Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Heading into the Federal Open Market Committee’s October session, a high-stakes environment is emerging for crypto markets. With the CME Group’s FedWatch Tool showing about a 96 % chance of a 25-basis-point rate cut, the market is eyeing how digital-asset prices might respond.

With macro liquidity on the radar again, these three altcoins stand out as tokens worth tracking under the spotlight of the Fed’s next move.

1. Chainlink (LINK)

Chainlink has been acting under pressure, trading inside a falling wedge, a pattern which sometimes marks the end of a downtrend. Still, some caution flags remain. Over the past month LINK has been trading downwards, though it’s gained some strength in the last week amid renewed buying interest. The key support around $17.08 remains critical, if LINK closes below that, a drop toward $16 could be triggered.

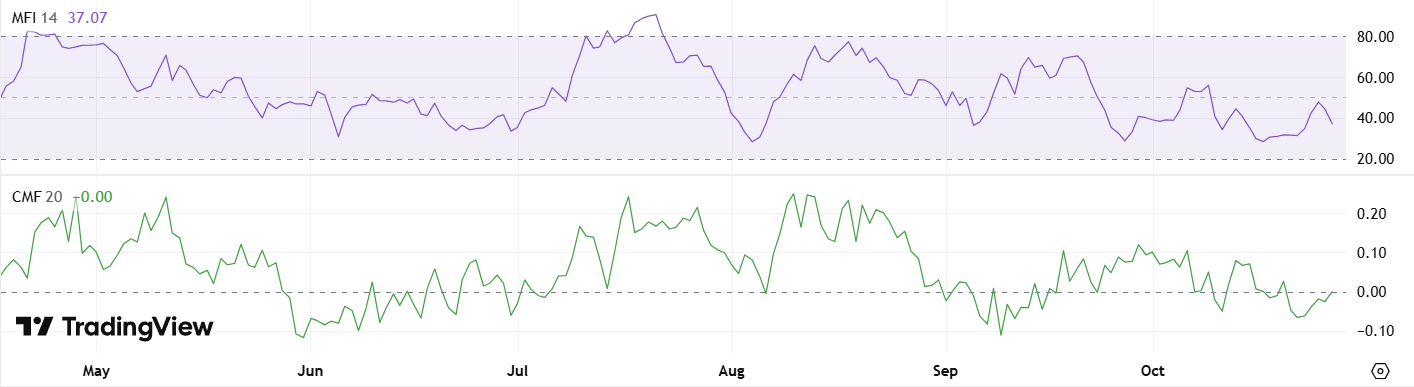

Conversely, diagnostics like the Money Flow Index (MFI) and Chaikin Money Flow (CMF) are showing signs of life, hinting at growing accumulation from larger holders. Combine this with a potentially dovish Fed decision, and Chainlink could be gearing for something special.

2. Dogecoin (DOGE)

Dogecoin enters the FOMC event with a bit of range-bound suspense. Since October 11, DOGE has been oscillating between $0.17 and $0.20, waiting for a trigger. A clean breakout above $0.21 could open the door to a move back towards $0.27, especially if risk-on sentiment returns.

Volume and whale‐level data add texture to the setup. The Wyckoff volume profile recently flipped from seller control to buyer control, suggesting strategic accumulation may be underway. DOGE may be quieting down before a move, a scenario traders should keep front of mind as the Fed’s decision could stir things.

3. Uniswap (UNI)

Uniswap offers compelling recovery stories entering the FOMC session. The token experienced a sharp drop on October 10, with the RSI falling below 30, classic oversold territory. Since then, UNI has rallied from near $6.20 toward $6.50, supported by strong volume on the breakout. Holding above $6.40 may confirm that buying interest is sustained.

For longer-term watchers, UNI’s former highs at $12.15 in August and $18.71 in December set the stage for what could become a multi-leg recovery if macro conditions cooperate. In a market where liquidity expectations hinge on the Fed, Uniswap's rebound has the potential to accelerate, particularly if altcoin capital begins rotating into DeFi infrastructure.

The Verdict

These tokens aren't just compelling because of their individual fundamentals, it's how those fundamentals intersect with the current macro picture. With markets rebounding and rate cuts looking increasingly likely, crypto stands to gain. Lower rates typically fuel risk appetite, unlock liquidity, and drive capital toward speculative plays, creating tailwinds that can supercharge momentum in well positioned altcoins.

That said, the Fed could also surprise with restraint, and even another “standard” 25-basis-point cut may be viewed as lukewarm. In such scenarios, the dollar may strengthen and risk assets could wobble. Traders and investors should therefore approach the market with discipline, track the macro context, and be prepared for either direction.

When Satoshi Nakamoto created Bitcoin, he designed it in such a way that should the value increase dramatically, there would still be an inclusive decimal value for the masses. Satoshis could one day be how we buy a cup of coffee anywhere in the world, using the same currency from Britain to Japan.

How Many Satoshis Are in One Bitcoin?

Often shortened to SAT, Satoshi is the smallest unit of Bitcoin, the world’s first and most popular cryptocurrency. Just like the U.S. dollar divides into cents, Bitcoin divides into Satoshis, but on a much finer scale. One Bitcoin equals 100,000,000 Satoshis (0.00000001 BTC).

This structure ensures that Bitcoin remains usable for everyday financial transactions, even as its market value rises. Whether someone is investing a few dollars or buying a cup of coffee, the Bitcoin network allows precise division and ownership down to a single Satoshi, making the digital currency accessible to everyone.

Why Satoshis Matter

Bitcoin’s price often exceeds tens of thousands of U.S. dollars, creating a psychological barrier for newcomers who assume they must buy an entire coin. Satoshis remove that barrier by enabling fractional ownership.

This level of accessibility supports financial inclusion, allowing individuals from all backgrounds (including those in developing markets) to participate in the cryptocurrency economy.

From micropayments to online services, Satoshis make purchasing small products, tipping creators possible, etc. As adoption grows, the ability to transact in Satoshis could become a standard part of personal finance and global economic development.

How to Convert Satoshis

Because 1 BTC = 100,000,000 SATs, converting between the two is very simple math:

Satoshis = Bitcoin × 100,000,000

Bitcoin = Satoshis ÷ 100,000,000

For instance, if Bitcoin trades at $60,000, then:

- 1 SAT = $0.0006

- 10,000 SATs = $6

- 100,000 SATs = $60

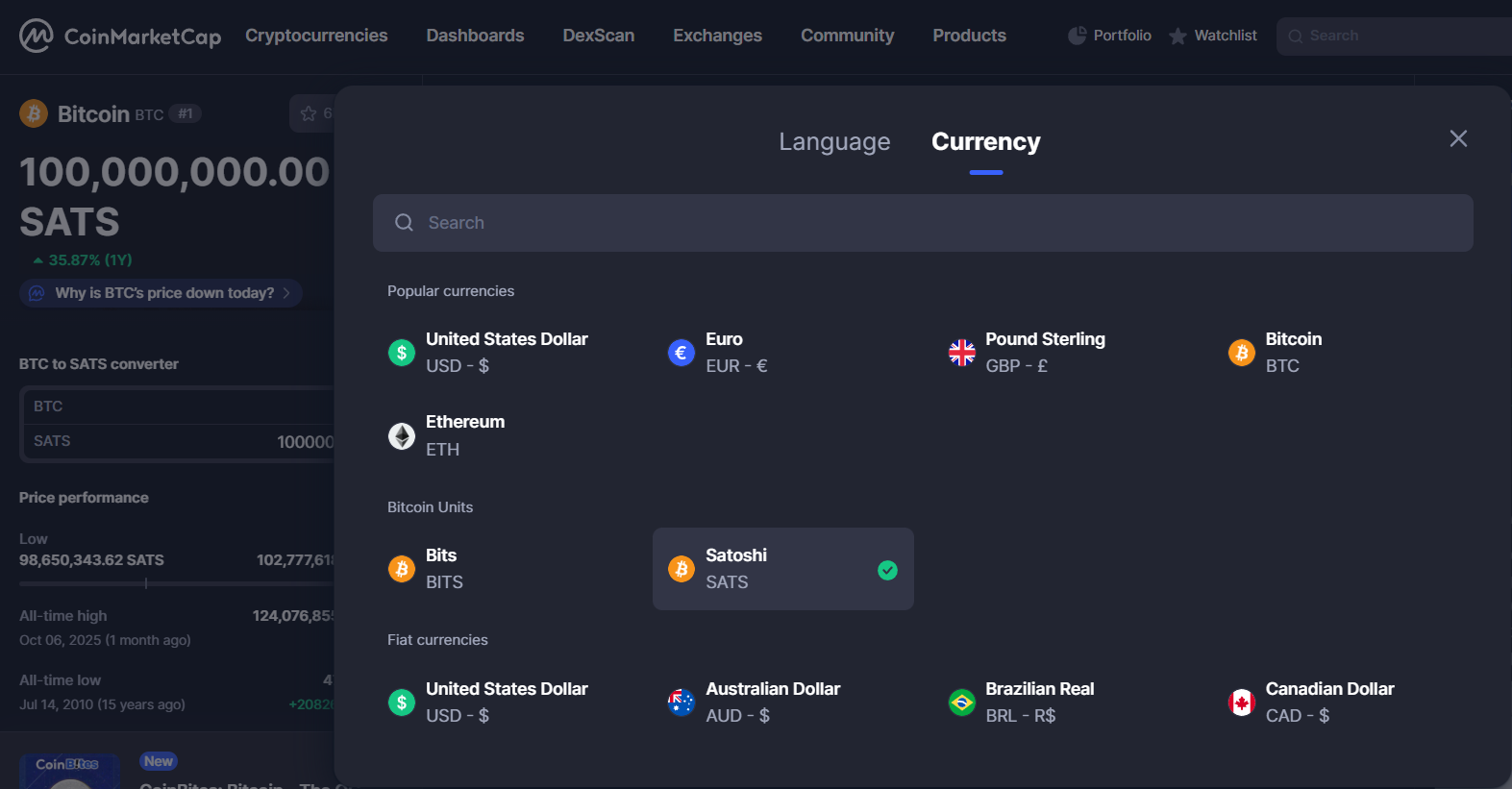

To simplify conversions, users can access Satoshi calculators or adjust display preferences within their cryptocurrency wallet or favorite platform. Many platforms also allow price displays in SATs to improve user experience and accuracy.

For instance, on CoinMarketCap, you can change the default currency to SATs by selecting the currency drop down option in the top right-hand corner. Select the Satoshi option under Bitcoin units. This will then display all values as Satoshis.

The History Behind the Name

The name “Satoshi” honors Satoshi Nakamoto, the mysterious programmer who invented Bitcoin and published its white paper in 2008.

The term was first proposed in 2010 on the BitcoinTalk forum by a user named Ribuck, who suggested defining a smaller Bitcoin unit for microtransactions. The community endorsed it, and “Satoshi” became the standard reference for Bitcoin’s smallest fraction.

This naming not only pays tribute to Bitcoin’s anonymous creator but also reflects the peer-to-peer and community-driven nature of the blockchain project.

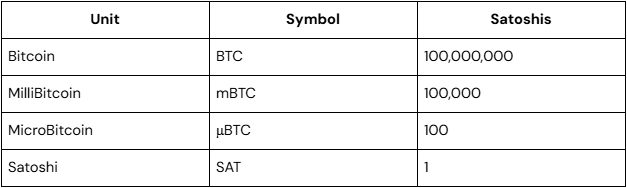

Bitcoin Unit Hierarchy Explained

Bitcoin can be divided into several measurement units, which make it easier to display or calculate different values depending on trade size or market purpose:

Users can choose their preferred unit in most cryptocurrency wallets or mobile apps, which helps reduce confusion when managing balances. This hierarchical structure is part of Bitcoin’s software design, ensuring precision, scalability, and transparency across every financial service or exchange that integrates it.

Real-World Applications of Satoshis

The use of Satoshis extends far beyond calculations. They play a vital role in everyday transactions and digital finance. Examples include:

- Micropayments. Paying for an article, video, or song online using fractions of Bitcoin.

- Remittances. Sending money across borders with minimal fees and no intermediary banks.

- Retail payments. Buying coffee, subscriptions, or services priced in SATs.

- Mining rewards. Bitcoin miners earn Satoshis as rewards for validating blocks on the blockchain.

- Lightning Network transactions. Enables instant, low-cost peer-to-peer payments denominated in milli- or micro-Satoshis.

These use cases show us how cryptocurrency adoption supports faster, cheaper, and more inclusive financial transactions, which helps bridge gaps between traditional fiat money and the digital economy. Satoshis make it easier to represent these small, day-to-day amounts.

Satoshis vs Other Cryptocurrency Units

Other blockchains have their own smallest units. For example, Ethereum uses the Wei, where 1 ETH = 1,000,000,000,000,000,000 Wei (18 decimal places). While Ethereum’s extreme divisibility helps with DeFi and smart contract operations, Bitcoin’s 8-decimal precision balances usability and simplicity. The Satoshi system keeps values easy to calculate, supports market liquidity, and provides enough granularity for future adoption.

This approach makes Bitcoin user-friendly, maintaining accuracy and precision in every financial transaction without overwhelming users with excessive mathematical complexity.

Considerations

Despite its simplicity, using the Satoshi unit can bring some hurdles too:

- Many newcomers are unfamiliar with terms like “Satoshi” or how to interpret BTC in fractional units.

- Since Bitcoin’s price fluctuates, the value of a Satoshi changes constantly, affecting everyday purchasing power.

- Not all wallets and exchanges display Satoshis by default, creating potential confusion for the end user.

- While some companies and fintech platforms already support SAT-based payments, widespread retail exposure is still limited.

Overcoming these hurdles will require better user experience design, educational content, and standardized software development practices across the industry.

The Future of Satoshis

As Bitcoin adoption expands, Satoshis may play an even bigger role in daily finance. With the Lightning Network, users can already transact in milli-satoshis, enabling high-speed, low-cost microtransactions far below one SAT.

In the long term, Bitcoin’s fractional-reserve capabilities and tokenization could make it a backbone for financial services, virtual payments, and cross-border trade. For emerging economies, Satoshis could represent economic empowerment, offering a stable, global currency that anyone around the world can use.

In short, Satoshis are not just a mathematical fraction. They are the mathematical foundation of a global peer-to-peer financial system that continues to evolve.

Key Takeaways

- 1 Satoshi = 0.00000001 Bitcoin

- Enables fractional ownership and global accessibility

- Named after Satoshi Nakamoto, Bitcoin’s anonymous creator

- Used for microtransactions, payments, and mining rewards

- Essential for the future of financial inclusion and digital payments

Getting Started: How to Buy and Use Satoshis

You can acquire the exact amount of Satoshis you're looking for through the Tap app, making it easy to begin your journey into the exciting world of Bitcoin.

Whether you're new to investments or you've been active in the markets for years, it's never too late (or early) to get your head around the different types of investment opportunities available. As we know, one size never fits all, so in this piece we're going to run you through the options out there and help you to determine which category will best suit your needs.

The 3 tiers of investments

First and foremost, when diving into the world of investing one must first determine their risk tolerance. How much risk you are willing to engage in will help you establish which investment avenue to go down. The three options are:

1. Low-risk

These types of investors are not looking to take risks with their capital. The primary goal is to preserve the initial investment despite the opportunity to gain returns. This is a great start for new investors as the risk is minimal while they learn the ropes.

A great investment option here is a money market fund. The funds are typically managed by professional, licensed fund managers, and involve bank deposits, commercial papers and treasury bills. While the risk is low, the potential for returns is moderate and the investment is liquid, meaning that the investor typically have access to the funds at any time.

2. Medium-risk

Providing an option for the more confident investor, medium-risk investments incorporate moderate risks but have measures in place to stop any high losses. This strategy is often made up of low-risk and high-risk investments, ensuring a balance between the two components.

Medium-risk options include a mix of mutual funds and dollar funds, which will invest in medium-risk stocks, bonds and treasury bills. The risk of losing capital is therefore lower than with high-risk investments while your potential for returns are higher than low-risk investment options.

3. High-risk

This category is for the investors with an appetite for risk. They're comfortable with losing their invested capital in the pursuit of higher gains. A huge note here is that Ponzi schemes are never good investments. Rather stick to professionally managed investment funds that are catered to those with a high-risk threshold.

These might include equity mutual funds that invest in stocks of vetted companies with large public listings. These are best catered to long-term timelines, as volatility might hinder the returns in a shorter space of time. High-risk investments have the potential to bring about higher returns, however this is never a guarantee.

How to distinguish what type of investor you are

While a professional financial advisor can do this for you, we've created a three step, simple way to determine whether you fit into the conservative investor (low-risk), moderate investor (medium-risk) or aggressive investor (high-risk) category. Consider these three factors below:

- what is your age?

If you're younger, there are more years ahead of you to recover from a bad investment. As a result, each passing birthday slightly lowers your risk tolerance.

- what is your marital status?

As a general rule of thumb being married incurs more expenses and allows for less risk taking when compared to a single person with no-one else to be responsible for. With fewer financial responsibilities comes a high opportunity for risk-taking.

- what is your net-worth?

Last but not least, your net-worth will also impact your appetite for risk. The more money you have, the more you can risk to make that money grow (and the bigger the cushion if an investment does go south).

In conclusion

It's important to remember that one investor type is not better than another, rather, it is what's best suited to your needs and requirements. The longer you leave these investments the higher the returns, so be sure to have a solid savings account built up prior to investing to ensure that should something go wrong you have alternative sources of funds to support that. Liquidating your investment early might lead to losses and most certainly lost opportunity.

Sure, crypto markets reacting negatively to macroeconomic policy shifts is nothing new, but these “worse than expected” Liberation Day tariff announcements have been particularly brutal.

Looking at the numbers, the sweeping tariffs introduced by U.S. President Donald Trump have resulted in mass liquidations. Almost a week later, $8.27 trillion has been wiped from global stock markets and $233 billion from crypto markets, bringing the overall crypto market cap down 8.5%.

But how exactly do tariffs influence crypto? The immediate reaction was a sharp downturn, with big names like Bitcoin falling below $82,000, and later $74,700, and Ethereum dropping to lows of $1,400.

In the long term, could these economic policies position crypto as a safe haven? Let’s explore the interplay between trade policy, traditional finance, and crypto prices.

Firstly, what are tariffs, and how do they affect the markets?

In a nutshell, tariffs, or taxes on imported goods, create ripple effects across various financial markets. Historically, they have had an impact on:

- Foreign exchange (FX) markets: The USD typically strengthens when tariffs are imposed, as more global investors seek stability, and in response, a stronger USD often puts downward pressure on Bitcoin and altcoins.

- Equities: Stocks, particularly in sectors reliant on global trade, tend to decline as tariffs increase business costs and disrupt supply chains.

- Inflation & interest rates: Tariffs can contribute to higher consumer prices, influencing Federal Reserve policy and liquidity conditions, which in turn affect investment in risk assets like crypto.

The interconnected nature of these macroeconomic factors proves once again that digital assets are not insulated from traditional market turbulence. Let’s explore the damages.

Trump’s “Liberation Day” tariff announcement

So, what happened? On 3 April, Trump announced a 10% baseline tariff on U.S. imports, with 60 countries, including Cambodia, China, Vietnam, Malaysia, and Bangladesh, facing tariffs of up to 50%. Companies in the EU will see 20% tariffs, all taking effect a week later.

Previously announced 25% tariffs on steel, aluminum, and foreign-made cars remain in place.

How the crypto market responded

Never missing a beat, the crypto market reacted swiftly to the tariff announcements:

- Bitcoin has dropped ~10% since February. On 3 April, the price fell from $87,106 to $82,526 in a matter of hours, falling to lows of $74,700 days later.

- Ethereum followed a similar trajectory, dipping to lows of $1,430.

- Altcoins were hit harder, with SOL dropping nearly 25% to $97.52 - its first dip below $100 since February 2024.

- Crypto-related equities tanked, with Strategy (formerly MicroStrategy) down 15%, and mining firms like MARA Holdings and Riot Platforms losing 11%.

- Correlation with equities strengthened, as the Nasdaq and S&P 500 also experienced sharp declines.

According to technical analysis, the overall market cap formed a bear flag pattern, signaling potential price declines (this pattern appears after a sharp drop, followed by a temporary upward channel). If the price breaks below this channel, a further decline is likely.

Source: Emmaculate, published on TradingView, April 3, 2025

Why Bitcoin might bounce back

A note from the bears. Despite the initial sell-off, Bitcoin could see a rebound for several reasons:

- Bitcoin as "digital gold": During economic uncertainty, BTC has historically been viewed as a hedge against inflation and fiat devaluation.

- Institutional movements: Exchange outflows suggest that institutions are holding rather than panic-selling, reducing BTC liquidity and potentially driving prices higher in the future.

- Monetary policy shifts: If the Federal Reserve pivots toward rate cuts or quantitative easing (QE), Bitcoin could benefit from increased liquidity.

BitMEX co-founder Arthur Hayes has argued that such macro conditions could push BTC toward $150,000 in the next cycle.

Do tariffs + the U.S. Dollar = a crypto opportunity?

The impact of tariffs on the U.S. dollar has direct implications for crypto:

- Reduced exports and lower bond demand could weaken the USD over time.

- A weaker dollar typically boosts Bitcoin, as investors look for alternative stores of value.

- Grayscale suggests that Bitcoin could benefit from a fragmented monetary landscape, particularly as central banks diversify reserves away from USD.

Tariffs, regulation & crypto’s role in the financial system

Trump’s policies could indirectly accelerate crypto adoption by:

- Increasing the use of crypto for trade settlements due to currency uncertainties.

- Encouraging alternative reserve assets beyond the U.S. dollar.

- Aligning with a potentially pro-crypto regulatory stance under a second Trump administration.

What should crypto investors do now?

Crypto investors should watch a few key things closely:

- When and how the new tariffs are rolled out, and if any changes are made along the way

- How other countries respond, especially with their own tariffs

- Changes in crypto regulations, as governments adjust to the new economic climate

- How money moves between traditional markets and crypto, which can impact prices and sentiment

- Consider long-term portfolio strategies, as crypto’s role in a shifting financial landscape could strengthen.

Conclusion: Tariffs may hurt now, but crypto could emerge stronger

While recent tariffs triggered a downturn across both traditional and crypto markets, it’s worth noting that this was driven more by uncertainty than fundamentals. As has previously been the case, crypto’s response is often tied to macro trends, with Liberation Day tariffs being no exception.

The bottom line is that market dynamics are changing. As liquidity patterns shift and capital moves differently, crypto’s role within broader portfolios continues to evolve. While this can have both a positive and negative impact on portfolios, continuing to stay informed is the wisest step one could take.

.webp)

In the colorful and often chaotic world of crypto, there exists a quirky corner dominated by what are affectionately known as “memecoins." These digital assets, born from the memes and trends that dominate online culture, are the playful jesters of the crypto kingdom. Despite their playful charm, memecoins are often caught up in pump-and-dump schemes and other scams, making them quite the rollercoaster ride. Their volatility is high, and the risk is real.

What draws people to these digital jokes? Simple, some memecoins have handed out enormous returns to those daring enough to dive in. However, while memecoins may gain popularity via social media, endorsements or fan communities, they often lack intrinsic utility. That makes them vulnerable to scams because of a low barrier to creation, hype-driven valuations, and little oversight. In many cases, the money made by early buyers or insiders comes directly from later retail investors in a negative-sum game. Because of this speculative nature, these tokens can attract opportunistic actors aiming to profit quickly at the expense of others.

So, with a whole galaxy of memecoins out there, how do you spot the stars from the scams? Stick around for some handy tips.

What Makes Memecoins Popular?

Memecoins, like the iconic Dogecoin or Shiba Inu, often start as jokes, are often associated with entertainment rather than usability, and often gain traction thanks to the power of community, social media, and, occasionally, celebrity endorsements.

Unlike more traditional cryptocurrencies such as Bitcoin or Ethereum, memecoins generally lack complex technology or specific use cases. They're not about solving grand technological challenges but rather are about capturing the spirit of the internet in a tokenised form. This means that their value is often driven by pure enthusiasm, online buzz, and the thrill of being part of a viral movement.

So why are these coins so popular? The appeal of memecoins lies in their accessibility and the sense of belonging they create. They're fun, easy to understand, and often tied to shared cultural experiences that resonate with a broad audience. The sense of community and the potential possibility of rapid gains draw people in, making some memecoins a fascinating aspect of the crypto landscape.

The Downside to Memecoin’s Popularity

Lately, memecoins have been the talk of the town, sparking a wave of enthusiasm, and unfortunately, a spike in scams too. Navigating the crypto market's more playful corner requires a keen eye. Before you leap into a memecoin, take a good look at the project and the brains behind it, as well as its development plan and the project’s overall transparency.

It's wise to tread carefully in these waters and resist the urge to jump in just because a memecoin is all the rage.

Common Types of Memecoin Scams

Scammers have refined their playbook to exploit FOMO, trust in influencers, and the general chaos of low-cap tokens. Some scams are obvious in hindsight, but many are sophisticated enough to fool even experienced traders. The key is knowing what to look for before you do anything. Whether it's a coordinated pump-and-dump or a malicious smart contract designed to trap your funds, these schemes all share common patterns. Let's break down the major scam types you're most likely to encounter, and the red flags that should make you think twice.

- Rug Pulls

Scammers launch a token, build hype, attract liquidity, then withdraw the funds (pull the rug) leaving the token worthless. - Pump-and-Dump Schemes

Coordinated groups inflate a token's price (often with influencer shilling), then dump it at a high. Late investors are left holding the bag. - Celebrity Scams

Scammers exploit trust by faking endorsements or hijacking social media accounts of well-known figures. - Fake Partnerships & Endorsements

Polished websites, vague whitepapers and purported brand deals are used to convey legitimacy, despite little substance. - Technical Exploits

Memecoins may embed malicious smart-contract code, honeypots or unlimited minting rights for the devs, enabling extraction of funds. - Insider Trading & Market Manipulation

Whales, early wallets and wash-trading inflate token value while retail buyers enter too late. Scam clusters often reuse contracts and patterns.

How to Spot a Memecoin from a Scam

- Beyond jokes and buzz

The initial charm of a memecoin may come from its humour, but lasting appeal requires more substance. Look for memecoins that offer real utility and a role within a broader ecosystem, these are signs of a coin that could stick around. - Transparency is key

Steer clear of memecoins shrouded in mystery, where details about the team and their updates are scarce. A trustworthy memecoin project is open about its progress and the people behind it. - Security measures

Given that memecoins often attract the attention of hackers, robust security is a must. A credible memecoin will have undergone thorough security audits and checks. If a coin lacks evidence of strong security measures, it's a red flag. - Community strength

A vibrant and active community is crucial for a memecoin's success. Memecoins that are driven by their communities tend to have a more promising future, thriving on the collective support and engagement of their members.

As memecoins continue to capture the imagination of the online world, they've also caught the eye of regulators. The wild, unregulated environment in which these coins thrive poses challenges for authorities trying to protect consumers from potential scams or market manipulation. Despite this, the decentralised nature of most memecoins makes regulation a complex issue, leaving this corner of the crypto world as something of a digital Wild West.

Who’s at Risk of Memecoin Scams?

Memecoins tend to pull in younger investors who are drawn by viral marketing, FOMO, and the thrill of high-risk bets. For many, it's less about fundamentals and more about the rush, the community, or simply being part of the next big thing. Investors with limited experience, shaky financial planning, or an appetite for risk seem to be especially susceptible. When you combine that with fast-moving markets and social media hype, it's easy to see why so many get caught up in the chaos.

Conclusion

Memecoins are the whimsical, unpredictable, and culturally significant players in the cryptocurrency arena. They bring together the lightheartedness of internet memes with the fast-paced world of digital assets, creating a unique blend of humour and speculation. Whether you're laughing with them or at them, memecoins have undeniably become a fascinating part of the crypto narrative.

However, the very traits that make memecoins so appealing (i.e. their viral nature and community-driven buzz) also make them a hotspot for speculative bubbles and financial mishaps. As they continue to captivate the imagination of the online masses, they also pose significant challenges and risks, often operating in the murky waters of regulatory oversight. This unregulated and often wild market dynamic invites both opportunistic gains and blatant scammers.

For enthusiasts and investors alike, navigating this landscape means staying informed, vigilant, and discerning. Understanding the signs of a genuine memecoin versus a scam is crucial. It's not just about the initial buzz or the humour; it's about the underlying value, security measures, transparency, and community engagement that support the token's longevity and potential growth.

Tap (XTP) är en banbrytande fintech-plattform lanserad 2019, som förändrar hur vi hanterar pengar genom att kombinera traditionell bank med kryptovalutor. Plattformen möjliggör omedelbara, avgiftsfria överföringar inom sitt nätverk, vilket gör det enklare att dela kostnader och skicka pengar – samtidigt som användarna belönas. Målet? Att demokratisera finans och ge alla tillgång till smarta, säkra och kraftfulla ekonomiska verktyg.

Vad är Tap (XTP)?

Att hantera flera appar, valutor och överföringar kan vara krångligt. Tap (XTP) är en helhetslösning som bygger en bro mellan klassisk ekonomi och kryptovalutor – allt i en och samma app.

Sedan lanseringen 2019 har Tap haft som mål att förenkla ekonomi för alla. Appen gör det möjligt att skicka och ta emot pengar eller krypto avgiftsfritt inom nätverket Tap2Tap, betala räkningar, samt köpa, sälja och växla ett brett utbud av kryptovalutor.

Med Tap kan du enkelt konvertera fiat till krypto – eller ta ut dina tillgångar med låga avgifter. Slipp valutaväxlingspåslag och onödiga appar när du är utomlands.

Nyckeln till det hela är Tap’s egna kryptovaluta, XTP-token, en ERC-20-token som ger tillgång till exklusiva funktioner som upp till 8 % cashback, belöningar och premiumförmåner i hela Tap-ekosystemet. Du kan också använda Tap Mastercard – fysiskt eller virtuellt – och handla med krypto var du än befinner dig i världen.

Tap i praktiken – hur fungerar det?

Tap är en allt-i-ett-plattform som samlar traditionell ekonomi och kryptohantering på ett ställe. Huvudgränssnittet är mobilappen – enkel, säker och byggd för att göra finans tillgängligt.

För att börja använda Tap krävs en verifieringsprocess enligt KYC- och AML-regler. När kontot är godkänt kan användare köpa, sälja och lagra upp till 50 olika kryptovalutor.

Plattformen accepterar flera betalningsmetoder, inklusive banköverföring och kortbetalning. Användare kan också överföra krypto från externa plånböcker till Tap, eller växla sina innehav till fiat och skicka direkt till sina bankkonton.

Med Tap Mastercard kan du dessutom förladda ditt kort direkt från din Tap-plånbok, ta ut kontanter i bankomater över hela världen och få cashback – upp till 8 % beroende på ditt medlemsnivå. Kortet erbjuder även konkurrenskraftiga växlingskurser.

Vad gör Tap unikt?

Slipp växla mellan appar. Tap kombinerar krypto och traditionell ekonomi i en och samma plattform. Växla digitala tillgångar till fiat direkt och använd dem i vardagen – eller bygg en kryptoportfölj med ett stort urval av tillgångar.

Det som verkligen särskiljer Tap är dess on-ramp och off-ramp-funktion. Växla mellan fiat och krypto – direkt, snabbt och utan krångel. Tap passar både nybörjare och erfarna användare som vill ha kontroll över sin ekonomi, oavsett om det gäller spenderande eller investering.

Vad ingår i Tap-ekosystemet?

Tap är mer än bara en app – det är ett komplett ekosystem för din ekonomi.

Flervaluta-plånbok

Säker och krypterad digital plånbok som stödjer över 50 olika kryptovalutor samt fiat. Lätt att hantera, växla och använda både för vardag och investering.

Kryptobörs

Tap erbjuder ett brett utbud av kryptovalutor att handla med – utan begränsningar i handelspar. Appen prioriterar snabbhet, flexibilitet och användarvänlighet.

Tap Mastercard

Tap’s förbetalda Mastercard låter dig handla globalt, både fysiskt och online. Finns som både fysisk och virtuell version.

Cashback

Alla som använder Tap-kortet får cashback. Genom att uppgradera din plan kan du tjäna upp till 8 % tillbaka på varje köp.

Tap2Tap-överföringar

Skicka pengar och krypto gratis till andra Tap-användare, direkt i appen – var du än är i världen.

Stöd för fiatvalutor

Tap stöder flera nationella valutor, så att du kan hantera både fiat och krypto smidigt i samma plattform.

Investerings- och handelsverktyg

Få tillgång till smarta funktioner som realtidsdata, prisnotiser, marknadsrapporter och nyhetsbrev – allt samlat på ett ställe.

Smart Trading Router

Tap’s egna router skannar flera börser och likviditetsleverantörer i realtid för att hitta bästa möjliga pris på din transaktion.

Vad är XTP-token?

XTP är den inhemska kryptovalutan i Tap-ekosystemet – och nyckeln till att låsa upp premiumfunktioner.

Du kan använda XTP för att:

- Få rabatt på handelsavgifter

- Låsa upp premiumplaner och funktioner

- Tjäna upp till 8 % cashback

- Sänka växlingsavgifter

- Öka kortets spendergränser

- Få tillgång till exklusivt innehåll som marknadsbrev och prioriterad support

XTP-token finns i flera handelspar och kan växlas mot ett flertal kryptovalutor direkt i appen, vilket gör det enkelt att diversifiera din portfölj.

Dessutom kan XTP skickas avgiftsfritt mellan Tap-konton – en snabb och kostnadseffektiv metod för internationella överföringar.

Alla XTP-innehav lagras säkert i appens integrerade plånbok, så att du kan fokusera på att växa din portfölj utan att oroa dig för säkerheten.

TAP'S NEWS AND UPDATES

Redo att ta första steget?

Gå med i nästa generations smarta investerare och pengaanvändare. Lås upp nya möjligheter och börja din resa mot ekonomisk frihet redan idag.

Kom igång