Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

.png)

Imagine a world where email providers couldn’t communicate. Gmail users couldn’t message Outlook users, and Yahoo Mail existed in complete isolation. This is essentially the state of today’s blockchain ecosystem: fragmented networks operating in silos, unable to share data or value efficiently. This is where Quant Network comes in.

Made up of the Overledger blockchain operating system and QNT token, the goal of the Quant Network is to allow multiple blockchains to work together and to give more flexibility when it comes to linking different global networks, services, and chains. With an impressive founder and resilience to the bear market, QNT has made a considerable impression in the industry.

What Is The Quant Network?

The Quant Network was designed to connect blockchains and networks on a global scale, prioritising interoperability and trust functions between them using the Overledger operating system, the first OS built for blockchains.

The Overledger network acts as the backbone of the project and is not a blockchain but rather an Application Programming Interface (API) gateway that allows developers to build decentralised multi-chain applications (known as Mapps) and bridges the gap between various blockchain networks.

The Quant project believes that this technology will be the foundation on which the future digital economy will be built. In light of this, the network has been working with central banks in the US and UK to build Central Bank Digital Currencies (CDBCs).

Founded in 2015 the platform officially launched in 2018 following a successful ICO earlier that year. July 2020 marks the launch of the world’s first blockchain operating system in July 2020, Version 1.0.

Who Created The Quant Network?

Quant was founded by Gilbert Verdian, a cybersecurity expert who has held government-level positions around the world. These positions include the UK Treasury, the Australian Department of Health, and the US Federal Reserve, and private sector roles at HSBC Bank, Mastercard’s Vocalink, BP, and more.

With over two decades of experience in the cybersecurity space, Verdian learned the power that blockchain technology holds when it comes to solving a plethora of security problems related to the exchange of digital assets and information on a global level.

Verdian sits as the chair of the UK Blockchain and Distributed Ledger Technology committee and is a member of the EU’s Blockchain Observatory and the Federal Reserve.

In 2017, Colin Paterson and Paolo Tasca joined the project as co-founders, each bringing their own impressive experience. Paterson, acting Chief Technology Officer, is a cybersecurity expert having worked with Deutsche Bank and Vocalink and acted as the chief information officer of NSW Ambulance, the CISO of eHealth NSW, and the security lead of the Ministry of Justice, UK, prior to joining the project.

Tasca, Chief Strategist, serves as the Executive Director of the University College London (UCL) Centre for Blockchain Technologies, Executive Board Member of the DEC Institute, and as Co-Chair of the Hedera Treasury Management and Token Economics Committee.

How Does The Quant Network Work?

The Overledger Operating System

Quant’s technology revolves around Overledger, which functions as a distributed ledger gateway rather than another blockchain. This distinction is key: Overledger doesn’t process transactions itself but rather facilitates communication between different blockchains that do. The system uses a four-layer architecture:

- Transaction Layer: This foundational layer connects to various blockchains like Bitcoin, Ethereum, Ripple, Hyperledger Fabric, and R3 Corda. It reads and writes transactions across these different ledgers without interfering with their native operations.

- Messaging Layer: Acting as the communication hub, this layer verifies, orders, and shares transaction data between connected blockchains. It ensures that information moving between networks maintains integrity and security.

- Filtering & Ordering Layer: This layer validates off-chain messages and filters out data so that only relevant information reaches the application.

- Application Layer: Here, developers build multi-chain decentralized applications (called Mapps or mDapps) that can operate across multiple blockchains simultaneously. This layer provides APIs and interfaces that simplify cross-chain development.

Multi-Chain Applications (Mapps)

Traditional dApps run on a single platform (like Ethereum or Polkadot), limiting their utility and user base. Mapps break these barriers.

For example, a Mapp could use Bitcoin for value storage, Ethereum for smart contract execution, and Hyperledger for regulated transaction records, all within a single application. This flexibility allows businesses to choose the best blockchain for each specific function rather than compromising with a one-size-fits-all solution.

APIs and Development

Quant prioritizes usability for enterprise adoption. The platform offers standardized APIs that allow developers to connect existing business processes and infrastructure to multiple blockchains with minimal coding. The drag-and-drop interface for creating smart contracts and tokens (using Quant’s QRC-20 standard, similar to Ethereum’s ERC-20) means even teams with limited blockchain experience can operate across multiple chains.

This approach significantly reduces the cost and time required to implement blockchain technology, addressing what has been a major obstacle.

What Makes Quant Different?

Blockchain Agnosticism

Overledger connects a wide array of public and private blockchains through a single API, without requiring them to adopt new protocols or compromise their security models. This feature is particularly valuable for financial institutions and corporations with existing blockchain investments.

Business-First Design

Quant was built from the ground up for enterprise adoption, with features addressing business needs: regulatory compliance, data security, integration with legacy systems, and scalability on a global scale. The team’s background in financial services and government projects informs these design choices.

Production-Ready Technology

While many interoperability projects remain in development, Quant’s technology is already deployed in production environments. Partnerships with central banks, healthcare sector organizations, and financial institutions demonstrate real-world utility beyond theoretical innovation.

Patent-Protected Innovation

Quant holds multiple patents for its Overledger technology, providing intellectual property protection and potential competitive barriers. This factor may appeal to institutional investors concerned about sustainable competitive advantages.

What Is QNT?

QNT is an ERC-20 token that is used to access the Overledger network and validate transactions on the network. There is a maximum supply of 14.88 million QNT tokens, of which over 81% are in circulation, at the time of writing.

All product users, developers, and gateway operators are required to purchase annual licences, used to maintain platform efficiency. These licence fees are converted to QNT and locked up in the Quant treasury. If a user does not renew their licence, they forfeit their fees, discouraging them from dumping tokens on the market if the price increases.

Transaction fees for using Overledger are paid in QNT to gateway operators. Since its launch in August 2018, QNT has seen consistent price growth and activity on the network.

Where Can I Get QNT?

You can trade QNT on the Tap app, one of the most secure solutions in the crypto space as being a fully regulated crypto fintech. Using a range of cryptocurrencies and fiat currencies on offer, users can exchange any of the supported currencies to build a healthy portfolio that can be safely stored in its unique wallet linked to your account.

Ever sent ETH and wondered where it went? Interacted with a smart contract and want to verify if it worked? This is where Etherscan comes in.

Etherscan is the most widely used tool for exploring and verifying activity on the Ethereum blockchain. It allows you to track financial transactions, inspect smart contracts, monitor wallets, and analyze on-chain data in real time, all through a simple web page.

In a decentralized system where no single organization controls the ledger, a tool like Etherscan plays a critical role in transparency, trust, and verification. Instead of relying on intermediaries, you can independently confirm payments, balances, contract interactions, and network fees.

So, join us. We’ll learn what Etherscan is, how it works, and how to use it step by step. By the end, you’ll be able to navigate Ethereum data confidently, whether you’re a complete newbie, an investor, or simply curious about Web3.

What Is Etherscan?

Etherscan is a blockchain explorer and analytics platform built specifically for the Ethereum network. Its primary function is to retrieve, organize, and display public blockchain data in a way that end users can easily understand and verify.

Think of Etherscan as a search engine for Ethereum. Instead of indexing web content on the internet like Google, it indexes blockchain data such as transaction records, wallet balances, smart contracts, tokens, and non-fungible tokens. Every action recorded on Ethereum’s distributed ledger can be searched, viewed, and validated through Etherscan.

A common misconception is that Etherscan is a wallet or a payment service. It is not. Etherscan does not store cryptocurrency, manage private keys, process payments, or execute trades. It is strictly a read-only interface that displays information already stored on the blockchain.

The platform was founded by Matthew Tan and is headquartered in Kuala Lumpur, Malaysia. Over time, it has become the most trusted and widely used Ethereum block explorer due to its accuracy, speed, usability, and depth of data.

Etherscan is free to use and does not require account creation for basic features. Advanced users, developers, and programmers can optionally access APIs, notification systems, and analytics tools.

What Is a Block Explorer?

A block explorer is application software that visualizes blockchain data. Because blockchains are decentralized and lack a central dashboard, explorers act as the main interface between raw blockchain data and human users.

In simple terms, a block explorer is like Google for blockchains. Instead of searching articles or websites, you search transaction hashes, wallet addresses, blocks, or smart contracts. The software retrieves this information from the network and presents it in a structured, point-and-click format.

Every major blockchain, including Ethereum and Bitcoin, has one or more block explorers. Without them, verifying transactions, analyzing market activity, or learning how blockchain technology works would be significantly more difficult.

How Does Etherscan Work?

Etherscan operates through a three-step technical process, simplified for accessibility.

First, data retrieval. Etherscan connects to Ethereum nodes using remote procedure calls and communication protocols. These nodes maintain copies of the blockchain ledger and continuously update with new blocks and transactions through peer-to-peer networking.

Second, data organization. All retrieved transaction data, contract interactions, token transfers, and balance changes are indexed into a structured database. This allows fast information retrieval, statistical analysis, and historical tracking across millions of records.

Third, data presentation. Etherscan displays this information through a clean user interface optimized for web browsers and mobile devices. Tables, charts, timestamps, calendar dates, and analytics tools help users interpret complex data accurately.

Importantly, Etherscan does not control Ethereum or any other cryptocurrency, validate transactions, or influence mining. It simply reads the ledger and presents it in near real-time. No permission, consent, or account is required to view public data.

What Can You Do With Etherscan?

Track Ethereum Transactions

Every Ethereum payment generates a unique transaction hash, also known as a TXID. By pasting this identifier into Etherscan, you can track the transaction’s status, confirmations, value, gas fee, and timestamp.

This is especially useful for verifying payments, checking failed transactions, monitoring settlement speed, and confirming whether funds were successfully transferred.

Monitor Wallet Addresses

Etherscan allows you to analyze any public wallet address. You can view ETH balances, transaction history, token holdings, NFT assets, and incoming or outgoing payments.

This feature is commonly used for portfolio tracking, investment research, surveillance of large holders, and due diligence on projects and organizations.

Explore Smart Contracts

Smart contracts power decentralized applications, decentralized finance platforms, swaps, and tokenization systems. Etherscan lets you inspect verified contract code, view functions, validate creators, and analyze contract interactions.

For developers and advanced users, this helps with verification, debugging, and understanding how application software behaves on-chain.

Check Gas Prices

Ethereum uses gas fees to process transactions. Etherscan’s gas tracker shows real-time gas prices, historical averages, and estimated costs using weighted arithmetic mean calculations.

This helps users time transactions during periods of lower network congestion, reducing costs.

Analyze Tokens and NFTs

Etherscan provides detailed data on ERC-20 tokens and non-fungible tokens. You can view market value, supply and demand metrics, transfer statistics, holder distribution, and contract details.

How to Use Etherscan: Step-by-Step Guide

1. Basic Search

- Visit the official Etherscan website

- Locate the search bar at the top

- Enter one of the following:

- Wallet address

- Transaction hash

- Contract address

- ENS domain

- Block number

- Press Enter to retrieve results

2. Reading a Transaction Page

A transaction page displays:

- Transaction hash

- Status (pending, success, failure)

- Block number and confirmations

- Timestamp

- Sender and recipient

- Transferred value

- Transaction fee and gas price

This data allows verification and validation of any Ethereum transaction.

3. Analyzing a Wallet Address

Wallet pages show:

- ETH balance and fiat value

- Token balances

- NFTs

- Full transaction history

- Analytics charts tracking balance changes

How To Find A Transaction On Etherscan

Understanding how to track your transactions can be a powerful tool in the world of cryptocurrency, from seeing how many confirmations it has gone through to the amount of gas fees paid.

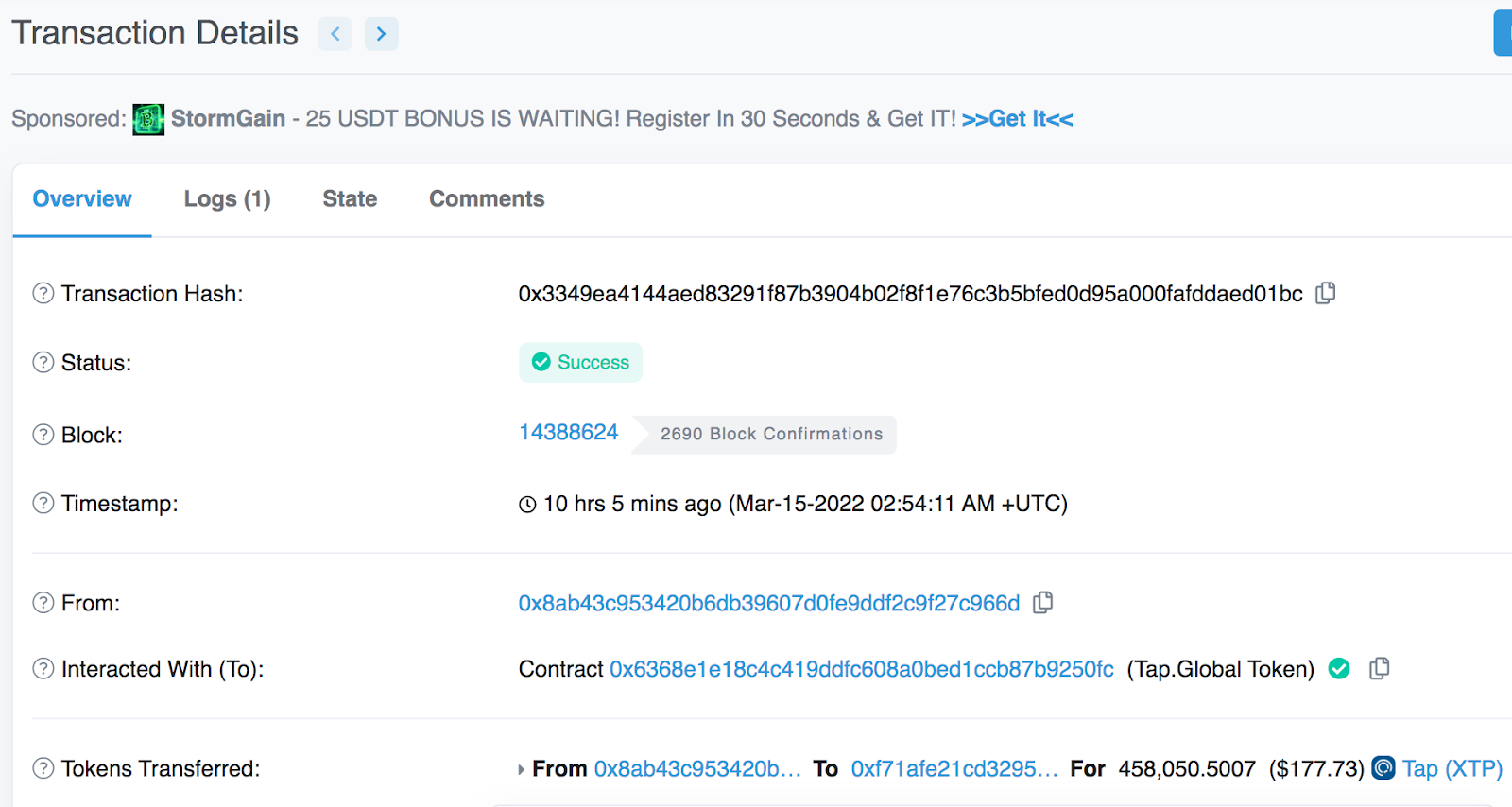

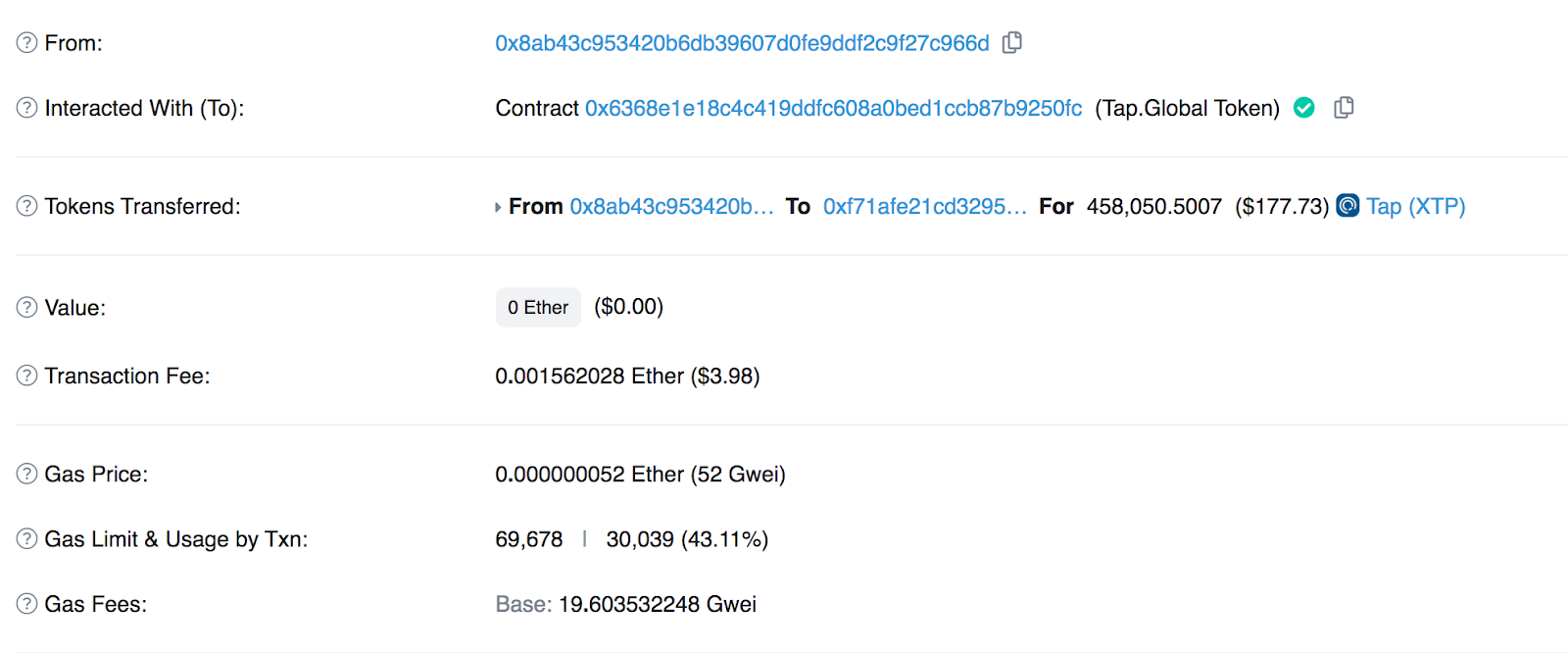

Each transaction on the blockchain is given a transaction ID (TXID) or transaction hash which identifies the specific transaction (similar to a person's identity number). It looks something like this:

0x3349ea4144aed83291f87b3904b02f8f1e76c3b5bfed0d95a000fafddaed01bc

In order to get the real-time updates on a transaction, you will need to enter this TXID into the space provided on the Etherscan website.

It will then display all the information pertaining to this transaction, as below:

If you aren’t familiar with all the terms associated with Etherscan, don’t worry. See our breakdown below.

Etherscan Terminology

Transaction Hash: the TXID associated with your particular transaction.

Status: status of your transaction (in progress, failed, or successful) .

Block: the number of the block that your transaction was included in (block confirmations indicate the number of blocks that have followed since then).

Timestamp: the date and time that this transaction was executed.

From: the wallet address that the transaction was sent from.

To: the wallet address or smart contract receiving the transaction.

Value: the value of the transaction.

Transaction Fee: the gas fees or transaction fees paid.

Gas Price: the cost per unit of gas at the time of the transaction execution (displayed in Ether and Gwei).

Key Features of Etherscan

Etherscan offers advanced filters, API access for programmers, verified contract badges, token approval checkers, real-time gas tracking, NFT analytics, labeled addresses, multilingual support, and mobile responsiveness. These features make it a powerful information technology service for individuals, developers, and organizations.

Is Etherscan Free? Understanding Costs

Etherscan is completely free to use. You do not pay to search transactions, view wallet balances, or analyze blockchain data. No subscription or account is required for core features.

However, if you interact with smart contracts through Etherscan, such as claiming tokens or executing functions, you must pay Ethereum gas fees. These fees go to miners or validators on the network, not to Etherscan.

Etherscan is simply the interface. The blockchain processes the transaction.

How Does Etherscan Make Money?

Etherscan generates revenue primarily through advertising, premium API plans, and enterprise analytics services. Banner ads and sponsored listings support free access for everyday users, while developers and businesses can pay for higher API limits and advanced data tools.

This model keeps blockchain information open and accessible without compromising decentralization.

Benefits of Using Etherscan

Etherscan empowers users with transparency, accuracy, and trust. It enables independent verification, improves security awareness, supports learning, aids investment research, and provides insight into decentralized finance, token markets, and blockchain infrastructure.

Conclusion

Etherscan is an essential tool for anyone interacting with Ethereum. It transforms complex blockchain data into clear, searchable, and verifiable information. Whether you’re tracking payments, analyzing smart contracts, learning how blockchain works, or validating transactions, Etherscan gives you full visibility into the Ethereum ledger.

With tools like Etherscan, blockchain moves from abstract technology to something you can actually see, verify, and trust. The best way to learn is to explore it yourself.

You've likely come across the term "ERC-20" in your crypto endeavours, with plenty of these token standards currently ranked in the top 10 (even top 100) cryptocurrencies. But what does ERC-20 actually mean, and what is a token standard? In this piece, we're uncovering everything you need to know about these popular crypto terms.

To start things off, ERC stands for Ethereum request for comment.

What is a token standard?

Let's start at the beginning. When Ethereum was created to provide developers with a platform on which to build decentralized apps (Dapps), the team incorporated several token standards.

These token standards allow new projects to create, issue and deploy various functioning tokens on the blockchain. Each token standard is a smart contract that holds a set of particular "rules" that must be followed in order to be created.

In recent years a number of blockchain platforms that provide Dapp creation functionality have created their own token standards, however, for the sake of this article we are only looking at Ethereum.

The most popular token standards on Ethereum are the ERC-20, ERC-721, ERC-777, and ERC-1155 tokens. Each holds its own functionality and would be utilized depending on what the Dapp intends to use it for, i.e. will it be a transferable asset or be used to hold ownership rights.

What is an ERC-20 token?

By far the most popular token standard utilized on the Ethereum network, the ERC-20 token is a fungible token that can be bought, sold and traded in the blockchain ecosystem. To date over 350,000 ERC-20 tokens have been created.

Similar to the functioning of other cryptocurrencies like Bitcoin and Litecoin, ERC-20 tokens also hold value and are able to be bought and sold, however, they operate solely on the Ethereum blockchain. This means that all ERC-20 transactions conducted are executed on the Ethereum blockchain network.

The rules associated with this particular token ensure that it can function optimally on the Ethereum blockchain, and must be submitted to the community leadership for approval prior to its launch. While some rules are mandatory and others optional, the required ERC-20 rules are as follows:

- total supply: defines the total supply of the token

- balance of: indicates how many tokens are in a wallet address

- transfer To, Transfer From: must be able to be transferred from one user to another

- allowance: ensures that wallets have a sufficient amount before making a transaction

- approve: checks total supply against transactions

The optional elements are centred around the token's name, its ticker symbol and how many decimal places it would have %u200BFor instance, Ethereum's token name is Ether, its ticker symbol is ETH and it is divisible by up to 18 decimal places.

Examples of ERC-20 tokens are Augur (REP), Basic Attention Token (BAT), Maker (MKR), USD Coin (USDC) and OmiseGO (OMG).

Can you mine ERC-20 tokens?

ERC-20 tokens, unlike Ethereum and its native coins (ether), cannot be mined. That is, new tokens are 'minted' when a planned initial token offering (ICO) or security token offering (STO) event takes place. Usually, these events involve users sending ether to a smart contract address and in return receiving the newly minted ERC-20 token.

An ERC-20 token is technically a smart contract so it's possible for the developer team behind an ERC-20 token to issue new tokens at will. However, this isn't recommended because users would be less likely to trust these tokens if they could be minted at will. There must be a measure of scarcity in order for tokens to be valuable.

The pros & cons of ERC-20 tokens:

Some of the main benefits of ERC-20 tokens include:

Fungible

Fungible ERC20 tokens are interchangeable, just like cash. Although the coins are technically distinct, they function in exactly the same way. You can trade one for another and they will be functionally equivalent, just like cash or gold.

Fungible tokens are fantastic, and there's a lot of value in the technical aspect. On a technical level, it's worth noting that fungible tokens don't add extra value to goods. They're typically beneficial in a variety of commercial scenarios.

Broad adoption

The popularity of ERC-20 tokens is quite apparent in the cryptocurrency industry. The number of exchanges, wallets, and smart contracts that already support newly-launched tokens has made it easy for new projects to integrate with them. There is plenty of developer support and documentation to go around.

Flexibility

The first thing to note about ERC-20 tokens is that they are highly flexible and may be used in a variety of circumstances and applications. This is due to the fact that these tokens are very customizable. They can be used in a lot of different scenarios such as Loyalty points programs, in-game currencies, or digital collectibles such as NFT's.

Some of the main cons of ERC-20 tokens include:

Mainstream

The popularity of ERC-20 tokens is also their greatest weakness. There are so many projects using the same standard that it's difficult to stand out from the crowd without differentiating your token in some way. Moreover, since they're essentially all the same on a technical level.

Fraud and Scams

It takes minimal effort to create a simple ERC-20 token, meaning that anyone could do it for good or bad purposes. As such you want to be careful with what you're investing in when considering blockchains projects because there are some Pyramid schemes masquerading as legitimate projects out there and trying to get unsuspecting investors involved in their scams. As a result, when looking at blockchain projects, you need to be cautious with what you invest in.

Other ERC Token Standards

While there is a large range of ERC tokens available, below we've outlined the most popular ones (excluding the ERC-20 one as it is listed above).

ERC-721

This token standard is for a non-fungible token (NFT) which gained huge popularity in the last year across the gaming and digital art worlds. These tokens represent ownership of something, and cannot be used interchangeably.

ERC-777

An evolution of the ERC-20 token, the ERC-777 provides more usability, particularly pertaining to its ability to mint or burn tokens. It also holds improved transaction privacy and an emergency recovery function.

ERC-1155

This token standard allows for the creation of both utility tokens and non-fungible tokens. Making trading more efficient, the token standard allows for bundling of transactions which in turn saves costs.

Learn more about cryptocurrencies and blockchain

You can learn more about crypto basics from our specially created Learn centre, which covers everything a trader ought to know about cryptocurrencies and the blockchain industry.

You don’t need to call your bank to issue a debit card anymore. That world is gone. Today, all sorts of brands can launch branded debit card programs by partnering with all sorts of financial licensed institutions. It doesn’t matter if you’re managing gig-economy payouts, or operating any business where users hold balances. Your business can be anything! A debit card program can increase engagement, strengthen loyalty, unlock revenue through fees, and give users seamless access to their funds.

We’ll show you what a debit card program actually is, why businesses launch them, how they differ from credit cards and prepaid cards, what they cost, and the exact steps required to bring one to market. But first a little spoiler: despite the tools that modern technology puts at our disposal, launching a program from scratch isn’t for everyone.

What Is a Debit Card Program?

A debit card program will allow your business to issue a branded card that dares funds directly from a linked bank account. So, when a user makes a purchase, money is deducted immediately from their balance. This is the main difference with credit cards, which extend credit and fall under an entirely separate set of rules and regulations. Debit cards work under electronic funds transfer regulations and require real-time computing to check balances and prevent overdrafts. Simple enough, right?

Here’s what’s important to understand. Launching a debit card program does not mean starting a bank. Creating a bank requires tens of millions in capital, years of regulatory approval, and expertise in risk, compliance, and a whole ecosystem of banking operations. A debit card program, by contrast, is built through partnerships with licensed banks that act as issuers and BIN sponsors. Programs can support physical debit cards, virtual cards for online payments, or both. They are commonly used for consumer banking apps, employee spending, payroll access, gig-economy payouts, etc.

Why Launch a Debit Card Program?

If your business already manages user balances or financial workflows, debit cards unlock real advantages. First, debit cards increase customer engagement. First, debit cards increase customer engagement. Every transaction becomes a brand touchpoint. This means there will be constant interaction with your mobile app or platform. Second, they strengthen customer loyalty by keeping spending within your ecosystem rather than external wallets or banks. If your users can access their money through your card, they are less likely to move their funds elsewhere.

Debit card programs also provide data insights into spending behavior. This means you will learn more about their transaction frequency, and usage patterns, and this in turn will lead to better product decisions and personalization. You will also see what merchants your users prefer and when they spend. This information is invaluable for improving your users’ experience.

From a revenue perspective, businesses earn interchange fees on each transaction, creating usage-based income. Every swipe, tap, or online payment generates a small fee, and at scale, those fees can add up to a meaningful revenue stream. Debit cards will also simplify operations by giving you access to funds for customers, employees, or contractors. This will reduce issues regarding payments, withdrawals, and everyday spending.

Common use cases are neobanks issuing consumer debit cards, payroll platforms offering instant wage access through direct deposit cards, or marketplaces enabling wallet-to-card functionality so freelancers and gig workers can access earnings immediately.

Debit Card vs Other Card Types: Understanding the Difference

Debit cards can be confused with other card products, but the differences matter. Let’s go through a quick comparison to set the record straight.

- Debit cards are linked to a bank account and only allow spending of available funds. Users do not undergo credit checks, and transactions settle in near real time using real-time computing infrastructure. Because there's no credit risk, the regulatory framework is simpler.

- Credit cards extend a line of credit, require underwriting to assess risk, and are governed by lending regulations such as the Truth in Lending Act in the U.S., for instance. They carry higher interchange fees and greater risk for the issuer.

- Prepaid cards hold a stored balance that is loaded in advance and is not necessarily tied to a traditional bank account. They follow different compliance rules and are commonly used for gift card programs, incentive rewards, subscription services, or travel. Prepaid cards can be useful, but they lack the direct connection to a user’s finances.

How Much Does It Cost to Launch a Debit Card Program?

Costs vary based on scale, features, and geography, but you can expect them to follow a similar pattern. Let's break it down. You can expect smart cards to cost you between $2 to $10 dollars per card. The production of cards accounts for plastic and chips with integrated circuits. You can expect cards with near-field communication (NFC) to cost more, while premium cards such as metal cards can cost as much as $20 dollars simply to produce.

Beyond the cost of acquiring the cards you need, you will need to spend on BIN sponsorship applications, legal review, and card design. Then you will need to pay for ongoing expenses like technology fees, BIN sponsorship, compliance monitoring, fraud detection systems, and customer support infrastructure. In short, you can easily expect costs to surpass $100,000 in the first year of your program.

Key Requirements for Launching a Debit Card Program

- Bank partnership to sponsor the program.

- Registered business entity to be in a good legal and financial standing.

- Compliance infrastructure such as KYC, AML, and fraud monitoring.

- Technology stack for card management APIs and account systems.

- Operating capital to support settlements and growth.

- Customer support to dispute handling and cardholder assistance.

- Security standards such as PCI DSS and data protection controls.

To launch a debit card you will need to sort out these factors first. Partnering up with a bank will take care of most of these, but you’re still responsible for understanding how they work and ensuring your program meets regulatory standards.

Step-by-Step Guide to Launching Your Debit Card Program

Step 1: Define Your Debit Card Program Objectives

Start by identifying who the card is for: customers, employees, contractors, or students. Clarify use cases such as daily spending, ATM withdrawals, online payments, or payroll access. Are you trying to improve user experience, create a new revenue stream, or reduce friction in your existing workflows?

Decide whether you’ll issue virtual cards, physical cards, or both. Virtual cards can be issued instantly and are great for online commerce, streaming media subscriptions, and digital purchases. Physical cards take longer to produce and mail but are essential for point of sale transactions and ATM access. Estimate expected card volume and budget. How many users do you expect in year one? What's your target market? What's your projected transaction frequency? These numbers will guide your partnership conversations and help you understand the full cost and resource requirements.

Step 2: Choose Your Debit Card Program Model

Select the structure that fits your business. Open-loop debit cards work anywhere Visa or Mastercard is accepted, giving users maximum flexibility. White-label programs keep your brand front and center, while co-branded models share visibility with partners like banks or payment processors.

You’ll also choose between consumer debit cards and business debit cards depending on your target market. Consumer cards are designed for personal spending, while business cards may include features like expense tracking, invoice management, and accounting integrations.

Think through your value proposition: what makes your card better than what users already have? Is it lower fees, better rewards, instant access to funds, or seamless integration with your platform? If you can’t answer this clearly, your adoption rates will suffer.

Step 3: Select a Bank Partner and BIN Sponsor

Your issuing bank provides regulatory coverage and access to card networks. This partnership is foundational, so choose carefully.

You will evaluate partners based on:

- Debit card experience : Have they launched similar programs before?

- Transparency on fees: Are costs clear and predictable?

- Compliance support: Will they help you navigate AML, KYC, and fraud prevention?

- Technology compatibility: Does their infrastructure integrate with your systems?

- Time to market: How long will the partnership and implementation process take?

Some banks specialize in fintech partnerships and have streamlined onboarding processes. Others may require months of negotiation and technical integration. Ask questions upfront and get clear commitments on timelines and support.

Step 4: Choose a Payment Network

Most debit cards run on Visa or Mastercard due to near-universal acceptance. Users expect to be able to use their cards at any merchant, online or in person, and these networks provide that reach.You may also need access to regional ATM networks for cash withdrawals. Without ATM partnerships, your users will face fees and limited access, which can hurt adoption and satisfaction.

Network coverage, fees, and geographic reach should match your customer base. If you're launching in the U.S., for instance, make sure your network agreements support domestic transactions and ATM access. If you’re expanding to the European Union or other regions, consider multi-currency support and international acceptance.

Step 5: Build the Technology Infrastructure

Your platform must support real-time balance checks, transaction authorization, card lifecycle management, and fraud monitoring. A mobile interface is strongly recommended for balance visibility, transaction alerts, PIN management, and digital wallet integration.

Step 6: Ensure Regulatory Compliance

In the U.S., for instance, debit cards fall under Regulation E and the Electronic Fund Transfer Act. You’ll need to tools to consider:

- Error resolution

- Transaction disputes

- KYC verification

- AML monitoring

- PCI DSS compliance

Your bank partner typically provides regulatory guidance, but accountability remains shared. You’re responsible for understanding the rules, implementing proper controls, and maintaining compliance over time. Cutting corners here can result in fines, program suspension, or legal action.

Step 7: Design Your Debit Card

Design must follow payment network branding rules and avoid restricted imagery such as explicit content, or prohibited products. Visa and Mastercard have specific guidelines on logo placement, color usage, and trademark requirements.

Physical cards must clearly display required elements like:

- Card number

- Expiration date

- Cardholder name

- Network logo (Visa, Mastercard, etc.)

- Security features (CVV, chip, contactless symbol)

Virtual card designs should also translate cleanly into digital wallets and mobile apps. Think about how your card will appear in Apple Pay, Google Pay, and other platforms. It should feel cohesive with your brand and easy to recognize.

Step 8: Launch and Distribute

Finally, you’ll decide on a phased or full launch. A phased approach lets you test with a small group first, gather feedback, and fix issues before scaling. A full launch gets your product to market faster but carries more risk if something goes wrong. Make sure support channels are live before the first cards are issued. You won’t want users contacting you with questions or problems and finding no one there to help.

Common Challenges with Debit Card Programs

Debit card programs introduce operational complexity that shouldn’t be underestimated. Fraud is especially sensitive because transactions impact user funds directly. Unlike credit cards, where the bank absorbs losses, debit card fraud hits users immediately. Real-time monitoring, instant card controls (freeze, block, replace), and strong authentication methods are critical to maintaining trust.

Customer disputes must be handled quickly. If a user reports an unauthorized transaction, you have specific legal timelines to investigate and resolve the issue. Missing those deadlines can result in regulatory penalties and user dissatisfaction.

ATM access expectations can also be challenging without the right network partnerships. If users can't withdraw cash easily or face high fees, they’ll abandon your card for alternatives that work better.

Finally, maintaining accurate real-time balances is non-negotiable. Any lag can erode trust and create overdraft risk, making infrastructure quality a top priority. Your systems need to track every transaction, update balances instantly, and prevent users from spending money they don't have. Get these fundamentals right, and your debit card program can become a powerful tool for growth. Get them wrong, and it’ll have been all for nothing.

Skip the Grind: Launch with Tap Instead

Here’s the truth: building a debit card program from scratch means months of talks, compliance setup, technology integration, and ongoing operational overhead. It's doable, yes. But it’s not quick, and it’s definitely not cheap.

Tap offers a faster path. Our white label card platform handles the heavy lifting, so you can focus on what you care about: your product and your users. While building from scratch can take a year or more, Tap enables you to launch a fully branded debit card program in as little as 12 weeks.

Tap’s platform is built for flexibility and growth. Whether you’re issuing your first hundred cards or scaling to hundreds of thousands, the infrastructure adapts to your needs. Cards are fully customizable, allowing you to create a payment experience that feels like an authentic extension of your brand.

Ready to explore what a tailored debit card program could do for your business? Get in touch with our team today.

Payments are not what they used to be. Credit cards used to be the exclusive domain of banks, but white label cards and embedded payment solutions have turned this plastic item that used to sit in your wallet into a product with personality that non-financial brands can now bring to market. Industry projections estimate the global white label card market will grow to $33.72 billion by 2032.

So, what's driving this big shift? In recent years, businesses have discovered that integrating payments and financial services directly into their customer journey isn't just convenient, but game-changing for both users and revenue.

If you want to launch a branded credit card program, we will share with you the secrets to create a credit card that aligns with your business model, generates new revenue streams, and boosts customer loyalty. A good credit card program has the potential to increase purchasing frequency, deepen brand engagement, and provide valuable transaction data.

But mind you, launching a credit card comes with its own set of challenges. And it’s not a small one. It demands significant resources, careful planning, regulatory compliance, technology, and long-term commitment. We will show you how credit card programs work, the challenges involved, and the step-by-step process required to bring one to market.

Understanding the Credit Card Ecosystem

Key Players in Card Programs

A credit card program relies on a network of participants working together. At the center is the issuing bank or credit union, i.e., a regulated financial institution that extends the line of credit and holds the cardholder accounts. Businesses launching card programs do not become banks themselves but rather partner up with an issuing bank that operates under financial regulations.

Payment networks you may be familiar with such as Mastercard, Visa, or American Express provide the global infrastructure that routes transactions between merchants, payment terminals, and banks. These networks set operating rules and acceptance standards across retail and e-commerce settings. Payment processors handle the technical execution of transactions. They authorize purchases, manage settlements, apply fraud controls, and make sure that money moves correctly between accounts.

Who Should Launch a Credit Card Program?

Credit card and debit card programs are not limited to traditional retail banks. As we discussed earlier, they are increasingly used by businesses that already manage transactions, customer accounts, or recurring payments.

Companies with strong loyalty programs, such as retail and lifestyle brands, often use credit cards to reward repeat purchasing with cashback or exclusive benefits. Marketplaces and multi-sided platforms integrate cards to streamline purchasing and settlement between buyers and sellers.

Travel and leisure businesses are another common example. By embedding a credit card into booking or expense, they reduce friction for end users and therefore capture more value per customer. Fintech startups and neobanks can also launch cards as part of a broader mobile banking or personal finance offering. Across these examples, successful programs share common traits: an existing customer base, regular transaction volume, a clear incentive for adoption, and the financial capacity to invest upfront.

Challenges You’ll Need to Overcome

Launching a credit card program involves much more than product design. Regulatory compliance is one of the most important and complex challenges you will need to tackle. You will need to comply with PCI DSS standards, KYC and anti money laundering (AML) requirements, consumer protection laws, and data privacy rules that vary by jurisdiction. These requirements are manageable but demand expertise and oversight.

Technology is another challenge. Security vulnerabilities or software bugs can quickly erode trust. For this reason, credit cards require secure, scalable infrastructure that integrates with payment networks, fraud prevention systems, apps, and customer support tools. Beyond development and compliance, your business needs to fund customer support, marketing, fraud losses, and all operational costs.

How to Launch Your Own Credit Card: Step-by-Step Process

Step 1: Define Your Strategic Goals

Before anything else, get clear on why you want to launch a credit card. The programs that succeed are the ones solving real problems for real people. That can be making purchasing easier, giving customers better expense control, or rewarding loyalty in meaningful ways. Are you chasing revenue? Trying to keep customers around longer? Trying to stand out? All of the above? Pin that down.

You will also want to get specific about your target market. What do their spending patterns look like? How do they make decisions about money? What's their credit history telling you? Set up success metrics from day one. Keep track of things like transaction volume, active cards in circulation, customer lifetime value, and how much revenue the program contributes to your business. A simple document that gets everyone on the same page is worth its weight in gold.

Step 2: Find the Right Partners

Here’s where things get interesting. You could go the full build route and create your own infrastructure, negotiating directly with banks, the whole nine yards. This gives you maximum control and the ability to customize everything, but it’s a big undertaking. We're talking months or years of work and serious resources. It is best suited to large enterprises with unique requirements and massive transaction volume.

That's why most businesses opt for a card-as-a-service model instead. These platforms handle the end-to-end infrastructure, regulatory compliance, and banking relationships so you don't have to. This approach typically allows for launch within three to six months with lower upfront investment and lower risk.

Step 3: Build or Integrate Technology Infrastructure

Your technology choices will shape both the user experience and scalability. White-label solutions offer faster deployment with limited customization, while embedded solutions allow deeper integration into your mobile app or website. You will need to take care of components such as card issuance and management systems, transaction processing, fraud and risk controls, reporting tools, and customer dashboards.

Step 4: Navigate Regulatory Requirements

Compliance is a continuous process, not a one-time task to take off your to-do list. You will deal with PCI DSS standards, KYC and KYB procedures, anti-money laundering monitoring, consumer protection regulations, and data privacy laws that vary depending on where you operate. Businesses often bring in specialized compliance counsel and rely on partners to manage much of the operational workload. Cutting corners in this area can result in fines, program suspension, or reputational damage.

Step 5: Design for User Experience

User experience plays a major role in adoption. Card design should reflect your brand while meeting payment network requirements. Onboarding should be mobile-first, crystal clear, and efficient. Nobody wants to wade through confusing terms or hidden fees. Cardholders should have real-time visibility into transactions, balances, limits, and rewards. Customer support must also be accessible and responsive.

Step 6: Test Thoroughly Before Launch

Before launch, you will need to conduct extensive testing. This includes internal testing of all transaction types, closed beta programs with a limited user group, stress testing for high transaction volume, and security assessments. Testing helps uncover technical issues, refine fraud rules, and prepare support teams. Consider at least a few extra weeks for this

Step 7: Launch Smartly

Going all-in on day one can be tempting, but a phased rollout is usually smarter. Launching first to existing customers or a specific segment allows you to monitor performance and adjust before scaling. Marketing, sales, and customer support teams should be aligned around a clear value proposition. Incentives such as introductory rewards can accelerate early adoption, but your messaging should focus on long-term value, not just short-term promotions. You want customers who stick around.

Step 8: Monitor, Optimize, and Scale

After launch, treat your credit card like the living product it is. Track metrics such as activation rate, transaction frequency, fraud levels, customer support volume, and customer lifetime value. Regular performance reviews will inform future improvements and your decision-making. Over time, you can expand features, enter new markets, and explore additional partnerships to grow the program sustainably.

Credit Card Programs for Startups

Launching a credit card program is a fundamentally different project from issuing a debit card. While both are payment cards and bring similar benefits, credit cards will introduce lending and long-term risk management into your business model. But for the right startup company, credit cards can be a game changer.

How Credit Cards Differ from Debit Cards for Startups

The most important distinction is credit risk. A credit card extends a revolving line of credit rather than spending from a bank account or deposit balance. This means your company must support underwriting, interest calculation, settlement deferral, and regulatory compliance tied to lending.

Credit cards typically generate higher interchange and fee revenue than debit cards, but they also come with higher costs. These include underwriting systems, fraud modeling, dispute handling, and compliance with laws such as the Truth in Lending Act and fair credit regulations. Time to market is usually longer too. For fintech startups, credit cards are often positioned as a premium product layered on top of an existing debit card or wallet experience.

When a Credit Card Program Makes Sense for a Startup

Credit cards are best suited for startups that:

- Have a clearly defined target market with predictable spending habits

- Want to monetize through interest, fees, and loyalty programs, not just interchange

- Are building long-term customer relationships rather than transactional usage

- Can leverage data, scoring models, and customer insights for underwriting

- Have sufficient funding to support credit exposure and regulatory overhead

Some examples can be B2B expense platforms, student or freelancer-focused financial products, retail-linked loyalty cards, and premium consumer fintech brands.

Scaling and Measuring Success

Successful credit card programs focus on:

- Card activation and usage frequency

- Customer lifetime value and repayment behavior

- Balance growth and portfolio performance

- Engagement marketing through incentives and rewards

Is Launching a Credit Card Right for Your Business?

Before moving forward, it is important to assess readiness. Businesses are typically well-positioned if they serve more than 10,000 active users, have stable revenue, and see clear demand for integrated payment or credit solutions. An upfront investment of hundreds of thousands of dollars is to be expected, along with a six to twelve month timeline before meaningful revenue is generated.

If your core product is still seeking its place in the market, your customer base is small, or your organization lacks resources for compliance, security, and customer support, it may be better to wait or seek an alternative.

Make your Journey Easier: Partner up with Tap

Instead of navigating the complexities of building a card program from scratch, you can partner with Tap for a streamlined solution. Tap's white label card does the heavy lifting for you. This frees your team to focus on your product and customer experience rather than backend infrastructure. While traditional card issuing can take years, Tap enables you to launch a fully branded card program in as little as 12 weeks.

Tap's platform is built for flexibility and growth. Whether you're starting small or planning to scale up, Tap’s infrastructure adapts to your needs. Cards are fully customizable, allowing you to create a payment experience that feels like an organic extension of your brand.

Ready to explore what a tailored card program could do for your business? Get in touch with Tap's team today.

Most people discover crypto through investing. Buying it is easy. Watching charts is simple enough. But actually trying to use crypto in everyday life? That’s where things get harder. Some apps tell you to convert first. Others give you limits, delays, or hidden fees. So, crypto enthusiasts often find themselves wondering the same thing, why can’t spending crypto be as simple as tapping my card?

That’s exactly what Tap is for. Instead of treating crypto as something separate from your daily life, Tap makes it work exactly the way you want: fast, familiar, and accepted almost everywhere. Here’s how it works.

A Debit Card Powered by Your Crypto

Tap is a fully regulated crypto platform that issues a debit Mastercard you can use anywhere Mastercard is accepted. That is more than 110 million merchants worldwide. The Tap card draws from your crypto and converts it automatically when you pay. No manual selling, no swapping, no timing the market before dinner.

It looks and feels like a normal card, but it’s so much more.

Instant Crypto Conversion at Checkout

When you pay with Tap, your crypto gets converted to fiat right there at checkout. No waiting around for blockchain confirmations, no selling manually before you can spend. The card supports all your favorites: BTC, ETH, XRP, USDT, SOL, and 65+ others.

Auto Top-Ups so Your Card Doesn’t Decline

If your balance runs low mid-purchase, Tap automatically tops it up from whichever crypto wallet you've picked. The whole thing happens in the background while your transaction processes.

That means no awkward declined transactions, no scrambling to open the app and convert something, and no checking if your card has enough balance. The card just works. Everywhere. Every time.

How Fast Can You Top Up with Crypto?

One word. Instantly.

Top-ups happen in real time with zero settlement delay. There are no hidden limits, no annoying cooldowns, and no surprise conversion fees.

You add crypto → it’s available → you spend.

Exactly as it should be.

Accepted Everywhere Mastercard Is Accepted

You can use your Tap Card for grocery runs, international travel, online shopping, streaming subscriptions, restaurants, bars, hotels, ATM withdrawals, and basically everything else.

If they take Mastercard, Tap works. Your crypto becomes an actual spending tool you can use anywhere in the world, running on the same trusted payment network that processes billions of transactions daily.

Cashback & Perks: Making Spending Feel Like a Win

What really sets Tap apart is the fact that you actually get rewarded for spending. With Tap's Cashback program, you can earn up to 8% back on every single purchase.

Buying groceries? Get Cashback.

Ordering takeout? Cashback.

Booking a trip? Even more Cashback.

Your rewards drop straight into your Tap account. Want to unlock higher rates? Just level up by upgrading to a premium tier and locking XTP tokens into your account.

The Cashback rates go from 0.5% on the Essential tier (which is free) all the way up to 8% on Prestige. In between, you've got Plus at 1.5%, Prime at 3%, Premier at 4%, and Platinum at 6%. Rewards hit your account immediately, and you can unlock better rates by staking XTP.

To get Prestige, you'll need €25,000 XTP locked. Platinum requires €15,000, Premier needs €5,000, Prime is €2,500, and Plus starts at just €300. Essential doesn't require anything, it's completely free.

Tier requirements

- Prestige: €25,000 XTP locked

- Platinum: €15,000

- Premier: €5,000

- Prime: €2,500

- Plus: €300

- Essential: free

Fees? Simple, Transparent, and Based on Your Tier

Tap keeps everything straightforward. There are no hidden fees, no surprise costs, and no fees for topping up your card.

ATM withdrawals are free up to certain limits depending on your tier. Prestige users get unlimited free withdrawals, and Platinum gets €1,000, while everyone from Platinum down to Essential gets €500 free per month.

Your monthly plan cost depends on which tier you go with and the perks you get. Plus, Tap's top tier lets you spend up to €30,000 per month. So whether you're covering everyday stuff or paying for travel, you won't run into annoying limits that mess up your plans.

Extra Features That Make Life Easier

Tap includes practical tools that make the card feel safer and way more flexible.

You get a virtual card for shopping online, instant freeze and unfreeze if you lose track of your card, multi-currency support, and real-time notifications. The security is handled through standard encryption protocols and the app connects directly to the card network for immediate control.

It’s built for the way we actually use money in today’s world.

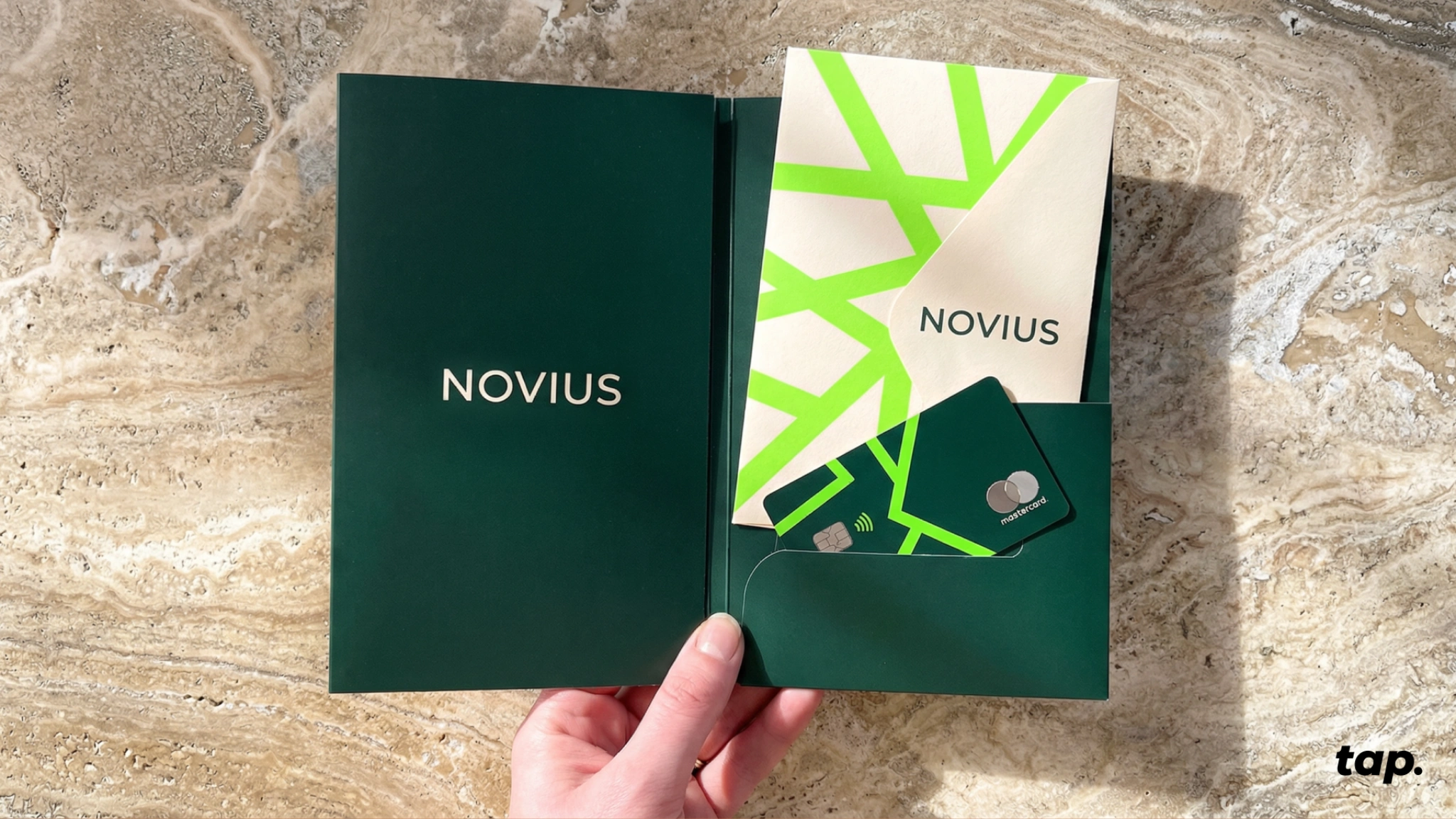

Built for a Modern Lifestyle

The Tap card feels premium from the very first moment you hold it. With its sleek, minimalist aesthetic and quality build, it's made for people whose lives don't fit only into one country or currency. Whether you're hopping between time zones, shopping across borders online, or just navigating daily life in a digital-first world, the Tap card is built to keep with your pace.

High spending limits mean you're never caught off guard. Clean, understated design ensures it looks as sharp as it performs.

Can You Trust Tap?

Tap isn't some sketchy offshore card operation. It's a fully compliant, audited financial product. It's regulated by the FCA in the United Kingdom, compliant with MiCA for users across Europe, the card is issued by Mastercard, and crypto custody is handled by Fireblocks, one of the industry's leading custody providers.

How to Get the Tap Card

- Download the Tap app

- Sign up

- Order your card

- Choose which crypto you want to spend

- Start tapping everywhere Mastercard is accepted

That’s it. It’s that simple.

Tap into a smarter way to pay today.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Say goodbye to low-balance stress! Auto Top-Up keeps your Tap card always ready, automatically topping up with fiat or crypto. Set it once, and you're good to go!

Read moreWhat’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started

.webp)

.webp)