Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Le slippage peut faire toute la différence dans vos résultats de trading. Il représente l’écart entre le prix que vous pensiez payer et le prix réel au moment de l’exécution d’un ordre. Voici tout ce que vous devez savoir pour comprendre ce phénomène, gérer le risque et l’éviter autant que possible.

C’est quoi le slippage en crypto ?

Le slippage se produit lorsqu’un ordre d’achat ou de vente est exécuté à un prix différent de celui initialement affiché, en raison de mouvements du marché entre le moment où l’ordre est passé et celui où il est exécuté.

Pourquoi le slippage se produit-il ?

Deux grands facteurs sont à l’origine du slippage : la volatilité et la liquidité.

- Volatilité : Les marchés crypto sont connus pour leurs mouvements de prix rapides. Cela signifie que le prix peut changer entre le moment où vous validez un ordre et son exécution.

- Liquidité : Si une crypto est peu échangée, l’écart entre l’offre et la demande est plus large, ce qui peut entraîner un prix d’exécution bien moins avantageux. Cela arrive souvent sur les altcoins peu liquides, et encore plus fréquemment sur les DEX (échanges décentralisés).

Slippage positif vs. slippage négatif

- Slippage positif : L’ordre est exécuté à un prix plus avantageux que prévu. Par exemple, vous achetez moins cher ou vous vendez plus cher.

- Slippage négatif : L’ordre est exécuté à un prix moins favorable. Cela peut sérieusement impacter votre rentabilité si cela se répète souvent.

Peut-on éviter le slippage ?

On ne peut pas l’éliminer totalement, mais voici quelques techniques pour le limiter :

1. Utiliser des ordres limités

Contrairement aux ordres au marché, les ordres limités vous permettent de fixer un prix maximum (ou minimum) pour l’achat ou la vente. L’ordre ne sera exécuté que si ce prix est atteint.

2. Définir un taux de slippage

Certains échanges permettent de fixer une tolérance de slippage (ex. 0,1 % à 5 %). Cela empêche l’ordre de passer si le prix varie trop. Attention toutefois à ne pas fixer un seuil trop bas, sinon l’ordre pourrait ne jamais être exécuté.

3. Comprendre la volatilité d’un token

Plus vous en savez, mieux vous tradez. Renseignez-vous sur les mouvements passés du token, et sur la volatilité de la plateforme utilisée. Cela vous aidera à prendre des décisions plus éclairées.

Comment calculer le slippage ?

Le slippage peut être exprimé en valeur absolue (en euros ou dollars) ou en pourcentage.

- Montant du slippage : Prix réel - Prix attendu

- Pourcentage : (Montant du slippage ÷ Différence entre prix attendu et prix limite) × 100

Exemple : Vous voulez acheter du Bitcoin à 50 000 $, avec un ordre limite à 50 500 $. Finalement, l’ordre est exécuté à 50 250 $.

- Slippage = 250 $

- Pourcentage = (250 ÷ 500) × 100 = 50 %

Dans cet exemple, votre slippage est de 250 $ ou 50 %.

Vous voulez en savoir plus sur les crypto-monnaies et le trading ? Consultez tous nos autres articles éducatifs ici.

.png)

Que vous soyez fidèle à votre écran d’ordinateur ou adepte du smartphone, vous vous êtes sûrement déjà demandé comment insérer le symbole de la livre sterling (£) dans un document, un email ou un message. Ne cherchez plus — ce guide pratique vous montre comment taper rapidement le symbole £ sur Mac, PC ou mobile.

💡 Et si vous devez envoyer des livres sterling à l’étranger, Tap vous permet de transférer des fonds facilement avec des frais réduits et un excellent taux de change. Envoyez, dépensez ou échangez des GBP ou EUR depuis l’app, partout dans le monde — et gratuitement entre utilisateurs Tap.

D’où vient le symbole de la livre sterling ?

La livre sterling (GBP), symbolisée par £, possède une histoire riche de plus de 1 200 ans. À l’origine, elle représentait un poids d’argent dans l’Angleterre anglo-saxonne. Elle est devenue monnaie officielle en 1694 sous le règne de Guillaume III.

Avec l’expansion de l’Empire britannique, la livre a gagné une importance mondiale. Même après des événements majeurs comme les guerres, la dévaluation de 1967 ou encore le Brexit, elle reste une devise clé de l’économie mondiale.

Selon la Banque d’Angleterre, le symbole £ vient de la lettre L, initiale du mot latin libra, qui signifiait « une livre de monnaie ». L’ajout de la barre horizontale (le trait du £) remonte au moins à 1660, sur un ancien chèque conservé par la banque.

📌 En anglais, le symbole £ est toujours placé avant le montant : par exemple, £10 signifie dix livres. Petite anecdote : en 1970, un billet de £20 représentant William Shakespeare a été émis — une tradition est née, celle d’honorer des figures emblématiques sur les billets et pièces.

Comment insérer le symbole £ dans un document ?

Maintenant que vous connaissez son origine, voyons comment taper le symbole £ selon l’appareil que vous utilisez.

Sur Mac

Le raccourci le plus rapide est :Option (ou Alt sur certains claviers) + 3

Cette combinaison fonctionne sur les claviers européens. Si vous avez un clavier américain, vous devrez peut-être ajuster votre configuration régionale pour activer les symboles monétaires européens.

Sur Windows

Sur la plupart des claviers Windows, utilisez simplement :Alt + 0163 (en utilisant le pavé numérique)

Ou, si vous avez un clavier britannique :Maj + 3 vous donnera directement le symbole £, souvent visible juste au-dessus du chiffre.

💡 Vous pouvez aussi copier-coller ce symbole directement ici : £

Sur smartphone (iOS ou Android)

Sur votre clavier mobile, appuyez sur le bouton ?123 ou symbole, puis cherchez le £ dans les options.

Si vous ne le voyez pas immédiatement :

- Maintenez le doigt appuyé sur le symbole $ (dollar)

- D’autres symboles monétaires apparaîtront, dont £

Sans clavier ? Aucun souci

Si vous utilisez Microsoft Word ou Google Docs, vous pouvez insérer le symbole sans taper quoi que ce soit.

Voici comment faire :

- Dans Word, cliquez sur Insertion > Symbole > recherchez £

- Dans Google Docs, allez dans Insertion > Caractères spéciaux > puis sélectionnez la catégorie Monnaie

Cliquez sur le symbole £ pour l’insérer dans votre texte.

Et voilà !

Vous savez désormais comment insérer le symbole £ facilement, que vous soyez sur ordinateur ou sur téléphone. Que ce soit pour un mail professionnel, une facture ou un post sur les réseaux, vous êtes prêt·e à taper £ en toute simplicité

.

Vous connaissez peut-être déjà l’achat et la vente de cryptomonnaies, mais avez-vous déjà entendu parler des airdrops ? Ces distributions gratuites de tokens sont en réalité des stratégies marketing visant à faire connaître un projet blockchain. Elles permettent de toucher une large audience et de créer de l’engagement. Explorons ensemble comment fonctionnent les airdrops et ce qu’ils peuvent réellement apporter.

Qu’est-ce qu’un airdrop crypto ?

Un airdrop crypto, c’est lorsqu’un projet distribue gratuitement ses tokens natifs à des utilisateurs — souvent pour attirer l’attention, élargir sa communauté ou encourager l’adoption. En clair : de la crypto gratuite, parfois en échange d’une petite action (suivre un compte, s’inscrire à une newsletter), parfois sans rien faire du tout.

Les tokens sont transférés dans les portefeuilles des utilisateurs existants ou potentiels. Cette technique a explosé lors du boom des ICOs en 2017, et reste encore largement utilisée. Même si ces tokens sont donnés gratuitement, leur valeur peut augmenter avec le temps — ce qui les rend parfois très intéressants pour les détenteurs.

C’est aussi une méthode pour augmenter le nombre de portefeuilles actifs (un bon indicateur pour les nouveaux projets) et favoriser la décentralisation en élargissant la détention des tokens.

Comment fonctionne un airdrop crypto ?

Les airdrops sont souvent planifiés dans la feuille de route d’un projet et se déclenchent après avoir atteint certains objectifs. Les modalités varient, mais en général, de petites quantités de tokens (souvent sur Ethereum ou une autre blockchain compatible avec les smart contracts) sont envoyées à plusieurs portefeuilles.

Certains airdrops sont entièrement gratuits, d’autres demandent de remplir quelques conditions : s’abonner à un canal Telegram, relayer un post sur X, ou simplement détenir un certain nombre de tokens.

Un airdrop bien pensé génère souvent du bouche-à-oreille autour du projet avant même sa cotation sur un exchange.

Quelle est la différence entre un ICO et un airdrop ?

Même s’ils sont tous deux liés au lancement de nouveaux projets crypto, la différence est claire :

- Un ICO (Initial Coin Offering) demande aux participants d’acheter des tokens, généralement pour lever des fonds.

- Un airdrop, lui, consiste à distribuer gratuitement des tokens, sans engagement financier.

Les ICO sont donc des moyens de financement, tandis que les airdrops sont des outils marketing.

Quels sont les différents types d’airdrops ?

Il existe plusieurs formes d’airdrops. Voici les plus courants :

Airdrops exclusifs

Réservés aux utilisateurs précoces ou aux membres actifs de la communauté, ces airdrops récompensent la fidélité. Exemple célèbre : Uniswap, qui a distribué 400 UNI à chaque portefeuille ayant interagi avec la plateforme avant une certaine date. Ces tokens de gouvernance donnaient un droit de vote sur les décisions du projet.

Airdrops “bounty”

Ces airdrops exigent une participation active : suivre des comptes, partager des contenus, inviter des amis, etc. Le projet peut demander une preuve d’engagement avant de distribuer les tokens.

Airdrops pour détenteurs (holders)

Ici, seuls les portefeuilles détenant déjà des tokens du projet sont récompensés. Le projet effectue une capture d’écran (snapshot) des soldes à un moment donné, et distribue des tokens aux portefeuilles éligibles.

Certains projets utilisent aussi des airdrops pour attirer des utilisateurs d’autres blockchains. En 2016, par exemple, Stellar (XLM) a distribué 3 milliards de XLM aux détenteurs de Bitcoin, dans l’idée d’élargir sa base d’utilisateurs.

Les risques liés aux airdrops

Comme souvent dans l’univers crypto, tout n’est pas toujours rose. Les airdrops attirent aussi des acteurs malveillants.

Exemples de scams courants :

- Vous recevez des tokens inconnus dans votre portefeuille. En les bougeant, votre portefeuille est vidé.

- Un faux projet vous incite à connecter votre wallet à une plateforme frauduleuse. Résultat : vos données privées sont récupérées.

⚠️ Un airdrop légitime ne vous demandera jamais de payer quoi que ce soit, ni de fournir votre seed phrase ou clé privée. Restez toujours vigilant et faites vos propres recherches (DYOR).

Autre point à surveiller :

Un airdrop massif peut fausser la perception de la popularité d’un projet. Si un token est envoyé à des milliers de wallets mais n’est quasiment jamais échangé, attention au miroir aux alouettes. Assurez-vous que le volume de trading réel correspond au nombre d’utilisateurs actifs.

Picture this: You're scrolling through DeFi platforms, and suddenly you see two different projects. One screams "12% APR!" while another boasts "12% APY!" Your brain probably thinks, "Same, right?"

Wrong. Very wrong.

When it comes to comparing interest rates, APR and APY might look like twins… but they’re not. Far from it. The difference between them can determine whether you grow your savings or overpay on a loan. In this guide, we’ll break down what APR and APY really mean, how they work in banking, lending, and crypto, and how understanding them can help you make smarter financial decisions.

Key Takeaways

- APR (Annual Percentage Rate) shows the yearly cost of borrowing, including interest and certain fees.

- APY (Annual Percentage Yield) reflects your total yearly return, factoring in compounding.

- For borrowers, lower APR = lower total cost. For savers, higher APY = higher returns.

- In crypto and DeFi, compounding frequency can turn modest APRs into much higher APYs.

APY vs APR: The Essential Difference

At a glance, APR tells you how much interest you’ll pay (or earn) over a year, without compounding. APY, on the other hand, includes compounding, the process where interest earns more interest over time.

When comparing financial products, whether a credit card, savings account, or staking pool, this distinction matters. For borrowers, APR reveals the true cost of debt, while for investors, APY highlights the power of compound growth.

TL;DR. APR is about cost, APY is about growth. Knowing which one applies helps you choose between competing offers with confidence.

What Is APR (Annual Percentage Rate)?

APR represents the yearly interest rate charged to borrow money, or the rate you earn before compounding if you lend it. It includes interest and certain fees, helping you understand the total cost of credit.

APR is widely used in credit cards, personal loans, mortgages, and auto financing. For example, if your credit card has an 18% APR, you’ll pay 18% interest on any carried balance. Fixed-rate loans maintain the same APR, while variable-rate loans fluctuate with market conditions and Federal Reserve changes.

Example: Borrow $10,000 at 10% APR for one year. You’ll owe $1,000 in interest. Simple and transparent, without compounding surprises.

What Is APY (Annual Percentage Yield)?

APY measures how much your money grows over a year, including compounding. It reflects how often your interest is added to your balance (daily, monthly, or annually) which then generates more interest.

This is the standard metric for savings accounts, money market accounts, and certificates of deposit (CDs). Banks and digital financial platforms often advertise APY because it paints a more complete picture of earning potential.

Example: Deposit $10,000 in an account with a 5% APY, compounded monthly. After one year, your balance grows to $10,511, slightly higher than a flat 5% APR return.

The more frequent the compounding, the greater the growth, especially important in DeFi protocols that compound every few minutes.

APR vs APY in Different Financial Products

Credit Cards and Loans (APR)

When borrowing, APR helps you understand the true borrowing cost. For instance, if a mortgage advertises a 6.5% APR, that includes both the interest and certain closing costs.

Car loans, student loans, and credit cards use APR to keep comparisons straightforward across lenders. The key? Lower APR = less expensive borrowing.

Savings and Investment Accounts (APY Focus)

If your goal is wealth building, APY is your guide. A high-yield savings account with 4.5% APY grows faster than one with 4% because compounding quietly amplifies returns.

For certificates of deposit (CDs) or fixed deposits, APY helps you compare the real impact of compounding frequency.

Cryptocurrency and DeFi (Both APR and APY)

In crypto lending, staking, or yield farming, both metrics appear and can be easily confused.

- APR shows base rewards (without compounding).

- APY assumes you’re constantly reinvesting.

Example: A DeFi pool may show 100% APR, but with daily compounding, it becomes 171% APY. The key is understanding how often you can claim rewards and whether gas fees make compounding worthwhile.

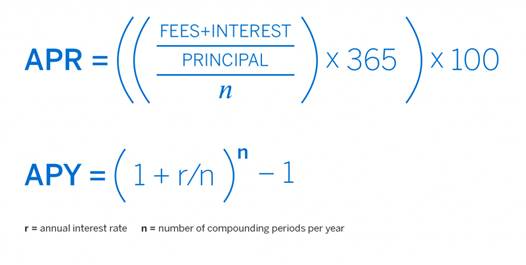

How to Calculate APR vs APY

To compare offers correctly, you can calculate one from the other:

Example: 12% APR compounded monthly

APY = (1 + 0.12/12)^12 - 1 = 12.68%

Compounding more frequently increases APY slightly each time.

Which Should You Focus On?

- If you’re borrowing, prioritize APR. It reflects the total cost of debt.

- If you’re saving or investing, look at APY. It shows how compounding boosts earnings.

- In crypto, check both. APR tells you the base reward, APY reveals potential if you reinvest.

When comparing offers, always read the fine print; frequency, fees, and conditions can shift the real value dramatically.

Common Misconceptions and Pro Tips

Myth: “APY is always better.”

Reality: Only if compounding happens, or if you reinvest earnings.

Myth: “APR ignores compounding, so it’s useless.”

Reality: APR helps borrowers compare costs clearly.

Pro Tip: Use online APR-to-APY calculators for quick comparisons. They’re free and eliminate guesswork.

The Bottom Line

APR and APY aren't just different ways of saying the same thing, they represent two different approaches to measuring returns.

When you see APR, you're looking at simple interest calculated over a year. When you see APY, you're seeing what happens when earnings get reinvested and compound over time. Both are valid measurements, just showing different scenarios.

This distinction becomes more noticeable with higher interest rates. A 50% APR becomes closer to 65% when compounded daily. The higher the base rate, the bigger the difference between these two numbers becomes.

Understanding which one you're looking at helps you compare options accurately. APR gives you the base rate, while APY shows the potential with compounding factored in.

Once you get the hang of spotting the difference, those financial offers suddenly make a lot more sense. No more squinting at numbers wondering why similar-sounding deals seem to work out so differently. It's like finally understanding why some recipe measurements are in cups and others in ounces - same concept, different scales, and knowing which is which makes all the difference.

Yield farming is a method to generate more crypto with your crypto holdings. The process involves you lending your digital assets to others by means of the power of computer programs known as smart contracts.

Cryptocurrency holders have the option of leaving their assets idle in a wallet or binding them into a smart contract to assist with liquidity. Yield farming allows you to benefit and gain rewards from your cryptocurrency without spending any more of it. Sounds quite easy, right?

Well, hold on because it isn't that straightforward and we are just getting started.

Yield farmers employ highly advanced tactics in order to improve returns.

They constantly move their cryptocurrencies among a variety of lending markets in order to optimize their returns. After a quick Google search, you would wonder why there isn't more content surrounding strategies and why these yield farmers are so tight-lipped about the greatest yield farming procedures.

Well, the answer is quite simple: the more people are informed about a strategy, the less effective it becomes. Yield farming is the lawless territory of Decentralized Finance (DeFi), where farmers compete for the opportunity to grow the highest-yield crops.

As of November 2021, there is $269 billion in crypto assets locked in DeFi, gaining an impressive almost 27% in value compared to the previous month of October.

The DeFi yield farming rise shows that the excitement in the crypto market has extended far beyond community- and culture-based meme tokens and planted itself in the centre of the hype. What exactly does it take to be a yield farmer?

What kinds of yields can you anticipate? Where do you start If you're considering becoming a yield farmer? Here, we'll guide you through everything you need to know.

What is Yield Farming?

Also referred to as liquidity farming, yield farming is a method for generating profits using your cryptocurrency holdings instead of leaving them idle in an account on a crypto website. In a nutshell, it involves bidding cryptocurrency assets into platforms that offer lending and borrowing services and earning a reward for it.

Yield farming is similar to bank loans or bonds in that you must pay back the money with interest when the loan is due. Yield farming works the same way, but this time, the banks are replaced in this scenario by crypto holders like yourself in a decentralized environment. Yield farming is a form of cryptocurrency investment in which "idle cryptocurrencies" that would have otherwise been held on an exchange or hot wallet are utilized to provide liquidity in DeFi protocols in exchange for a return.

Yield farming is not possible without liquidity pools or liquidity farming. But, what is a liquidity pool? It's basically a smart contract that contains funds. Liquidity pools are working with users called liquidity providers (LP) that add funds to liquidity pools. Find more information about liquidity pools, liquidity providers, and the automated market maker model below.

How Does Yield Farming Work?

Liquidity pools (smart contracts filled with cash) are used by yield farming platforms to offer trustless methods for crypto investors to make passive revenue by loaning out their funds or crypto using smart contracts.

Similar to how people create bonds to pay off a house and then pay the bank interest for the loan, users can tap into a decentralized loan pool to pay for the bonds.

Yield farming is a type of investment that involves the use of a liquidity provider and a liquidity pool in order to run a DeFi market.

- A liquidity provider is a person or company who puts money into a smart contract.

- The liquidity pool is a smart contract filled with cash.

Liquidity providers (LPs), also known as market makers, are in charge of staking funds in liquidity pools enabling sellers and purchasers to transact conveniently by executing a buyer-seller agreement utilizing smart contracts. LPs earn a reward for providing liquidity to the pool. Yield farming is based on liquidity providers and liquidity pools, which are the foundations of yield farming. These work by staking or lending crypto assets on DeFi protocols to earn incentives, interest or additional cryptocurrency. It's similar to how venture capital firms invest in high-yield equities, which is the practice of investing in equities that offer better long term results.

Yield farmers will frequently shuffle their money between diverse protocols in search of high yields. For this reason, DeFi platforms may also use other economic incentives to entice more capital onto their platform as higher liquidity tends to attract more liquidity. The method of distribution of the rewards will be determined by the specific implementation of the protocol. By yield farming law, the liquidity providers get compensated for the amount of liquidity they contribute to the pool.

How Are Yield Farming Returns Calculated?

Estimated yield returns are calculated on an annualized model. This estimates the returns that you could expect throughout a year. The primary difference between them is that annual percentage rates (APR) don't consider compound interest, while annual percentage yield (APY) does. Compounding is the process of reinvesting current profits to achieve greater results (i.e. returns). Most calculation models are simply estimates. It is difficult to accurately calculate returns on yield farming because it is a dynamic market and the rewards can fluctuate rapidly leading to a drop in profitability. The market is quite volatile and risky for both borrowers and lenders.

Before Getting Started, Understand The Risks Of Yield Farming

Despite the obvious potential benefits, yield farming has its challenges. Yield farming isn't easy. The most successful yield farming techniques are quite complex, recommended only to advanced users or experts who have done their research.

Here are the different risks:

Smart contract

Smart contracts are computerized agreements that automatically implement the terms of the agreement between parties and predefined rules. Smart contracts remove intermediaries, are less expensive to operate and are a safer way to conduct transactions. However, they are vulnerable to attack vectors and bugs in the code.

Liquidation risks

DeFi platforms, like traditional finance platforms, use customer deposits to create liquidity in their markets. However, if the collateral's value falls below the loan's price, you would be liquidated. Collateral is subject to volatility, and debt positions are vulnerable to under-collateralization in market fluctuations.

If you borrow XX collateralized by YY a rise in the value of XX would force the loan to be liquidated since the collateral YY value would be inferior to the value of the XX loan.

DeFi Rug Pulls

In most cases, rug pulls are obvious exit scams that are intended to entice investors with a well-manufactured promising project in order to attract investors.

A crypto rug pull happens when developers create a token paired with a valuable cryptocurrency. When funds flow into the project and the price rises, developers then seize as much liquidity they can get their hands on resulting in losses for the investors left in.

Impermanent loss

Impermanent loss happens when a liquidity provider deposits their crypto into a liquidity pool and the price changes within a few days. The amount of money lost as a result of that change is what is called an impermanent loss. This situation is counter-intuitive yet crucial for liquidity providers to comprehend.

Exercise Caution When Getting Into Yield Farming

If you have no prior knowledge of the cryptocurrency world, entering into the yield farming production may be a hazardous endeavour. You might lose everything you've put into the project. Yield farming is a fast-paced and volatile industry. If you want to venture into yield farming, make sure you don't put more money in than you can afford, there's a reason why the United Kingdom has recently implemented serious crypto regulations.

What The Future Holds For Yield Farming

We hope that after reading this article you will have a much deeper understanding of yield farming and that it answered some of your burning questions.

In summary, yield farming uses investors' funds to create liquidity in the market in exchange for returns. It has significant potential for growth, but it's not without its faults.

What else might the decentralized financial revolution have in store for us? It's difficult to anticipate what future applications may emerge based on these present components. However, trustless liquidity protocols and other DeFi technologies are driving finance, cryptoeconomics, and computer science forward.

Certainly, DeFi money markets have the ability to contribute to the development of a more open and inclusive financial system that is accessible to everyone with an Internet connection.

As you navigate the waters of the cryptocurrency market you're likely to come across a term called "coin burning". In this article, we're exploring the process used to manage the token supply of projects, a means for companies to manually alter the supply (and thereby demand) of a token's circulating supply. While not adopted by every project, coin burning has proven over the years to be successful in increasing the price of a digital currency.

What Is A Coin Burn

Diving right in, a coin burn is the process of removing a certain number of tokens from circulation by sending them to an invalid address, a "black hole" of sorts. This process is written into the project's code and implemented at various increments as outlined in the whitepaper. While Bitcoin doesn't make use of coin burning, many projects on the Ethereum network, particularly ERC-20 tokens, have been known to implement it.

Through the use of a smart contract, also known as a burn function, the network would remove a specified number of tokens from circulation, decreasing the total supply and thereby (hopefully) increasing the demand. Coin burns have been known to lead to an increase in price, as the supply-demand ratio is altered.

An Example Of Coin Burning

A top 10 cryptocurrency project underwent a coin burn last year that is believed to be the biggest layer 1 token burn to date. 88.7 million LUNA, the native coin to the Terra project, were burned in November 2021 following a vote by the community. This was effectively worth $4.5 billion at the time. A few days following the coin burn the LUNA token hit a new record high.

The burn aimed to remove value from Terra’s community pool, but in reality, it simply moved the value from the pool to the individual holders of the cryptocurrency.

Bitcoin Cash and Stellar are two other high profile cryptocurrencies that have made use of the coin burning initiative. Shiba Inu is another cryptocurrency to have undergone a coin burn, although this wasn't the initial intention of the project. The project's developers gifted half of the SHIB supply to Ethereum creator Vitalik Buterin, who went on to donate 10% and burn the remaining 90%.

How Does Coin Burning Work?

Should a project wish to implement a coin burn they will need to create a smart contract. Smart contracts are digital agreements that execute when certain criteria have been met. Say a project wants to implement a coin burn every 200,000 blocks, they will create the burn function to include this instruction.

When this milestone is achieved, the coins will automatically move from the designated wallet to a wallet address that does not have a private key. Without a private key, these coins can never be recovered. The coins will then be sent from the one wallet address to the other and effectively be removed from circulation. The transaction (burn) will be added to the network's blockchain records and be available to view through the blockchain explorer.

The Downside To Coin Burning

Before you invest in a project that undergoes coin burning it is important to note that coin burning does not guarantee an increase in the coin's price. The increase in price will depend on the network, the market climate and the current sentiment. During the Shiba Inu coin burn, while the price rose considerably, it soon returned to a more stable and substantially lower level.

Coin burning can also be used by ill acting developers to deceive the community. Say a project has a total supply of 100 million tokens and allocates 10 million to the platform's developers. They could then burn 40 million tokens, increasing their hold to 60% of the circulating supply on the network.

As with all transactions conducted on the blockchain, all payments are irreversible meaning that once you burn coins they can never be recovered.

What Is Proof Of Burn?

Not to be confused with coin burning, Proof of Burn (PoB) is a consensus mechanism similar to Proof of Work and Proof of Stake. The model utilizes an element of coin burning in its mining practice and is known to use considerably less energy than its PoW counterpart.

The process requires miners to burn tokens in order to participate in the mining process. The more coins burned the more blocks they can create, meaning the more rewards (in the form of transaction fees) they can earn. Miners are still required to use mining hardware. The benefit of this is to provide a less energy-intensive blockchain network that can run optimally through a network of decentralized mining participants.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.BOOSTEZ VOS FINANCES

Prêt à passer à l’action ? Rejoignez celles et ceux qui prennent une longueur d’avance. Débloquez de nouvelles opportunités et commencez à façonner votre avenir financier.

Commencer