Boost your income

- Level up your career: Ask for raises, pursue promotions, learn high-value skills

- Create side hustles: Freelancing, online businesses, passive income streams

- Invest in yourself: Education and skills that increase your earning power

Supercharge your assets

- Diversify smartly: Don't put all eggs in one basket

- Think long-term: Focus on assets that appreciate over time

- Get professional help: Financial advisors can spot opportunities you might miss

- Review regularly: Markets change - your strategy should too

Crush your debt

- Target high-interest debt first: Credit cards are wealth killers

- Consider consolidation: Lower interest rates = more money for you

- Create a payoff plan: Set deadlines and stick to them

- Avoid new debt: Unless it's for appreciating assets

Master the long game

- Emergency fund: 3-6 months of expenses (minimum!)

- Retirement planning: Start early, contribute consistently

- Professional guidance: Sometimes paying for advice saves you thousands

- Track progress: What gets measured gets improved

The bottom line: your financial transformation starts now

Your net worth isn't just a number; it's your financial GPS, showing exactly where you stand and where you're headed. Whether you're starting with negative net worth like Mark or building on a solid foundation like Sarah, the principles remain the same.

Remember: Every financial giant started with a single step. Your current net worth is just your starting line, not your finish line.

Start tracking your net worth today, and watch as this simple practice transforms not just your bank account, but your entire relationship with money. Your future self will thank you!

Ready to take control of your financial destiny? Calculate your net worth this week and set your first wealth-building goal. The journey to financial freedom starts with knowing where you stand.

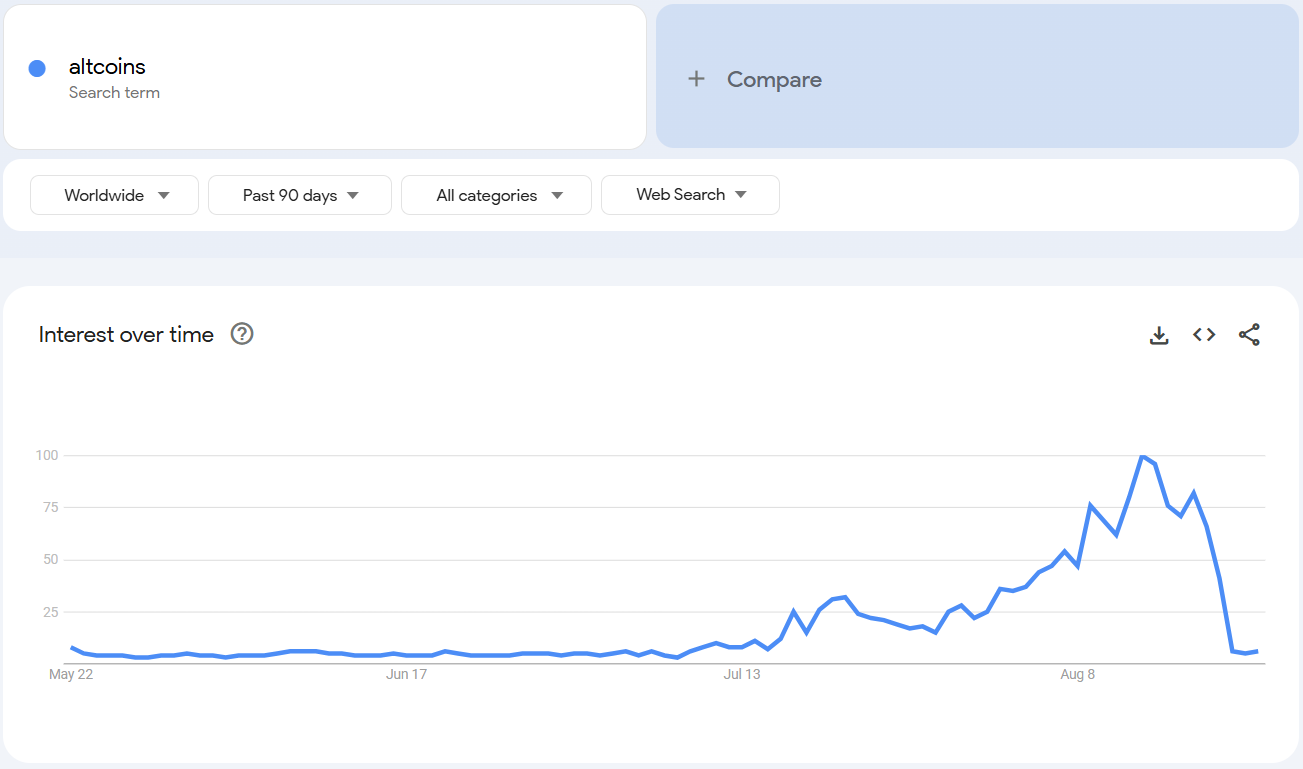

For a fleeting moment, it looked like altcoin season was finally here. Google searches for “altcoins” skyrocketed to record highs, 𝕏 was buzzing, and retail excitement seemed to return in full force. But within a week, that hype fizzled out almost as quickly as it appeared, leaving traders wondering if the long-awaited alt season was just a mirage.

A Spike That Vanished Overnight

Search interest for “altcoin” on Google Trends hit its highest score ever in early August, only to fall back to baseline levels within days. Globally, the same pattern played out, with scores dropping from 100 to just 16 in a week, mimicking a “pump and dump” pattern that you would expect from a memecoin.

Market cap data told the same story. The total value of altcoins (excluding Bitcoin and Ethereum) briefly climbed by $100 billion before giving it all back, leaving investors wondering whether the hype had any real weight behind it.

Naturally, some saw the collapse as proof that the altcoin season had ended before it really began. Others, however, like analyst Cyclop, argue the spike shows something deeper: that “altcoin” has become the mainstream term retail uses today, replacing “crypto” in 2021. In his view, this isn’t the peak. Rather, it’s just the beginning of broader interest.

Why Google Trends Doesn’t Tell the Whole Story

Relying on Google searches to measure retail demand may no longer work the way it used to. With AI tools increasingly replacing traditional search, and with concepts like “altcoins” now part of everyday investor vocabulary, Trends data might not be capturing where and how money is really flowing.

Instead, analysts point to on-chain and trading activity as better indicators of where momentum is building. And in August, that momentum was fragmented.

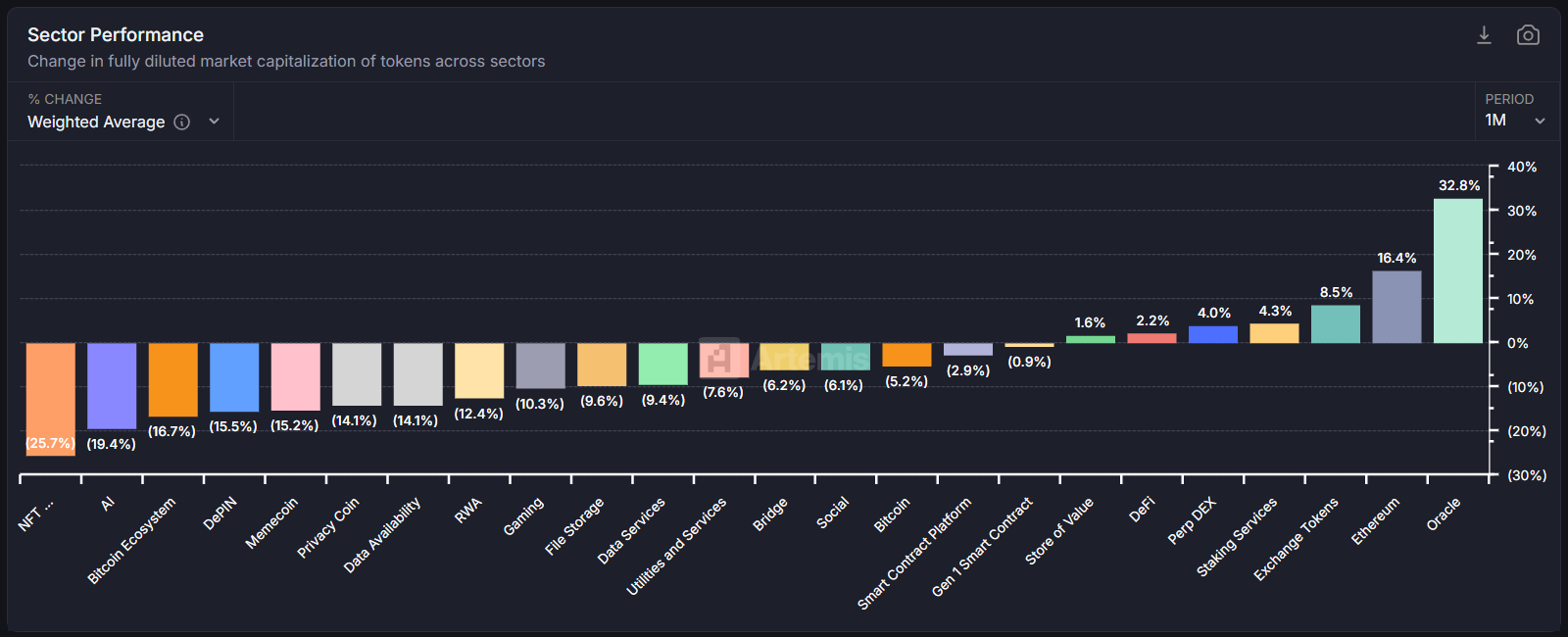

A Season of Winners and Losers

Data from Artemis showed only a few categories outperforming last month: Ethereum, exchange tokens, and oracles.

Beyond these bright spots, however, most altcoins struggled. The result? A patchwork “mini season” rather than the explosive, across-the-board surge that retail and social media had been hoping for.

Polygon’s co-founder Sandeep put it bluntly: "Retail is searching, but institutions aren't buying the narratives yet. Old altcoin seasons were driven by speculation and promises and narratives and marketing. Institutional money is smarter money. It cares about real utility and cash flows. The next "alt season" won't look like 2017 or 2021. It’ll be fewer tokens with actual usage, not just tokens with better marketing." Sandeep said.

The Road Ahead

That doesn’t mean altcoin season is dead, it probably just means it’s evolving. Coinbase has suggested that the next true wave could arrive as early as September, but that it likely won’t be a full-scale altcoin season.

Bottom line? The altcoin season isn’t gone; it’s just different. It’s maturing. And the next leg up may not belong to every token in the market, but only to the select few proving they can deliver value beyond mere speculation.

The internet has made earning money easier than ever - whether you want a side hustle for some extra cash or a full online business, the opportunities keep growing fast. From quick gigs to long-term passive income streams, there’s something for everyone.

But don’t expect to get rich overnight (and if someone promises you that, it’s more than likely a scam). With focus, patience, and smart moves, you can build real, sustainable income online.

This guide breaks down proven ways people are making money from home, some with zero upfront costs, others aimed at long-term growth. The trick? Find what fits your skills, time, and goals.

Let’s dive in!

1. Best ways to make money online quickly (low skill, high interest)

If you're new to making money online (see our beginners’ guide here) or need cash fast, these low-barrier options can help you start building income without any special skills. They won’t replace your 9-5, but they’re great for extra cash or to start building your online income game.

Paid online surveys

Surveys remain one of the easiest ways to start earning online. Companies pay for your honest opinion. No skills needed, just some spare time.

- Top platforms: Swagbucks, Branded Surveys, YouGov, Prolific

- Earnings: Typically £0.50-£3 per survey, 10-20 minutes each

- Tip: You’ll need to hit a payout threshold (usually £10-20) before withdrawing

Get paid to click, watch, or search

Earn small amounts doing simple online tasks like watching videos or using a search engine. It won’t replace a full income, but it adds up if you’re consistent.

- Try: Qmee, InboxPounds, Swagbucks

- Earnings: Pennies per task, but easy to do anytime

Micro-tasks

These quick gigs need human input, like data entry or web research.

- Platforms: Clickworker, Amazon Mechanical Turk, Lionbridge

- Pay: £2–£10 per hour, flexible hours

Test websites and apps

Give feedback on the usability and functionality of websites or apps.

- Sites: UserTesting, Userlytics, TryMyUI

- Pay: £8-£12 per 20-minute test

- Requirements: Good communication skills and reliable internet

Competitions and prize draws (comping)

Not guaranteed income, but some people win prizes worth thousands annually by entering competitions.

- Follow brands on social media for exclusive contests

- Use aggregator sites like LoquaxTM and MSE's Competition Corner

2. Medium-effort methods with reliable returns

These options require more skill or time investment but offer better earning potential and more engaging work.

Freelance writing and editing

Content demand is booming. If you can write clearly, this is a solid way to earn.

- Get started: Upwork, Intch, Freelancer

- Rates: Beginners £10-20/article; experienced £30-100+/hour

- Tip: Build a niche and portfolio gradually

Sell stock photos or videos

Monetise your photography/videography skills on platforms like Shutterstock or Adobe Stock.

Become a Virtual Assistant (VA)

Support businesses with admin tasks, social media, customer service, and more.

- Pay: £8-25/hour

- Build: Long-term client relationships for stable income

Sell handmade products

Use Etsy, Folksy, or Amazon Handmade to turn crafts into cash.

Sell digital products

High margins, no inventory. Popular items include Notion templates, Canva designs, ChatGPT prompts, and planners.

- Platforms: Gumroad, Etsy, Creative Market

3. Scalable and passive income streams

These take real effort up front, but once they’re set up, they can bring in steady income with little to no maintenance.

Dropshipping tips

Sell products online without inventory, using Shopify or WooCommerce.

- Profit margins: 3-7% after ads

- Requires skills in marketing and customer service

Print-on-demand

Design items like t-shirts or mugs are printed only when ordered.

- Platforms: Printful, Printify, Merch by Amazon, Redbubble

Start a blog or niche website

Earn through ads, affiliate links, sponsored content, and digital products.

- Takes roughly 6-18 months to grow, but can generate substantial passive income

Create and sell online courses

Share your expertise on platforms like Udemy, Teachable, Skillshare, or Coursera.

Write and publish ebooks

Self-publish on Kindle Direct Publishing or Smashwords. Good editing and marketing matter.

Launch a YouTube channel

Earn through ads, memberships, super chats, sponsorships, and affiliate marketing.

Side hustles that use your environment or possessions

Why not monetise what you already own?

- Rent property through Airbnb or Booking.com for significant income.

- Rent belongings like cars (Turo), equipment (Fat Llama), or parking spaces (JustPark).

- Sell unused items on Facebook Marketplace, eBay, or Vinted - many earn hundreds decluttering.

- Use cashback apps like Shoppix and TopCashback (or from your Tap card - up to 8% people) for purchases you're already making.

These options work especially well in urban areas and thankfully require minimal upfront investment.

What to watch out for

The internet is full of legitimate opportunities, but scams are unfortunately common. Protecting yourself is crucial.

Avoid scams, watch for:

- Promises of guaranteed big money with little effort

- Upfront payment requests for “training” or “kits”

- Pyramid or multi-level marketing schemes

Know your tax obligations. In the UK, you must report online income over £1,000 to HMRC. Keep good records and consider professional advice.

Understand platform rules. Check minimum payouts, fees, payment methods, and account policies before signing up. Always read the ts and cs.

Tips for success when earning online

Unlock your online earning power with these 5 no-fluff strategies:

- Use a separate email for online earning to stay organised and secure

- Track your earnings and time with a spreadsheet for insights and taxes

- Focus on higher-paying platforms and build skills accordingly

- Start small, then scale what works best for you

- Learn digital skills (SEO, copywriting, design, social media) via free online tutorials

Final thoughts

Making money online gives you freedom, but it also takes effort and patience. There’s no magic formula - some people thrive blogging, others with surveys or micro-tasks. Start small, learn, and expand gradually.

And lastly, watch out for scams, keep good records, and keep adding value. If you’ve made it this far, we believe you’re ready to take control of your online income journey!

When it comes to trading or investing, understanding how to read charts is essential. While some might choose to rely on intuition, it's important to have a strategy based on probabilities and risk management. That's where candlestick charts come in. In this article, we'll explore what candlestick charts are and how to interpret them.

What is a candlestick chart?

Candlestick charts, dating back to 17th-century Japan with their creation credited to a Japanese rice trader named Homma, are a crucial tool in financial analysis. They differ from traditional line and bar charts by offering a richer visual representation of price movements, as they are composed of structures that resemble a candle and represent different periods, ranging from seconds to years.

Candlesticks consist of a "body" representing the price range between opening and closing, with "wicks" or "shadows" extending above and below, illustrating high and low prices. Their unique design allows traders to quickly grasp market sentiment and potential reversals, making them indispensable in technical analysis.

Whether identifying bullish or bearish patterns, understanding candlestick chart basics is fundamental for anyone delving into the world of investment and trading.

Understanding how candlestick charts work

To create a candlestick, four price points are needed: open, high, low, and close. The open is the first recorded trading price, while the high and low represent the asset's highest and lowest prices during the timeframe. The close refers to the last recorded trading price.

These four points determine the shape of the candlestick, with the distance between the open and close called the body, and the distance between the body and the high/low referred to as the wick or shadow. The overall range of the candlestick is the distance between the high and low.

How to use candlestick charts

Popular with stock market traders, candlestick charts are often considered easier to read than traditional bar or line charts. They provide a simple representation of price action at a glance, as each candlestick represents the battle between buyers (bulls) and sellers (bears) during a specific time period. A longer body indicates stronger buying or selling pressure, while if the wicks are short, it means the high or low of the period was near the closing price.

The colour of the candlestick can vary, but generally, green means the asset closed higher than it opened, while red signifies a lower closing price. Some traders prefer black and white representation, where up movements are hollow candles and down movements are black candles.

Examples of single candlestick charts

Doji: A Doji has a small body with upper and lower wicks of roughly equal length, resembling a cross or plus sign. It signifies market indecision and potential reversals.

Hammer: The Hammer exhibits a small body at the top with a long lower wick, resembling a hammer. This candlestick advocates for a potential bullish reversal after a downtrend.

Shooting Star: The Shooting Star has a small body at the bottom with a long upper wick, resembling a falling star. It hints at a potential bearish reversal after an uptrend.

Spinning Top: A Spinning Top has a small body and short upper and lower wicks. It denotes market indecision, with neither bulls or bears in control.

Marubozu: A Marubozu features a long body with no wicks, indicating strong buying or selling pressure. A bullish Marubozu has a long green body, while a bearish one has a long red body.

These single candlestick patterns offer traders valuable information for decision-making in various market conditions.

Bullish and bearish candlestick charts

Bullish and bearish candlestick patterns are critical indicators in financial analysis, offering insights into market sentiment. Bullish patterns signal optimism, suggesting potential price increases. Examples include the Hammer, signalling a possible price reversal upward, and the Three White Soldiers, indicating strong buying momentum.

On the other hand, bearish patterns imply pessimism and potential price declines. The Shooting Star, for instance, hints at a reversal downward, while the Three Black Crows signify a bearish trend.

These candlestick patterns provide traders with visual cues regarding market sentiment, helping them make informed decisions. Recognizing these patterns empowers investors to gauge the market direction and make strategic moves in response to prevailing sentiment.

Candlestick charting strategies

Candlestick charting strategies are powerful tools for traders, providing insights into market sentiment and potential price movements. These strategies encompass various approaches to maximise trading success:

1. Trend reversal strategies

These strategies focus on identifying shifts in market direction using candlestick patterns. Traders look for reversal patterns like the Hammer or Shooting Star to pinpoint potential trend changes. These patterns offer valuable entry and exit points for both bullish and bearish trends, enhancing the trader's ability to capitalise on market reversals.

2. Continuation strategies

Continuation strategies involve using candlestick patterns to trade in the direction of the existing trend. Traders seek patterns that confirm the ongoing trend, such as the Bullish Engulfing pattern during an uptrend or Bearish Engulfing during a downtrend. Effective use of these patterns provides confirmation signals and risk management techniques to stay aligned with the trend's momentum.

3. Combination strategies with other technical indicators

To increase trading accuracy, traders often combine candlestick patterns with other technical indicators like Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). This approach offers a comprehensive view of market conditions, enhancing decision-making and reducing false signals. Learning to integrate candlestick patterns with these indicators is crucial for traders looking to refine their strategies.

Incorporating these candlestick charting strategies empowers traders to make informed decisions and navigate the complex world of financial markets with greater precision and confidence.

What candlestick charts can’t illustrate

Although candlesticks provide a good overview of price action, they don't provide all the details for a comprehensive analysis. For example, they don't show the details of what happened between the open and close, only the distance between these two points. Additionally, candlestick charts can contain a lot of noise, especially when analysing lower timeframes.

What are Heikin-Ashi candlesticks?

Apart from traditional candlestick charts, there are other methods to calculate and interpret candlesticks. One such method is the Heikin-Ashi technique, which stands for "average bar" in Japanese. Heikin-Ashi candles rely on a modified formula that uses average price data to smooth out price action and filter market noise. This technique makes it easier to spot trends, patterns, and possible reversals in the market.

Traders often use Heikin-Ashi candles in combination with traditional candlesticks to avoid false signals and increase the chances of identifying market trends. Green Heikin-Ashi candles with no lower wicks indicate a strong uptrend, while red candles with no upper wicks suggest a strong downtrend.

However, it's important to note that Heikin-Ashi candlesticks have their limitations. Since they use averaged price data, patterns may take longer to develop, and they may not show price gaps or obscure other price information.

In conclusion

Candlestick charts are a fundamental tool for traders and investors. They provide a visual representation of price action and allow for analysis across different timeframes. By studying candlestick charts and patterns, combined with an analytical mindset and practice, traders can gain an edge in the market. However, it's also important to consider other methods, such as fundamental

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started

.webp)

.webp)