An in-depth look at XRP’s 2025 momentum, as legal clarity, technical strength, and growing institutional interest converge for the first time since 2017.

Keep reading

This week, XRP has been building pressure at $3.30, with three powerful catalysts aligning for the first time since 2017 - setting up what could be the token's most explosive run yet.

TLDR:

- XRP price surged 21% after the SEC Ripple Labs case was officially dismissed

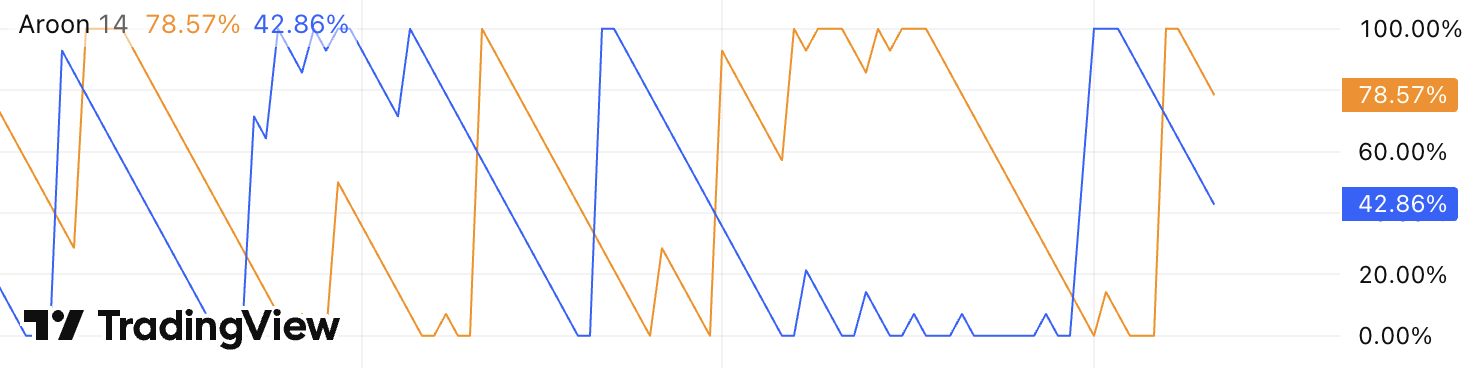

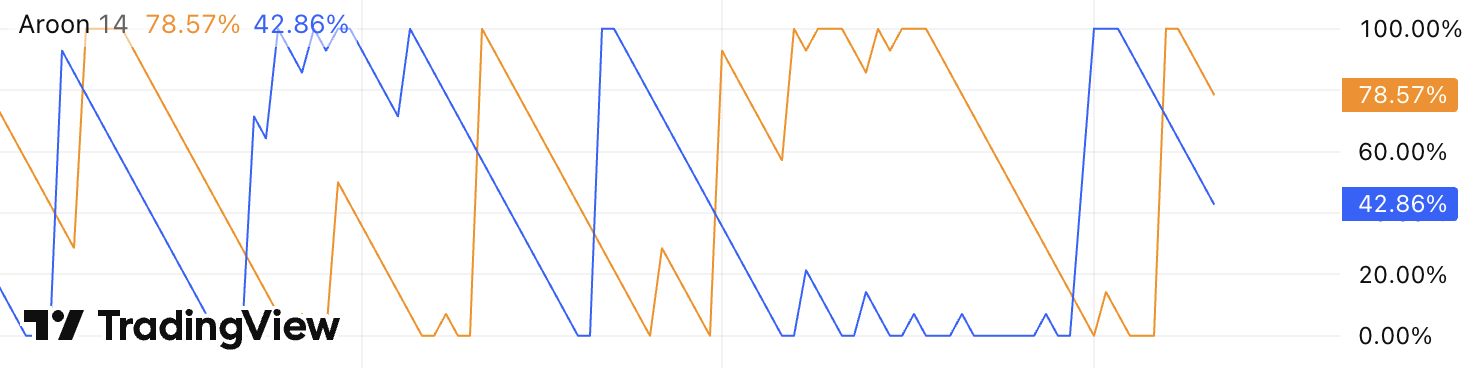

- Technical indicators show buy-side momentum peaking, with Aroon Up hitting 100%

- Nine major asset managers now have pending XRP ETF applications, with 88% market odds for 2025 approval

- CME's XRP futures launched in May have already generated over $1.6 billion in trading volume

Three big forces are hitting XRP at once: legal clarity, strong technical momentum, and rising institutional demand. In the past, this mix has sent prices soaring.

The legal victory that changes everything

The SEC's formal dismissal of its case against Ripple Labs isn't just another regulatory win - it's the removal of XRP's biggest institutional adoption barrier. After nearly five years of uncertainty, corporate treasuries and institutional investors finally have the green light they've been waiting for.

And the timing couldn't be better. Just as regulatory clouds clear, analysts are agreeing that XRP's technical setup is screaming bullish signals that haven't been seen since the 2017 run-up.

Technical momentum reaches peak levels

XRP's chart tells a compelling story of institutional accumulation disguised as consolidation:

→ For starters, the token has climbed 21% over the past seven days, hitting a recent high of $3.36 (just 8% below its ATH). Momentum indicators suggest this is just the beginning.

→ The Aroon Up line is holding at 100%, showing that buyers are consistently driving XRP to fresh highs. This sustained strength often comes before major moves - especially with the price holding above the key $3.15–$3.16 support area. *To view the current Aroon line, log into Trading View and add the indicator.

→ Market sentiment has shifted decisively bullish, with XRP's weighted sentiment score hitting a two-week high of 1.17. More telling is the token's social dominance, which has climbed to a recent high of 7.95%, meaning XRP is dominating an increasingly larger share of crypto conversations as retail interest reignites.

The institutional infrastructure is already built

While crypto X debates ETF timelines, institutional players have quietly constructed the infrastructure needed for serious XRP adoption. CME Group launched regulated XRP futures in May, providing the hedging tools institutions will need before taking major positions.

The results speak volumes: CME's XRP futures have already surpassed $1.6 billion in trading volume, signalling genuine institutional demand beyond retail speculation. These aren't just paper trades; they represent real institutional capital positioning for XRP's next move.

Nine major asset managers now have pending XRP ETF applications, including heavyweights like Grayscale, ProShares, and 21Shares. Polymarket traders are pricing in 88% odds for SEC approval by year-end, creating a feedback loop where institutional preparation drives retail anticipation.

Why this time is different

Previous XRP rallies were driven primarily by retail speculation and partnership announcements. But today's setup combines retail enthusiasm with genuine institutional infrastructure and regulatory clarity: a trifecta that hasn't existed since XRP's 2017-2018 surge.

The numbers back this up. Institutional trading volumes have spiked 208% to $12.40 billion following the SEC dismissal, while derivatives open interest climbed 15% to $5.90 billion.

Large-order flows are consistently defending the $3.15 support level, suggesting institutional accumulation even during short-term volatility.

What traders are watching

Analysts are saying that technical analysis points to immediate resistance at $3.39-$3.40, with sustained bullish momentum (bolstered by institutional flows and ETF positioning) raising the odds of a breakout, particularly if the Aroon Up indicator remains high.

According to market insiders, a successful move higher could fuel a run toward the $3.50-$3.75 range, with a longer-term target of $3.66+ for a cycle high retest.

Key levels to monitor:

- Support: $3.15-$3.16 (proven institutional buying zone)

- Resistance: $3.39-$3.40 (breakout confirmation level)

- Bull target: $3.66+ (cycle high retest)

Legal clarity, a technical breakout, and rising institutional demand are all hitting XRP at once - a rare mix of fundamentals and market momentum. For holders who’ve endured years of regulatory uncertainty, some are interpreting this as a potential breakout scenario.

NEWS AND UPDATES

An in-depth look at XRP’s 2025 momentum, as legal clarity, technical strength, and growing institutional interest converge for the first time since 2017.

This week, XRP has been building pressure at $3.30, with three powerful catalysts aligning for the first time since 2017 - setting up what could be the token's most explosive run yet.

TLDR:

- XRP price surged 21% after the SEC Ripple Labs case was officially dismissed

- Technical indicators show buy-side momentum peaking, with Aroon Up hitting 100%

- Nine major asset managers now have pending XRP ETF applications, with 88% market odds for 2025 approval

- CME's XRP futures launched in May have already generated over $1.6 billion in trading volume

Three big forces are hitting XRP at once: legal clarity, strong technical momentum, and rising institutional demand. In the past, this mix has sent prices soaring.

The legal victory that changes everything

The SEC's formal dismissal of its case against Ripple Labs isn't just another regulatory win - it's the removal of XRP's biggest institutional adoption barrier. After nearly five years of uncertainty, corporate treasuries and institutional investors finally have the green light they've been waiting for.

And the timing couldn't be better. Just as regulatory clouds clear, analysts are agreeing that XRP's technical setup is screaming bullish signals that haven't been seen since the 2017 run-up.

Technical momentum reaches peak levels

XRP's chart tells a compelling story of institutional accumulation disguised as consolidation:

→ For starters, the token has climbed 21% over the past seven days, hitting a recent high of $3.36 (just 8% below its ATH). Momentum indicators suggest this is just the beginning.

→ The Aroon Up line is holding at 100%, showing that buyers are consistently driving XRP to fresh highs. This sustained strength often comes before major moves - especially with the price holding above the key $3.15–$3.16 support area. *To view the current Aroon line, log into Trading View and add the indicator.

→ Market sentiment has shifted decisively bullish, with XRP's weighted sentiment score hitting a two-week high of 1.17. More telling is the token's social dominance, which has climbed to a recent high of 7.95%, meaning XRP is dominating an increasingly larger share of crypto conversations as retail interest reignites.

The institutional infrastructure is already built

While crypto X debates ETF timelines, institutional players have quietly constructed the infrastructure needed for serious XRP adoption. CME Group launched regulated XRP futures in May, providing the hedging tools institutions will need before taking major positions.

The results speak volumes: CME's XRP futures have already surpassed $1.6 billion in trading volume, signalling genuine institutional demand beyond retail speculation. These aren't just paper trades; they represent real institutional capital positioning for XRP's next move.

Nine major asset managers now have pending XRP ETF applications, including heavyweights like Grayscale, ProShares, and 21Shares. Polymarket traders are pricing in 88% odds for SEC approval by year-end, creating a feedback loop where institutional preparation drives retail anticipation.

Why this time is different

Previous XRP rallies were driven primarily by retail speculation and partnership announcements. But today's setup combines retail enthusiasm with genuine institutional infrastructure and regulatory clarity: a trifecta that hasn't existed since XRP's 2017-2018 surge.

The numbers back this up. Institutional trading volumes have spiked 208% to $12.40 billion following the SEC dismissal, while derivatives open interest climbed 15% to $5.90 billion.

Large-order flows are consistently defending the $3.15 support level, suggesting institutional accumulation even during short-term volatility.

What traders are watching

Analysts are saying that technical analysis points to immediate resistance at $3.39-$3.40, with sustained bullish momentum (bolstered by institutional flows and ETF positioning) raising the odds of a breakout, particularly if the Aroon Up indicator remains high.

According to market insiders, a successful move higher could fuel a run toward the $3.50-$3.75 range, with a longer-term target of $3.66+ for a cycle high retest.

Key levels to monitor:

- Support: $3.15-$3.16 (proven institutional buying zone)

- Resistance: $3.39-$3.40 (breakout confirmation level)

- Bull target: $3.66+ (cycle high retest)

Legal clarity, a technical breakout, and rising institutional demand are all hitting XRP at once - a rare mix of fundamentals and market momentum. For holders who’ve endured years of regulatory uncertainty, some are interpreting this as a potential breakout scenario.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Millennials and Gen Z are revolutionizing the financial landscape, leveraging cryptocurrencies to challenge traditional systems and redefine money itself. Curious about how this shift affects your financial future? Let's uncover the powerful changes they’re driving!

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

Unveiling the future of money: Explore the game-changing Central Bank Digital Currencies and their potential impact on finance.

Since the debut of Bitcoin in 2009, central banks have been living in fear of the disruptive technology that is cryptocurrency. Distributed ledger technology has revolutionized the digital world and has continued to challenge the corruption of central bank morals.

Financial institutions can’t beat or control cryptocurrency, so they are joining them in creating digital currencies. Governments have now been embracing digital currencies in the form of CBDCs, otherwise known as central bank digital currencies.

Central bank digital currencies are digital tokens, similar to cryptocurrency, issued by a central bank. They are pegged to the value of that country's fiat currency, acting as a digital currency version of the national currency. CBDCs are created and regulated by a country's central bank and monetary authorities.

A central bank digital currency is generally created for a sense of financial inclusion and to improve the application of monetary and fiscal policy. Central banks adopting currency in digital form presents great benefits for the federal reserve system as well as citizens, but there are some cons lurking behind the central bank digital currency facade.

Types of central bank digital currencies

While the concept of a central bank digital currency is quite easy to understand, there are layers to central bank money in its digital form. Before we take a deep dive into the possibilities presented by the central banks and their digital money, we will break down the different types of central bank digital currencies.

Wholesale CBDCs

Wholesale central bank digital currencies are targeted at financial institutions, whereby reserve balances are held within a central bank. This integration assists the financial system and institutions in improving payment systems and security payment efficiency.

This is much simpler than rolling out a central bank digital currency to the whole country but provides support for large businesses when they want to transfer money. These digital payments would also act as a digital ledger and aid in the avoidance of money laundering.

Retail CBDCs

A retail central bank digital currency refers to government-backed digital assets used between businesses and customers. This type of central bank digital currency is aimed at traditional currency, acting as a digital version of physical currency. These digital assets would allow retail payment systems, direct P2P CBDC transactions, as well as international settlements among businesses. It would be similar to having a bank account, where you could digitally transfer money through commercial banks, except the currency would be in the form of a digital yuan or euro, rather than the federal reserve of currency held by central banks.

Pros and cons of a central bank digital currency (CBDC)

Central banks are looking for ways to keep their money in the country, as opposed to it being spent on buying cryptocurrencies, thus losing it to a global market. As digital currencies become more popular, each central bank must decide whether they want to fight it or profit from the potential. Regardless of adoption, central banks creating their own digital currencies comes with benefits and disadvantages to users that you need to know.

Pros of central bank digital currency (CBDC)

- Cross border payments

- Track money laundering activity

- Secure international monetary fund

- Reduces risk of commercial bank collapse

- Cheaper

- More secure

- Promotes financial inclusion

Cons of central bank digital currency (CDBC)

- Central banks have complete control

- No anonymity of digital currency transfers

- Cybersecurity issues

- Price reliant on fiat currency equivalent

- Physical money may be eliminated

- Ban of distributed ledger technology and cryptocurrency

Central bank digital currency conclusion

Central bank money in an electronic form has been a big debate in the blockchain technology space, with so many countries considering the possibility. The European Central Bank, as well as other central banks, have been considering the possibility of central bank digital currencies as a means of improving the financial system. The Chinese government is in the midst of testing out their e-CNY, which some are calling the digital yuan. They have seen great success so far, but only after completely banning Bitcoin trading.

There is a lot of good that can come from CBDCs, but the benefits are mostly for the federal reserve system and central banks. Bank-account holders and citizens may have their privacy compromised and their investment options limited if the world adopts CBDCs.

It's important to remember that central bank digital currencies are not cryptocurrencies. They do not compete with cryptocurrencies and the benefits of blockchain technology. Their limited use cases can only be applied when reinforced by a financial system authority. Only time will tell if CBDCs will succeed, but right now you can appreciate the advantages brought to you by crypto.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

LATEST ARTICLE

The world of cryptocurrency is constantly evolving, as are the threats that come with it. As hackers and cybercriminals are always looking for new ways to steal or compromise digital assets, bank-grade security has become a vital component needed when engaging in custodial wallet solutions.

By implementing bank-grade security measures, platforms and services can ensure the safety and protection of customer funds, build trust and confidence with users, and attract new investors.

The importance of bank-grade security in crypto custodial wallets

When it comes to cryptocurrencies, bank-grade security is crucial for any platform or service that provides custody or storage solutions for digital assets.

It involves a set of protocols, technologies, and procedures that are specifically designed to protect cryptocurrencies from theft, hacking, and other cyber-attacks.

In terms of custodial and non-custodial wallets, custodial wallets have a third-party manage the custody of a user's private keys, assuming responsibility for managing the private key, safeguarding assets, and signing transactions. As the responsibility is now shifted away from the user, it becomes increasingly important that the correct security measures are put in place.

At Tap, we understand the importance of bank-grade security in managing and storing cryptocurrencies. We are committed to providing our clients with the highest level of security measures to ensure the safety and protection of their crypto assets.

So what are the benefits of using bank-grade security when dealing with cryptocurrencies? Before we answer this let's first take a look at the difference between custodial and non-custodial wallets.

Custodial wallets vs non-custodial wallets

Custodial wallets and non-custodial wallets are two types of digital wallets used to store and manage cryptocurrencies. As mentioned above, custodial accounts are provided by third-party services, such as crypto exchanges or wallet providers, and they hold the private keys to the user's cryptocurrencies.

Non-custodial wallets, on the other hand, allow users to hold and manage their own private keys without the involvement of a third-party service.

In terms of security, custodial wallets have some advantages and disadvantages compared to non-custodial wallets. Custodial accounts offer convenience and ease of use, as the third-party service takes care of the security and management of the user's assets. This can be particularly helpful for beginners in the crypto space who may not have the technical knowledge or experience to manage their own wallets.

However, custodial accounts also come with some risks. Since the third-party service holds the private keys, users are essentially trusting the service to keep their assets secure. If the service provider is hacked or experiences a security breach, the user's assets could be lost or stolen. Hence the importance of these services implementing stringent security measures.

Non-custodial wallets such as hardware wallets, on the other hand, offer users complete control over their assets. In this case, the user holds the private key and has full control over their cryptocurrencies ensuring that they are stored and managed securely.

Non-custodial wallets can also be considered more private, as users are not required to share their personal information with a third-party service.

While non-custodial wallets hold one's crypto investments they typically do not provide the range of services offered by a third-party service provider.

Protecting your private keys with bank-grade security measures

First and foremost, bank-grade security offers a high level of protection against cyber threats. Cryptocurrencies are often considered a prime target for hackers and cybercriminals due to their decentralized nature and lack of regulation.

When using a custodial crypto wallet, the platform on which you are storing your cryptocurrencies is therefore responsible for your private key and responsible for keeping your personal information safe.

With bank-grade security measures in place, crypto assets are stored in secure offline wallets, protected by multi-layered encryption, and monitored 24/7 by a team of security experts. This significantly reduces the risk of theft or loss of cryptocurrencies from a crypto wallet.

How bank-grade security can attract institutional investors to crypto

In addition to protecting against cyber threats, bank-grade security also provides peace of mind for investors and traders. When dealing with traditional financial institutions, customers expect a certain level of security and protection for their assets. The same should be true for cryptocurrencies. By implementing bank-grade security measures, platforms and services can build trust and confidence with their customers.

Additionally, bank-grade security can help attract these investors to the world of cryptocurrency. Institutional investors, such as hedge funds and pension funds, often have strict requirements for custody and storage solutions. They need to know that their crypto wallet and assets are secure and protected from theft or loss.

By offering bank-grade security measures, platforms and services can appeal to these investors and open up new opportunities for growth and expansion.

The role of HSMs, multi-factor authentication, and encryption in crypto wallets

Investing in cryptocurrencies requires a high degree of security and protection, and bank-grade security measures are essential to ensure the safety and protection of crypto assets stored in crypto wallets. Hardware security modules (HSMs), multi-factor authentication, and encryption are three critical components of bank-grade security measures that play a significant role in protecting crypto wallets.

HSMs are specialized hardware devices that provide secure storage and management of cryptographic keys. They are designed to prevent unauthorized access to assets by requiring multiple layers of authentication and verification. HSMs are widely used in the financial industry and are considered one of the most secure methods for storing and managing cryptocurrencies.

Multi-factor authentication is another key component of bank-grade security. It involves requiring users to provide more than one form of authentication to access their crypto wallet. For example, a user may be required to enter a password and a one-time code sent to their mobile phone. This significantly reduces the risk of unauthorized access and ensures that only authorized users can access their custodial or non-custodial wallet.

Encryption is also a critical component of bank-grade security. It involves transforming assets into an unreadable format that can only be deciphered with a decryption key. This ensures that even if a hacker manages to access the custodial or non-custodial wallet, they will not be able to read or use them.

By implementing bank-grade security measures, platforms and custodial account services can ensure the safety and protection of their customers' crypto holdings, build trust and confidence, and attract investors.

Bank-grade security vs other types of security measures used by a crypto exchange

What makes bank-grade security different from other types of security measures is the combination of technology and protocols used to securely store the crypto wallet. Crypto exchanges typically implement bank-grade security solutions that include a combination of hardware and software-based security measures, such as HSMs, multi-factor authentication, and encryption.

Looking ahead, the importance of bank-grade security in the world of cryptocurrency exchanges is only going to increase. As more people adopt cryptocurrencies and the market continues to grow, the need for secure storage and custody solutions will become even more pressing. Platforms and custodial account services that can offer bank-grade security measures will be better positioned to compete and succeed in this rapidly evolving industry.

In conclusion

Bank-grade security is essential for anyone who wants to use cryptocurrencies safely and securely. It ensures the protection of custodial wallets and instills a degree of trust in those utilizing the custodial wallets on offer.

Whether you're an investor, trader, or simply someone who wants to store your assets, bank-grade security measures provide peace of mind and protection against cyber threats through implementing strong security measures. At Tap, we take security very seriously and are committed to providing our customers with the highest level of protection for their assets and crypto wallets.

I kryptovärldens historia finns få ögonblick som är lika ikoniska – eller lika aptitretande – som Bitcoin Pizza Day. Den 22 maj varje år firas detta speciella datum, en påminnelse om när Bitcoin för första gången användes för att köpa något i den riktiga världen. Vad som började som ett pizzabegär blev i efterhand ett symboliskt startskott för en global finansrevolution.

Hur allt började

Den 18 maj 2010 skrev Laszlo Hanyecz, en programmerare från Florida, ett inlägg på forumet BitcoinTalk. Han ville köpa två stora pizzor – i utbyte mot 10 000 Bitcoin. Ja, du läste rätt. Han specificerade sina topping-önskemål och bad om hemleverans, så enkelt som möjligt.

Fyra dagar senare svarade en annan Bitcoin-entusiast, Jeremy Sturdivant (även känd som “jercos”), på förfrågan. Han köpte pizzorna för cirka 25 dollar och skickade dem hem till Laszlo. I gengäld fick han 10 000 BTC

.

En historisk transaktion

Detta blev den första dokumenterade verkliga köpet med Bitcoin – och det satte standarden för framtida användningsområden. Idag skulle de där 10 000 BTC vara värda miljontals kronor, beroende på marknadspriset.

Det är därför Bitcoin-communityn varje år hedrar denna dag med entusiasm – både för den historiska betydelsen och för den nästan absurda prislappen i efterhand. Bitcoin Pizza Day handlar om mer än bara en måltid – det handlar om Bitcoin som tog sitt första steg mot verklig användning.

Bitcoin Pizza Day är inte bara en nostalgitripp – det är också en chans att blicka framåt. Sedan Laszlos pizzaköp har kryptovärlden exploderat: tusentals nya projekt, innovativa tillämpningar och bredare adoption inom allt från finans och logistik till sjukvård.

Bitcoin själv har blivit en globalt erkänd tillgång. Och berättelsen om två pizzor är numera ett klassiskt exempel som ofta delas med nybörjare inom kryptovalutor – som en lektion i innovation, mod och hur snabbt saker kan förändras.

En påminnelse om vad som är möjligt

Laszlos pizzaköp är inte bara en kul historia – det är en symbol för hur långt Bitcoin har kommit. Från en digital valuta i sin linda till ett globalt fenomen. Det visar vad som händer när en idé får stöd från en engagerad community.

Så nästa gång du tar en tugga på en slice den 22 maj – kom ihåg att du är en del av en historia som fortfarande skrivs. 🍕

Vill du lära dig mer om Bitcoin? Utforska gärna det ursprungliga whitepaper-dokumentet från Satoshi Nakamoto, eller kolla in vår guide till blockchainteknik för en lättförståelig introduktion till grunderna.

Glad Bitcoin Pizza Day! 🧡🍕 Må firandet vara fyllt av skratt, lärdomar – och riktigt god pizza.

Considering going on a last-minute travel adventure? While we’ve been programmed to think that last-minute travel equates to more expensive, this isn’t necessarily always the case. In this article, we’re dishing out the top 5 last-minute travel tips and ways in which you can score big and tap into great last-minute travel deals.

From tips on how to google flights to finding hotel rooms with perks and everything else you might need for your last-minute bookings, we've got you covered right here.

1) Be flexible

Flexibility is key to saving on any last-minute travel needs you may have. And the number one way of doing so is by being f.l.e.x.i.b.l.e.

Whether it’s with your travel dates, flight times, or destination, flexibility can save you a lot of money in the long run. Accommodation and flight prices depend on a plethora of factors such as whether it's in-season or off-season, if you're only looking at popular destinations, or if there are events taking place nearby at the same time, i.e. a conference.

Be sure to check out a range of options before deciding on a specific date and time, just a day’s difference can equate to hundreds of dollars. You might end up surprised by how much money you can save on your last-minute travel adventure by just going with the flow.

2) Fly wise, fly cheap

The most significant savings come from hotel deals and package deals—not airplane tickets. Flight prices usually go up in cost as the date of departure gets closer, but there is hope for last-minute travel deals. If you want to fly out of town within the same week that you book your seats, try buying your tickets on a Sunday or Tuesday, airlines frequently discount their fares on these days and offer the best deals.

You'll be saving some decent money by avoiding flying on Fridays and Mondays as fares are expected to be higher since they're the most popular days for weekend travelers. Opt for mid-week travel if possible.

Another top tip that many individuals are unaware of is that their browser keeps track of the terms they search for on a regular basis. If the platform notices that someone is searching for anything related to holidays or last-minute flights, the price will rise.

To avoid paying more for the same thing, make sure to open your browser in an incognito window before you google flights and thus prevent being tracked or leaving a history of your searches. The same applies to airline websites and online travel agencies. Not just a last-minute travel hack, but one to use across all varieties of travel.

3) Be on the lookout for perks

If you're looking for a more affordable way to vacation, then pay attention to the perks and benefits offered by travel companies and accommodations, especially when it comes to last-minute travel. Consider booking accommodation that includes free breakfast and/or complimentary parking, every little bit helps.

You will be surprised at how much money some of these perks can save! For instance: free breakfast could save you about $20 to $25 per day while parking can easily range from anything between $30 to $45 a day if you opt to get a rental car.

Always do the math before deciding if a specific accommodation is worth it. Check out platforms like Booking.com, Travago, and a specific hotel website you like for the best deals and last-minute travel options, as well as travel apps for any last-minute deals.

4) Read the fine print

When it comes to a last-minute trip, be aware of the fine print when booking your flight, adventure, or accommodation. Make sure to read up on their cancellation policies as many airlines now offer relaxed rules for changing plans at short notice which means you may be able to change dates without penalty if necessary.

While last-minute deals and spontaneity are exciting, sometimes life has a way of getting in the way so be sure to know the specific terms of your flights and hotels.

5) Prep like a pro

If you're looking to travel on a budget, there's more to think about than just withdrawing cash from an ATM. With a little planning ahead, you can become a savvy traveler and save yourself some money - even with last-minute travel!

Many of us have been abroad and had to pay outrageous ATM and credit card fees. And all because we didn’t do our research and plan ahead. By taking your Tap card with you, you’ll save a substantial amount of money on your ATM withdrawal fees and foreign exchange fees thanks to its low to zero fees plans compared to that of traditional banks.

All operated through the app, you can stay up to date on your transaction history and your balances in real-time, and easily - and instantly - transfer funds between accounts. The card also allows you to swipe at merchants worldwide and make quick payments no matter where in the world you might be.

It's also worth doing your research on whether the place you are traveling to prefers guests paying cash or if it is more card transaction based. You would hate to have to travel around with a wad of cash that is difficult to get rid of.

Be wise

Booking for a honeymoon, anniversary, or simply a romantic getaway? Last-minute travel might not be appropriate for you if you’re set on a particular type of accommodation at a particular location or must go during specific travel dates.

If everything has to be in harmony with your plans, we would strongly recommend you book ahead of time instead of opting for a last-minute trip. You wouldn’t want to cut corners to save money on your once-in-a-lifetime memories.

Travel smart to travel far

Embrace all that life has to offer by exploring different corners of the globe and get more bang for your buck with these 5 travel tips. From saving a few bucks here and there, you could end up saving big on your last-minute trip.

Be sure to switch to incognito mode and start searching for your dream holiday, it might be just around the corner!

We are delighted to announce the listing and support of Balancer (BAL) on Tap!

BAL is now available for trading on the Tap mobile app. You can now Buy, Sell, Trade or hold BAL for any of the other asset supported on the platform without any pair boundaries. Tap is pair agnostic, meaning you can trade any asset for any other asset without having to worries if a "trading pair" is available.

We believe supporting BAL will provide value to our users. We are looking forward to continue supporting new crypto projects with the aim of providing access to financial power and freedom for all.

Balancer, a popular choice for traders and liquidity providers in the crypto space, is an AMM platform built on the Ethereum network that functions as a self-balancing weighted portfolio, liquidity provider, and price sensor.

Balancer allows users to create liquidity pools of digital assets using smart contracts. These self-balancing index funds automatically adjust the proportion of assets in the Balancer pools to maintain their desired ratios, even as individual coin prices fluctuate.

The BAL token is the native utility token for the Balancer protocol, which is used to govern the platform and incentivize liquidity providers. The token was launched three months after the initial platform launch following the success of the COMP token on the Compound network.

Get to know more about Balancer (BAL) in our dedicated article here.

In a world where dreams often seem out of reach, we find ourselves humbled and elated to share a remarkable achievement with all of you: Tap has reached an incredible milestone of 150,000 users and counting! Today, we take a moment to pause, reflect, and appreciate the extraordinary journey that has brought us here.

As we trace our steps back to the beginning, we are reminded of the countless hours, late nights, and tireless efforts poured into building something meaningful— Tap, a financial app that would make a difference in people's lives.

Our dedicated team of talented individuals, driven by a shared vision, embarked on this magical journey with a humble determination to reshape the future of finance.

Together, we faced challenges, learned from our mistakes, and celebrated small victories along the way. It was a journey filled with passion, resilience, and unwavering belief in the transformative power of our app. But we couldn't have come this far without the unwavering support and trust of our incredible user community.

To every single user who embraced Tap, believed in our mission, and allowed us to be a part of their financial lives, we express our deepest gratitude. Your feedback, enthusiasm, and inspiring stories have fueled our motivation and guided us on the path to improvement.

From the stories of individuals triumphing over debt, saving for their first homes, or pursuing their entrepreneurial dreams, we have witnessed the impact of our app in transforming lives. It is your dedication, commitment, and unwavering belief in our shared journey that has brought us to this momentous milestone.

But let us not rest on our laurels. As we celebrate this remarkable achievement, we look to the future with eager anticipation.

The landscape of finance is ever-evolving, and together, we have the power to shape its course. It is our collective responsibility to continue building a future of finance that is inclusive, empowering, and accessible to all.

As we navigate the uncharted territories ahead, we remain committed to listening, learning, and evolving. We will continue to harness our team's collective knowledge, passion, and expertise to bring you even more groundbreaking features, enhanced user experiences, and financial solutions that inspire and uplift.

With hearts full of gratitude and excitement, we celebrate this moment. To our dedicated team, our invaluable user community, and all the individuals who believe in our mission, we extend our deepest appreciation.

Together, let us forge ahead and build the future of finance that transforms lives and paves the way for countless new dreams to be realized.

Investors looking to establish a passive income stream often turn to a dividend investing strategy as it provides regular payments from their investments. While dividend investing might sound intimidating to beginner investors, the truth is that with adequate research and understanding it is very simple to tap into.

Dividends are a portion of a company's earnings that are distributed to its shareholders and can provide a reliable source of income (also referred to as dividend income) over the long term. However, not all dividend-paying stocks are created equal, and investors need to carefully evaluate the companies they invest in to make sure that they are making sound financial decisions.

In this article, we will provide six tips for dividend investing that can help investors choose the right stocks and maximize their returns in terms of dividend payments.

Look to mature companies

When implementing a dividend investing strategy and looking at which stocks pay dividends, it is generally advisable to focus on established, mature companies rather than start-ups. Established companies have a proven track record of stability and success, which can provide investors with a sense of security and confidence. Investors will also often research a company's dividend yield to confirm their decision.

A dividend yield is a dividend per share divided by the price per share. It can also be calculated as a company's total annual dividend payments divided by its market capitalization if the number of shares is constant. A good dividend yield is anywhere from 2% - 6%, the higher the better. Lower dividend yields can make a stock appear less competitive relative to its industry.

Mature companies typically have a more predictable revenue stream, which makes it easier to forecast their future earnings and dividends. They also tend to have a history of paying dividends consistently, which is a crucial factor for dividend investors.

Ultimately, it is important for investors to carefully evaluate the financial health and stability of any company they are considering investing in, but for those seeking consistent dividends, established, mature companies are typically a safer and more reliable option.

Look at the company’s dividend payout ratio

The dividend payout ratio represents the proportion of the company's net income that is distributed to shareholders as dividends. This ratio is expressed as a percentage of the company's earnings that are paid out to its shareholders in the form of dividend income.

The payout ratio gives investors a look at how much income is being paid to investors and how much is being retained and used by the company. If a company with high-yield dividend stocks has a high payout ratio (i.e. paying out a large portion of its income to shareholders) this should raise red flags as if this income stream diminishes the dividend income will too.

Stability pays out in the long run

When looking for dividend-paying stocks, it is important to prioritize stability over quantity. This means choosing companies with a proven track record of steady earnings and consistent dividend payments, rather than simply seeking out the highest dividend yield.

By selecting quality investments, investors can minimize their risk exposure and reduce the likelihood of unexpected drops in dividend payouts or stock value. Additionally, companies with strong financial health are better positioned to weather market volatility and economic downturns, which can help to protect investors' portfolios in the long term.

Ultimately, prioritizing stability over quantity is key for any dividend investing strategy.

Always establish your financial goals early on

When looking at buying dividend-paying stocks, first establish a few key goals, like whether growth investing or value investing is a priority for your investment strategy. This will help you determine which companies to seek out, and whether your portfolio can incorporate younger companies. While mature ones will offer consistent and steady payouts, newer ones might present impressive dividend yields in the short term.

By establishing your financial goals before investing you will be able to create a formula to follow that allows you to explore a potentially wider range of options. Always be sure to look at past and present returns and consider the company’s future potential. This will help to establish how profitable the company might be in the future from a dividend growth perspective.

Know when to cut your losses

Investing in dividend stocks requires a balance between patience and knowing when to cut your losses. While waiting for an investment to pay off can be tempting, holding onto a failing stock can result in significant losses. Recognizing when a stock is underperforming and taking action is crucial to successful dividend investing.

It's important to monitor the financial health and performance of a company and reevaluate the investment if it fails to meet expectations. Knowing when to cut your losses and sell a stock that is no longer viable can protect your portfolio and help to prevent significant financial losses. Being aware of market trends and the performance of the companies you invest in is key to making informed investment decisions.

Don’t put all your eggs in one basket

Diversifying your portfolio is crucial when investing in dividend stocks to minimize risk and maximize returns. Putting all your money into one or a few stocks exposes you to significant risk if any of them fail.

By diversifying across multiple companies and sectors, you can spread your risk and minimize the impact of a single stock's performance on your portfolio. Investing in companies with varying levels of financial health and dividend yields can help to create a more balanced portfolio.

Diversification is a key strategy for long-term dividend investors who want to build a stable and sustainable source of passive income while mitigating the risk of significant financial losses.

Additionally, some investors opt to implement a dividend investment strategy that looks to increase dividend yields over time. This process centers around dividend reinvestment which essentially means reinvesting the dividend payout one received. This over time will contribute to dividend growth, in the same way as compound interest works.

In conclusion

Investing in dividend-paying stock is an excellent way of building passive income streams while still building an impressive investment portfolio. With the right approach and adequate research, this can contribute to significant gains for your greater financial goals.

The golden key is to gauge which stocks, in this case, dividend stocks, provide the strongest returns with minimal risk, and which stocks have the highest dividend growth potential. Implement these 6 golden rules above to better position yourself for success.

Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started