Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

When it comes to navigating the cryptocurrency markets, staying informed and staying away from FUD can oftentimes be more complicated than one might imagine. In this article, we're going to guide you through how to recognize FUD in the blockchain space and how to avoid it.

Since Bitcoin entered the scene in 2009, the crypto markets have seen their fair share of ups and downs. Although it's true that each market downturn has been followed by a recovery and considerable development, experienced and novice traders alike may find that times of decline are difficult to navigate. Particularly with the rise in FUD.

Before we cover the tools of the trade to recognize and avoid FUD, let's first cover what FUD is exactly.

What is FUD?

FUD in the cryptocurrency realm stands for Fear, Uncertainty and Doubt. This term is used to refer to inaccurate information released by people who wish to manipulate the markets. Releasing FUD content is intended to influence a trader to make decisions that might affect the cryptocurrency's price or their holdings in some way (usually encouraging them to sell).

While commonly used against Bitcoin, Ethereum and other cryptocurrencies are also targeted. FUD typically leads to investors selling off their coins, leading to a panic sell which snowballs and results in a significant loss in value for the coin.

Often mentioned alongside FUD is the term FOMO, Fear Of Missing Out. FOMO is centered around the fear of people missing out on profits, leading them to make quick decisions that aren't necessarily the best ones. While FUD tends to instigate selling an asset, FOMO tends to drive traders to buy an asset. Essentially, these two terms are designed to tap into human emotions that lead to quick decisions.

FUD is typically released through a rumor published on a well-respected website, a negative news item, or a well-known figure expressing concerns about a certain asset (commonly done over Twitter ). Content surrounding FUD and FOMO tend to be from organizations or individuals that have something to gain from the intended action. The content is designed to strongly influence the reader.

FUD and FOMO aren't strictly related to the crypto market, such tactics have also been witnessed in the stock market and other commodity trading spaces. The jargon has become synonymous with trading.

How to recognise FUD

The crypto community might seem tight-knit but there are often ill-actors that gain access to the trusted space and infiltrate it with bad news. This is often seen when people use a commonly discussed topic, such as regulation, to build a narrative that isn't necessarily true to influence traders.

Here are several tips to ensure that you don’t fall victim to FUD:

Establish a trading goal

Before you enter the crypto market ensure that you have definitive goals, with accompanying timelines. When faced with FUD or FOMO information, consider if the resulting actions of this news will move you closer to your goal or further away. If you stay focused on your goal you are less likely to be swayed by market sentiment.

Build a trading strategy before entering a trade

A trading strategy generally involves determining a stop loss, entry point, target sell point, and amount of capital. By establishing this before entering the trade, you will have clear objectives to follow and be less likely to fall victim to FUD-centered misinformation.

Stay informed, but verify sources

Keeping an eye on the crypto markets and staying informed is imperative for any trader, especially day traders. Ensure that the places that you acquire your information from are reputable and legitimate, and if something sounds suspicious, verify it through a number of other sources.

Be patient and consistent

Engaging in crypto trading involves making well-informed decisions based on market trends and supporting technology. Rather than seeking rapid financial gains, it's important to maintain patience and consistency in working toward your goals, while staying focused on your intended path.

Navigating FUD

Despite this sounding difficult, FUD is easily avoidable if you stick to these tips above and only seek information from reliable news sources. While Twitter may have quick tips, it's also hard to determine what the author's intentions are.

Consider whether something sounds accurate or not, and always conduct your own research when considering involvement in a new project. From a financial standpoint, participating in digital currency can be a profitable endeavor, so be sure to act responsibly and observe market trends with a critical perspective.

As we explore the world of crypto assets, we take a look at the different types of crypto assets on the market and at the wide range of diversity in the new-age industry. As more people enter the market and start exchanging digital assets, the industry grows and expands to allow new variations.

Below we explore the vast diversity in the industry, from crypto assets used as money to ones that reward users for viewing a website. Each business offers a unique solution, and to navigate this we offer you guidance below.

What Are Crypto Assets?

The terms "crypto asset" and "cryptocurrency" can be used interchangeably. They both refer to a digital asset built using blockchain that can be transferred in a direct peer-to-peer manner. The first crypto asset to launch is Bitcoin, which entered (and created) the scene in 2009. Since then thousands of crypto assets have been created, each one with its own unique use case.

The Different Types Of Crypto Assets

While crypto assets might fall into one or more categories, each has its own set of rules and use cases.

Payment-Focused

These crypto assets can be used to pay for everyday goods and services or as a store of value (in some cases). These include the likes of Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), etc.

Stablecoins

Stablecoins are crypto assets that have their value pegged to a fiat currency or commodity. These crypto assets are designed to bypass the volatility synonymous with the crypto market. These include the likes of Tether (USDT) and USD Coin (USDC).

Privacy Coins

Privacy coins are digital assets that hide details of the transaction, such as the origin, destination and amount. These crypto assets offer untraceable monetary transfers. These include the likes of Monero (XMR) and ZCash (ZEC).

CBDCs

Central Bank Digital Currencies (CBDCs) are crypto assets built and maintained by banks. Used as digital currencies alongside the traditional currency, CBDCs are designed to provide a digital version of the local fiat to which the value is pegged.

Governance Tokens

Common among decentralized finance (DeFi) protocols, governance tokens provide holders with a say in the platform and in future updates.

Utility Tokens

Utility tokens will typically provide a service to the holder on the platform on which it was created. Commonly created using the ERC-20 token standard, utility tokens might represent a subscription on a platform or a use case specific to that ecosystem.

Non-Fungible Tokens

Non-fungible tokens, also known as NFTs, are crypto assets that cannot be used interchangeably and instead hold unique and rare properties. Each NFT represents a singular function that cannot be changed.

How Are Crypto Assets Created And Distributed?

Before crypto assets are created the project's intentions are generally circulated through a white paper. In this white paper, the asset's tokenomics will be outlined which will cover how the asset is created and distributed.

Bitcoin, for example, uses a Proof of Work consensus which means that new coins are entered into circulation through miners solving complex mathematical problems. The network was designed to only ever have 21 million coins created, and new coins are slowly entered into the system each time a miner verifies and adds a new block to the blockchain.

Ethereum on the other hand has no limit to the number of ETH that can be created. The platform is currently moving from a PoW to a Proof of Stake consensus, which alters the way in which transactions are verified, however, new coins still enter circulation through verifying transactions.

XRP minted all its coins prelaunch and slowly release them into the system through a central authority while Tether creates USDT on demand. For each $1 sent, 1 USDT is created, which can later be removed from circulation should it be sold.

The Future Of Crypto Assets

With the ICO Boom in 2017, the DeFi boom in 2020 and the more recent NFT Craze, crypto assets aren't going anywhere. With constant innovation and increasing adoption, crypto assets have become an integral part of the modern day financial landscape.

While mainstream adoption is on the rise, a few wrinkles still need to be ironed out. For one, regulatory bodies around the world are working toward creating legal frameworks in which these crypto assets can exist, while centralized banks are exploring whether CBDCs can co-exist with their physical counterparts. While the world seeks to figure these out, one this is for certain: crypto assets are here, and the industry is becoming bigger by the day.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

Money talks, but some currencies whisper so quietly you need a magnifying glass to hear them. In the grand theatre of global finance, not all currencies are created equal, while some strut around like peacocks (looking at you, Kuwaiti Dinar), others shuffle about with the confidence of a wet paper bag.

The Lebanese Pound (LBP) currently holds the unfortunate distinction of being the world's weakest currency in 2025, with an exchange rate so low that one U.S. dollar equals approximately 89,500 Lebanese pounds. To put this in perspective, you'd need a small suitcase to carry the equivalent of $100 in Lebanese pounds, assuming you could find enough physical notes.

Currency weakness isn't just about having a lot of zeros after the decimal point. It reflects a complex web of economic factors, including inflation rates, political stability, monetary policy decisions, and investor confidence. This guide on the world's weakest currencies in 2025, explores the economic stories behind their struggles and what it means for the countries (and the people) who use them.

Top 10 weakest currencies in the world (2025)

Here's the lineup of currencies that make your wallet feel surprisingly heavy when travelling abroad:

| Rank | Currency | Country | Approx. units per USD |

|---|---|---|---|

| 1 | Lebanese Pound (LBP) | Lebanon | 89,500-90,000 LBP |

| 2 | Iranian Rial (IRR) | Iran | 800,000-890,000 IRR |

| 3 | Vietnamese Dong (VND) | Vietnam | 25,960-26,100 VND |

| 4 | Laotian Kip (LAK) | Laos | 21,500-21,600 LAK |

| 5 | Indonesian Rupiah (IDR) | Indonesia | 15,400 IDR |

| 6 | Uzbekistani Som (UZS) | Uzbekistan | 12,700-12,800 UZS |

| 7 | Syrian Pound (SYP) | Syria | 13,000 SYP |

| 8 | Guinean Franc (GNF) | Guinea | 8,600 GNF |

| 9 | Paraguayan Guarani (PYG) | Paraguay | 7,800 PYG |

| 10 | Malagasy Ariary (MGA) | Madagascar | 4,600 MGA |

Exchange rates are approximate and fluctuate daily. Data compiled from multiple financial sources as of July 2025.

What makes a currency weak?

Before we roll our eyes at long strings of zeros, let’s get clear on what actually drives currency weakness.

Exchange rates show how much of one currency you need to buy another, usually measured against the U.S. dollar. But a low exchange rate isn’t automatically a red flag. Just like shoe sizes, bigger numbers aren’t necessarily worse, they’re just different.

The real reasons a currency weakens?

- Persistent inflation that eats away at value

- Short-term monetary policies that undermine long-term confidence

- Trade imbalances and shrinking foreign reserves

- Political instability that rattles investor trust

When investors lose faith, money moves fast, and exchange rates feel the impact. In short, weak currencies aren’t a punchline, they’re a signal of deeper economic tension.

Country spotlights - case studies behind the weakest currencies

Lebanon | A financial collapse without precedent

Lebanon’s currency crisis is a case study in how not to run an economy. As of mid-2025, the Lebanese pound trades at over 89,500 LBP per USD, making it one of the weakest currencies in the world.

The collapse stemmed from a banking sector that functioned like a state-sponsored Ponzi scheme: banks attracted deposits with sky-high interest rates, only to lend most of those funds to a debt-laden government. When confidence evaporated, the system imploded. Add in the 2019 mass protests and the devastating 2020 Beirut port explosion, and the result was economic freefall.

Today, Lebanese citizens navigate a surreal economy where ATMs limit withdrawals to tiny amounts, and many businesses have shifted to unofficial dollar pricing. A shadow economy thrives alongside the official one, proof that when trust in institutions fails, people find their own workarounds.

Iran | Sanctions, inflation, and isolation

The Iranian rial now trades at over 1,000,000 IRR per USD (yes, that's six zeros). Sanctions have cut Iran off from the global financial system, leaving its oil-rich economy unable to fully monetise its most valuable resource.

It's like owning a garage full of Ferraris with no keys to drive them. In response, Iran has attempted to bypass sanctions with crypto experiments and barter agreements, but none have stabilised the currency.

Inflation routinely exceeds 40%, and as a result Iranians have turned to gold, property, and U.S. dollars to preserve what little value they can. In a country known for its resilience, the rial’s collapse remains a stark reminder of the long-term costs of economic isolation.

Vietnam | Weak by design, not disaster

The Vietnamese dong trades at around 26,000 VND per USD, but that doesn’t signal a crisis, it actually reflects deliberate policy. Vietnam maintains a weaker currency to keep exports competitive, a strategy known as competitive devaluation.

This has helped transform Vietnam into a global manufacturing hub, attracting companies looking to diversify away from China. It's like running a permanent sale on your national output - foreign buyers love the prices, and Vietnamese factories stay busy.

The challenge lies in balance. The government works to avoid the inflation traps that have plagued other countries on this list, proving that not all weak currencies come from failure, some are tools of long-term economic strategy.

Laos | Trapped by debt and dependency

The Laotian kip now trades at around 21,800 LAK per USD, weighed down by inflation above 25% and a debt-to-GDP ratio over 125%. Much of that debt is owed to China, tied to major infrastructure projects that haven’t yet paid off economically.

Laos is a landlocked nation with limited industrial capacity and high import dependence, leaving its currency exposed whenever commodity prices shift. With little monetary wiggle room, the kip’s trajectory reflects deeper economic vulnerabilities.

Sierra Leone | A currency redefined, but still fragile

In 2022, Sierra Leone redenominated its currency, removing three zeros from the leone to simplify transactions. But even the new leone remains weak due to decades of disruption: civil war, the Ebola outbreak, COVID-19, and swings in diamond prices.

This is an economy that's faced shock after shock, and recovery is slow. The mining sector, especially diamonds, still dominates, leaving the leone vulnerable to commodity price drops.

Healthcare challenges and limited infrastructure add even more pressure, reducing productivity and increasing fiscal strain. The leone’s weakness tells the story of a country rebuilding piece by piece, with its currency reflecting both the past and the uphill path ahead.

Why some countries choose to keep their currency weak

Believe it or not, some countries actually prefer their currencies to be weaker - and for good economic reasons. It's counterintuitive, like preferring to drive in the slow lane, but the strategy can be remarkably effective.

Export competitiveness represents the primary motivation. A weaker currency makes domestic products cheaper for foreign buyers, essentially providing a permanent discount. German cars might be excellent, but if Vietnamese motorcycles cost 70% less due to currency differences, guess which ones developing countries will buy?

Countries like China famously maintained an artificially weak currency for decades, helping fuel their manufacturing boom. The strategy worked so well that other countries accused them of "currency manipulation" - the economic equivalent of being too good at a game and getting accused of cheating.

However, this approach carries significant risks. Import costs rise dramatically, making everything from oil to smartphones more expensive for domestic consumers

Long-term currency weakness can also trigger capital flight, where wealthy citisens move their money abroad. When your own citisens don't trust your currency, convincing foreigners becomes considerably more challenging.

Does a weak currency mean a weak economy?

We’ve established that a weak currency doesn't automatically signal economic disaster,sometimes it's just a reflection of different economic structures and historical circumstances.

Indonesia and Vietnam serve as the best examples of countries with numerically weak currencies but relatively strong economies. Both nations have achieved consistent growth, reduced poverty, and built increasingly diversified economies despite their currencies requiring calculators to count properly.

The key lies in purchasing power parity - what matters isn't how many zeros follow your currency symbol, but what those zeros can actually buy. A Vietnamese worker earning 10 million dong monthly isn't necessarily poor if that amount provides a comfortable living standard within the Vietnamese economy.

The real measure of economic health involves factors like employment rates, productivity growth, infrastructure development, and living standards. A country with a weak currency but growing wages, improving infrastructure, and expanding opportunities may be economically healthier than a nation with a strong currency but declining industries and rising unemployment.

What are the consequences of a weak currency?

In essence, a weak currency makes daily life more expensive, with rising prices on imports like food, fuel, and electronics. Added into the mix, Inflation erodes savings, and capital flight accelerates as people move their money into more stable currencies.

Over time, foreign currencies may replace the local one in everyday use, limiting government control. Internationally, weak currencies hurt credit ratings and investor confidence, reinforcing instability.

Final thoughts

Currency weakness is more than just numbers, it’s a signal. We’ve learnt above that it can both expose deep economic flaws or reflect deliberate strategies for growth. Lebanon and Iran highlight how instability and isolation can erode value fast, while Vietnam shows how weakness can fuel exports and development.

These disparities then shape the country’s trade, capital flows, and financial stability worldwide, causing a wider ripple effect. In a global economy, no currency moves alone; each affects the rest. And behind every weak currency are real people navigating inflation, opportunity, or uncertainty.

If you’re interested in staking Ethereum, you came to the right place. The largest liquid staking protocol in the crypto ecosystem, trusted by thousands of ETH holders who want rewards without losing liquidity, has a name: Lido DAO.

Ethereum's Leading Liquid Staking Protocol

How does it work?

Lido DAO is a decentralized autonomous organization that provides a liquid staking solution on the Ethereum 2.0 blockchain as well as other Proof of Stake (PoS) platforms like Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM).

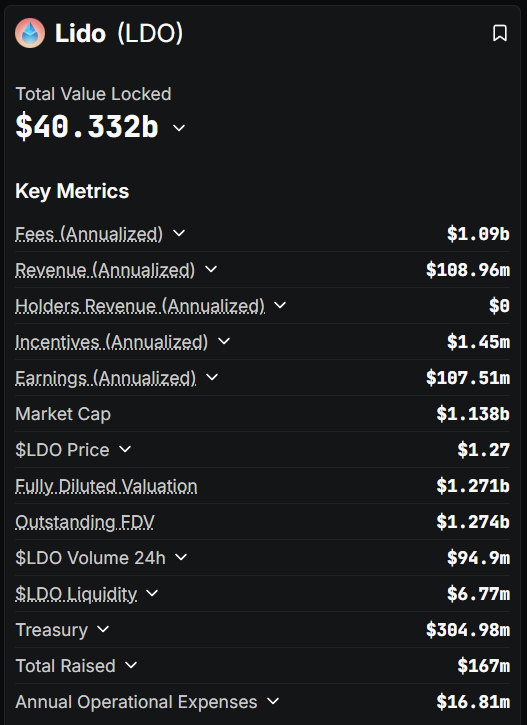

Instead of locking up funds, users stake ETH and receive stETH tokens in return, which represent their staked ETH plus accrued rewards. This allows users to continue trading, lending, or using their tokens across DeFi while still benefiting from staking yields. Since launching in 2020, Lido DAO has grown to manage more than $40.33B in Total Value Locked (TVL), with staking rewards currently averaging an annual percentage rate (APR) of 2.71%. The protocol is governed by holders of the LDO token, ensuring community-driven decision-making.

Where did it come from?

Lido DAO was co-founded by Kasper Rasmussen and Jordan Fish, also known as CryptoCobain. Behind the Lido DAO are a number of individuals and organizations that are well-regarded within the DeFi space. Since its inception in December 2020, shortly after ETH 2.0's release, the platform has been overseen by the Lido DAO, with several key members including Semantic VC, Chorus, ParaFi Capital, P2P Capital, Libertus Capital, Terra, StakeFish, Bitscale Capital, StakingFacilities, and KR1. Several of the highly esteemed angel investors include Stani Kulechov of Aave, Banteg of Yearn, Will Harborne of Deversifi, Julien Bouteloup from Stake Capital, and Kain Warwick from Synthetix.

Since then, Lido DAO has gained an impressive reputation for its liquid staking capabilities, and now boasts over $13 billion in staked assets. Its core focus is on Ethereum, yet its horizons are expanding to other blockchain networks including Terra and Solana, both of which launched staking capabilities in 2021, as well as several other layer 1 PoS blockchains.

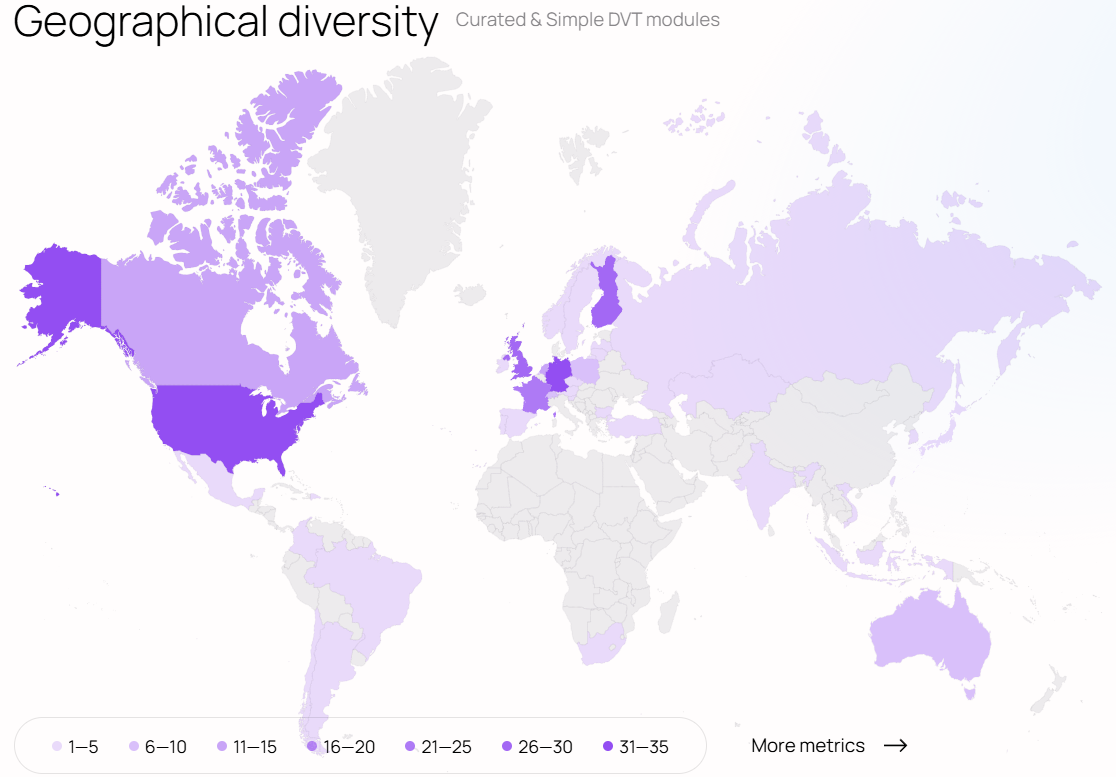

Liquid Staking Made Simple

Lido DAO simplifies staking into a three-step process: deposit ETH, receive stETH, and start earning rewards automatically. When a user deposits ETH, the protocol delegates funds to a decentralized network of professional node operators. There are over 800 node operators worldwide, who manage validation securely and efficiently.

The stETH tokens received are liquid ERC-20 assets whose value increases over time as rewards accumulate. With one-click staking through Lido DAO’s interface, users can skip the hassle of running their own validator while enjoying a 98.2% validator performance.

How validator rewards are earned from staked assets

So, in order to stake ETH, become a validator and earn rewards for validating payments on the Ethereum platform, users are required to stake a minimum of 32 ETH tokens. What if I don’t have 32 ETH? You may ask. To bypass this minimum requirement and still earn rewards, Lido DAO allows users to stake a fraction of this amount and earn a proportionate amount of block rewards.

Users will then deposit ETH into the Lido smart contract and receive the same number of stETH. These tokens are minted once the funds have been received and are burned when the users withdraw their original ETH. The staked funds will then be distributed to the validators on the Lido network and deposited into the Ethereum Beacon Chain from where they will be secured in a smart contract.

The Lido DAO will then assign, onboard, support and enter the validators' addresses to the smart contract registry before being given a set of keys for the validation. All ETH that users have deposited on the Lido platform will be split into groups of 32 ETH among the active Lido node operators who will use this public validation key to validate transactions. The block rewards will then be shared proportionately.

Notably, this distribution process of sharing staked assets eliminates single-point-of-failure risks common among single-validator staking.

Your Liquid Staking Asset

At the center of Lido DAO’s system is stETH, the tokenized representation of staked ETH. stETH trades on major exchanges, offering deep liquidity and integration with several DeFi protocols. Staking rewards are earned automatically, so users never need to claim manually.

Users can stake any amount of ETH to the Beacon Chain without having to deal with lock-up requirements or withdrawal delays. This way Ethereum holders can enjoy both liquidity and yield simultaneously. For providing this staked ETH service, a 10% fee is collected by Lido for each process.

DeFi Integration Opportunities

For advanced users, stETH unlocks a wide range of yield optimization strategies. Lending platforms like AAVE accept stETH as collateral, while liquidity pools on CURVE and UNISWAP offer additional yield opportunities. Leveraged staking strategies also allow users to compound rewards further.

Proven Security

Security and safety are central to Lido DAO's success. Since the beginning, the protocol has undergone a dramatic array of independent audits, conducted by top-tier firms including Statemind, Certora, Hexens, Oxorio, MixBytes, and Ackee Blockchain.

Importantly, Lido DAO has never suffered a major protocol-wide hack. The protocol takes advantage of open-source code, multisig governance, and safeguards like GateSeal for emergency pauses, deposit security modules, and DAO oversight to anticipate and mitigate emerging threats. These layers of defense, combined with a multi-validator, geographically distributed network, reduce single points of failure.

What is Lido DAO token (LDO)?

Governance of the Lido DAO is powered by the LDO token, which grants voting rights to its holders. With a market capitalization of $1.14B and an all time high (ATH) price of $2.38 USD, LDO plays a central role in shaping the protocol’s future. Token holders vote on proposals, influence fee structures, and participate in selecting node operators. The governance community is highly active, with regular proposals and ongoing discussions that ensure the protocol evolves in a decentralized and transparent way.

How to buy Lido LDO?

Staking with Lido DAO is meant to be as accessible as possible. There are no minimum deposit requirements; end users can stake any amount of ETH. You can connect an Ethereum wallet, confirm the transaction, and receive stETH instantly.

If you're looking to expand your digital currencies portfolio, LDO tokens can be a potential addition. The Tap app provides an easy and secure way for anyone with an account to add these tokens to their portfolios in no time, making it one of the most effortless trading experiences around.

You can utilize the Tap app to access the Lido ecosystem by purchasing LDO tokens with either crypto or fiat currencies. End users can then choose to store their LDO tokens securely in the integrated crypto wallet or transfer them to the Lido platform and engage in the platform's earning potential. All you need to do to get started is download the app and create an account in minutes.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Redo att ta första steget?

Gå med i nästa generations smarta investerare och pengaanvändare. Lås upp nya möjligheter och börja din resa mot ekonomisk frihet redan idag.

Kom igång