November 2025 could be a turning point for crypto. From ETFs to major network upgrades, here are six catalysts that could shape the market.

Keep reading

As we move into November 2025, the crypto-market is gearing up for one of its most intriguing phases yet. From spot-ETF momentum to narrative shifts, network upgrades and real-world asset tokenization, multiple catalysts are aligning. Here are six key developments to watch.

1. Seasonality & Historical Momentum Could Kick In

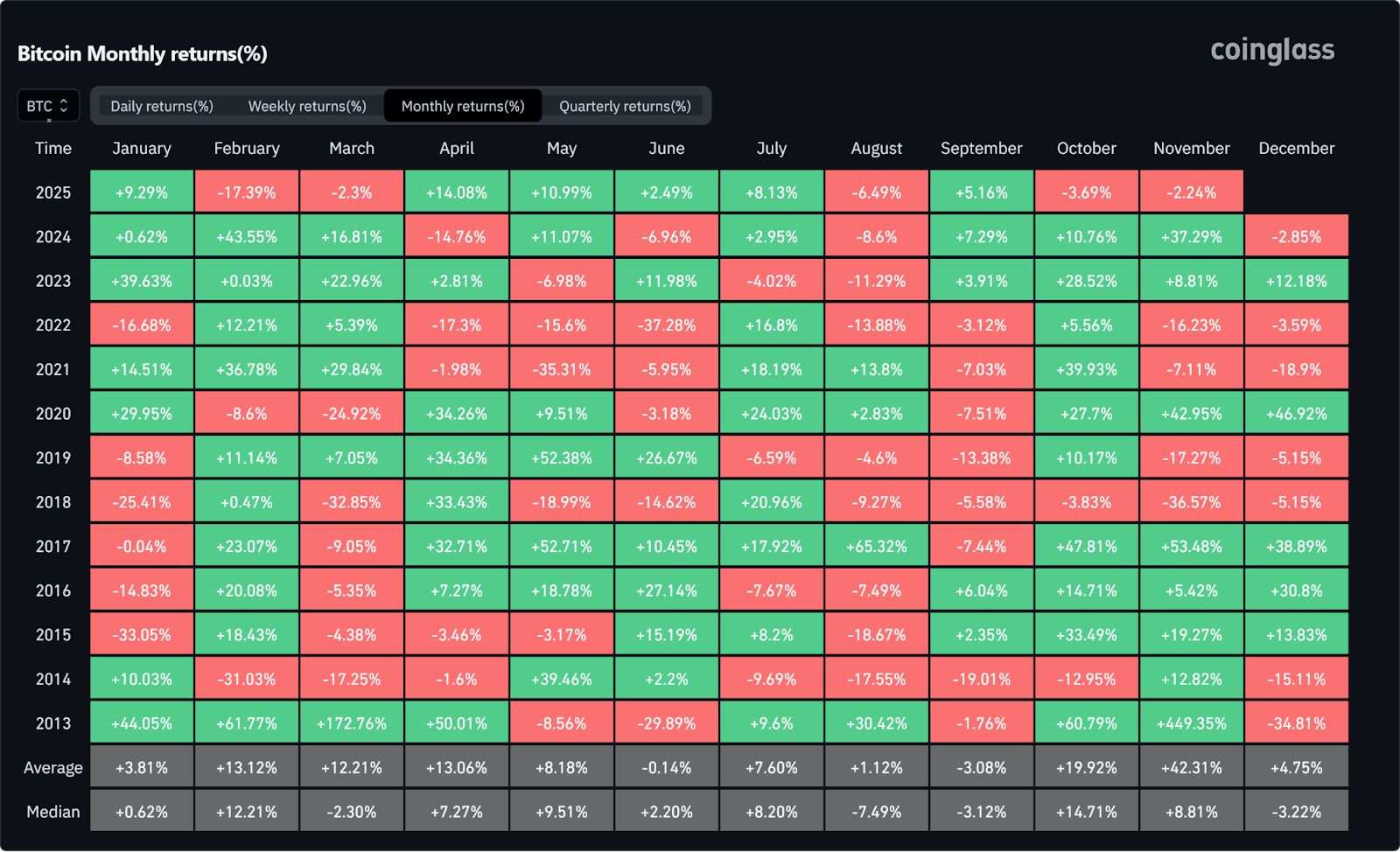

While "Uptober" fell short of expectations, November could tell a different story. Historically, it's been one of the strongest months for digital assets, with Bitcoin in particular averaging +42.31% gains in recent years.

When combined with the renewed ETF narrative, increased whale accumulation, and a stronger appetite for risk assets, market momentum appears to be building. Participants are closely monitoring how these dynamics could influence sentiment, especially as trading volumes and key technical levels come into play. If Bitcoin maintains stability around the $100K zone and Ethereum shows signs of renewed strength, November could become a more active month for crypto markets compared to October.

2. Ether’s Next Move Could Set the Tone for Altcoins

The final weeks of 2025 may prove pivotal for Ethereum (ETH). Although retail accumulation has paused somewhat, wallet-level data shows large holders (1,000 to 100,000 ETH wallets) added roughly 1.6 million ETH in October (around $6 billion), it’s a sign that whales and larger holders are staying active as the year winds down.

If ETH begins to break out or even stabilize around current levels, it could unlock the broader altcoin market, which has been lagging for months. The playbook that many are hoping for is the following one: ETH strength leads to improved risk appetite, which in turn sparks an altcoin rotation as investors seek higher risk exposure.

Ethereum remains the accepted benchmark for gauging sentiment across the non-Bitcoin segment of the market, and its performance frequently acts as a catalyst for capital flows into smaller assets. Keeping an eye on its fundamentals (from staking yield to liquidity shifts on major exchanges) will be important. In many ways, ETH could potentially become the gatekeeper to the next phase of the market’s recovery and the tone-setter for the coming months.

3. ETF Comeback After Delays

The recent U.S. government shutdown briefly froze several crypto-spot ETF filings, leaving the “ETF narrative” in suspense. But now the pause is over for Bitwise’s Spot Solana ETF. It has finally launched with strong early inflows, and the broader momentum is returning.

With this foundation, November could reignite the ETF trade in earnest, we may finally see filings for Ethereum staking products, new spot-Bitcoin funds and renewed institutional interest. If filings begin to stack up and regulatory engagement deepens, this could mark the next major inflection for how crypto is accessed in traditional portfolios.

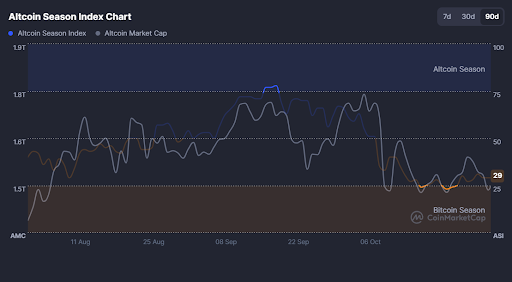

4. Altcoins at an Inflection Point

The broader altcoin sector enters November under pressure as the Altcoin Season Index sits near 29, signaling a reset after October’s downturn. But inflection points often follow pressure. If ETH sets the tone (as many are hoping for), mid-cap and high-beta altcoins (such as SOL, AVAX, NEAR) could begin to capture rotation flows.

Traders might want to watch for flow changes such as increased volumes, wallet relocations and new project launches. While caution is still prevailing, this may be the window where sentiment begins to swing back into “altcoin season”.

5. Major Network Upgrades

Technical infrastructure is not just background noise; it often creates catalyst-events. For example, Ethereum’s upcoming Fusaka Upgrade (scheduled for early December) is designed to increase layer-2 data capacity and reduce transaction costs.

Meanwhile, various Layer-2 ecosystems are preparing upgrades and cross-chain activations. One such upgrade, Shibarium Upgrade’s security overhaul on the Shiba Inu network. These events may ignite renewed network activity, developer interest and capital flows into ecosystems ready to scale.

6. Real-World Asset (RWA) Tokenization Accelerates

The tokenization of real-world assets (RWAs), such as real estate, bonds, equities, is moving from niche to mainstream. For instance, according to Standard Chartered, this market is projected to grow to around $2 trillion by 2028. Institutional interest is burgeoning, and regulatory frameworks are emerging.

As November unfolds, we may see announcements of large tokenization initiatives or new platforms bridging DeFi and traditional finance. For crypto holders and ecosystem observers, this means the familiar “crypto only” narrative is expanding into real-asset integration, a meaningful broadening of the opportunity set.

The Verdict

November 2025 is shaping up to be more than just another month. Spot-ETFs potential, ETH’s path, altcoin rotation, seasonal tailwinds, infrastructure upgrades and RWA tokenization all sit in motion. Each one individually is significant; together they create a multi-vector setup.

For those in the crypto space, whether you're holding long-term, actively trading, or building the next wave of infrastructure, November is likely to be eventful. This isn't a month to coast on autopilot. Track where capital is flowing. Pay attention to which narratives are gaining momentum and which are fading. The players are moving, and the pieces are falling into place.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

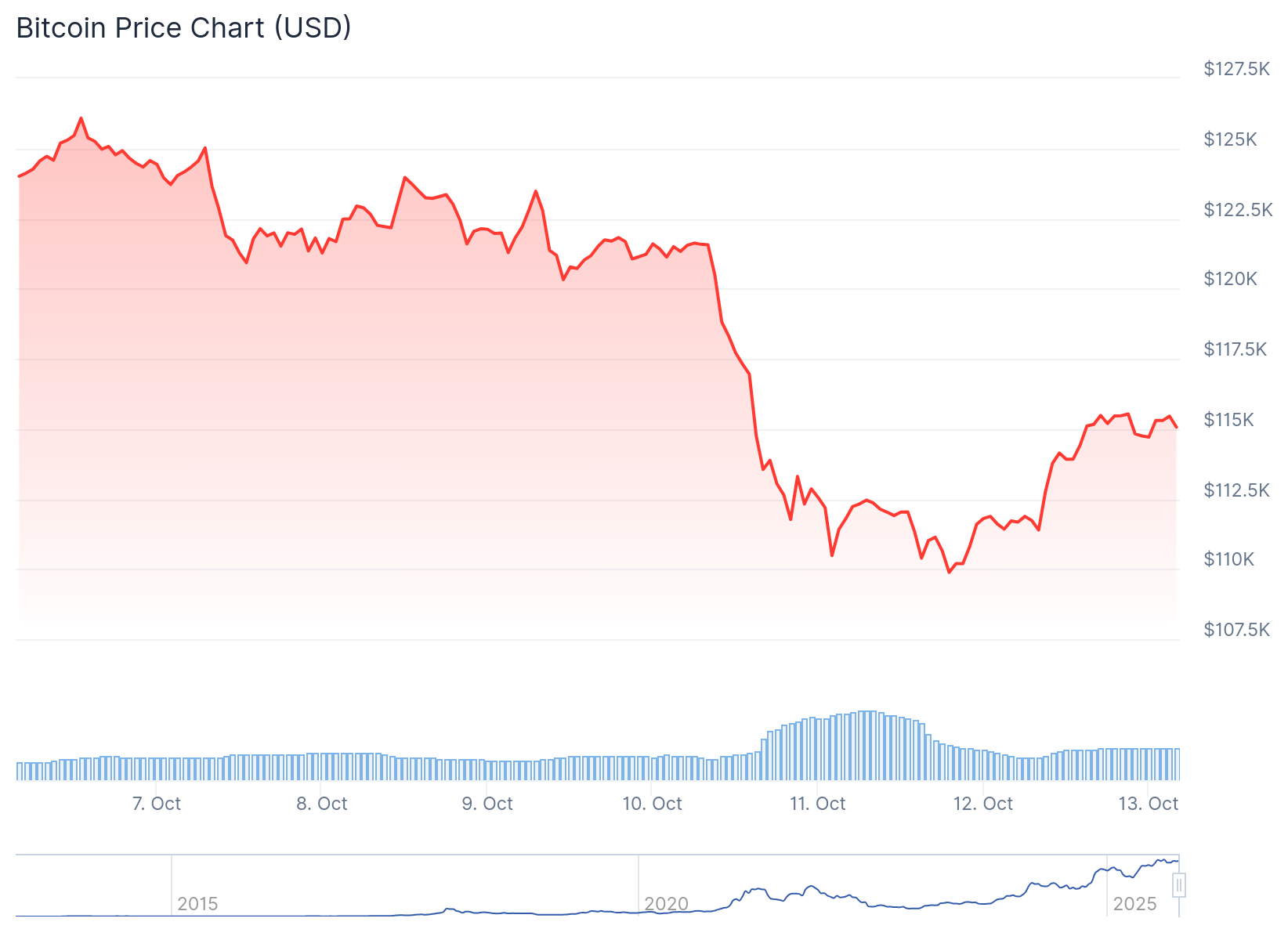

The Crash That Shook It All

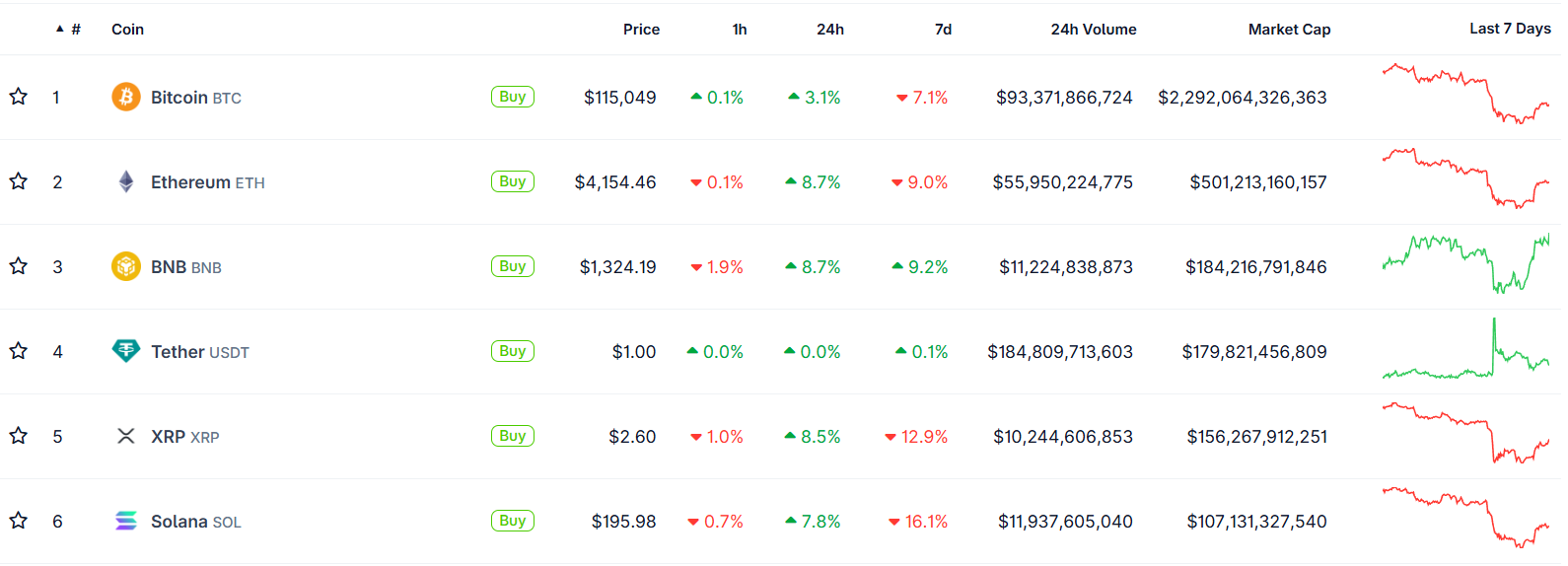

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

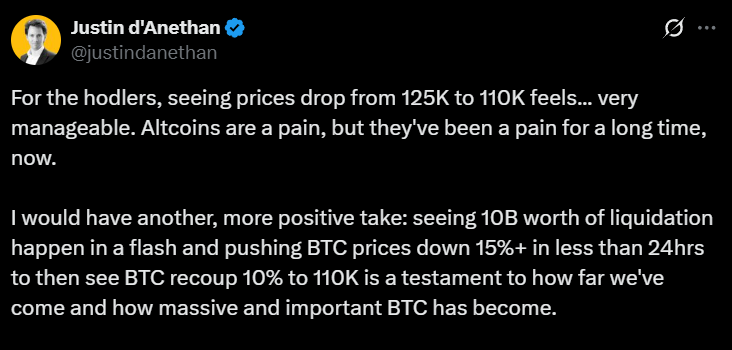

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

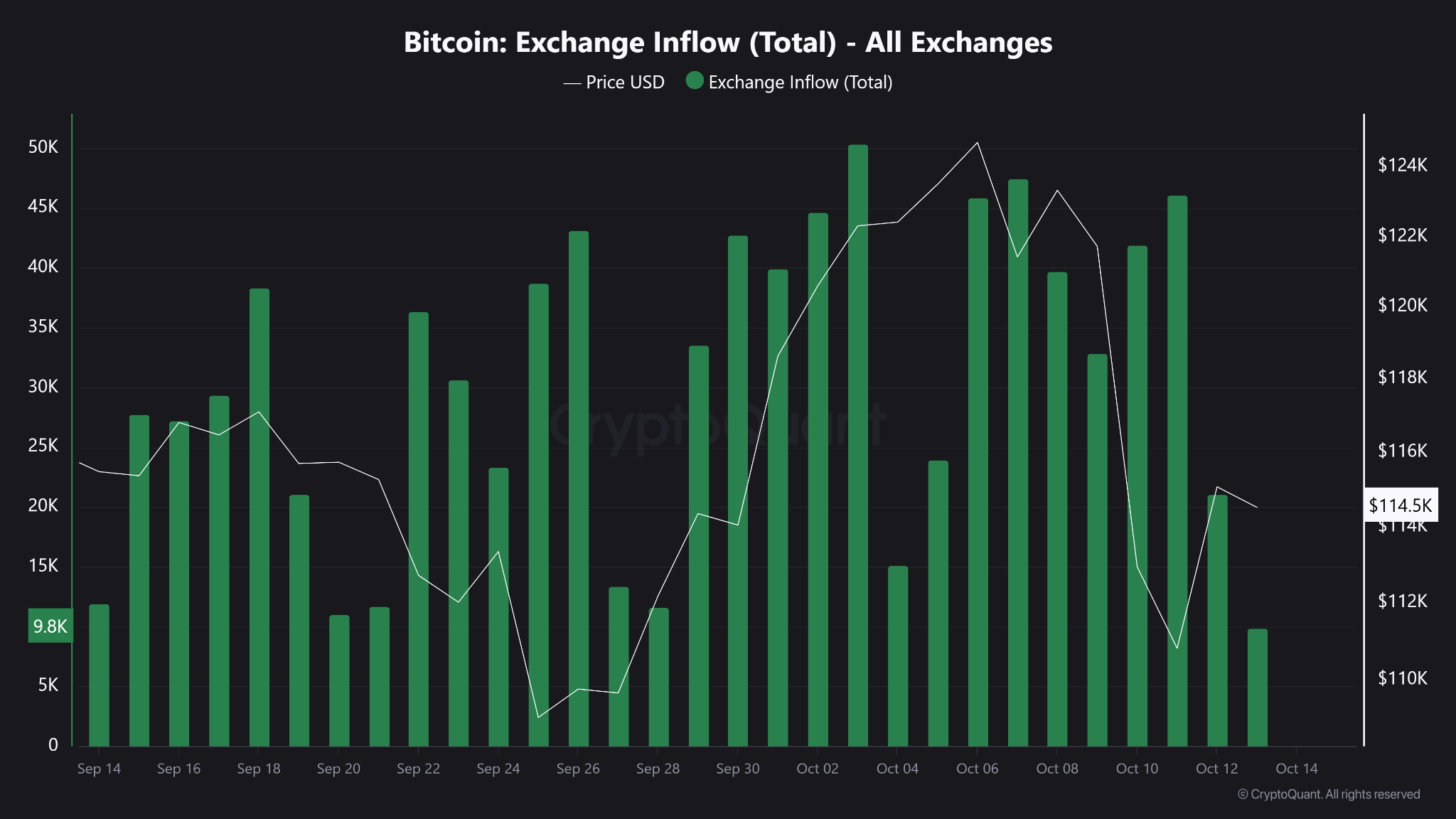

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

LATEST ARTICLE

So, you're in your thirties and starting from square one when it comes to your finances. Don't worry, you're not alone, and the good news is that it's never too late to take control and set yourself up for financial success. Congratulations on taking the first step.

In this article, we're going to walk you through a step-by-step guide of practical tips and empower you to make informed decisions as you navigate your financial journey with enthusiasm. It’s not rocket science, we promise.

Step 1: Assess your current financial situation

Getting a grip on where you currently stand financially is the first step toward building a solid foundation for your wealth. Let's take a closer look at how to assess your situation and define your goals, without breaking a sweat or drowning in crippling anxiety.

Take a close look at your income, expenses, and debts, writing them down or putting them in a spreadsheet. Identify areas where you can make adjustments to free up funds to save money or invest, and then set some clear goals, both short-term and long-term. Want to buy a house in 5 years, or take a trip to visit your friend in Hong Kong? Jot them down, goals are motivating.

Step 2: Build a strong foundation

Armed with a realistic picture of what your finances look like, work your way through the following three steps to start establishing a strong financial foundation.

- Create a budget and track expenses

The boring news is that establishing a budget is essential to gain control over your finances. No, we're not here to tell you to cut out all the things you enjoy. Creating a budget is about understanding your money flow and finding ways to save without sacrificing your happiness. Learn what your living expenses really are, and how much the interest rates hikes have affected you. It's about taking control of your money, rather than letting your money control you.

If spreadsheets seem daunting, use budgeting tools and apps to simplify the process and stay on top of your spending.

- Work on saving money effectively

No matter how you look at it, saving money is the cornerstone of building wealth. But saving money doesn't have to be a painful experience, it's all about being smart and resourceful.

A good starting point is to set aside a percentage of your income each month for emergencies and future investments. Automate your savings to ensure consistency and consider opening a high-yield savings account to maximize your returns. Look at opportunities available to you to get "free money" (reward points, employer compensations, etc).

A good starting point is to open that savings account and check out our simplified guide on building an emergency fund.

- Manage debt and improve your credit score

Debt can be overwhelming, but we're here to help you tackle it with confidence. Make a list of all your outstanding debts and approach it strategically by prioritizing the high-interest ones. From student loan debt to credit card debt, don't let these weigh you down forever, rather make a plan today that your future self will thank you for.

At the same time, work on improving your credit score by paying bills on time and not opening new credit accounts. Grab the reigns, you’re in control of your financial future.

Step 3: Explore generating additional income

Unsurprisingly, earning more money will equate to more wealth (we told you it’s not rocket science). As all-nighters are replaced with embarrassingly-sensible bedtimes, now is as good a time as any to pick up a small side hustle and generate income. It doesn’t need to earn you millions, the idea is to generate a little bit extra to accelerate your journey toward financial freedom.

- Explore side hustles and part-time opportunities

Who says you can't have fun and make money at the same time? Here are some side hustle ideas and part-time opportunities that might align with your interests. It’s time to turn your passions into profit and allow a new income stream to make your savings account a little plumper.

- Leverage your skills and talents for freelance work

You've got unique talents, and it's time to put them to work. Platforms like Upwork and Fiverr are great ways to gain exposure and find work that allows you to tap into your skills and find freelance opportunities that not only bring in more money but also allow you to showcase your awesomeness. Embrace entrepreneurship and transform your skills into a profitable venture.

- Invest in personal growth for career advancement

Investing in yourself is one of the best investments you can make. Invest in your personal and professional development to boost your earning potential and open doors to exciting career advancements.

Acquire new skills, pursue certifications, or enroll in relevant courses. Continuous learning not only amplifies your marketability but also positions you for better career prospects and greater earning power. It's time to level up.

Step 4: Investing for the future

Don’t be overwhelmed by the word “invest”. Let’s go through this together, one small step at a time. Consider this the start of your golden investment era.

- Understand the basics of investing

Investing doesn't have to be complicated jargon that leaves you breaking out in a sweat. Start small and familiarize yourself with the basics of investing. Learn about stocks, bonds, mutual funds, and real estate, and educate yourself on the concept of risk and reward. If in doubt, contact a financial adviser to get you started.

- Identify suitable investment options for beginners

You don't need to be a Wall Street expert to start investing, or need to know what real estate investment trusts are for that matter (yet). Consider beginner-friendly investment options that are easy to understand and offer steady growth, like low-cost index funds or exchange-traded funds (ETFs).

A word from the wise: stay away from get-rich-quick schemes and get started investing in assets aligned with your risk tolerance and long-term goals. Get ready to dip your toes into the investment pool.

- Diversification and risk management strategies

To minimize risk, spread your investments across different asset classes. Diversification is like having a cool umbrella that shields your portfolio from those crazy market storms. Don't forget to give your investments some love and attention from time to time. Review your strategy, do a little rebalancing dance if needed, and stay in the know about economic trends that could sway your investments.

Step 5: Overcome financial challenges

Don’t get caught off guard, navigate financial hurdles and stretch your money like a pro while still staying motivated on your wealth-building journey. Yes, it’s possible.

- Dealing with limited funds and unexpected expenses

Starting from scratch often means facing financial limitations. And we get it, life happens, and unexpected expenses can throw us off track. But fear not! The key step in learning how to stretch your money and navigate financial hurdles with confidence is to build an emergency fund to soften the blow when hard times hit.

The unfortunate truth is that you’re also going to have to learn how to prioritize needs over wants to make the most of your resources.

- Set realistic expectations and stay motivated

Building wealth takes time and patience. Be sure to set realistic goals and celebrate the small victories along the way. Stay motivated by envisioning the life you want to lead and remind yourself of the long-term benefits of your small efforts today.

- Seek professional advice and support

Hey, we're here to guide you, but we're not financial advisors. That's why it's essential to seek professional advice when needed. A qualified financial advisor can provide you with personalized advice and help you navigate complex financial decisions, offer investment strategies tailored to your goals, and ensure you're on the right track.

Step 6: Long-term wealth building

Rome wasn't built in a day, and neither will your financial wealth.

- Set long-term financial goals

Picture your dream life and let's make it a reality. Define your long-term financial goals, like buying a house, planning for a comfortable retirement, or starting a business, and break them down into achievable milestones. Then develop a roadmap to reach them. As you hit the milestones and manage the ebb and flow of life, be sure to regularly review and adjust your goals along the way.

- Retirement planning and saving strategies

Retirement might seem far away, but it's never too early to start preparing for it. Take advantage of compound interest and explore strategies for retirement savings that make sense for your current situation, like a retirement account or participating in employer-sponsored retirement plans (particularly ones that offer tax relief).

Be sure to maximize contributions to these accounts whenever possible and look into tax-efficient investment funds. Let's ensure your golden years are as golden as can be.

- Reviewing and adjusting your financial plan periodically

Flexibility is key to your financial journey. Regularly review your budget, investment account, and progress as you move confidently toward your goals. Make necessary adjustments to your investment strategy to stay on track and seize new opportunities that align with your evolving financial situation. Life changes, and so should your financial plan. Keep it adaptable and exciting.

Final thought

Starting from €0 in your thirties may seem challenging, but with the right mindset, knowledge, and practical steps, you can embark on a fulfilling financial journey. By budgeting effectively, saving diligently, generating additional income, investing wisely, and overcoming obstacles, you can build a solid foundation for long-term wealth and financial security.

While it's no walk in the park, it’s not rocket science. Empower yourself with the tools and resources available, and remember that every step you take today brings you closer to a brighter financial future and fuller savings account.

We are delighted to announce the listing and support of Ethereum Name Service (ENS) on Tap!

ENS is now available for trading on the Tap mobile app. You can now Buy, Sell, Trade or hold ENS for any of the other asset supported on the platform without any pair boundaries. Tap is pair agnostic, meaning you can trade any asset for any other asset without having to worries if a "trading pair" is available.

We believe supporting ENS will provide value to our users. We are looking forward to continue supporting new crypto projects with the aim of providing access to financial power and freedom for all.

Ethereum Naming Service is a branch from the original blockchain network which aims to make the crypto space, particularly within the DeFi and Web3 sectors, more user-friendly and accessible. Similar to how Domain Name Service made the internet more accessible, Ethereum Name Service aims to do the same and become a fundamental component of these sectors.

Users can register a name through various ENS domain registrars or directly through the ENS manager. Once registered, the name is added to the Ethereum Name Service Registry, and the user becomes the owner of that name. ENS uses a hierarchical system of domains similar to the DNS system used for the internet.

Once registered, the user can then set the resolver, which is a smart contract that provides information about the Ethereum wallet address associated with the ENS name.

The Ethereum Name Service (ENS) system is similar to the DNS (Domain Name System) used on the internet. Users can register an ENS domain name under the .eth top-level domain and associate them with their Ethereum addresses by using the platform's smart contracts.

The Ethereum Name Service (ENS) did not have its own token until recently. In 2021, the ENS team announced the launch of a new governance token called ENS, which is separate from the old ERC-20 token with the same name.

Get to know more about Ethereum Name Service (ENS) in our dedicated article here.

Tap experienced a significant growth in our user base during Q1 2023. While this was a cause for celebration, it also attracted the unwanted attention of fraudsters. Lured by our platform's quick onboarding and seamless fiat and crypto transactions, these fraudsters exploited remote access tools like Teamviewer and Anydesk to abuse vulnerable individuals . In response, we felt compelled to implement a robust and necessary Anti-Scam Protection Feature.

This feature, while stringent and non-negotiable, is not designed to control our users' app preferences. Instead, it is a forceful, yet crucial measure to ensure their safety and protect the integrity of our platform.

Regulatory Responsibility: As a regulated financial entity, we're duty-bound to shield our users from potential threats and foster safe digital practices. Our Anti-Scam Protection Feature stands as testament to this commitment. It doesn't merely warn users about potentially risky apps; it mandates their removal to ensure the secure use of our services.

Proactive Measures: Scams utilizing remote access tools can be highly sophisticated and often slip past even the most vigilant defenses. Our feature is a stringent proactive measure, akin to a car's seatbelt, designed to preemptively avert such situations.

User Autonomy: At Tap, we deeply value our users' autonomy and their ability to manage their digital safety. However, we also acknowledge that scammers' tactics can be complex and deceptive. The Anti-Scam Protection Feature is our firm stand against such threats, ensuring all users can safely navigate the digital banking landscape.

At Tap, we go beyond secure transactions. Our vision is to create a 'super app' that caters to everyone's needs. We prioritize the protection and well-being of all our customers, including our beloved pops and nans. Understanding the older generation's vulnerability to scams, we are committed to making digital banking accessible and safe for people of all ages. This feature is a significant step towards that vision.

Now, it's crucial to understand an often-overlooked concept outside the payments industry – the "fraud threshold." This measure ensures that financial platforms don't profit from fraudulent transactions. While a high fraud rate may inflate revenues temporarily, it risks losing critical payment services like GBP - Faster Payments and Euro SEPA transfers over time.

Weighing the pros and cons of our Anti-Scam Protection Feature provides a clearer perspective:

CONS:

- Potential displeasure amongst users of apps like Teamviewer, Anydesk, and others.

- Possible loss of a few users.

PROS:

- Protection of user life savings.

- Deterrence of scammers.

- Preservation of crucial payment relationships.

- Ensuring availability of payment rails for all our users.

The Anti-Scam Protection Feature is an assertive measure, and we understand it may cause some inconvenience. But it's an essential step in our commitment to providing a safe, secure, and accessible digital banking environment for everyone.

Are you ready to embrace the future of cashless payments? As Europeans increasingly rely on digital payment methods, the European Union is exploring implementing a safe and effective transition. Enter the digital euro, a potential game-changer in the world of virtual money.

In this article, we'll dive into what the digital euro is all about and how it works. Get ready to discover how this innovative currency could streamline transactions, reduce costs, and empower individuals and businesses throughout the Eurozone. It's high time we unlock the possibilities of the digital euro and embrace the convenience of a cashless future.

What is the digital euro?

The digital euro, at its core, is a virtual currency designed for the Eurozone. It operates entirely digitally, making transactions fast, secure, and innovative. As a digital currency, it exists in electronic form, with no physical counterpart like traditional banknotes or coins.

The European Central Bank (ECB) plays a crucial role in issuing and managing the digital euro, ensuring its legal value and guaranteeing its acceptance alongside physical cash. With the ECB's oversight, the digital euro aims to provide a seamless and convenient payment method for businesses and individuals alike, revolutionising the way we handle money in the digital age.

Is the digital euro a cryptocurrency?

No, the digital euro is not considered a cryptocurrency. While both the digital euro and cryptocurrencies are virtual assets, there are key differences between them.

Cryptocurrencies, like Bitcoin, are typically decentralised and operate independently of central banks or public authorities. They are often issued by private individuals and allow for peer-to-peer transactions without the need for intermediaries like central banks.

In contrast, the digital euro will be issued and regulated by the European Central Bank (ECB), making it a central bank digital currency (CBDC). The digital euro will operate on a centralised system and will be managed and regulated using blockchain technology operated by the central bank.

Why do we need a digital euro?

The digital euro has several key objectives aimed at transforming the financial landscape. Firstly, it seeks to enhance financial integration within the Eurozone by providing a common and easily accessible digital payment solution for all member countries.

Secondly, the digital euro aims to bolster security, offering a safe and trusted digital currency that can mitigate risks associated with traditional payment methods. For users, the digital euro promises convenience by enabling fast and seamless transactions, eliminating the need for physical currency.

Additionally, it has the potential to be cost-effective, reducing transaction fees and providing efficient payment options for both businesses and individuals. The digital euro also allows anyone to use the currency without creating a bank account associated with the central bank.

How will the digital euro work?

The virtual currency operates on an innovative framework, known as blockchain technology, revolutionising the way we transact. To use the digital euro, individuals and businesses will need to create a digital wallet, similar to those used for cryptocurrencies.

However, unlike cryptocurrencies, the digital euro will be issued and regulated by the European Central Bank (ECB), ensuring its stability and legal value. Despite it being a digital currency, it is still regarded as central bank money as it is operated by the central bank. Users won't require a traditional bank account, as the digital euro can be deposited directly at the European Central Bank. This empowers individuals to engage in peer-to-peer transactions without relying on commercial banks as intermediaries.

With blockchain technology as its backbone, the digital euro ensures secure, traceable, and efficient transactions, making it a cutting-edge payment method for the modern era while remaining central bank money.

Advantages of implementing the digital euro

The modern payment tool is designed to empower all private citizens and businesses in the Eurozone. Once approved, the digital euro will revolutionise transactions with its simplicity and immediacy. Here's what it brings:

Streamlined processes

The digitization of payments will make purchases and money transactions simpler and faster.

Cost savings

The digital euro significantly reduces costs associated with payment systems, putting more money back in your pocket.

Environmental benefits

By embracing the digital euro project, we contribute to a drastic reduction in the ecological footprint associated with monetary and payment systems within the financial sector.

Instant support

In times of need, governments can swiftly provide economic aid to citizens, thanks to the digital euro.

Anti-money laundering

With transaction registration, we can effectively combat money laundering and tax evasion.

Financial inclusion

The digital euro ensures everyone, even those without a bank account, can enjoy the simplicity and security of digital payments within the financial system.

Risks associated with the digital euro

While the digital euro brings numerous benefits, it's important to be aware of potential risks. Here are a few considerations:

Privacy

The digital euro complements physical cash, known for its anonymity. While it aids in anti-money laundering, tracking payments could limit citizen privacy to some extent.

Impact on banks

As the digital euro gains popularity, deposits in credit institutions may decrease, potentially affecting loan availability. Credit institutions and payment intermediaries, and even national central banks, may need to revise their business models to adapt to the digital euro ecosystem and safeguard financial stability within the greater financial system.

Traditional euro vs the digital euro

When comparing the digital euro to traditional currency, there are both similarities and differences to consider. In terms of similarities, both the digital euro and physical currency share the fundamental purpose of facilitating transactions and serving as a medium of exchange. While the digital euro operates in the digital realm, central banks physical banknotes and coins continue to play a significant role in everyday transactions alongside the digital euro. It's important to note that both are central bank money.

However, key differences set the digital euro apart. The digital euro offers advantages such as faster transactions, as it eliminates the need for physical exchange and reduces processing times.

Additionally, the digital euro promotes financial inclusion by enabling individuals without a bank account to participate in the digital economy, expanding access to secure and convenient payment methods. The digital euro is not designed to replace the traditional currency, but rather coexist alongside it.

It is, however, poised to shape the future of currency.

The current landscape of CBDCs

While the digital euro is expected to take 5 years to implement, other countries around the world are also in the running to release a central bank digital currency of their own. In fact, approximately 50 central banks around the world are actively researching or experimenting with central bank digital currencies, confirming that the race to embrace digital currencies and central bank money is on.

The Bahamas lead the pack with their Sand Dollar, a digital version of the Bahamian dollar launched in October 2020. The dollar offers users free mobile transactions and a safer option than carrying cash. Other noteworthy initiatives include China with the digital renminbi (e-CNY) already in testing and Sweden’s e-krona, and now, the digital euro project.

This thriving landscape in the financial system signifies the growing acceptance of digital currencies by central banks. As financial inclusion, individual financial stability, streamlined payment systems, and the emergence of private cryptocurrencies take centre stage, the exploration of CBDCs empowers nations and central banks to shape the future of money and unlock new possibilities for a digitally empowered society.

Final thoughts

In conclusion, the digital euro represents a transformative leap toward a cashless future. With its aim of enhancing financial integration, strengthening security, and providing convenient payment options, the digital euro has the potential to revolutionise the way we handle money in the Eurozone.

Operating on blockchain technology and regulated by the European Central Bank, the digital euro offers fast, secure, and efficient transactions, empowering individuals and businesses alike. While the digital euro coexists with physical currency, its advantages, such as faster transactions and increased financial inclusion, make it a promising addition to the financial landscape.

As countries worldwide explore the potential of central bank digital currencies, including the Sand Dollar, the future of digital currencies appears bright, heralding a new era of financial empowerment. Keep an eye out for the digital euro in months to come.

In the rapidly evolving landscape of cryptocurrencies, investors are always searching for dependable platforms that provide effortless trading experiences and a diverse array of features. Among the multitude of options available, distinguishing between Tap and traditional crypto exchanges can be challenging. Although both facilitate cryptocurrency trading, they exhibit notable disparities in their offerings and functionalities. In this article, we will delve into five fundamental distinctions that position Tap as a superior choice when compared to traditional crypto exchanges.

All-in-One Platform:

One of the most significant advantages of Tap over traditional crypto exchanges is its all-in-one platform. Tap is not solely a cryptocurrency exchange but a comprehensive financial platform that seamlessly integrates cryptocurrencies with traditional fiat financial services. Users can hold and exchange various cryptocurrencies alongside fiat currencies in a single account. This unique feature provides unparalleled convenience, allowing customers to manage their finances and investments in one place. On the other hand, traditional crypto exchanges usually only support cryptocurrency trading, requiring users to transfer funds back and forth between different accounts for fiat-related transactions.

User-Friendly Interface:

Tap prides itself on its user-friendly interface, designed to cater to both seasoned traders and newcomers to the crypto space. The platform's intuitive design makes it easy for users to navigate, monitor market trends, and execute trades efficiently. Additionally, Tap provides real-time market data, educational resources on its blog, and insights to help users make informed decisions. Conversely, many traditional crypto exchanges can be overwhelming, especially for beginners, with complex interfaces and limited educational support.

Instant Fiat-Crypto Conversion:

Another standout feature of Tap is its instant fiat-crypto conversion. Users can easily convert their fiat currency into a wide range of cryptocurrencies at competitive exchange rates, without the need for additional transactions or fees. This convenience streamlines the trading process and allows users to capitalize on market opportunities swiftly. In contrast, traditional crypto exchanges often require users to deposit funds, wait for approval, and then execute trades, which can take hours or even days to complete.

Broad Range of Cryptocurrencies:

Tap offers an extensive selection of 40+ cryptocurrencies, including popular options like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and many more. With Tap, users have the flexibility to diversify their crypto portfolio easily. Moreover, the platform regularly adds new cryptocurrencies to its offerings, ensuring users have access to the latest and most promising digital assets. In contrast, some traditional crypto exchanges have a limited selection of cryptocurrencies, restricting users' investment options.

Pair Agnostic Trading:

A key advantage that sets Tap apart from traditional crypto exchanges is its pair agnostic trading feature. With Tap, users can seamlessly exchange any crypto asset for any other crypto asset directly on the platform. This eliminates the need for multiple exchanges or restrictions on which assets can be traded against each other. Unlike traditional crypto exchanges that often impose limitations on trading pairs, Tap empowers its users with unmatched flexibility, allowing them to swiftly trade between a vast array of cryptocurrencies or fiat.

Enhanced Security and Regulation:

Tap sets a high standard for security and regulatory compliance. As a regulated financial institution, the platform follows stringent security measures to safeguard users' funds and personal data. Tap employs advanced encryption protocols and two-factor authentication to protect accounts from unauthorized access. Additionally, it complies with regulatory requirements, ensuring a safe and reliable trading environment. On the other hand, traditional crypto exchanges may not always adhere to the same level of regulatory scrutiny, leaving users potentially exposed to security risks and uncertainties.

In conclusion:

In conclusion, Tap stands out as a superior choice compared to traditional crypto exchanges due to its all-in-one platform, user-friendly interface, instant fiat-crypto conversion, broad range of cryptocurrencies, and enhanced security and regulation. Its seamless integration of cryptocurrencies with traditional financial fiat services makes it a one-stop solution for financial management and investment needs. With Tap, users can trade cryptocurrencies with ease and confidence, backed by a robust and secure platform. Whether you are a seasoned crypto investor or a newcomer to the world of digital assets, Tap offers a compelling and competitive solution for your trading and financial needs.

We are delighted to announce the listing and support of Loopring (LRC) on Tap!

LRC is now available for trading on the Tap mobile app. You can now Buy, Sell, Trade or hold LRC for any of the other asset supported on the platform without any pair boundaries. Tap is pair agnostic, meaning you can trade any asset for any other asset without having to worries if a "trading pair" is available.

We believe supporting LRC will provide value to our users. We are looking forward to continue supporting new crypto projects with the aim of providing access to financial power and freedom for all.

Addressing the speed and cost concerns associated with the Ethereum platform and decentralized cryptocurrency exchanges, Loopring delivers a new layer to the DeFi space. Describing itself as “an open-source, audited, and non-custodial exchange protocol,” Loopring is bringing something new and innovative to the space.

The Loopring Exchange aims to offer a hybrid platform combining the best features of centralized exchanges and decentralized exchanges, addressing issues like structural limitations and transparency. The platform combines centralized order matching with decentralized blockchain order settlement, using zero-knowledge proofs (ZKPs) for enhanced privacy, reduced costs, and high speeds.

The Loopring cryptocurrency, LRC, plays a crucial role in the operations of the protocol.

To operate a decentralized exchange on Loopring, a minimum of 250,000 LRC needs to be locked up. This allows the exchange operator to utilize on-chain data proofs. Alternatively, an operator can stake 1 million LRC to run an exchange without this feature.

LRC serves as an incentive for the proper utilization of the Loopring network. Exchange operators who deposit LRC may face confiscation of their deposits by the protocol if they operate exchanges poorly. These confiscated funds are then distributed to users who choose to lock up LRC.

Get to know more about Loopring (LRC) in our dedicated article here.

Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started