After a volatile October, crypto faces a defining moment. Discover what's fueling both the bullish and bearish cases right now.

Keep reading

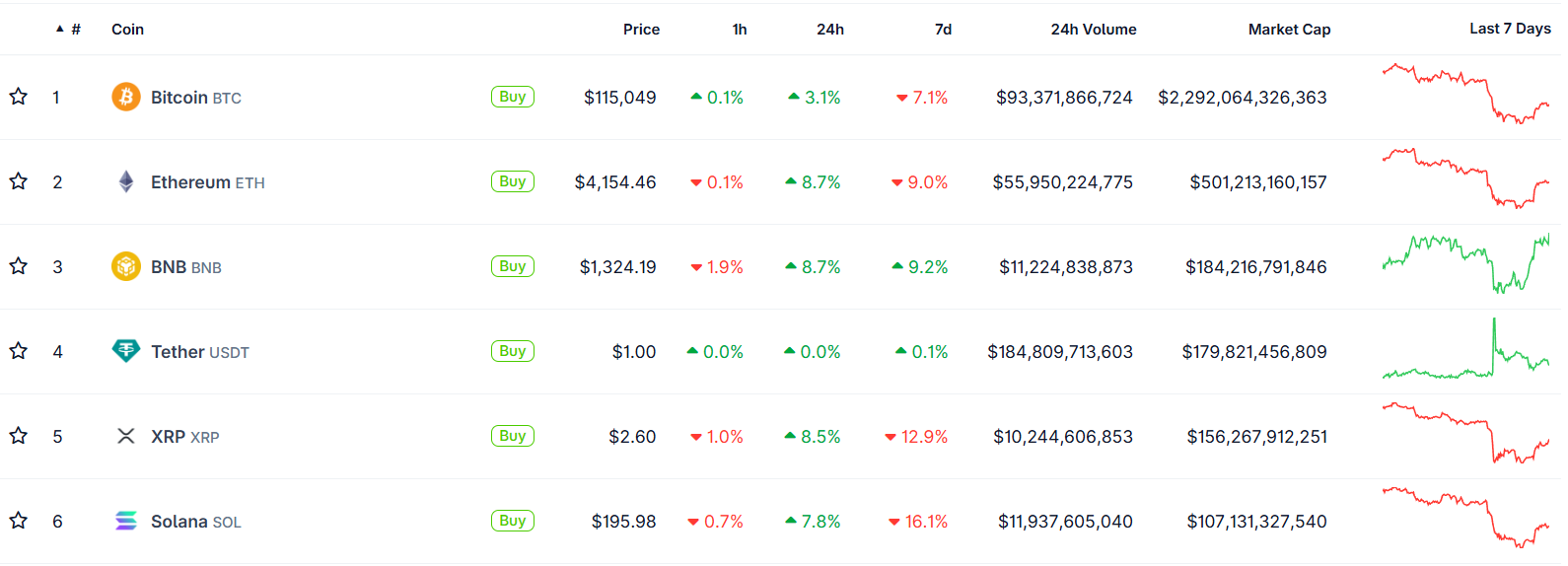

After a volatile October that saw one of the sharpest two-day liquidations of the year, the crypto market is trying to regain its footing, but conviction remains divided. Bitcoin has stabilized near key support levels, while altcoins fight against selling pressure. With macro, policy, and on-chain factors all in play, the debate between the bull and bear camps is as alive as ever. Let’s unpack the forces shaping both sides of the ledger.

The Bear Case

When Good News Don’t Move Prices

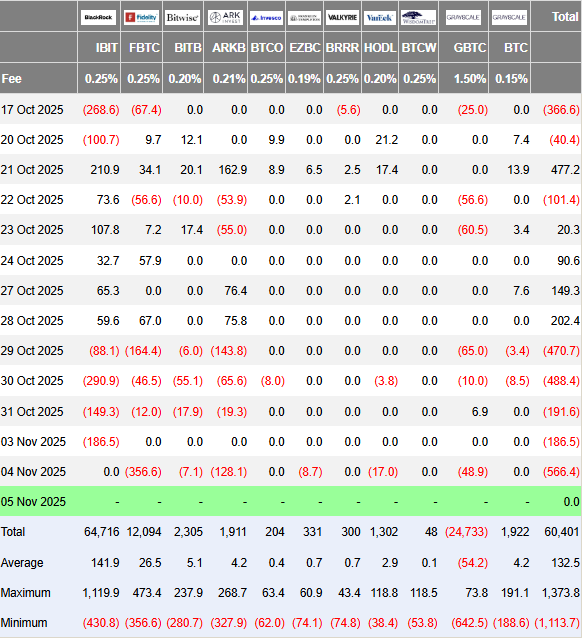

Despite encouraging ETF data and easing rate expectations, crypto failed to rally in late October, a classic warning sign of risk fatigue. According to Farside Investors, U.S. spot Bitcoin ETFs saw outflows of $470 million, $488 million, and $191 million between October 29 and 31, signaling that short-term traders were taking profits or stepping aside after “Uptober” fizzled out.

The AI Narrative

Macro sentiment still casts a long shadow. The tech-heavy equity rally, driven by AI infrastructure and chip stocks, has stirred debate about overvaluation. Nvidia’s brief breach of a $5 trillion valuation in late October triggered flashbacks of the dot-com era. If AI equities begin to deflate, crypto could feel the wealth effect unwind, as liquidity shifts from speculative assets to safer havens.

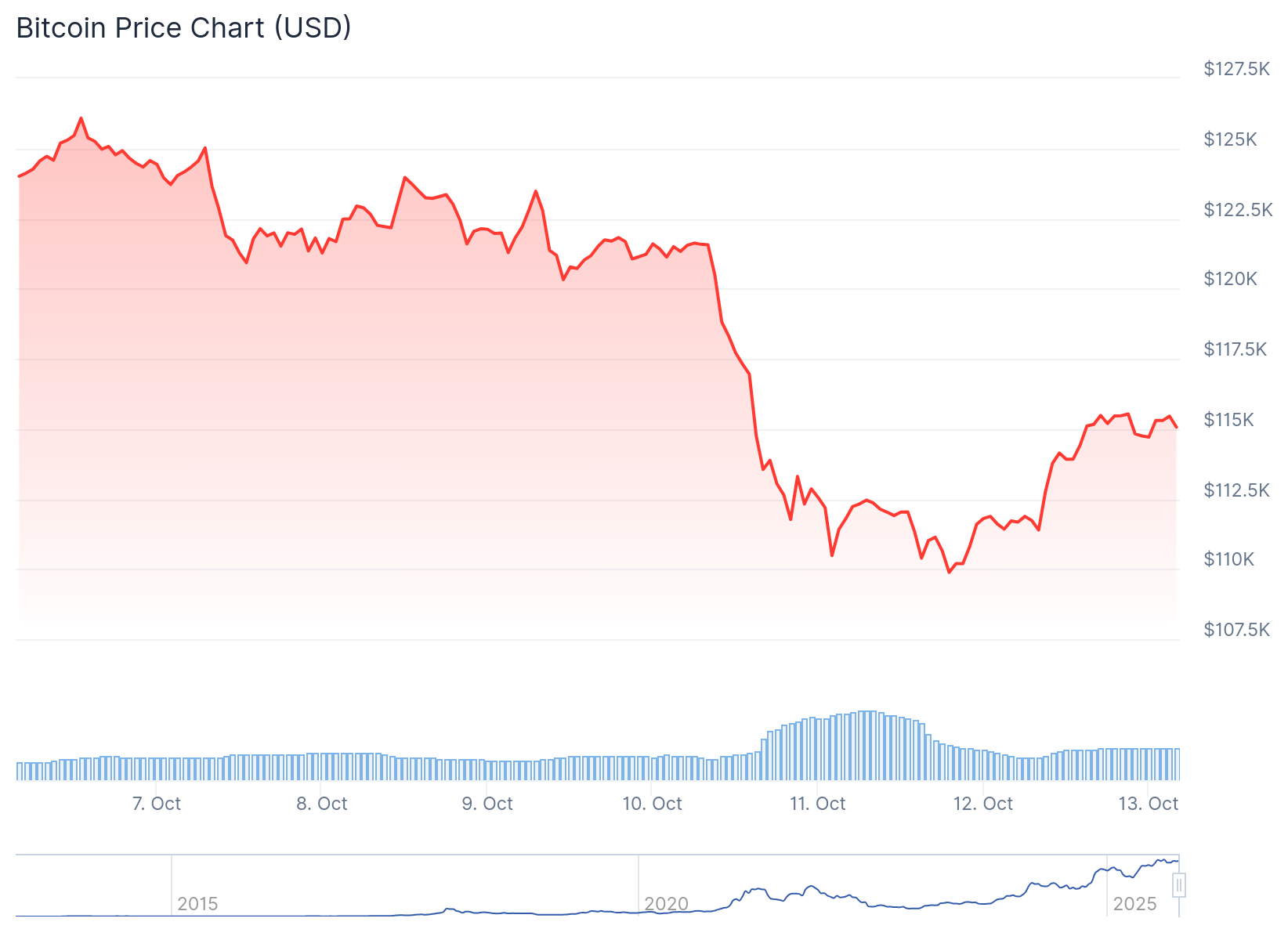

The 10/10 Crash Aftershock

The October 10 downturn marked one of the largest single-day liquidations in recent memory. Analysts note that this event left traders hunting for “dead entities” and potential hidden losses, injecting caution across the market. Even with recovery underway, scars from that drop remain fresh.

Post-Halving Cycle Timing

Bitcoin’s halving on April 20, 2024 (block 840,000) reset expectations, but it also reignited the age-old question: where are we in the cycle? Historically, the strongest rallies have occurred before or shortly after the halving, not a full year later. Some analysts now argue that the current consolidation could represent a late-cycle phase rather than the start of a new one.

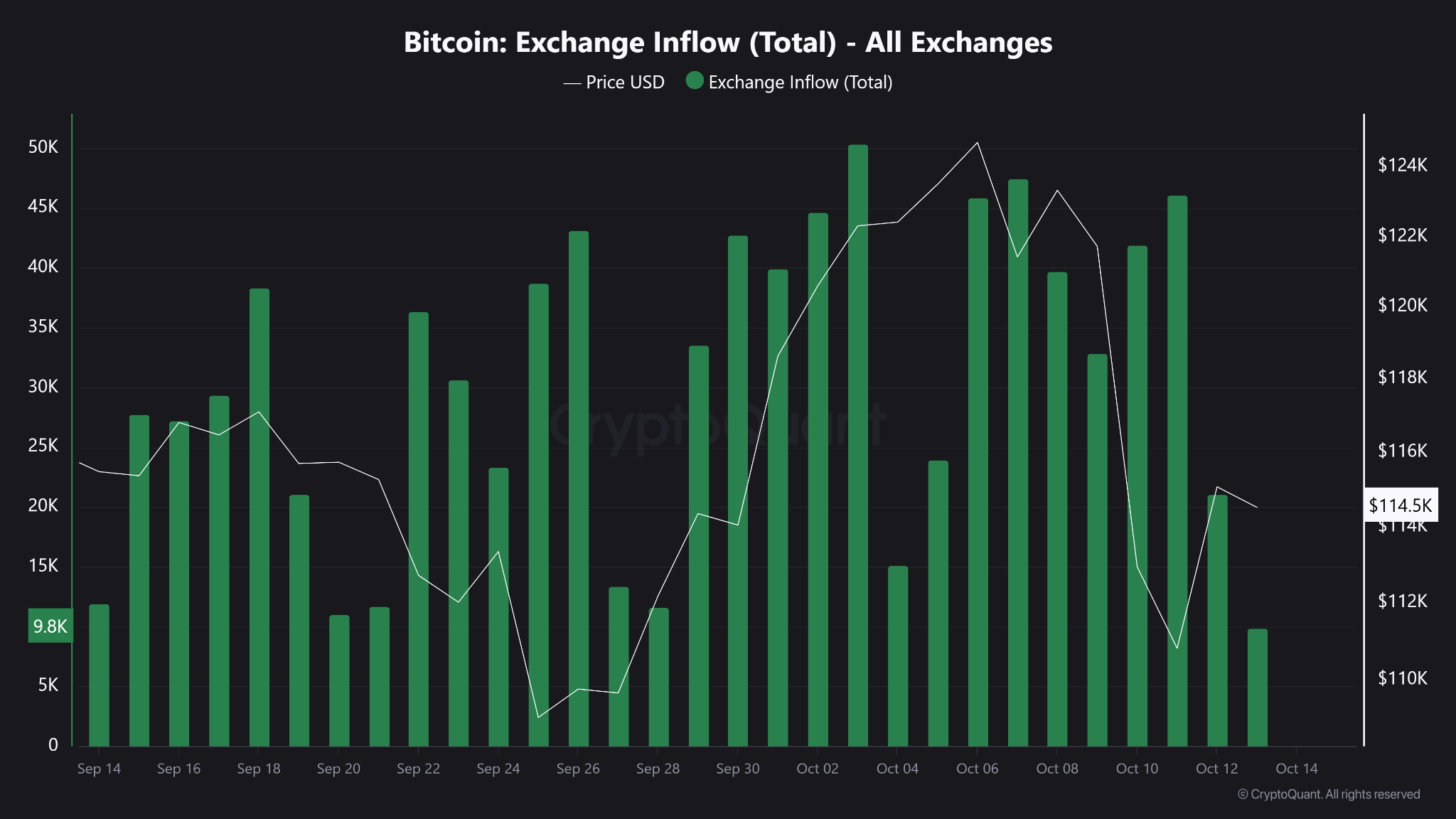

Dormant Wallets Awakening

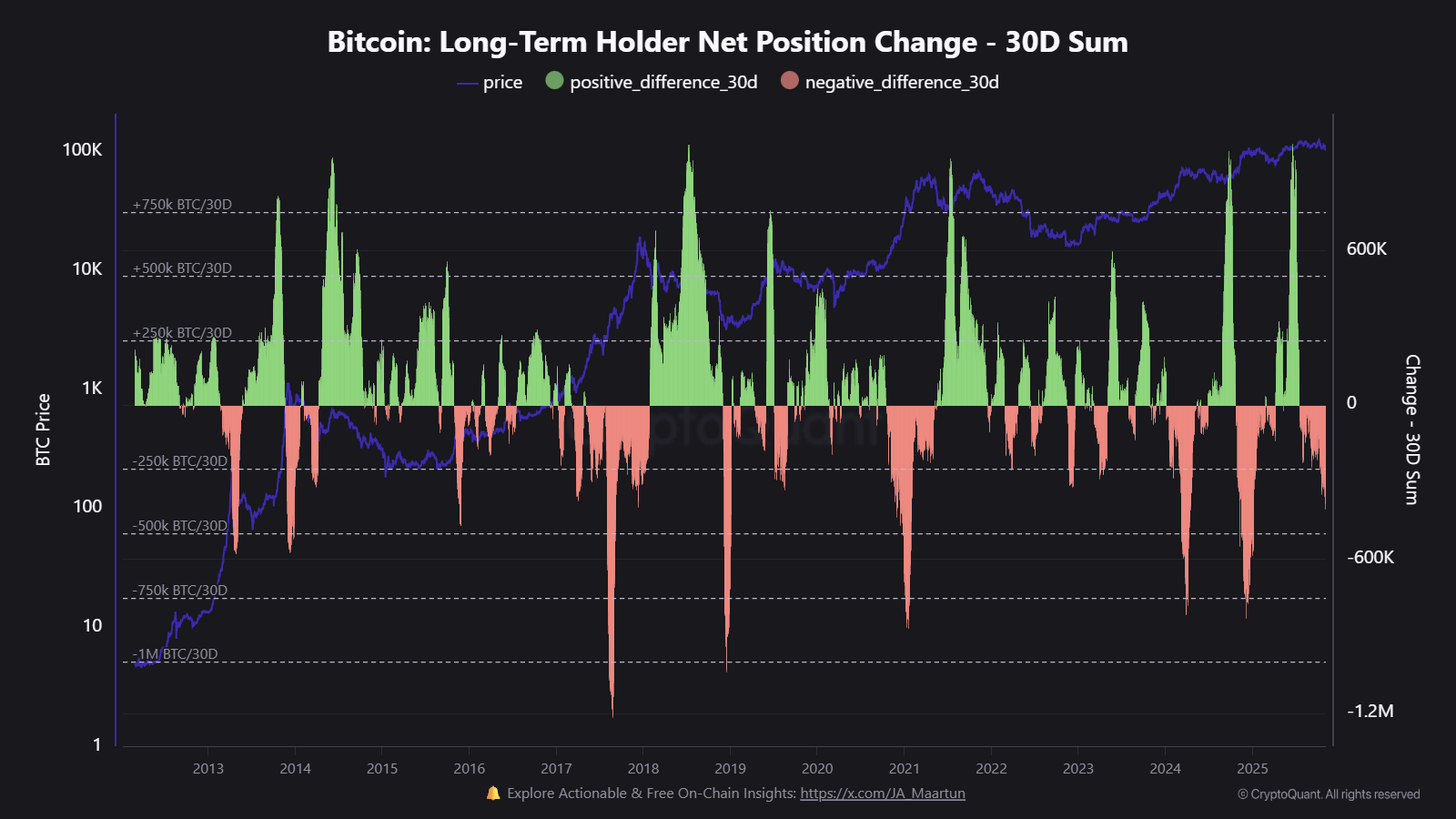

On-chain data from CryptoQuant shows that long-term holders have increased net distribution since mid-October, with tens of thousands of BTC re-entering circulation. Several Satoshi-era wallets have also moved funds, not necessarily bearish in isolation, but enough to add pressure and short-term supply.

The Bull Case

No Signs of Euphoria

Market positioning remains far from overheated. The Crypto Fear & Greed Index currently sits in the 20s, and has been recently hovering between “Fear” and “Neutral.” That’s a far cry from the exuberant 80s to 90s readings that often precede blow-off tops. In practical terms, this suggests there’s still room for sentiment to improve before the market becomes dangerously crowded.

Liquidity Is Turning

Central banks are easing. The European Central Bank has already paused, the Bank of England has begun cutting, and the U.S. Federal Reserve is expected to follow suit with at least one more rate cut by year-end. According to the CME FedWatch Tool, the odds of a 0.25% cut currently stand above 70%. Historically, easing cycles have correlated strongly with renewed crypto uptrends, as lower yields push investors back into risk assets.

Institutional Adoption Keeps Compounding

Spot ETFs remain the biggest driver of credibility and inflows this year. Despite short-term outflows, global crypto investment products reached $921 million as recently as last week. That steady institutional presence gives crypto markets deeper liquidity and a stronger foundation than in previous cycles, where retail speculation dominated.

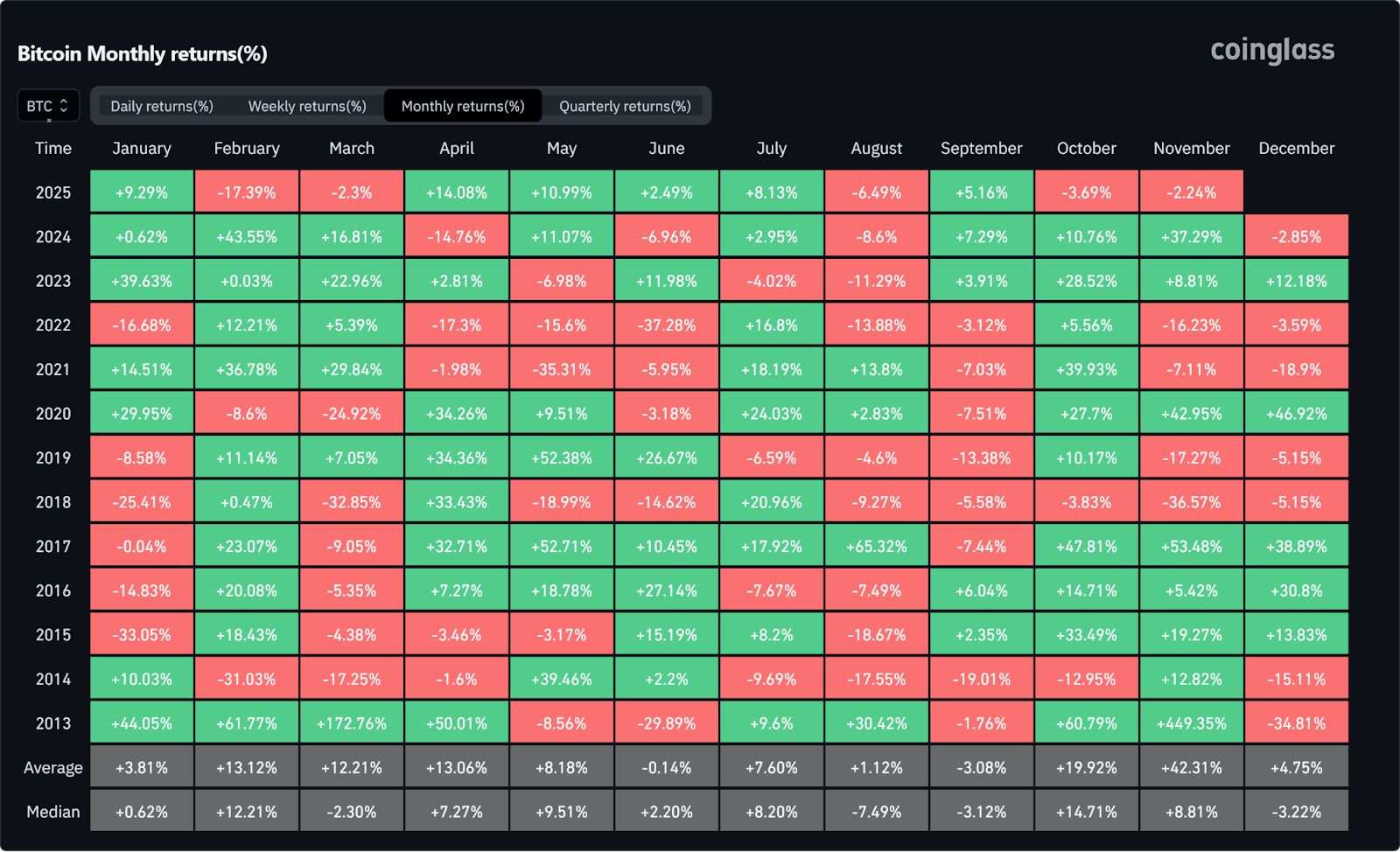

The Seasonal Edge

Seasonality adds another bullish data point. Since 2013, Q4 has consistently been Bitcoin’s strongest quarter on average. With November historically delivering above-average performance, many traders see the current consolidation not as a ceiling, but as a potential setup, particularly if macro data softens and ETF inflows resume.

Improving Global Sentiment

Finally, the U.S.–China trade thaw is a quiet but important catalyst. China has agreed to pause 24% tariffs on U.S. goods, marking the most significant de-escalation yet. For global risk assets, that’s a relief valve, potentially restoring confidence in emerging markets and crypto alike.

Final Verdict

Crypto’s tug-of-war between optimism and caution is far from over. The bull camp points to liquidity, policy progress, and institutional growth as evidence of a maturing ecosystem. The bears, on the other hand, warn that cycle timing, macro fragility, and old-wallet selling could cap any short-term rally.

Currently, the most realistic view lies somewhere in between these two extremes. After October's flash crash sent shockwaves through the market, a period of recalibration has taken hold. Whenever the next significant high arrives, the current environment may be best described not as peak fear or euphoria, but as consolidation.