Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

La tokenomics, ou économie des tokens, est l'étude de l'économie des jetons numériques. Elle englobe tous les aspects de la création, de la gestion et parfois de la suppression d'une cryptomonnaie au sein d'un réseau blockchain. Le terme "tokenomics" est un mot-valise combinant "token" (jeton) et "economics" (économie), largement utilisé dans l'écosystème crypto pour évaluer le potentiel d'une cryptomonnaie. En somme, la tokenomique explique comment la valeur d'un token est déterminée et ce qui l'influence.

Tokenomique et cryptomonnaies

La tokenomique et les cryptomonnaies sont étroitement liées. La tokenomics fait référence à l'ensemble des règles et principes qui régissent le fonctionnement des cryptomonnaies. Elle inclut des aspects importants tels que le nombre de tokens existants, leur mode de distribution et leurs utilisations possibles. Ces règles sont cruciales pour concevoir et gérer efficacement les cryptomonnaies.

La tokenomique joue un rôle significatif dans la détermination de la valeur des cryptomonnaies. Elle influence la perception et l'évaluation de la valeur d'une cryptomonnaie. Des facteurs tels que la rareté des tokens (offre limitée), leur utilité dans diverses applications et le niveau de demande peuvent impacter le prix et l'acceptation d'une cryptomonnaie.

Une tokenomics bien conçue peut favoriser la confiance, l'adoption et augmenter la valeur globale d'une monnaie numérique. À l'inverse, une tokenomics mal conçue peut entraver l'adoption et limiter la valeur perçue d'une cryptomonnaie lors de l'échange contre des devises fiduciaires ou d'autres cryptomonnaies. Par conséquent, créer un modèle de tokenomique solide et réfléchi est essentiel pour le succès et l'acceptation générale des cryptomonnaies.

Un exemple de tokenomique : Bitcoin

Bitcoin fonctionne selon un modèle spécifique de tokenomique Il a une offre maximale de 21 millions de pièces qui entreront en circulation, assurant ainsi la rareté et l'appréciation de la valeur dans le temps. Ethereum, par exemple, a un nombre illimité de pièces. L'émission de nouveaux Bitcoins par le minage crée des incitations pour la sécurité du réseau, tandis que les événements de halving réduisent le taux de nouvelle offre.

De plus, la nature décentralisée de Bitcoin et son adoption généralisée contribuent à sa valeur, la demande du marché et l'utilité déterminant son prix sur le marché libre. Ces éléments de tokenomique font de Bitcoin un actif numérique déflationniste avec un modèle économique unique dans l'écosystème des cryptomonnaies.

Pourquoi la tokenomique est-elle importante ?

La tokenomique est particulièrement importante dans l'espace crypto en raison du manque de réglementation. En l'absence de lois régissant les cryptomonnaies, la tokenomique offre une opportunité d'évaluer les cryptomonnaies selon leur mérite réel, et pas seulement selon leur façon d'être échangées sur les plateformes.

Quels sont les avantages de la tokenomique ?

La tokenomics offre plusieurs avantages au sein de l'écosystème des cryptomonnaies. Tout d'abord, elle établit des règles et des incitations claires, assurant un système économique équitable et transparent pour les participants. La tokenomics peut encourager des comportements souhaitables, tels que le staking ou la contribution à la sécurité du réseau, favorisant ainsi la croissance et la durabilité globales du réseau.

De plus, la tokenomics permet de créer de l'utilité et de la valeur pour les tokens, offrant divers avantages économiques aux détenteurs. Elle permet le développement d'applications décentralisées (dapps) et la création d'écosystèmes dynamiques autour des cryptomonnaies. De même, la tokenomics facilite les opportunités de liquidité et de trading, permettant aux utilisateurs d'acheter, de vendre et d'échanger des tokens sur différents marchés.

Dans l'ensemble, la tokenomique favorise l'innovation, incite à la participation et contribue à la croissance et au succès global de l'écosystème des cryptomonnaies.

Quels sont les aspects négatifs de la tokenomics ?

Bien que la tokenomique présente de nombreux avantages, il existe certains inconvénients à prendre en compte. L'un d'entre eux est le potentiel de volatilité du marché, car les prix des tokens peuvent être sujets à des fluctuations rapides influencées par divers facteurs, notamment la spéculation du marché et le sentiment des investisseurs.

De plus, des modèles de tokenomique inadéquats ou mal conçus peuvent entraîner des inefficacités économiques, un manque d'utilité des tokens, voire une vulnérabilité à la manipulation. Il est important de noter que la tokenomique ne garantit pas la stabilité de la valeur à long terme, et les investisseurs doivent soigneusement évaluer les risques associés à des tokens et projets spécifiques avant de s'engager sur le marché des cryptomonnaies.

Les différents termes de la tokenomique expliqués

Évaluation des actifs :

Le processus de détermination de la valeur d'une pièce ou d'un token. Cela est particulièrement utile pour les investisseurs qui souhaitent acheter de nouvelles pièces. S'ils peuvent estimer la valeur future d'une pièce, il peut être plus facile de décider si son prix vaut l'investissement maintenant.

Inflation :

Dans le contexte de la tokenomics, l'inflation fait référence à l'augmentation de l'offre de tokens au fil du temps, entraînant une diminution du pouvoir d'achat et de la valeur du token.

Déflation :

Dans la tokenomique, la déflation fait référence à la diminution de l'offre de tokens, entraînant une augmentation du pouvoir d'achat et de la valeur du token au fil du temps.

Élasticité de l'offre et de la demande :

Si une pièce a une élasticité élevée de l'offre et de la demande, son prix sera plus affecté par les changements de la demande par rapport à son offre.

Récompenses communautaires :

Lorsqu'une pièce a une communauté importante, celle-ci peut jouer un rôle dans l'amélioration des fondamentaux de la pièce.

Schémas "pump and dump" :

Un schéma "pump and dump" est une pratique manipulatrice où un groupe gonfle artificiellement le prix d'un token par des achats coordonnés, créant une "pompe". Cela crée une fausse impression de valeur et attire des investisseurs non avertis. Une fois le prix atteint un pic, le groupe vend ses avoirs, provoquant une baisse rapide des prix, ou "dump", laissant les autres investisseurs en perte.

En conclusion

La tokenomique joue un rôle vital dans l'écosystème des cryptomonnaies en établissant des règles, des incitations et des principes économiques. Elle influence la valeur et l'acceptation des cryptomonnaies en déterminant des facteurs tels que la rareté, l'utilité et la demande.

Une tokenomics bien conçue peut favoriser la confiance, l'adoption et augmenter la valeur globale des cryptomonnaies. Cependant, il est important d'être conscient des inconvénients potentiels, tels que la volatilité du marché et les modèles de tokenomics mal conçus. Comprendre la tokenomics aide les investisseurs et les participants à évaluer le mérite réel des cryptomonnaies et à prendre des décisions éclairées.

Audius is one of the most interesting projects in the Web3 space. A decentralized music streaming platform built to give power back to the artists. Instead of relying on record labels or centralized platforms, Audius connects creators directly with fans, letting them publish, share, and monetize their music on their own terms. It’s a platform where listeners stream music freely, while artists earn rewards in the platform’s native cryptocurrency, AUDIO.

Founded in 2018 by Roneil Rumburg and Forrest Browning, Audius has attracted millions of monthly users and hundreds of thousands of artists, including support from big names like Katy Perry, Nas, Steve Aoki, and Jason Derulo. Its mission is simple: remove middlemen and let artists truly own and profit from their work.

How Does Audius Work?

Under the hood, Audius runs on a decentralized network powered by content and discovery nodes. Content nodes host and secure music files on behalf of artists, while discovery nodes index them so fans can easily find tracks. This system replaces centralized servers with a distributed network, ensuring better censorship resistance and transparency.

Artists can upload music directly to Audius, choose how they want to share it (free or paid), and even unlock exclusive content for top fans. Unlike traditional streaming platforms that pay based on plays, Audius rewards artists for overall engagement, from trending tracks to verified uploads and fan interaction.

Originally built on the Ethereum blockchain, Audius later migrated its content system to Solana for faster, cheaper transactions while keeping AUDIO as an ERC-20 token. That hybrid setup combines Ethereum’s reliability with Solana’s scalability.

What Makes Audius Different?

Audius challenges the norms of the music industry by flipping the profit structure. In traditional streaming, artists might receive only about 12% of total revenue. On Audius, artists receive 90% of the rewards directly in AUDIO tokens, while the remaining 10% goes to node operators who help secure the network.

This approach creates a more transparent and equitable mode, one that empowers artists to connect directly with listeners, share exclusive releases, or run their own communities. The platform even partners with TikTok, allowing creators to link Audius tracks directly to TikTok videos, giving exposure across mainstream social media.

Because content is hosted through decentralized storage (via AudSP, an IPFS-based system), artists retain control over their music files. That makes the platform both censorship-resistant and artist-friendly, a rare combination in the streaming world.

The AUDIO Token

The AUDIO token is the backbone of the Audius ecosystem. It serves several roles:

- Staking and Network Security. Node operators stake AUDIO to run network infrastructure and earn rewards.

- Governance. Each AUDIO token grants one vote in protocol decisions, giving users a voice in how the platform evolves.

- Feature Access. Holding or staking AUDIO unlocks premium features, early access to new tools, and artist badges.

AUDIO has an initial supply of one billion tokens and is used for platform rewards, community incentives, and ongoing network security. Holders can also earn additional AUDIO through staking or by helping to grow the ecosystem.

Why Audius Matters

Audius is more than a music app; it’s a proof of concept for how blockchain can reshape creative industries. In short, it offers:

- Direct artist-to-fan connections without middlemen

- Transparent revenue sharing through on-chain rewards

- Censorship-resistant storage for music and metadata

- Cross-chain scalability with Ethereum and Solana interoperability

For artists, it’s a fairer deal. For listeners, it’s a chance to support creators directly and explore new music communities powered by crypto.

Bottom Line

Audius reimagines what music streaming could be in the Web3 era: a fair, open, and decentralized ecosystem where creativity and ownership coexist. It bridges blockchain technology and cultural expression, proving that decentralization isn’t just for finance.

Where to Get AUDIO

Interested in the project? You can get the AUDIO token directly on the Tap app and start exploring the decentralized future of music today.

Imagine your favourite social media platform, say 𝕏 or Facebook, but enhanced with crypto tools. The ability to send tokens, post encrypted messages, join decentralized apps (dApps) and interact with NFTs, all without leaving the feed you already know and love. That’s the promise of Mask Network. The project builds a bridge between Web2 (traditional social media) and Web3 (blockchain + crypto) by embedding decentralized functionality directly into familiar platforms, without requiring the end user to understand networking terms like IP address, IPv4, or anything about how a computer network actually routes information.

At its core, Mask Network operates via a browser extension and multi-chain wallet that detect supported social platforms and add a Web3 layer of features. Users can send crypto to friends in a social feed, post content that only certain people can see, and even link across blockchains without leaving their social app. This design resembles how a router or routing protocol quietly manages data packets in the background. The complex technical work stays invisible, while the experience remains simple on the surface.

How Does the Mask Network Work?

When you install the Mask Network extension (for example in Chrome or Firefox), it adds extra buttons or options to supported sites. According to the official site, it currently supports multiple social platforms where the extension overlays crypto tools such as encrypted messaging, self-custody assets, dApp interaction, and identity aggregation. The browser extension works across major operating systems like Microsoft Windows and macOS, behaving like lightweight software that integrates seamlessly into your web browser.

Technically, the platform supports multiple EVM-compatible chains (so you’re not locked into just one). The extension detects posts, token ticker mentions, or chat boxes and injects extra Web3 controls. For example, turning a simple tweet into a point of token tipping or encrypted file sharing. Users don’t have to migrate to a brand-new social network; instead, their existing feed becomes Web3-enabled through a layer that feels like a cross-platform software upgrade rather than an entirely new product.

The process is similar to how an Internet Protocol layer sits on top of computer hardware, managing the flow of data across different environments. Mask does something comparable in the realm of social networking: the legacy platform remains intact, but a new functional layer is added on top.

What Is the MASK Token Used For?

The native token, MASK, is the fuel and governance key for the ecosystem. With a fixed supply of 100 million tokens, the scarcity is defined from the start. Here’s what it powers:

- Governance. Token holders can vote on project changes or protocol upgrades.

- Participation. Some features, membership or premium tools are unlocked via MASK.

- Utility & on-platform services. Whether it’s encrypted posts, content rights, DeFi interactions inside the social feed, MASK underpins many of those activities.

Why Traders and Users Might Keep an Eye On It

For anyone paying attention to where crypto meets everyday life, Mask Network offers some genuinely compelling reasons to watch closely. It’s designed to work within the social platforms you're already glued to. Instead of asking people to abandon their favorite social media for some obscure decentralized alternative, Mask plugs directly into those networks. That's a huge deal because it opens the door not just to crypto enthusiasts, but to the billions of people scrolling social media every day. If even a fraction of that audience starts using Web3 features without realizing they've "entered crypto," you're looking at real adoption potential.

Then there's the privacy angle, which feels more relevant than ever. We're living in an era where data breaches make headlines constantly and people are increasingly uncomfortable with how much Big Tech knows about them. Mask’s ability to let you encrypt posts, control exactly who can see your content, and link your activity to a decentralized identity gives users a level of control they simply don't have on traditional platforms. It's not just a technical feature, it's a response to a growing demand for digital autonomy.

From a technical standpoint, Mask isn't putting all its eggs in one basket either. It's built with a multi-chain design and supports modular components like dApplets, identity layers, and wallet integrations. That flexibility means it's not locked into a single blockchain's fate and can evolve as the broader ecosystem shifts. And here's where it gets interesting for traders: MASK token utility is directly tied to the platform's growth. It powers governance decisions, unlocks premium features, and fuels ecosystem participation. The more people actually use Mask Network's features, the more integral the token becomes.

Things to Keep in Mind

Of course, no project exists in a vacuum, and Mask Network comes with its share of risks worth considering. For starters, the whole idea of blending Web3 with social media is still in its early days. While the concept is promising, achieving mainstream adoption is a different beast entirely. It requires not just a great product, but also the kind of viral momentum and user trust that takes time to build. Right now, most people aren’t thinking about decentralized social features when they scroll through 𝕏, and changing that behavior is no small task.

There are also some practical concerns. Browser extensions, by their very nature, create additional security vulnerabilities. They can be targets for phishing attacks or malicious updates, so users need to stay vigilant about what they're installing and keeping up to date. On the financial side, MASK remains a relatively smaller-cap token, which means it's subject to the wild price swings that come with the territory in crypto. Strong technology doesn't automatically insulate a project from market volatility.

Finally, Mask Network's success isn't entirely in its own hands. The project depends heavily on how major social platforms respond to third-party integrations, whether through policy changes, API restrictions, or outright blocks. Add in evolving regulations around crypto and privacy, plus the constant challenge of making these tools user-friendly enough for non-technical audiences, and you've got a complex path forward. It's a fascinating project with real potential, but these external factors will play a huge role in determining how far it can go.

Bottom Line

If you’re curious about projects at the intersection of social media and crypto, Mask Network stands out as a creative play. It’s less about traditional “DeFi only” and more about everyday digital interaction powered by blockchain. The platform’s success will depend on how smoothly it integrates into user habits and how many people adopt the social-crypto combo.

Where to Get MASK

The MASK token is available on the Tap app, making it easy to buy, hold and track right alongside your crypto portfolio.

Badger DAO (BADGER) est une organisation autonome décentralisée (DAO) dédiée à la création d’infrastructures permettant d’intégrer Bitcoin dans les écosystèmes DeFi. Dans un univers crypto où Bitcoin et DeFi évoluent souvent en parallèle, Badger se distingue en créant des passerelles permettant aux détenteurs de BTC de participer à l’écosystème DeFi d’Ethereum — sans devoir renoncer à leur exposition au Bitcoin.

Voici comment cette plateforme s’attaque aux défis de l’intégration du BTC dans la DeFi, de la génération de rendement et de l’interopérabilité inter-chaînes.

TL;DR

- Bitcoin dans la DeFi : Badger développe une infrastructure permettant d’utiliser des BTC tokenisés (comme WBTC, renBTC…) dans l’écosystème Ethereum.

- Gouvernance communautaire : En tant que DAO, Badger fonctionne par gouvernance décentralisée — les détenteurs du token BADGER votent sur les décisions clés du protocole.

- Écosystème multi-produits : Inclut BadgerDAO (gouvernance), Sett Vaults (stratégies de rendement) et DIGG (token à offre élastique indexé sur le prix du BTC).

Badger DAO, c’est quoi exactement ?

Fondée en 2020 par Chris Spadafora et une équipe de passionnés de DeFi, Badger DAO a été lancée en décembre 2020 selon un modèle de distribution équitable, sans prévente ni financement par capital-risque.

L’objectif : permettre aux détenteurs de Bitcoin d’utiliser leurs BTC dans des applications DeFi tout en conservant leur exposition au prix du Bitcoin.

Badger cherche à résoudre plusieurs limites traditionnelles du BTC dans la DeFi — comme le manque d'opportunités de rendement, l’absence de ponts entre blockchains, ou encore la complexité technique d’intégration.

La plateforme met à disposition une infrastructure permettant d’optimiser le rendement sur des actifs BTC tokenisés, tout en simplifiant l’expérience utilisateur.

Lors de son lancement, les tokens BADGER ont été distribués gratuitement aux utilisateurs ayant déjà interagi avec différents protocoles DeFi. Depuis, la plateforme continue d’évoluer : nouveaux vaults, nouvelles stratégies, et partenariats avec d’autres protocoles DeFi.

En 2021, Badger a également lancé DIGG, un token à offre élastique visant à s’aligner dynamiquement sur le prix du BTC.

Aujourd’hui, Badger reste l’une des plateformes les plus visibles axées sur Bitcoin dans l’univers DeFi.

Comment fonctionne la plateforme Badger ?

L’architecture de Badger repose sur trois composants clés :

- BadgerDAO : la couche de gouvernance. Les détenteurs de BADGER votent sur les décisions liées au protocole et à la gestion de la trésorerie.

- Sett Vaults : des coffres automatisés qui déploient des stratégies DeFi sur des BTC tokenisés comme WBTC ou renBTC.

- DIGG : un token à offre élastique, dont le prix cible est indexé sur celui du Bitcoin.

La gouvernance se déroule sur la blockchain Ethereum, avec un système participatif où chaque utilisateur peut proposer des changements et voter.

Les BTC tokenisés déposés dans les Sett Vaults sont ensuite utilisés dans différentes stratégies DeFi prédéfinies, permettant d’accéder aux possibilités de l’écosystème Ethereum, sans convertir directement ses BTC en ETH.

L’ensemble vise à concilier optimisation, simplicité d’utilisation, et gouvernance communautaire — une approche pensée à la fois pour les utilisateurs orientés Bitcoin et pour les amateurs de DeFi.

Le token BADGER est au cœur de cet écosystème : il sert à voter sur les décisions, orienter l’utilisation des fonds communautaires, et inciter à la participation au protocole.

Quelles mesures de sécurité pour les utilisateurs ?

Badger a mis en place une architecture de sécurité renforcée :

- Audits de smart contracts réalisés par plusieurs sociétés spécialisées.

- Timelocks appliqués aux modifications de gouvernance, laissant aux utilisateurs le temps d’agir en cas de désaccord.

- Outils internes comme le Badger Audited Vault Evaluator (BAVE), pour renforcer le contrôle des stratégies.

Il est important de noter qu’un incident de sécurité majeur est survenu en décembre 2021, entraînant une perte importante de fonds. Depuis, Badger a déployé des efforts considérables pour renforcer sa sécurité, améliorer ses processus communautaires et restaurer la confiance.

Une réserve d’assurance gérée par la trésorerie du protocole a également été mise en place pour atténuer certains risques imprévus.

Ce que Badger apporte à l’écosystème

Selon l’équipe de Badger, la plateforme simplifie largement l’accès à la DeFi pour les détenteurs de Bitcoin. Elle propose une interface unifiée, où les utilisateurs peuvent gérer leurs BTC tokenisés, activer des stratégies automatisées, et interagir avec plusieurs protocoles sans avoir à jongler entre les outils ou les blockchains.

Badger vise aussi à réduire la fragmentation de la DeFi autour de Bitcoin, tout en rendant ces services accessibles aux utilisateurs sans expertise technique avancée.

Après l’incident de 2021, la feuille de route s’est élargie pour inclure plus de sécurité, des développements multi-chaînes et une intégration renforcée avec les solutions Layer 2. L’ambition reste claire : apporter de la liquidité Bitcoin à l’ensemble de la DeFi.

BADGER : cas d’usage

Le réseau Badger permet aux utilisateurs — particuliers comme institutions — d’utiliser leurs BTC dans des applications DeFi de manière fluide, que ce soit pour :

- le farming via des vaults,

- la fourniture de liquidité,

- ou encore des opérations de collatéralisation sans vente des BTC.

C’est l’une des premières plateformes à combiner les caractéristiques fondamentales du Bitcoin avec les mécanismes de la DeFi, en plaçant les utilisateurs au cœur du système.

Grâce à son orientation vers la gouvernance communautaire, la sécurité, et l’interopérabilité entre chaînes, Badger construit une infrastructure pensée pour s’adapter aux besoins variés de l’écosystème.

Comment acheter BADGER sur Tap

Le token BADGER est disponible à l’achat et à la vente dans l’application Tap. Une fois votre compte créé et vérifié, vous pouvez accéder à l’offre directement depuis la plateforme.

Téléchargez l’appli pour commencer.

Bitcoin Crashes Below $82K in Brutal Sell-Off

After breaking through several support levels, Bitcoin is trading around $82,000, extending a punishing downtrend that has erased more than 30% of its value since October's peak at $126,000.

The cause? A perfect storm of selloffs in U.S. equity markets, which triggered a wave of risk aversion that swept through global markets. Meanwhile, the Federal Reserve's cautious stance on further rate cuts has injected fresh uncertainty into trading floors. Markets still anticipate a 0.25% cut, but with recession fears intensifying, traders are hitting the exits. Crypto found itself directly in the crosshairs of this flight to safety

The damage extended well beyond Bitcoin. Estimates show around $2 billion in crypto positions liquidated, as forced selling and evaporating liquidity accelerated the downturn across digital assets. But here's a twist for you: Bitcoin is now entering territory that has historically preceded major recoveries. Let’s dive in.

Bitcoin Is Officially Oversold… And That Matters

The Relative Strength Index (RSI) has officially moved into oversold territory for the first time in nine months, signaling extreme selling pressure. The last time BTC hit oversold levels was in February, right before a notable rebound. Oversold signals don’t guarantee an immediate reversal, but they often mark the beginning of seller exhaustion.

In the previous oversold event, BTC dropped around an additional 10% before bouncing. If that were to happen again, BTC could briefly dip toward $77,000 before bulls regain momentum. If the current selling eases earlier, a shorter-term bounce could happen sooner.

MVRV Points to Undervaluation

Another key indicator worth looking at is Bitcoin’s MVRV Ratio. This on-chain indicator reveals whether investors are collectively sitting on profits or losses. An MVRV Ratio above 1 means the average holder is in the green; below 1 signals most are underwater.

BTC’s MVRV now sits at 1.5, its lowest level in over two years. When MVRV enters a “opportunity zone”, it suggests two things:

- Many short-term holders are underwater

- Downside selling pressure is approaching exhaustion

Key Levels to Watch

If bearish pressure continues, it’s possible BTC could revisit the $80,000 level, with a deeper support level around $77,000, matching the RSI’s recent historical pattern.

But there’s also a realistic bullish scenario: reclaiming $92,000 could turn the structure decisively bullish, opening the door to the $95,000 region and beyond.

What Can We Expect From BTC This November?

Beyond the indicators, there’s a seasonal angle worth emphasizing: Bitcoin has historically shown strong end-of-year recoveries and rallies. Even during weaker macro environments, Q4 has often delivered rebounds driven by renewed risk appetite and improved liquidity flows.

Combine that with oversold technicals, undervaluation signals, and easing macro uncertainty if the Fed does follow through on cuts, and the current levels could start looking less like panic territory and more like potential opportunity.

The Takeaway

Bitcoin's slide doesn’t appear to be driven by broken fundamentals; it's the result of macro turbulence, risk-off positioning, and temporary sentiment shifts. Short-term chop may persist, but on the flip side, key indicators are flashing oversold conditions which have historically marked turning points.

Corrections are part of Bitcoin's DNA. It has survived far steeper crashes and consistently emerged more resilient. Whether the bounce starts today or after one final shake-out, the pattern is familiar: selling exhaustion plants the seeds for the next rally. Patient holders have seen this pattern many times, and more often than not, their patience has been rewarded.

.webp)

Ready to cut through traditional banking barriers and dive into the world of crypto payments? From buying falafels at your local cafe to luggage from a store in Japan, crypto payments are fast, cost-effective, and easier than you can imagine.

In this guide, we will walk you through exactly how to pay with crypto - from opening your account to making your first transaction. By the end, you'll have the confidence to make crypto payments anywhere, anytime.

Is paying with crypto legal?

Let's address the elephant in the room first. Paying with crypto is legal in most major markets, including the United States, the European Union, Canada, and the UK. However, some countries, like China and India, have restrictions on crypto transactions.

Here's the global snapshot:

- Fully legal: US, EU, UK, Canada, Australia, Singapore, Switzerland

- Restricted or banned: China, India (limited use), Russia (complex regulations)

- Grey areas: Some developing nations with evolving frameworks

Why does this matter? Operating within legal boundaries protects you from compliance issues and ensures your transactions won't be flagged or reversed. Rest assured, Tap only operates in jurisdictions where crypto payments are fully compliant.

How crypto payments work

Think of crypto payments like sending an email instead of traditional mail. With email, your message goes directly from your computer to the recipient's inbox through the internet.

Similarly, crypto payments travel directly from your cryptocurrency wallet to the merchant's wallet through a blockchain network - no banks or financial middlemen required.

Here's what happens behind the scenes:

- Your payment gets recorded on a decentralised ledger (blockchain)

- Multiple computers verify the transaction

- Once confirmed, the payment is permanent and irreversible

- The entire process typically takes minutes, not days

This system eliminates the need for banks, reduces fees, and works 24/7 globally.

Common payment methods

There are several ways to pay with crypto, each suited for different situations. Here are the two most popular:

On-chain wallet transfers involve scanning a QR code or copying a wallet address to send payments directly from your wallet to theirs. This method works well for peer-to-peer transactions and in-store payments. As a side note: Tap users can enjoy free transfers between users, anywhere in the world.

Tap’s crypto-backed debit card lets you spend your crypto anywhere Mastercard and Visa are accepted. The card automatically converts your crypto to fiat at the point of sale.

Setting up your Tap account

Here’s how to get started:

- Download the app and create your account.

- Complete the quick identity check.

Since Tap is licensed and regulated, we ask for some basic verification - just like any trusted fintech app. It only takes a few minutes. - Once you're approved, you're in.

You’ll be ready to explore the crypto world.

Order your Tap card

Tap the “Card” tab in the app (between Hub and Cash), and follow the steps to order your card. It’ll arrive in a few days, depending on where you are.

Now all you need is crypto.

Topping up your wallet is simple.

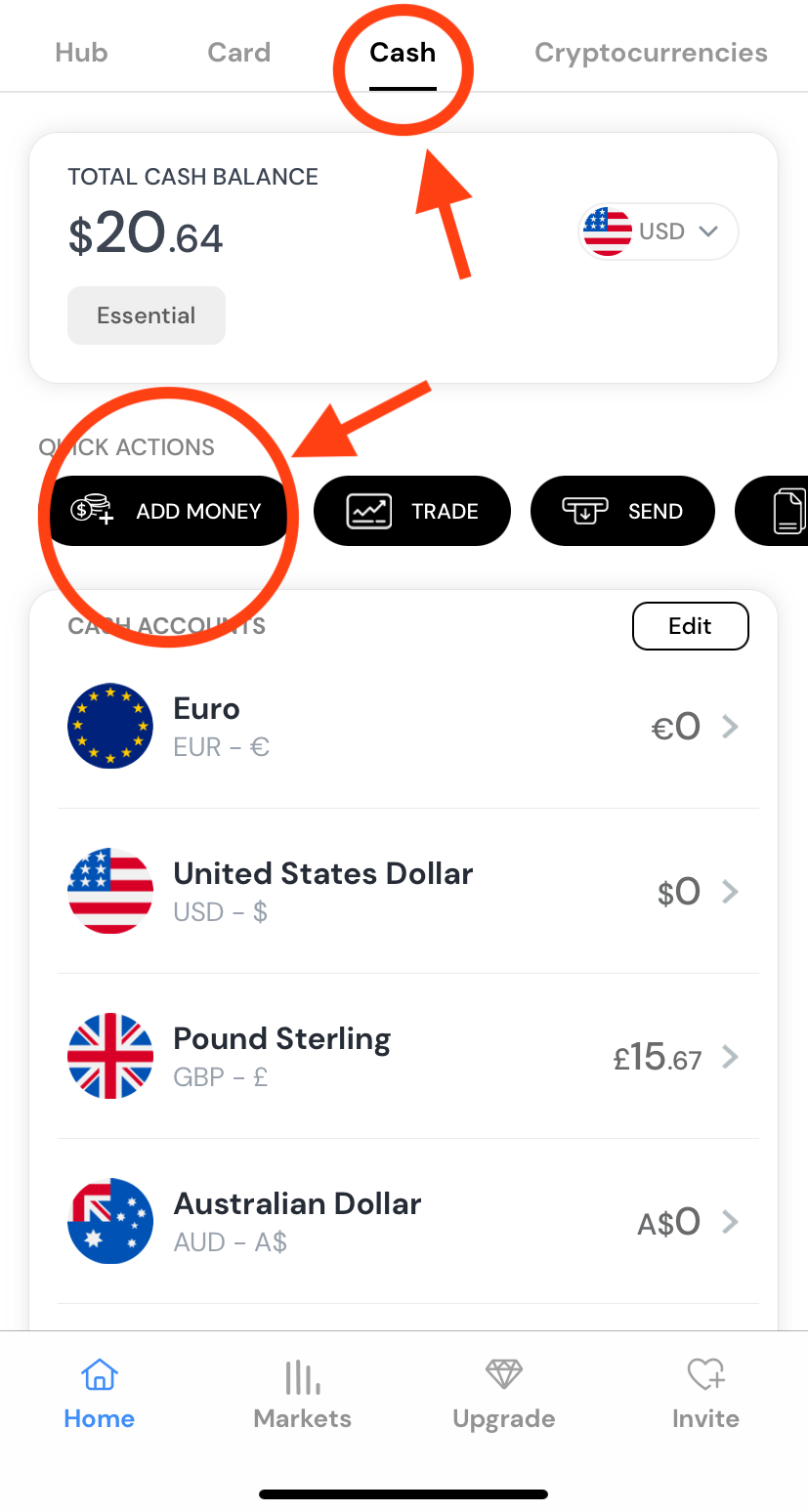

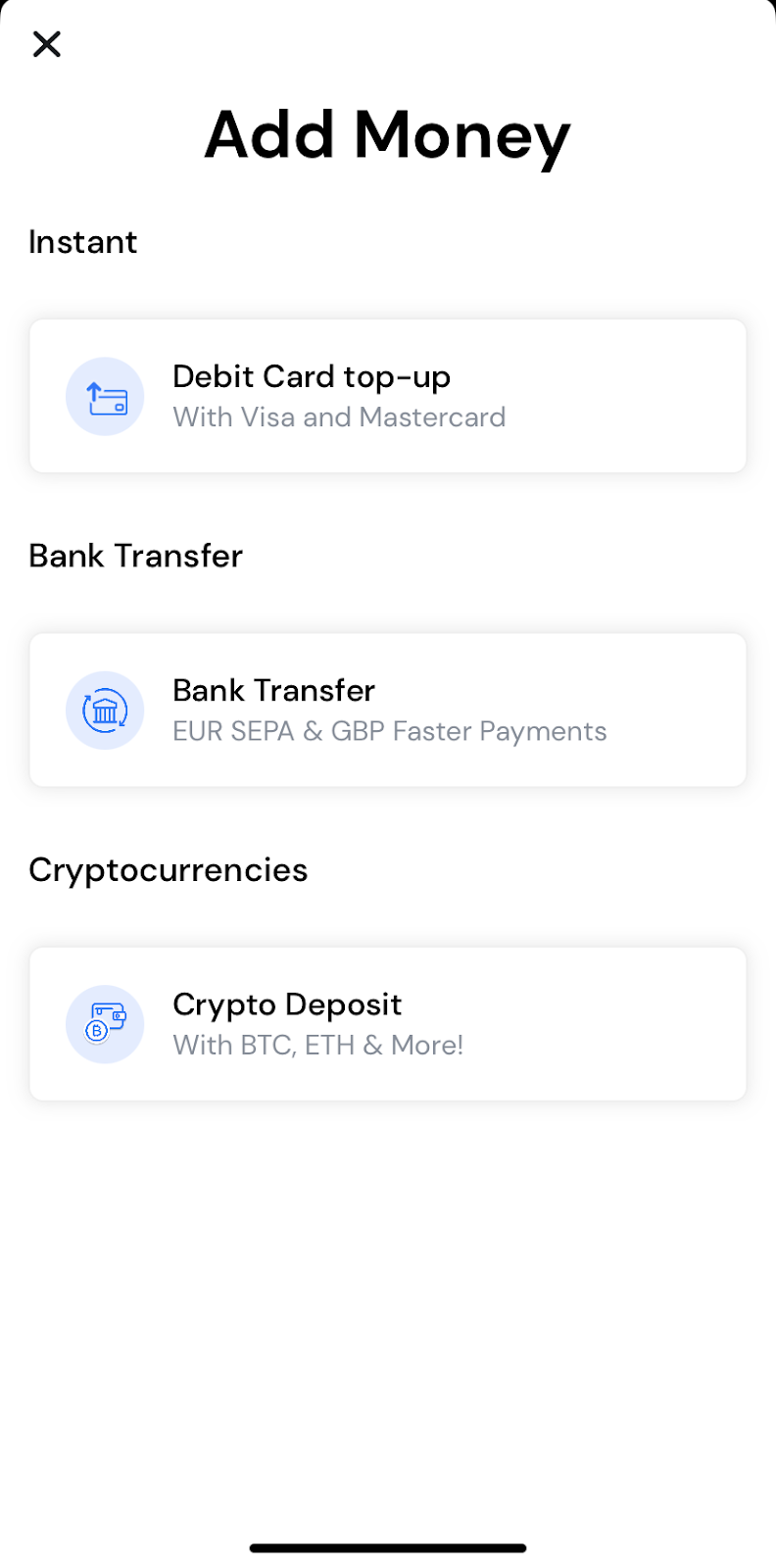

To load fiat (USD, EUR, GBP, AUD, CAD, CHF, JPY), tap “Cash” in the top menu and hit the black “Add Money” button. Choose your preferred method and follow the instructions.

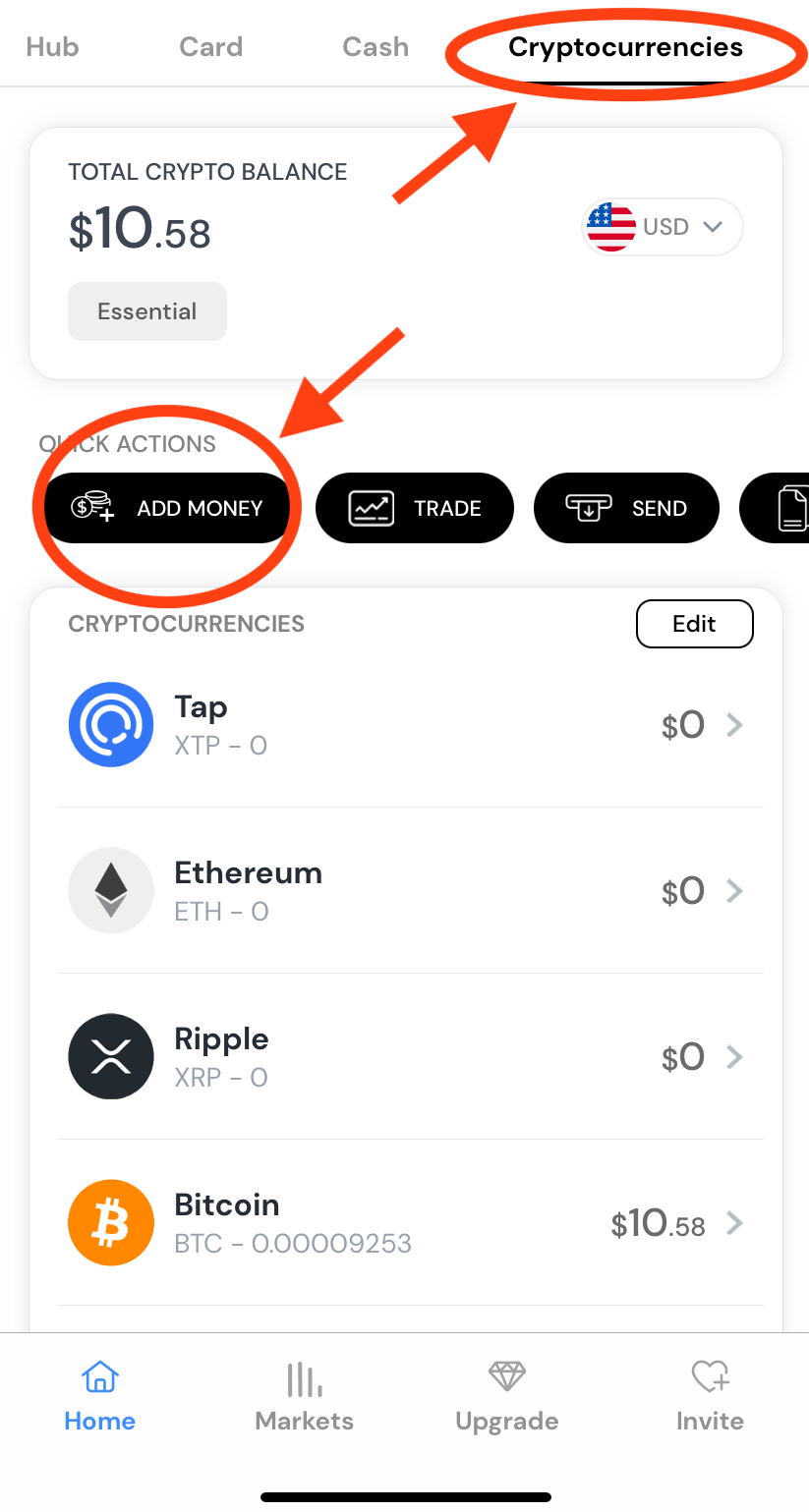

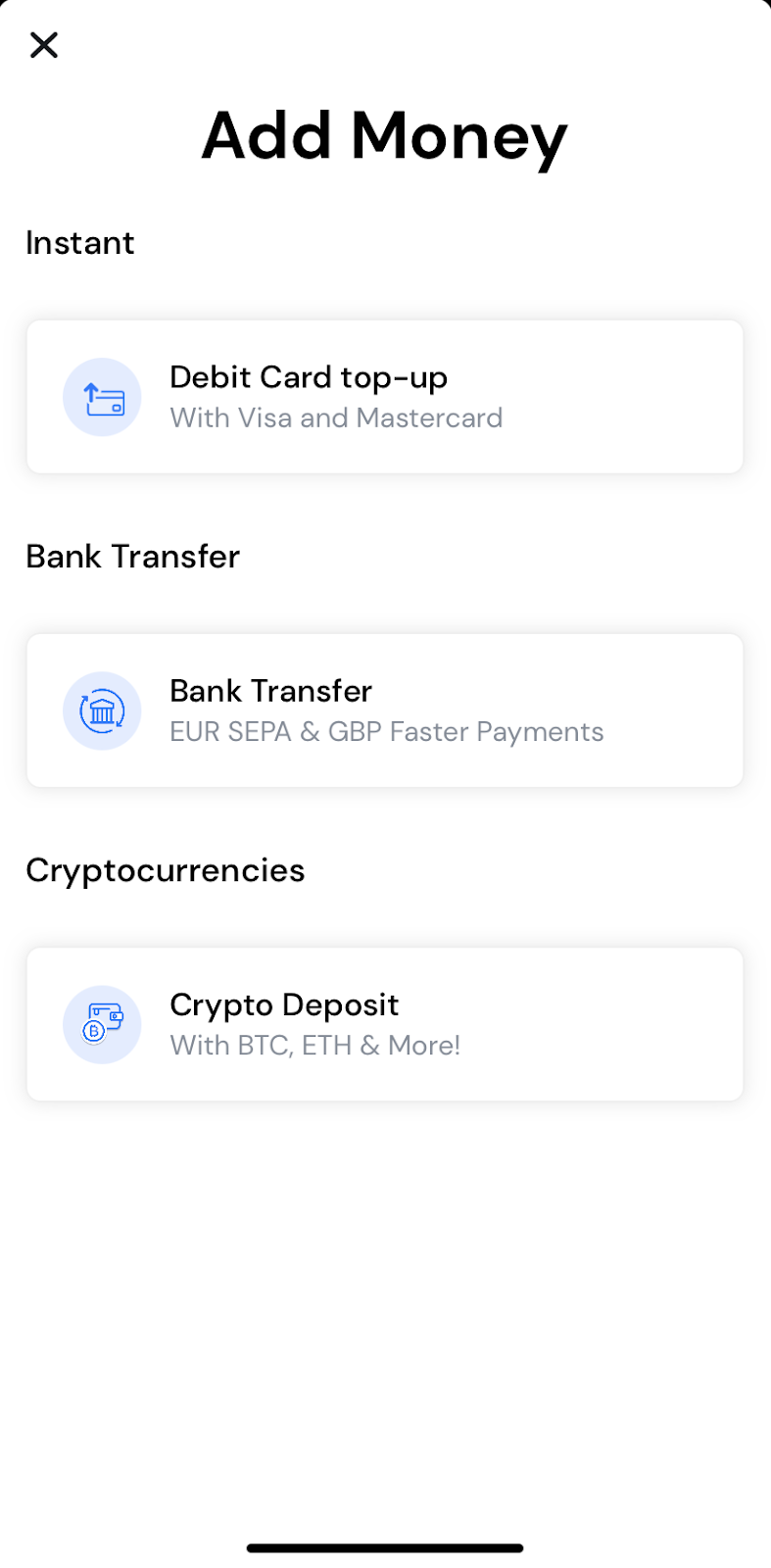

If you already have crypto, select Cryptocurrencies from the top menu, Add Money, and then the last option (Crypto Deposit). It’ll take a few minutes to clear (depending on the network).

When your card arrives, move funds to the Card section of your wallet, and you’re all set.

Step-by-step: how to make a crypto payment with Tap

Ready to make your first crypto payment? Let’s get stuck in:

Step 1: Take your Tap card out of your wallet.

Step 2: Swipe or tap at the merchant.

That’s it. Couldn’t be simpler.

Making a crypto payment through the app

If you don’t have a card or are waiting for it to arrive, here is the alternative option:

Step 1: Go to the “Cryptocurrencies” section of the app.

Step 2: Tap on “Send”.

Step 3: Choose “Crypto Withdrawal”.

Step 4: Pick the crypto you’d like to use.

Step 5: Tap the blue + New icon in the upper right corner.

Step 6: Choose “External Beneficiary” and carefully enter the wallet address.

Step 7: To complete the transfer, select the Beneficiary you just added and initiate the transfer.

Most payments are confirmed within minutes, though some networks may take longer during high-traffic periods.

Converting crypto to fiat & using crypto cards

Not every merchant accepts crypto directly, but that doesn't limit your spending power. Tap offers seamless conversion options that bridge the gap between crypto and traditional payments.

Our instant conversion feature lets you convert crypto to fiat currencies within your Tap account. Simply select the amount you want to convert, choose your target currency, and confirm the transaction. The converted funds appear in your fiat balance immediately.

The Tap Card takes this further by allowing you to spend crypto anywhere Mastercard and Visa are accepted. When you make a purchase, the card automatically converts the required amount from your crypto balance to fiat at competitive exchange rates. You can use it for online shopping, in-store purchases, or ATM withdrawals globally. Simply load the money onto your card through the app, and we’ll handle the rest.

Conversion happens in real-time, so you always get current market rates. *For real-time FX rates, click on your profile picture on the homepage and scroll down to “FX Calculator".

Fees, speeds & network choices

Understanding fees helps you make cost-effective payment decisions. There are two types of fees to consider:

Network fees go to blockchain validators who process your transaction. These vary by network and have nothing to do with Tap.

Bitcoin during peak times might cost $10-50, while networks like Polygon often cost under $0.01. Lightning Network Bitcoin payments typically cost less than a penny.

Tap fees are transparent and competitive. We charge a small percentage for conversions and premium features, but basic payments between Tap users are free.

Confirmation times depend on your chosen network:

- Lightning Network: Instant

- Ethereum: 1-5 minutes

- Bitcoin: 10-60 minutes

- Polygon: Under 1 minute

Best practice: For small, everyday purchases, use fast, low-cost networks like Lightning or Polygon. For larger transactions where security is important, Bitcoin's main network offers maximum security despite higher fees.

Security & common pitfalls

Crypto payments are irreversible, making security crucial. Here are the main risks and how to avoid them:

Wrong addresses are the top cause of lost payments. Always double-check recipient addresses and use QR codes when possible. Try to avoid typing wallet addresses manually unless necessary.

Phishing attacks trick users into entering wallet details on fake websites. Always bookmark legitimate sites and verify URLs carefully. Do not follow links from emails or text messages.

Rug pulls and scam projects promise unrealistic returns. Stick to established cryptocurrencies and verified merchants when making payments.

Tap's built-in safeguards include two-factor authentication and automated AML checks that flag suspicious transactions.

Tax & reporting considerations

Here's something many users overlook: spending crypto is a taxable event in most jurisdictions. When you use crypto to buy goods or services, you're technically selling that crypto, which may trigger capital gains tax.

How it works: If you bought Bitcoin at $30,000 and spent it when Bitcoin was $40,000, you owe tax on the $10,000 gain, even though you used it for a purchase rather than selling for cash.

Record-keeping is essential. To stay on the safe side, keep records of your transactions that include purchase dates, sale dates, amounts, and calculated gains or losses.

Regional differences matter:

- United States: IRS treats crypto spending as taxable events with capital gains implications

- European Union: VAT applies to crypto purchases, but capital gains treatment varies by country

- Other regions: Consult local tax advisors as regulations continue evolving

We recommend consulting with a crypto-savvy accountant to ensure you’re on the right side of your local tax obligations.

Why choose Tap to pay with crypto

We've built Tap specifically to solve the pain points of crypto payments. Here's what sets us apart:

Instant settlement means merchants receive payments immediately, not after blockchain confirmations. This solves the biggest barrier to crypto adoption for businesses.

Multi-chain support lets you use Bitcoin, Ethereum, stablecoins, and 60+ other cryptocurrencies through a single platform. No need to manage multiple wallets or apps.

Built-in compliance handles KYC/AML requirements automatically, so you can focus on payments rather than paperwork. We operate within regulatory frameworks.

Global reach without the complexity of international banking. Accept payments from anywhere, settle in your preferred currency, and expand your market instantly.

Ready to start paying with crypto? Download the Tap app and join the future of digital payments.

TAP'S NEWS AND UPDATES

BOOSTEZ VOS FINANCES

Prêt à passer à l’action ? Rejoignez celles et ceux qui prennent une longueur d’avance. Débloquez de nouvelles opportunités et commencez à façonner votre avenir financier.

Commencer