You’ve probably heard whispers about the "whales" swimming in the crypto seas. But these aren’t your typical marine mammals. They’re the ultra-wealthy folks and organizations holding massive amounts of digital currency.

What Exactly is a Crypto Whale?

So, what makes someone a crypto whale? There’s no hard-and-fast rule, but it generally comes down to owning a huge chunk of a coin’s total supply. If we’re talking over 10% of the available coins for a particular cryptocurrency, then that’s an ocean-sized wallet!

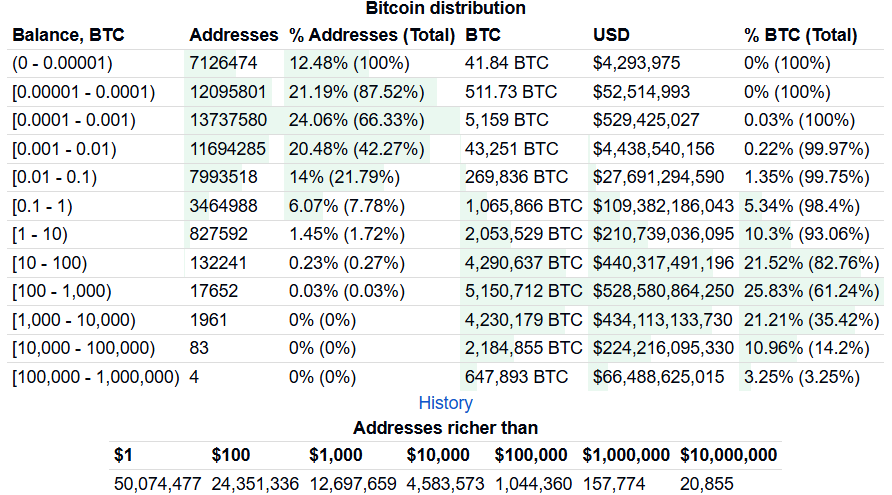

Take Bitcoin, for example. In October 2025, the wealthiest addresses controlled over 14% of all Bitcoin in existence. From Satoshi Nakamoto himself to MicroStrategy. Now that’s some serious whale power!

Bitcoin isn’t the only one with its share of whales. Dogecoin, the beloved meme coin, had a pretty wild concentration too. In 2025, just 3 addresses held over 32% of its total supply. Even Vitalik Buterin, the mastermind behind Ethereum, is considered an Ether whale thanks to his massive stake in the coin he created.

How Much Money Makes You a Crypto Whale?

The exact percentage threshold varies by cryptocurrency, but Bitcoin probably offers the clearest benchmark. Analysts typically define a Bitcoin whale as anyone holding over 1,000 BTC, worth around $100 million USD at recent 2025 market prices.

What About Other Assets?

- Whales usually hold 10,000 ETH or more.

- Generally, 500,000 SOL or more.

These thresholds aren’t clear-cut, and they shift as market value, liquidity, and overall supply and demand evolve. In simple terms, whales are the elite of the cryptocurrency market, capable of moving markets with a single transaction.

How Whales Make Waves

With that kind of buying power, whales can really make waves in the crypto marketplace. If a whale decides to sell off a giant chunk of their holdings, it creates a tidal wave of downward pressure on prices due to the sheer volume and lack of liquidity. Other crypto enthusiasts are always on the lookout for signs of an impending "whale dump," closely monitoring exchange inflows to spot potential dangers.

Here’s the twist, though – whales keeping their coins locked away actually reduces trading liquidity in the market since there are fewer coins actively circulating. Their massive idle fortunes are like icebergs weighing down the crypto ocean.

Tracking Whale Movements

Not every whale transaction is a sell-off. These giants could simply be migrating to new wallets, switching exchanges, or making monster-sized purchases. But you can bet experienced crypto folks keep a keen eye on those huge whale wallets, carefully tracking any ripples they make to navigate the ever-shifting tides of the market.

Whale Alert is a popular service that tracks these large transactions and reports them, often on Twitter. Whenever a whale makes a big move, it’s usually publicized quickly, giving everyone a heads-up on potential market changes.

Below is an example from Twitter from Whale Alert:

The Human Side of Whales

Behind these massive holdings are real people and organizations. Some whales are early adopters who bought into Bitcoin or other cryptocurrencies when they were cheap. Others are companies that have invested heavily in the belief that cryptocurrencies will continue to grow in value. For instance, Ethereum’s founder, Vitalik Buterin, is the biggest Ethereum whale because he holds a significant amount of the cryptocurrency he created.

How Whales Affect Crypto's Price

Price volatility can be increased by whales, particularly when they move a significant amount of one cryptocurrency in one go. For example, when an owner tries to sell their BTC for fiat currency, the lack of liquidity and enormous transaction size create downward pressure on Bitcoin's price. When whales sell, other investors become extremely vigilant, looking for hints of whether the whale is "dumping" their crypto (and whether they should do the same).

The exchange inflow mean, also known as the average amount of a certain cryptocurrency deposited into exchanges, is one of the most common indicators crypto investors look for. If the mean transaction volume rises above 2.0, it implies that whales are likely to start dumping if there are a large number of them using the exchange. This can be viewed by regular crypto traders as a time to act before losing any potential profit.

How Whales Affect Liquidity

When it comes to learning about whales and liquidity, one must remember that while whales are generally considered neutral elements in the industry, when a large number of whales hold a particular cryptocurrency, instead of using it, this reduces the liquidity in the market due to there being fewer coins available.

What Crypto Whales Mean to Investors

In terms of the relationship between whales and investors, one must remember that there are various situations in which a person may transfer their cryptocurrency holdings. It's worth mentioning that moving one's assets doesn't always indicate that you're selling them; they might be switching wallets or exchanges, or making a major purchase.

Occasionally, whales may sell portions of their holdings in discrete transactions over a longer period to avoid drawing attention to themselves or generating market anomalies that send the price up or down unpredictably. This is why investors keep an eye on known whale addresses to check for the number of transactions and value. This is not necessarily a task that newbie investors need to actively be involved with, however, understanding the terms and how whale accounts can affect the market is recommended.

Why Whales Matter

Whether you love them or hate them, whales are a formidable force in the crypto world, shaping its dynamics in profound ways. These giants, whether they’re creators, collectors, or traders, have a tremendous impact across the digital waters. When they make a move, it can trigger monumental swells that ripple through the entire market.

By understanding whale activity, anyone involved in cryptocurrency can better navigate these choppy waters. Staying informed about whale movements helps both newbies and seasoned traders make smarter decisions and stay afloat in this ever-changing space. Keep an eye on these behemoths; their actions can significantly influence your crypto journey.

While tracking whale activity can offer valuable insights into the cryptocurrency market, it's important to complement this knowledge with expert advice. Consulting with a financial advisor can help you navigate the complexities of investing and ensure your strategies align with your personal financial goals and risk tolerance.

This article is for general information purposes only and is not intended to constitute legal, financial or other professional advice or a recommendation of any kind whatsoever and should not be relied upon or treated as a substitute for specific advice relevant to particular circumstances. We make no warranties, representations or undertakings about any of the content of this article (including, without limitation, as to the quality, accuracy, completeness or fitness for any particular purpose of such content), or any content of any other material referred to or accessed by hyperlinks through this article. We make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up-to-date.