More than a million Bitcoin have vanished because owners didn’t plan ahead. Without a crypto inheritance plan, your family could lose access to your assets forever. Here’s how to safeguard them.

Keep reading

As digital assets become a core part of personal wealth, one uncomfortable question lingers: what will happen to your crypto when you’re gone? Unlike traditional assets that can be managed through banks or brokers, cryptocurrencies are bound entirely to whoever holds their private keys. Lose the keys, and the funds are gone. Permanently.

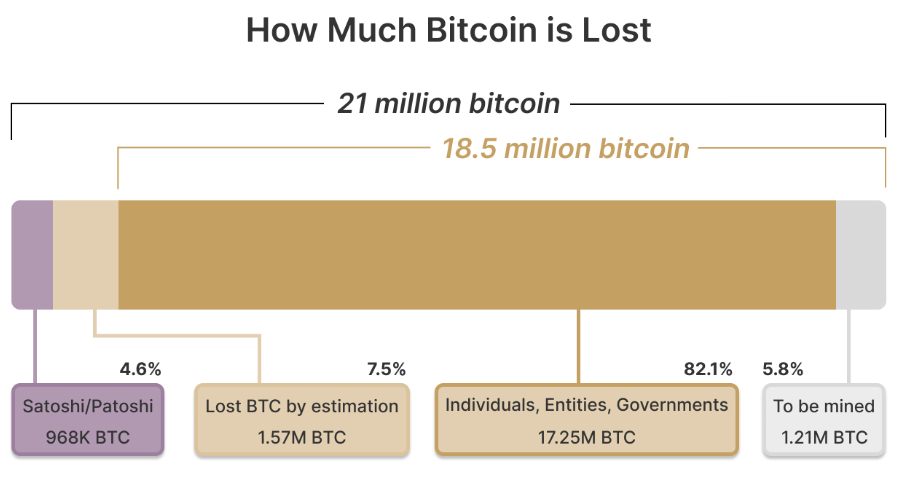

Each year, millions of dollars in Bitcoin, Ether, and other tokens vanish into the digital void when holders pass away without sharing access. It is estimated that around 1.5 million BTC (roughly 7.5% of total supply) may already be lost forever. With digital wealth now part of countless estates, preparing for the inevitable is no longer optional; it’s the responsible thing to do.

Why Planning for Crypto Inheritance Matters

In traditional finance, wealth transfer is handled through wills, trusts, and custodians. But crypto flips that model: you are the bank. Your heirs can’t simply request a password reset or call customer service. Without private keys, wallets, or access instructions, those assets are unrecoverable for all effects and purposes.

A crypto inheritance plan ensures that your digital assets, from Bitcoin and altcoins to NFTs and DeFi holdings, remain both secure and accessible to the people you choose. It bridges two crucial needs: protecting your funds today and ensuring your legacy tomorrow.

Beyond personal security, inheritance planning also reduces emotional and financial stress for your loved ones. By documenting how and where assets can be accessed, you prevent confusion and potential legal disputes.

Building the Foundation of a Crypto Inheritance Plan

Start with Legal Clarity

Consult an attorney familiar with digital assets. A properly structured will or trust should identify your crypto holdings, list beneficiaries, and outline how they can access those funds. Many jurisdictions still lack explicit laws for digital assets, so expert guidance helps ensure compliance and enforceability.

Secure Your Keys… But Don’t Overshare

The biggest challenge in crypto inheritance is private key management. If you die with your keys, your crypto dies with you. However, leaving keys in plain text within a will or document is just as risky. Instead, consider approaches like:

- Multisignature wallets, which require multiple approvals to move funds.

- Shamir’s Secret Sharing, which means splitting your seed phrase into parts distributed among trusted people.

- Encrypted backups or sealed letters stored in secure, offline locations.

Document recovery procedures in plain language so your heirs can follow them even without technical knowledge.

Choose the Right Executor

A traditional executor may not understand how to navigate crypto. You can appoint a tech-literate executor or designate a digital asset custodian to handle that portion of your estate. This ensures smooth execution and reduces the risk of errors or loss.

In a market driven by innovation and constant change, a well-structured inheritance plan offers something rare in crypto, certainty.

New Tools for a Digital Age

The rise of blockchain-based “death protocols” and smart contract automation adds a new layer of possibilities. Some platforms allow transfers to trigger automatically after certain conditions are met (for example, a verifiable death certificate or extended inactivity).

Ethereum and similar chains already support programmable inheritance systems, but these should complement, not replace, legal documents. Technology can help enforce your intentions, but law remains the foundation of inheritance.

Some investors even use “dead man’s switches”, automated systems that transfer funds if the owner doesn’t log in for a set period. While clever, it might be best to pair them with legal documents to prevent accidental activations.

Protecting Privacy While Planning Ahead

While planning for the future, it’s crucial to maintain security in the present. Avoid including wallet addresses, private keys, or passwords in public wills, which become part of the legal record. Instead, store such details in encrypted files or sealed envelopes accessible only to specific individuals.

Tools like decentralized identifiers (DIDs) and verifiable credentials can also help manage long-term identity and access rights. These systems allow you to define who can access what, and when, without intermediaries.

Custodial vs. Non-Custodial: Finding the Balance

When structuring inheritance, knowing whether your assets are held in custodial or non-custodial wallets makes all the difference.

Custodial services (like major exchanges) manage private keys on your behalf, which simplifies recovery if your heirs can provide proper documentation. However, it introduces third-party risk. Accounts can be frozen, hacked, or shut down.

Non-custodial wallets, on the other hand, offer maximum control and privacy but demand greater responsibility. If your heirs lose the seed phrase, there’s no backup plan. There’s also the possibility of taking a hybrid approach: keeping long-term holdings in non-custodial storage for security, while using reputable custodians for smaller, more accessible amounts.

Keep It Up to Date

A crypto inheritance plan is not a “set it and forget it” document. Prices change, portfolios evolve, and wallet technologies become obsolete very often. It may be wise to revisit your plan regularly, especially after major life events such as marriage, divorce, or the birth of a child.

It’s also worth keeping track of regulatory updates in your jurisdiction. Laws surrounding digital assets and inheritance are rapidly evolving, and what’s compliant today may not be tomorrow.

Common Inheritance Pitfalls

Even the best intentions can go wrong. Here are the most frequent mistakes to avoid:

- Including seed phrases directly in your will. As we mentioned before, this makes them public and vulnerable.

- Neglecting to educate heirs. Without guidance, even secure plans can fail.

- Relying solely on exchanges. Centralized platforms can fail or freeze funds.

Planning isn’t just about distributing wealth; it’s about ensuring continuity. A clear inheritance strategy preserves your crypto’s value and prevents it from becoming part of the estimated $100 billion in lost digital assets worldwide.

Protecting More Than Just Coins

Preparing a crypto inheritance plan isn’t merely about money; it’s about legacy. For all the talk about decentralization and autonomy, responsibility and forward-thinking remain at the heart of crypto ownership. By taking the time to plan ahead, you safeguard not only your wealth but also your family’s peace of mind.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

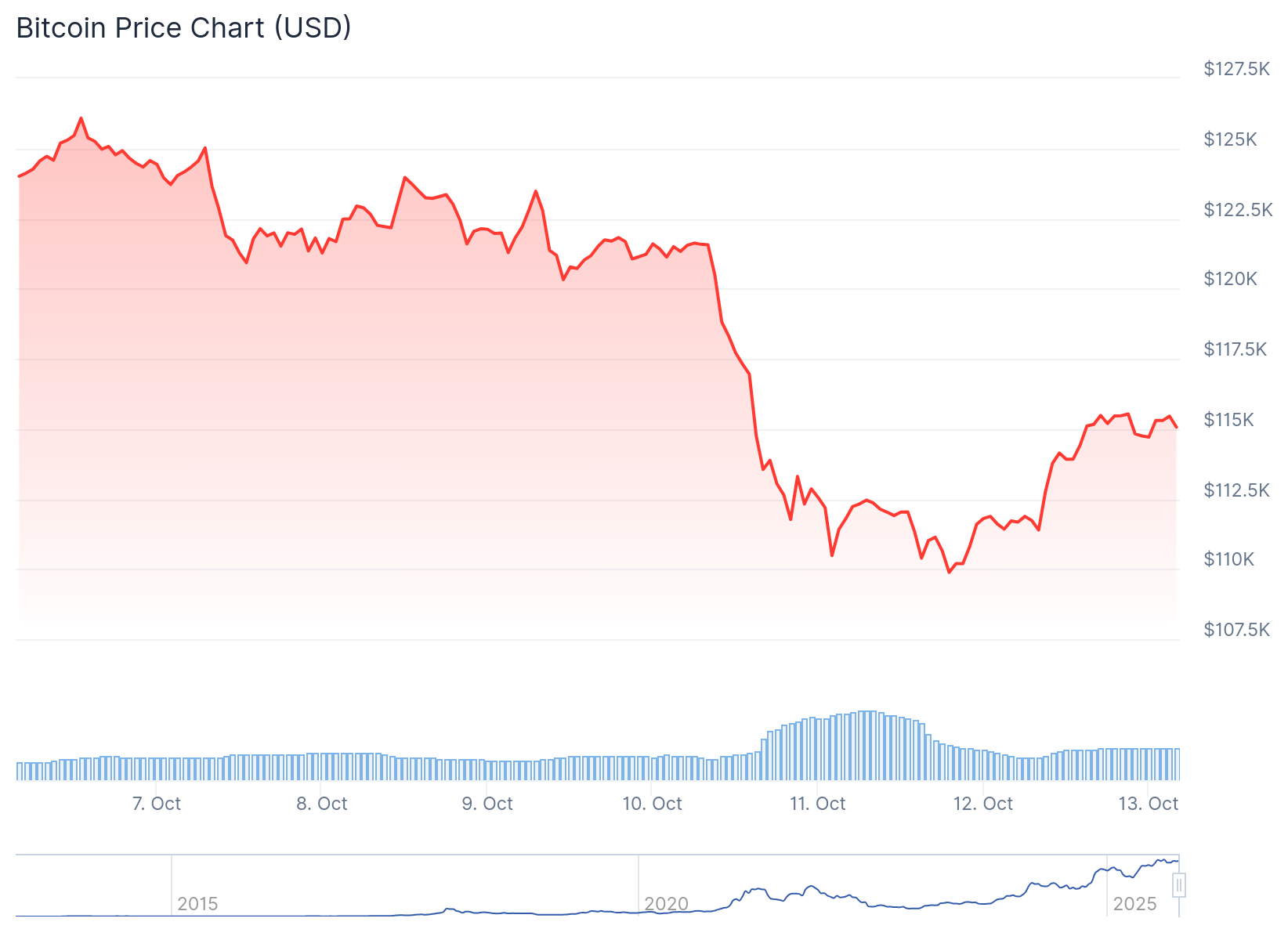

The Crash That Shook It All

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

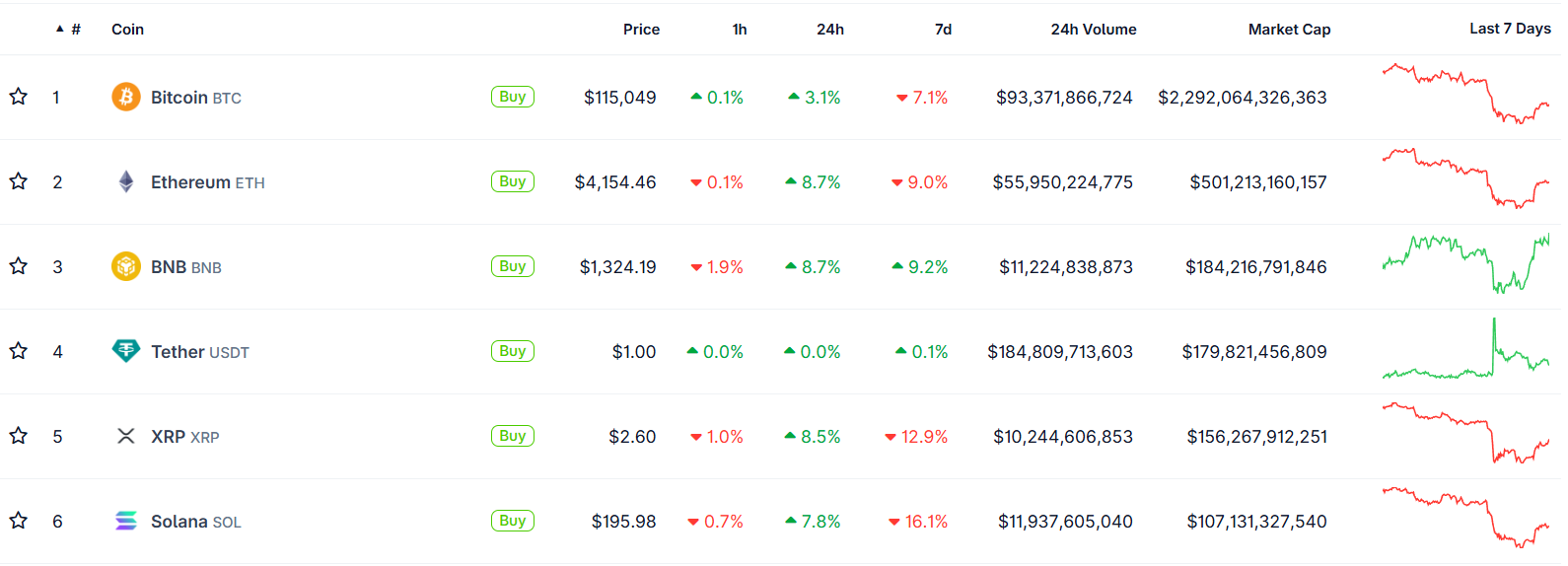

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

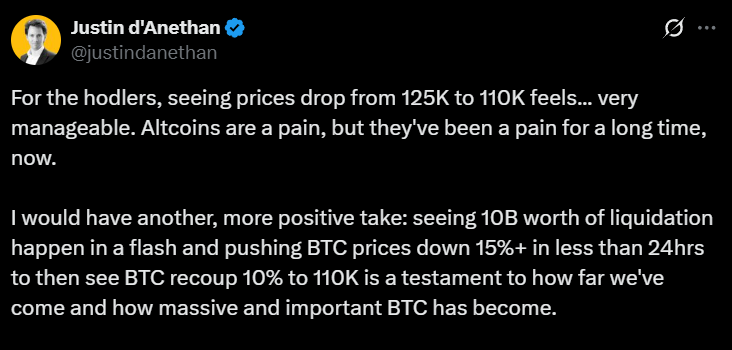

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

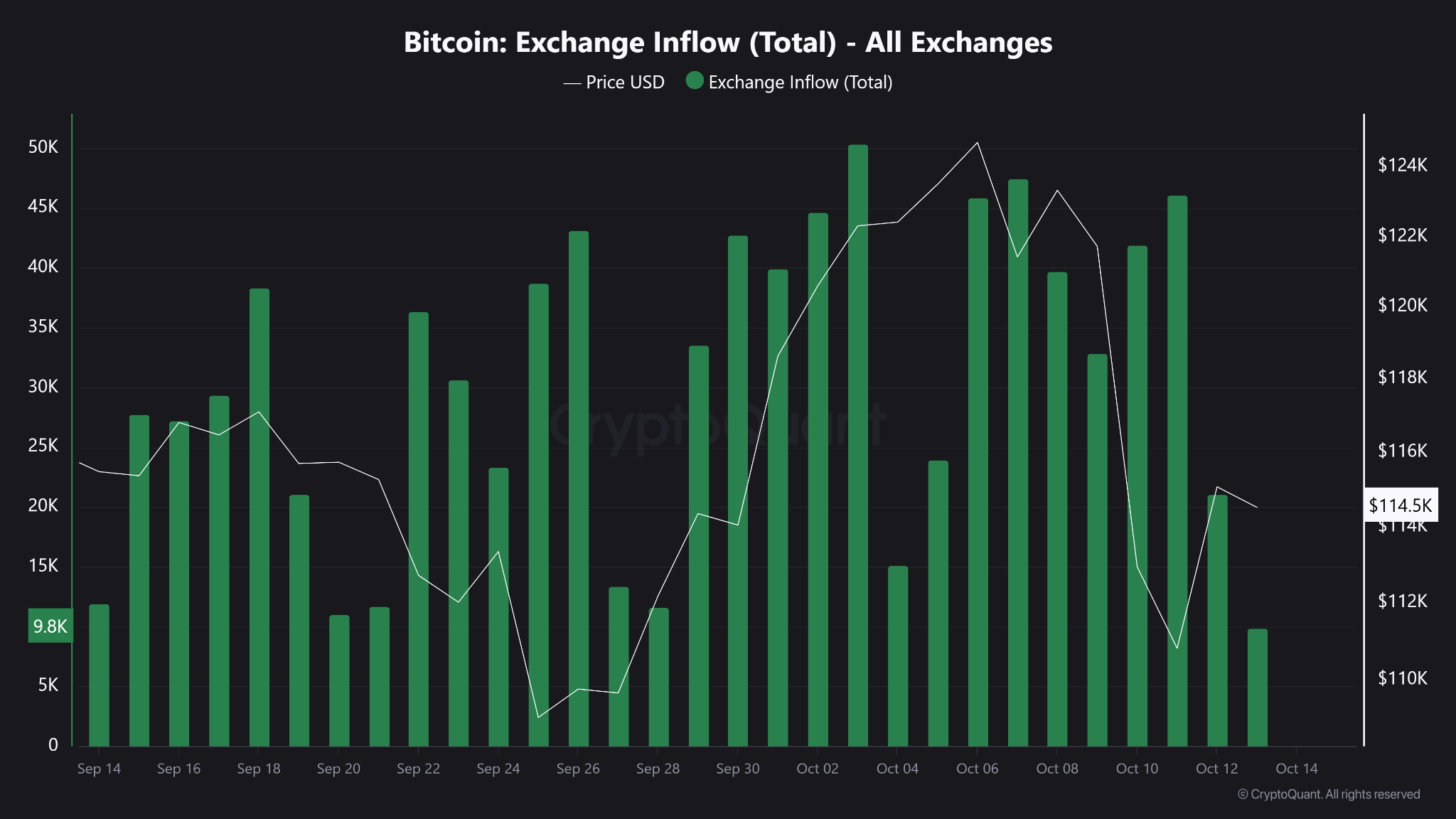

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore why Bitcoin and the crypto market are worth $2.1 trillion and why skepticism still lingers among Americans in this deep dive.

Decoding the disconnect: America's cautious approach to crypto

Bitcoin and the broader crypto market have soared to a staggering $2.1 trillion in value, but why does skepticism still linger among so many Americans?

Despite increasing adoption, digital currencies remain shrouded in doubt, revealing a significant trust gap that continues to challenge the industry. As cryptocurrencies become more woven into everyday financial transactions, closing this trust deficit is essential for ensuring sustained growth and mainstream acceptance.

In this article, we'll dive into the key reasons behind this persistent mistrust, uncover the expanding real-world uses of digital assets, and explore how education and technological advancements can help bridge the confidence gap. Keep in mind, the data presented draws from multiple studies, so some figures and age groupings may vary slightly.

A Look at the Current State of Crypto Trust

To truly understand cryptocurrency adoption and the accompanying trust issues, it’s essential to examine the latest statistics and demographic data. This section breaks down public sentiment toward crypto and provides a snapshot of its user base.

General Public Sentiment

Percentage of Americans Who Own Cryptocurrency

Cryptocurrency adoption has seen slow but steady growth over the years. According to surveys conducted by Pew Research Center in 2021 and 2023, 17% of Americans have invested in, traded, or used cryptocurrency, up slightly from 16% in 2021.

While estimates vary, Security.org places this figure higher, estimating that roughly 40% of the U.S. population - around 93 million adults - own some form of cryptocurrency.

Both studies agree that younger generations are driving much of this growth, with 30% of Americans aged 18-29 reporting they have experience with crypto.

Trust Levels in Cryptocurrency

Despite rising adoption rates, trust in cryptocurrency remains a significant hurdle. Pew Research Center found that 75% of Americans have little or no confidence that cryptocurrency exchanges can safeguard their funds. Similarly, a recent report by Morning Consult shows that 7 in 10 consumers familiar with crypto express low or no trust in it.

This contrasts the 31% who have some or high trust, or the 24% in the Pew study who are “somewhat” to “extremely” confident in cryptocurrencies.

Demographics of Crypto Adopters

- Age Groups

Cryptocurrency adoption trends reveal a distinct generational divide. According to the 2023 Morning Consult survey, Gen Z adults (ages 18-25) lead in crypto ownership at 36%, closely followed by Millennials at 30%.

These younger groups are also more inclined toward future investments, with 39% of Gen Z and 45% of Millennials planning to invest in crypto in the coming years. Over half of both generations view cryptocurrency and blockchain as the future, while a notable percentage (27% of Gen Z and 21% of Millennials) considered opening an account with a crypto exchange in the past year.

When compared to other asset classes, data from Bankrate’s 2021 survey reveals that younger Millennials (ages 25-31) favor real estate and stock market investments, while Baby Boomers have the least interest in cryptocurrency. Older Millennials (32-40) lean toward cash investments, with cryptocurrency’s appeal steadily declining with age.

Interestingly, the report also highlights gender differences, showing that 80% of women familiar with crypto express low confidence, compared to 71% of men, indicating a broader trust gap among female users.

- Income Levels

Contrary to common assumptions, cryptocurrency adoption is not confined to high-income individuals. The same Pew Research Center survey revealed that crypto ownership is relatively evenly spread across income brackets:

- 13% of those earning less than $56,600 annually own crypto.

- 19% of those earning between $56,600 and $169,800 own crypto.

- 22% of those earning over $169,800 own crypto.

This data suggests that while higher earners may be more inclined to own cryptocurrency, the appeal of digital assets spans various income levels.

- Educational Background

Education also plays a role in crypto adoption. A 2022 report by Triple-A found that the majority of crypto owners are “highly educated”:

- 24% of crypto owners have graduated from middle or high school.

- 10% have some vocational or college education.

- 39% are college graduates.

- 27% hold postgraduate degrees.

This shows that while those with some college education or a degree are more likely to own crypto, it is not exclusively a pursuit of the highly educated.

This demographic data paints a picture of cryptocurrency adopters as predominantly younger, spread across a range of income levels, and with diverse educational backgrounds. However, the trust gap between crypto and traditional financial systems remains a significant barrier to wider acceptance of digital assets.

Key Trust Barriers

To bridge the gap between cryptocurrency adoption and trust, it’s crucial to understand the major concerns fueling skepticism. This section explores these concerns and contrasts them with similar risks in traditional financial systems.

The Primary Concerns of Skeptics

Volatility

One of the most significant barriers to cryptocurrency adoption is its notorious volatility, particularly for investors seeking stable, long-term assets. Bitcoin, the most well-known cryptocurrency, symbolizes this risk.

In 2022, Bitcoin’s volatility was stark. Its 30-day volatility reached 64.02% in June, driven by broader economic uncertainty and market downturns, compared to the S&P 500’s much lower volatility of 4.71% during the same period.

Over the course of the year, Bitcoin’s price swung from a peak of $47,835 to a low of $18,490, marking a substantial 61% decline from its highest point in 2022. Factors such as rising interest rates, geopolitical tensions, and major crypto market disruptions, like the TerraUSD collapse and Celsius’ liquidity crisis, played a pivotal role.

This extreme volatility reinforces the perception of cryptocurrencies as high-risk investments.

However, traditional stock markets, while typically more stable than crypto, can also experience sharp fluctuations, especially in times of economic stress. For instance, the CBOE Volatility Index (VIX), which measures expected near-term volatility in the U.S. stock market, dropped by 23% to 28.71 on June 30, 2022, far below the 82.69 peak recorded during the early COVID-19 market turbulence in March 2020. This shows that even stock markets, generally seen as safer, can experience moments of intense volatility, particularly during global crises.

Additionally, when compared to the "Magnificent Seven" (a group of top-performing and influential stocks) Bitcoin’s volatility doesn't stand out as unusual. In fact, over the past two years, Bitcoin has shown less volatility than Netflix (NFLX) stock.

On a 90-day timeframe, NFLX had an average realized volatility of 53%, while Bitcoin’s was slightly lower at 46%. The reality is that among all S&P 500 companies, Bitcoin has demonstrated lower annualized historical volatility than 33 of the 503 constituents.

In October 2023, Bitcoin was actually less volatile than 92 stocks in the S&P 500, based on 90-day realized historical volatility figures, including some large-cap and mega-cap companies.

Security

Security concerns are another major hurdle in building trust with cryptocurrencies. Cryptocurrency exchanges and wallets have been targeted by numerous high-profile hacks and frauds, raising doubts about the safety of digital assets. It comes as no surprise that a study from Morning Consult found that 67% of Americans believe having a secure and trustworthy platform is essential to entering the crypto market.

While security threats in the crypto space are well-documented, traditional banking systems are not immune to fraud either. Federal Trade Commission data reveals that consumer fraud losses in the traditional financial sector hit a record high of $10 billion in 2023, marking a 14% increase from the previous year.

Although traditional banks have more safeguards in place to protect consumers, they remain vulnerable to attacks, showing that security is a universal challenge across both crypto and traditional finance.

Prevention remains key, which in this case equates to using only reliable platforms or hardwallets.

Regulatory Uncertainty

Regulatory ambiguity continues to be a critical barrier for both cryptocurrency investors and businesses. The evolving landscape creates uncertainty about the future of digital assets.

Currently, cryptocurrency is legal in 119 countries and four British Overseas Territories, covering more than half of the world’s nations. Notably, 64.7% of these countries are emerging and developing economies, primarily in Asia and Africa.

However, only 62 of these 119 countries (52.1%) have comprehensive regulations in place. This represents significant growth from 2018, when only 33 jurisdictions had formal regulations, showing a 53.2% increase, but still falls short in creating a sense of “unified safety”.

In the United States, regulatory views remain fragmented. Various agencies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have conflicting perspectives on how to classify and regulate cryptocurrencies. Since 2019, the SEC has filed over 116 crypto-related lawsuits, adding to the regulatory uncertainty faced by the industry.

The Growing Integration Of Digital Assets In Daily Life

As we progress further into the digital age, cryptocurrencies and digital assets are increasingly becoming part of our everyday financial transactions. This shift is driven by two key developments: the rise of crypto payment options and the growing adoption of Central Bank Digital Currencies (CBDCs).

According to a MatrixPort report, global cryptocurrency adoption has now reached 7.51% of the population, underscoring the expanding influence of digital currencies worldwide. By 2025, this rate is expected to surpass 8%, signaling a potential shift from niche usage to mainstream acceptance.

The list of major retailers embracing cryptocurrency as a payment method continues to grow. Some notable companies now accepting crypto include:

- Microsoft: Accepts Bitcoin for Xbox store credits.

- AT&T: The first major U.S. mobile carrier to accept crypto payments.

- Whole Foods: Accepts Bitcoin via the Spedn app.

- Overstock: One of the first major retailers to accept Bitcoin.

- Starbucks: Allows customers to load their Starbucks cards with Bitcoin through the Bakkt app.

A 2022 Deloitte survey revealed that nearly 75% of retailers plan to accept either cryptocurrency or stablecoin payments within the next two years. This trend highlights the growing mainstream acceptance of digital assets as a legitimate payment method.

Crypto-backed debit cards are further bridging the gap between digital assets and everyday transactions. These cards enable users to spend their cryptocurrency at any merchant that accepts traditional debit cards.

According to Factual Market Research, the global crypto card market is projected to reach $9.5 billion by 2030, with a compound annual growth rate (CAGR) of approximately 31.6% from 2021 to 2030. This growth reflects the increasing popularity of crypto-backed debit cards as a way for consumers to integrate their digital assets into daily spending.

The Rise of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) represent digital versions of a country’s fiat currency, issued and regulated by the national monetary authority. In 2024, the global progress of CBDCs has seen a significant uptick, with marked advances in both research and adoption. As of this year:

- 11 countries have fully launched CBDCs, including the Bahamas, Nigeria, Jamaica, and China.

- 44 countries are conducting pilot programs, up from 36, reflecting growing interest in testing the functionality and stability of digital currencies.

- 66 nations are at advanced stages of CBDC development, contributing to a global landscape where 134 countries (accounting for 98% of the world’s economy) are engaged in CBDC projects.

In the United States, the Federal Reserve is exploring the feasibility of a CBDC through Project Hamilton, a collaborative research initiative with MIT. This exploration aligns with broader goals to reduce reliance on cash, enhance financial inclusion, and improve control over national monetary systems amid the rise of digital payments and cryptocurrencies.

The introduction of CBDCs could significantly reshape daily financial transactions in several ways:

- Increased financial inclusion: CBDCs could offer digital payment access to the 1.4 billion adults who remain unbanked, according to World Bank estimates.

- Faster and cheaper transactions: CBDCs could streamline both domestic and cross-border payments, reducing costs and settlement times.

- Enhanced monetary policy: Central banks would gain more direct control over money supply and circulation.

- Improved traceability: CBDCs could help combat financial crimes and reduce tax evasion by providing greater transaction transparency.

However, challenges persist, including concerns about privacy, cybersecurity risks, and the potential disruption of existing banking systems.

As digital assets continue to integrate into everyday life, they hold the potential to transform how we think about and use money. Despite these challenges, trends in both private cryptocurrency adoption and CBDC development point to a future where digital assets play a central role in our financial systems.

Building Trust Through Technology and Education

According to the 2023 Web3 UI/UX Report, nearly 48% of users cite security concerns and asset protection as the primary barriers to crypto adoption. Other challenges include high transaction fees and the steep learning curve needed to fully grasp both the technology and its benefits.

Despite these obstacles, the blockchain sector has made significant strides as it matures, particularly in enhancing security. Hack-related losses in the crypto market dropped from $3.7 billion in 2022 to $1.8 billion in 2023, underscoring the progress in safeguarding digital assets.

The increased adoption of offline hardware wallets and multi-signature wallets, both of which add critical layers of security, reflects this momentum. Advances in smart contract auditing tools and stronger compliance standards are also minimizing risks, creating a safer environment for both users and institutions.

These improvements highlight the industry’s commitment to establishing a more secure foundation for digital transactions and bolstering confidence in blockchain as a reliable financial technology.

In another positive development, in May 2023, the European Council approved the first comprehensive legal framework for the cryptocurrency industry. This legislation sets a new standard for regulatory transparency and oversight, further reinforcing trust.

Financial Literacy Initiatives

The rise of crypto education in the U.S. is playing a pivotal role in increasing public understanding and encouraging adoption. Programs such as Coinbase Earn aim to simplify the onboarding process for new users, directly addressing the complexity and security concerns that often deter people from engaging with crypto.

According to recent data, 43% of respondents feel that insufficient knowledge is a key reason they avoid the sector, highlighting the ongoing need for crypto-related learning.

Additionally, Chainalysis' 2024 Global Crypto Adoption Index noted a significant increase in crypto interest following the launch of spot Bitcoin ETFs in the U.S. earlier in the year. This development enabled investors to trade ETF shares tied to Bitcoin directly on stock exchanges, making it easier to enter the market without needing extensive technical expertise - thus driving a surge in adoption.

These advancements in security and education are gradually fostering greater trust in the cryptocurrency ecosystem. As the sector continues to evolve, these efforts may pave the way for broader adoption and deeper integration of digital assets into daily financial life.

The Future of Digital Asset Adoption

As digital assets continue to evolve and capture mainstream attention, their potential to transform the financial landscape is becoming increasingly evident. From late 2023 through early 2024, global crypto transaction volumes surged, surpassing the peaks of the 2021 bull market (as illustrated below).

Interestingly, much of this growth in adoption was driven by lower-middle income countries, highlighting the global reach of digital assets.

Below, we explore projections for cryptocurrency usage and its potential impact on traditional banking and finance.

Projections for Crypto Usage in the Next 5-10 Years

Several studies and reports offer insights into the expected growth of cryptocurrency over the next decade:

Global Adoption

The global cryptocurrency market revenue is projected to reach approximately $56.7 billion in 2024, with the United States leading the charge, expected to generate around $9.8 billion in revenue. Statista predicts the number of global crypto users will hit 861 million by 2025, marking a significant shift toward mainstream use.

Institutional Adoption

The 2023 Institutional Investor Digital Assets Study found that 65% of the 1,042 institutional investors surveyed plan to buy or invest in digital assets in the future.

As of 2024, digital currency usage among U.S. organisations is expanding, particularly in sectors such as finance, retail, and technology. Hundreds of financial services and fintech firms are now involved in digital assets, whether in payment processing, investments, or blockchain-based applications. This includes major companies utilising cryptocurrencies as stored value and exploring stablecoin use cases to enhance transaction efficiency.

Notably, major U.S. companies are increasingly engaging with blockchain and digital assets, as regulatory clarity improves and security concerns are addressed.

Retail Adoption

At present, about 85% of major retailers generating over $1 billion in annual online sales accept cryptocurrency payments. In contrast, 23% of mid-sized retailers, with online sales between $250 million and $1 billion, currently accept crypto payments. This growing trend points to an expanding role for digital assets in retail, especially among large-scale businesses.

Potential Impact on Traditional Banking and Finance

The rise of digital asset utilisation is poised to reshape traditional banking systems in multiple areas. For starters, the growth of blockchain technology and digitised financial services is driving the decentralised finance (DeFi) market, which is projected to reach $450 billion by 2030, with a compound annual growth rate (CAGR) of 46%.

In Q3 2024 alone, trading on decentralised exchanges surpassed $100 billion, marking the third consecutive month of growth in trading volume. This trend underscores the increasing interest and activity in the decentralised finance space.

As Central Bank Digital Currencies (CBDCs) are likely to be adopted by 80% of central banks by 2030, the role of commercial banks in money distribution could diminish significantly. Meanwhile, blockchain technology and stablecoins are expected to revolutionise cross-border B2B payments, with 20% of these transactions powered by blockchain by 2025. Stablecoin payment volumes are projected to hit $620 billion by 2026.

Furthermore, the investment landscape is set to evolve as asset tokenisation scales, potentially reaching a value of $16 trillion, making crypto a standard component in investment portfolios.

With regulatory clarity expected to improve - more than half of financial institutions anticipate clearer rules within the next three years - crypto integration is likely to become more widespread. These developments emphasise the transformative potential of digital assets across payments, investments, and financial structures globally.

Bridging the trust gap in crypto adoption

The cryptocurrency landscape is experiencing a surge in institutional interest, which could be a pivotal moment for integrating digital assets into traditional finance. Financial giants like BlackRock are at the forefront of this movement, signaling a shift in mainstream perception and adoption of cryptocurrencies.

Historically, the introduction of new investment vehicles around Bitcoin has spurred market growth. As Markus Thielen, founder of 10x Research, highlights, the launch of spot ETFs could bring about a new wave of institutional involvement, potentially driving the next phase of market expansion.

This growing institutional momentum, combined with evolving regulatory frameworks, is reshaping the crypto ecosystem. However, a key question remains: Will these developments be enough to close the trust gap and push cryptocurrencies into mainstream adoption?

As we stand at this crossroads, the future of digital assets hangs in the balance. The coming years will be critical in determining whether cryptocurrencies can overcome persistent skepticism and fully integrate into the global financial system, or if they will remain a niche, yet impactful, financial instrument.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

Tap makes entering the Bitcoin world simple. Buy, sell, hold, and trade Bitcoin easily on our secure platform.

Welcome to this week's Crypto Update, your go-to destination for the latest news in the exciting world of cryptocurrencies. Let's dive right into the highlights of the past week in the dynamic crypto market.

Etherscan's AI Tool for Smart Contracts:

Etherscan has launched Code Reader, an advanced tool that utilizes AI to retrieve and interpret source code from specific Ethereum contract addresses. Code Reader leverages OpenAI's powerful language model to generate comprehensive insights into contract source code files. The tool allows users to gain a deeper understanding of contract code, access comprehensive lists of smart contract functions, and explore contract interactions with decentralized applications. To access and utilize Code Reader, users need a valid OpenAI API Key and sufficient OpenAI usage limits. However, researchers caution about the challenges posed by current AI models, including computing power limitations, data synchronization, network optimization, and privacy concerns.

SEC's increased scrutiny on cryptocurrencies sparks debate:

The U.S. Securities and Exchange Commission's (SEC) increased scrutiny has led to a prominent debate concerning the future of XRP and Ethereum. Max Keiser, a well-known Bitcoin advocate, predicts the downfall of XRP and Ethereum due to regulatory overreach. In contrast, John Deaton, representing XRP holders, opposes this view, arguing for a more balanced regulatory approach. The cryptocurrency community is now anxiously awaiting regulatory clarity, as the SEC's actions remain unpredictable.

It's important to note that the regulatory environment is constantly evolving and can have significant impacts on the cryptocurrency market, including Ethereum. Therefore, it is advisable to stay informed about the latest developments.

A Call for Clarity: Federal reserve governor advocates for clearer crypto regulations:

Michelle Bowman, a Federal Reserve Governor, has urged global regulators to establish clearer regulations for emerging banking activities, particularly banking as a service and digital assets. She emphasized the need for a well-defined regulatory framework to address the supervisory void and uncertainties that financial institutions currently face. Bowman's call aligns with the growing demand for enhanced regulation of digital assets. A robust and comprehensive regulatory framework is crucial for ensuring the stability and integrity of the banking sector, mitigating risks, protecting consumers, and fostering innovation.

Turkish lira hit a record low against the US dollar

The Turkish lira hit a historic low, trading at 25.74 per US dollar, following Turkey's central bank decision to raise interest rates by 650 basis points to 15%. While the hike was expected, it fell short of the anticipated 21%, and analysts believe a larger increase was needed to show the government's resolve to fight inflation. The lira's devaluation has been part of a larger trend, prompting citizens to invest in alternative assets like digital currencies and gold. The central bank, now under new leadership, has adopted a more gradual approach to rate adjustments, seeking to stabilize the economy. However, the uncertainty surrounding Turkey's economic future persists.

Biggest Movers on Tap - Last 7 days

LATEST ARTICLE

Civic (CVC) is a blockchain-based identity verification platform focused on providing secure, cost-effective identity management solutions. As digital identity verification becomes increasingly important in today’s world, Civic distinguishes itself with its decentralised approach and user-centric control over personal data.

Let's explore how this platform is addressing the challenges of digital identity verification, privacy, and security.

TLDR

- Decentralised identity verification: Civic provides secure personal data verification without storing user information centrally, reducing fraud and identity theft risks.

- User-controlled identity: Users maintain ownership of their personal data, selectively sharing only required information with service providers through the Civic app.

- Multi-layered ecosystem: Utilises the Identity Verification Marketplace and Civic Pass for DeFi access control.

What is the Civic network all about?

Founded in 2015 by Vinny Lingham and Jonathan Smith, Civic launched its Initial Coin Offering (ICO) in June 2017, raising $33 million. The platform enables users to verify their identities on the blockchain while maintaining control over their personal information.

It aims to overcome traditional identity verification drawbacks, such as centralised data storage, repetitive KYC processes, and privacy concerns—and it uses blockchain technology to achieve this. The platform’s infrastructure allows for reusable KYC, minimising the need to repeatedly share personal documents with different service providers, all while reducing verification costs.

In June 2017, Civic conducted its token sale, selling $33 million worth of CVC tokens. Since then, the platform has continued to evolve, introducing Civic Pass in 2021, serving as an identity gateway for DeFi apps, NFT platforms, and DAOs requiring compliance.

At the time of writing, it remains one of the notable blockchain-based identity verification solutions in the cryptocurrency ecosystem.

How does the Civic platform work?

Civic's core architecture revolves around three main components that work together to provide comprehensive identity verification services:

- Identity Verification Marketplace - connects identity requesters with trusted validators to verify user information.

- Civic Pass - provides access control for DeFi applications and other services requiring compliance checks.

It’s worth noting that their product Civic Pay was quietly retired in 2020-2021.

The Identity Verification Marketplace operates on the blockchain, creating a trusted ecosystem where validators (trusted entities that verify identity information) and service providers can interact. When users provide identity information through the Civic app, it's encrypted and stored on their device, not on Civic's servers.

By distributing the verification process across the blockchain and putting users in control of their data, Civic promises to deliver security, privacy, and convenience without compromises. Because users can reuse their verified identity across multiple platforms, this makes it an efficient solution for both individual users and businesses requiring KYC processes.

Civic created CVC to be the utility token across its ecosystem, used for paying for verification services, rewarding validators, and incentivising ecosystem participation.

The advantages of the Civic platform

According to the Civic team, the platform significantly reduces verification costs compared to traditional identity verification methods. It's also capable of completing verifications in minutes rather than days. This makes it a superior solution for businesses looking to streamline their KYC processes while maintaining regulatory compliance.

Beyond that, Civic is designed to address major issues facing identity systems today: data breaches and identity theft. This is done by eliminating centralised databases of personal information, ensuring that even if Civic were compromised, users' personal data would remain secure.

It's also highly inclusive. While many identity verification systems require extensive documentation, Civic works to provide solutions for the unbanked and underbanked populations globally, potentially bringing financial services to billions of people.

In 2021, Civic expanded its offerings with enhanced DeFi protection tools and NFT verification services, ensuring that its identity solutions remain relevant in the evolving blockchain ecosystem. The platform continues to develop new use cases for its technology, particularly in combating bot activity and fraud in decentralised applications.

Civic use cases

The Civic network allows individuals and businesses to verify identity information securely and efficiently, whether for account creation, age verification, or compliance with regulatory requirements.

It is one of the first platforms to combine blockchain technology with identity verification to create a user-centric system that puts individuals in control of their personal data while still meeting the verification needs of businesses.

Due to the platform's focus on privacy and security, businesses can implement strong KYC procedures without creating vulnerable centralised databases of user information. This provides them with compliance solutions that protect both the business and its customers.

How to buy CVC

If you’re looking to incorporate CVC into your crypto portfolio, users can effortlessly buy and sell the token on the Tap app (after completing the account registration process). Download the app to get started.

FAQs

How does Civic protect user data?

Civic employs a decentralised identity architecture where users’ personal data is stored locally on their devices, not on central servers. Data is encrypted and hashed, and Civic leverages zero-knowledge proofs in some cases to validate information without exposing the data. Only attestations (proofs of verification) are stored on the blockchain, not the personal data itself. Users maintain control over what information is shared and with whom.

Can you mine CVC tokens?

No, CVC tokens cannot be mined. The total supply of CVC was created during its token generation event in 2017, and no new tokens were issued. As an ERC-20 token on the Ethereum blockchain, CVC transactions are secured by Ethereum’s Proof of Stake mechanism, but CVC is not mined or staked for rewards.

What is the CVC price?

As the market is known to change regularly, please check the Tap app to find the most relevant CVC price.

If you've been exploring the world of cryptocurrency beyond Bitcoin and Ethereum, you've probably heard of Sushi. No, not the Japanese dish – we're talking about a powerful player in the decentralised finance (DeFi) space that's been making waves since its dramatic entrance in 2020.

Sushi, or SushiSwap as the platform is called, burst onto the crypto scene with what many called a "vampire attack" on Uniswap, another popular decentralised exchange (DEX). This bold move involved attracting over a billion dollars of liquidity from its competitor in just a few days.

Today, SushiSwap stands as one of the leading decentralised exchanges in the crypto ecosystem, offering a suite of financial services that go well beyond simple token swapping. With its native SUSHI token, the platform has created an ecosystem that allows users to trade, earn, lend, borrow, and more – all without traditional financial intermediaries.

What makes Sushi truly stand out is how it's putting financial power back into the hands of regular users. By democratising access to sophisticated financial tools that were once only available to privileged institutions, Sushi is helping to create a more open, accessible financial system for everyone.

What is Sushi (SUSHI)?

At its core, Sushi is a DEX and DeFi protocol that allows users to trade cryptocurrencies directly with each other without any middlemen. Unlike centralised exchanges, there's no company controlling your funds or verifying your identity – it's just you, smart contracts, and the blockchain.

Think of SushiSwap as an online marketplace where instead of a company facilitating trades, everything runs on code. It's like if eBay operated without eBay the company – just buyers and sellers interacting through an automated system.

The relationship between SushiSwap and SUSHI is important to understand:

- SushiSwap is the platform – the actual decentralised exchange and suite of DeFi services

- SUSHI is the native token that powers the ecosystem – like owning a piece of the project

The Sushi ecosystem has evolved significantly since its launch, now offering a full menu of DeFi services:

- Token swapping (the basic exchange function)

- Liquidity providing (where users can earn fees)

- Yield farming (earning rewards by supporting the platform)

- Lending and borrowing

- Token launches

- NFT marketplace

- Cross-chain functionality (operating across multiple blockchains)

When compared to other DEXs like Uniswap and PancakeSwap, Sushi stands out for its community-first approach and wide range of features. While Uniswap pioneered the automated market maker model that Sushi uses, Sushi expanded on this foundation by adding more ways for users to participate and earn rewards.

And while PancakeSwap operates primarily on the Binance Smart Chain, Sushi has expanded to multiple blockchains, including Ethereum, Polygon, Avalanche, and more.

The history of Sushi

Sushi's history reads like a crypto soap opera – complete with controversy, drama, and unexpected twists. Grab the popcorn.

It all began in August 2020 when an anonymous developer going by the name "Chef Nomi" created SushiSwap as a fork (essentially a copy with modifications) of Uniswap's code. But Chef Nomi didn't just launch a competitor; they executed what became known as a "vampire attack" – a strategy to drain liquidity from Uniswap by offering better incentives.

Users who provided liquidity to Uniswap could stake their LP (liquidity provider) tokens on SushiSwap to earn SUSHI rewards. Then, in a coordinated event called "The Migration," over $1 billion in crypto assets moved from Uniswap to SushiSwap virtually overnight. The crypto community was stunned by the aggressive yet innovative approach.

But the drama was just beginning. Shortly after the successful migration, Chef Nomi suddenly converted a large amount of SUSHI tokens (worth about $14 million at the time) into Ethereum and withdrew it. The community viewed this as an "exit scam," and the price of SUSHI plummeted.

In a surprising turn of events, Sam Bankman-Fried, then-CEO of FTX (a major crypto exchange at the time), stepped in to take control of the project. Days later, Chef Nomi returned all the funds and apologised to the community.

Control of the project was then transferred to a multi-signature wallet controlled by several trusted community members, transitioning SushiSwap to true community governance. Since then, the protocol has seen steady development and expansion, including:

- Launch of Kashi lending platform (March 2021)

- Introduction of BentoBox, a yield-generating vault (Q1 2021)

- Expansion to multiple blockchains beyond Ethereum

- Release of Miso launchpad for new tokens

- Development of Shoyu, an NFT marketplace

Despite its tumultuous beginnings, Sushi managed to establish itself as a serious contender in the DeFi space through continuous innovation and a strong community focus.

How does SushiSwap work?

SushiSwap operates on a model called an automated market maker (AMM), which is fundamentally different from traditional exchanges. Here's how it works in simple terms:

Instead of matching buyers with sellers (the way stock exchanges work), SushiSwap uses liquidity pools – essentially big pots of cryptocurrencies that users can trade against. Imagine a vending machine that's always ready to exchange one token for another, rather than waiting to find someone who wants the opposite side of your trade.

These pools are created and maintained by liquidity providers – regular users who deposit pairs of tokens (like ETH and USDT) into the pools. In return for providing this liquidity, they earn fees from trades that happen in their pool.

When you want to swap tokens on SushiSwap, here's what happens:

- You select the tokens you want to exchange (for example, ETH for USDT)

- Smart contracts calculate the exchange rate based on the ratio of tokens in the relevant liquidity pool

- The more of one token you want, the more expensive it gets (this is called "slippage")

- A small fee (0.3% of the trade) is taken and distributed to liquidity providers

- The tokens are exchanged directly in your wallet

The beauty of this system is that it's all handled by smart contracts – self-executing code on the blockchain. There's no company processing your trade or holding your funds; it's all automated and trustless.

Of this 0.3% fee, 0.25% goes directly to liquidity providers in the pool, while the remaining 0.05% is converted to SUSHI tokens and distributed to SUSHI stakers. This creates a sustainable revenue model where active users earn from the platform's success.

Key features of the Sushi ecosystem

Sushi has evolved from a simple token exchange into a comprehensive DeFi ecosystem. Let's explore the main ingredients in Sushi's expanding menu:

SushiSwap DEX: The heart of the ecosystem is the decentralised exchange where users can swap virtually any ERC-20 token (and tokens on other supported blockchains). With competitive rates and deep liquidity across many trading pairs, it's the foundation of the Sushi experience.

Kashi: This lending and margin trading platform allows users to borrow assets against their crypto collateral. What makes Kashi unique is its isolated risk markets – meaning a problem in one lending market won't affect others, making it potentially safer than some competitors.

BentoBox: Think of this as a smart crypto savings account. BentoBox is a token vault that generates yield on deposited assets while they're waiting to be used in other Sushi products. It's like your money earning interest while sitting in your wallet, ready to use.

Onsen: This liquidity mining program incentivises users to provide liquidity for specific token pairs by offering additional SUSHI rewards. It's named after Japanese hot springs – places where people gather and relax, much like how Onsen gathers liquidity for the platform.

Miso: A launchpad for new tokens, Miso helps projects conduct token sales with various auction types. It's like Kickstarter for new crypto projects, helping them raise funds and distribute tokens fairly.

Shoyu: Sushi's NFT marketplace allows for the creation, buying, and selling of digital collectables. While newer than some competitors, it aims to offer lower fees and better integration with the rest of the Sushi ecosystem.

Cross-chain deployment: Unlike many DeFi protocols that only exist on Ethereum, Sushi has expanded to numerous blockchains including Polygon, Avalanche, Binance Smart Chain, Fantom, and more. This multi-chain approach helps users avoid Ethereum's sometimes high transaction fees while still accessing Sushi's services.

This diverse ecosystem makes Sushi a one-stop shop for many DeFi activities, allowing users to move seamlessly between trading, earning, lending, and more.

SUSHI tokenomics

The SUSHI token is the special sauce that brings the whole Sushi ecosystem together. Let's break down how it works:

Total supply: SUSHI has no maximum supply cap. New tokens are minted at a rate of 100 SUSHI per Ethereum block (roughly every 12 seconds), though this emission rate has been adjusted through governance votes over time.

Token utility: The SUSHI token serves several important functions:

- Governance: SUSHI holders can vote on proposals to change the protocol

- Fee sharing: When staked, SUSHI entitles holders to a portion of all trading fees

- Liquidity mining rewards: Users can earn SUSHI by providing liquidity

- Platform access: Some features may require SUSHI holdings or staking

Governance rights: Holding SUSHI means having a say in the future of the platform. Token holders can propose and vote on changes ranging from technical upgrades to treasury management and new feature development.

xSUSHI mechanism: When users stake their SUSHI tokens, they receive xSUSHI in return. This represents their share of the staking pool, which constantly grows as trading fees are added to it. When users unstake, they get their original SUSHI plus their portion of accumulated fees – making it a passive income opportunity.

Staking rewards: The current APY (Annual Percentage Yield) for staking SUSHI varies depending on platform volume and the number of stakers, but it has historically offered attractive returns compared to traditional finance.

Market performance: As with many cryptocurrencies, SUSHI has experienced significant price volatility since its launch. After reaching all-time highs during the 2021 bull market, the token has settled into a more stable trading range.

The tokenomics of SUSHI are designed to align the interests of users, liquidity providers, and token holders – when the platform succeeds, SUSHI holders benefit through increased value and fee sharing.

How to buy and sell SUSHI

Looking to get your hands on some SUSHI tokens? Here's how you can do it through the Tap app:

How to buy SUSHI on the Tap App:

- Download the Tap app from your device's app store

- Create an account and complete the required verification

- Fund your account using a supported payment method (bank transfer, card, etc.)

- Navigate to the crypto section and search for SUSHI

- Enter the amount you want to buy

- Review the transaction details and confirm your purchase

- Your SUSHI tokens will appear in your Tap wallet

How to sell SUSHI on the Tap App:

- Navigate to your SUSHI wallet in the app

- Select the Sell option

- Enter the amount you want to sell, and what currency you would like in return (crypto or fiat)

- Review and confirm the transaction details

- Your desired currency will appear in the relevant Tap wallet

Conclusion

Sushi has come a long way from its controversial beginnings to establish itself as a cornerstone of the DeFi ecosystem. What started as a fork of Uniswap has evolved into a comprehensive financial platform that offers trading, earning, lending, and more – all without traditional financial intermediaries.

By addressing one of the biggest pain points in DeFi – high Ethereum gas fees – through multi-chain deployment, Sushi makes decentralised finance more accessible to everyday users.

As with any cryptocurrency project, Sushi faces challenges and competition, but its innovative features, passionate community, and continuous development make it a project worth watching in the years to come.

In the same way that Bitcoin revolutionised the financial landscape, stablecoins are here to revolutionise international payments. And they’re ready to go.

We know that in the high-stakes world of global commerce, every second and every cent counts. Now there is a financial technology that can slice through the bureaucratic red tape of international payments, eliminating weeks of waiting and thousands in unnecessary fees.

Welcome to the stablecoin revolution – a game-changing innovation that's quietly rewriting the rules of global business transactions.

The hidden cost of traditional payments

Traditional international payments can often feel like navigating a labyrinth blindfolded. Banks and financial intermediaries create a complex web of fees, delays, and opacity that can transform what should be a straightforward transaction into a costly, time-consuming nightmare.

Multinational corporations have long accepted these inefficiencies as an unavoidable cost of doing business – until now.

Enter stablecoins

Stablecoins represent more than just a technological upgrade; they're a strategic weapon for forward-thinking businesses. Unlike volatile cryptocurrencies, these digital currencies are anchored to stable assets like the Euro or U.S. dollar, providing a rock-solid foundation for international transactions.

Breaking down the benefits:

- Transforming cost structures

Stablecoins don't just reduce costs – they fundamentally reimagine them. By eliminating intermediaries, businesses can slash transaction fees by up to 80%. For a mid-sized multinational, this could mean millions of dollars saved annually, redirected towards innovation, expansion, or talent acquisition.

- Lightning fast transactions

Where traditional bank transfers crawl, stablecoins sprint. A transaction that once took 3-5 business days can now be completed in minutes. Offering a serious competitive advantage - imagine closing an international deal before your competitors have even processed their paperwork.

- Predictability in an unpredictable world

Currency volatility has long been the bane of international business. Stablecoins provide a predictable, consistent value that allows financial planners to create robust, long-term strategies without constantly hedging against exchange rate fluctuations.

The transparency revolution

Blockchain ensures that both sides of the transactions are fully in the know, at all times. Every single transaction is recorded on a distributed ledger, creating an immutable audit trail.

For compliance officers and financial controllers, this means real-time tracking, instant verification, and dramatically reduced risk of fraud.

Offering a new paradigm of business expansion

Offering a passport to global business dealings, small and medium enterprises can now compete on an international stage without the traditional barriers of complex banking relationships or prohibitive transaction costs.

Despite the technological sophistication, the most significant breakthrough of stablecoins is fundamentally human. They restore trust in a financial system that has become increasingly opaque and complex. By providing clear, instantaneous, and secure transactions, stablecoins are rebuilding the most critical currency in business: confidence.

Getting started with stablecoins in business

How stablecoins actually work

Before the “how”, let’s explore the “what”. At their core, stablecoins are digital tokens that operate on blockchain networks but maintain a stable value by being pegged to traditional assets. Unlike Bitcoin or Ethereum, which can fluctuate wildly in price, stablecoins aim to maintain a consistent value, typically 1:1 with a fiat currency like the Euro or US dollar.

The stability is maintained through one of three primary mechanisms:

- Fiat-collateralized: Backed by reserves of traditional currency held by a custodian

- Crypto-collateralized: Backed by other cryptocurrencies with excess collateral to account for volatility

- Algorithmic: Use smart contracts to automatically expand or contract the supply based on demand

For business purposes, fiat-collateralized stablecoins offer the most straightforward and trusted solution, essentially functioning as a digital version of the backing currency with blockchain-powered benefits.

Popular stablecoins for business transactions

Several stablecoins have emerged as leaders in the business space:

US dollar-backed stablecoins:

- USDC (USD Coin), USDT (Tether), USDP (Pax Dollar)

Euro-backed stablecoins:

- EUROC (Euro Coin), EURS (Stasis Euro), agEUR (Angle Euro)

Crypto-backed stablecoins:

- DAI (DAI), FRAX (Frax), USDD (USDD)

Multi-currency backed stablecoins:

- XSGD (Xfers Singapore Dollar), CAUD (TrueAUD), NZDS (New Zealand Dollar Stablecoin)

For most business applications, USDC and USDT offer the most immediate utility due to their widespread acceptance and established compliance frameworks. Be sure to research the ones you are interested in before diving in.

Getting started with the Tap App

The Tap app provides one of the most streamlined onboarding experiences for businesses looking to leverage stablecoins. Get in touch with us here, and an account manager will make contact and discuss how stablecoins can assist with your business needs.

We’ll run you through the entire process – from concept to implementation – explaining everything along the way and ensuring all your questions are answered.

Looking forward