Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

As digital assets become a core part of personal wealth, one uncomfortable question lingers: what will happen to your crypto when you’re gone? Unlike traditional assets that can be managed through banks or brokers, cryptocurrencies are bound entirely to whoever holds their private keys. Lose the keys, and the funds are gone. Permanently.

Crypto Vanishes All the Time

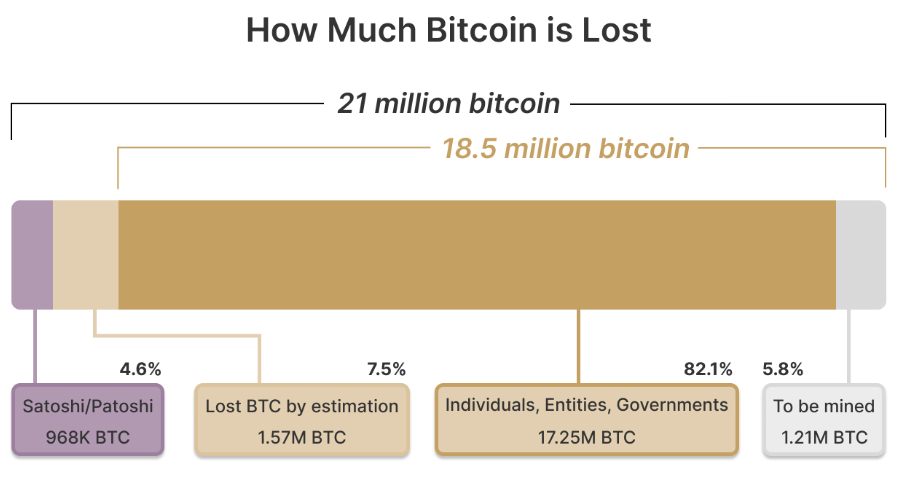

Each year, millions of dollars in Bitcoin, Ether, and other tokens vanish into the digital void when holders pass away without sharing access. It is estimated that around 1.5 million BTC (roughly 7.5% of total supply) may already be lost forever. With digital wealth now part of countless estates, preparing for the inevitable is no longer optional; it’s the responsible thing to do.

Why Planning for Crypto Inheritance Matters

In traditional finance, wealth transfer is handled through wills, trusts, and custodians. But crypto flips that model: you are the bank. Your heirs can’t simply request a password reset or call customer service. Without private keys, wallets, or access instructions, those assets are unrecoverable for all effects and purposes.

A crypto inheritance plan ensures that your digital assets, from Bitcoin and altcoins to NFTs and DeFi holdings, remain both secure and accessible to the people you choose. It bridges two crucial needs: protecting your funds today and ensuring your legacy tomorrow.

Beyond personal security, inheritance planning also reduces emotional and financial stress for your loved ones. By documenting how and where assets can be accessed, you prevent confusion and potential legal disputes.

Building the Foundation of a Crypto Inheritance Plan

Start with Legal Clarity

Consult an attorney familiar with digital assets. A properly structured will or trust should identify your crypto holdings, list beneficiaries, and outline how they can access those funds. Many jurisdictions still lack explicit laws for digital assets, so expert guidance helps ensure compliance and enforceability.

Secure Your Keys… But Don’t Overshare

The biggest challenge in crypto inheritance is private key management. If you die with your keys, your crypto dies with you. However, leaving keys in plain text within a will or document is just as risky. Instead, consider approaches like:

- Multisignature wallets, which require multiple approvals to move funds.

- Shamir’s Secret Sharing, which means splitting your seed phrase into parts distributed among trusted people.

- Encrypted backups or sealed letters stored in secure, offline locations.

Document recovery procedures in plain language so your heirs can follow them even without technical knowledge.

Choose the Right Executor

A traditional executor may not understand how to navigate crypto. You can appoint a tech-literate executor or designate a digital asset custodian to handle that portion of your estate. This ensures smooth execution and reduces the risk of errors or loss.

In a market driven by innovation and constant change, a well-structured inheritance plan offers something rare in crypto, certainty.

New Tools for a Digital Age

The rise of blockchain-based “death protocols” and smart contract automation adds a new layer of possibilities. Some platforms allow transfers to trigger automatically after certain conditions are met (for example, a verifiable death certificate or extended inactivity).

Ethereum and similar chains already support programmable inheritance systems, but these should complement, not replace, legal documents. Technology can help enforce your intentions, but law remains the foundation of inheritance.

Some investors even use “dead man’s switches”, automated systems that transfer funds if the owner doesn’t log in for a set period. While clever, it might be best to pair them with legal documents to prevent accidental activations.

Protecting Privacy While Planning Ahead

While planning for the future, it’s crucial to maintain security in the present. Avoid including wallet addresses, private keys, or passwords in public wills, which become part of the legal record. Instead, store such details in encrypted files or sealed envelopes accessible only to specific individuals.

Tools like decentralized identifiers (DIDs) and verifiable credentials can also help manage long-term identity and access rights. These systems allow you to define who can access what, and when, without intermediaries.

Custodial vs. Non-Custodial: Finding the Balance

When structuring inheritance, knowing whether your assets are held in custodial or non-custodial wallets makes all the difference.

Custodial services (like major exchanges) manage private keys on your behalf, which simplifies recovery if your heirs can provide proper documentation. However, it introduces third-party risk. Accounts can be frozen, hacked, or shut down.

Non-custodial wallets, on the other hand, offer maximum control and privacy but demand greater responsibility. If your heirs lose the seed phrase, there’s no backup plan. There’s also the possibility of taking a hybrid approach: keeping long-term holdings in non-custodial storage for security, while using reputable custodians for smaller, more accessible amounts.

Keep It Up to Date

A crypto inheritance plan is not a “set it and forget it” document. Prices change, portfolios evolve, and wallet technologies become obsolete very often. It may be wise to revisit your plan regularly, especially after major life events such as marriage, divorce, or the birth of a child.

It’s also worth keeping track of regulatory updates in your jurisdiction. Laws surrounding digital assets and inheritance are rapidly evolving, and what’s compliant today may not be tomorrow.

Common Inheritance Pitfalls

Even the best intentions can go wrong. Here are the most frequent mistakes to avoid:

- Including seed phrases directly in your will. As we mentioned before, this makes them public and vulnerable.

- Neglecting to educate heirs. Without guidance, even secure plans can fail.

- Relying solely on exchanges. Centralized platforms can fail or freeze funds.

Planning isn’t just about distributing wealth; it’s about ensuring continuity. A clear inheritance strategy preserves your crypto’s value and prevents it from becoming part of the estimated $100 billion in lost digital assets worldwide.

Protecting More Than Just Coins

Preparing a crypto inheritance plan isn’t merely about money; it’s about legacy. For all the talk about decentralization and autonomy, responsibility and forward-thinking remain at the heart of crypto ownership. By taking the time to plan ahead, you safeguard not only your wealth but also your family’s peace of mind.

After a volatile October that saw one of the sharpest two-day liquidations of the year, the crypto market is trying to regain its footing, but conviction remains divided. Bitcoin has stabilized near key support levels, while altcoins fight against selling pressure. With macro, policy, and on-chain factors all in play, the debate between the bull and bear camps is as alive as ever. Let’s unpack the forces shaping both sides of the ledger.

The Bear Case

When Good News Don’t Move Prices

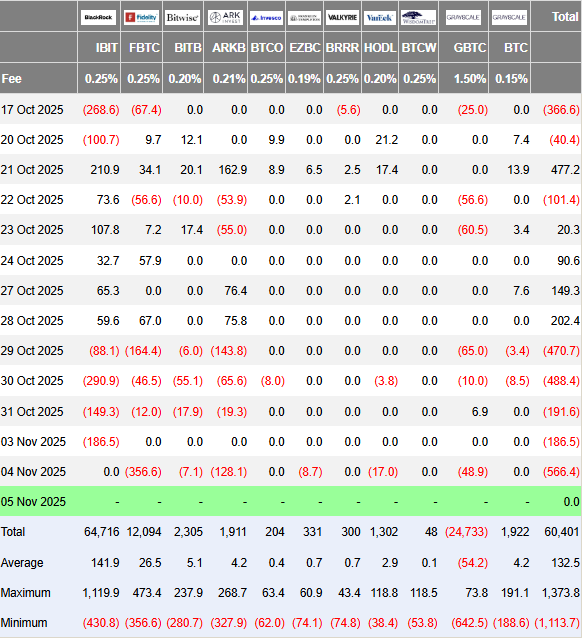

Despite encouraging ETF data and easing rate expectations, crypto failed to rally in late October, a classic warning sign of risk fatigue. According to Farside Investors, U.S. spot Bitcoin ETFs saw outflows of $470 million, $488 million, and $191 million between October 29 and 31, signaling that short-term traders were taking profits or stepping aside after “Uptober” fizzled out.

The AI Narrative

Macro sentiment still casts a long shadow. The tech-heavy equity rally, driven by AI infrastructure and chip stocks, has stirred debate about overvaluation. Nvidia’s brief breach of a $5 trillion valuation in late October triggered flashbacks of the dot-com era. If AI equities begin to deflate, crypto could feel the wealth effect unwind, as liquidity shifts from speculative assets to safer havens.

The 10/10 Crash Aftershock

The October 10 downturn marked one of the largest single-day liquidations in recent memory. Analysts note that this event left traders hunting for “dead entities” and potential hidden losses, injecting caution across the market. Even with recovery underway, scars from that drop remain fresh.

Post-Halving Cycle Timing

Bitcoin’s halving on April 20, 2024 (block 840,000) reset expectations, but it also reignited the age-old question: where are we in the cycle? Historically, the strongest rallies have occurred before or shortly after the halving, not a full year later. Some analysts now argue that the current consolidation could represent a late-cycle phase rather than the start of a new one.

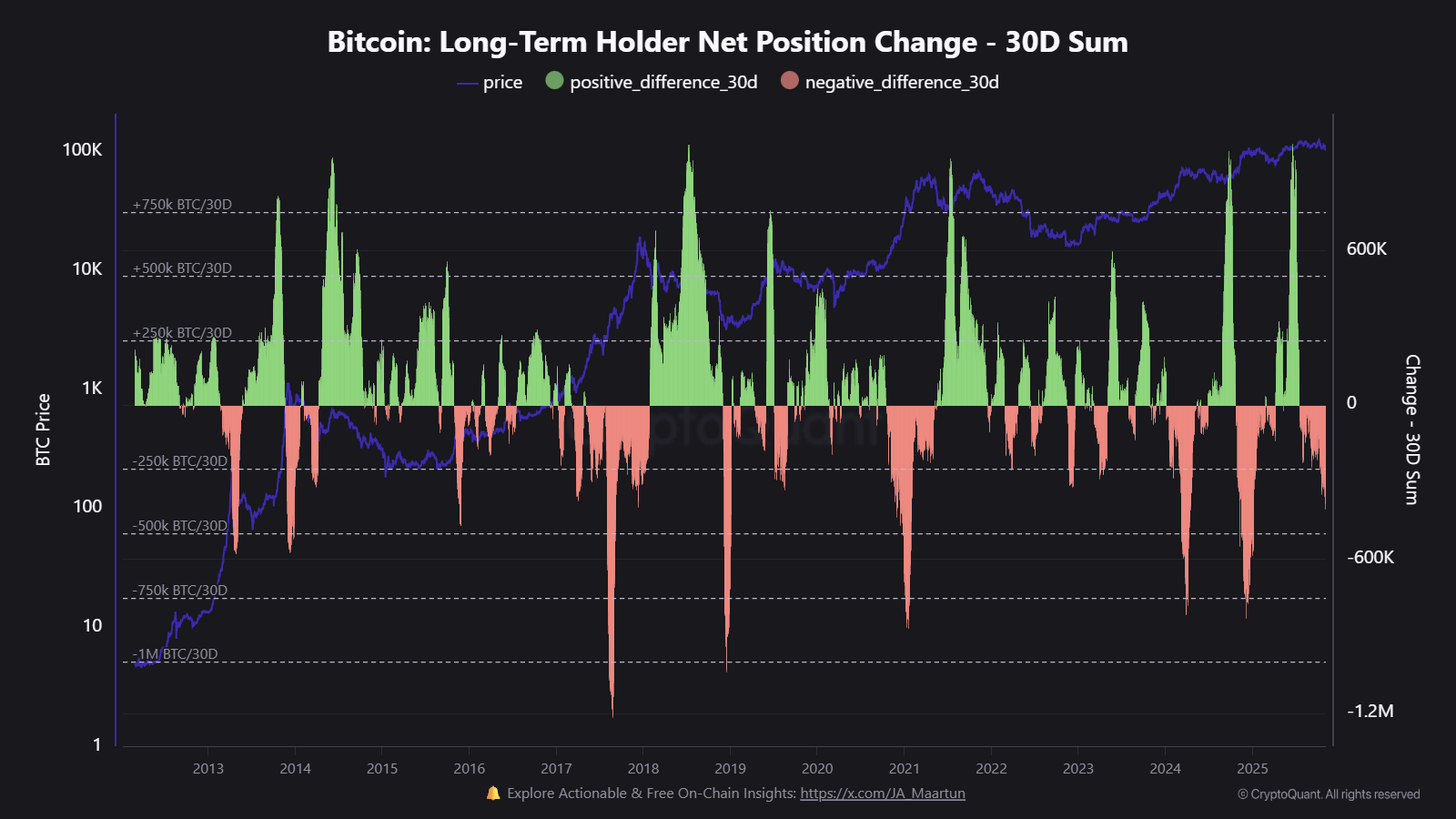

Dormant Wallets Awakening

On-chain data from CryptoQuant shows that long-term holders have increased net distribution since mid-October, with tens of thousands of BTC re-entering circulation. Several Satoshi-era wallets have also moved funds, not necessarily bearish in isolation, but enough to add pressure and short-term supply.

The Bull Case

No Signs of Euphoria

Market positioning remains far from overheated. The Crypto Fear & Greed Index currently sits in the 20s, and has been recently hovering between “Fear” and “Neutral.” That’s a far cry from the exuberant 80s to 90s readings that often precede blow-off tops. In practical terms, this suggests there’s still room for sentiment to improve before the market becomes dangerously crowded.

Liquidity Is Turning

Central banks are easing. The European Central Bank has already paused, the Bank of England has begun cutting, and the U.S. Federal Reserve is expected to follow suit with at least one more rate cut by year-end. According to the CME FedWatch Tool, the odds of a 0.25% cut currently stand above 70%. Historically, easing cycles have correlated strongly with renewed crypto uptrends, as lower yields push investors back into risk assets.

Institutional Adoption Keeps Compounding

Spot ETFs remain the biggest driver of credibility and inflows this year. Despite short-term outflows, global crypto investment products reached $921 million as recently as last week. That steady institutional presence gives crypto markets deeper liquidity and a stronger foundation than in previous cycles, where retail speculation dominated.

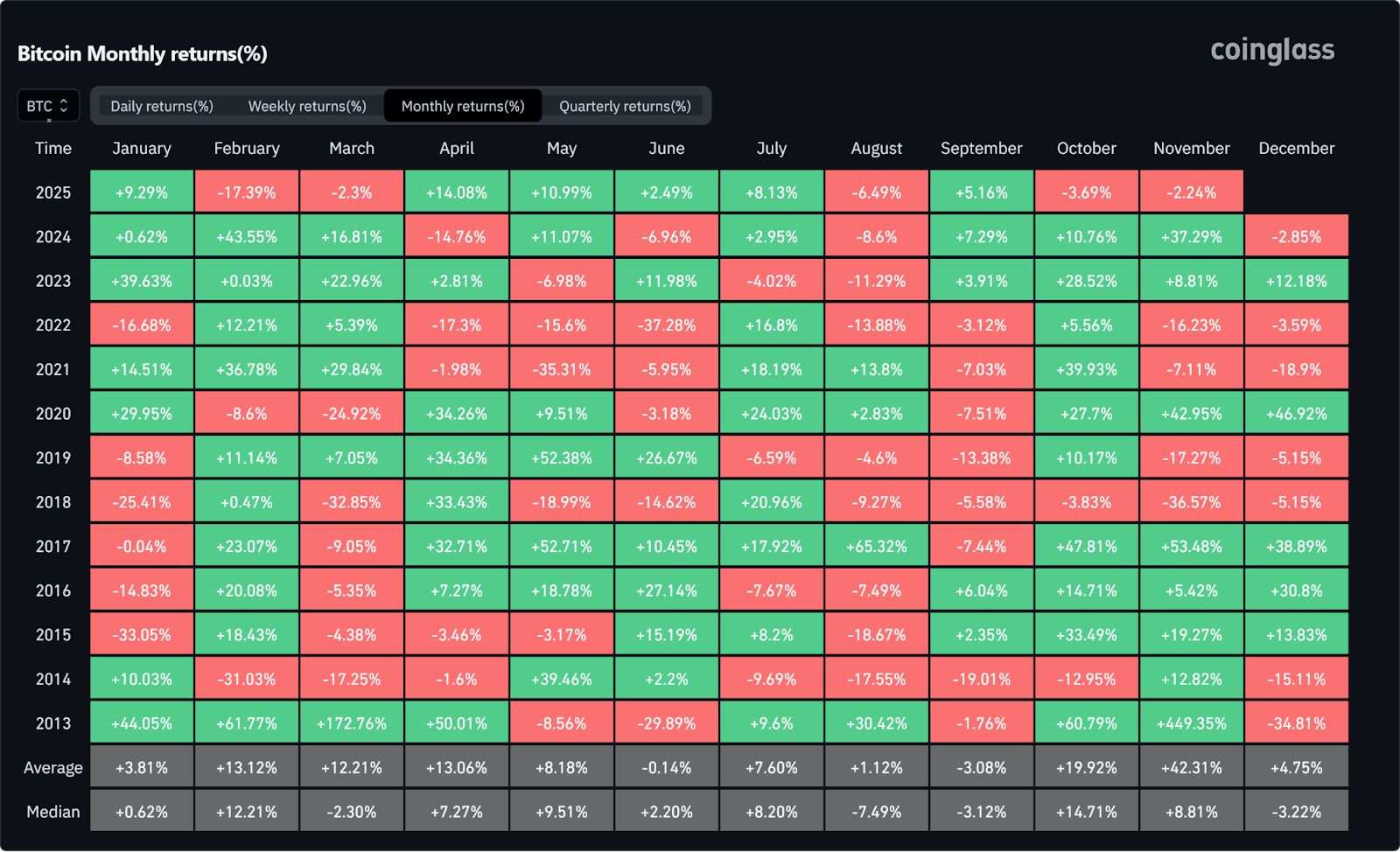

The Seasonal Edge

Seasonality adds another bullish data point. Since 2013, Q4 has consistently been Bitcoin’s strongest quarter on average. With November historically delivering above-average performance, many traders see the current consolidation not as a ceiling, but as a potential setup, particularly if macro data softens and ETF inflows resume.

Improving Global Sentiment

Finally, the U.S.–China trade thaw is a quiet but important catalyst. China has agreed to pause 24% tariffs on U.S. goods, marking the most significant de-escalation yet. For global risk assets, that’s a relief valve, potentially restoring confidence in emerging markets and crypto alike.

Final Verdict

Crypto’s tug-of-war between optimism and caution is far from over. The bull camp points to liquidity, policy progress, and institutional growth as evidence of a maturing ecosystem. The bears, on the other hand, warn that cycle timing, macro fragility, and old-wallet selling could cap any short-term rally.

Currently, the most realistic view lies somewhere in between these two extremes. After October's flash crash sent shockwaves through the market, a period of recalibration has taken hold. Whenever the next significant high arrives, the current environment may be best described not as peak fear or euphoria, but as consolidation.

Something's shifting in crypto, and it's not just the charts. After weeks of sideways action and uncertainty, major developments out of the United States could be the catalyst that many were hoping for.

The timing couldn't be more interesting. Retail appetite is quietly building, whales are accumulating aggressively (especially in XRP), and macro conditions are starting to tilt back in crypto's favor. Individually, each of these catalysts matters. Combined, they set the stage for the kind of conditions that have historically preceded major shifts. Here's what you need to know, and why the next few weeks might be more important than most people realize.

1. U.S. Tariff Dividend

One of the biggest stories to watch is the “tariff dividend” President Donald Trump announced, a direct payment that could reach around $2,000 per person. The idea is that funds collected from higher import tariffs could be redistributed to citizens, effectively a form of economic stimulus. This could inject billions into consumer wallets, creating new liquidity across markets.

If history is any guide, such payouts can ripple into crypto. During the 2020 stimulus-era, Bitcoin saw a sharp uptick as retail investors channeled part of their checks into digital assets. The same pattern could repeat if a new wave of disposable income reaches American households, especially with crypto platforms now far more accessible than they were five years ago.

2. U.S. Government Shutdown Ending

Another factor lifting sentiment is the prospect of the U.S. government reopening. Political gridlock has weighed on markets, but signs of resolution have already sparked rallies across equities and digital assets alike. The relief comes as investors regain confidence that key economic functions will resume smoothly.

The last comparable event came in 2019, when a record-long U.S. shutdown ended after 35 days. Shortly afterward, Bitcoin began a sustained recovery, climbing from roughly $3,500 in late January 2019 to over $13,000 by mid-year. While correlation doesn’t imply causation, renewed fiscal clarity and market confidence often coincide with higher risk-appetite, the environment where crypto tends to thrive.

3. Pending ETF Approvals: Keep an Eye on XRP

Finally, the next big trigger could come from the regulatory side. Several new spot crypto ETF applications are nearing decision windows, with assets like XRP and Solana drawing heavy attention. The success of Bitcoin and Ethereum ETFs has already shown how much institutional demand can reshape liquidity and credibility in the space.

In particular, XRP could be one of the biggest winners. According to recent on-chain data, whales have accumulated more than $560 million worth of XRP in the past few weeks, a sign of growing confidence ahead of potential ETF approval. Broader adoption through regulated investment vehicles could finally unlock fresh capital inflows for alternative crypto assets beyond Bitcoin and Ethereum.

Bottom Line

Nothing is set in stone in crypto. But when liquidity, regulatory progress, and accumulation all start pointing in the same direction? That's when things get very interesting.

We're heading into the final stretch of 2025 with more aligned positive factors than we've seen in months. So, for anyone involved in crypto, whether you're trading daily or holding, now's the time to stay plugged in.

When Satoshi Nakamoto created Bitcoin, he designed it in such a way that should the value increase dramatically, there would still be an inclusive decimal value for the masses. Satoshis could one day be how we buy a cup of coffee anywhere in the world, using the same currency from Britain to Japan.

How Many Satoshis Are in One Bitcoin?

Often shortened to SAT, Satoshi is the smallest unit of Bitcoin, the world’s first and most popular cryptocurrency. Just like the U.S. dollar divides into cents, Bitcoin divides into Satoshis, but on a much finer scale. One Bitcoin equals 100,000,000 Satoshis (0.00000001 BTC).

This structure ensures that Bitcoin remains usable for everyday financial transactions, even as its market value rises. Whether someone is investing a few dollars or buying a cup of coffee, the Bitcoin network allows precise division and ownership down to a single Satoshi, making the digital currency accessible to everyone.

Why Satoshis Matter

Bitcoin’s price often exceeds tens of thousands of U.S. dollars, creating a psychological barrier for newcomers who assume they must buy an entire coin. Satoshis remove that barrier by enabling fractional ownership.

This level of accessibility supports financial inclusion, allowing individuals from all backgrounds (including those in developing markets) to participate in the cryptocurrency economy.

From micropayments to online services, Satoshis make purchasing small products, tipping creators possible, etc. As adoption grows, the ability to transact in Satoshis could become a standard part of personal finance and global economic development.

How to Convert Satoshis

Because 1 BTC = 100,000,000 SATs, converting between the two is very simple math:

Satoshis = Bitcoin × 100,000,000

Bitcoin = Satoshis ÷ 100,000,000

For instance, if Bitcoin trades at $60,000, then:

- 1 SAT = $0.0006

- 10,000 SATs = $6

- 100,000 SATs = $60

To simplify conversions, users can access Satoshi calculators or adjust display preferences within their cryptocurrency wallet or favorite platform. Many platforms also allow price displays in SATs to improve user experience and accuracy.

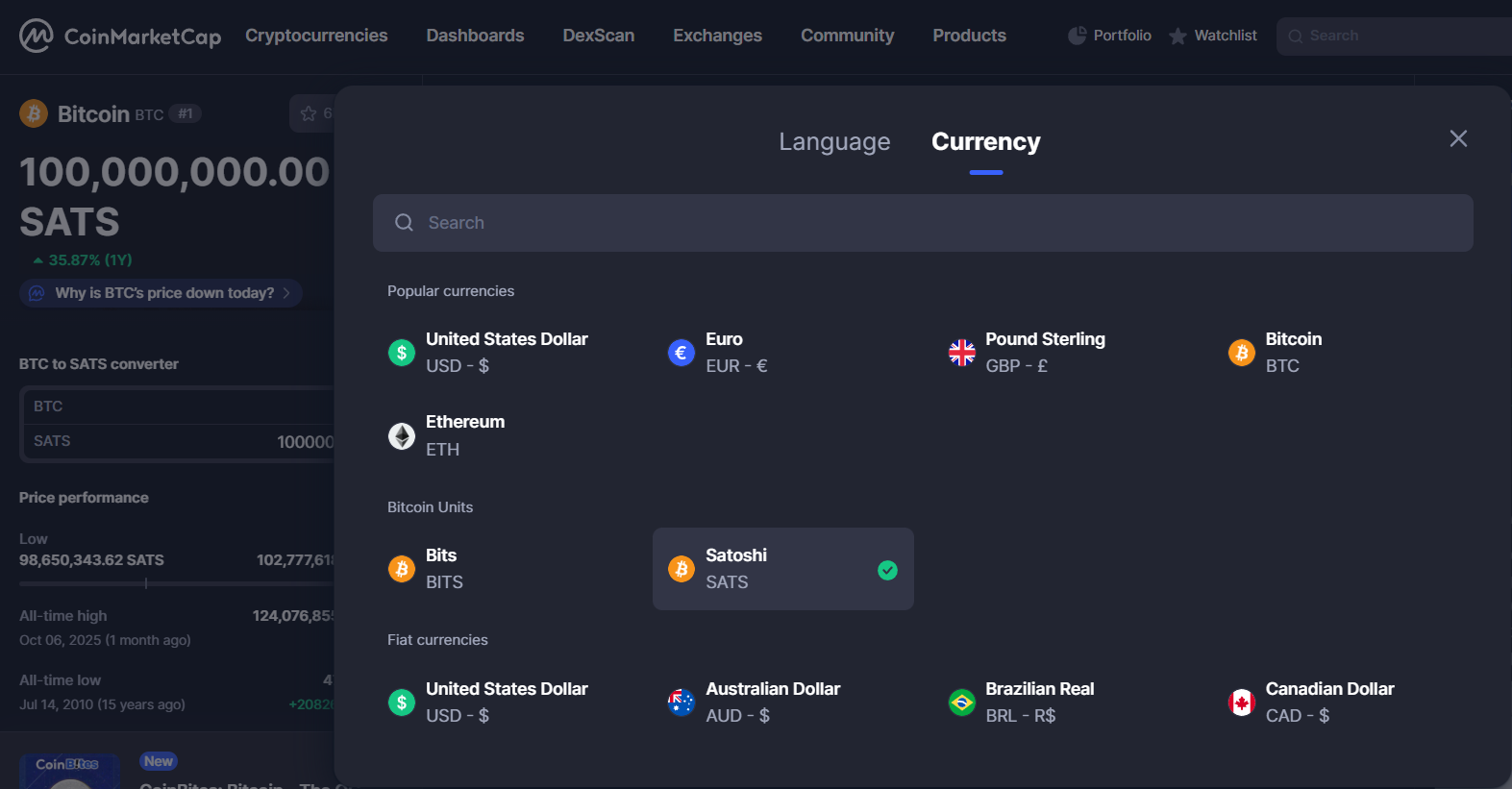

For instance, on CoinMarketCap, you can change the default currency to SATs by selecting the currency drop down option in the top right-hand corner. Select the Satoshi option under Bitcoin units. This will then display all values as Satoshis.

The History Behind the Name

The name “Satoshi” honors Satoshi Nakamoto, the mysterious programmer who invented Bitcoin and published its white paper in 2008.

The term was first proposed in 2010 on the BitcoinTalk forum by a user named Ribuck, who suggested defining a smaller Bitcoin unit for microtransactions. The community endorsed it, and “Satoshi” became the standard reference for Bitcoin’s smallest fraction.

This naming not only pays tribute to Bitcoin’s anonymous creator but also reflects the peer-to-peer and community-driven nature of the blockchain project.

Bitcoin Unit Hierarchy Explained

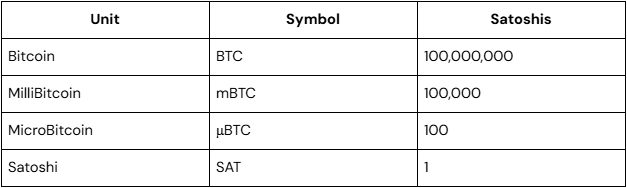

Bitcoin can be divided into several measurement units, which make it easier to display or calculate different values depending on trade size or market purpose:

Users can choose their preferred unit in most cryptocurrency wallets or mobile apps, which helps reduce confusion when managing balances. This hierarchical structure is part of Bitcoin’s software design, ensuring precision, scalability, and transparency across every financial service or exchange that integrates it.

Real-World Applications of Satoshis

The use of Satoshis extends far beyond calculations. They play a vital role in everyday transactions and digital finance. Examples include:

- Micropayments. Paying for an article, video, or song online using fractions of Bitcoin.

- Remittances. Sending money across borders with minimal fees and no intermediary banks.

- Retail payments. Buying coffee, subscriptions, or services priced in SATs.

- Mining rewards. Bitcoin miners earn Satoshis as rewards for validating blocks on the blockchain.

- Lightning Network transactions. Enables instant, low-cost peer-to-peer payments denominated in milli- or micro-Satoshis.

These use cases show us how cryptocurrency adoption supports faster, cheaper, and more inclusive financial transactions, which helps bridge gaps between traditional fiat money and the digital economy. Satoshis make it easier to represent these small, day-to-day amounts.

Satoshis vs Other Cryptocurrency Units

Other blockchains have their own smallest units. For example, Ethereum uses the Wei, where 1 ETH = 1,000,000,000,000,000,000 Wei (18 decimal places). While Ethereum’s extreme divisibility helps with DeFi and smart contract operations, Bitcoin’s 8-decimal precision balances usability and simplicity. The Satoshi system keeps values easy to calculate, supports market liquidity, and provides enough granularity for future adoption.

This approach makes Bitcoin user-friendly, maintaining accuracy and precision in every financial transaction without overwhelming users with excessive mathematical complexity.

Considerations

Despite its simplicity, using the Satoshi unit can bring some hurdles too:

- Many newcomers are unfamiliar with terms like “Satoshi” or how to interpret BTC in fractional units.

- Since Bitcoin’s price fluctuates, the value of a Satoshi changes constantly, affecting everyday purchasing power.

- Not all wallets and exchanges display Satoshis by default, creating potential confusion for the end user.

- While some companies and fintech platforms already support SAT-based payments, widespread retail exposure is still limited.

Overcoming these hurdles will require better user experience design, educational content, and standardized software development practices across the industry.

The Future of Satoshis

As Bitcoin adoption expands, Satoshis may play an even bigger role in daily finance. With the Lightning Network, users can already transact in milli-satoshis, enabling high-speed, low-cost microtransactions far below one SAT.

In the long term, Bitcoin’s fractional-reserve capabilities and tokenization could make it a backbone for financial services, virtual payments, and cross-border trade. For emerging economies, Satoshis could represent economic empowerment, offering a stable, global currency that anyone around the world can use.

In short, Satoshis are not just a mathematical fraction. They are the mathematical foundation of a global peer-to-peer financial system that continues to evolve.

Key Takeaways

- 1 Satoshi = 0.00000001 Bitcoin

- Enables fractional ownership and global accessibility

- Named after Satoshi Nakamoto, Bitcoin’s anonymous creator

- Used for microtransactions, payments, and mining rewards

- Essential for the future of financial inclusion and digital payments

Getting Started: How to Buy and Use Satoshis

You can acquire the exact amount of Satoshis you're looking for through the Tap app, making it easy to begin your journey into the exciting world of Bitcoin.

You’ve probably heard whispers about the "whales" swimming in the crypto seas. But these aren’t your typical marine mammals. They’re the ultra-wealthy folks and organizations holding massive amounts of digital currency.

What Exactly is a Crypto Whale?

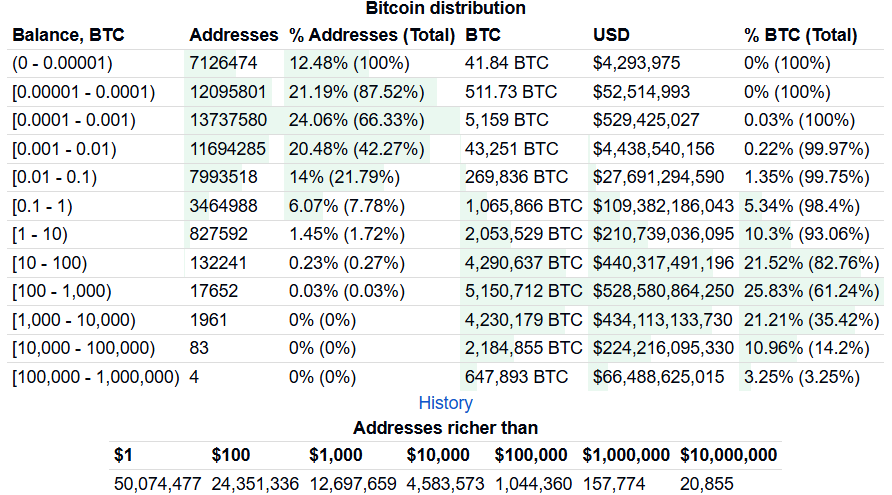

So, what makes someone a crypto whale? There’s no hard-and-fast rule, but it generally comes down to owning a huge chunk of a coin’s total supply. If we’re talking over 10% of the available coins for a particular cryptocurrency, then that’s an ocean-sized wallet!

Take Bitcoin, for example. In October 2025, the wealthiest addresses controlled over 14% of all Bitcoin in existence. From Satoshi Nakamoto himself to MicroStrategy. Now that’s some serious whale power!

Bitcoin isn’t the only one with its share of whales. Dogecoin, the beloved meme coin, had a pretty wild concentration too. In 2025, just 3 addresses held over 32% of its total supply. Even Vitalik Buterin, the mastermind behind Ethereum, is considered an Ether whale thanks to his massive stake in the coin he created.

How Much Money Makes You a Crypto Whale?

The exact percentage threshold varies by cryptocurrency, but Bitcoin probably offers the clearest benchmark. Analysts typically define a Bitcoin whale as anyone holding over 1,000 BTC, worth around $100 million USD at recent 2025 market prices.

What About Other Assets?

- Whales usually hold 10,000 ETH or more.

- Generally, 500,000 SOL or more.

These thresholds aren’t clear-cut, and they shift as market value, liquidity, and overall supply and demand evolve. In simple terms, whales are the elite of the cryptocurrency market, capable of moving markets with a single transaction.

How Whales Make Waves

With that kind of buying power, whales can really make waves in the crypto marketplace. If a whale decides to sell off a giant chunk of their holdings, it creates a tidal wave of downward pressure on prices due to the sheer volume and lack of liquidity. Other crypto enthusiasts are always on the lookout for signs of an impending "whale dump," closely monitoring exchange inflows to spot potential dangers.

Here’s the twist, though – whales keeping their coins locked away actually reduces trading liquidity in the market since there are fewer coins actively circulating. Their massive idle fortunes are like icebergs weighing down the crypto ocean.

Tracking Whale Movements

Not every whale transaction is a sell-off. These giants could simply be migrating to new wallets, switching exchanges, or making monster-sized purchases. But you can bet experienced crypto folks keep a keen eye on those huge whale wallets, carefully tracking any ripples they make to navigate the ever-shifting tides of the market.

Whale Alert is a popular service that tracks these large transactions and reports them, often on Twitter. Whenever a whale makes a big move, it’s usually publicized quickly, giving everyone a heads-up on potential market changes.

Below is an example from Twitter from Whale Alert:

The Human Side of Whales

Behind these massive holdings are real people and organizations. Some whales are early adopters who bought into Bitcoin or other cryptocurrencies when they were cheap. Others are companies that have invested heavily in the belief that cryptocurrencies will continue to grow in value. For instance, Ethereum’s founder, Vitalik Buterin, is the biggest Ethereum whale because he holds a significant amount of the cryptocurrency he created.

How Whales Affect Crypto's Price

Price volatility can be increased by whales, particularly when they move a significant amount of one cryptocurrency in one go. For example, when an owner tries to sell their BTC for fiat currency, the lack of liquidity and enormous transaction size create downward pressure on Bitcoin's price. When whales sell, other investors become extremely vigilant, looking for hints of whether the whale is "dumping" their crypto (and whether they should do the same).

The exchange inflow mean, also known as the average amount of a certain cryptocurrency deposited into exchanges, is one of the most common indicators crypto investors look for. If the mean transaction volume rises above 2.0, it implies that whales are likely to start dumping if there are a large number of them using the exchange. This can be viewed by regular crypto traders as a time to act before losing any potential profit.

How Whales Affect Liquidity

When it comes to learning about whales and liquidity, one must remember that while whales are generally considered neutral elements in the industry, when a large number of whales hold a particular cryptocurrency, instead of using it, this reduces the liquidity in the market due to there being fewer coins available.

What Crypto Whales Mean to Investors

In terms of the relationship between whales and investors, one must remember that there are various situations in which a person may transfer their cryptocurrency holdings. It's worth mentioning that moving one's assets doesn't always indicate that you're selling them; they might be switching wallets or exchanges, or making a major purchase.

Occasionally, whales may sell portions of their holdings in discrete transactions over a longer period to avoid drawing attention to themselves or generating market anomalies that send the price up or down unpredictably. This is why investors keep an eye on known whale addresses to check for the number of transactions and value. This is not necessarily a task that newbie investors need to actively be involved with, however, understanding the terms and how whale accounts can affect the market is recommended.

Why Whales Matter

Whether you love them or hate them, whales are a formidable force in the crypto world, shaping its dynamics in profound ways. These giants, whether they’re creators, collectors, or traders, have a tremendous impact across the digital waters. When they make a move, it can trigger monumental swells that ripple through the entire market.

By understanding whale activity, anyone involved in cryptocurrency can better navigate these choppy waters. Staying informed about whale movements helps both newbies and seasoned traders make smarter decisions and stay afloat in this ever-changing space. Keep an eye on these behemoths; their actions can significantly influence your crypto journey.

While tracking whale activity can offer valuable insights into the cryptocurrency market, it's important to complement this knowledge with expert advice. Consulting with a financial advisor can help you navigate the complexities of investing and ensure your strategies align with your personal financial goals and risk tolerance.

In recent years, cryptocurrency, and therefore cryptocurrency exchanges, have firmly established themselves in the global financial market. As they become increasingly popular, many concerns have been raised over the regulation of these entities, and how they are preventing illicit monetary activity from taking place.

In an attempt to crack down on funds being illegally moved, exchanges are required to implement KYC (Know Your Customer) and AML (anti-money laundering) policies. Regulatory bodies are working to build legal frameworks for the industry, in an attempt to fight crime conducted using blockchain technology.

The biggest challenge for these regulatory bodies is to find a solution that doesn't hamper the innovative qualities of cryptocurrencies.

In the UK there is the Financial Conduct Authority, a financial regulatory body that operates outside of the UK government. In 2020, the FCA required every company participating in any crypto activity in the sector to comply with its Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 policy (the 'MLR's). This obligation requires crypto service providers to complete the necessary registration and infrastructural requirements.

What is AML in crypto?

AML stands for anti-money laundering and involves protocols that ensure that every transaction can be tied to an identity, thus providing greater transparency. This ensures that if any suspicious activity is flagged, the origins and/or destination of the funds can be confirmed on the platform.

Due to the anonymous, or more accurately pseudonymous, nature of cryptocurrencies, many believe that it provides an easy opportunity for ill actors to engage in money laundering. Money laundering is the act of changing large amounts of illicit income into a legitimate avenue, the money is "laundered" so as to appear clean.

While cryptocurrencies seemingly provide a perfect platform for money laundering due to the lack of central authority or third parties, AML processes are implemented on exchanges to stop this activity in its tracks.

What are the risks hindering AML practices?

The first risk that challenges AML practices is privacy coins, cryptocurrencies designed to conceal transactions and the relevant information attached to them. Platforms like Monero offer users the opportunity to send funds with no record of the transaction taking place.

The data associated with the transactions like the sender, receiver and amount sent are encrypted and often broken up when stored on the blockchain to ensure they are untraceable.

The second risk is coin join platforms that mix cryptocurrency transactions, hiding the origin and destination of the funds. These platforms essentially provide a service that can make ordinary cryptocurrencies anonymous.

While cryptocurrencies have their benefits, there are a number of challenges they pose to regulatory bodies, AML and CFT (Combating the Financing of Terrorism) intentions:

- The anonymity they can provide

- Opportunity for gaps when transacting cross-border transactions

- Absence of one central authority to ensure compliance

- The limited scope of identity verification processes

Differentiating between illicit activity and investors just wanting to safeguard their investments is a tricky business. Bad actors might make use of paper wallets to hide funds and keep them secret, while an investor might make use of a paper wallet in order to protect their funds against theft.

AML in crypto exchanges

Despite the challenges it faces, AML has proven to be valuable in cracking down on illegal activity conducted on crypto exchanges.

In July, $1.45 billion worth of illegal cross-border crypto transactions were traced back to 33 individuals on the South Korean exchange, Bithump. The platform quickly banned all foreign transactions, requiring a mobile KYC verification, and increased the KYC requirements so as to align with the country's AML regulations.

Bitcoin ATMs, a notorious option for mixing funds, have come together to form the Cryptocurrency Compliance Cooperative (CCC). This operation calls for cash-based cryptocurrency services, financial institutions, and regulators to participate in building universal compliance factors.

Does AML help or hinder the crypto market?

While AML tends to go against the decentralized nature of cryptocurrencies, the crypto community actively welcomes these regulatory efforts as it drives more trust and interest in the market on top of innovation and adoption. For example, an institution or retail investor is more likely to invest in a regulated asset than in a lawless, anything-goes market.

TAP'S NEWS AND UPDATES

BOOSTEZ VOS FINANCES

Prêt à passer à l’action ? Rejoignez celles et ceux qui prennent une longueur d’avance. Débloquez de nouvelles opportunités et commencez à façonner votre avenir financier.

Commencer