More than a million Bitcoin have vanished because owners didn’t plan ahead. Without a crypto inheritance plan, your family could lose access to your assets forever. Here’s how to safeguard them.

Keep reading

As digital assets become a core part of personal wealth, one uncomfortable question lingers: what will happen to your crypto when you’re gone? Unlike traditional assets that can be managed through banks or brokers, cryptocurrencies are bound entirely to whoever holds their private keys. Lose the keys, and the funds are gone. Permanently.

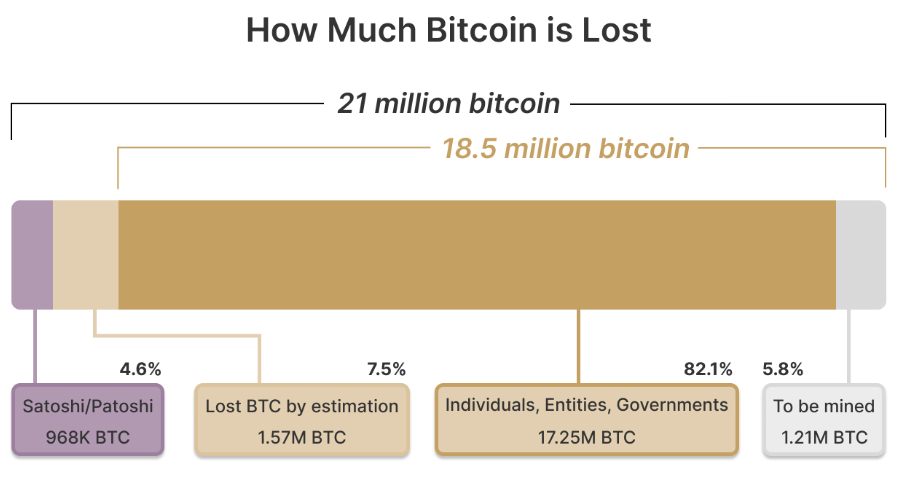

Each year, millions of dollars in Bitcoin, Ether, and other tokens vanish into the digital void when holders pass away without sharing access. It is estimated that around 1.5 million BTC (roughly 7.5% of total supply) may already be lost forever. With digital wealth now part of countless estates, preparing for the inevitable is no longer optional; it’s the responsible thing to do.

Why Planning for Crypto Inheritance Matters

In traditional finance, wealth transfer is handled through wills, trusts, and custodians. But crypto flips that model: you are the bank. Your heirs can’t simply request a password reset or call customer service. Without private keys, wallets, or access instructions, those assets are unrecoverable for all effects and purposes.

A crypto inheritance plan ensures that your digital assets, from Bitcoin and altcoins to NFTs and DeFi holdings, remain both secure and accessible to the people you choose. It bridges two crucial needs: protecting your funds today and ensuring your legacy tomorrow.

Beyond personal security, inheritance planning also reduces emotional and financial stress for your loved ones. By documenting how and where assets can be accessed, you prevent confusion and potential legal disputes.

Building the Foundation of a Crypto Inheritance Plan

Start with Legal Clarity

Consult an attorney familiar with digital assets. A properly structured will or trust should identify your crypto holdings, list beneficiaries, and outline how they can access those funds. Many jurisdictions still lack explicit laws for digital assets, so expert guidance helps ensure compliance and enforceability.

Secure Your Keys… But Don’t Overshare

The biggest challenge in crypto inheritance is private key management. If you die with your keys, your crypto dies with you. However, leaving keys in plain text within a will or document is just as risky. Instead, consider approaches like:

- Multisignature wallets, which require multiple approvals to move funds.

- Shamir’s Secret Sharing, which means splitting your seed phrase into parts distributed among trusted people.

- Encrypted backups or sealed letters stored in secure, offline locations.

Document recovery procedures in plain language so your heirs can follow them even without technical knowledge.

Choose the Right Executor

A traditional executor may not understand how to navigate crypto. You can appoint a tech-literate executor or designate a digital asset custodian to handle that portion of your estate. This ensures smooth execution and reduces the risk of errors or loss.

In a market driven by innovation and constant change, a well-structured inheritance plan offers something rare in crypto, certainty.

New Tools for a Digital Age

The rise of blockchain-based “death protocols” and smart contract automation adds a new layer of possibilities. Some platforms allow transfers to trigger automatically after certain conditions are met (for example, a verifiable death certificate or extended inactivity).

Ethereum and similar chains already support programmable inheritance systems, but these should complement, not replace, legal documents. Technology can help enforce your intentions, but law remains the foundation of inheritance.

Some investors even use “dead man’s switches”, automated systems that transfer funds if the owner doesn’t log in for a set period. While clever, it might be best to pair them with legal documents to prevent accidental activations.

Protecting Privacy While Planning Ahead

While planning for the future, it’s crucial to maintain security in the present. Avoid including wallet addresses, private keys, or passwords in public wills, which become part of the legal record. Instead, store such details in encrypted files or sealed envelopes accessible only to specific individuals.

Tools like decentralized identifiers (DIDs) and verifiable credentials can also help manage long-term identity and access rights. These systems allow you to define who can access what, and when, without intermediaries.

Custodial vs. Non-Custodial: Finding the Balance

When structuring inheritance, knowing whether your assets are held in custodial or non-custodial wallets makes all the difference.

Custodial services (like major exchanges) manage private keys on your behalf, which simplifies recovery if your heirs can provide proper documentation. However, it introduces third-party risk. Accounts can be frozen, hacked, or shut down.

Non-custodial wallets, on the other hand, offer maximum control and privacy but demand greater responsibility. If your heirs lose the seed phrase, there’s no backup plan. There’s also the possibility of taking a hybrid approach: keeping long-term holdings in non-custodial storage for security, while using reputable custodians for smaller, more accessible amounts.

Keep It Up to Date

A crypto inheritance plan is not a “set it and forget it” document. Prices change, portfolios evolve, and wallet technologies become obsolete very often. It may be wise to revisit your plan regularly, especially after major life events such as marriage, divorce, or the birth of a child.

It’s also worth keeping track of regulatory updates in your jurisdiction. Laws surrounding digital assets and inheritance are rapidly evolving, and what’s compliant today may not be tomorrow.

Common Inheritance Pitfalls

Even the best intentions can go wrong. Here are the most frequent mistakes to avoid:

- Including seed phrases directly in your will. As we mentioned before, this makes them public and vulnerable.

- Neglecting to educate heirs. Without guidance, even secure plans can fail.

- Relying solely on exchanges. Centralized platforms can fail or freeze funds.

Planning isn’t just about distributing wealth; it’s about ensuring continuity. A clear inheritance strategy preserves your crypto’s value and prevents it from becoming part of the estimated $100 billion in lost digital assets worldwide.

Protecting More Than Just Coins

Preparing a crypto inheritance plan isn’t merely about money; it’s about legacy. For all the talk about decentralization and autonomy, responsibility and forward-thinking remain at the heart of crypto ownership. By taking the time to plan ahead, you safeguard not only your wealth but also your family’s peace of mind.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

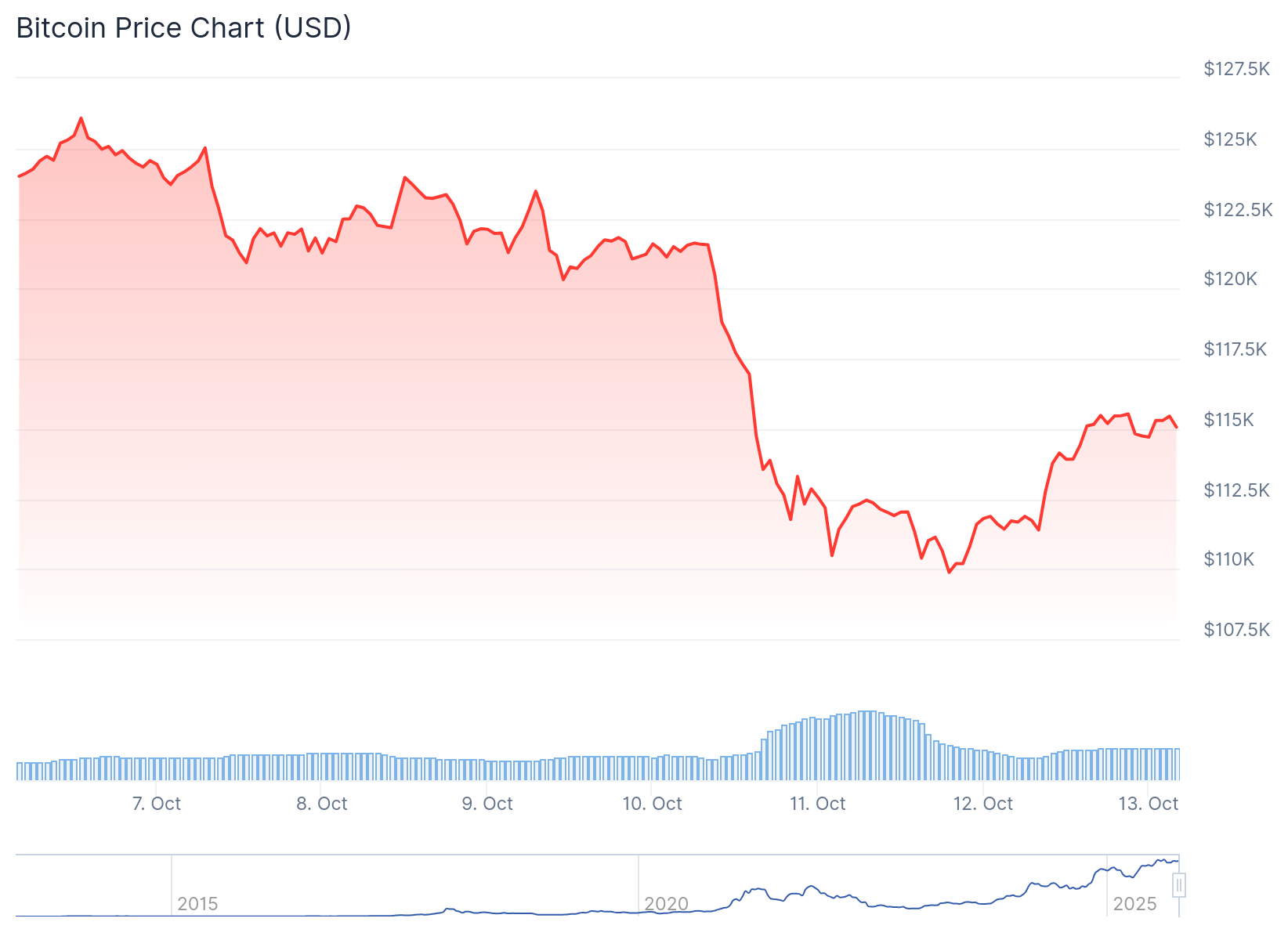

The Crash That Shook It All

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

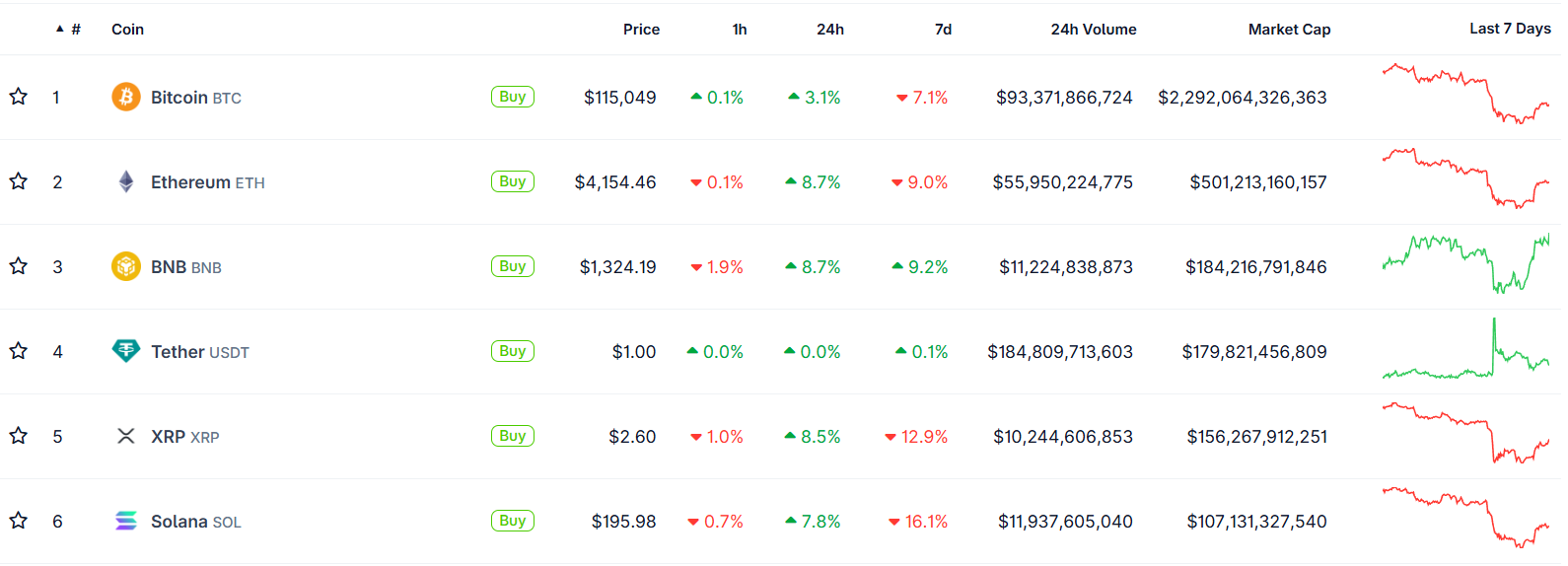

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

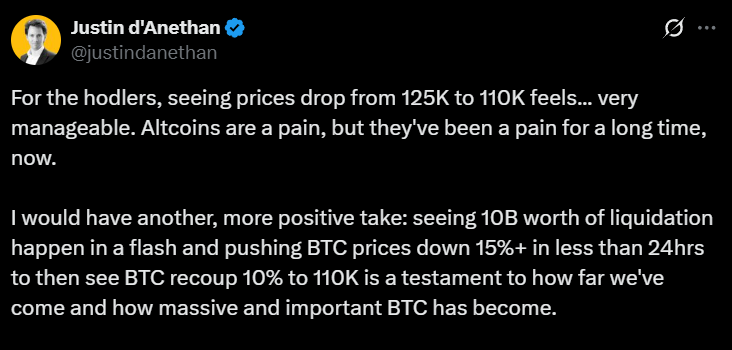

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

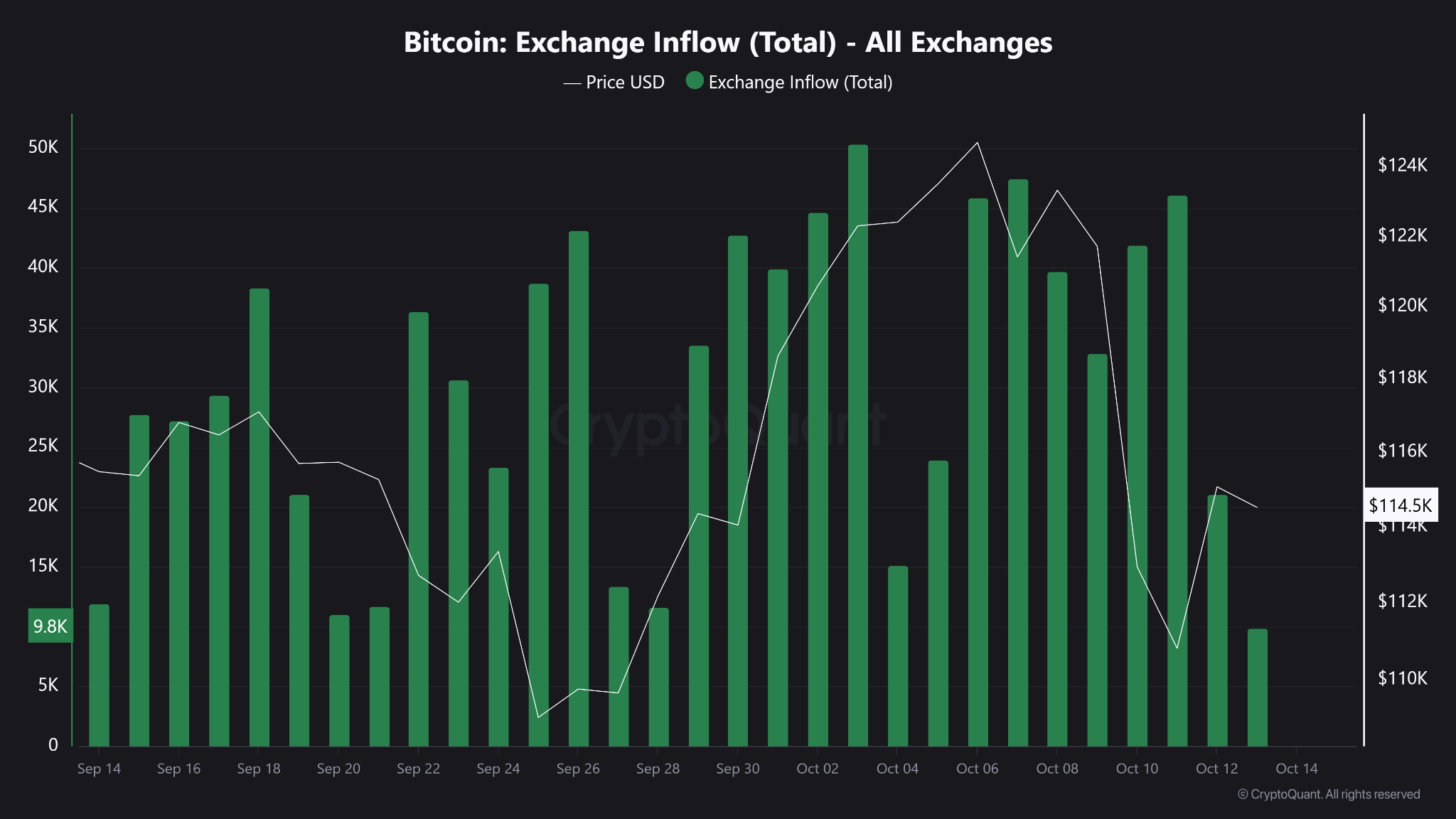

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

LATEST ARTICLE

Vi har goda nyheter – Auto Top-Up för kortet är äntligen här, och det kommer göra din vardag så mycket enklare.

Glöm stressen vid kassan när saldot är för lågt. Den här nya funktionen fyller automatiskt på ditt kort när balansen sjunker – helt på dina villkor.

Ni bad om det – vi lyssnade. Tack vare er feedback har vi byggt Auto Top-Up för att ta bort onödig stress från din vardag. Kortet är alltid redo – så du kan fokusera på viktigare saker (som att välja vad du ska äta till lunch 🍜).

Och här är det bästa av allt: du kan nu använda dina krypto till att betala direkt. Välj vilken kryptotillgång du vill, fyll på kortet – och börja spendera. Så enkelt är det.

Inga fler “Oj, saldot är slut!” 😬

Vi har alla varit där – man ska betala något viktigt, men kortet har för lite pengar. Auto Top-Up ser till att du alltid har pengar på kortet, utan att du ens behöver tänka på det.

Ställ in det en gång – sen kan du slappna av

Aktivera Auto Top-Up en gång, så sköter det sig själv. Du slipper ladda kortet manuellt varje gång saldot sjunker.

Dina pengar, dina regler 💸

Vill du använda fiat? Krypto? Båda? Du bestämmer själv vilken valuta som används vid varje påfyllning.

Alltid redo att betala

Oavsett om du handlar i butik, online eller reser – med Auto Top-Up är ditt kort alltid redo att användas.

Hur funkar det? ✨

Med Auto Top-Up har du full kontroll. Du bestämmer:

- Vilket saldo som ska trigga en automatisk påfyllning.

- Hur mycket som ska fyllas på varje gång.

- Vilken valuta som ska användas – fiat eller krypto.

Tänk dig att du ska betala något viktigt och upptäcker att saldot är för lågt – irriterande, eller hur? Med Auto Top-Up händer inte det längre. Ställ in din gräns och Tap fyller automatiskt på ditt kort innan du ens märker att det behövs – helt enligt dina inställningar.

Så här kommer du igång

- Logga in i din Tap-app

- Gå till kortinställningar

- Aktivera Auto Top-Up och välj dina preferenser

- Klart! Ditt kort är alltid redo

Byggt för sinnesro 😌

Oavsett om du är på resa, shoppar eller betalar vardagsutgifter – med Auto Top-Up slipper du oroa dig för att kortet inte räcker till. Kortet håller sig laddat, så du slipper tänka på det.

Börja använda Auto Top-Up redan idag

Se till att din Tap-app är uppdaterad, gå till kortfliken och aktivera Auto Top-Up där.

Har du frågor? Vårt supportteam finns här för att hjälpa dig komma igång!

Civic (CVC) är en blockchain-baserad plattform för identitetsverifiering som fokuserar på att erbjuda säkra och kostnadseffektiva lösningar för hantering av digital identitet. I takt med att behovet av tillförlitlig identitetsverifiering växer, särskiljer sig Civic genom sin decentraliserade struktur och användarcentrerade kontroll av personlig data.

Låt oss utforska hur Civic tacklar utmaningarna inom digital identitet, integritet och säkerhet.

Kort sammanfattning (TLDR)

- Decentraliserad verifiering: Civic erbjuder säkra identitetsverifieringar utan att lagra data centralt, vilket minskar risken för bedrägerier och identitetsstölder.

- Användarens kontroll: Du äger din data och väljer själv vad du vill dela – och med vem – via Civic-appen.

- Ekosystem: Använder Identity Verification Marketplace och Civic Pass för att möjliggöra åtkomstkontroll, särskilt inom DeFi.

Vad är Civic-nätverket?

Civic grundades 2015 av Vinny Lingham och Jonathan Smith och genomförde en tokenförsäljning 2017 där man tog in 33 miljoner dollar. Målet var att modernisera identitetsverifiering med hjälp av blockchain – där du inte längre behöver skicka dina ID-dokument till olika tjänster gång på gång.

Istället bygger plattformen på återanvändningsbara verifieringar (reusable KYC), vilket minskar både risk och kostnad för användare och företag.

Civic Pass, som lanserades 2021, fungerar som en identitetsnyckel för DeFi-tjänster, NFT-plattformar och DAO:er som kräver efterlevnad. Plattformen fortsätter att vara en av de mer framträdande lösningarna för digital ID-verifiering i blockchainvärlden.

Hur fungerar Civic?

Plattformen bygger på tre huvudkomponenter:

- Identity Verification Marketplace – Kopplar ihop verifieringstjänster med betrodda validerare.

- Civic Pass – Erbjuder åtkomstkontroll för DeFi och andra tjänster med krav på identitetsverifiering.

All information lagras lokalt på användarens enhet – aldrig centralt hos Civic – och verifieras via blockchain. Genom att kombinera decentralisering och datakontroll erbjuder Civic både säkerhet och smidighet.

CVC-token används inom ekosystemet för att betala för verifieringstjänster och belöna validerare.

Fördelar med Civic

Enligt Civic-teamet kan verifieringsprocesser genomföras snabbare och billigare än traditionella metoder. Dessutom elimineras centrala databasrisker, vilket minskar hotet om dataintrång och identitetsstölder.

Plattformen är även inkluderande – lösningar finns för personer som inte har tillgång till traditionella finansiella tjänster, vilket kan bidra till ökad ekonomisk tillgänglighet globalt.

Sedan 2021 har Civic utvecklat verktyg för DeFi-säkerhet och NFT-verifiering, och fortsätter att hitta nya användningsområden inom decentraliserade applikationer.

Användningsområden

Civic används för säker och effektiv identitetsverifiering, oavsett om det gäller kontoskapande, åldersverifiering eller efterlevnad av regelverk. Företag kan implementera starka KYC-rutiner utan att behöva hantera känslig information i sårbara databaser.

Vad är CVC?

CVC är den inbyggda tokenen i Civic-ekosystemet. Den används för:

- Att betala transaktionsavgifter och verifieringstjänster

- Belöningar till validerare

- Incitament inom nätverket

CVC är en ERC-20-token med en fast total tillgång och kan inte brytas.

Hur köper jag CVC?

Du kan enkelt köpa, sälja och lagra CVC i Tap-appen. Allt du behöver göra är att registrera ett konto och komma igång direkt.

%201.webp)

Ever wondered how companies launch those shiny credit cards with their logos on them? Let's dive into the world of card programs and break down everything you need to know to launch one successfully.

What's a card program, anyway?

Think of a card program as your business's very own payment ecosystem. It's like having your own mini-bank, but without the vault, technical infrastructure and security guards. Companies use card programs to offer payment solutions to their customers or employees, whether a store credit card, a corporate expense card, or even a digital wallet.

As you’ve probably figured, the financial world is quickly moving away from cash, and card payments are becoming the norm. In fact, they're now as essential to business as having a product, website or social media presence.

Why should your business launch a card program?

Launching a card program isn't just about joining the cool kids' club – it's about creating real business value and heightened exposure. Here's what you can achieve:

Keep your customers coming back

Remember those loyalty cards from your favourite coffee shop? Card programs take that concept to the next level. When customers have your card in their wallet, they're more likely to choose your business over competitors. Plus, every time they pull out that card, they (and everyone else around) see your brand.

Show me the money!

Card programs open up exciting new revenue streams. You can earn from:

- Interest charges (if applicable)

- Transaction fees from merchants

- Annual membership fees

- Premium features and services

- Insights and information on spending habits

Know your customers better

Want to know what your customers really want? Their spending patterns tell the story. Card programs give you valuable insights into customer behaviour, helping you make smarter business decisions.

Understanding the card program ecosystem

Let's break down the key players in this game:

The dream team

Picture a football team where everyone has a crucial role:

- Card networks (like Visa and Mastercard) are the referees, setting the rules

- Card issuers (like Tap) are the coaches, making sure everything runs smoothly

- Processors (overseen by Tap) are the players, handling all the transactions on the field

Open vs. closed loop: what's the difference?

Open-loop and closed-loop cards differ in where they can be used and who processes the transactions. Let’s break this down:

Open-loop cards:

These cards are branded with major payment networks like Visa, Mastercard, or American Express, and are accepted almost anywhere the network is supported, both domestically and internationally.

Examples: Traditional debit or credit cards, prepaid cards branded by major networks.

Pros: Wide acceptance and flexibility.

Cons: May come with fees for international use or transactions.

Closed-loop cards:

Cards issued by a specific retailer or service provider for exclusive use within their ecosystem. These cards are limited to the issuing brand or select partners.

Examples: Store gift cards (like Starbucks or Amazon), fuel cards for specific gas stations.

Pros: Often come with brand-specific rewards or discounts.

Cons: Limited to specific merchants; less flexibility.

Challenges that may arise

Let's be honest – launching a card program isn't all smooth sailing. Here are the hurdles you'll need to jump:

The regulatory maze

Remember trying to read those terms and conditions? Well, card program regulations are even more complex. You'll need to navigate through compliance requirements that would make your head spin.

Security

Fraud is like that uninvited guest at a party – it shows up when you least expect it. You'll need robust security measures to protect your program and your customers.

We’ve designed our card program to handle these niggles, so that you can bypass the challenges and reap the rewards. With a carefully curated experience, we take care of the setup, programming and hardware so that you can focus on the benefits and users.

Closing thoughts

Launching a card program is like building a house – it takes careful planning, the right tools, and expert help. But when done right, it can become a powerful engine for business growth.

Contact us to get started on building a card program tailored to your company. After all, the future of payments is digital, and there's never been a better time to get started.

Currency volatility is a challenge that businesses operating across borders can’t afford to ignore. Exchange rate fluctuations can erode profits, increase costs, and create financial uncertainty, making it difficult for companies to plan effectively.

For businesses that deal with international transactions, traditional solutions like foreign exchange (forex) hedging can be expensive and complicated. Thankfully now, there's a smarter, more efficient alternative—stablecoins.

Stablecoins offer businesses a way to bypass the unpredictability of currency fluctuations by providing a digital asset pegged to stable currencies like the US dollar. The black and white of it is that they make cross-border payments faster, cheaper, and more reliable.

In this article, we’ll explore why stablecoins are an ideal solution for tackling currency volatility in global financial management.

The challenges of currency volatility in global finance

Global businesses are constantly exposed to currency risks, for a range of reasons, including:

- Geopolitical events – Trade wars, conflicts, or political instability can impact currency values.

- Inflation and interest rate changes – Central bank policies can cause sudden shifts in exchange rates.

- Market speculation – Traders and investors can drive rapid price swings.

For businesses, currency volatility can lead to higher transaction costs, as moving money internationally becomes more expensive. It can also result in unpredictable revenue, making it difficult for companies operating in multiple countries to manage pricing. Additionally, if a currency depreciates suddenly, businesses may face financial losses as profits shrink overnight.

Many businesses use forex hedging strategies (such as forward contracts and options) to manage risk, but these methods are often costly, complex, and require expert knowledge. A simpler, more efficient solution is needed—and that’s where stablecoins come in.

Why stablecoins are the perfect hedge for businesses

Stablecoins offer a practical way for businesses to protect themselves against currency volatility. Unlike traditional cryptocurrencies (which are often highly volatile), stablecoins are pegged to a fiat currency providing a reliable and steady value.

Key benefits for businesses:

- Price stability – With stablecoins, businesses don’t have to worry about sudden exchange rate swings affecting their revenue or costs.

- Fast, low-cost transactions – International payments using stablecoins settle in minutes, not days, with significantly lower fees than traditional banking systems.

- No dependence on banks – Unlike wire transfers, stablecoin payments don’t require intermediaries, reducing delays and extra costs.

- Transparent and secure transactions – Built on blockchain technology, stablecoins ensure auditable, tamper-proof payments, adding an extra layer of security.

For businesses engaging in global trade, payroll, treasury management, or e-commerce, stablecoins offer a modern financial tool to streamline operations and avoid currency-related risks.

Choosing the right stablecoin for your business needs

Not all stablecoins are created equal. Businesses need to choose the right one based on factors like trust, regulation, and network efficiency.

Top stablecoins to consider:

💰 USDT (Tether) – The most widely used stablecoin, but with some concerns around transparency.

💰 USDC (USD Coin) – Fully backed by regulated financial institutions, making it a trusted option.

💰 DAI – A decentralized stablecoin, offering stability without relying on a central issuer.

💰 EUROC (Euro Coin) – A fully backed euro-denominated stablecoin issued by Circle, providing a stable digital alternative for euro transactions.

Key considerations:

- Regulatory compliance – Ensure the stablecoin follows financial regulations in your operating regions.

- Blockchain network – Some stablecoins operate on multiple blockchains (Ethereum, Tron, Solana). Choosing the right network affects transaction speed and fees.

- Liquidity and acceptance – Businesses should opt for stablecoins with high liquidity and broad industry adoption.

Choosing the right stablecoin is essential for seamless global transactions while ensuring stability and security.

The future of stablecoins in global finance

Stablecoins are no longer just a niche tool—they are gaining mainstream acceptance among businesses, financial institutions, and regulators.

Growing adoption – Companies like PayPal and Visa are integrating stablecoins into their payment systems.

Institutional backing – Banks and investment firms are exploring stablecoin use for settlements and asset management.

Regulation on the rise – Governments are working on stablecoin frameworks, aiming to balance innovation with security.

Emerging financial products – Stablecoin-based loans, savings accounts, and remittance services are expanding the financial ecosystem.

As stablecoins evolve, their role in global financial management will only grow, making them a key tool for businesses worldwide.

Conclusion

Currency volatility remains a major challenge for businesses operating globally, as traditional hedging strategies are often expensive and inefficient, leaving companies searching for a better way to manage financial risk.

As outlined above, stablecoins offer a simple, effective, and low-cost solution to tackling currency fluctuations. By providing price stability, fast transactions, and reduced banking dependency, stablecoins empower businesses to operate seamlessly across borders.

For companies looking to future-proof their global financial operations, stablecoins are an answer worth considering. Now is the time to explore how they can be integrated into your business strategy: and we’re here to help.

Onyxcoin (XCN), tidigare känt som Chain (CHN), representerar ett stort steg framåt inom blockchaininfrastruktur. Sedan omprofileringen i mars 2022 har projektet blivit ett ledande alternativ för företag som vill bygga finansiella tjänster på privata blockchain-nätverk. Men vad är det som gör XCN så intressant? Låt oss dyka in.

Vad är XCN?

XCN är kryptovalutan bakom Onyx Protocol – ett flexibelt blockchainnätverk som är utvecklat för att förbättra finansiella avvecklingar. Det används både som nyckel för att få tillgång till tjänster och som styrningsverktyg inom det decentraliserade ekosystemet.

Onyx Protocol möjliggör att separata nätverk kommunicerar smidigt genom gemensamma standarder. Det är både säkert och flexibelt tack vare ett system där tillgångskontroll separeras från registersynkronisering. Nätverket förlitar sig på ett utvalt antal ”block signers” för att säkerställa integritet och en enda ”block generator” för effektiv blockskapande.

Allt detta styrs via Onyx DAO på Ethereum, där XCN används för styrning, premiumtjänster och uppgraderingar av nätverket.

Projektet startades 2014 och har stöttats av investerare som Nasdaq och Citigroup. Det har sedan dess utvecklats till en avancerad och självständig blockchainlösning.

Viktiga egenskaper:

- Molnbaserad blockchain-infrastruktur för företag

- Anpassningsbara verktyg för tillgångsskapande

- Smart contracts via "control programs"

- DAO-styrning för användarinflytande

- Tjänstnivåer: standard och premium

Marknadsanalys: Tekniskt och fundamentalt

Tokenomics

Det finns totalt 48,47 miljarder XCN, varav cirka 65 % redan är i cirkulation. Av detta är 15 miljarder reserverade för stiftelsen och 10 miljarder för DAO:n, med en månadsvis tilldelning om 200 miljoner XCN för att hålla utbudet under kontroll.

Teknisk arkitektur

- Parallella blockchain-nätverk

- Strikt åtkomstkontroll för tillgångar

- Validering via betrodda noder

- Effektiv blockproduktion

Volym, volatilitet och marknadssentiment

Handelsvolym

XCN:s handelsvolymer kan säga mycket om marknadsintresset. Höga eller stabila volymer tyder ofta på stark aktivitet, medan hastiga upp- eller nedgångar kan spegla spekulation eller nyheter.

Prisvolatilitet

XCN:s pris har växlat mellan stabilitet och snabba rörelser. Volatilitet lockar vissa investerare men kan avskräcka andra. Rörelserna påverkas ofta av makroekonomiska faktorer och branschens övergripande humör.

Sentiment

Via sociala medier, forum och nyhetsrapportering kan man få en bild av marknadens attityd. Positiva nyheter om projektets utveckling har genererat optimistiskt sentiment, medan osäkerhet kan trycka ner stämningen.

Korttidsprognoser (1–3 år)

Möjligt positivt scenario

Drivkrafter:

- Företagsanpassning (partnerskap, adoption)

- Teknologiska förbättringar (transaktionstider, avgifter)

- Ökat institutionellt intresse

Prognos: $0.005 – $0.015 beroende på utveckling och marknadens respons

Möjligt negativt scenario

Risker:

- Regulatorisk osäkerhet

- Konkurrens från liknande projekt

Prognos: $0.001 – $0.0017

Långsiktsprognoser (3–5 år)

Möjligt positivt scenario

Drivkrafter:

- Utbredd användning av Onyx-teknik

- Ekosystemets tillväxt

- Kryptomarknadens generella expansion

Prognos: $0.02 – $0.08 beroende på tillväxt och innovation

Möjligt negativt scenario

Risker:

- Lång nedgång i kryptomarknaden

- Överlägsen konkurrens

Prognos: $0.0005 – $0.0015

Slutsats

Onyxcoin (XCN) har potential att växa genom ökad användning och teknisk utveckling, men står också inför utmaningar som kan påverka dess framtid. Prognoserna varierar kraftigt beroende på marknadens riktning, teknologins framsteg och investerarnas förtroende.

Som alltid när det gäller digitala tillgångar, är det klokt att läsa på ordentligt, följa utvecklingen nära och reflektera över sin egen risktolerans. Håll koll på XCN direkt i Tap-appen för senaste uppdateringar och prisrörelser.

%20_.webp)

Vad är Onyxcoin (XCN)?

Onyxcoin är den inhemska tokenen för Onyx Protocol, en molnbaserad blockchain-infrastruktur som gör det möjligt för företag att skapa privata blockchain-nätverk för finansiella tjänster. Till skillnad från offentliga blockkedjor erbjuder Onyx en sluten och säker miljö för att utfärda, lagra och överföra digitala tillgångar, vilket minimerar risker som säkerhetsintrång och transaktionsförseningar.

Onyx Protocol är utformat för att ansluta oberoende nätverk under gemensamma standarder, vilket säkerställer smidig interoperabilitet. Genom att separera kontrollen över tillgångar från synkroniseringen av huvudboken levererar det både säkerhet och flexibilitet till användarna.

Användningsområden för XCN

XCN fungerar både som en nyttotoken och en styrningstoken inom Onyx-ekosystemet. Det används för att betala för premiumtjänster, finansiera nätverksuppgraderingar och ger innehavare möjlighet att påverka protokollets framtida utveckling genom deltagande i Onyx DAO, en decentraliserad autonom organisation på Ethereum.

Företag kan använda Onyx Protocol för att skapa anpassade "utfärdandeprogram" för tillgångsskapande, som hanteras av "kontrollprogram" som möjliggör skapandet av avancerade smarta kontrakt. Nätverkets säkerhet upprätthålls av en federation av "blocksignerare" för att förhindra förgreningar, medan en enda "blockgenerator" säkerställer effektiv blockskapande.

Framtidsutsikter för XCN

Prognoser för XCN varierar beroende på marknadsscenarier. I ett positivt scenario, med ökad företagsadoption och teknologiska framsteg, kan XCN:s pris öka betydligt över de kommande åren. I ett mindre gynnsamt scenario, med ökad konkurrens och regulatoriska utmaningar, kan priset förbli stabilt eller minska.

Det är viktigt att notera att kryptovalutamarknaden är mycket volatil, och priserna kan påverkas av en mängd faktorer, inklusive teknologiska framsteg, marknadssentiment och globala ekonomiska förhållanden.

Vanliga frågor om Onyxcoin (XCN)

Är Onyxcoin (XCN) relaterat till JP Morgan?

Nej, Onyxcoin är ett oberoende projekt och har ingen koppling till JP Morgan eller dess tidigare blockchain-enhet, som nu är känd som Kinexys.

Hur kan jag köpa och använda XCN?

XCN kan köpas på flera större kryptovalutabörser. För att delta i styrningen av Onyx Protocol eller använda premiumtjänster, kan innehavare satsa sina tokens genom den officiella plattformen.With Tap

Vad är den maximala tillgången på XCN?

Den maximala tillgången på XCN är 48,4 miljarder tokens, med cirka 65% för närvarande i cirkulation.

För att hålla dig uppdaterad om XCN:s prisrörelser och nyheter kan du följa dess sida inom Tap-appen.

Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started