Some crypto companies are fully compliant, fully regulated, and still can't keep their bank accounts. Learn why the financial system is quietly freezing them out.

Keep reading

Why can't a fully compliant, regulated crypto business secure a bank account in 2025?

If you're operating in this space, you already know the answer. You've lived through it. You've submitted the documentation, walked through your AML procedures, and demonstrated your regulatory compliance… only to be rejected. Or worse still, waking up to find your existing account frozen, with no real explanation and no path forward.

This isn't about isolated cases or bad actors being weeded out. It's a pattern of systematic risk aversion that's creating real barriers to growth across the entire sector, and it's throttling one of the most significant financial innovations of our generation.

We're Tap, and we're building the infrastructure that traditional banks refuse to provide.

The Economics Behind the Blockade

Let's examine what's actually driving this exclusion, because it's rarely about the reasons banks cite publicly.

The European Banking Authority has explicitly warned against unwarranted de-risking, noting it causes "severe consequences" and financial exclusion of legitimate customers. Yet the practice continues, driven by two fundamental economic pressures that have nothing to do with your business's actual risk profile.

The compliance cost calculation

Financial crime compliance across EMEA costs organizations approximately $85 billion annually. For traditional banks, the math is simple: serving crypto businesses requires specialized expertise, enhanced monitoring, and ongoing due diligence. As a result, it's cheaper to reject the entire sector than to build the infrastructure needed to serve it properly.

The regulatory capital burden

New EU regulations impose a 1,250% risk weight on unbacked crypto assets such as Bitcoin and Ethereum. This isn't a compliance requirement; it's a capital penalty that makes crypto exposure commercially unviable for traditional institutions, regardless of the actual risk individual clients present.

In the UK, approximately 90% of crypto firm registration applications have been rejected or withdrawn, often citing inadequate AML controls. Whether those assessments are accurate or not, they've created the perfect justification for blanket rejection policies.

The result? Compliant businesses are being treated the same as bad actors; not because of what they've done, but because of the sector they're in.

The Real Cost of Financial Exclusion

Financial exclusion isn’t just an hiccup; it creates tangible operational barriers that ripple through every part of running a crypto business.

Firms that have secured MiCA authorization, built robust compliance programs, and met regulatory requirements can find themselves locked out of basic banking services. Essential fiat on-ramps and off-ramps remain inaccessible, slowing payments, limiting growth, and complicating cash flow management.

Individual cases illustrate the problem vividly as well. Accounts are closed because a business receives a payment from a regulated exchange. Others are dropped with vague references to “commercial decisions,” offering no substantive justification. Founders frequently struggle to separate personal and business finances, as both are considered too risky to serve.

The irony is striking. By refusing service to compliant businesses, traditional banks aren’t mitigating risk; they’re amplifying it. Forced to operate through less regulated channels, these legitimate firms face higher operational and compliance risks, slower transactions, and reduced investor confidence. Over time, this slows innovation, and raises the cost of doing business for firms that are legally and technically sound.

Debanking Beyond Europe: U.S. Crypto Firms Face Their Own Challenges

Limited access to banking services isn’t exclusive to Europe. Leading firms in the U.S. crypto industry have faced numerous challenges regarding the banking blockade. Alex Konanykhin, CEO of Unicoin, described repeated account closures by major banks such as Citi, JPMorgan, and Wells Fargo, noting that access was cut off without explanation. Unicoin’s experience echoes a broader sentiment among crypto executives who argue that traditional financial institutions remain wary of digital asset businesses despite recent policy shifts toward a more pro-innovation stance.

Jesse Powell, co-founder of Kraken, has also spoken out about being dropped by long-time banking partners, calling the practice “financial censorship in disguise.” Caitlin Long, founder of Custodia Bank, recounted how her institution was repeatedly denied services. Gemini founders Tyler Winklevoss and Cameron Winklevoss shared similar frustrations.

These experiences reveal a pattern many in the industry interpret as systemic risk aversion. Even in a market as large and mature as the United States, crypto-focused businesses continue to encounter obstacles in maintaining basic financial infrastructure. The issue became especially acute after the collapse of crypto-friendly banks such as Silvergate, Signature, and Moonstone; institutions that once served as key bridges between fiat and digital assets. Their exit left a gap few traditional players have been willing to fill.

Why Tap Exists

The crypto industry has reached an inflection point. Regulatory frameworks like MiCA are providing clarity. Institutional adoption is accelerating. The technology is proven and tested. But the fundamental infrastructure gap remains: access to business banking that actually works for digital asset businesses.

This is precisely why we built Tap for Business.

We provide business accounts with dedicated EUR and GBP IBANs specifically designed for crypto companies and businesses that interact with digital assets. This isn't a side offering or an experiment, it's our core focus.

Our approach is straightforward

We built our infrastructure for this sector

Rather than retrofitting traditional banking systems to reluctantly accommodate crypto businesses, we designed our compliance, monitoring, and operational frameworks specifically for digital asset flows. This means we can properly assess and serve businesses that others automatically reject.

We price in the actual risk, not the sector

Blanket rejection policies exist because they're cheap and simple. We take a different approach: evaluating each business based on their actual controls, compliance posture, and operational reality. It costs more, but it's the only way to serve this market properly.

We're committed to sector normalization

Every time a legitimate crypto business is forced to operate without proper banking infrastructure, it reinforces outdated stigmas. By providing professional financial services to compliant businesses, we're helping demonstrate what should be obvious: crypto companies can and should be served by the financial system.

It isn't about taking on risks that others won't. It's about properly evaluating risks that others refuse to understand.

Moving Forward

The industry is maturing. Regulatory clarity is emerging. Institutional adoption is accelerating. But you can't put your business on hold while traditional banks slowly catch up to reality.

That's not sustainable in the long run.

As a firm, you shouldn't have to beg for a bank account. You shouldn't have to downplay your crypto operations just to access basic financial services. And you certainly shouldn't have to accept that systematic exclusion with little to no explanation other than “It’s just how things are."

The crypto sector is building the future of finance. Your banking partner should believe in that future too. If you're ready to work with financial infrastructure built for your business, not in spite of it, here we are.

Talk today with one of our experts to understand how we can help your business access the banking infrastructure you need.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

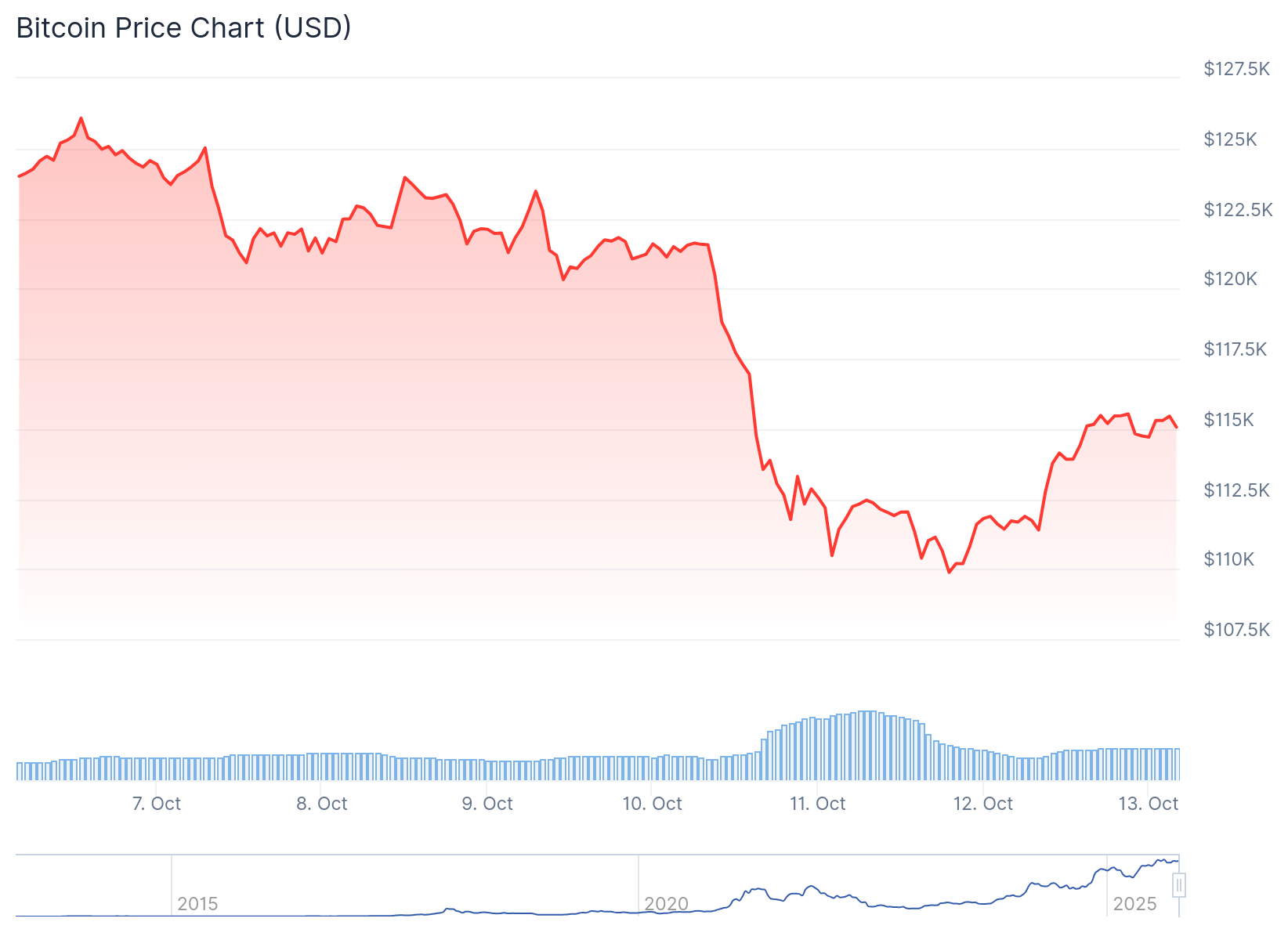

The Crash That Shook It All

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

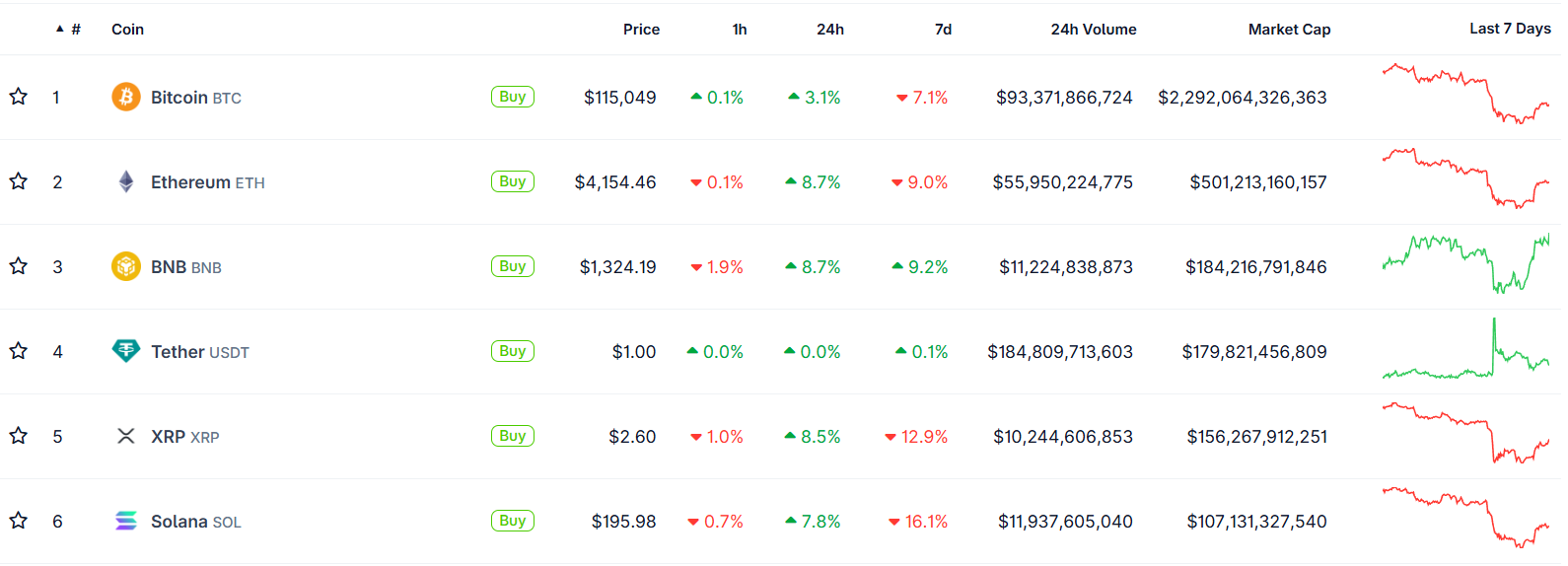

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

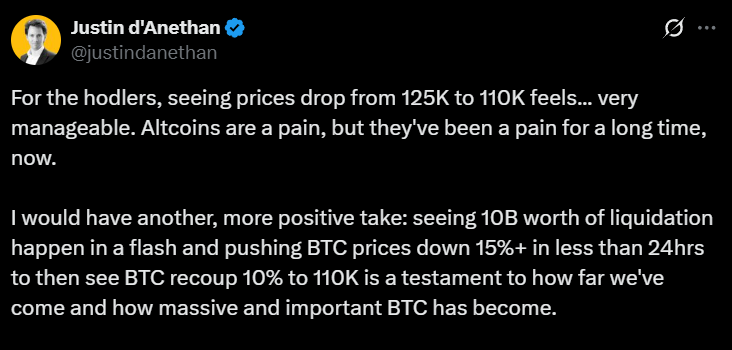

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

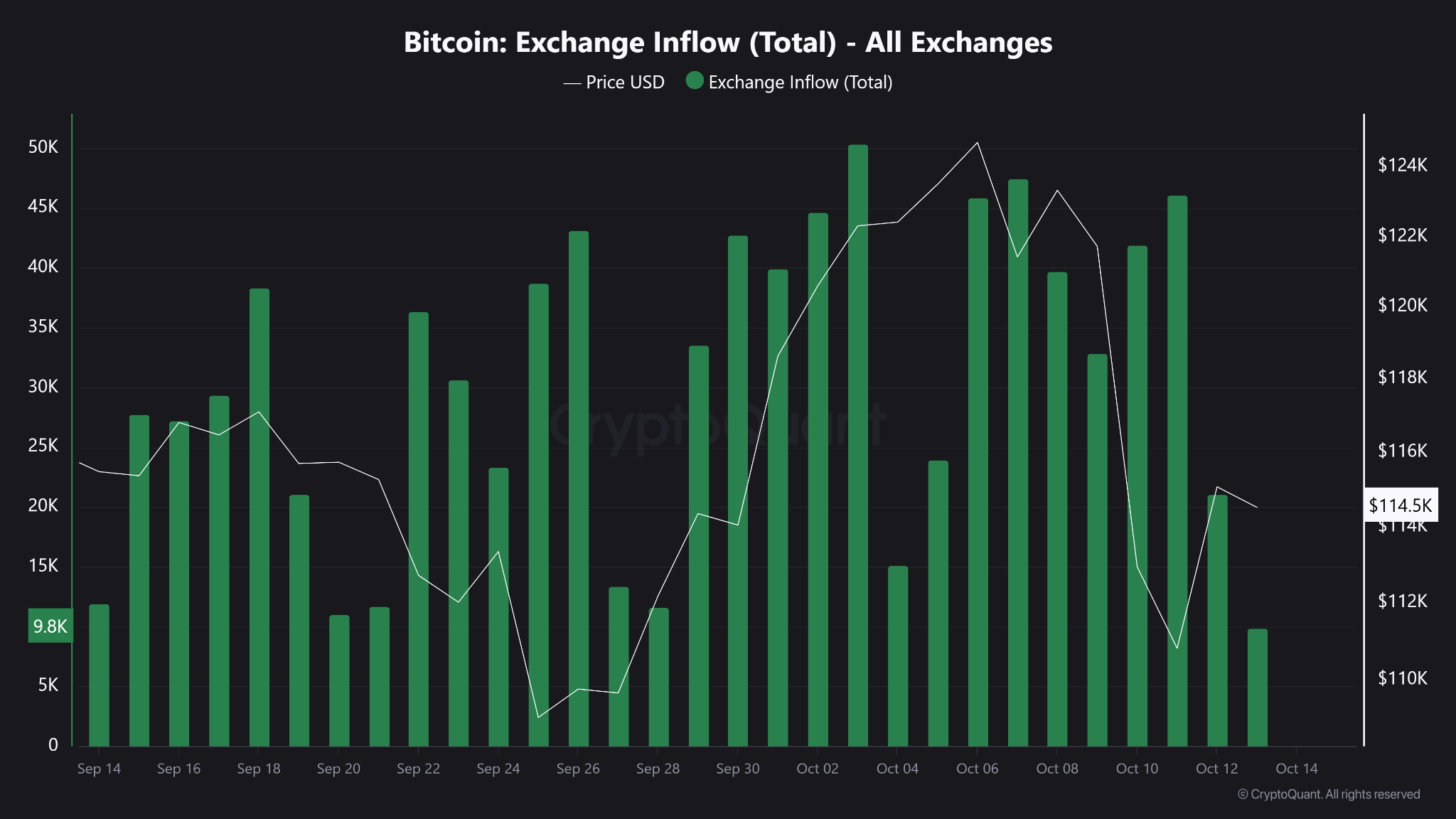

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

Unveiling the future of money: Explore the game-changing Central Bank Digital Currencies and their potential impact on finance.

Since the debut of Bitcoin in 2009, central banks have been living in fear of the disruptive technology that is cryptocurrency. Distributed ledger technology has revolutionized the digital world and has continued to challenge the corruption of central bank morals.

Financial institutions can’t beat or control cryptocurrency, so they are joining them in creating digital currencies. Governments have now been embracing digital currencies in the form of CBDCs, otherwise known as central bank digital currencies.

Central bank digital currencies are digital tokens, similar to cryptocurrency, issued by a central bank. They are pegged to the value of that country's fiat currency, acting as a digital currency version of the national currency. CBDCs are created and regulated by a country's central bank and monetary authorities.

A central bank digital currency is generally created for a sense of financial inclusion and to improve the application of monetary and fiscal policy. Central banks adopting currency in digital form presents great benefits for the federal reserve system as well as citizens, but there are some cons lurking behind the central bank digital currency facade.

Types of central bank digital currencies

While the concept of a central bank digital currency is quite easy to understand, there are layers to central bank money in its digital form. Before we take a deep dive into the possibilities presented by the central banks and their digital money, we will break down the different types of central bank digital currencies.

Wholesale CBDCs

Wholesale central bank digital currencies are targeted at financial institutions, whereby reserve balances are held within a central bank. This integration assists the financial system and institutions in improving payment systems and security payment efficiency.

This is much simpler than rolling out a central bank digital currency to the whole country but provides support for large businesses when they want to transfer money. These digital payments would also act as a digital ledger and aid in the avoidance of money laundering.

Retail CBDCs

A retail central bank digital currency refers to government-backed digital assets used between businesses and customers. This type of central bank digital currency is aimed at traditional currency, acting as a digital version of physical currency. These digital assets would allow retail payment systems, direct P2P CBDC transactions, as well as international settlements among businesses. It would be similar to having a bank account, where you could digitally transfer money through commercial banks, except the currency would be in the form of a digital yuan or euro, rather than the federal reserve of currency held by central banks.

Pros and cons of a central bank digital currency (CBDC)

Central banks are looking for ways to keep their money in the country, as opposed to it being spent on buying cryptocurrencies, thus losing it to a global market. As digital currencies become more popular, each central bank must decide whether they want to fight it or profit from the potential. Regardless of adoption, central banks creating their own digital currencies comes with benefits and disadvantages to users that you need to know.

Pros of central bank digital currency (CBDC)

- Cross border payments

- Track money laundering activity

- Secure international monetary fund

- Reduces risk of commercial bank collapse

- Cheaper

- More secure

- Promotes financial inclusion

Cons of central bank digital currency (CDBC)

- Central banks have complete control

- No anonymity of digital currency transfers

- Cybersecurity issues

- Price reliant on fiat currency equivalent

- Physical money may be eliminated

- Ban of distributed ledger technology and cryptocurrency

Central bank digital currency conclusion

Central bank money in an electronic form has been a big debate in the blockchain technology space, with so many countries considering the possibility. The European Central Bank, as well as other central banks, have been considering the possibility of central bank digital currencies as a means of improving the financial system. The Chinese government is in the midst of testing out their e-CNY, which some are calling the digital yuan. They have seen great success so far, but only after completely banning Bitcoin trading.

There is a lot of good that can come from CBDCs, but the benefits are mostly for the federal reserve system and central banks. Bank-account holders and citizens may have their privacy compromised and their investment options limited if the world adopts CBDCs.

It's important to remember that central bank digital currencies are not cryptocurrencies. They do not compete with cryptocurrencies and the benefits of blockchain technology. Their limited use cases can only be applied when reinforced by a financial system authority. Only time will tell if CBDCs will succeed, but right now you can appreciate the advantages brought to you by crypto.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

LATEST ARTICLE

Cryptocurrencies have been revolutionary in their pursuit of merging decentralization with the finance sector. The industry has grown to provide many alternative options to the traditional financial products available, with most of them at a fraction of the cost. Cryptocurrencies have digitized the way we view, use and manage our funds, and it's only the beginning of the digital assets revolution.

What is cryptocurrency?

Cryptocurrency is the blanket term used to describe any digital asset that utilizes blockchain technology or distributed ledger technology to operate. The first cryptocurrency that came into existence was the Bitcoin network, created in 2009 by the mysterious Satoshi Nakamoto.

The cryptocurrency was designed to provide an alternative monetary system to the traditional banking sector, free from politics. Instead of a central authority, Bitcoin operates using a decentralized network of computers that work together to transact and verify any financial transactions using the Bitcoin protocol. For the first time ever people could manage their money without having to rely on a centralized institution.

Since Bitcoin's success, many other cryptocurrencies have emerged, some providing a revised solution to the digital cash system Bitcoin created, while others have brought innovation to the crypto space.

The Ethereum blockchain, as an example, provides the industry with a platform on which developers can create decentralized apps (dapps) merging the app concept with the decentralized nature of blockchain technology.

Cryptocurrency vs traditional currencies

Traditional currencies, also known as fiat currencies, are operated by government institutions while cryptocurrencies are maintained through a network of computers following a specific protocol. While a Federal Reserve typically sits behind a fiat currency, the key players in a cryptocurrency's existence typically involve:

- Core developers, responsible for updating a network's protocol

- Miners, responsible for validating and executing transactions

- Users, the people using the cryptocurrency

- Exchanges and trading platforms, facilitating the trade of these cryptocurrencies.

While governments have free control over printing new money, most cryptocurrencies are created with a hard cap. For instance, Bitcoin was designed with a maximum limit of 21 million coins, meaning that there will only ever be that number in existence. Not all cryptocurrencies have this hard cap though, Ethereum has an infinite supply due to the nature of the platform and the cryptocurrency.

Unlike fiat currencies, Bitcoin and many other cryptocurrencies were designed to be deflationary, with the necessary factors in place to ensure that the value of the currency increases over time (based on simple supply-demand economics).

Another pressing difference between cryptocurrencies and fiat currencies is that cryptocurrencies are still undergoing regulatory processes. While they are not illegal to trade (in most countries), they are not yet considered to be legal tenders (again, in most countries). Regulators around the world are working on a legal framework in which cryptocurrencies can operate in mainstream markets.

How do cryptocurrencies work?

Now that we've covered the basics on what is cryptocurrency, let's take a look at how these digital currencies actually function. First and foremost, through the use of blockchain technology. While not all cryptocurrencies use this technology, most do and we will use it as an example (as the concept is roughly the same).

Blockchain technology explained

Blockchain is best explained as a digital record-keeping system, or a distributed database. All transactions made on the network are stored in a transparent manner for anyone to see, with no way to edit or omit any of the information. All data is stored in blocks, which are added chronologically to a chain, hence the name.

A block will contain information relating to every cryptocurrency transaction, like timestamps of when it took place, the sending and receiving wallet addresses, transactional hash, and amounts. Depending on their size, blocks typically store data for a few hundred to a few thousand transactions. Blocks will then also hold a block hash, a unique identifying number associated with the block, and the hash of the previous block to prove its order.

When companies incorporate blockchain technology into their businesses they will typically use a private network where the information is only transparent to certain users. This is referred to as a "permissioned" blockchain, different from a "permissionless" blockchain used for Bitcoin and other cryptocurrencies.

Cryptocurrency transactions explained

While blockchain forms the backbone of a cryptocurrency network, miners facilitate the transactions. In a process called mining, cryptocurrency transactions are validated and executed, and through cryptocurrency mining new coins are minted. To make this easier to understand, we're going to use an example of Lucy sending Bitcoin to Jane.

From her Bitcoin wallet, Lucy will initiate a transaction to Jane, sending 1 BTC. After entering Jane's wallet address, she will confirm the network fees presented (these are paid directly to the miner for their time and effort), and execute the transaction.

The transaction will then enter a pool of transactions waiting to be executed called a mempool. Miners then compete to be the first to solve a computational puzzle, the winner of which will be rewarded with verifying and executing the next batch of transactions (cryptocurrency mining).

Confirming that each wallet address exists and each sender has the available funds, the miners will collect each of the network fees that the senders paid. The data from the confirmed transactions will then be added to a block and added to the blockchain right after the last published one. For adding a new block to the blockchain, the miner receives a block reward.

This block reward is based on the current rate, which is halved every 210,000 blocks (roughly every 4 years). This is how new Bitcoin enters circulation and the currency is able to maintain a deflationary status.

Jane will then receive a notification to say that she has received 1 BTC, and depending on her wallet will need to wait for 3 - 6 confirmations before being able to access the funds. Each confirmation is when a new block is added to the blockchain, which typically takes 10 minutes.

This process is typical of a proof of work network, used on networks like Bitcoin. This process is also the same whether you are buying crypto from crypto exchanges or sending to a friend.

The only time this differs is when using a cryptocurrency blockchain that utilizes a proof of stake consensus. In this case, instead of miners competing to solve the puzzle (requiring a lot of energy), validators will be selected by the network to conduct the verification process afterwhich this information will be verified and added to the relevant blockchain ledger.

The different types of cryptocurrencies

With tens of thousands of virtual currencies on the market, a number of subcategories have been created. While Bitcoin is a digital cash system providing a store of value and a medium of exchange, not all cryptocurrencies follow this structure.

Cryptocurrencies that are not Bitcoin are referred to as altcoins, (alternative coins), a term coined in the early days when new coins started emerging. Some altcoins are focused on providing heightened privacy, security, or speed while others are created for entertainment and leisure.

There are nine main types of cryptocurrencies, which we'll briefly highlight below:

- Utility, provide access to the platform service

- Payment, used to pay for goods and services within and outside of its network

- Exchange, native to cryptocurrency exchange platforms

- Security, where its usage and issuance are governed by financial regulations

- Stablecoins, digital currencies with prices pegged to fiat currencies

- DeFi tokens, digital currencies used on DeFi (decentralized finance) exchanges

- NFTs, non-fungible tokens representing unique identities that cannot be replicated

- Asset-backed tokens, where their underlying value is backed by a real-world asset

Another category that is gaining popularity around the world is Central Bank Digital Currencies, CBDCs. These digital currencies are operated and maintained by a central bank with the price pegged to the local currency.

What are the benefits of digital currency?

Cryptocurrencies are known for their fast and secure transactions, not limited by borders or government intervention. Below are several highlights that cryptocurrencies bring to the financial sector.

- Decentralized. Eliminating third parties and centralized authority, cryptocurrencies make the transfer of assets possible while reducing costs and time constraints.

- Security. Blockchain provides a transparent and immutable means of storing transactional data ensuring smooth and accountable operations.

- Deflationary. Most cryptocurrencies with a limited supply are designed to be deflationary in nature due to the decreasing supply mechanisms set in place. With basic supply-demand economics, a reduced supply and increased demand drive the price up.

- Reduced transaction fees. Cryptocurrencies provide a much cheaper alternative to sending fiat currencies across borders. With no need to exchange currencies and bypass several middlemen, cryptocurrencies are able to be sent on a peer-to-peer basis in a matter of minutes.

- Diversification. When it comes to investing, cryptocurrencies present a measure of diversification. Considering your risk tolerance and asset allocation, cryptocurrencies could be a part of your investment portfolio.

What are the risks associated with cryptocurrencies?

While there are plenty of benefits, as with any "new" asset class, there are risks to be considered too.

- Market volatility. Cryptocurrencies are prone to bouts of volatility with prices rising and falling dramatically in various frames of time.

- Market manipulation. Some cryptocurrencies might fall victim to a pump-and-dump scheme through no fault of the networks'. These are typically orchestrated by third parties.

- Theft. While blockchains can't typically be hacked, many cryptocurrency exchanges and wallets that don't utilize the necessary security measures can fall prey to hackers. To avoid this ensure that you always stick to a regulated platform with high-security measures.

How does one store cryptocurrency?

Cryptocurrency is stored in a digital wallet, similar to how one would store money at financial institutions only with cryptocurrency you are entirely in control of your funds. From the wallet you can make crypto transactions, store a wide range of cryptocurrency assets and hold your cryptocurrency investments long term.

Each cryptocurrency wallet is specifically designed to hold a certain type of cryptocurrency. For example, you cannot accept Bitcoin in an Ethereum wallet or send Bitcoin Cash to a Bitcoin wallet. Each wallet also comes with a set of public and private keys, the latter of which gives the holder access to the funds.

How to trade cryptocurrencies on cryptocurrency exchanges

Now that you understand what is cryptocurrency, let's cover how to enter the world of crypto assets. Entering the world of cryptocurrencies can be both exciting and rewarding. While we encourage every single person to conduct their own research prior to getting involved, once you're ready to start your journey into the cryptocurrency space, we're here for you.

Crypto exchanges

In order to buy any digital currency, traders will need to utilize cryptocurrency exchanges. These exchanges facilitate the buying and selling of crypto assets, and depending on the structure, often require users to offer some proof of identification before conducting any cryptocurrency transactions.

Decentralized vs centralized

The cryptocurrency market is made up of decentralized exchanges and centralized exchanges. The difference between the two is how they are operated, with centralized exchanges have a central authority. Typically, the centralized ones are more reliable and trustworthy as they require licenses which hold them accountable to certain standards within the financial sector. When looking to trade any digital currency, find an exchange that is regulated and licensed by a financial body.

The Tap app is a mobile app that allows users to buy, sell, trade, store and even earn crypto through a secure wallet infrastructure. Supporting a number of popular cryptocurrencies, users gain access to a wide range of markets. Fully regulated by the Gibraltar Financial Services Commission, the app uses top-of-the-range security technology to ensure that all data and funds are secured at all times.

Open an account

To engage in the cryptocurrency market all one needs to do is create an account. To open an account on Tap simply download the app from the App or Google Play store, enter the details required and complete the KYC process, an international requirement on all reputable digital currency platforms. Users will then gain access to a number of crypto and fiat wallets, with the ability to accumulate a wide range of cryptocurrencies.

From there, users can make cryptocurrency transactions, whether to friends also using the platform, external wallets or even external bank accounts for online payments, such as municipalities. The app offers a modern approach to banking services where funds can be used for real world payments.

Decentralized finance, or "DeFi," refers to financial services that provide many of the same features as traditional banks - like earning interest on your money and borrowing from others - but without middlemen who take a fee or charge interest, paperwork, or privacy trade-offs. A chartered accountant and Blockchain do not have much in common, but they are starting to as DeFi and FinTech take over. I

nstead of relying on financial services like banks, users can utilize smart contracts on blockchain. Cryptocurrencies ensuring even more ease of use for DeFi users, providing the hottest speeds, fees, and transparency. Defi and digital currencies are growing in popularity thanks to the perks of Blockchain technology. Let us get more into the concept and how it caters to a larger audience.

The aim and use of DeFi

Decentralized finance is the future of financial services, and it's already here. The aim of DeFi is to provide a decentralized financial services platform that is open and accessible to anyone in the world, using tech like crypto to help advance the everyday life of anyone and any business willing to give decentralization a try.

In the past decade, we've seen a rise in peer-to-peer lending platforms such as Lending Club, Patreon, BTCJam, and an explosion of digital currencies such as Bitcoin and Ethereum.

All of these developments have taken us one step closer to the decentralized future of finance that we've been dreaming about, but there's still more work to be done.

What's wrong and how can DeFi fix it

Many institutions in the financial sector are slow and expensive when it comes to providing basic services like payments. Online lender contracts can charge interest rates as high as 30 percent, and the global remittance industry charges fees that can be as high as 12 percent.

These fees and delays mean some of the most vulnerable individuals of our society are paying the highest prices for financial services when they need them most. While the traditional financial system can be slow and expensive, it doesn't have to be this way. Decentralized finance (DeFi) is an emerging category of services where trust intermediaries such as banks are replaced with cryptographic code and smart contracts, which reduces costs for everyone involved - especially when it comes to international payments.

DeFi is a new category of services that are globally accessible and built on top of blockchain infrastructure, without any charge or barrier to entry. It's also much more secure than traditional financial systems because the technology used isn't connected to a central server that can be hacked. DeFi users smart contracts applications to ensure ease of use and instant transfers of information and funds.

Your money is always yours; it's just moving from one smart contract to another. No permission from an intermediary is required in order to use it. All you need to do is have a cryptocurrency wallet, computer or mobile device, and internet connection like everyone else using DeFi services today.

DeFi isn't coming, it's already here

When you ask yourself, "where is DeFi going?", the answer is simple: everywhere. DeFi can be used from every corner of the world, and it's already available today. Innovation at its finest.

DeFi services are not theoretical. They're already being used by real people today to make real asset payments, earn interest on their digital savings, and borrow money from both friends and strangers, all without ever going through a bank or traditional financial institution. Whether you are investing, a money maker, or an asset holder, the shift to DeFi is inevitable.

Blockchain technology provides the first-ever opportunity for these separate building blocks to come together in order for the entire financial system to work seamlessly without any intermediaries, so it will only get better with time. From an economic standpoint, DeFi offers better rates and all the perks of FinTech. Cryptocurrency assets like Ethereum have seen plenty of investment opportunities arise as DeFi and Blockchain merge.

DeFi pros and cons

In order to get a complete picture of what DeFi is, it's important to understand all the good and bad parts that we are facing now. So let's dive into the details.

DeFi pros:

- The interest rate on savings and money lending is relatively high, just as it would be without intermediaries.

- Financial services are more accessible than in traditional bank systems because there aren't any barriers to entry, like non-existent internet infrastructure or bank account fees.

- Transaction and disruption times are much faster because DeFi transactions can move directly from peer to peer without having to go through intermediaries.

DeFi Cons:

- Some transactions might not be as private due to the public records of smart contracts on a blockchain (keeping that in mind, transparency is always beneficial). This however increases security because fraud or reversal can't happen.

- Access to DeFi services can be limited if you live in a part of the globe where these services aren't supported or don't have high enough adoption rates, as compared to traditional banking systems in developed countries. Regulator issues may also occur.

- There isn't a built-in mechanism for handling consumer disputes between peers because the technology simply wasn't designed with this function in mind.

- It's difficult to understand what you're getting yourself into when joining a DeFi service, since it varies from one application to the next and is based on new technology. This doesn't have to be the case in the future.

As of now, it's still the early days for DeFi and there are some challenges to overcome before we can look at it as a real alternative. There's still a lot of work to be done, but it will all pay off in the end.

Du har säkert hört talas om denna kryptojätte — men vet du egentligen vad Ethereum är? I den här guiden tittar vi närmare på Ethereum och vilken roll plattformen spelar inom blockkedjevärlden. Spoiler: en riktigt stor roll.

Som den näst största kryptovalutan och med över 20 % av marknadsandelen är det ett perfekt tillfälle att lära sig mer om Ethereum.

Vad är Ethereum?

Ethereum är en blockkedjeplattform som gör det möjligt för utvecklare att skapa sina egna decentraliserade applikationer (dapps) och smarta kontrakt. Med målet att bygga vidare på hela blockkedjeindustrin erbjuder Ethereum en plattform där företag och individer från alla branscher kan använda sig av decentraliserad teknik.

Smarta kontrakt är digitala avtal som automatiskt utförs när fördefinierade villkor är uppfyllda. Ethereum fungerar som en decentraliserad datorplattform, där ett globalt nätverk av datorer driver och underhåller nätverket — precis som hos Bitcoin.

Plattformen möjliggör inte bara digitala transaktioner utan även skapandet av nya kryptovalutor ovanpå sitt nätverk.

Vad är ETH?

ETH, även känt som Ether, är den digitala valutan som driver Ethereum-nätverket. När folk pratar om Ethereumpriset, är det egentligen priset på ETH de syftar på. Ethereum är alltså själva plattformen, medan ETH är kryptovalutan som används inom nätverket.

Hur fungerar Ethereum?

Ethereum är just nu inne i en övergång från konsensusmodellen Proof-of-Work (PoW) till Proof-of-Stake (PoS), vilket förändrar hur nätverket fungerar i grunden.

I det nya PoS-systemet kommer nätverket att förlita sig på validatorer istället för miners för att verifiera och genomföra transaktioner. För att bli validator måste man satsa (stake) en viss mängd ETH i nätverket. Att stakea innebär att man låser sina ETH-tokens i nätverket, vilket fungerar som en säkerhet för att validatorerna ska agera pålitligt.

Alla transaktioner sparas i blockkedjan, som är en öppen och transparent digital huvudbok. Varje block innehåller en uppsättning data som lagras i kronologisk ordning.

Vad ger Ethereum sitt värde?

Ethereum är i dag den största plattformen för skapande av dapps och smarta kontrakt — och också den mest använda. Med starkt ledarskap och ett passionerat community av utvecklare har Ethereum fått ett rykte om sig att vara en pålitlig, innovativ och positiv kraft i blockkedjeindustrin.

När det gäller ETH bestäms värdet, som hos andra kryptovalutor, av tillgång och efterfrågan. Dessutom används ETH för att betala så kallade "gas fees", vilket gör det möjligt att genomföra transaktioner och driva applikationer på nätverket.

Hur skiljer sig Ethereum från Bitcoin?

När man jämför de två största kryptovalutorna är det viktigt att förstå att de tjänar olika syften.

Både Bitcoin och Ethereum kan användas för att överföra värde globalt på bara några minuter. Men Bitcoin skapades främst som ett digitalt betalningssystem utan central kontroll — ett peer-to-peer-nätverk och ett starkt värdeförvar, vilket prisutvecklingen under åren har visat.

Ethereum, däremot, är utformat som en dataplattform där användare kan bygga decentraliserade applikationer ovanpå blockkedjan. Plattformens syfte är att främja utvecklingen av hela blockkedjeekosystemet och göra det tillgängligt för alla intresserade.

Vad används Ethereum till?

Ethereum används främst för att skapa dapps och smarta kontrakt. Dessutom kan användare överföra värde genom plattformen med hjälp av ETH som digital valuta.

ETH fungerar även som ett värdeförvar — många användare köper och håller ETH med förhoppningen om framtida värdeökning.

Vem grundade Ethereum?

Idén om Ethereum presenterades först 2013 av den unge kryptoentusiasten Vitalik Buterin i ett blogginlägg. Han slog sig samman med flera utvecklare och entreprenörer och började bygga den decentraliserade plattformen senare samma år.

Enligt en av grundarna bestod teamet ursprungligen av Vitalik Buterin, Anthony Di Iorio, Charles Hoskinson, Mihai Alisie och Amir Chetrit i december 2013. Under början av 2014 anslöt även Joseph Lubin, Gavin Wood och Jeffrey Wilcke till projektet.

År 2014 genomförde Ethereum ett framgångsrikt crowdsale-event, där man sålde 72 miljoner ETH och samlade in cirka 18 miljoner dollar. Plattformen lanserades officiellt den 30 juli 2015.

Hur köper man Ethereum?

Om du vill lägga till Ethereum i din portfölj kan du köpa ETH via en pålitlig kryptobörs. Med Tap-appen får du tillgång till flera smidiga betalningsalternativ samt en säker Ethereum-plånbok där du kan lagra dina ETH-tokens tryggt.

Sedan Bitcoin introducerades 2009 har begreppet fiatvaluta blivit allt vanligare. Men vad betyder det egentligen? I den här artikeln går vi igenom vad fiatpengar är, varifrån termen kommer, hur systemet fungerar, och vilken roll kryptovalutor spelar i sammanhanget.

Vad är fiatpengar?

Fiatpengar är pengar som ges ut av en regering och har status som lagligt betalningsmedel – alltså en nations officiella valuta.

Ordet “fiat” kommer från latin och betyder ungefär ”ske så”, vilket anspelar på att valutan fått sitt värde genom en statlig förordning, inte genom något fysiskt innehåll som guld eller silver.

Fiatpengar trycks av landets centralbank och används i vardagen för att betala varor och tjänster. Sedan 2020 räknas all internationell valuta som fiat, vilket innebär att dess värde bygger på allmänhetens förtroende för staten – inte någon underliggande råvara.

Centralbanker styr penningpolitiken och bestämmer hur mycket pengar som finns i omlopp. Exempel på fiatvalutor är US-dollar, euro, brittiska pund, japanska yen och svenska kronor.

Fiatpengar vs fiatvaluta – finns det en skillnad?

I praktiken betyder fiatpengar och fiatvaluta samma sak. Båda syftar på den valuta som används i ett land, utgiven av staten. Idag finns cirka 180 fiatvalutor i världen, och växelkursen visar värdet av en fiatvaluta jämfört med en annan.

Fiatvaluta vs råvarubaserad valuta

Den största skillnaden mellan fiatpengar och råvarubaserad valuta (commodity money) handlar om inneboende värde.

- Fiatvaluta har inget eget värde – den är värdefull eftersom staten säger det.

- Råvarubaserad valuta har värde baserat på sitt innehåll, till exempel guld- eller silvermynt.

Fiatvaluta fungerar tack vare förtroende, medan råvarubaserad valuta bygger på faktiska tillgångar.

Hur uppstod fiatvalutor?

Allt började med enklare system för att spåra skulder – något vi idag skulle kalla IOU (”I owe you”). Här är en kort sammanfattning av fiatpengarnas historia:

🔄 Byteshandel

Förr bytte man varor direkt. En bonde kunde byta 2 kg mjöl mot 10 pumpor vid skörd. Ett handskrivet löfte kunde fungera som kvitto.

🪙 Från guld till mynt

Guld blev en accepterad bytesvara, men var svårt att väga vid varje köp. Så länder började prägla standardiserade mynt i specifik vikt – enklare, tryggare och mer pålitligt.

🏦 Banker införs

Eftersom guld var tungt att bära, började folk förvara det i banker. Banken gav ut kvitton som bevis på innehav – dessa kunde bytas tillbaka mot guld.

💵 Papperspengar

Regeringar började själva trycka kvitton (sedlar), som representerade det guld de förvarade. Men med tiden slutade folk lösa in sedlar mot guld – de använde istället pappret direkt som valuta.

Varför lämnade vi guldstandarden?

Det fanns flera problem med att knyta pengar till guld:

- Om någon hittade mycket nytt guld sjönk värdet på alla valutor.

- Länder kunde manipulera guldflödet och påverka andra ekonomier.

Därför avskaffades guldstandarden, och vi gick över till ett system där pengar bara är värda det som står på sedeln – "på dekret".

Är fiatpengar fortfarande relevanta?

Ja. Trots framväxten av kryptovalutor är fiatpengar fortfarande grunden i världens ekonomi.

Bitcoin och andra kryptovalutor har öppnat dörren för nya sätt att tänka på pengar, och vissa länder har till och med erkänt Bitcoin som lagligt betalningsmedel. Men fiatpengar dominerar fortfarande den globala handeln – och kommer sannolikt att fortsätta göra det.

Vad är CBDC?

En spännande utveckling är CBDC – Central Bank Digital Currency. Det är en statligt kontrollerad digital valuta, som använder blockkedjeteknik men är kopplad till landets fiatvaluta.

CBDC:

- Är digital men kontrolleras av centralbanken

- Har stabilt värde (ingen prisvolatilitet)

- Kombinerar det bästa av två världar: traditionell valuta + modern teknik

CBDC är alltså ett nytt sätt att distribuera fiatvaluta – utan att helt ersätta den.

Slutsats

Fiatvaluta må sakna ett fysiskt värde i sig, men den fungerar tack vare tillit, struktur och statlig styrning. Även om kryptovalutor utmanar det etablerade, är fiatpengar fortfarande ryggraden i den globala ekonomin.

Och även om pengarnas form förändrats genom historien – från glänsande stenar till digitala tokens – så handlar det fortfarande om ett gemensamt förtroende. Framtiden kan mycket väl inkludera både fiat, kryptovalutor och nya hybrider som CBDC.

Det som började som ett skämt har utvecklats till ett globalt fenomen – Dogecoin är idag en av de största kryptovalutorna sett till marknadsvärde. I den här guiden dyker vi ner i Dogecoins ursprung, vad som gör den unik, och hur den står sig jämfört med Bitcoin.

Dogecoin har lett vägen för meme-baserade kryptovalutor och blivit en oväntad favorit – tack vare sin låga prisnivå, breda community och starka synlighet på nätet. Visste du att det finns fler Dogecoin i omlopp än både Ethereum och Litecoin tillsammans?

Vem skapade Dogecoin?

Dogecoin skapades 2013 som ett skämt – baserat på den virala Shiba Inu-memen. Bakom projektet stod utvecklarna Billy Markus och Jackson Palmer, som ville göra en humoristisk poäng kring Bitcoin-hypen. Men projektet visade sig få ett långt större genomslag än någon förväntat sig.

Vad är Dogecoin?

Dogecoin är ett peer-to-peer betalningsnätverk där DOGE fungerar som den inhemska valutan. Kryptovalutan bygger på en hårdfork från Litecoin-nätverket och har ingen övre gräns för hur många mynt som kan skapas – i dagsläget finns över 131 miljarder DOGE i omlopp.

DOGE används främst för mikrobetalningar online, som till exempel att "tippa" bra innehåll på sociala plattformar som Reddit och X (tidigare Twitter).

Vad ligger bakom Dogecoins uppgång?

En av de främsta anledningarna till Dogecoins popularitet är Elon Musk. Tesla-VD:n har vid flera tillfällen nämnt DOGE i sina inlägg på sociala medier, vilket lett till kraftiga prisökningar. Hans tweets har till och med noterats som prisdrivande händelser på CoinMarketCap.

DOGE fungerar med liknande teknik som Litecoin och använder Scrypt-algoritmen i Proof-of-Work, vilket gör den snabb – en transaktion tar ungefär en minut.

Hur fungerar Dogecoin?

Dogecoin bygger på blockkedjeteknik och använder ett Proof-of-Work-system för att validera transaktioner. Användare behöver en digital plånbok för att kunna skicka, ta emot eller lagra DOGE. På det sättet fungerar DOGE likt andra kryptovalutor.

Under det senaste året har Dogecoin ökat kraftigt i värde, delvis tack vare uppmärksamheten från kända profiler och växande intresse från investerare. Dess marknadsvärde har till och med pressat ut Litecoin från topp 10-listan och närmat sig Ethereum.

Dogecoin Foundation

År 2014 startade Dogecoin-teamet en ideell stiftelse för att driva projektets utveckling. Efter några års tystnad återlanserades stiftelsen 2021 med ett starkt uppdaterat team – inklusive Ethereum-grundaren Vitalik Buterin och Jared Birchall, Elon Musks affärschef.

Stiftelsen träffas varje månad och medlemmarna ansvarar för olika områden: Billy Markus sköter communityn och memekulturen, Max Keller är teknisk rådgivare, Buterin agerar blockchain-expert och Birchall ansvarar för de juridiska och ekonomiska frågorna.

Dogecoins community

Dogecoin har haft en engagerad följarskara från start. Communityt har bland annat samlat in pengar för att sponsra en NASCAR-förare och hjälpa det jamaicanska boblandslaget till OS 2014.

Idag stöds DOGE av profiler som Elon Musk och miljardären Mark Cuban. Cubans NBA-lag Dallas Mavericks accepterar till och med Dogecoin som betalningsmedel för biljetter och merch.

Vad är skillnaden mellan Dogecoin och Bitcoin?

Trots att båda är digitala valutor med Proof-of-Work är skillnaderna stora:

- Hastighet: Dogecoin hanterar transaktioner på cirka 1 minut – Bitcoin tar 10.

- Utbud: Bitcoin har ett fast tak på 21 miljoner mynt (deflationärt), medan Dogecoin har ett obegränsat utbud (inflationärt).

- Användning: Bitcoin används främst som ett värdeförråd. Dogecoin används mer som ett digitalt "dricks-system" för betalningar.

DOGE passar därför bättre som ett dagligt betalningsmedel, medan BTC ofta används för långsiktig förvaring.

Hur köper jag Dogecoin?

Dogecoin har gått från meme till marknadsledare på bara några månader, med över 5 000 % i tillväxt under en period.

Om du vill lägga till DOGE i din kryptoportfölj kan du enkelt köpa den via Tap-appen. Appen gör det möjligt att köpa, sälja och lagra DOGE tillsammans med flera andra digitala valutor, direkt från mobilen – med både krypto- och fiatbetalningar.

Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started