Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Heading into the Federal Open Market Committee’s October session, a high-stakes environment is emerging for crypto markets. With the CME Group’s FedWatch Tool showing about a 96 % chance of a 25-basis-point rate cut, the market is eyeing how digital-asset prices might respond.

With macro liquidity on the radar again, these three altcoins stand out as tokens worth tracking under the spotlight of the Fed’s next move.

1. Chainlink (LINK)

Chainlink has been acting under pressure, trading inside a falling wedge, a pattern which sometimes marks the end of a downtrend. Still, some caution flags remain. Over the past month LINK has been trading downwards, though it’s gained some strength in the last week amid renewed buying interest. The key support around $17.08 remains critical, if LINK closes below that, a drop toward $16 could be triggered.

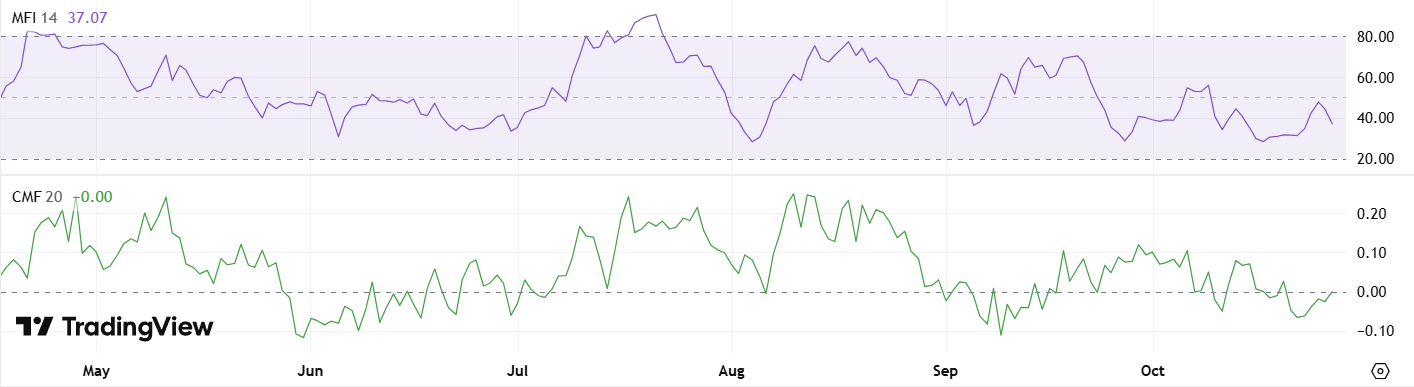

Conversely, diagnostics like the Money Flow Index (MFI) and Chaikin Money Flow (CMF) are showing signs of life, hinting at growing accumulation from larger holders. Combine this with a potentially dovish Fed decision, and Chainlink could be gearing for something special.

2. Dogecoin (DOGE)

Dogecoin enters the FOMC event with a bit of range-bound suspense. Since October 11, DOGE has been oscillating between $0.17 and $0.20, waiting for a trigger. A clean breakout above $0.21 could open the door to a move back towards $0.27, especially if risk-on sentiment returns.

Volume and whale‐level data add texture to the setup. The Wyckoff volume profile recently flipped from seller control to buyer control, suggesting strategic accumulation may be underway. DOGE may be quieting down before a move, a scenario traders should keep front of mind as the Fed’s decision could stir things.

3. Uniswap (UNI)

Uniswap offers compelling recovery stories entering the FOMC session. The token experienced a sharp drop on October 10, with the RSI falling below 30, classic oversold territory. Since then, UNI has rallied from near $6.20 toward $6.50, supported by strong volume on the breakout. Holding above $6.40 may confirm that buying interest is sustained.

For longer-term watchers, UNI’s former highs at $12.15 in August and $18.71 in December set the stage for what could become a multi-leg recovery if macro conditions cooperate. In a market where liquidity expectations hinge on the Fed, Uniswap's rebound has the potential to accelerate, particularly if altcoin capital begins rotating into DeFi infrastructure.

The Verdict

These tokens aren't just compelling because of their individual fundamentals, it's how those fundamentals intersect with the current macro picture. With markets rebounding and rate cuts looking increasingly likely, crypto stands to gain. Lower rates typically fuel risk appetite, unlock liquidity, and drive capital toward speculative plays, creating tailwinds that can supercharge momentum in well positioned altcoins.

That said, the Fed could also surprise with restraint, and even another “standard” 25-basis-point cut may be viewed as lukewarm. In such scenarios, the dollar may strengthen and risk assets could wobble. Traders and investors should therefore approach the market with discipline, track the macro context, and be prepared for either direction.

Why can't a fully compliant, regulated crypto business secure a bank account in 2025?

If you're operating in this space, you already know the answer. You've lived through it. You've submitted the documentation, walked through your AML procedures, and demonstrated your regulatory compliance… only to be rejected. Or worse still, waking up to find your existing account frozen, with no real explanation and no path forward.

This isn't about isolated cases or bad actors being weeded out. It's a pattern of systematic risk aversion that's creating real barriers to growth across the entire sector, and it's throttling one of the most significant financial innovations of our generation.

We're Tap, and we're building the infrastructure that traditional banks refuse to provide.

The Economics Behind the Blockade

Let's examine what's actually driving this exclusion, because it's rarely about the reasons banks cite publicly.

The European Banking Authority has explicitly warned against unwarranted de-risking, noting it causes "severe consequences" and financial exclusion of legitimate customers. Yet the practice continues, driven by two fundamental economic pressures that have nothing to do with your business's actual risk profile.

The compliance cost calculation

Financial crime compliance across EMEA costs organizations approximately $85 billion annually. For traditional banks, the math is simple: serving crypto businesses requires specialized expertise, enhanced monitoring, and ongoing due diligence. As a result, it's cheaper to reject the entire sector than to build the infrastructure needed to serve it properly.

The regulatory capital burden

New EU regulations impose a 1,250% risk weight on unbacked crypto assets such as Bitcoin and Ethereum. This isn't a compliance requirement; it's a capital penalty that makes crypto exposure commercially unviable for traditional institutions, regardless of the actual risk individual clients present.

In the UK, approximately 90% of crypto firm registration applications have been rejected or withdrawn, often citing inadequate AML controls. Whether those assessments are accurate or not, they've created the perfect justification for blanket rejection policies.

The result? Compliant businesses are being treated the same as bad actors; not because of what they've done, but because of the sector they're in.

The Real Cost of Financial Exclusion

Financial exclusion isn’t just an hiccup; it creates tangible operational barriers that ripple through every part of running a crypto business.

Firms that have secured MiCA authorization, built robust compliance programs, and met regulatory requirements can find themselves locked out of basic banking services. Essential fiat on-ramps and off-ramps remain inaccessible, slowing payments, limiting growth, and complicating cash flow management.

Individual cases illustrate the problem vividly as well. Accounts are closed because a business receives a payment from a regulated exchange. Others are dropped with vague references to “commercial decisions,” offering no substantive justification. Founders frequently struggle to separate personal and business finances, as both are considered too risky to serve.

The irony is striking. By refusing service to compliant businesses, traditional banks aren’t mitigating risk; they’re amplifying it. Forced to operate through less regulated channels, these legitimate firms face higher operational and compliance risks, slower transactions, and reduced investor confidence. Over time, this slows innovation, and raises the cost of doing business for firms that are legally and technically sound.

Debanking Beyond Europe: U.S. Crypto Firms Face Their Own Challenges

Limited access to banking services isn’t exclusive to Europe. Leading firms in the U.S. crypto industry have faced numerous challenges regarding the banking blockade. Alex Konanykhin, CEO of Unicoin, described repeated account closures by major banks such as Citi, JPMorgan, and Wells Fargo, noting that access was cut off without explanation. Unicoin’s experience echoes a broader sentiment among crypto executives who argue that traditional financial institutions remain wary of digital asset businesses despite recent policy shifts toward a more pro-innovation stance.

Jesse Powell, co-founder of Kraken, has also spoken out about being dropped by long-time banking partners, calling the practice “financial censorship in disguise.” Caitlin Long, founder of Custodia Bank, recounted how her institution was repeatedly denied services. Gemini founders Tyler Winklevoss and Cameron Winklevoss shared similar frustrations.

These experiences reveal a pattern many in the industry interpret as systemic risk aversion. Even in a market as large and mature as the United States, crypto-focused businesses continue to encounter obstacles in maintaining basic financial infrastructure. The issue became especially acute after the collapse of crypto-friendly banks such as Silvergate, Signature, and Moonstone; institutions that once served as key bridges between fiat and digital assets. Their exit left a gap few traditional players have been willing to fill.

Why Tap Exists

The crypto industry has reached an inflection point. Regulatory frameworks like MiCA are providing clarity. Institutional adoption is accelerating. The technology is proven and tested. But the fundamental infrastructure gap remains: access to business banking that actually works for digital asset businesses.

This is precisely why we built Tap for Business.

We provide business accounts with dedicated EUR and GBP IBANs specifically designed for crypto companies and businesses that interact with digital assets. This isn't a side offering or an experiment, it's our core focus.

Our approach is straightforward

We built our infrastructure for this sector

Rather than retrofitting traditional banking systems to reluctantly accommodate crypto businesses, we designed our compliance, monitoring, and operational frameworks specifically for digital asset flows. This means we can properly assess and serve businesses that others automatically reject.

We price in the actual risk, not the sector

Blanket rejection policies exist because they're cheap and simple. We take a different approach: evaluating each business based on their actual controls, compliance posture, and operational reality. It costs more, but it's the only way to serve this market properly.

We're committed to sector normalization

Every time a legitimate crypto business is forced to operate without proper banking infrastructure, it reinforces outdated stigmas. By providing professional financial services to compliant businesses, we're helping demonstrate what should be obvious: crypto companies can and should be served by the financial system.

It isn't about taking on risks that others won't. It's about properly evaluating risks that others refuse to understand.

Moving Forward

The industry is maturing. Regulatory clarity is emerging. Institutional adoption is accelerating. But you can't put your business on hold while traditional banks slowly catch up to reality.

That's not sustainable in the long run.

As a firm, you shouldn't have to beg for a bank account. You shouldn't have to downplay your crypto operations just to access basic financial services. And you certainly shouldn't have to accept that systematic exclusion with little to no explanation other than “It’s just how things are."

The crypto sector is building the future of finance. Your banking partner should believe in that future too. If you're ready to work with financial infrastructure built for your business, not in spite of it, here we are.

Talk today with one of our experts to understand how we can help your business access the banking infrastructure you need.

Tether (USDT) consistently ranks among the top cryptocurrencies by market cap and regularly posts the highest daily trading volume in the entire crypto market. It's become an essential tool for traders worldwide.

While critics point to crypto's volatility as a weakness, stablecoins like Tether offer a different value proposition: the speed and accessibility of digital currency with the stability of the US dollar.

What Is Tether (USDT)?

Tether (USDT) is a widely used stablecoin, a type of cryptocurrency designed to maintain a fixed value by being pegged to a fiat currency, in this case the United States dollar. Unlike Bitcoin, whose price fluctuates based on supply and market demand, USDT is meant to stay close to $1 USD, providing stability in otherwise volatile markets.

Originally launched in 2014 under the name Realcoin, Tether was rebranded and built to act as a bridge between fiat money and digital assets. It enables traders, exchanges, and users to move value quickly, reliably, and with less exposure to cryptocurrency volatility.

Because of its stability and liquidity, USDT is often used as a “parking spot” in crypto trading, when the market is unstable, investors might convert volatile tokens into USDT to preserve value without leaving the crypto ecosystem entirely.

As of 2025, Tether is consistently ranked among the top 3 cryptocurrencies by market capitalization, and its daily trading volume often surpasses that of other major tokens.

In this article, we’ll dig into how USDT works, why people use it, the risks and controversies, and how to buy and use it responsibly.

Who Created Tether?

As mentioned above Tether was initially called Realcoin when it was launched in 2014 and was created by Bitcoin investor Brock Pierce, entrepreneur Reeve Collins and software developer, Craig Sellars. It later changed its name to USTether, eventually settling on USDT.

All three co-founders have profound experience within the crypto industry, each co-founding and actively involved in several cryptocurrency and blockchain projects.

The business has also created a number of other stablecoins solving the volatility problem across numerous markets, notably a Euro-pegged Tether coin (EURT), a Chinese Yuan-pegged Tether coin (CNHT), and a gold-pegged Tether coin (XAUT).

How Does USDT Work?

Reserve Backing & Peg Mechanism

To maintain its peg (i.e. USDT = 1 USD), Tether claims each USDT in circulation is backed by reserves. These reserves include cash, cash equivalents, repos, commercial paper, U.S. Treasury bills, and other short-term assets.

In recent attestations, Tether reports that about 81.5% of its reserves are in cash and U.S. Treasuries, with smaller portions in other assets.

When demand for USDT increases, Tether issues (mints) new tokens; when demand falls, tokens can be destroyed (burned) to reduce supply. This dynamic supply adjustment helps keep the exchange rate close to 1 USD.

Blockchain Infrastructure & Multi-Chain Support

Tether does not have its own dedicated blockchain. Instead, USDT operates as a token on various blockchains, including Ethereum (ERC-20), TRON (TRC-20), Solana, Algorand, EOS, and more. This multi-chain deployment enhances accessibility and interoperability.

Transactions are handled by the underlying networks: you need to send USDT on the same chain type, or bridges/wrapping mechanisms if moving across chains. Mistakes sending USDT on mismatched chains can lead to permanent loss.

Minting, Burning & Peg Maintenance

Tether monitors supply vs demand. If too many redemptions occur, USDT supply contracts; if demand surges, new tokens are minted. The reserve assets are used to maintain liquidity for redemptions and guarantee that each USDT has backing.

To preserve the peg, Tether also relies on arbitrage: if USDT drifts slightly above $1, there’s an incentive to redeem or sell, and if it dips below, it encourages buyers. Combined with market forces and reserve backing, this helps anchor the price.

Why Do People Use USDT?

- Users often convert volatile crypto into USDT during turbulent markets to protect value without exiting the digital asset ecosystem.

- USDT is accepted in a vast array of exchanges and trading pairs, making it a preferred medium of exchange.

- Because it behaves like USD but lives on the blockchain, USDT can move quickly across borders without traditional banking friction.

- Many decentralized finance platforms use USDT as a base asset for lending, yield farming, and stable lending markets.

- In regions with unstable local currencies, USDT often provides a stable alternative for savings, payments, or transfers.

Is USDT Safe? Risks & Concerns

While USDT offers utility, it also attracts scrutiny and criticism.

Centralization & Counterparty Risk

Tether Limited acts as the central issuer. That means users must trust that the company actually holds sufficient reserves and will honor redemptions. This centralized model contrasts with fully decentralized cryptocurrencies.

Transparency & Reserve Audits

Tether publishes regular attestation reports, but has yet to provide a full independent audit by a Big Four firm in many periods.

In 2025, Tether announced it is in talks with a Big Four accounting firm to pursue a full audit.

Historical controversies include a fine by the New York Attorney General in 2021 over misrepresentation about reserve backing.

Regulatory & Legal Uncertainty

Stablecoins face evolving regulatory environments globally. Some jurisdictions may impose stricter rules, reserve requirements, or classification of USDT as a regulated instrument.

Reserve Composition & Liquidity Risk

Though cash and Treasury bills dominate reported reserves, some portion may be in less liquid assets. In times of mass redemptions, liquidity risk may strain backing.

Price Deviations & Peg Risk

While USDT is generally stable, in extreme market stress, the peg might deviate briefly. Arbitrage, reserve liquidity, and market confidence are key to restoring balance.

How to Buy, Sell & Use USDT

Buying USDT

You can acquire USDT on most major cryptocurrency exchanges (e.g. Binance, Coinbase, Kraken). Many platforms allow purchase via fiat currencies (bank transfer, card) or by trading other crypto for USDT.

In the Tap app, you can buy USDT and have it stored in your wallet, making it easier to manage alongside your other assets.

Storing USDT

Store USDT in wallets that support the relevant chain (ERC-20, TRC-20, etc.). Hardware wallets like Ledger or Trezor support ERC-20 USDT (via Ethereum).

Converting USDT to Fiat

On many exchanges, you can sell USDT for fiat (USD, GBP, EUR) and withdraw to your bank.

Using USDT for Payments or Transfers

Some platforms accept USDT as payment. You can also transfer USDT peer-to-peer across wallets quickly and globally, with network transaction fees (gas) depending on the chain used.

USDT Reserve Composition & Transparency

Tether provides quarterly transparency reports detailing reserve breakdowns, but falls short of full independent audits historically.

As of recent attestations, ~81.5% of reserves are held in cash & U.S. Treasuries, while smaller portions are in other assets.

Tether held over $127 billion in U.S. Treasuries as of Q2 2025.

Reserve composition evolves over time; Tether has reduced reliance on commercial paper and shifted toward safer instruments.

While attestations improve transparency, critics assert a full, external audit would bolster confidence.

USDT vs Other Stablecoins

While USDT remains dominant, several alternatives exist:

- USDC: Known for stricter auditing and regulatory compliance

- DAI: Decentralized, over-collateralized stablecoin

USDT held around 62–63% of the stablecoin market share as of 2025. It maintains dominance due to liquidity, widespread adoption, and support across exchanges and DeFi. However, users might opt for alternatives for perceived transparency or regulatory comfort.

Investment Considerations

USDT is not designed as a growth asset; its value is meant to remain stable. Its role is more of a utility token: liquidity provider, trading medium, and stability anchor.

That said, you can earn yield on USDT via lending platforms, DeFi protocols, or savings accounts, though returns may be modest and come with risk.

Consider that holding large amounts of USDT long-term yields little upside, and inflation or counterparty risk may erode value.

Always balance USDT exposure within a diversified strategy, rather than viewing it as an investment vehicle.

Conclusion

Tether (USDT) plays a critical role as the most widely used stablecoin in crypto, offering a digital dollar alternative that combines stability with blockchain utility. While its popularity and liquidity make it indispensable in trading and DeFi, it operates under risks tied to transparency, centralization, and regulatory shifts.

If using USDT, treat it as a tool for stability and liquidity, not speculative growth. Used wisely, USDT helps you move between crypto and fiat more fluidly, manage volatility, and access global financial systems with fewer intermediaries.

What is Return on Investment?

Return on investment is one of the most common measures of profitability and performance in both business and personal finance. It shows how much gain or loss you’ve made on an investment compared to its original cost.

In simple terms, ROI tells you whether your money has worked for you or not. Whether you’re investing in stocks, property, a business project, or a marketing campaign, ROI helps you compare how efficiently different investments use your capital. It’s widely used by companies to evaluate new projects, advertising performance, or expansion opportunities, and by individuals to assess savings, portfolios, or real estate ventures.

A clear ROI provides insight into the effectiveness of a decision and guides future strategies, whether the goal is increasing profit, cutting costs, or improving financial performance.

All investments, including stocks, bonds, real estate, and small businesses, come with the goal of making more money than you put in. The money you earn over and above your initial investment is called profit. As you’ll learn later, profit and ROI aren’t the same thing. When discussing investment profitability, however, people often use ROI. This metric expresses the amount of net profit one earned as a percentage of what the initial investment was.

ROI can help you assess if buying property or investing in a business is worth it. It also helps companies determine the value of adding new products, building more facilities, acquiring other businesses, advertising campaigns, etc.

In other terms, it's a way to compare different investments in order to figure out which ones are worth pursuing. For example, you could calculate ROI to decide whether selling one stock and buying another would be a good idea.

While there is no limit to a return on investment theoretically, in practice, no investment is guaranteed to have any return. If your ROI is negative, it means you not only failed to make a profit but also lost some of your original investment. The worst possible outcome would be -100% ROI, meaning you completely lost your initial investment. An ROI of 0% signifies that you at least recovered the money you put in, but gained nothing beyond that.

While ROI is often used as a marker of profitability, it isn't foolproof. There are several limitations to calculating ROI as your only measure which include the time frame in which you will earn back your investment, inflation rates, how risky a venture is, and additional maintenance costs that may be incurred.

ROI Terminology

Before we dive in, let's first cover some basic terminology.

Net profit or net income

Net profit is the amount of money left over after all operating costs, such as the cost of transaction costs or maintenance costs, and other expenses have been accounted for and subtracted from the total revenue. It is used to measure profitability. Net profit can also be called net income, net earnings, or the bottom line.

Total cost of investment

This figure will look at the amount of money invested in a particular investment.

How to Calculate ROI: The ROI Formula

The ROI formula is a simple equation that looks at the price change of the asset and the net profits (the initial cost of the investment minus its value when you sell it). When calculating ROI you would use this formula:

ROI = (Net Profit / Total Cost of Investment) x 100

To factor trading costs into your ROI figure, you'll use:

ROI = ((Value of Investment - Cost of Investment – Associated Costs) / Cost of Investment) x 100

As an example, let's say you buy 5 shares of $100 each in Tesla, equating to $500. You sell them a year later for $150 each, equating to $750. Let's say you paid $5 commission on each trade, costing you $25 in trading fees.

ROI = (($750 - $500 - $25) / $500) x 100 = 45%

This means that you made a 45% return on investment on that particular investment.

What is a Strong ROI

A "good" return on investment is any number above 0, as this means you made some profit. However, the ideal ROI should be higher than what you could've earned had you chosen another investment (the next best thing).

To compare this, investors often compare their earnings to what they could've made on the broader stock market or in a high-yield savings account. Using the S&P 500 as a control, over the past four decades it has made gains of around 7% (after inflation). An ROI is generally considered to be a strong one if it beats the stock market in the long term.

However, risk and return are directly linked. High ROIs often come with higher volatility or uncertainty. Property, stocks, and startups may yield better returns but can also result in losses. Safer investments, like savings accounts or government bonds, tend to offer lower but more predictable ROIs. Moreover, it's always important to note that past performance does not equate to future results.

Therefore, a strong ROI will vary depending on the investment's level of risk, your goals, and how much risk you're willing to take.

ROI vs Profits

ROI and profit are related but not identical. Profit is the absolute amount of money gained after costs, while ROI expresses that profit as a percentage of the original investment.

For instance, a $1,000 profit might sound good, but if it came from a $100,000 investment, the ROI is just 1%. That’s why ROI is a more useful metric for comparing opportunities or assessing performance across projects.

Use ROI for decision-making and benchmarking; use profit for understanding absolute earnings.

Benefits of Using ROI

Return on investment (ROI) is widely valued for its clarity and practicality. It allows both individuals and businesses to assess whether their financial choices are creating real value, providing a clear, quantitative foundation for better decision-making. It remains one of the simplest and most effective tools for:

- Comparing investments as it standardises performance across asset types.

- Guiding decisions, where it is used to prioritise projects or marketing strategies.

- Measuring performance by tracking financial efficiency over time.

- Allocating resources by showing where capital yields the best results.

Its simplicity and flexibility make it an essential concept in finance, marketing, and project management alike.

Where the ROI Formula Falls Short

The main limitation of using this return on investment ROI formula as a marker of success is that it doesn't show how long it took to earn the money back. When comparing various investments, the time it takes to mature will have a significant impact on the profits you could earn.

For instance, a year loan versus a bond held for five years versus a property held for 10 years will all have varying ROIs once you've established how long it will take to earn the specified ROIs.

In this scenario, the ROI calculations mentioned above skimp on the full story. It also doesn't account for risk. For instance, the loan repayments could be delayed or the property market might be in a slump, all affecting the potential profits earnable.

With many variables, it becomes harder to predict what the exact ROI calculation on an investment will be, so be sure to factor this in when using the return on investment ROI formula to determine how attractive an investment opportunity or business venture is.

ROI Alternatives

Although the return on investment doesn't consider how long you keep an asset, it's essential to compare the ROI of investments held for comparable lengths of time as a more clear performance measure. If that's not possible, there are a few other options.

Average Annual Return

Also known as annualized return on investment, this adjusts the ROI formula to factor in the timing. Here you would divide the ROI by the number of years you hold the asset.

Compound Annual Growth Rate (CAGR)

This option is more complicated but yields more accurate results as it factors in compound interest generated over time.

Internal Rate of Return (IRR)

This measure factors in the notion that profits earned earlier outway the same profits earned later, taking into account interest that could've been earned and factors like inflation. This equation is quite complicated but there are online calculators one can use.

Conclusion

A return on investment (ROI) is a formula used to calculate the net profit or loss of an investment in percentage form. The ROI calculation can present valuable information when investing capital or determining profitability ratios. The ROI equation looks at the initial value of one investment and determines the financial return. A negative ROI indicates that the investment returns were lower than the investment cost.

Since the advent of cryptocurrencies in 2009, the world has seen a substantial shift in the way that people transact and manage their money online. The first cryptocurrency, Bitcoin, sparked a wave that has impacted almost every corner of the globe, significantly shifting the financial landscape as we know it. Let’s explore how crypto is expanding economic freedom on a global scale.

What is economic freedom?

Before we evaluate how this $2 trillion industry is contributing to financial liberation, let’s first establish what economic freedom is. Explained simply, the term refers to measures that grant users the freedom to manage their money, property, and labour in each country, which is then compared globally.

More accurately, the measure of economic freedom is determined by using the Index of Economic Freedom, which weighs up 12 factors contributing to a country’s overall measure. This is broken down into 4 categories, each carrying varying subcategories, such as market openness measuring a country’s trade, financial and investment freedom. The others are regulatory efficiency, rules of law, and government size, each with its own subcategories.

This index was first published in 1995 by The Heritage Foundation and The Wall Street Journal and is used around the world today. This year, Singapore, New Zealand, Australia, Switzerland, and Ireland have ranked as the most financially free countries in the world.

Crypto and economic freedom

Cryptocurrencies were first established to provide an alternative monetary solution to the global financial crisis that sent the world into disarray in 2007. Satoshi Nakamoto created the new age payment system to empower individuals to hold control over their own finances, allowing them to manage and transact their money without the control of an authoritarian entity. For the first time in history, people were able to send money overseas without incurring the usual costly and time-consuming setbacks incurred with regular, global fiat transactions.

Due to the decentralized nature in which they are run, people are responsible for managing their own crypto wallets and specialised users on the network positioned across the globe are responsible for verifying and executing transactions. After Bitcoin entered the scene a significant number of new cryptocurrencies have been launched, over 12,000 at the time of writing. While some maintain the same “medium of exchange” model, many new cryptocurrencies have emerged providing alternative solutions to the industry.

Ethereum, the world’s second-biggest cryptocurrency, for example, provides a platform on which developers can create their own decentralized apps and cryptocurrencies, while other cryptocurrencies revolve around faster transaction times, cloud storage and private transactions. Each of these projects utilizes a blockchain network that was designed to improve and innovate the crypto and blockchain space.

Spanning beyond government control and lengthy paperwork, cryptocurrencies are able to provide a global currency that operates entirely online and is not confirmed to the borders of a country. Cryptocurrencies are global, accessible 24/7 and cannot be frozen in accounts.

How crypto is driving economic freedom

Requiring only an internet connection and start-up funds, Bitcoin (and cryptocurrencies in general) allows anyone around the world to create a wallet and start trading. One doesn’t need access to a large bank branch or lengthy paperwork, one simply needs an internet connection and a smartphone.

Curling back to the factors that contribute to economic freedom, cryptocurrencies are able to seamlessly check six of twelve of the categories of the Index of Economic Freedom through their innate properties.

- Trade Freedom [Market Openness]

- Financial Freedom [Market Openness]

- Business Freedom [Regulatory Efficiency]

- Labour Freedom [Regulatory Efficiency]

- Monetary Freedom [Regulatory Efficiency]

- Property Rights [Rule Of Law]

The remaining categories however revolve around the governments running the nations in question, particularly the rule of law and government size categories. Nevertheless, cryptocurrencies can still assist in creating better-functioning economies and provide the technology that allows for a more open and free financial system.

A free and open financial system

As cryptocurrencies remove the barriers of borders, they allow people to transact their money in the same way that they communicate with each other (through the internet). As the digital age continues to evolve, we are likely to continue seeing a significant increase in the level of economic freedom that crypto provides to users around the world, empowering both the individual and the nation.

Bitcoin and other cryptocurrencies are all about decentralised, worldwide, financial independence and liberty. Cryptocurrencies are borderless, censorship-resistant digital currencies that can be used by anybody with internet access.

As a result, crypto, at least in principle, appears to be the perfect solution for international travellers or "digital nomads." With the added advantage of having the Tap app, users can instantly and seamlessly use their cryptocurrencies as they would regular fiat currencies when travelling around.

With the growth rate of blockchain technology and crypto adoption increasing, it's only natural that we're seeing more options to spend and travel the world using cryptocurrency.

In this article, we'll look at a variety of different ways to spend your crypto while travelling with Tap and how to spend seamlessly with your Tap card. We will explore why people choose to use their crypto to travel and how the exploding $1 trillion travel market is important for the cryptocurrency industry.

Entirely Cashless

The beauty of travelling with crypto is that it is entirely cashless. You won't have to worry about dealing with foreign currency exchanges when entering or leaving a different country as all of your money is kept digitally online in your app.

With the Tap card, users can use their crypto balances to load their card and freely swipe away worldwide. The card allows for seamless payments at millions of merchants around the world, with the merchant none the wiser.

The option to upgrade to more premium accounts allows you to reduce or completely eliminate any FX fees. Get empowered and enjoy the best out of your money wherever you go.

Reduces Risk

Instead of being a target for muggings looking to steal cash, being entirely digital bypasses this risk.

Accessible

Should something happen at home you can easily and quickly send funds back. Operating 24/7 and only requiring an internet connection, sending money back home can be completed at a moment's notice. Send funds to your friends and family via crypto or fiat for free on their Tap account.

Discounts

Last but not least, many companies offer discounts to users paying with cryptocurrencies. From travel to retail, and everything in between, users can enjoy added discounts just by utilising crypto.

Should an event arise that you do need cash, users can easily withdraw cash from a regular ATM using their Tap card. Paying significantly lower fees than you would with your standard bank card, the Tap card allows you to seamlessly integrate into the foreign country with peace of mind.

How To Travel Abroad With Tap

This is the ultimate crypto vacation guide showing you how to buy everything that you might need through the Tap app for that epic crypto vacation abroad.

Flights

CheapAir.com was the first US online travel agency to open its doors to crypto, getting into the game as early as 2013. The company currently allows holidaymakers to make payments using Bitcoin, Litecoin, Bitcoin Cash and Dash.

In 2020, Travala and Expedia merged to give users access to millions of hotels and villas worldwide payable in over 30 popular types of cryptocurrencies. There is also Destinia.com in Spain, airBaltic in Latvia, Surf Air in the US, and Peach Aviation in Japan.

Conveniently buy everything you need with your Tap app by scanning the company’s QR code and confirming the transaction. Alternatively, you can make online purchases using your Tap card.

Accommodation

Travala, CheapAir.com and Destinia all allow users to book flights and accommodation in one smooth transaction. On Destinia look out for the GoCoin merchant plugin.

Booking.com has partnered with flight planner, A Bit Sky, to provide a location with both flight and accommodation options.

Savvy accommodation-seekers can look to Airbnb-style crypto startups like 99Flats in India or CryptoCribs on Reddit, or head over to XcelTrip,a decentralized travel ecosystem, which provides access to 400 airlines and 1.5 million hotels.

Food and Drink

CoinMap is an app for anyone and everyone wanting to find crypto-friendly companies. Felix Weis, as well as numerous other cryptocurrency influencers, has credited CoinMap with being the saviour for finding the closest cafe, bar, or restaurant that accepts Bitcoin, including international chains such as Subway and local providers who use crypto merchants. Say goodbye to walking around with boatloads of cash and just take your Tap app along instead.

Holidaymakers can also look to using crypto to buy a gift card which can be purchased online through Gyft or eGifter, with eGifter offering a 5% discount for purchases made with Bitcoin. eGifter offers gift cards to restaurants like Papa John, Taco Bell, Dunkin’ Donuts, TGI Fridays, UberEats and more.

Getting Around

Expedia, A Bit Sky, Destinia, and CheapAir all offer access to transfers or car rentals in their services, while Gyft and eGifter offer Uber vouchers. There is also SpendBitcoin.com, which locates different crypto-accepting services in an area, simply chose the car filter option.

Things To Do

Again, Gyft and eGifter provide access to options like Groupon where you can find local activities on offer, or head to purse.io for any last-minute Amazon purchases (snorkel, anyone?).

Travel The Tap Way

Both the Tap card and the Tap app can provide a seamless and cost-effective solution to using both fiat and cryptocurrencies when travelling. Simply load your wallet with crypto and fiat currencies, and pay directly from the app or use the card to pay at millions of merchants around the world. Say hello to easy travel and plenty of discounts.

With a range of coins on offer and an integrated smart engine that ensures the best possible prices in real time, travelling with cryptocurrencies and Tap is as smooth a ride as it gets.

With a range of coins on offer and an integrated smart router, Tap lets you store and manage your digital assets wherever, whenever. There are no border delays or inconvenient payment processes to worry about while travelling with crypto only speed and convenience. Tap is as seamless a journey as it gets.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started

.webp)

.webp)