Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Bitcoin Crashes Below $82K in Brutal Sell-Off

After breaking through several support levels, Bitcoin is trading around $82,000, extending a punishing downtrend that has erased more than 30% of its value since October's peak at $126,000.

The cause? A perfect storm of selloffs in U.S. equity markets, which triggered a wave of risk aversion that swept through global markets. Meanwhile, the Federal Reserve's cautious stance on further rate cuts has injected fresh uncertainty into trading floors. Markets still anticipate a 0.25% cut, but with recession fears intensifying, traders are hitting the exits. Crypto found itself directly in the crosshairs of this flight to safety

The damage extended well beyond Bitcoin. Estimates show around $2 billion in crypto positions liquidated, as forced selling and evaporating liquidity accelerated the downturn across digital assets. But here's a twist for you: Bitcoin is now entering territory that has historically preceded major recoveries. Let’s dive in.

Bitcoin Is Officially Oversold… And That Matters

The Relative Strength Index (RSI) has officially moved into oversold territory for the first time in nine months, signaling extreme selling pressure. The last time BTC hit oversold levels was in February, right before a notable rebound. Oversold signals don’t guarantee an immediate reversal, but they often mark the beginning of seller exhaustion.

In the previous oversold event, BTC dropped around an additional 10% before bouncing. If that were to happen again, BTC could briefly dip toward $77,000 before bulls regain momentum. If the current selling eases earlier, a shorter-term bounce could happen sooner.

MVRV Points to Undervaluation

Another key indicator worth looking at is Bitcoin’s MVRV Ratio. This on-chain indicator reveals whether investors are collectively sitting on profits or losses. An MVRV Ratio above 1 means the average holder is in the green; below 1 signals most are underwater.

BTC’s MVRV now sits at 1.5, its lowest level in over two years. When MVRV enters a “opportunity zone”, it suggests two things:

- Many short-term holders are underwater

- Downside selling pressure is approaching exhaustion

Key Levels to Watch

If bearish pressure continues, it’s possible BTC could revisit the $80,000 level, with a deeper support level around $77,000, matching the RSI’s recent historical pattern.

But there’s also a realistic bullish scenario: reclaiming $92,000 could turn the structure decisively bullish, opening the door to the $95,000 region and beyond.

What Can We Expect From BTC This November?

Beyond the indicators, there’s a seasonal angle worth emphasizing: Bitcoin has historically shown strong end-of-year recoveries and rallies. Even during weaker macro environments, Q4 has often delivered rebounds driven by renewed risk appetite and improved liquidity flows.

Combine that with oversold technicals, undervaluation signals, and easing macro uncertainty if the Fed does follow through on cuts, and the current levels could start looking less like panic territory and more like potential opportunity.

The Takeaway

Bitcoin's slide doesn’t appear to be driven by broken fundamentals; it's the result of macro turbulence, risk-off positioning, and temporary sentiment shifts. Short-term chop may persist, but on the flip side, key indicators are flashing oversold conditions which have historically marked turning points.

Corrections are part of Bitcoin's DNA. It has survived far steeper crashes and consistently emerged more resilient. Whether the bounce starts today or after one final shake-out, the pattern is familiar: selling exhaustion plants the seeds for the next rally. Patient holders have seen this pattern many times, and more often than not, their patience has been rewarded.

Did you know some chart patterns boast success rates of over 80% when spotted and used correctly? While the market often feels chaotic, decades of historical data reveal that price movements tend to repeat in recognisable ways.

For many investors and traders, these patterns are seen as the market’s “body language,” offering clues about shifts in momentum and sentiment. Every move on a stock chart reflects what investors are thinking and doing, and once you learn to “read” those signals, the idea is that you can spot whether a stock is likely to keep running or flip directions.

The real power isn’t in predicting the future (nobody can do that). It’s about stacking the odds in your favour. Patterns help you zero in on higher-probability setups, fine-tune your entries and exits, and manage risk more effectively, meaning smarter trades and fewer costly mistakes.

In this guide, we’ll break down several reliable patterns and show you which timeframes matter.

The best timeframes for chart pattern analysis

Before diving into specific patterns, you need to understand that timeframe selection dramatically impacts pattern reliability. The same asset can show completely different patterns depending on whether you're looking at 15-minute, daily, or weekly charts.

For instance, take Bitcoin below: the very same moment in time can look completely different on a daily chart versus a monthly chart.

Source: TradingView | 1 day vs 1 month trading charts

Daily charts

For most investors, daily charts often hit the sweet spot because they balance short-term noise with more reliable signals. Patterns that take weeks or months to form on daily charts tend to be more trustworthy because they reflect genuine shifts in market sentiment rather than momentary blips.

4-hour charts

If you’re swing trading (holding positions for days or weeks) 4-hour charts are likely going to be your best friend. They capture medium-term trends and provide more opportunities than daily charts, while still being reliable enough for professional traders to use when sharpening their entries and exits.

15-minute charts

Then there are 15-minute charts, the playground of active traders. They can be exciting, but here’s the catch: shorter timeframes often mean more false signals. You might spot plenty of patterns, but their accuracy drops fast. Only use these if you can stay glued to the screen and stick to strict risk controls.

Many traders chose to blend their timeframes in a layered strategy. Starting with daily charts to lock onto the bigger trend, then zooming into shorter ones to pinpoint their entry.

The 5 most well-known chart patterns for timing

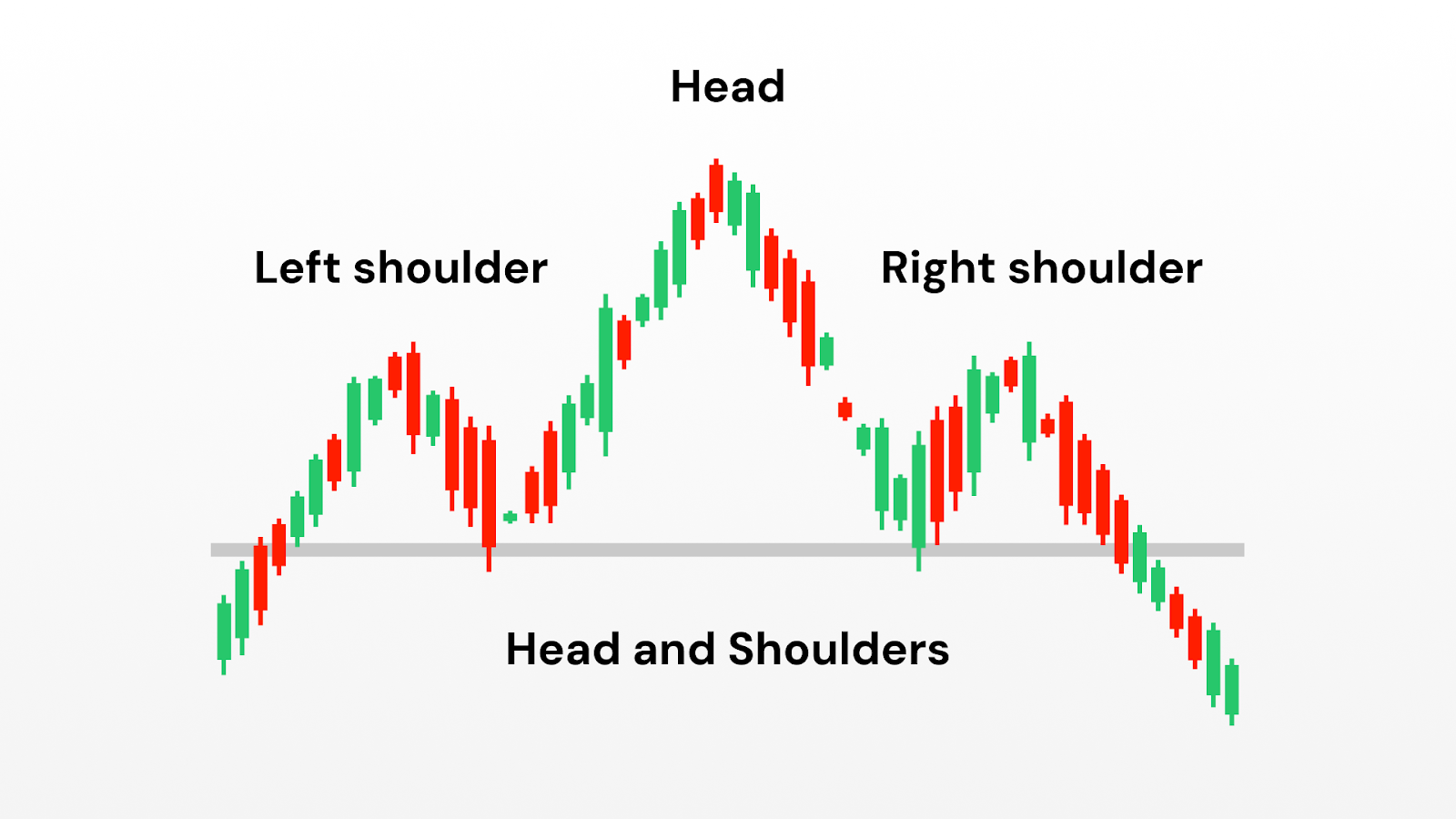

1. Head and Shoulders

The Head and Shoulders formation is one of the most widely studied and discussed reversal patterns in technical analysis. It’s often described as the market’s way of “topping out,” suggesting that an uptrend may be running out of steam.

Structure of the pattern

- The left shoulder: An initial rally creates a peak, followed by a decline.

- The head: A stronger rally pushes prices to a higher peak than before, but the move is not sustained.

- The right shoulder: A final attempt to rise falls short of the head’s height, showing reduced momentum.

- The neckline: A line connecting the two low points between the shoulders and the head, often used as a reference for when the pattern is considered “complete.”

When this sequence appears, many analysts view it as a sign that bullish pressure is fading and that selling interest is beginning to dominate.

Why it matters

The head and shoulders pattern is so closely followed because it reflects a psychological shift:

- The first rally shows enthusiasm.

- The higher peak shows overextension but also reveals strong optimism.

- The final, weaker rally shows that buyers no longer have the same conviction. This shift from strength to weakness is why the pattern is often considered a reliable reversal signal.

Variations

Inverse Head and Shoulders: The opposite version, often seen at market bottoms, where the formation suggests a shift from selling pressure to renewed buying interest.

Complex Head and Shoulders: In some markets, extra shoulders may form, reflecting prolonged tug-of-war before momentum reverses.

Caveats

Despite its reputation, the head and shoulders is not foolproof. False signals are common, particularly in thinly traded assets or during periods of high volatility.

Many traders treat it as a useful warning sign rather than a guarantee, and they often combine it with other forms of analysis (such as trend strength, support and resistance zones, or macro factors) to build confidence in their interpretation.

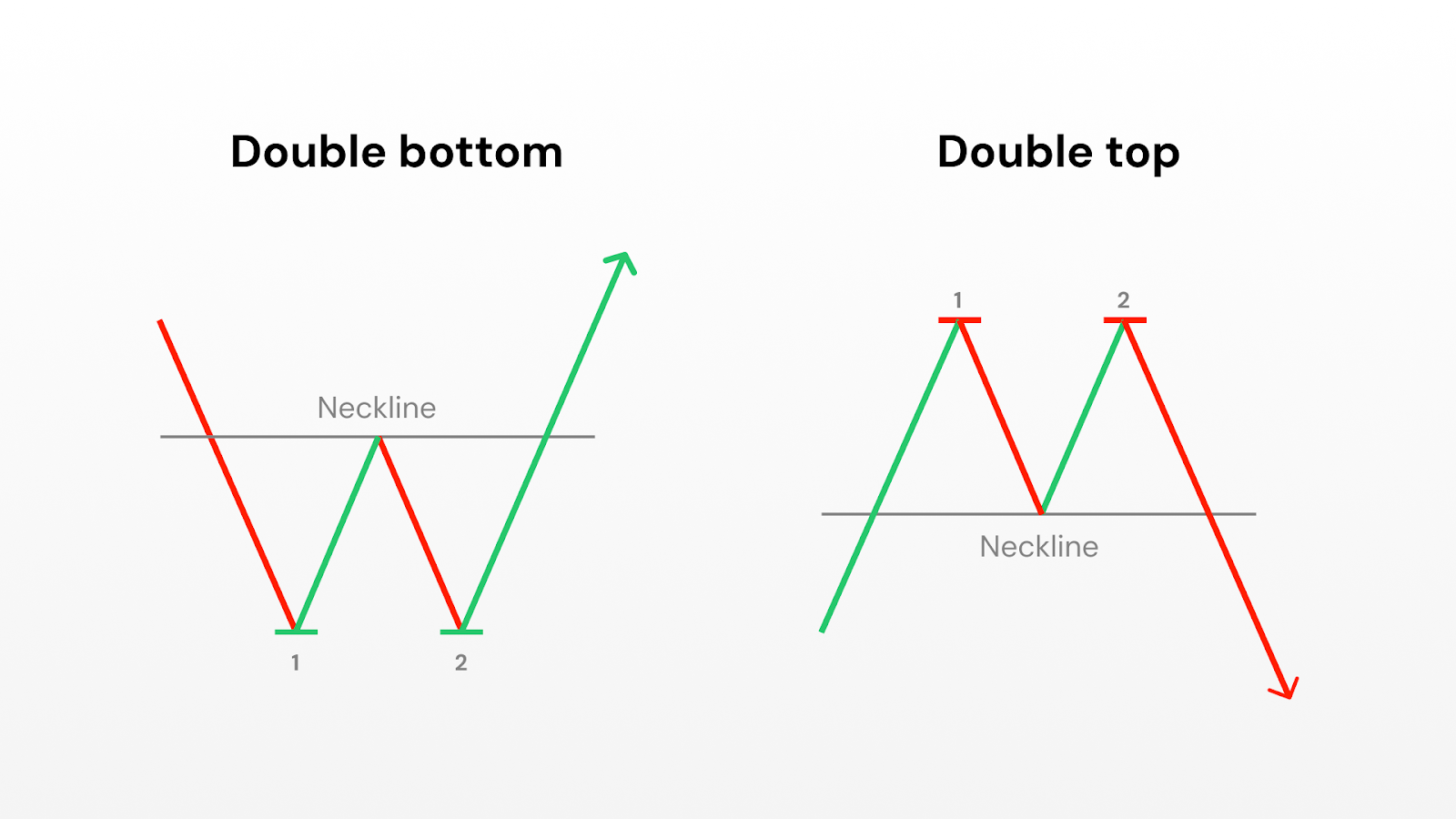

2. Double Bottom/Top

Double Bottoms (bullish) and Double Tops (bearish) are among the simplest and most recognisable reversal patterns in technical analysis.

They occur when the price tests the same level twice and fails to break through, creating what looks like a “W” (double bottom) or an “M” (double top) on the chart.

Analysts often interpret these formations as signals that a prevailing trend may be losing strength.

Structure of the pattern

- Double Bottom:

- The first trough forms after a decline, followed by a rebound.

- A second trough appears at or near the same price level as the first, showing that sellers were unable to push prices much lower.

- The interim peak between the two troughs creates a resistance line that observers often watch as a reference point.

- Double Top:

- The first peak forms after an advance, followed by a pullback.

- A second peak occurs at or near the same level as the first but fails to exceed it, showing reduced buying strength.

- The interim valley between the two peaks creates a support line that analysts watch for signs of confirmation.

Why it matters

Double tops and bottoms are considered significant because they capture a classic battle between buyers and sellers. The first test establishes an important price level, while the second test highlights the inability of the market to push through that level a second time. This repetition signals a potential turning point:

- In double bottoms, the failure to break support is often interpreted as a sign of strengthening demand.

- In double tops, the failure to break resistance is seen as evidence of weakening demand.

Variations

Broad or Narrow Spacing: The distance between the two peaks or troughs can vary. Wider spacing often indicates a more meaningful shift in sentiment.

Multiple Tests: Sometimes prices test the same support or resistance level more than twice before a trend change occurs, creating what some analysts call “triple tops” or “triple bottoms.”

Caveats

Like all technical formations, double tops and bottoms are not guarantees. False signals are common, especially in highly volatile markets where short-term noise can mimic the shape of a pattern without any true shift in momentum.

Analysts often combine this pattern with other tools, such as volume trends, broader market direction, or momentum indicators.

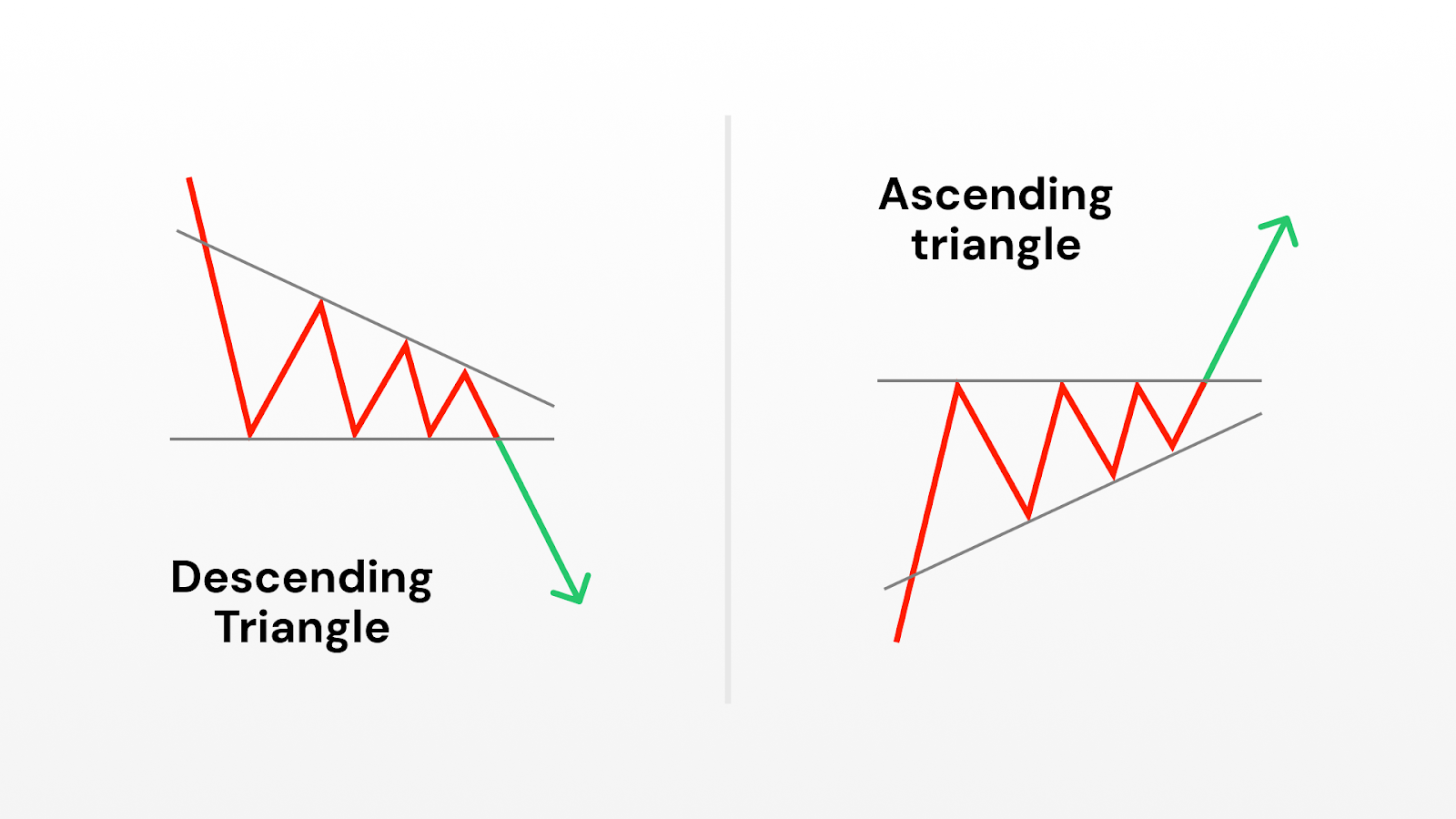

3. Ascending and Descending Triangles

Triangles are continuation patterns that appear when prices start moving in a narrower range. This usually signals a pause in the market before the existing trend continues. The two most common types are Ascending Triangles (often seen as bullish) and Descending Triangles (often seen as bearish).

Structure of the pattern

- Ascending Triangle: Price makes a series of higher lows while repeatedly testing the same horizontal resistance. This shows that buyers are becoming more aggressive, steadily bidding prices higher, while sellers defend a key level.

- Descending Triangle: Price makes a series of lower highs while testing a horizontal support. This suggests that sellers are increasingly dominant, though buyers continue to defend a price floor.

- The breakout level: The horizontal line of support (in descending) or resistance (in ascending) is the critical feature analysts watch, as it represents the point where supply or demand may finally give way.

Why it matters

Triangles reflect consolidation: a period where the market pauses, often as traders wait for new information or a decisive shift in sentiment.

- In ascending triangles, the sequence of higher lows highlights persistent demand, hinting at underlying bullish pressure.

- In descending triangles, lower highs point to mounting selling pressure, often seen as bearish.

Variations

Symmetrical Triangles: Unlike ascending or descending, both highs and lows converge toward a point. These are sometimes called “bilateral” patterns, as they can break in either direction.

Time to completion: Many studies suggest that triangle patterns typically resolve before prices reach the tip of the triangle; if not, the pattern may lose significance.

Caveats

While widely followed, triangles are not predictive in isolation. Breakouts can and do fail, particularly in choppy or news-driven markets. Analysts often seek confirmation through trading volume or other trend indicators before treating the pattern as meaningful.

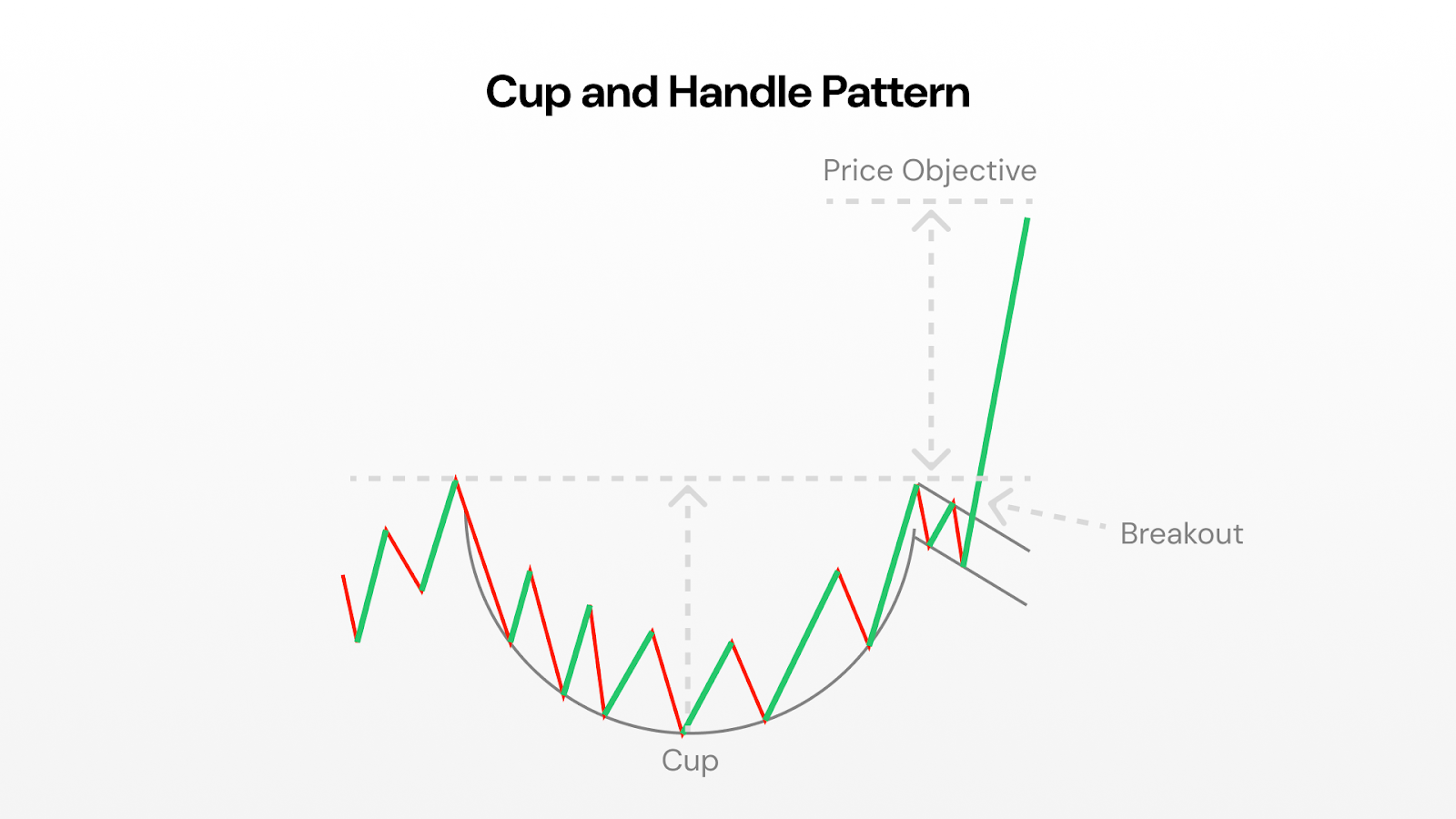

4. Cup and Handle

The Cup and Handle is a long-term bullish pattern named for its resemblance to a teacup. It is frequently studied in equity markets and is often associated with extended uptrends when it completes successfully.

Structure of the pattern

- The Cup: Prices decline gradually, bottom out, and then recover in a rounded, U-shaped curve. The depth of the cup reflects the extent of the pullback before sentiment recovers.

- The Handle: After the cup completes, prices typically consolidate sideways or drift slightly downward in a shorter, shallower formation. This pause is seen as a “shakeout” of weaker hands before a new advance.

- The Breakout Level: The top of the cup, where prices previously peaked before declining, becomes a reference level for confirmation.

Why it matters

The Cup and Handle is often interpreted as evidence of a market shaking off selling pressure and regaining strength. The extended base (the cup) suggests long-term accumulation, while the smaller handle shows short-term hesitation before renewed buying. This blend of consolidation and recovery is why the pattern is often associated with continuation of an uptrend.

Variations

Deep vs. shallow cups: Shallow cups are generally considered stronger, as they indicate lighter selling pressure. Very deep cups can signal weaker underlying demand.

No handle: Occasionally, prices break out directly after forming the cup without creating a handle. Some analysts treat these as valid, while others consider the handle an essential feature.

Caveats

Because cup and handle formations often take weeks or months to develop, they can be subjective. False signals are common if the “handle” drifts too low or if volume patterns don’t align with expectations. As with other patterns, context (i.e. broader market trends and sector strength) is critical.

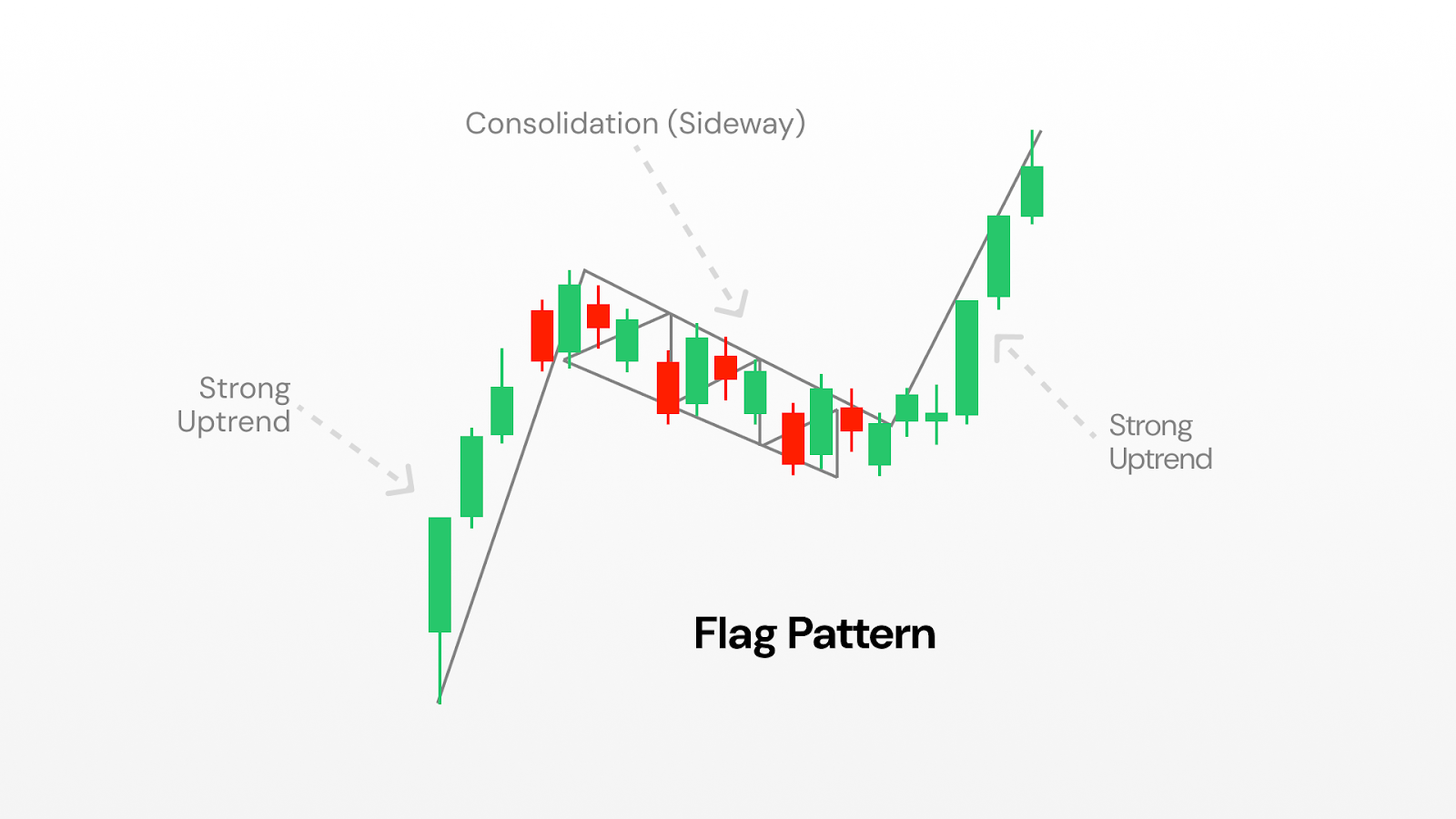

5. Flag Patterns

Flag patterns are short-term continuation formations that occur after sharp price movements, known as “flagpoles.” They are named for their resemblance to a flag on a pole: a rapid advance or decline, followed by a small rectangular consolidation sloping against the trend.

Structure of the pattern

- The Flagpole: A sudden, strong move in one direction, often accompanied by high trading volume.

- The Flag: A brief consolidation where prices move sideways or slightly against the prevailing trend, usually within parallel lines that slope modestly.

- Resolution: If the pattern holds, the prevailing trend resumes after the consolidation.

Why it matters

Flags capture the rhythm of momentum markets. The flagpole reflects urgency, often from institutional buying or selling, while the flag represents a pause where the market digests the move. This pause is considered healthy in a trend, as it can prevent overextension.

Variations

Bullish vs. Bearish Flags: Bullish flags slope downward after an upward flagpole, while bearish flags slope upward after a downward pole.

Pennants: A related pattern where consolidation takes the form of a small symmetrical triangle rather than a rectangle.

Caveats

Flags are short-term patterns, often lasting only a few sessions to a few weeks. Because they form quickly, they are prone to producing false signals, especially in volatile markets. Analysts stress the importance of volume dynamics and overall market context before giving weight to a flag formation.

Pattern categories: continuations vs reversals

Not all patterns tell the same story. Some hint that the market is just taking a breather before carrying on, while others warn that momentum is running out and a reversal could be around the corner.

Continuation patterns - think triangles, flags, and pennants - pop up roughly 70% of the time when a market is trending. They usually mean the pause is temporary and the trend is about to resume.

Reversal patterns - like head and shoulders or double tops and bottoms - are less common but pack more punch. When they appear, they often mark a major turning point.

Then there are bilateral patterns such as symmetrical triangles. These are trickier because they can break either way. They tend to shine in volatile, uncertain markets where direction isn’t obvious.

The secret is context. Continuation patterns work best when the trend is already strong, while reversal patterns are most powerful after a long, extended move. Match the pattern to the bigger picture, and you’ll read the market with far more accuracy.

How traders often approach chart patterns

Spotting a pattern is just the start. To trade them successfully, you need a clear set of rules for when to act, how much to risk, and when to walk away. These rules will be specific to your personal needs, and should be discussed with a financial advisor if you’re unsure.

Confirm your entry. Analysts generally stress the importance of waiting for confirmation (like a breakout or changes in volume) before treating a pattern as complete. Set alerts at key levels so you don’t waste hours glued to charts.

Protect yourself with stop-losses. Most traders place their stop just beyond the pattern’s critical level. For breakouts, that means just below the breakout point; for reversals, just beyond the highest high or lowest low.

Set realistic profit targets. The measured move gives you a solid first target. Many traders take partial profits there (say half the position) and let the rest ride with a trailing stop, locking in gains while leaving room for more upside.

Size your positions wisely. Risk management is often discussed in terms of position sizing. For example, some traders limit risk on a single trade to just a small percentage (e.g. 2-3%) of their account, so that several losses don’t cause major damage.

Respect the clock. Patterns don’t work forever. If the move hasn’t unfolded within the expected window (usually 2-3 weeks on daily charts), it’s often best to exit, even if your stop hasn’t been triggered.

Do chart patterns really work?

Chart patterns aren’t crystal balls, but they can give you a genuine statistical edge when used properly. Studies show that well-formed patterns on highly liquid stocks deliver success rates between 60-85%, far better than pure chance.

That said, no pattern is bulletproof. Around a quarter to nearly half of them will fail. This is why risk management and position sizing aren’t optional; they’re your safety net. You need to be able to take several hits without blowing up your account.

Patterns also don’t exist in a vacuum. They’re much more reliable when they line up with the bigger picture - things like the overall market trend, sector strength, or even key fundamentals. A bullish setup in a weak sector or during a bear market has the odds stacked against it.

And remember: context is everything. Chart patterns work best in “normal” market conditions. In periods of extreme volatility, major news events, or panic-driven trading, emotions often override technical signals.

Level up: advanced pattern techniques

Once you’re comfortable spotting the basics, a few advanced techniques can take your timing to the next level.

Watch the volume. Real breakouts usually come with a surge, at least 50% above recent average volume. Volume should also “fit the story”: tapering off during consolidation, then expanding sharply when the breakout hits.

Use multi-timeframe confluence. When the same pattern shows up on both daily and weekly charts, or when shorter-term setups align with longer-term trends, your odds of success might climb.

Validate with support and resistance. The strongest patterns often form at levels the market has respected before. Multiple past tests of support or resistance add weight to the signal and help filter out false moves.

And always remember: chart patterns aren’t fortune tellers. They’re tools to tilt the odds in your favour, not guarantees of profit. Combine them with sound risk management, diversification, and realistic expectations. With practice and discipline, pattern recognition can become a powerful part of your trading toolkit.

You know that feeling when the Fed announces a rate cut and suddenly everyone's talking about how "bullish" it is for crypto? Many people just nod along, but honestly have no clue why cheaper borrowing costs would make Bitcoin go up. Let's dig deep into this topic and share what the data shows – whether you're totally new to this stuff or already trading like a pro.

Let's Start Simple: What Are Interest Rates Anyway?

Okay, let's assume you're not an economics major here. Interest rates are basically the price of money. When you borrow money, you pay interest. When you save money, you (hopefully) earn interest. The big kahuna is the rate set by central banks like the Federal Reserve – this is the rate that affects pretty much everything else in the economy.

Here's the deal: when rates are high, borrowing money sucks because it's expensive. People spend less, businesses hold off on big investments, and suddenly that savings account looks pretty attractive. When rates are low, it's the opposite – borrowing is cheap, so people and businesses start spending and investing more aggressively.

A rate cut is just the central bank saying "Hey, we want people to spend more money and take more risks." And guess what falls into that "risky investment" bucket? Yep, crypto.

The Crypto Connection (Or: Why Bitcoin Doesn't Care About Your Savings Account)

Here's something that becomes clear when you think about it: Bitcoin doesn't pay you anything to hold it. Neither does Ethereum, Solana, or pretty much any other crypto sitting in your wallet. They're not like bonds or savings accounts that give you a steady income.

When interest rates are near zero, this isn't a big deal. But imagine government bonds are paying 5% with zero risk. Suddenly, holding volatile crypto that might crash 50% overnight doesn't look so smart, right?

So the math is pretty straightforward:

- High rates = "Why gamble on crypto when you can get guaranteed returns?"

- Low rates = "These bonds pay nothing, maybe Bitcoin looks interesting..."

This is probably the biggest reason why rate cuts get crypto people excited. When safe investments pay peanuts, risky assets start looking a lot more appealing.

How Rate Cuts Actually Push Money Into Crypto

Alright, let's get into the nitty-gritty of how this actually works. It's not just about psychology – there are real mechanisms at play here. Beyond simple psychology, several concrete mechanisms drive capital toward cryptocurrency markets when central banks ease monetary policy.

When central banks cut rates, they typically inject additional liquidity into the financial system. This expanded money supply creates excess capital that seeks higher returns, with crypto markets often benefiting from these flows.

Lower interest rates fundamentally alter investment opportunity costs. This is finance speak for "what am I giving up?" If I can only earn 0.5% in a savings account, the opportunity cost of holding Bitcoin (which pays nothing) is pretty low. But if savings accounts pay 5%, then holding Bitcoin means I'm giving up a lot of guaranteed income.

Here's something interesting: when the U.S. cuts rates, it often makes the dollar less attractive to international investors. A weaker dollar historically has been good for Bitcoin, especially since many people see it as "digital gold", a way to protect against currency debasement.

Accommodative monetary policy encourages risk-taking across markets. Traders can borrow more to make bigger bets, capital flows more easily toward crypto startups, and regular folks start FOMOing into altcoins. It's like the whole market gets a shot of adrenaline.

The COVID Case Study (AKA When Everything Went Bananas)

Want to see this in action? Look at what happened during COVID. In March 2020, everything crashed: stocks, crypto, you name it. Central banks freaked out and slashed rates to basically zero while printing money like it was going out of style.

At first, Bitcoin crashed along with everything else (down to around $3,200). But once all that stimulus money started flowing through the system, crypto went absolutely bonkers. Bitcoin went from that March low to nearly $70,000 by late 2021. That's more than a 20x return in less than two years!

Now, rate cuts alone didn't cause that rally, there was a lot going on, including institutional adoption, the whole "inflation hedge" narrative, and pure FOMO. But the massive liquidity injection definitely set the stage.

Fast forward to now, and we're starting to see rate cuts again. The Fed just cut rates for the first time in years, and everyone's wondering if we're about to see another crypto supercycle. Spoiler alert: it's complicated.

Why It's Not Always That Simple (The Plot Thickens)

The relationship between monetary policy and cryptocurrency prices isn't as straightforward as it seems. Rate cuts don't guarantee crypto rallies, and several factors can throw a wrench in this supposedly reliable connection.

Take timing, for instance. Monetary policy doesn't work like flipping a switch. The Fed cuts rates today, but that doesn't mean money suddenly floods into Bitcoin tomorrow. These effects take months to work through the financial system, creating frustrating delays between policy changes and actual market movements.

Then there's the whole expectations game. If everyone and their mother already expects a rate cut, the actual announcement might barely move markets. It's already baked into prices, as traders say. But when cuts come by surprise? That's when things get interesting, and volatile.

Inflation makes everything messier. Central banks get nervous about cutting rates when prices are already rising. And if they do cut while inflation is running hot, investors start worrying about the economy overheating. This is why smart money watches real interest rates, the actual rate minus inflation, which sometimes tells a completely different story than the headline numbers.

The Advanced Stuff (For Market Nerds)

Okay, this is where things get really interesting. If you're already trading and want to understand what moves the big money, here are the deeper dynamics that separate amateur hour from professional-grade analysis.

Real rates matter more than anything else. When rates sit at 2% but inflation runs at 4%, cash holders are losing 2% annually in purchasing power. That’s the kind of environment where Bitcoin’s ‘hard money’ narrative tends to resonate, and where institutional investors have historically shown greater interest.

The yield curve tells stories that headline rates can't. This relationship between short and long-term rates reveals market psychology. When short rates exceed long rates, the dreaded inverted curve, recession fears dominate. Rate cuts during these periods often fall flat because fear trumps greed, and nobody wants to touch risky assets regardless of how cheap money becomes.

But here's what separates the pros from everyone else: they know it's never just about rates. Credit spreads show how much extra yield risky borrowers pay compared to safe government debt. Dollar funding conditions reveal whether international markets can actually access all that cheap liquidity. And bank lending standards determine if that Fed money ever makes it past Wall Street desks into the real economy. The Fed can slash rates to zero, but if banks won't lend and credit markets freeze up, crypto won't see a dime of that stimulus.

The Dark Side (Because Nothing's Ever Perfect)

Let's be honest here, painting rate cuts as some magic crypto catalyst without acknowledging the risks would be doing everyone a disservice. Easy money creates bubbles, and when those bubbles burst, crypto typically gets damaged first and hardest.

The inflation trap is real and brutal. When rate cuts work too well and prices start spiraling upward, central banks panic and slam the brakes with aggressive rate hikes. That policy whiplash absolutely crushes speculative assets, with crypto leading the carnage every single time.

Then there's the liquidity trap – monetary policy's most frustrating failure mode. Sometimes rate cuts simply don't work. Banks refuse to lend, consumers won't borrow, and all that cheap money sits trapped in the financial system instead of flowing into markets. Japan learned this lesson painfully over decades of ineffective stimulus.

Here's an uncomfortable truth: despite all the "digital gold" rhetoric, crypto still dances to the stock market's tune most days. When rate cuts happen during genuine recessions and equities crater, Bitcoin rarely stays immune. The correlation breaks down only during very specific market conditions, not during broad-based selloffs.

Finally, there's the regulatory sword hanging over everything. Crypto rallies have this annoying habit of attracting government attention, especially when retail investors pile in and inevitably lose their shirts. That regulatory risk never disappears, it just sits there waiting for the next bubble to pop.

Strategic Approaches at Different Levels

The beauty of understanding rate cut dynamics is that you can apply this knowledge regardless of where you are in your trading journey. Here's how to think about it based on your experience level.

Starting out? Keep things dead simple. Track Fed meetings, watch inflation numbers, and brace for wild swings around major announcements. Don't get lost in the weeds trying to predict every twist and turn. Just remember that cheaper money generally makes crypto more attractive, even if the timing stays unpredictable.

Getting more serious about this game? Time to expand the toolkit. Real interest rates become your new best friend, along with the dollar index (DXY) and whatever the Fed chair actually says about future moves. Pay close attention to how crypto moves when stocks hiccup, that correlation hasn't disappeared just because Bitcoin hit some arbitrary price target.

Going full macro nerd? Now we're talking. Layer in yield curve analysis, credit spreads, and options flow data. The goal shifts from reacting to news toward positioning ahead of surprises. This means using derivatives to hedge positions and managing risk like the professionals do. At this level, it's less about being right and more about surviving when you're wrong.

The Bottom Line

So why are interest rate cuts good for crypto? Because they make safe assets less attractive, flood the system with liquidity, weaken fiat currencies, and make everyone a little more willing to take risks. For Bitcoin, that often strengthens its narrative as a store of value. For altcoins, it can fuel speculative rallies and bring more funding to interesting projects.

But here's the key insight: context is everything. Rate cuts during an economic expansion can be rocket fuel for crypto. Rate cuts during a deep recession might just keep things from getting worse. The difference comes down to liquidity conditions, market sentiment, and whether people actually believe the central bank's strategy will work.

For newcomers, the headline is simple enough: lower rates usually help crypto. For everyone else, remember that it's not just about the rate cut itself, it's about how that cut fits into the bigger macroeconomic puzzle.

The most successful traders don't just look at rate cuts in isolation. They consider the whole picture: inflation, employment, credit conditions, dollar strength, and market positioning. Because at the end of the day, markets are about human psychology as much as they are about monetary policy.

And honestly? That's what makes this whole game so fascinating, and frustrating at the same time.

Paw-sitively Profitable

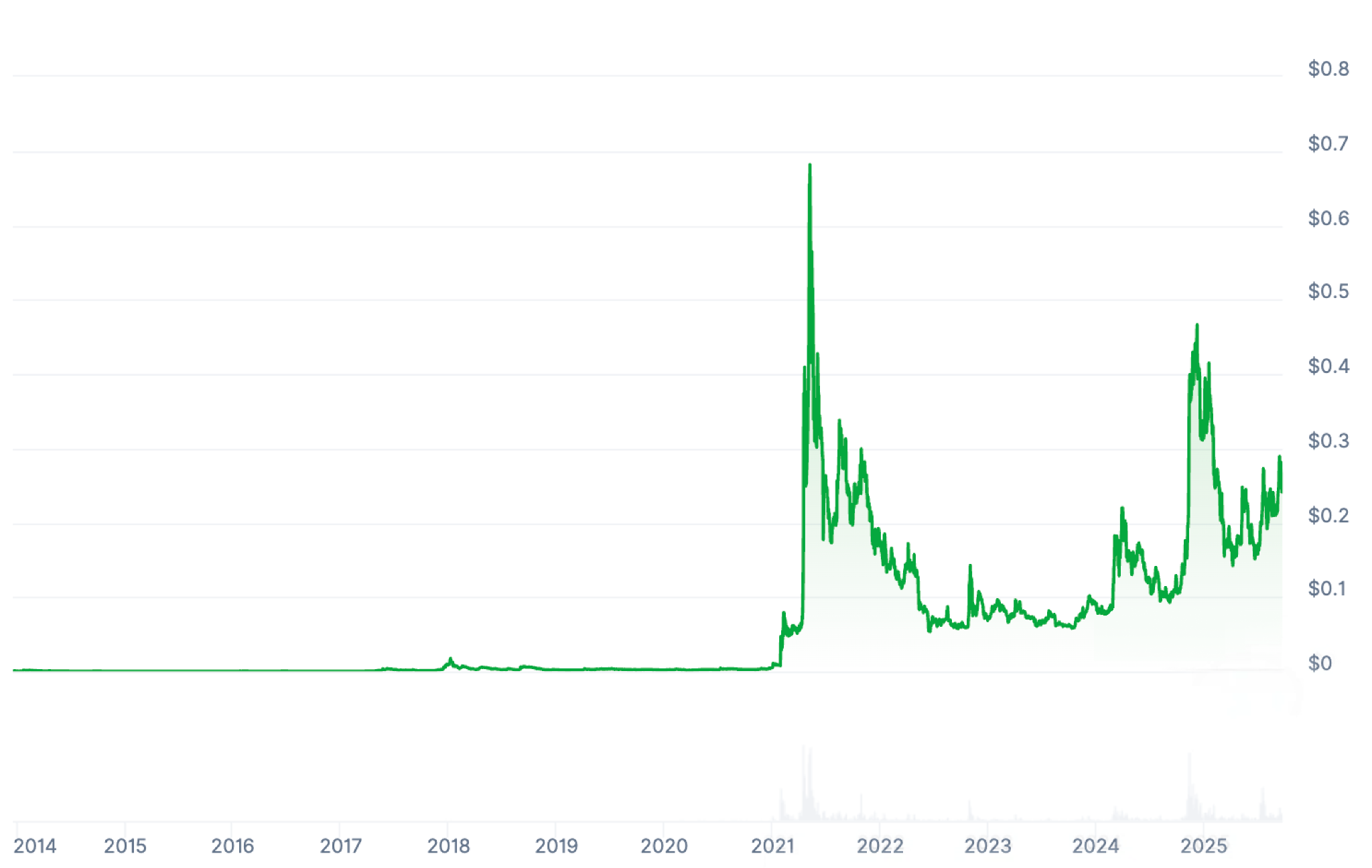

Back in 2013, Dogecoin (DOGE) launched as a tongue-in-cheek knock-off version of Bitcoin (BTC). It was inspired by Kabosu, an incredibly cute Shiba Inu dog that sadly passed away last year, though not without leaving an Instagram account full of posts to remember her by.

The picture that started the meme. Fundamentals… what? Look at this cute doggy. Source.

Fast forward to 2020, and Shiba Inu (SHIB) popped up as a parody of the parody. Both were brushed off as silly, short-lived plays… until they weren’t. In February 2021, a certain billionaire you might have heard of, called Elon Musk, drew attention to Dogecoin through a series of tweets. One could safely pinpoint that tweet spree as the origin of the memecoin bonanza.

Now, let’s fast forward to September 2025. A $100 bet on Dogecoin at $0.0002 would be worth about $124,850 today. The same stake in Shiba Inu at launch? Nearly $25.5 million. Meme magic at its wildest.

For a time, Shiba Inu looked like the stronger contender thanks to its growing ecosystem. But 2025 has flipped the script: SHIB is up a good 24%, while DOGE barked its way to a massive 173% gain. Let’s dig into why.

Two Breeds of Dogs

Dogecoin runs on Litecoin’s proof-of-work code, meaning it still relies on miners. It’s inflationary, has no max cap, and uses Scrypt for faster, cheaper payments than Bitcoin. That’s given it a reputation as the “fun” payments coin.

And of course, the Musk effect can’t be ignored. Elon has championed DOGE in tweets, Tesla accepts it for select merch, and even the government’s Department of Government Efficiency was cheekily nicknamed DOGE. Very few coins, memes or not, can summon mainstream buzz the way Dogecoin can.

Shiba Inu, on the other hand, was built on Ethereum. It ditched mining for staking, is deflationary thanks to aggressive token burns (over 40% gone already), and plugs into Ethereum’s smart contract universe. That makes it more versatile than DOGE on paper.

In recent years, Shiba Inu rolled out Shibarium, a Layer-2 chain for speed and lower costs, and ShibaDEX, a cross-chain DEX. The project isn’t just riding a meme, it’s trying to build an ecosystem too.

The Dog Race Is on

For starters, both coins could ride a friendlier U.S. regulatory environment as crypto advocates step into power.

For Dogecoin, near-term ups include:

- Possible integration into Musk’s 𝕏 platform as a payments option.

- Wider retailer adoption.

- Network upgrades for scalability.

- And, of course, the constant wildcard of Musk’s next DOGE tweet.

Rumors of a Dogecoin ETF keep swirling too, which could inject serious momentum.

Shiba Inu’s playbook looks different:

- Ongoing Shibarium growth and new developer activity.

- Token burns that keep tightening supply.

- A developing metaverse with virtual land sales.

However, without a Musk-like hype machine, SHIB’s catalysts may not hit as hard.

Elon Musk’s first Dogecoin tweet, which started it all. Source.

So… Which Meme Coin Will Bark the Loudest?

Both coins are speculative, fueled as much by community buzz as fundamentals. Shiba Inu has a deeper ecosystem and long-term ambition. Dogecoin has clearer short-term sparks and, crucially, Elon Musk’s megaphone.

If forced to pick for the next 12 months, Dogecoin seems to have the edge. It may be the older meme, but for now it still has more bite.

What Are Fiat On-Ramps and Off-Ramps?

For many users, one of the biggest challenges in the crypto space is figuring out how to move between traditional money and digital currencies safely and easily. That’s where fiat on-ramps and off-ramps come in. These essential gateways allow users to convert their local currency (like US dollars, GB pounds, or euros) into crypto and back again, helping bridge two financial worlds.

In this guide, we’ll break down what each type of ramp means, how they work, and why they’re critical for expanding real-world crypto adoption.

What Is a Fiat On-Ramp?

A fiat on-ramp is a service that lets users buy cryptocurrencies using traditional fiat currencies such as USD, EUR, or GBP. In other words, it’s the entry point into the world of crypto. Exchanges, brokerage platforms, and payment services act as intermediaries, processing financial transactions and converting fiat money into assets like Bitcoin, Ethereum, or stablecoins.

Common examples include centralized exchanges or fintech apps that integrate blockchain functionality. On-ramps are regulated financial services that typically require Know Your Customer (KYC) verification to comply with laws on anti-money laundering and consumer protection.

When choosing a fiat on-ramp, users should evaluate fees, supported currencies, and security standards to ensure a smooth and safe experience.

The Advantages and Disadvantages of Fiat On-Ramps

Fiat on-ramps make entering the crypto market much easier, particularly for beginners. They simplify the process of buying digital assets without requiring technical expertise.

They also open the door to a diverse set of cryptocurrencies, letting users explore different projects and blockchain networks. Some on-ramps even offer instant payment methods through debit or credit cards, wire transfers, or mobile apps like Google Pay, enabling fast transactions and greater convenience.

From a business perspective, on-ramps support financial inclusion by connecting traditional banking systems to blockchain-based platforms, driving mainstream adoption and innovation across the fintech industry.

While fiat on-ramps are convenient, they also come with a few challenges. Users must comply with verification and regulatory requirements, which can take time. Another potential issue is exposure to fraudulent or unlicensed platforms, which can compromise data or funds. To minimize these risks, users should choose on-ramps that offer transparent pricing and operate in full compliance with financial regulations, like Tap.

In addition, on-ramps might charge higher transaction or processing fees, especially for card purchases or smaller amounts. To keep fees low and help users get the best crypto deals without platform hopping, Tap uses a top-of-the-line smart router.

What Is a Fiat Off-Ramp?

A fiat off-ramp performs the opposite function: it lets users sell cryptocurrency and receive fiat money in their bank account. Off-ramps provide liquidity and help people turn crypto assets into spendable cash.

Off-ramps operate through centralized exchanges, peer-to-peer platforms, or crypto debit cards that automatically convert digital assets into fiat currency at the point of sale. This process makes cryptocurrencies more practical for daily use, enabling real-world purchases, payments, and withdrawals.

How Fiat Off-Ramps Work

The off-ramping process generally involves a few simple steps:

- Transfer crypto from your wallet to an exchange or service that supports fiat withdrawals.

- Sell or convert your chosen cryptocurrency into your preferred fiat currency.

- Withdraw funds to your linked bank account or payment method (for example, a debit card).

Processing times vary by provider and banking network, usually ranging from a few minutes to a few business days. Many platforms require identity verification to meet anti-fraud and regulatory standards. Key factors influencing the experience include withdrawal limits, transaction fees, and the fiat currencies supported.

The Advantages and Disadvantages of Fiat Off-Ramps

The main advantage of off-ramping is, of course, liquidity: the ability to convert digital currencies into usable cash when needed. Whether users want to pay bills, make everyday purchases, or take profits from crypto investments, off-ramping makes that possible.

It also provides flexibility in managing risk. When markets are volatile, selling crypto for fiat can help stabilize personal finances. Additionally, off-ramping plays a role in promoting transparency and regulatory compliance by ensuring that transactions are traceable and aligned with local laws.

Off-ramping faces similar challenges to on-ramping, including variable fees, conversion delays, and regulatory hurdles. Some banks restrict transactions related to cryptocurrency exchanges, causing delays or rejections. Others may require additional verification steps for large transfers.

Users should check whether a platform offers low-cost conversions, and has clear customer support channels. As always, verifying a provider’s regulatory compliance and reputation helps avoid potential issues.

The Connection Between Fiat On-Ramps and Off-Ramps

Together, fiat on-ramps and off-ramps form the foundation of the crypto-fiat ecosystem. They create a two-way bridge that connects digital currencies to the traditional financial system, improving liquidity, usability, and accessibility.

Seamless on-ramping attracts new users by making it easy to enter the market, while efficient off-ramping gives confidence that assets can be converted back to fiat when needed. This balance is what enables broader adoption of cryptocurrencies across businesses, consumers, and financial services.

Platforms like Tap exemplify this connection by offering both on-ramp and off-ramp capabilities through secure infrastructure, compliance with financial regulations, and support for multiple digital assets. Users can buy, sell, and transfer between crypto and fiat currencies using a single account, without needing multiple intermediaries.

Security and Best Practices

Security should always come first when using any financial platform. Here are a few best practices:

- Verify regulation. Check whether the platform follows financial authority standards and offers transparent reporting.

- Use two-factor authentication. This adds an extra layer of protection to your account.

- Confirm wallet and withdrawal addresses. Mistyped addresses are one of the most common causes of lost funds.

- Start with small transactions. Test the service before transferring large amounts.

- Keep records. Store transaction data securely for personal reference or tax reporting.

Following these measures helps maintain data integrity and protects against common cyber risks in digital finance.

Common Challenges and How to Overcome Them

Here are a few recurring challenges users may face:

- Banking restrictions on crypto-related transactions.

- High conversion fees that can reduce profit margins.

- Processing delays during peak trading hours.

- Strict verification procedures that slow onboarding.

The best way to overcome these obstacles is to work with reputable, user-friendly well-established providers that maintain transparent communication and have strong partnerships with trusted financial institutions, such as Tap.

In Conclusion

Now that we've explored what a fiat on-ramp and off-ramp are, it becomes clear how essential it is for cryptocurrency users and investors to understand these processes as they provide liquidity, investment opportunities, and the ability to realize profits (in fiat currency).

Looking ahead, the future of fiat on-ramps and off-ramps appears promising. As the cryptocurrency landscape continues to evolve, we can anticipate exciting advancements in these gateways, making crypto assets more accessible and further driving their adoption into mainstream use.

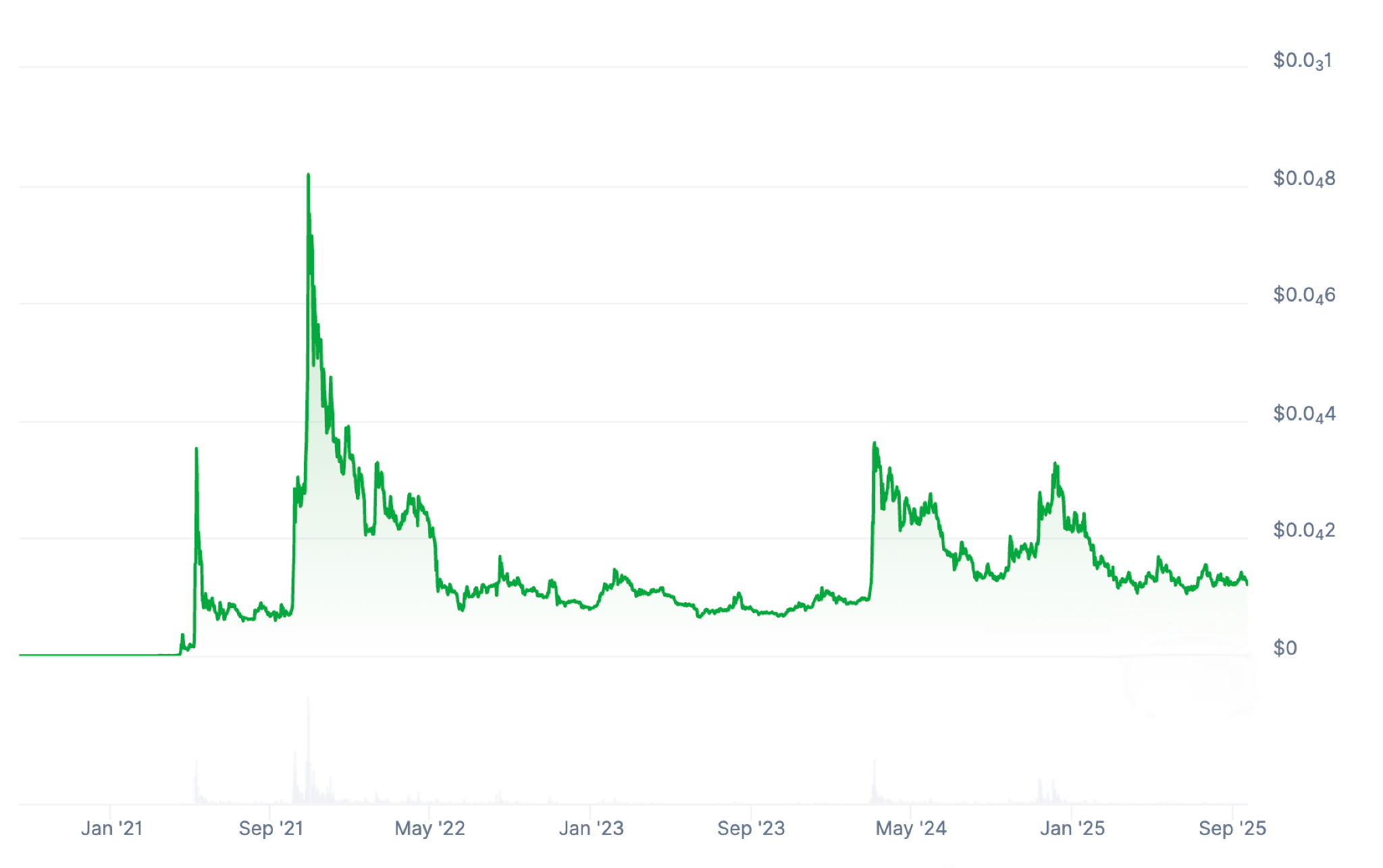

Axie Infinity är ett blockkedjebaserat strids- och samlarsystem där spelare kan föda upp, strida med och handla digitala varelser kallade Axies. Inspirerat av Pokémon och Tamagotchi kombinerar Axie Infinity spelvärlden med blockkedjeteknik och de populära NFT:erna (icke-fungibla tokens).

I takt med att Tap lägger till nya kryptovalutor, har AXS tagits upp på grund av sin höga handelsvolym, engagerade community och starka spelupplevelse. Genom att kombinera avancerad teknik med spelmekanik står Axie Infinity i frontlinjen för nästa generations spelplattformar. Här nedan får du veta mer om denna decentraliserade innovation.

Vad är Axie Infinity (AXS)?

Axie Infinity bygger på Ethereum-blockkedjan och använder NFT:er för att representera unika spelkaraktärer, förmågor, markplättar och andra tillgångar i spelet. Spelare kan tjäna både Axie Infinity Shards (AXS) och Smooth Love Potions (SLP) under spelets gång.

Varje Axie har unika attribut, med över 500 möjliga kroppsdelar fördelade över olika klasser som exempelvis beast, bird, plant och aquatic – med allt från vanliga till legendariska sällsynthetsnivåer. Det gör Axies till eftertraktade tillgångar i spelet och de bygger på Ethereum-standarden för NFT:er.

Vem skapade Axie Infinity?

Axie Infinity grundades 2018 av Trung Nguyen och Aleksander Larsen, tillsammans med Viet Anh Ho. De arbetar genom spelstudion Sky Mavis i Vietnam, ett teknikfokuserat företag med stark inriktning på blockkedjespel.

Projektet har lockat investerare som Blocktower Capital och Mark Cuban, och lyckades i sin sista finansieringsrunda genom Binance Launchpad samla in nästan 3 miljoner USD.

Hur fungerar Axie Infinity?

I spelet strider spelare med sina Axies – NFT:er som är unika och som har olika attribut som påverkar deras förmåga i strid. Dessa attribut inkluderar hälsa, moral, skicklighet och snabbhet.

Axies delas in i olika klasser som Aquatic, Beast, Bird, Plant och Reptile samt specialklasser som Dawn, Dusk och Mech. Varje Axie har sex kroppsdelar (rygg, öron, ögon, horn, mun och svans), vilket påverkar deras egenskaper i spelet.

Axies kan också födas upp, där varje uppfödning kräver både AXS och SLP. En Axie kan födas upp maximalt sju gånger, med ökande kostnad i SLP för varje gång.

En annan aspekt av spelet är mark: spelare kan köpa och sälja virtuella hem till sina Axies – dessa kallas Lunacias. Det finns också en marknadsplats inom spelet där spelare kan köpa och sälja Axies och tillgångar.

Vad är Axie Infinity Shards (AXS)?

AXS är spelets styrningstoken och bygger på Ethereum-standarden ERC-721. Dessa tokens används inte bara i spelet, utan även för att ge innehavare möjlighet att påverka spelets framtid genom röstning. AXS kan också handlas på externa börser.

SLP används istället som en ren spelvaluta för att föda upp Axies. Både AXS och SLP har blivit populära även utanför spelvärlden.

Kan man tjäna något genom att spela Axie Infinity?

Axie Infinity är ett av de mest framstående spelen i den växande "play-to-earn"-ekonomin. Här är tre sätt som spelare kan tjäna belöningar på:

Sälja SLP

Genom att delta i strider (Arena Mode), spela uppdrag (Adventure Mode) eller slutföra dagliga uppgifter kan spelare tjäna SLP. Dessa kan sedan säljas på externa marknadsplatser.

Föda upp sällsynta Axies

Genom att föda upp unika kombinationer kan spelare skapa sällsynta Axies som kan säljas vidare på spelets marknadsplats. Vissa Axies har sålts för hundratusentals kronor.

AXS-staking

I framtiden kommer det att vara möjligt att "stakea" AXS – det vill säga låsa sina tokens i smarta kontrakt – för att få belöningar över tid.

TAP'S NEWS AND UPDATES

Redo att ta första steget?

Gå med i nästa generations smarta investerare och pengaanvändare. Lås upp nya möjligheter och börja din resa mot ekonomisk frihet redan idag.

Kom igång