Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

USDT is everywhere in crypto: powering trades, bridging platforms, and acting as a go-to safe haven when markets turn volatile. Backed by Tether, it promises the stability of a dollar with the speed of digital assets. But how secure is that promise?

In this article, we’ll unpack how USDT works, the risks beneath the surface, and why it remains a key player in the crypto economy.

What is USDT and why it matters

Think of USDT (Tether) as the crypto world's attempt to create digital cash that doesn't give you a heart attack every time you check its price. Launched back in 2014 by a company called Tether Limited, USDT was designed to be a "stablecoin" - a cryptocurrency that maintains a steady 1:1 relationship with a certain fiat currency: the US dollar. One USDT should always equal one dollar. Simple, right?.

Well, like most things in crypto, it's a bit more complicated than that.

USDT has become the utility tool of crypto, offering a fast and flexible option to move in and out of positions without cashing out to traditional fiat. It’s the common language of the crypto ecosystem, enabling smooth transfers, seamless trading, and a place to park value when markets swing.

Tether Limited, the company behind USDT, operates globally, with roots in the British Virgin Islands and operations stretching from Hong Kong to the Bahamas. Unlike central banks, Tether isn’t printing dollars, though: it issues tokens, claiming each one is backed 1:1 by assets in reserve.

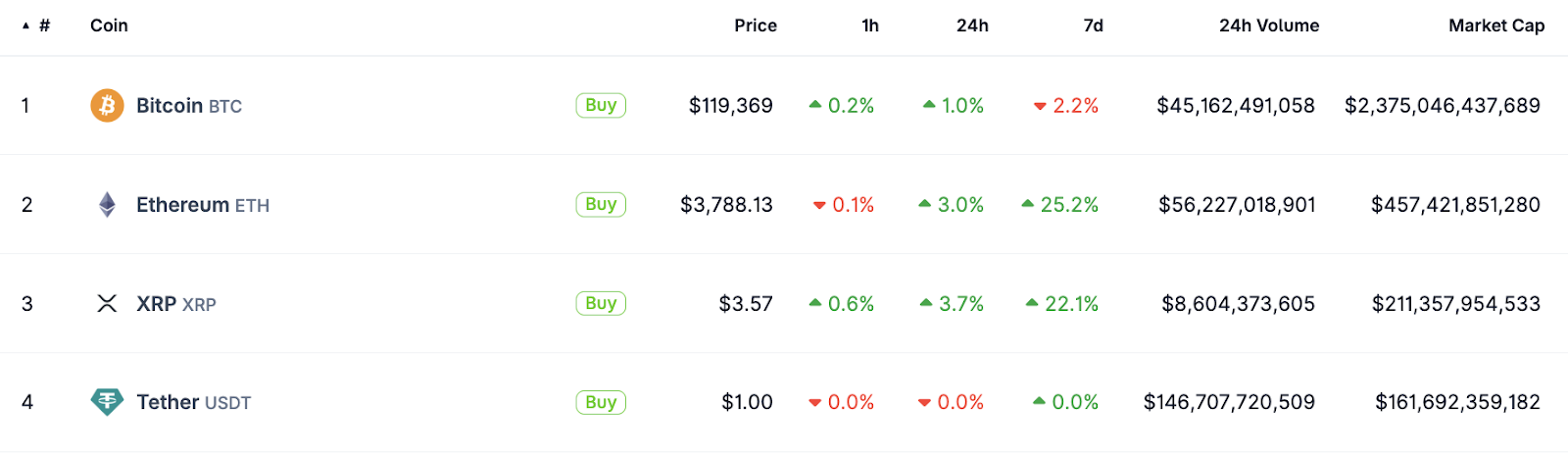

With over $160 billion in circulation as of mid-2025, USDT isn’t just a trading tool, it’s foundational infrastructure for the crypto economy. It’s also the largest stablecoin on the market, based on market cap and 24-hour trading volume.

Top cryptocurrencies by market cap at the time of writing. Source.

Is USDT safe?

The short answer? USDT exists in a grey area between "reasonably safe for what it is" and "proceed with caution."

The slightly longer answer? Here's what you need to know at a glance:

What's working:

- Maintained its dollar peg through multiple market crashes

- Backed by a mix of cash, government securities, and other liquid assets

- Most widely accepted stablecoin across exchanges and platforms

- Regular attestations from accounting firms

What's concerning:

- Limited transparency compared to some competitors

- Regulatory uncertainty and past legal issues

- Concentration risk (too big to fail, too big to save?)

- Not fully backed by cash alone

The reality check: USDT has survived crypto winters, bank runs, and regulatory pressure for nearly a decade. While it's not risk-free (nothing in crypto is), it's proven more resilient than many predicted. For short-term trading and payments, most users find it reliable. For long-term wealth storage? That's where you might want to consider your options more carefully.

How USDT is backed: understanding Tether's reserves

Here’s where things get more complex and where much of the scrutiny around Tether lies.

In simple terms, USDT operates like a digital receipt: you deposit dollars, and in return, you get tokens you can use across the entire crypto ecosystem. But what happens to those dollars? Are they sitting in a vault, or being put to work?

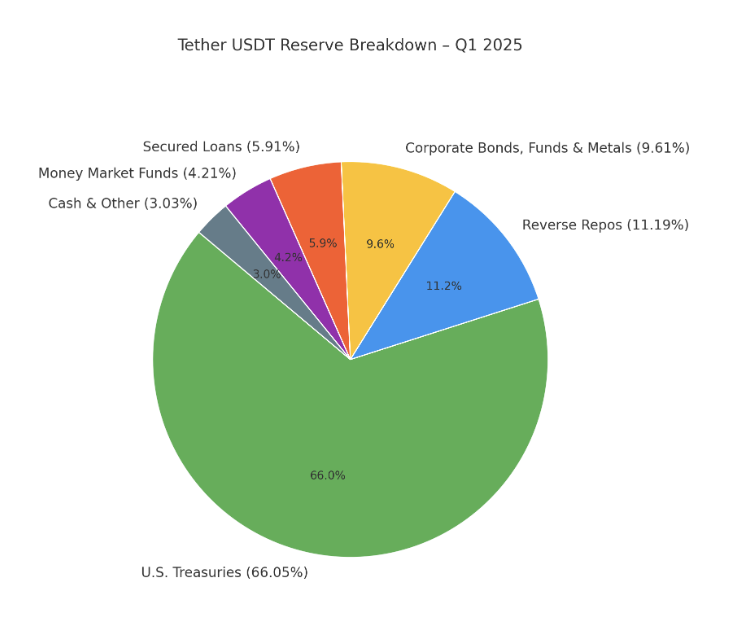

Tether has long opted for the investment route. Instead of holding pure cash, it backs USDT with a diversified portfolio of assets. According to its Q1 2025 attestation from BDO, Tether’s reserves looked roughly like this:

| Category | % of Reserves | Approx. Value (USD) | What It Means |

|---|---|---|---|

| U.S. Treasuries | 66.05% | $98.59b | Short-term U.S. government debt. Highly liquid, low-risk, and considered one of the safest financial instruments globally. These form the backbone of Tether’s reserve strategy. |

| Reverse Repos | 11.19% | $16.71b | Overnight agreements where Tether temporarily exchanges cash for Treasuries with a promise to reverse the deal. This improves liquidity while maintaining exposure to safe government assets. |

| Corporate Bonds, Funds & Metals | 9.61% | $14.34b | A diversified mix: $7.66b in Bitcoin, $6.66b in gold, and a small slice in corporate bonds ($14.35m). These carry more risk but also help generate yield. |

| Secured Loans | 5.91% | $8.83b | Overcollateralised loans issued by Tether. These are risk-managed but less liquid than government securities (a notable area regulators and analysts continue to monitor). |

| Money Market Funds | 4.21% | $6.29b | Conservative, cash-like investments that hold short-term debt. These are liquid and widely used by financial institutions to manage short-term liquidity. |

| Cash, Bank Deposits & Other | 3.03% | $4.53b | Includes actual cash in banks and miscellaneous low-risk investments. This small portion provides immediate liquidity. |

The shift toward U.S. Treasuries and away from riskier assets marked a significant improvement in its reserve quality. While not fully audited, Tether does publish quarterly attestations from BDO, providing some visibility into how reserves are managed. It’s not a full audit, but it’s a step forward from the opaque reporting of earlier years.

That being said, past controversies still shape how Tether is perceived. In 2019, Tether admitted that USDT was not fully backed by cash at all times and revealed it had lent $850 million to Bitfinex, its sister company. This led to a high-profile settlement with the New York Attorney General in 2021, requiring Tether to improve transparency and cease operations in New York.

Again, to put it in simple terms: imagine your bank quietly loaning out customer deposits to a related company without clearly telling you. Not necessarily illegal, but definitely a breach of trust for users expecting a 1:1 backed stablecoin.

Regulatory scrutiny & legal risks

If USDT were a person, it would probably have a thick file folder in regulatory offices around the world. Sure, being the largest stablecoin makes you a big target, but Tether has also found itself in the crosshairs of regulators who are still figuring out how to handle the crypto revolution.

In the United States, Tether operates in something of a regulatory twilight zone. The company has faced pressure from agencies like the Commodity Futures Trading Commission (CFTC), which fined Tether $41 million in 2021 for making false statements about being fully backed by US dollars.

The European Union is taking a more structured approach with its Markets in Crypto-Assets (MiCA) regulation, which will require stablecoins to be backed by highly liquid assets. This could actually work in Tether's favour, as they've already been moving in that direction.

Emerging markets present their own challenges. Some countries have embraced USDT as a hedge against local currency instability, while others have banned it outright, not far from a global game of regulatory whack-a-mole.

For users, the regulatory risks are real but indirect. If major jurisdictions crack down hard on Tether, it could affect the token's liquidity and usability. However, a complete overnight shutdown seems unlikely given USDT's deep integration into the crypto ecosystem.

The bigger risk might be increased compliance requirements that could make using USDT more cumbersome, similar to how traditional banking has become more regulated over time.

How safe is USDT for holding assets?

This is where we need to have an honest conversation about what "safe" means in crypto land.

For short-term use (days to weeks):

USDT works pretty well. If you're trading crypto or need to park funds briefly between investments, it's like using a decent hotel - not your forever home, but comfortable enough for a short stay.

The peg has held remarkably well through various market conditions, and liquidity is excellent across most major platforms.

For medium-term holdings (months):

Here's where things get a bit more nuanced. USDT has survived multiple "stress tests", including the Terra Luna collapse, FTX implosion, and various banking sector scares. However, you're essentially trusting that Tether's reserve management continues to work smoothly and that no major regulatory bombshell disrupts operations.

For long-term wealth storage (years):

This is where many experts start raising eyebrows. Holding large amounts in any stablecoin for extended periods comes with risks that compound over time. You're exposed to regulatory changes, potential company mismanagement, and the general "unknown unknowns" that come with relatively new financial instruments.

Essentially, USDT is like keeping money in a foreign bank account. It might work great for a while, but you're subject to the laws, regulations, and business practices of entities outside your home jurisdiction.

The key insight from the crypto community is diversification. Even USDT supporters rarely recommend putting all your eggs in the Tether basket.

Security best practices when using USDT

Using USDT safely isn't just about trusting Tether - it's also about protecting yourself from the various ways things can go wrong in the crypto world.

Platform risk management: Remember, USDT is only as safe as the platform you're using it on. The token itself might be fine, but if you're holding it on a sketchy exchange that gets hacked or goes bankrupt, you could lose everything. Stick to regulated platforms only.

Diversification strategies: Many crypto users often split their stablecoin holdings across multiple tokens and platforms. Think of it as not putting all your digital eggs in one digital basket. As an example, some might hold 40% USDT, 40% USDC, and 20% in other stablecoins or traditional assets.

For crypto beginners: Start small, learn the ropes, and, if you wish, gradually increase your holdings as you become more comfortable. Use well-established exchanges for your first purchases, enable two-factor authentication on everything, etc. Treat your crypto security like you would your online banking, that's essentially what it is.

USDT vs other stablecoins

The stablecoin world isn't a one-horse race, and understanding the alternatives helps put USDT's safety in perspective.

USDT vs USDC

USDT dominates in usage and global liquidity. It's the most widely accepted stablecoin across exchanges, DeFi platforms, and payment rails. But it has faced criticism over the years for a lack of full audits and historical opacity around reserves.

USD Coin (USDC), issued by Circle, takes a different approach. It’s often seen as the “regulated” stablecoin, with monthly attestations and a conservative reserve mix (primarily cash and short-term U.S. Treasuries).

- USDT is ideal for fast-moving markets and broad platform compatibility.

- USDC appeals to those who prioritise transparency and regulatory oversight.

USDT vs DAI

DAI takes a completely different route. Issued by MakerDAO, it’s a decentralised stablecoin backed by overcollateralised crypto assets like ETH, not fiat. There’s no single company behind it, just smart contracts and community governance.

While DAI offers full on-chain transparency and avoids centralised custodians, it also comes with higher complexity and potential risks tied to smart contract bugs or extreme market conditions.

- USDT provides speed and simplicity, backed by a traditional corporate structure.

- DAI offers a decentralised alternative, ideal for DeFi-native users.

USDT vs BUSD

BUSD, once a major player backed by Binance and Paxos, was phased out in 2024 due to regulatory pressure. It serves as a reminder that centralised stablecoins depend on both market forces and compliance frameworks, and can be wound down unexpectedly.

While USDT remains standing, BUSD’s sunset reinforces the importance of evaluating who’s behind the stablecoin and how stable their operations really are.

What happens if Tether fails?

Let's play out a hypothetical scenario: what if USDT actually collapsed?

Given USDT's role as the primary trading pair and liquidity source for much of the crypto market, a Tether failure would be like removing a major highway from a city's transportation network. The immediate effects would likely include:

Market chaos: Traders scrambling to exit USDT positions would create massive selling pressure across crypto markets. We're talking about potentially the largest fire sale in crypto history, as billions of dollars worth of USDT holders try to convert to other assets simultaneously.

Liquidity crisis: Many smaller cryptocurrencies rely heavily on USDT trading pairs. Without this liquidity, some tokens might become effectively untradeable, at least temporarily.

Contagion effects: Other stablecoins might face runs as confidence in the entire sector erodes. Even well-managed stablecoins could struggle if everyone tries to redeem at once.

The silver lining: The crypto ecosystem has become more resilient over time. Alternative stablecoins like USDC have grown substantially, providing some redundancy. Additionally, the market has survived previous "extinction-level events" and adapted.

Conclusion: Is USDT worth the risk?

USDT isn’t perfect, but it’s proven its place in the crypto ecosystem. With high liquidity and global acceptance, it’s a practical choice for trading, payments, and short-term value storage.

However, concerns around transparency and regulatory clarity mean it’s not ideal for long-term holding or users who prioritise full visibility. But like any financial tool, its value depends on how you use it.

The smart approach is to understand the trade-offs, diversify across stablecoins, and align your choices with your goals and risk tolerance. As the space evolves, USDT remains useful, but it’s just one part of a broader digital finance strategy.

There is no denying that innovation in the technology sector has amplified the fast-paced world of finance, instigating constant transformation from brands that want to stay ahead. As with any fast-paced industry, many trends emerge as companies fight to remain relevant. One such trend we will be exploring is the increase in white-label cards and the companies facilitating the issuing of them.

The process of issuing white-label cards has emerged as a powerful solution in the fintech space, offering customized payment experiences that cater to the unique needs of both businesses and customers. In this article, we will delve into the world of white-label cards, exploring its benefits, applications, and why it has become such a popular choice for financial institutions and fintech companies.

Understanding white-label cards

White-label cards, also known as private-label credit cards, involve the practice of businesses providing other businesses with the opportunity to offer customized credit or debit cards to their customers. Trusted financial institutions or fintech companies issue these cards on behalf of the businesses, while still reflecting the company's branding.

This approach allows businesses to incorporate their logo and branding on the private label credit card, granting the business ownership and control over the card's identity, all without the burden of creating or designing it from scratch.

By partnering with an established financial institution or fintech company, businesses can save time, effort, and resources by leveraging ready-to-use payment solutions instead of going through the costly and complex process of obtaining licenses from companies like Mastercard or Visa.

The shift toward customized payment solutions

Traditional banking systems have often been perceived as slow in adopting new systems and embracing innovation. As the demand for personalized payment experiences continues to grow, businesses are leveraging the opportunity to keep up with the evolving needs of customers seeking customized payment solutions and private-label credit cards.

Consumers today seek customized solutions that align with their preferences and reflect the brands they trust. This shift in consumer behavior has paved the way for white-label cards and in turn, card issuers, which offers businesses the ability to tailor payment solutions and private-label credit cards to their customers' needs.

Third-party establishments are now offering streamlined payment solutions to these businesses, allowing them to leverage this new technology without needing to complete extensive and costly onboarding processes. Instead, the card issuing companies undergo this process and once accredited are able to provide full-service payment options to their clients.

With co-branded private-label credit cards, customers can unlock a multitude of rewards, bonus points, and exclusive discounts that can be utilized across various services, retailers, and online shopping platforms. By offering these enticing benefits, businesses are able to enhance the overall purchasing experience for their customers, cultivating loyalty and satisfaction.

Private-label credit cards can also come in the form of virtual cards, allowing users to make online payments or use services like Apple Pay with their unique account that essentially acts as a bank account.

The advantages and benefits of private label credit cards

The advantages of businesses utilizing the services of white-label card issuers are numerous, benefiting not only businesses but individuals too.

For businesses

Firstly, white-label card programs offer a cost-effective alternative to building an in-house card program. By partnering with established providers, businesses can save on upfront costs, development time, and ongoing maintenance expenses.

White-label card programs also offer flexibility and scalability, making them suitable for businesses of all sizes. Whether you're a startup looking to launch a branded payment card quickly or an established business seeking to enhance your payment offerings, the processing of white-label cards can be tailored to meet your unique requirements.

From a branding perspective, white-label card programs provide businesses with heightened visibility and customer loyalty. By issuing branded payment cards, businesses can strengthen their brand identity and foster a deeper connection with their customers. Customizable card designs, exclusive rewards programs, and personalized customer experiences all contribute to building customer loyalty and market competitiveness.

For consumers

For individuals, white-label cards bring convenience and security. These cards can be seamlessly integrated into existing payment ecosystems, enabling individuals to make secure transactions while enjoying the benefits and perks offered by the businesses they frequent.

Whether it's earning loyalty points, accessing exclusive discounts, or tracking expenses, white-label cards empower individuals with a seamless and tailored payment experience.

Addressing security and regulatory concerns

As with any financial solution, security and regulatory compliance are paramount. Financial institutions and fintech companies offering white-label card programs implement robust security measures to safeguard cardholder data and prevent fraudulent activities.

Compliance with industry regulations, such as PCI DSS (Payment Card Industry Data Security Standard), ensures that customer data is handled securely. Additionally, data privacy and protection measures are put in place to give cardholders peace of mind when using white-label cards.

Examples of brands that have launched a private label card

Below are two examples of prominent brands that have embraced the white-label card trend in its early stages.

Square

In 2019, Square, a prominent payment processing company, partnered with Marqeta's white-label card processing platform to introduce the Square Card, a business debit card designed specifically for Square's sellers. This strategic move allowed Square's business customers to gain immediate access to funds, reducing their reliance on traditional banking services.

By leveraging Marqeta's solution, Square not only expanded its product portfolio but also strengthened its relationships with its existing customer base.

Shopify

Another notable fintech player, Stripe, offers businesses APIs to issue their own credit cards, debit cards, and prepaid cards. Shopify, a renowned e-commerce platform, utilized Stripe's card issuing services to create the Shopify Balance Card, designed to help businesses start, grow and run their operations.

This card enables over 1 million of Shopify’s merchants to access their earnings instantly through a smart money management tool. The response to the launch was immediate and overwhelmingly positive, as over 100,000 small businesses in the United States embraced Shopify Balance accounts within the first four months.

Through the implementation of Stripe's white-label solution, Shopify added significant value to its merchants, setting itself apart from other e-commerce platforms.

Benefits reported in the case studies

Companies that have implemented the processes to issue white-label cards have reported several potential benefits, including:

Speed to market

Utilizing a white-label solution enables companies to launch card programs more swiftly. These solutions handle critical aspects such as regulatory compliance, technology development, card design, and manufacturing, which can be time-consuming and costly to manage in-house.

Cost reduction

White-label solutions generally require less investment than building a card-issuing infrastructure from scratch. Consequently, companies can save costs associated with development, maintenance, and compliance.

Enhanced customer engagement and retention

By offering a branded payment solution, companies can build stronger customer loyalty. Customers appreciate the convenience and exclusive perks that come with these cards, leading to higher engagement and retention rates.

Creation of new revenue streams

Companies can generate additional revenue streams by offering supplementary services through the card, such as cash-back rewards, premium subscriptions, or lending services.

What businesses should consider before implementing

Implementing a white-label card program requires careful planning and consideration. While the benefits listed above have been reported by companies that have implemented these strategies, these outcomes are not guaranteed. Businesses need to collaborate closely with their chosen white-label card issuer to ensure a smooth implementation process.

This involves outlining the desired features and functionalities, integrating with existing payment infrastructure and systems, and training staff to manage the program effectively. Technical requirements, such as API integrations and data synchronization, should be addressed to ensure a seamless user experience.

Future trends and innovations in white-label card programs

Looking ahead, the future of issuing white-label cards holds great promise, driven by several key factors:

Market demand

The ever-evolving demand for financial services presents a significant opportunity. Regardless of their size or industry, businesses are increasingly seeking to expand their service offerings with payment and financial solutions.

This trend aims to cultivate customer loyalty and explore new revenue streams. As a result, the demand for issuing white-label cards is expected to continue its upward trajectory.

Technological advancements

Fintech advancements, such as the widespread use of APIs and enhanced security measures, are simplifying the adoption of issuing white-label cards for businesses. As technology continues to progress, platforms issuing white-label cards are poised to become even more efficient, flexible, and secure, providing a seamless experience for both businesses and customers.

Developments in financial institutions' regulations

The regulatory landscape in the financial services sector is undergoing significant changes. Regulatory bodies worldwide are displaying a willingness to embrace fintech innovation, with some jurisdictions creating "fintech sandboxes" that facilitate controlled testing of new financial products. Should this trend persist, it could streamline the process for businesses to launch the issuing of white-label card programs.

The future of companies issuing white-label cards faces challenges primarily from increasing competition in the market. With more companies entering the space, businesses may experience pricing pressures and difficulties in standing out from the competition. To succeed, businesses need to differentiate themselves through innovation, personalized experiences, and strong partnerships.

They must also navigate regulatory uncertainties, address cybersecurity risks, and employ strategies to seize opportunities and overcome challenges in this dynamic sector. Continuous monitoring, agile decision-making, and a proactive approach are essential for businesses operating in the white-label card-issuing industry.

Tap’s white-label card solution

Tap’s business portfolio offers a streamlined card-issuing service to businesses of all kinds. Fully accredited, Tap is able to offer its partnering companies Mastercard-powered private cards for a fraction of the cost and time it would take if done directly with the financial services company.

In 2023, Tap provided Bitfinex, the longest-running and most liquid major crypto exchange, with a white-label prepaid card solution. By providing the behind-the-scenes financial infrastructure, the established exchange provided its clients with a unique payment solution and created a new revenue stream for the business.

With the necessary card-issuing license and already-established in-house processing system in place, businesses can quickly create their own white-label cards through Tap’s fiat and cryptocurrency-to-fiat funded card programs and other innovative services.

Conclusion

White-label card issuing is revolutionizing the payment landscape, with its rise signifying a powerful solution in the fintech space, delivering customized payment experiences that cater to the unique needs of businesses and customers.

As technology continues to drive innovation, white-label card programs offer speed to market, cost reduction, enhanced customer engagement, and the creation of new revenue streams. However, businesses should carefully consider implementation factors and address potential challenges, such as regulatory compliance and cybersecurity risks.

The future of private-label credit card issuing appears promising, driven by market demand, technological advancements, and regulatory developments. To capitalize on this trend, businesses must differentiate themselves in a competitive landscape and adapt to evolving market dynamics.

Tap's white-label card solution exemplifies the potential of such programs, providing businesses with streamlined card-issuing services and opening new opportunities for revenue growth. As the industry continues to evolve, white-label card issuing will play a vital role in shaping the future of finance, enabling seamless and tailored payment experiences for businesses and individuals alike.

%201.webp)

Ever wondered how companies launch those shiny credit cards with their logos on them? Let's dive into the world of card programs and break down everything you need to know to launch one successfully.

What's a card program, anyway?

Think of a card program as your business's very own payment ecosystem. It's like having your own mini-bank, but without the vault, technical infrastructure and security guards. Companies use card programs to offer payment solutions to their customers or employees, whether a store credit card, a corporate expense card, or even a digital wallet.

As you’ve probably figured, the financial world is quickly moving away from cash, and card payments are becoming the norm. In fact, they're now as essential to business as having a product, website or social media presence.

Why should your business launch a card program?

Launching a card program isn't just about joining the cool kids' club – it's about creating real business value and heightened exposure. Here's what you can achieve:

Keep your customers coming back

Remember those loyalty cards from your favourite coffee shop? Card programs take that concept to the next level. When customers have your card in their wallet, they're more likely to choose your business over competitors. Plus, every time they pull out that card, they (and everyone else around) see your brand.

Show me the money!

Card programs open up exciting new revenue streams. You can earn from:

- Interest charges (if applicable)

- Transaction fees from merchants

- Annual membership fees

- Premium features and services

- Insights and information on spending habits

Know your customers better

Want to know what your customers really want? Their spending patterns tell the story. Card programs give you valuable insights into customer behaviour, helping you make smarter business decisions.

Understanding the card program ecosystem

Let's break down the key players in this game:

The dream team

Picture a football team where everyone has a crucial role:

- Card networks (like Visa and Mastercard) are the referees, setting the rules

- Card issuers (like Tap) are the coaches, making sure everything runs smoothly

- Processors (overseen by Tap) are the players, handling all the transactions on the field

Open vs. closed loop: what's the difference?

Open-loop and closed-loop cards differ in where they can be used and who processes the transactions. Let’s break this down:

Open-loop cards:

These cards are branded with major payment networks like Visa, Mastercard, or American Express, and are accepted almost anywhere the network is supported, both domestically and internationally.

Examples: Traditional debit or credit cards, prepaid cards branded by major networks.

Pros: Wide acceptance and flexibility.

Cons: May come with fees for international use or transactions.

Closed-loop cards:

Cards issued by a specific retailer or service provider for exclusive use within their ecosystem. These cards are limited to the issuing brand or select partners.

Examples: Store gift cards (like Starbucks or Amazon), fuel cards for specific gas stations.

Pros: Often come with brand-specific rewards or discounts.

Cons: Limited to specific merchants; less flexibility.

Challenges that may arise

Let's be honest – launching a card program isn't all smooth sailing. Here are the hurdles you'll need to jump:

The regulatory maze

Remember trying to read those terms and conditions? Well, card program regulations are even more complex. You'll need to navigate through compliance requirements that would make your head spin.

Security

Fraud is like that uninvited guest at a party – it shows up when you least expect it. You'll need robust security measures to protect your program and your customers.

We’ve designed our card program to handle these niggles, so that you can bypass the challenges and reap the rewards. With a carefully curated experience, we take care of the setup, programming and hardware so that you can focus on the benefits and users.

Closing thoughts

Launching a card program is like building a house – it takes careful planning, the right tools, and expert help. But when done right, it can become a powerful engine for business growth.

Contact us to get started on building a card program tailored to your company. After all, the future of payments is digital, and there's never been a better time to get started.

As cryptocurrencies grow in popularity and adoption, they are fast becoming a household term, a norm if you will. 2021 was a big year for digital assets, with the entire market cap exceeding $3 trillion, institutional investment at its highest, and countries like El Salvador declaring Bitcoin as a legal tender.

On top of this financial institutions around the world are incorporating the asset class into their balance sheets and many are exploring the concept of CBDCs (central bank digital currencies). As digital assets become increasingly integrated into our daily lives and a more popular option for the customer, it's time we harness the power of this nascent technology.

What is crypto as a service (CaaS)?

CaaS stands for Crypto as a Service and is a white-label solution for businesses and financial institutions that want to provide cryptocurrency services to their consumers. CaaS is essentially banking as a service for digital currencies.

CaaS works as a simple plug-and-play system for businesses wanting to provide their customers with digital assets trading, brokerage and custody services. Customers can interact with the services directly, without having to go through the providing company.

This infrastructure can then be used by any platform, from fintech, bank, or financial services businesses, as well as be integrated into mobile applications.

Given that asset managers manage £6.6 trillion in the United Kingdom alone, and that listed company values reach a staggering $93 trillion overall, the potential to offer traditional institutions with crypto cloud services is huge. As banking as a service has taken off, the expectation is that CaaS is going to follow its lead.

How does CaaS work?

The Crypto as a Service solution allows businesses and financial institutions, such as neobanks, to establish new revenue streams by providing a simple means for their customers to engage in crypto payments and the digital assets market. The consumer will be able to:

- Buy and sell digital assets

- Pay for goods and services using their digital wallet

- Securely store cryptocurrencies

The companies providing these services also receive access to highly secure and compliant transaction data monitoring and risk management systems. They will also be responsible for developing the global payments user interface, as CaaS functions as a back-end-only tool.

This ensures that the crypto services are entirely aligned with the brand, and do not appear to be a third party intervention. Through this interface, users can engage in crypto payments and manage crypto funds.

The main company providing Crypto as a Service will be responsible for aspects like KYC/AML, order processing, transaction monitoring, and digital assets custody, relevant to each jurisdiction.

For example, the regulatory requirements will be different in the United States and United Kingdom. This will establish the underlying trust when it comes to new customers engaging in crypto markets and other asset classes. These innovative business models are revolutionising the way in which people around the world can engage in decentralized finance without the risk.

Who would use CaaS?

Crypto as a Service allows regulated central banks and fintech firms to enable their customers to invest, store, trade, and pay in crypto. As these businesses offer cryptocurrency services they too can open new revenue streams.

The technology provider will also allow pension funds and asset managers to invest in Bitcoin and the greater crypto ecosystem on behalf of their clients. This new technology generates increased cash flow for businesses and an increased demographic of users.

Remittance firms will be able to send cross-border payments for a fraction of the cost while gaming companies, e-retailers, and brands can all begin utilizing digital wallets to allow their clients to make purchases in cryptocurrency and an overall improved experience.

CaaS is designed to assist any business looking to innovate their global payments system and enter the global market with crypto services.

Tap's CaaS service

Tap provides businesses with a reliable Crypto as a Service service that allows the company to leverage their already existing infrastructure and incorporate cryptocurrencies. The leading plug-and-play solution easily integrates into the company's hardware and allows any business to tap into a new demographic of crypto-interested customers and level of efficiency.

As we saw a demand for businesses looking to integrate cryptocurrencies into their already established models, these collaborative services were the logical next step.

Through the on-demand Crypto as a Service service, we are able to deliver another layer of crypto services on top of our already established mobile app.

With Tap's high-performance CaaS services, businesses are able to provide their customers with instant access to the crypto sector, with a secure and convenient means of buying, selling, and trading cryptocurrencies as well as access to a yield-generating wallet (a crypto savings account).

While a crypto exchange can take a minimum of two years to build, our CaaS can be implemented in a few weeks. Tap also holds the necessary regulatory compliance and insurance required for companies offering this level of service in the crypto environment.

The integration of these services removes the workload of managing cryptocurrencies and allows your business to focus on more scalable endeavors. No blockchain expertise needed.

To learn more or for more information, please visit this page and contact us should you wish to incorporate this level of innovation into your business.

Closing Thoughts

The greatest obstacle in the path to global crypto adoption is the belief that crypto is too volatile and that it lacks regulation.

While the markets are known to engage in volatile price movements, the understanding is that once regulatory frameworks are imposed this will be curbed.

Government bodies around the world are working to achieve this, as cryptocurrencies have firmly become a permanent feature on the greater financial landscape. As banking as a service (BAAS) has taken off, in light of the rise in crypto adoption, CaaS is the next step forward.

Crypto as a Service aims to provide both access and education to those looking to incorporate this crypto-centered product into their business and lives and integrate themselves into the digital asset ecosystem. Be sure to find a reputable platform that provides CaaS services with an easy-to-integrate API and high regulatory standards.

These crypto-powered products and services will assist the general public with becoming more familiar with the technology while allowing those already interested in harnessing and leveraging their crypto portfolios. After all, cryptocurrencies and the greater asset class are here to stay.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Bitcoin versus gold: it's like asking whether you prefer chocolate or vanilla ice cream, except the stakes feel a bit higher when we're talking about assets that people use to preserve wealth.

This comparison has become one of the most fascinating conversations in modern finance. You'll find everyone from your tech-savvy nephew to seasoned Wall Street veterans weighing in on this debate. The reason it captures so much attention? Both assets serve similar purposes for many people in that they're often viewed as alternatives to traditional currencies and ways to maintain value over time.

Media outlets regularly feature this matchup, and it's not hard to see why. We're essentially watching a clash between the old guard and the new kid on the block, between something you can hold in your hands and something that exists purely in the digital realm.

Similarities between Bitcoin and gold

Before we dive into their differences, let's talk about what these two have in common, and honestly, it's more than you might think.

Both Bitcoin and gold operate like that friend who marches to the beat of their own drum. They don't need permission from central banks or governments to exist. Gold has been doing its own thing for thousands of years, while Bitcoin has been independently chugging along since 2009, free from the control of any single authority.

Here's where it gets interesting: both are naturally scarce. There's only so much gold buried in the earth, and Bitcoin has a built-in limit of 21 million coins. It's like having a limited-edition collectible - the scarcity is part of what makes people pay attention.

This is where the "digital gold" nickname comes from. People started calling Bitcoin this because, like gold, it's rare, it's not controlled by governments, and many view it as a way to store value. It could be gold's tech-savvy cousin who traded in the physical form for a digital existence.

Both assets have also been described as stores of value, meaning people turn to them when they want to preserve their purchasing power over time. The idea is that what you put in today will still hold meaningful value tomorrow.

Differences in utility and form

Gold has been humanity's companion for millennia. You can touch it, wear it, and even use it in your smartphone (yes, there's actually gold in there!). Industries rely on gold for everything from electronics to medical equipment. Central banks stack it in their vaults like a financial security blanket, and jewellers craft it into pieces that mark life's special moments.

Bitcoin, on the other hand, exists purely in the digital world. You can't hold it, but you can send it across the globe faster than you can say "blockchain." It's supported by a network of computers that work together to verify transactions, creating a system that operates 24/7 without taking coffee breaks.

Think of gold as the sturdy oak tree: deeply rooted, physically present, and serving multiple purposes. Bitcoin is more like the wind: you can't see it, but you can feel its effects, and it moves with incredible speed and efficiency.

Historical trends and market behaviour

Let’s take a look at how these assets have behaved over time.

Gold has earned a reputation as the steady friend who shows up when times get tough. During economic uncertainty, gold often sees increased interest as people seek stability.

Bitcoin, meanwhile, is known for its dramatic personality. It can swing from exhilarating highs to stomach-dropping lows, sometimes within the same week. This volatility means Bitcoin can experience significant price movements: some days it feels like it's reaching for the stars, other days it seems to be taking a scenic route through the valleys.

These different personalities mean they each attract different types of attention and serve different roles in people's financial lives.

Reactions to global events

Nothing reveals character quite like a crisis, and both Bitcoin and gold have had their share of testing moments.

During the 2008 financial crisis, gold saw increased demand as people sought alternatives to traditional investments. When the COVID-19 pandemic hit in 2020, gold initially attracted attention as uncertainty gripped global markets.

Bitcoin has had its own unique responses to global events. During certain periods of economic uncertainty, some have turned to Bitcoin as an alternative. However, during market stress, Bitcoin has sometimes moved in unexpected directions, reminding everyone that this digital asset often writes its own rules.

Inflationary periods have also provided interesting case studies. Gold has historically been viewed as a hedge against inflation, while Bitcoin's response has been more varied and unpredictable. The Bitcoin vs gold debate is essentially watching two different strategies play out in real-time.

Adoption and access

The way people access these assets tells its own story about our changing world.

Bitcoin has recently been making headlines with the introduction of exchange-traded funds (ETFs), making it easier for traditional investors to gain exposure without having to figure out digital wallets and private keys.

The digital nature of Bitcoin means you can access it from anywhere with an internet connection. No need to worry about storage space or security guards - just remember your password (and any other safeguards you have in place).

Gold, meanwhile, has the advantage of thousands of years of infrastructure. Banks have vaults, dealers have established networks, and there's a whole industry built around buying, selling, and storing the precious metal.

Risks and transparency

Every asset comes with its own set of considerations, and both Bitcoin and gold have their unique profiles.

Bitcoin operates in a world where regulations are still being written. There are also cybersecurity considerations, as digital assets exist in a realm where hackers and technical glitches can pose risks.

Gold has more traditional concerns. Storage and insurance can be costly, and there's always the physical risk of theft or damage. You need to think about where to keep it safe and how to protect it.

Both assets have their own transparency characteristics. Bitcoin transactions are recorded on a public ledger that anyone can view, while gold transactions often happen through traditional channels with varying levels of public visibility.

Perspectives from experts

The financial world is full of smart people with different opinions, and this topic certainly brings out diverse viewpoints.

Institutions like BlackRock have entered the Bitcoin space with ETF offerings, suggesting growing institutional interest. While the CME Group, which offers futures contracts for both assets, has observed how institutional trading has evolved for each.

These expert perspectives form part of a broader ongoing conversation about how these assets might fit into the modern financial landscape.

What's fascinating is how these viewpoints continue to evolve as both assets mature and as global economic conditions change.

Framing the question: what role might each play?

Rather than asking which is "better," perhaps the more interesting question is: what role might each play in different contexts?

Consider what qualities matter most to you in a store of value. Are you drawn to the tangible nature of physical assets, or does the digital convenience appeal to you? How do you feel about volatility: is it something you can live with, or do you prefer steadier movements?

The answer often depends on individual circumstances, goals, and comfort levels. Some people find comfort in gold's long history, while others are excited by Bitcoin's technological innovation. Some appreciate gold's physical nature, while others value Bitcoin's portability and accessibility.

These aren't questions with universal answers, they're personal considerations that vary from person to person.

Final thoughts

The Bitcoin versus gold discussion continues to evolve as both assets mature and as our understanding of their roles in modern finance deepens. Rather than viewing this as a winner-take-all scenario, perhaps the most interesting approach is to understand how each asset's unique characteristics might serve different purposes in our increasingly complex financial world.

What matters most is understanding your own needs, risk tolerance, and goals before making any financial decisions. After all, the best asset is the one that aligns with your personal circumstances and financial objectives.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started

.webp)

.webp)