November 2025 could be a turning point for crypto. From ETFs to major network upgrades, here are six catalysts that could shape the market.

Keep reading

As we move into November 2025, the crypto-market is gearing up for one of its most intriguing phases yet. From spot-ETF momentum to narrative shifts, network upgrades and real-world asset tokenization, multiple catalysts are aligning. Here are six key developments to watch.

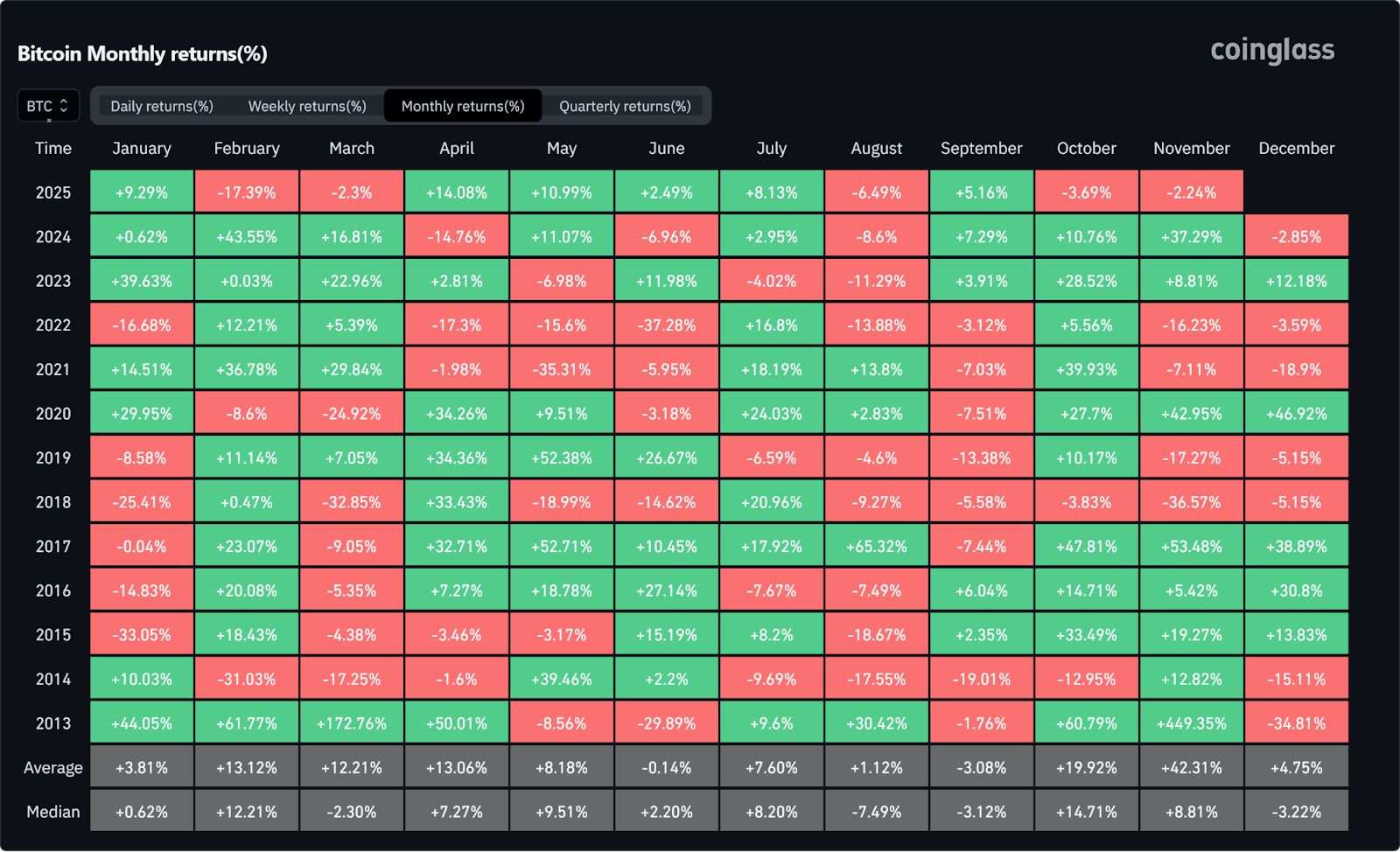

1. Seasonality & Historical Momentum Could Kick In

While "Uptober" fell short of expectations, November could tell a different story. Historically, it's been one of the strongest months for digital assets, with Bitcoin in particular averaging +42.31% gains in recent years.

When combined with the renewed ETF narrative, increased whale accumulation, and a stronger appetite for risk assets, market momentum appears to be building. Participants are closely monitoring how these dynamics could influence sentiment, especially as trading volumes and key technical levels come into play. If Bitcoin maintains stability around the $100K zone and Ethereum shows signs of renewed strength, November could become a more active month for crypto markets compared to October.

2. Ether’s Next Move Could Set the Tone for Altcoins

The final weeks of 2025 may prove pivotal for Ethereum (ETH). Although retail accumulation has paused somewhat, wallet-level data shows large holders (1,000 to 100,000 ETH wallets) added roughly 1.6 million ETH in October (around $6 billion), it’s a sign that whales and larger holders are staying active as the year winds down.

If ETH begins to break out or even stabilize around current levels, it could unlock the broader altcoin market, which has been lagging for months. The playbook that many are hoping for is the following one: ETH strength leads to improved risk appetite, which in turn sparks an altcoin rotation as investors seek higher risk exposure.

Ethereum remains the accepted benchmark for gauging sentiment across the non-Bitcoin segment of the market, and its performance frequently acts as a catalyst for capital flows into smaller assets. Keeping an eye on its fundamentals (from staking yield to liquidity shifts on major exchanges) will be important. In many ways, ETH could potentially become the gatekeeper to the next phase of the market’s recovery and the tone-setter for the coming months.

3. ETF Comeback After Delays

The recent U.S. government shutdown briefly froze several crypto-spot ETF filings, leaving the “ETF narrative” in suspense. But now the pause is over for Bitwise’s Spot Solana ETF. It has finally launched with strong early inflows, and the broader momentum is returning.

With this foundation, November could reignite the ETF trade in earnest, we may finally see filings for Ethereum staking products, new spot-Bitcoin funds and renewed institutional interest. If filings begin to stack up and regulatory engagement deepens, this could mark the next major inflection for how crypto is accessed in traditional portfolios.

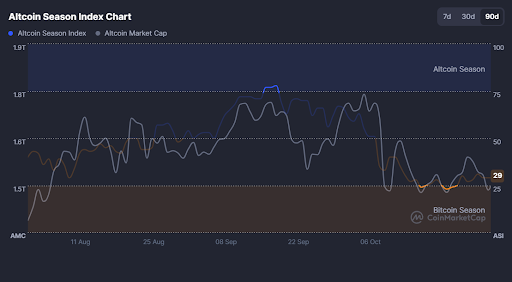

4. Altcoins at an Inflection Point

The broader altcoin sector enters November under pressure as the Altcoin Season Index sits near 29, signaling a reset after October’s downturn. But inflection points often follow pressure. If ETH sets the tone (as many are hoping for), mid-cap and high-beta altcoins (such as SOL, AVAX, NEAR) could begin to capture rotation flows.

Traders might want to watch for flow changes such as increased volumes, wallet relocations and new project launches. While caution is still prevailing, this may be the window where sentiment begins to swing back into “altcoin season”.

5. Major Network Upgrades

Technical infrastructure is not just background noise; it often creates catalyst-events. For example, Ethereum’s upcoming Fusaka Upgrade (scheduled for early December) is designed to increase layer-2 data capacity and reduce transaction costs.

Meanwhile, various Layer-2 ecosystems are preparing upgrades and cross-chain activations. One such upgrade, Shibarium Upgrade’s security overhaul on the Shiba Inu network. These events may ignite renewed network activity, developer interest and capital flows into ecosystems ready to scale.

6. Real-World Asset (RWA) Tokenization Accelerates

The tokenization of real-world assets (RWAs), such as real estate, bonds, equities, is moving from niche to mainstream. For instance, according to Standard Chartered, this market is projected to grow to around $2 trillion by 2028. Institutional interest is burgeoning, and regulatory frameworks are emerging.

As November unfolds, we may see announcements of large tokenization initiatives or new platforms bridging DeFi and traditional finance. For crypto holders and ecosystem observers, this means the familiar “crypto only” narrative is expanding into real-asset integration, a meaningful broadening of the opportunity set.

The Verdict

November 2025 is shaping up to be more than just another month. Spot-ETFs potential, ETH’s path, altcoin rotation, seasonal tailwinds, infrastructure upgrades and RWA tokenization all sit in motion. Each one individually is significant; together they create a multi-vector setup.

For those in the crypto space, whether you're holding long-term, actively trading, or building the next wave of infrastructure, November is likely to be eventful. This isn't a month to coast on autopilot. Track where capital is flowing. Pay attention to which narratives are gaining momentum and which are fading. The players are moving, and the pieces are falling into place.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

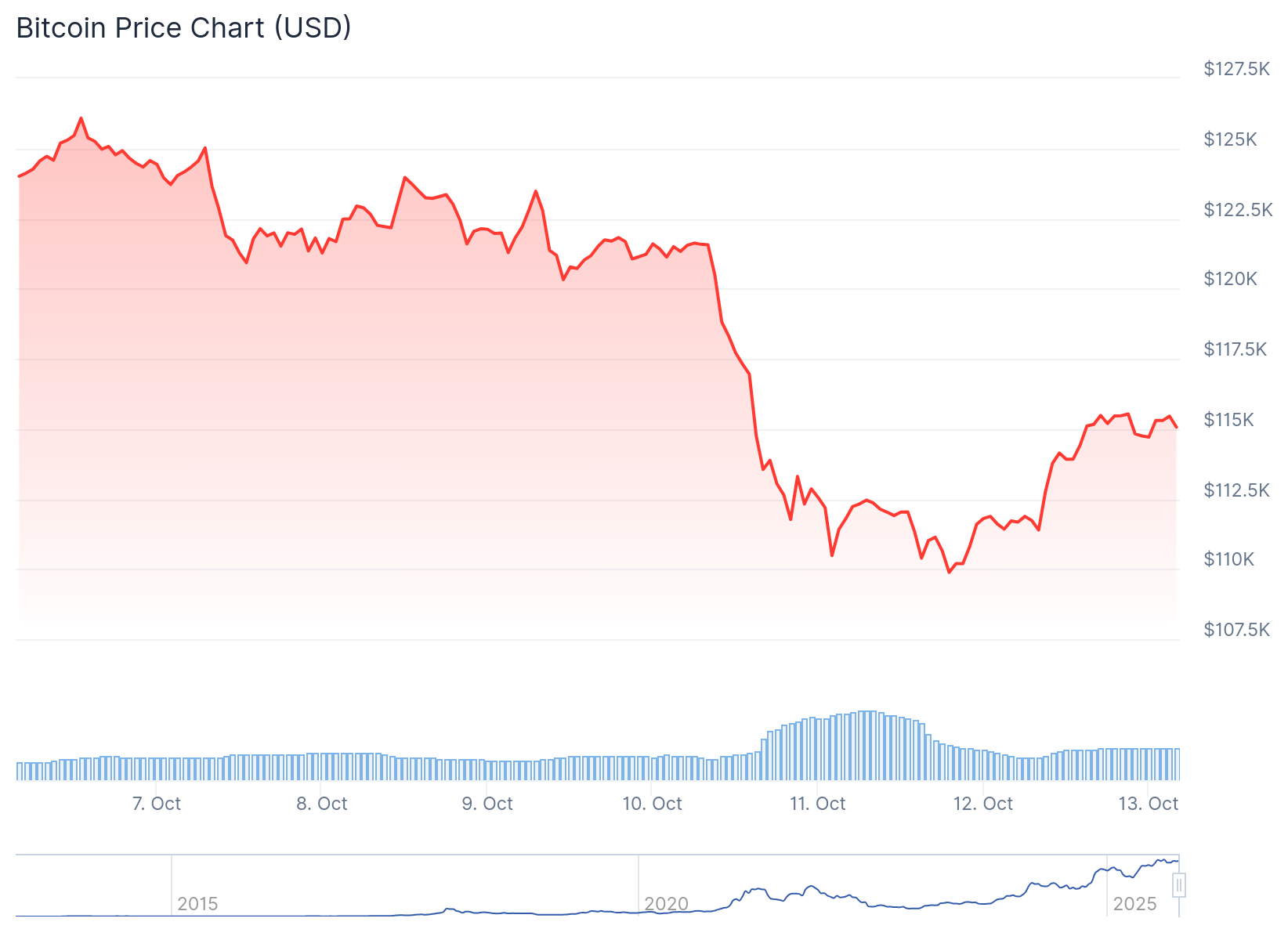

The Crash That Shook It All

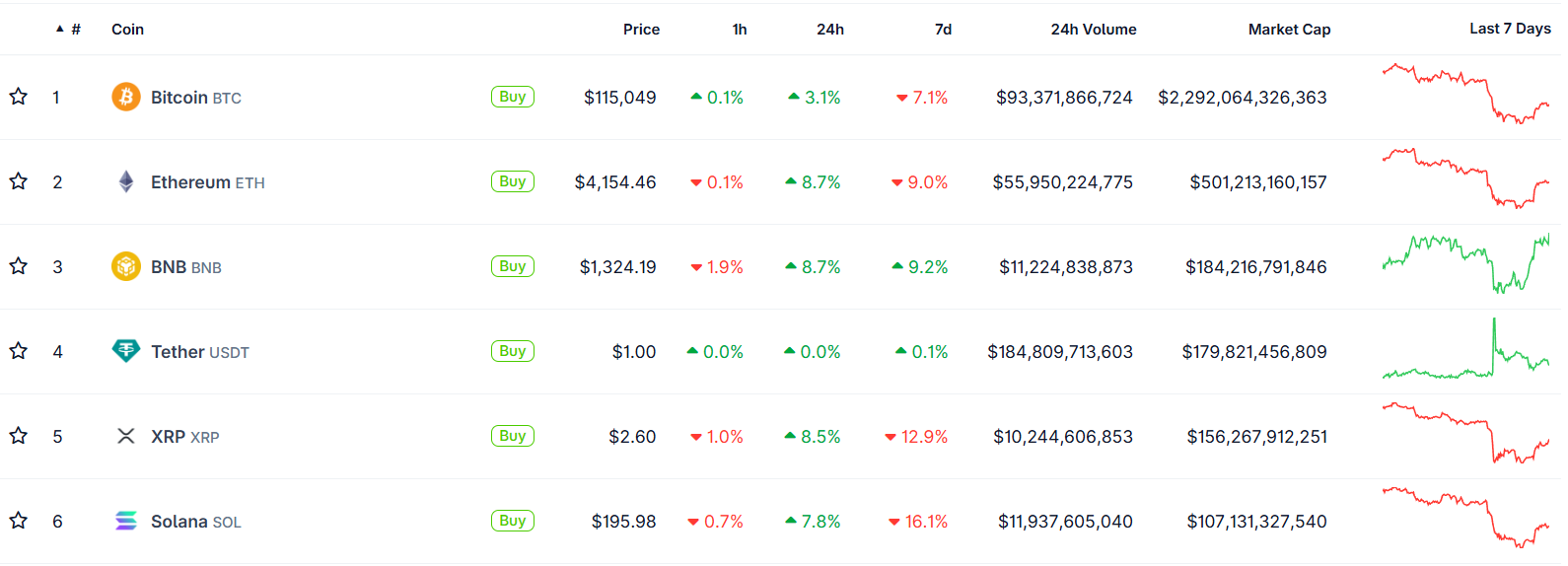

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

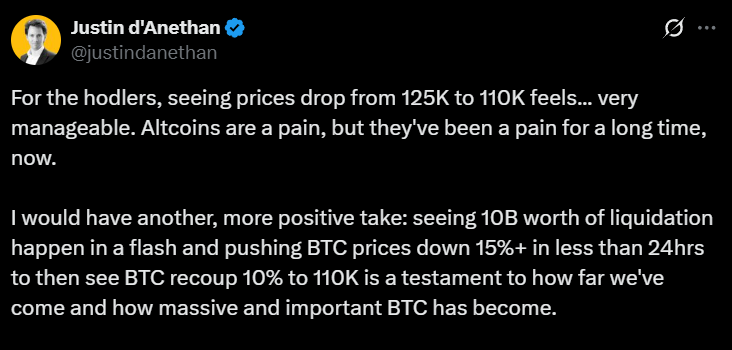

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

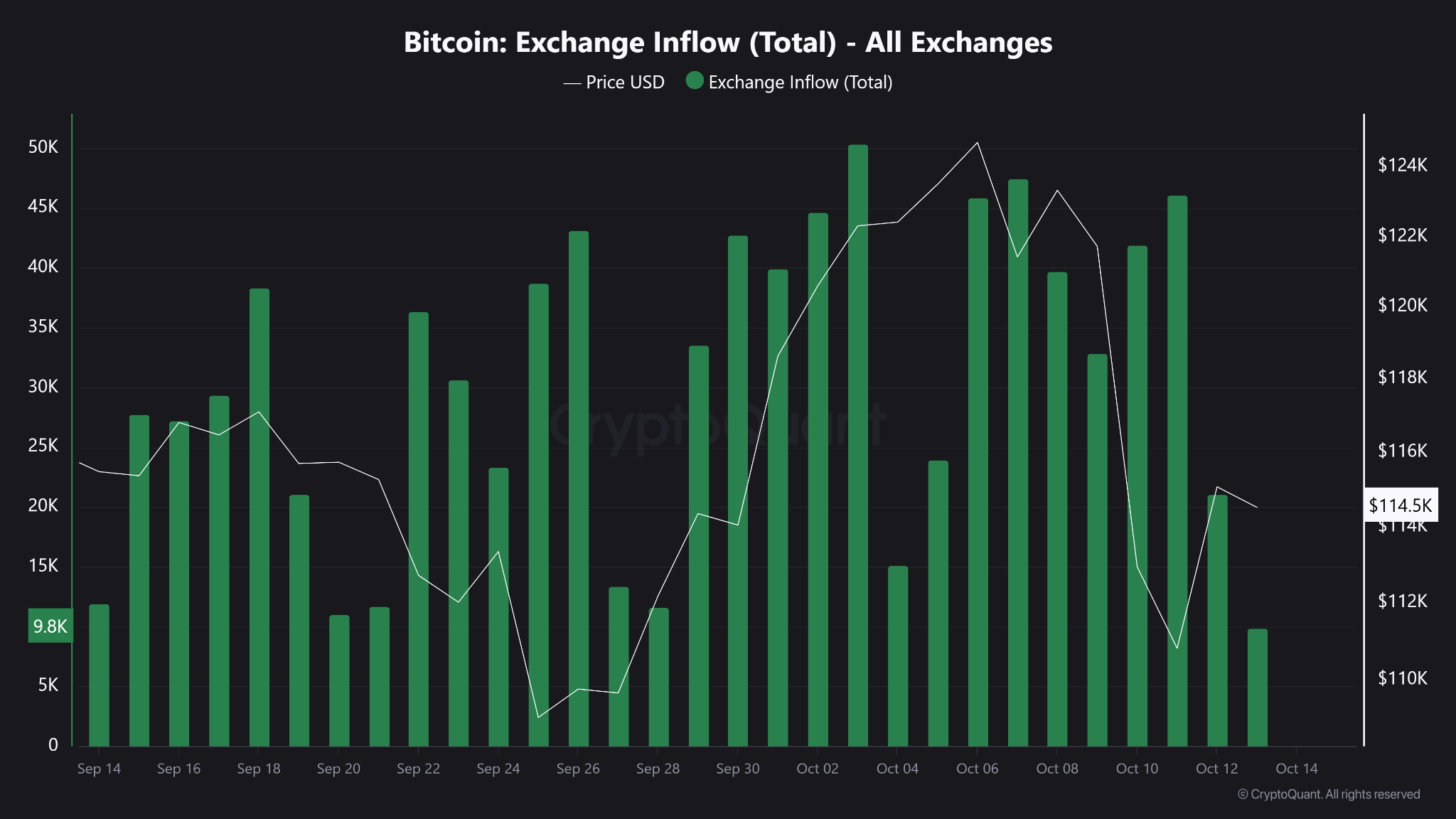

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

LATEST ARTICLE

You might have come across the term p.a. in traditional investment cycles, but how does it relate to crypto? In this article, we’re breaking down what p.a. means, how to get in on it and how it relates to the crypto industry.

What does P.A. mean?

P.a. is an investment term that stands for per annum. This refers to the interest an investor can gain over a year's period and provides insight into the yields that the investment will generate. This is calculated on a simple basis and not compound.

You might see digital wallet platforms offering reward rates of 8% p.a. Or 14% p.a., this tells the potential investor that the platform will provide 8% of the initial investment, over a 12 month period.

PA can also stand for price action, a popular term used on crypto Twitter. In this piece we're focusing on the annual interest rates version.

How can users make money with crypto assets?

There are several ways in with industry participants can earn cryptocurrency. Below we outline the most widely used, and safest options. Be sure to check each option with the relevant blockchain network as these will differ from network to network.

Crypto Mining

Crypto mining can be a lucrative means of generating a passive income, however, the costs might run high depending on where you live and what cryptocurrency you are mining. Each network has its own way of minting new coins, which require different hardware and electricity means.

Bitcoin, for instance, is a Proof of Work network that requires miners to use large amounts of energy as they race to finish a complex cryptographic puzzle. The first to complete this is rewarded with mining the next block and receiving the associated payoffs.

Bitcoin requires a large amount of electricity, not practical in areas with high electricity costs, and either a graphics processing unit (GPU) or an application-specific integrated circuit (ASIC), which can also be costly.

If you wish to get involved with mining cryptocrrencies be sure to do adequate research on what will be required and what income this could generate before investing any money.

Crypto Staking

Crypto staking is an alternative minting solution for Proof of Stake networks, such as Cardano and soon-to-be Ethereum. Crypto staking requires users putting their funds in a smart contract usually for a predetermined lock up period to confirm transactions on the network. This will typically require a minimum amount, so as to ensure that individuals hold a “stake” in the network and will act on good intentions.

When crypto traders stake the minimum balance, a node will deposit these funds into a staking pool on the network, similar to a deposit. The bigger the stake, the higher the chances of that user, now referred to as a node, being chosen to verify transactions. When the node is chosen to confirm transactions, they will create a new block and receive a reward for adding it to the blockchain.

Reward rates are specific to each blockchain network so be sure to check the details relevant to platform on which you wish to stake. As a security mechanism, the staked coin in the network is typically taken away if the node acts with ill intent.

Passive Income

There are a number of crypto initiatives that allow users to earn passive income through their crypto assets. These work in a similar way to holding funds in a wallet, however, these wallets will likely be on a cryptocurrency exchange or DeFi wallet and the user will typically not be able to access the funds for a certain period of time.

Over the duration the user will earn interest as stipulated in the initial agreement. Note that p.a. Values are subject to change with market fluctuations, rising when prices rise and falling when an asset’s price takes a dip. This typically works in the same way as a savings account.

Its worth noting that the onus lies on the traders to pay taxes on any income generated. It is important to check the crypto specific tax laws in your region.

Disclaimer: This article is intended for communication purposes only, you should not consider any such information, opinions, or other material as financial advice.

When referring to the yield on an investment, this indicates the earnings generated over a certain period of time. It is generally presented in percentage form and includes the interest or dividends relevant to the initial investment.

While returns are calculated using the difference in value at two specific points in time, the yield will calculate the total (net) value earned over a period of time. This provides an invaluable tool in helping you understand the potential value of an investment.

Basic yield is calculated as the net realised return divided by the initial investment amount. For example, if an investor bought $100 worth of Bitcoin which grew to $2,000 in the next year, then the formula would look like this:

$1,900 / $100 = 19

-> which translates to 1900%.

There are several different formulas based on the type of yield you wish to calculate. These include:

- Yield on Stocks

- Yield on Bonds

- Yield to Maturity

- Yield to Worst

- Yield to Call

A high yield isn’t necessarily a good thing. Should the market’s decline or the company pays out high dividends the yield will still reflect as high. Always do your own research when considering an investment, or trust a financial advisor.

Since stablecoins emerged in the crypto sphere, many have questioned their legitimacy. While cryptocurrencies are perhaps more frequently used as a tool for value storage rather than a means of transaction, coins (or any financial products) that cannot appreciate in value certainly raise several questions. So why have stablecoins become so popular among businesses and individuals alike? Below we're taking a look at their use cases and reporting on whether they're the safe haven of crypto.

What are stablecoins?

Before we continue, let's clarify what stablecoins are. These types of cryptocurrencies are "stable assets" that have their value pegged to a fiat currency or commodity. This might include the US dollar, Euros, the price of gold or even other cryptocurrencies. So while Bitcoin (BTC) and Ethereum (ETH) are subject to bouts of volatility, stablecoins remain consistent with the price of the money they are pegged to.

Stablecoins are not to be confused with CBDCs (central bank digital currencies) which are operated by a government-controlled organisation, usually a country's national bank. Stablecoins are controlled by a company and utilise blockchain technology to facilitate transactions, store the relevant data and maintain security.

Stablecoins' economic policy ensures that they maintain their value through the use of smart contracts, algorithms and reserves. For each Tether in circulation, for example, one US dollar needs to be held in a reserve account. These types of cryptocurrency tokens provide a reliable and non-volatile means of making payments with the companies issuing them regulating the circulating supply.

What value do Stablecoins provide?

While many might not initially see that value in a fiat-pegged cryptocurrency, stablecoins are actually hugely useful in a largely volatile market. Let the current top 5 biggest cryptocurrencies based on market cap in the industry be an indication, with two of the five being stablecoins.

As stablecoins utilise blockchain technology, the coins naturally inherit all the characteristics of seamless and fast digital transactions (as well as transparency when it comes to transactions). Much like traditional digital assets, stablecoins can be transferred across borders instantly, a much faster and cheaper alternative to using fiat currencies and without the chance of price swings. Users, whether consumers or businesses are able to buy, store and sell stablecoins as they would any other cryptocurrency on the market.

For example, should you wish to pay a business in another country for services rendered or any other expense, it would prove to be much faster and cheaper to use a stablecoin than to send your local currency via traditional banking services. Stablecoins offer a much more streamlined means of completing the job.

Stablecoins also provide an entry into exchanges that don't work with fiat currencies, providing a reliable means of trading on those platforms. Stablecoins have also come to be known as "risk-off" assets, giving newer traders a chance to "test" the markets without the volatility.

This innovation in the blockchain space has opened many new markets to the use of cryptocurrencies, certainly more mainstream markets across a wide range of countries. As information regarding how they work spreads, more businesses have opened their mind to using them in everyday working life. Stablecoins have also become a popular option with users trading on DeFi (decentralised finance) platforms, providing a secure and efficient means of using the products.

Are stablecoins the safe haven of crypto?

In essence, yes. Since the advent of stablecoins (marked by the launch of Tether) in 2014, there has been a number of new stablecoins to emerge, resulting in more confidence in crypto markets. This has equated to more movement and trade volume, and a lower risk management sector.

So while one isn't going to make huge returns (if any) on stablecoins, they bring value to the market due to their stability and transaction ability.

As stablecoins are used by traders to hedge against falling markets, they provide a safe haven for their digital funds until the markets return to normal levels. Businesses around the world use stablecoins as they provide a faster and cheaper means of settling bills, allowing them to harness the power of blockchain technology without the worry of prices rising or falling in a short space of time.

Tap into stability

Tap can support your market entry endeavors by providing a platform to include a variety of assets in your portfolio. Whether you're considering accumulating stablecoins during market shifts or looking to engage in various transactions, Tap offers a streamlined experience. You can easily acquire, sell, trade, store, and manage widely utilized stablecoins like Tether (USDT) and USD Coin (USDC), all from a single secure platform.

The global financial crash in 2007 was the catalyst for the creation of Bitcoin. Designed to provide a decentralized way in which people can manage their own money, digital currencies slowly infiltrated the greater financial markets.

Almost a decade later, crypto adoption is at its highest and for the first time challenging traditional financial institutions and their product range. So, which is better? Let's explore the pros and cons of each category.

Blockchain technology has seen an incredible increase in interest in the last few years. While it provides a universal backbone relevant to almost any industry, it has also brought the world cryptocurrencies, NFTs, decentralized finance (DeFi) and other digital assets.

Tackling existing centralized monetary challenges, blockchain technology and digital currencies are two of the greatest inventions of the 21st century.

Digital currency versus banking

Cryptocurrencies are decentralized digital currencies that can be used to exchange goods and services as well as a store of value. They're typically acquired through crypto exchanges and kept in secure crypto wallets. These virtual currencies are autonomous, operate in a secure manner with little human interaction, and are increasingly considered the future of finance.

The predominant financial systems in the world are currently banks. They provide financial services to those that meet their requirements, including loans, savings, and other financial services.

However, unlike cryptocurrencies, they have several problems core to them being centralized and susceptible to biases. They're also slower than cryptos, and some of them charge exorbitant interest rates on loans as well as routine purchases.

The pros and cons of the Banking system vs digital currencies

There has been little development in the banking sector in the last several decades, so while the products are useful there has been very little innovation in the space. Below we outline the current challenges that the traditional systems face when compared to the advantages of a digital currency.

Financial Inclusivity

Banks are notorious for requiring lengthy paperwork and in-depth background checks. They are also known to provide different products and limits to different groups of people, including payment durations, soft loans, limits, etc.

When creating the digital currency Bitcoin, Satoshi Nakamoto wanted to counteract this financial inclusivity pertaining to fiat currencies and the greater financial system and instead provide a financial product available to all. Cryptocurrencies, therefore, do not require any paperwork or identification to operate or open a digital wallet.

While buying digital assets on an exchange will require personal information, they do not require any background checks or credit scores. Unlike in the traditional financial system, engaging in crypto markets is also not exclusive to location, allowing anyone from any corner of the globe to immediately access the digital payment systems.

Accessibility

Banking institutions operate within certain hours and are closed on weekends, meaning that transactions can sometimes take days to clear. They will also typically require an in-person authentication for very large transactions, and affect the remittance markets in the global financial system.

Cryptocurrencies on the other hand operate 24/7 (even on public holidays) as they are maintained by members all around the world. Cryptocurrencies provide zero downtime with unlimited amounts and do not require third-party authentication before making transactions. One digital currency can send value to the other side of the world in minutes, requiring no in-person authentication.

Security

The banking industry, particularly online systems, are susceptible to being hacked, alongside fraudulent activities and money embezzlement. While this is not always the direct fault of the central bank or financial institutions, it has become a common problem as ill actors have learned how to navigate the security systems and trick the owners of these accounts.

Through the use of blockchain technology, transactions cannot be intercepted or reversed, and are handled in a peer-to-peer nature ensuring that they do not go through a third party for authentication and require minimal human interference.

Fees and Transaction Times

During transaction periods, banks often add on extra costs and taxes. When sending and receiving money, banks frequently charge very high transaction fees and taxes, especially when conducting international remittances. These transactions also take a long time to clear due to their sluggish procedures, especially for large amounts of cash.

Cryptocurrencies provide an excellent solution to the remittance markets as they provide fast and cheap transactions. Blockchain technology ensures that they clear in several minutes (depending on the cryptocurrency and the network’s congestion at the time) and that they are sent directly to the recipient’s wallet (as opposed to waiting for the receiving bank to clear the transaction).

Diversification

Traditional banking services generally lack significant diversification options due to their competitive pricing structures. However, cryptocurrencies enable users to engage with multiple products simultaneously, which can provide opportunities for leveraging various networks and creating portfolios with reduced risk concentration.

Smart Contracts

Another advantage that blockchain currently holds over traditional banking systems is the use of smart contracts. Smart contracts are digital agreements that automatically execute once predetermined criteria have been met. Leveraging smart contracts in the financial services industry offers a seamless and entirely decentralized approach to modern banking.

Which is Better: The central bank or digital assets?

Comparing central banks and digital assets reveals intriguing aspects of both systems. Banking systems have become an integral part of modern society, underpinning economies and facilitating everyday financial transactions. They offer stability, regulatory frameworks, and familiarity to the masses.

On the other hand, cryptocurrencies introduce a realm of innovation. Their decentralized nature challenges traditional financial paradigms, enabling secure and direct peer-to-peer transactions. Additionally, cryptocurrencies empower novel applications such as smart contracts, decentralized finance (DeFi), and tokenization of assets.

Selecting one over the other isn't straightforward due to their contrasting strengths. Central banks provide stability and a well-established foundation, while digital assets spark possibilities for disruption and financial inclusivity.

Presently, these financial systems coexist synergistically. The banking system maintains its role as a bedrock for economic operations, while digital assets complement by offering alternative avenues for value exchange and financial exploration. As both systems continue to evolve, it's likely that their interaction will shape the financial landscape in intricate and unexpected ways.

Why not use both? Tap offers the perfect solution to merging the best of both worlds through an innovative alt-banking mobile app. Through the app, users can load both fiat and cryptocurrencies into their unique, secure digital wallets and use both interchangeably to pay bills, send money to friends, and even earn interest. Get the best of both worlds by enjoying the benefits of both the traditional banking systems and cryptocurrencies.

Why not harness the strengths of both paradigms? Embracing this dual approach, Tap presents a groundbreaking solution that seamlessly blends the attributes of both money accounts and digital assets within an innovative mobile application. Tap empowers users to effortlessly load fiat currencies alongside cryptocurrencies into their individualized, secure digital wallets.

This fusion enables users to fluidly alternate between these assets for various purposes, such as settling bills, conducting peer-to-peer transactions, and even capitalizing on interest-earning opportunities. By embracing this convergence, you can truly enjoy the advantages offered by both traditional finance and the dynamic potential of cryptocurrencies.

We are delighted to announce the listing and support of Lido (LDO) on Tap!

LDO is now available for trading on the Tap mobile app. You can now Buy, Sell, Trade or hold LDO for any of the other asset supported on the platform without any pair boundaries. Tap is pair agnostic, meaning you can trade any asset for any other asset without having to worries if a "trading pair" is available.

We believe supporting LDO will provide value to our users. We are looking forward to continue supporting new crypto projects with the aim of providing access to financial power and freedom for all.

Lido's liquid staking service allows users to tap into the benefits of staking rewards without compromising their tokens' liquidity. Lido aims to empower users to put their staked assets to use, supporting a number of PoS cryptocurrencies. The platform offers a liquid staking solution that provides users with a system that allows them to earn rewards on staked coins while also receiving a tokenized version of the staked coins which can generate returns in other DeFi protocols.

The Lido DAO token (LDO) is an ERC-20 token, the native utility token to the Lido protocol used to reward users. The token has a total supply of 1 billion tokens and serves three primary functions.

The LDO token grants holders with governance rights in the operations of the Lido DAO, as well as the removal or addition of Lido node operators and helping with the management of fee parameters and distribution.

Get to know more about Lido (LDO) in our dedicated article here.

The Curve protocol and Curve DAO token form another innovative project to come from the DeFi movement and one that provides a particularly unique and well-designed concept. Improving on functionalities that DeFi platforms like Uniswap and Sushiswap have otherwise neglected, Curve focuses on providing a viable alternative solution to traditional financial platforms in the blockchain industry.

The Curve Finance platform, launched in January 2020, later released a decentralised autonomous organisation (DAO) alongside the Curve DAO token eight months later. CRV functions as the in-house token of the platform.

What Is Curve DAO (CRV)?

The Curve platform, formally known as Curve Finance, provides traders with a decentralised exchange on which to swap digital assets. Curve aims to provide minimum price slippage between two tradable crypto assets by focusing on stablecoins or assets of similar value. Through an automated market maker (AMM) and focused smart contracts, the decentralised exchange is able to manage liquidity.

While the platform can be compared to Uniswap, in reality, it has some key differences and a much higher amount of locked liquidity. The platform and its liquidity providers are more focused on stablecoins and other coins of that nature. CRV tokens fuel the network and are a tradable asset for crypto users.

The Curve DAO provides more decentralised governance to Curve's trading platform. The Curve protocol has grown into a well-respected financial asset within the DeFi ecosystem with its strong DeFi protocol.

Who created the Curve protocol?

The Curve platform was created by a Russian scientist with ample experience in the crypto industry. Michael Egorov both founded the platform and acts as its CEO. He previously co-founded a crypto business focused on building privacy-oriented protocols and infrastructure, NuCypher, in 2015, as well as LoanCoin, a decentralised bank and loans network.

As of August 2020, Egorov holds 71% of the governance tokens after locking up a large amount of CRV tokens in response to yearn.finance’s increasing voting power in the Curve network. In a statement made later, Egorov admitted to “overreacting”.

How does Curve work?

Launched prior to Uniswap V2, Curve Finance operates similarly to the DeFi platform but has implemented some key differences. The decentralised exchange differentiates itself from the original AMM platform by innovating the liquidity pool trading structure and relevant smart contracts.

The Curve DAO trading platform is managed by a mathematical function called a bonding curve, which is designed to let cryptocurrencies trade for the best possible price amongst each other. Bonding curves are also used by other DeFi trading platforms, like Uniswap.

Due to the Curve DAO platform being primarily focused on stablecoins, its bonding curve is specifically focused on these pegged digital currencies and is able to trade a larger amount of stablecoins with less change in their relative prices in a liquidity pool.

Lending pools

In order for the Curve DAO platform to operate, it requires a group of users who are willing to lock up their cryptocurrencies in order for them to be traded by others. The platform provides a return on their coins plus a portion of the fees from trades when incentivizing liquidity providers.

The platform manages the coins in the liquidity pools by making them more expensive or cheaper, based on their fluctuating amounts, thereby making them more attractive to buyers and sellers using the platform.

On Uniswap, liquidity pools are based strictly on predetermined trading pairs while on Curve DAO the liquidity pools comprise multiple assets. On Curve DAO, entire liquidity pools can also be used as an asset inside another liquidity pool.

How does a trader use the liquidity pools?

Once a trader adds liquidity to a specific pool, through stablecoins or other digital assets, the user will receive a token specific to that pool. 3pool is an example of one of the most popular liquidity pools on the Curve platform.

While the platform is known to provide trading for stablecoins, it also supports mirrored assets such as renBTC and wBTC. These assets are both built on the Ethereum blockchain and track the price of Bitcoin in a typical derivatives fashion. Since the prices are close in value they can function in the same pool and be traded using the Curve DEX.

What is the Curve DAO token (CRV)?

The CRV token is the utility token and governance token of the Curve DAO platform, providing users with governance rights, an incentive structure for fee payments, as well as providing long-term rewards to liquidity providers. CRV tokens are awarded to users based on their liquidity commitment and length of ownership.

The Curve DAO token was launched alongside the Curve DAO in August 2020. The maximum supply is 3.03 billion CRV tokens, with 62% of that being distributed to liquidity providers. The rest is allocated between employees (3%), and shareholders (30%), and a small percentage is kept for community reserves (5%). Employee and shareholder allocations work off of a two-year vesting schedule.

At the time of writing, over 531 million CRV tokens are in circulation, roughly 16% of the total supply. The market cap at the time was around $365 million, positioning the Curve DAO token network in the top 20 biggest platforms in the DeFi ecosystem.

How can I buy Curve DAO tokens?

If you’d like to buy Curve DAO tokens to include in your crypto portfolio, you can do so easily through the Tap mobile app. Providing a highly secure and equally simple crypto trading platform, users can buy CRV with British Pounds or Euros, or exchange tokens for other cryptocurrencies supported on the platform such as Bitcoin or Ethereum.

Simply download the app, create an account and follow the steps to get verified through the KYC process. You will then have access to several wallets, and a much simpler crypto trading experience.

Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started