As AI assistants evolve, GPT-5 and Claude Sonnet 4.5 stand out as the most capable large language models yet. Dive in and see how they stack up.

Keep reading

2025 has been a defining year for AI. OpenAI’s GPT-5 and Anthropic’s Claude Sonnet 4.5 have raised the bar once again, each one aiming to blend stronger reasoning, longer memory, and more autonomy into one seamless system. Both are built to handle coding, research, writing, and enterprise-scale tasks, yet their design philosophies differ sharply.

This breakdown explores how the two stack up across performance, reasoning, coding, math, efficiency, and cost, helping users and teams decide where each model truly shines.

A Quick Overview

Claude Sonnet 4.5 builds on Anthropic’s refined Claude family. It extends memory across sessions, handles million-token contexts via Amazon Bedrock and Vertex AI, and features smart context management that prevents sudden cut-offs. It can run autonomously for 30 hours on extended tasks, making it ideal for ongoing workflows.

Meanwhile, GPT-5 is OpenAI’s flagship successor to GPT-4, tuned for agentic reasoning, where the model plans, executes, and coordinates tools on its own. Its adaptive reasoning system dynamically chooses between shallow or deep “thinking” paths, letting users balance speed, cost, and depth per task. GPT-5 also offers specialized variants (Mini, Nano) for lighter workloads.

Reasoning and Analysis

Both models far exceed their 2024 counterparts, but they differ in how they reason.

GPT-5’s deep-reasoning mode significantly boosts performance in multi-step logic, scientific, and spatial tasks. It can break problems into chains, test sub-hypotheses, and self-correct mid-process. However, disabling this mode reduces accuracy sharply, it can be brilliant when “thinking deeply,” but more variable when not.

Claude Sonnet 4.5, by contrast, stays stable even without added configuration. It’s particularly strong in financial, policy, and business logic, where structure and coherence matter more than creative leaps. For enterprise Q&A or decision support, that predictability is valuable.

If you want an AI that reasons steadily, Claude takes the lead. If you need exploratory logic (i.e. complex hypothesis testing or cross-domain synthesis) GPT-5’s deeper path is unmatched.

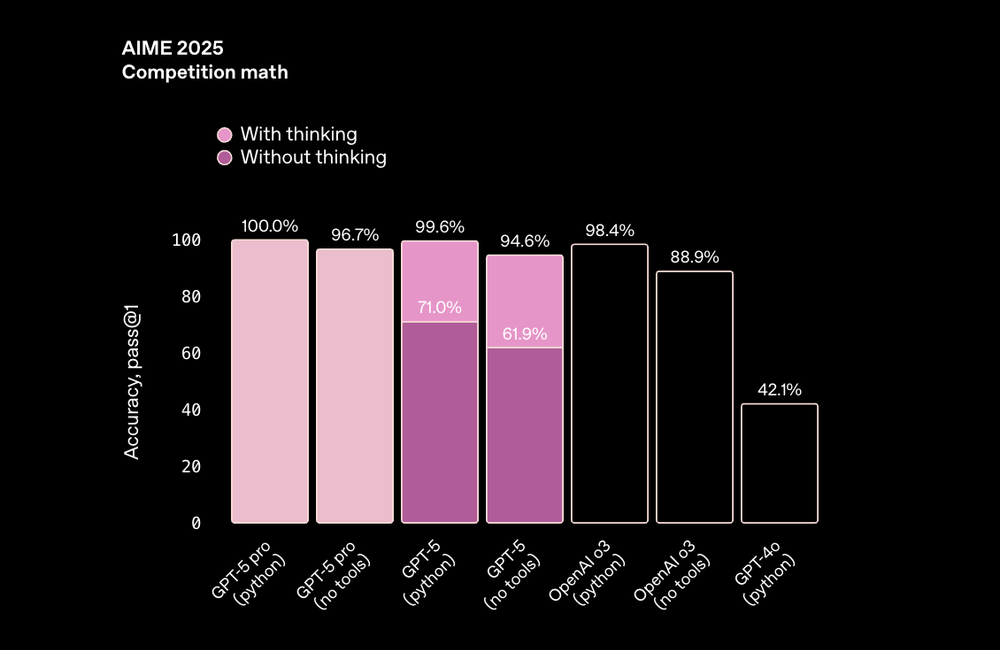

Math and Structured Problem Solving

As seen in the benchmarks provided by Anthropic, Claude Sonnet 4.5 continues its consistency streak. Whether calculating directly or using Python tools, it achieves top-tier math accuracy. This means it handles structured logic even in constrained environments.

GPT-5 also reaches near-perfect accuracy, but only when tool use and reasoning depth are active. Disable them, and results drop noticeably. It relies heavily on its reasoning pipeline to stay sharp.

Verdict:

- Claude Sonnet 4.5: dependable out-of-the-box math solver.

- GPT-5: flexible but needs tuning to perform at its best.

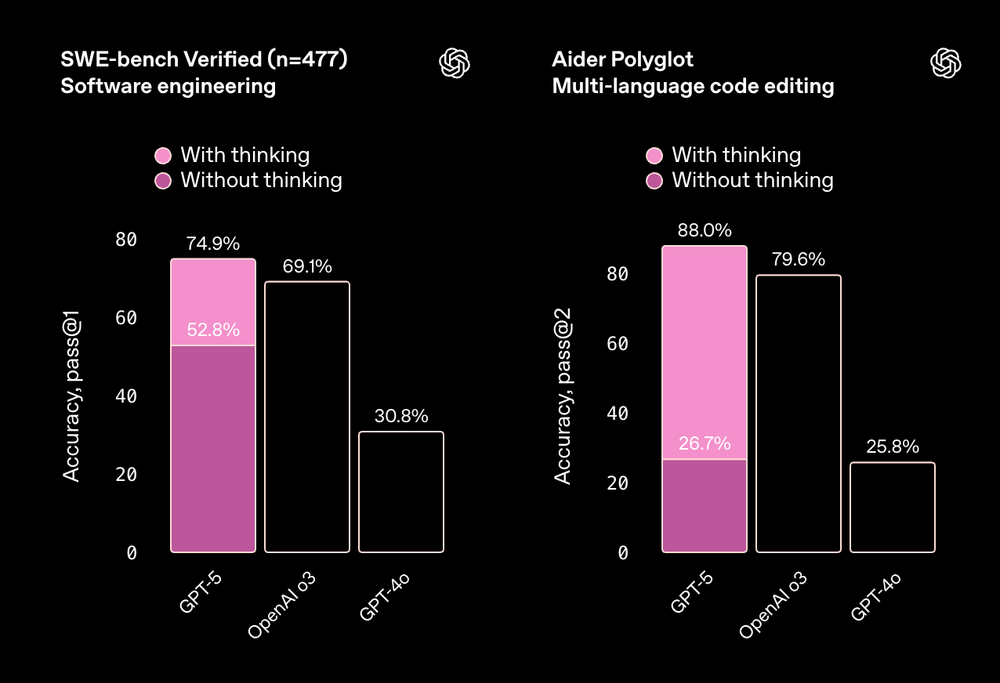

Coding and Software Engineering

When it comes to coding, the two models diverge in style.

Claude Sonnet 4.5 delivers stable performance without special tuning. In tests resembling HumanEval+ and MBPP+, it maintains high accuracy across conditions, making it dependable for production pipelines. Its strength lies in consistency, results rarely fluctuate, which is crucial for enterprise use.

By contrast, GPT-5 achieves higher peak scores when its advanced reasoning is enabled, especially in multi-language or large-project contexts. In JavaScript and Python refactoring tasks, for instance, it outperformed Sonnet when its “high-reasoning” mode was active — though baseline runs without that mode varied more.

For agentic coding, where the AI calls external tools or terminals, Sonnet 4.5 often executes with fewer dropped commands. GPT-5, on the other hand, can chain more tool calls simultaneously, making it better for complex orchestration, provided you configure it carefully.

Verdict:

- Claude Sonnet 4.5: predictable, steady engineering partner.

- GPT-5: versatile powerhouse, but performance hinges on setup.

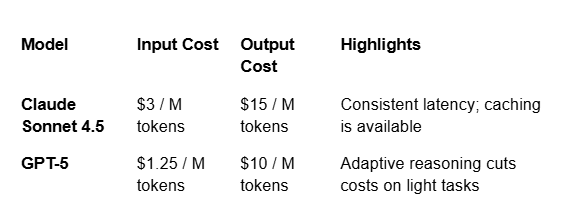

Cost and Efficiency

GPT-5 is clearly cheaper per token, particularly for large inputs. Its adaptive router also saves compute by running simple prompts on lighter paths.

Claude Sonnet 4.5 charges more but maintains predictable latency, a key factor for production environments that value reliability over marginal savings. For very large prompts, its cost rises faster than GPT-5’s, though batch discounts narrow the gap.

TL;DR: GPT-5 wins on price and scalability, whereas Claude wins on timing consistency and stability.

Pricing for Premium Plans

Beyond API access, both OpenAI and Anthropic offer premium subscriptions for individual users, which differ in features and pricing.

ChatGPT Plus, powered by GPT-5, is priced at $20 per month, giving users priority access to GPT-5, faster response times, and early access to new features and memory. OpenAI’s unified ChatGPT experience also includes file uploads, image generation, and custom GPTs.

Claude Pro, meanwhile, costs $20 per month as well and grants access to Claude Sonnet 4.5, offering faster responses, higher rate limits, and longer context windows. While it lacks built-in multimodal tools, Claude focuses on text clarity and structured reasoning, appealing to researchers, analysts, and writers seeking dependability over versatility.

TL;DR: both Plus plans are tied in price; what sets them apart, however, is their offering.

Different Strengths for Different Needs

It’s tempting to crown one “best,” but GPT-5 and Claude Sonnet 4.5 serve different priorities for different users and teams.

- Claude Sonnet 4.5: best for reliability and sustained performance. If you want consistent outputs and clear memory behavior, Claude delivers.

- GPT-5: best for depth, flexibility, and scalability. When configured properly, it surpasses rivals in creative reasoning, multimodal integration, and adaptive tool use.

Most teams may find the strongest setup is multi-model, using Claude where consistency matters most, and GPT-5 for data-intensive workflows.

Ultimately, these aren’t just chatbots anymore, they’re full-fledged digital collaborators, each with distinct personalities. Claude Sonnet 4.5 is your calm, methodical analyst. GPT-5 is your ambitious polymath. Which one you pick depends less on their individual benchmarks and more on your mission.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

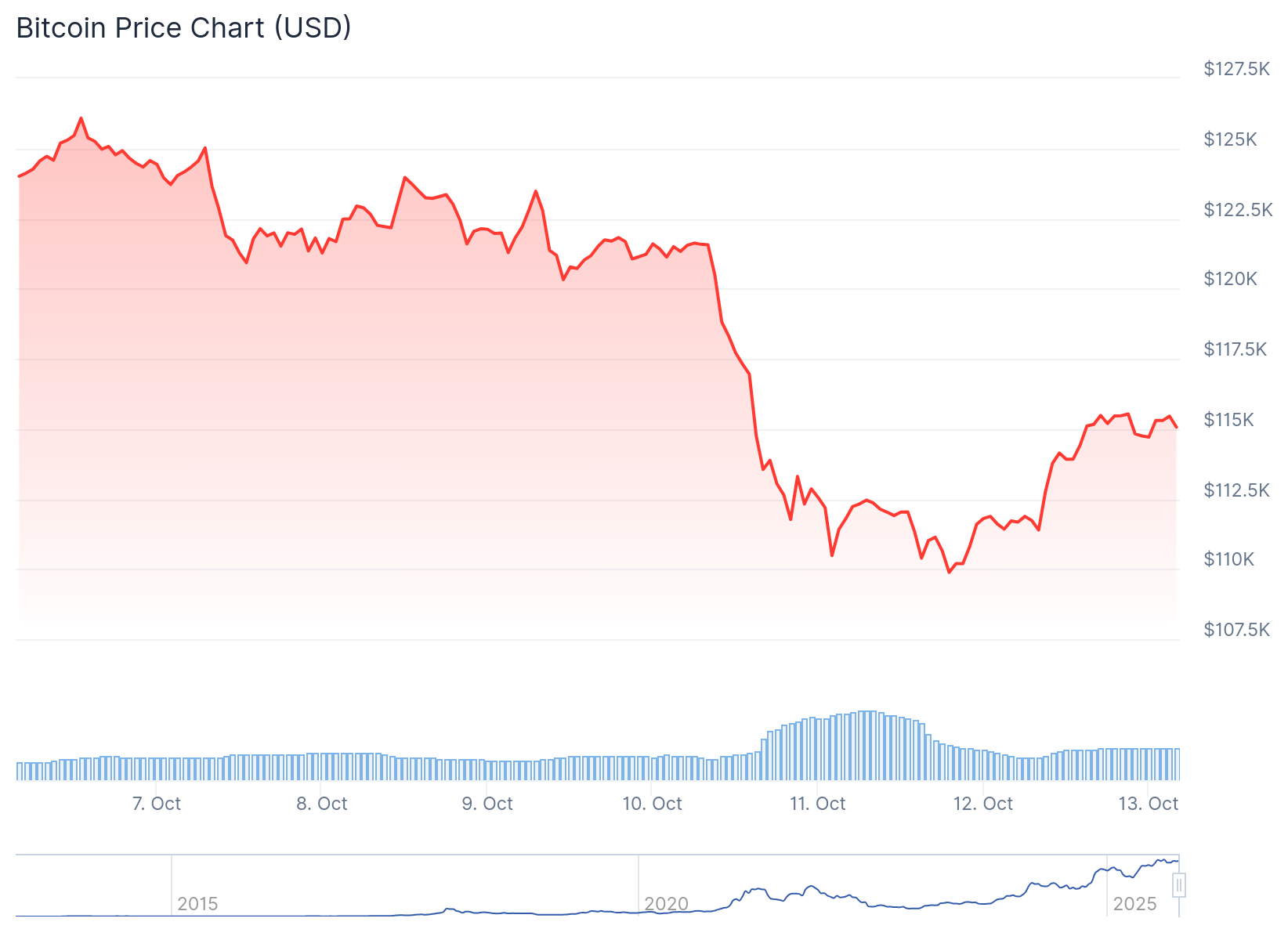

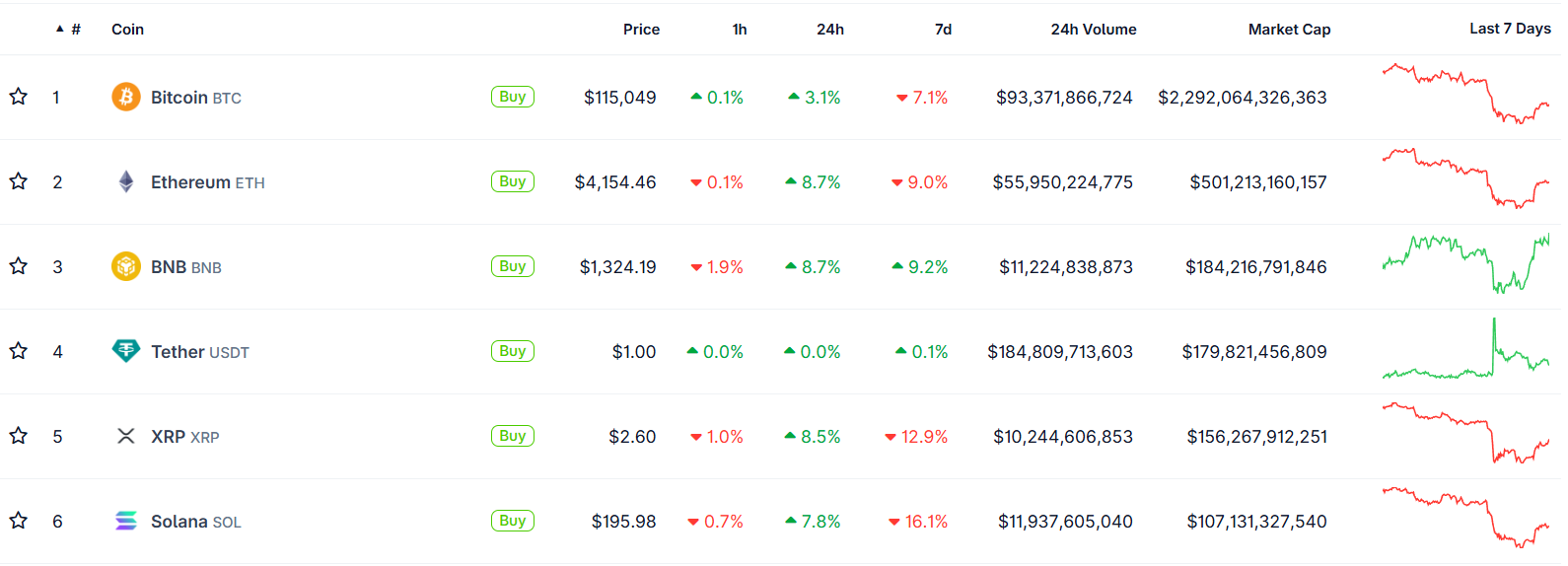

The Crash That Shook It All

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

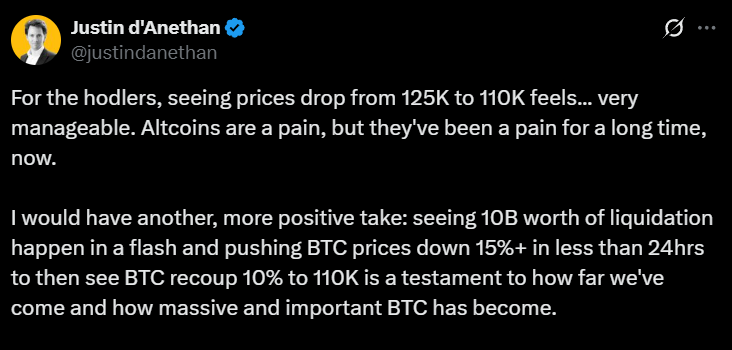

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

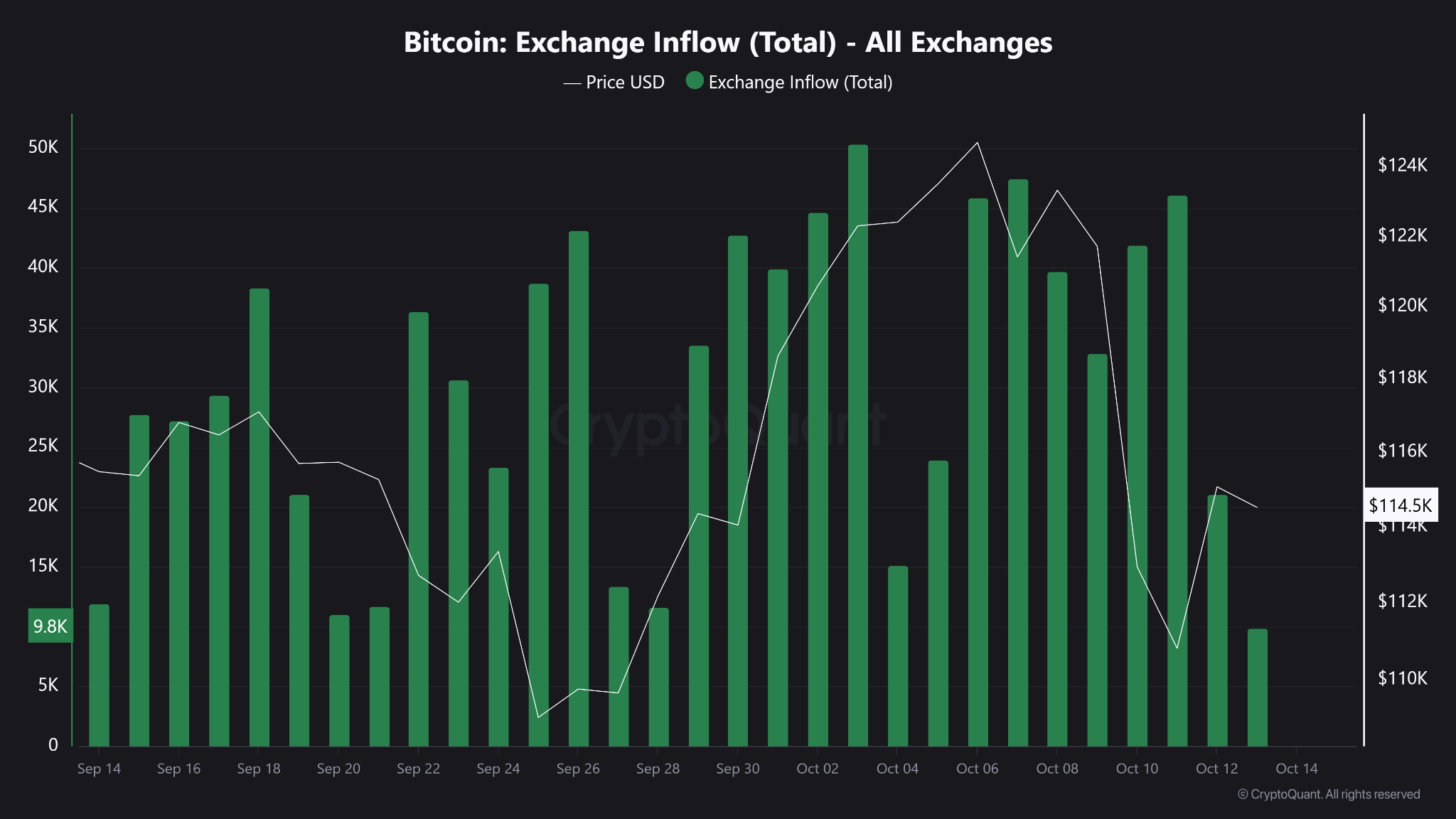

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

LATEST ARTICLE

The financial industry has seen significant growth within its digital sector due to the adaptation required during Covid-19. With the increased interest in digital payments has come the rise of virtual cards.

Shopping online and online purchases continue to break barriers that traditional financial institutions never predicted. While these institutions do allow users to do online shopping, there are still a lot of limitations and risks to be wary of.

Every time you shop online, you risk your account number and details being stolen and used against you. Credit card companies have had to evolve, and one way they have done that is through the introduction of an actual account-linked virtual card.

How do virtual credit cards and debit cards work?

Virtual cards are stored on your mobile device and can be used to make contactless payments in store or online. A virtual card has its own unique card number, CVC, and expiration date. These virtual cards are simply a copy of your physical card, linked to your bank account, and stored on your application or phone. Think of it as an online account and card.

Virtual cards are very similar to an actual credit or debit card, with the main difference being that they only exist digitally, and can not be used to withdraw physical cash. Virtual credit cards provide the same features and mechanics as traditional credit and debit cards.

A virtual credit card still has an expiry date and 16-digit account number, and CVV codes. They are connected to payment networks like Visa and Mastercard and are generally accepted by merchants who use physical card machines, similar to Apple and Google Pay.

Your virtual card information and virtual credit card number are stored digitally, eliminating the risk of someone stealing your card and simply entering your details when shopping online.

Virtual credit cards act as digital wallets, providing more advanced security and ease of online access. Virtual cards are created for one-time use or act as a temporary account number, but what are the benefits of a limited-use virtual card number? Let’s get into it.

Benefits of a virtual credit card

The first and foremost virtual credit card feature benefit that you can expect is an enhanced layer of security. To combat fraudulent activity, a data breach, and account information being stolen, virtual cards have randomly generated and disposable card numbers. This makes virtual cards one of the safest payment methods, eliminating physical and confirmed details, meaning your temporary information can not be stolen or lost. If your info is compromised, you can cancel it without having to create a new bank account or waiting for a new card in the mail.

Control and customization is an additional layer of benefits users can expect from using virtual credit cards. Users can customize how many virtual account numbers they want, set spending limits, choose their preferred currencies, and more. Similar to a normal debit card account, you can also create recurring payments with merchant details, as tailored to the amount, time, and so on.

Some virtual credit cards provide users with point-earning rewards or store credit when used. Credit card companies can also easily access your information to improve your credit score based on your recurring payments set up.

Creating multiple virtual debit cards allows you to distribute, allocate, and track funds with ease. This means at the end of the day, you have more visibility of your funds going in and out and can create a dedicated virtual debit card for a specific area of your financial responsibilities.

Getting your virtual card number

Whether you are trying to manage your funds with your debit or credit cards accounts, a virtual card can make matters easier. All you need is a debit or credit card account, such as the one offered by Tap and you can create your unique virtual card at the click of a button. With some traditional banks you can even create multiple cards if you want, each with its own unique account number and expiration date.

These digital wallets and accounts provide ease when you want to shop online, avoid physical wallet and card theft, as well as easier fund management. A virtual debit card is a big part of the future, as we move into the digital era.

Experience a whole new world of digital payments and money management from the safety of your mobile device. You should be able to use your virtual card at any merchant that accepts debit and credit card payments, or contactless transactions, such as Apple Pay or Google Pay. Create your virtual account number today and enjoy purchases online and in-store. The future of payments is here.

In recent years, cryptocurrency, and therefore cryptocurrency exchanges, have firmly established themselves in the global financial market. As they become increasingly popular, many concerns have been raised over the regulation of these entities, and how they are preventing illicit monetary activity from taking place.

In an attempt to crack down on funds being illegally moved, exchanges are required to implement KYC (Know Your Customer) and AML (anti-money laundering) policies. Regulatory bodies are working to build legal frameworks for the industry, in an attempt to fight crime conducted using blockchain technology.

The biggest challenge for these regulatory bodies is to find a solution that doesn't hamper the innovative qualities of cryptocurrencies.

In the UK there is the Financial Conduct Authority, a financial regulatory body that operates outside of the UK government. In 2020, the FCA required every company participating in any crypto activity in the sector to comply with its Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 policy (the 'MLR's). This obligation requires crypto service providers to complete the necessary registration and infrastructural requirements.

What is AML in crypto?

AML stands for anti-money laundering and involves protocols that ensure that every transaction can be tied to an identity, thus providing greater transparency. This ensures that if any suspicious activity is flagged, the origins and/or destination of the funds can be confirmed on the platform.

Due to the anonymous, or more accurately pseudonymous, nature of cryptocurrencies, many believe that it provides an easy opportunity for ill actors to engage in money laundering. Money laundering is the act of changing large amounts of illicit income into a legitimate avenue, the money is "laundered" so as to appear clean.

While cryptocurrencies seemingly provide a perfect platform for money laundering due to the lack of central authority or third parties, AML processes are implemented on exchanges to stop this activity in its tracks.

What are the risks hindering AML practices?

The first risk that challenges AML practices is privacy coins, cryptocurrencies designed to conceal transactions and the relevant information attached to them. Platforms like Monero offer users the opportunity to send funds with no record of the transaction taking place.

The data associated with the transactions like the sender, receiver and amount sent are encrypted and often broken up when stored on the blockchain to ensure they are untraceable.

The second risk is coin join platforms that mix cryptocurrency transactions, hiding the origin and destination of the funds. These platforms essentially provide a service that can make ordinary cryptocurrencies anonymous.

While cryptocurrencies have their benefits, there are a number of challenges they pose to regulatory bodies, AML and CFT (Combating the Financing of Terrorism) intentions:

- The anonymity they can provide

- Opportunity for gaps when transacting cross-border transactions

- Absence of one central authority to ensure compliance

- The limited scope of identity verification processes

Differentiating between illicit activity and investors just wanting to safeguard their investments is a tricky business. Bad actors might make use of paper wallets to hide funds and keep them secret, while an investor might make use of a paper wallet in order to protect their funds against theft.

AML in crypto exchanges

Despite the challenges it faces, AML has proven to be valuable in cracking down on illegal activity conducted on crypto exchanges.

In July, $1.45 billion worth of illegal cross-border crypto transactions were traced back to 33 individuals on the South Korean exchange, Bithump. The platform quickly banned all foreign transactions, requiring a mobile KYC verification, and increased the KYC requirements so as to align with the country's AML regulations.

Bitcoin ATMs, a notorious option for mixing funds, have come together to form the Cryptocurrency Compliance Cooperative (CCC). This operation calls for cash-based cryptocurrency services, financial institutions, and regulators to participate in building universal compliance factors.

Does AML help or hinder the crypto market?

While AML tends to go against the decentralized nature of cryptocurrencies, the crypto community actively welcomes these regulatory efforts as it drives more trust and interest in the market on top of innovation and adoption. For example, an institution or retail investor is more likely to invest in a regulated asset than in a lawless, anything-goes market.

Anyone that has been watching the markets closely for the last several months will have noticed a definite chill in the air (not to mention a decline in their money). As the bears become more prominent, weak hands are losing faith and exiting the market. Why are we talking about a cryptocurrency winter now? Before we firmly declare this to be a crypto winter, let's explore the recent dips of the digital asset market and what previous crypto winters have detailed.

What is a cryptocurrency winter?

A cryptocurrency winter is a term used in the crypto market to describe a long term bear market. A bear market is classified as a declining market where shares have fallen below 20%. Investors typically call it a crypto winter when the markets have struggled to reclaim highs previously witnessed (usually right before the winter set in). Does that mean cryptocurrency investors should take out their snow shoes? Metaphorically, yes. And by snow shoes we mean thick skin and strong hands.

The recent market climate (five month period).

Since reaching its most recent all-time high, Bitcoin has dropped over 40%. After reaching highs of $68,789.63 in November 2021, Bitcoin has gone through a red-tainted slump reaching lows of $33,710 in late January and since recovering to just under the $40,000 mark.

Ethereum, the second-biggest cryptocurrency, has experienced a similar fate, dropping from highs of $4,891 in November 2021 to lows of $2,211 in late January. Ethereum has since corrected to the $2,800 region as it generates interest in its move to a Proof-of-Stake consensus.

It's no secret that the stock markets have suffered a similar fate in recent months, with seemingly only gold remaining unscathed. Experts have suggested in various articles that the uncertainty in global politics is playing a considerable role in the decline of various markets and businesses.

Buterin confirms a crypto winter

As touched on above, the current ongoing war between Russia & Ukraine has played a large role in driving investors' uncertainty as prices bounce through the highly volatile period. While we've seen an increase in trading volume, there have also been strong price swings.

This paired with the declining prices has led to a downfall in companies and traders entering the market, further fuelling the problem. This has become known in the industry as a crypto winter.

Ethereum founder, Vitalik Buterin, recently confirmed the case, although he also highlighted the positives, particularly for those on the development side. He pointed out that crypto winters offer a period of rejuvenation for the industry, allowing unsustainable projects to fall away.

"They welcome the bear market because when there are these long periods of prices moving up by huge amounts as it does - it does obviously make a lot of people happy - but it does also tend to invite a lot of very short-term speculative attention."

He added that it encompasses a "time when a lot of those applications fall away and you can see which projects are actually long-term sustainable, like both in their models and in their teams and their people." If one factors the development side of things in, we can bank on the industry coming out stronger after this period.

Unwrapping the previous crypto winter

The last crypto winter we experienced took place in 2018 after the highs of December 2017 (when Bitcoin almost reached $20,000). This bear market continued until mid-2019 before it started showing signs of recovery. It wasn't until Bitcoin defied the odds in 2020 and overcame the pandemic that it soared to higher heights, almost triple that of the previous all-time high.

While losing 40% of its value this season sounds rough, the previous crypto winter saw losses of 84%. As cryptocurrencies further emerge themselves into the mainstream financial markets, many believe it is only a matter of time before the prices enter the green again. Time also tends to play a regulator role when it comes to changing crypto seasons.

Bitcoin's four year cycle theory

There is a growing belief in the industry that Bitcoin has a definitive four-year cycle of prices rising and falling. This aligns with the halving mechanism which takes effect every 210,000 blocks, or roughly every four years.

The halving, the last of which took place in May 2020, halves the rewards given to miners for verifying transactions and effectively halves the number of new coins entering circulation. History has shown that a bull run succeeds these events, roughly twelve to eighteen months later.

Surviving the chill

While many can agree that the crypto winter is upon us, there is no saying how long it might last, or how low it may go. Analysts suggest that traders use the time to sharpen their investment strategies and implement plans of action that keep risk to a minimum. As blockchain and cryptocurrencies have already passed a significant milestone in their adoption, there is no stopping it now. For any traders concerned over the crypto winter, fear not. It will pass.

It's 2025 and you've decided to get involved in the crypto industry and find out what the fuss is all about. You've made a smart choice, and we're pleased to welcome you. In this step-by-step guide, we'll be showing you a simple overview of how to complete the following:

- Create an account

- Deposit funds

- Buy Bitcoin, Ethereum or any other cryptocurrency

- Sell a cryptocurrency

- Withdrawal funds

Investing in digital currencies can feel daunting at first, but once you've made your first purchase, transaction, or sale, you'll see that using cryptocurrencies is simpler than expected. Be sure to keep an eye on market prices, as volatility in the crypto industry can go through waves, and educate yourself on the coins that you wish to purchase. Whether you're a trader/investor in the UK, EU, EEA, or USA, everyone can gain access to the crypto markets through the Tap mobile app.

In this article, we're going to show you the ropes, guide you through the process and explain step-by-step how to gain the skills to successfully operate in the crypto space and increase your investment portfolio. No previous trading experience is necessary (stocks or crypto).

Step 1: create an account

The first and most important decision to make before buying cryptocurrencies is determining where to buy them from. With plenty of options available on the market and plenty more news stories about them, it's imperative that you select a trustworthy and reliable source.

The Tap mobile app ticks these boxes and proves so by being licensed and regulated by the Gibraltar Financial Services Commission. The platform has over 300,000 registered users, at the time of writing, operates in 28 countries across the globe, and has been nominated multiple times for PAY360 Awards (previously the Emerging Payments Awards).

To create an account on Tap, simply follow these steps:

- Download the Tap mobile app from either the Apple or Google Play store.

- Create an account by filling in the relevant information. If you make a mistake, simply go back and alter it before moving to the next step.

- Once the account is set up you will be asked to complete the KYC / identity verification process. Simply follow the onscreen prompts and submit the required information.

- You will receive an email confirmation once your account is all set up.

Step 2: deposit funds

In order to buy cryptocurrency through the Tap app, you will need to deposit funds. This can be done in both crypto and fiat currencies, however, we will focus on the fiat deposits today.

- Select the Cash option in the top horizontal menu.

- Select the fiat currency you would like to deposit, your options are US dollars, Pound Sterling, or Euros.

- We're selecting GBP, then select one of the options: deposit or debit card top-up.

- Fill in the relevant information and perform the transaction.

- Once the funds have cleared they will appear in the relevant Cash wallet.

Step 3: Buy Bitcoin, Ethereum, or any other cryptocurrency

Now for the exciting part! It's time to buy digital currency. For the sake of this tutorial, we're going to show you how to buy Bitcoin, however, the process is consistent across all cryptocurrencies.

- In the top horizontal menu, select Cryptocurrencies.

- Choose the cryptocurrency you would like to purchase.

- Once in the crypto wallet, select the blue Buy button.

- You'll be given the option to decide how to pay, simply scroll to the bottom and select Pound Sterling (or the crypto or fiat currency that you deposited).

- Enter the amount that you would like to purchase.

- Select the Execute Trade button.

- Once the transaction is completed, the funds will appear in your Bitcoin wallet.

Step 4: Sell A Cryptocurrency

Now that you're familiar with how to buy crypto, it's high time you learned how to sell.

- To sell Bitcoin (or any other cryptocurrency), go to the relevant wallet in the Crypto section.

- Select the blue Sell button.

- From here you can decide whether you'd like to sell the cryptocurrency for another cryptocurrency or for a fiat currency. In this example, we'll sell BTC for GBP.

- Select the Pound Sterling option and enter the amount of BTC you'd like to sell.

- Proceed with the Execute Trade button.

- The funds will then be available in your Cash GBP wallet.

Step 5: Withdrawal Funds

Completing the final process in this step-by-step guide, we're going to explain how to withdraw funds. You have several options here as the Tap app allows users to withdraw funds directly into their bank account, instantly send funds to other Tap users, or withdraw cryptocurrencies.

- In the top horizontal menu, select Cash.

- Choose the Withdraw button, located underneath your balance.

- Select the option most preferable to you: Instant, to a Tap user; bank transfer; Crypto withdrawal.

- Follow the relevant instructions and select Execute Trade once complete.

Tap into a brighter future with crypto

On top of the simple and easy-to-use app, Tap also offers highly secure wallet solutions that are integrated into your account from the get-go. With Tap, you can securely store and manage a wide range of cryptocurrencies from one convenient location, and even more easily spend them using the Tap card.

Bitcoin 101

Here are several frequently asked questions regarding Bitcoin, the first cryptocurrency to come into existence.

Many investors have made a lot of money through the stock markets, however, in recent years a new asset class has entered the scene. Not just any asset class, the best performing asset in the last decade. While conservative investors have steered clear, many investors have incorporated cryptocurrencies into their investment portfolios.

In this article, we explore the differences between crypto vs stocks. While investments are driven by profits, understanding the difference between the two and what each one is is arguably fundamental to making any money from them.

What Are Stocks?

Stock, also referred to as equity or shares, is a financial product sold by companies that offer a percentage of ownership in the company. These "certificates of ownership" entitle the holder to dividends from the company's market performance.

Stock in a company holds equal risk and reward. Should the company have a bad year, the stock price will reflect this with a decline in the unit price, but should it perform very well the price will increase. The profits are shared through a simple transaction.

These financial products are legally considered securities and are used by businesses or governments to raise capital from the market, offering the holder part ownership in the company selling the stock. Stocks are traded on authorised stock exchanges, of which there are over 60 around the world. The most popular are NASDAQ and the New York Stock Exchange (NYSE) which manage the sales of stocks relevant to that platform.

What Are Cryptocurrencies?

Cryptocurrencies are digital assets native to blockchain platforms. The first cryptocurrency launched in 2009 and provided an alternative cash system that allowed users to transact and store their funds without the authorisation of a third party. As a solution to the global financial crisis plaguing the world at the time, Bitcoin offered a decentralized solution to people taking control of their own money.

Following the launch of development-focused Ethereum several years later, cryptocurrencies started to offer solutions beyond just payment platforms. There are over 20,000 cryptocurrencies on the market today, ranging from utility tokens to governance tokens to meme tokens.

Cryptocurrencies are defined as using blockchain technology to facilitate and maintain the network. Blockchain ensures that all transactions are recorded in a public ledger for anyone to see and are immutable. They also use cryptography to ensure the security of the network established through an elaborate means of information.

Cryptocurrencies can be traded on the following platforms, each incurring its own fees:

- peer-to-peer exchanges, where cryptocurrencies are directly traded between two users

- Decentralized exchanges, largely unregulated exchanges where there is no central authority

- Centralized exchanges, operated as a business with an entity in charge and managing operations as well as regulatory obligations

Cryptocurrencies are largely considered to be "digital commodities" around the world, however, most countries are in the process of building a legal framework to better identify and regulate the new asset class.

Due to their incredible growth and price gains over the last decade, cryptocurrencies have become a widely popular investment vehicle for both retail and institutional investors.

Do You Have to Pay Taxes on Cryptocurrency?

As is the case with profits gained from any investment, individuals are required to pay taxes on their crypto earnings. While this remains largely unregulated, most countries have created a legal framework that requires users to pay on any profits made. These levies are then paid to the government and contribute to the functioning of the country. The onus lies on the individual to establish what these laws are and adhere to them.

What Are The Difference Between Crypto vs Stocks

Below we flesh out the differences between these two financial products to build a better understanding of the two. We'll be looking at:

Ownership

Arguably the biggest difference between crypto and stocks is the ownership rights. Stock provides the holder with ownership rights vehicle cryptocurrency typically doesn't (in the traditional financial ownership sense at least).

Cryptocurrencies are designed in such a way that their decentralized nature ensures that no one owns the network. Some cryptocurrencies provide governance rights that allow the holders to vote on network changes and have a say in the development of the project.

Risk vs reward

The cryptocurrency market is renowned for being more volatile providing considerably higher risks and rewards when compared to the stock markets.

In a 5 year comparison, at the time of writing, NASDAQ has seen 167% growth while Bitcoin has seen 3,574% growth.

Liquidity

Stock markets typically hold more liquidity as most stocks can be traded across exchanges and quickly converted to cash. Cryptocurrencies, particularly the smaller capped coins, hold less liquidity, although the bigger ones like Bitcoin and Ethereum can easily be traded on most exchanges. Bigger crypto exchanges have more liquidity due to the higher trade volumes on the platform.

Regulation

Another big difference between crypto and stocks is the regulation aspect. While all stock exchanges have at least one government entity regulating all activity on the platforms, cryptocurrency is largely unregulated around the world.

Regulation in the crypto space is a developing topic as many countries are working to legally define the asset and implement it into their financial system. Having said that, most centralized exchanges are regulated, complying with laws in the countries in which they operate. For safe crypto trading ensure the platform you're using is regulated.

Investment Reasons

While both stocks and cryptocurrencies are largely invested in for profit-seeking reasons, the alternative motivators vary substantially. Some investors also invest in stocks due to the initiatives that the company supports.

Cryptocurrencies on the other hand offer several more alternative investment motivators, including:

- Getting involved in the blockchain and dapp space

- Making use of its decentralized nature and lack of centralized authority

- Exploring a more discreet means of transacting and storing value

- Supporting an innovative product that offers a high-impact solution

In Conclusion

Stocks are a more popular and regulated investment vehicle while cryptocurrencies offer a higher risk vs reward opportunity. While stocks are considered securities are largely regulated, cryptocurrencies offer higher use case potential and have proven to have higher ROIs.

Cryptocurrency and blockchain technology are not the easiest topics to understand, especially with fast and ever-growing industries forming beneath them. Even if you have a grasp on the core details, there is still a lot of external factors that come into play. While Bitcoin and other cryptocurrencies hold undeniable value, external factors still hold considerable influence and can affect the financial value of these assets.

When it comes to trading cryptocurrencies, having an understanding of the market can prove incredibly useful, while having an understanding of crypto fundamental analysis can prove to be invaluable for traders, investors, and those curious about sentiment. In order to understand why crypto fundamental analysis is so important, we need to understand what it is.

What is fundamental analysis?

Fundamental analysis can be understood as methods to evaluate the core metrics and proposition of an asset, in this case the world of digital money, cryptocurrencies. Fundamental analysis is more than looking at the price of a cryptocurrency, but rather delving deeper into the external factors that could impact the product, such as macro and micro factors.

Fundamental analysis is about looking at all the available data of a financial asset. This can include countries' sentiment towards the currency, how many people are using the digital cash every day, or even the team behind the project.

The process of fundamental analysis can be started by taking a wider outlook before narrowing it down and focusing on smaller details. You would start by evaluating the projects' market cap and how healthy the ecosystem is in terms of daily buy-in or sales data. You could then look at the projects' marketing approach, the team, and what the public has to say about the token, for an example of strategy.

To put it simply, looking at what the media is saying about Bitcoin would be an in-depth outlook, whereas just looking at the price would be considered more of a broad approach, all these factors work together to create fundamental analysis.

There are three metric areas of analysis that investors generally look at, so let's take a deeper look at those fundamentals.

Fundamental analysis metrics

These are a few of the most common metrics investors look out for, although there are definitely more things to keep in mind. At the basics of fundamental analysis, it is just doing your own research and seeing if a project aligns with what you are looking for, whether that be long-term or short-term.

The three main metrics that people evaluate are on-chain metrics, project metrics, and financial metrics. There are some things within those metrics to be considered:

On-chain Metrics

- Transaction Count

- Active Addresses

- Fees

- Hash Rate

Financial Metrics

- Market Cap

- Liquidity

- Token Supply

Project Metrics

- Whitepaper

- Tokenomics

- Competitors

- Team

These metrics will help you vet projects you potentially want to invest in or trade. Let's take a look at an example from each one. Starting with project metrics, looking at the team behind a project often shows whether they have the experience or commitment to see a project through to success. When it comes to financial metrics, understanding the token supply and the potential it has on the market cap in the future can be greatly rewarding.

Finally, for on-chain metrics, finding out how many active addresses there are within that blockchain can pinpoint whether this chain has a flourishing and healthy ecosystem for buyers and sellers. All points should be taken into consideration to verify your fundamental analysis.

Crypto fundamental analysis Q+A

After covering what fundamental analysis is, how it affects cryptocurrency investing, and what metrics to consider, let's look at some of the frequently asked questions. These are the most commonly asked questions when it comes to cryptocurrency fundamental analysis.

Is there fundamental analysis in crypto?

Yes, as outlined by this article. Fundamental analysis in crypto is very similar to that of more traditional financial assets, just with a few different metrics in place.

How do you analyse crypto?

As already stated, there are three main metrics investors and traders look at: projects metrics, financial metrics, and on-chain metrics. There are more metrics to be considered, but these have been proven to be the most helpful.

What fundamentals affect Bitcoin?

Bitcoin doesn't have much of a focus on project metrics, as it lacks a team and tokenomics for the future. The metrics relating to market cap, token supply, transaction count, active addresses, and fees are still very much important to look at.

Is fundamental or technical analysis better?

That depends on what your goal is, without going into too much detail about technical analysis, most prefer it for short-term reasoning whereas fundamental analysis can be used for short-term and long-term reasoning, although it is much better for the long term.

Does fundamental analysis work?

Yes, it most certainly does when done properly. It's basically just in-depth research of a project to see whether it has the potential to succeed or fail.

Crypto fundamental analysis conclusion

And now you know. These are the basics of fundamental analysis when it comes to cryptocurrency, as vague as they may seem, these are the markers to consider when vetting a project you want to put funds into. Sadly we can not help you vet every project you come across, but we hope this guide will assist you in more confidently doing the analysis yourself.

Every project is different, from its founding date to the project economics, but the above information should help you get a rough idea of whether it is a project you are interested in. In crypto, it always comes down to "DYOR", or do your own research, and crypto fundamental analysis is no different. Good luck and happy fundamental analysing.

Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started