With a Fed rate cut nearly certain, these three altcoins are positioned to capitalize on the macro shift, here's what makes them stand out.

Keep reading

Heading into the Federal Open Market Committee’s October session, a high-stakes environment is emerging for crypto markets. With the CME Group’s FedWatch Tool showing about a 96 % chance of a 25-basis-point rate cut, the market is eyeing how digital-asset prices might respond.

With macro liquidity on the radar again, these three altcoins stand out as tokens worth tracking under the spotlight of the Fed’s next move.

1. Chainlink (LINK)

Chainlink has been acting under pressure, trading inside a falling wedge, a pattern which sometimes marks the end of a downtrend. Still, some caution flags remain. Over the past month LINK has been trading downwards, though it’s gained some strength in the last week amid renewed buying interest. The key support around $17.08 remains critical, if LINK closes below that, a drop toward $16 could be triggered.

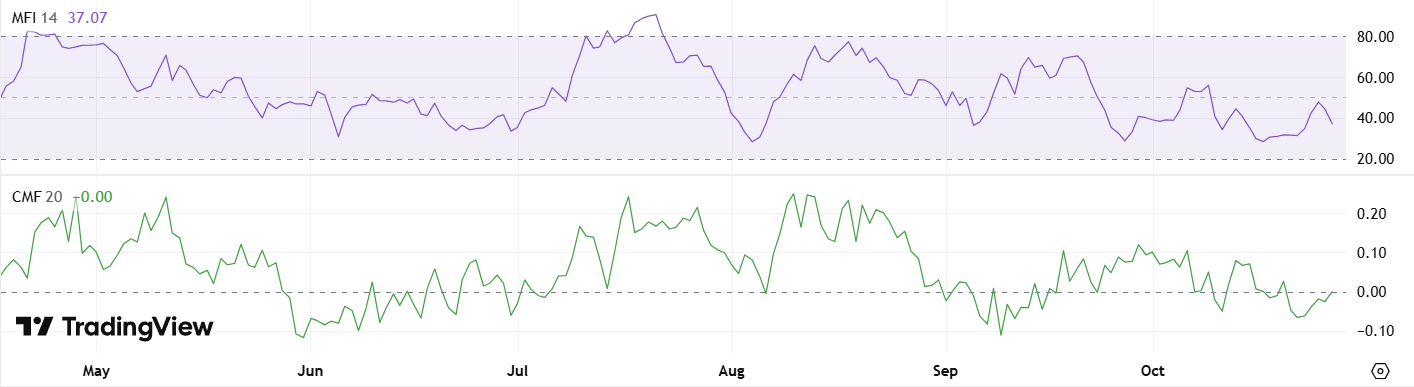

Conversely, diagnostics like the Money Flow Index (MFI) and Chaikin Money Flow (CMF) are showing signs of life, hinting at growing accumulation from larger holders. Combine this with a potentially dovish Fed decision, and Chainlink could be gearing for something special.

2. Dogecoin (DOGE)

Dogecoin enters the FOMC event with a bit of range-bound suspense. Since October 11, DOGE has been oscillating between $0.17 and $0.20, waiting for a trigger. A clean breakout above $0.21 could open the door to a move back towards $0.27, especially if risk-on sentiment returns.

Volume and whale‐level data add texture to the setup. The Wyckoff volume profile recently flipped from seller control to buyer control, suggesting strategic accumulation may be underway. DOGE may be quieting down before a move, a scenario traders should keep front of mind as the Fed’s decision could stir things.

3. Uniswap (UNI)

Uniswap offers compelling recovery stories entering the FOMC session. The token experienced a sharp drop on October 10, with the RSI falling below 30, classic oversold territory. Since then, UNI has rallied from near $6.20 toward $6.50, supported by strong volume on the breakout. Holding above $6.40 may confirm that buying interest is sustained.

For longer-term watchers, UNI’s former highs at $12.15 in August and $18.71 in December set the stage for what could become a multi-leg recovery if macro conditions cooperate. In a market where liquidity expectations hinge on the Fed, Uniswap's rebound has the potential to accelerate, particularly if altcoin capital begins rotating into DeFi infrastructure.

The Verdict

These tokens aren't just compelling because of their individual fundamentals, it's how those fundamentals intersect with the current macro picture. With markets rebounding and rate cuts looking increasingly likely, crypto stands to gain. Lower rates typically fuel risk appetite, unlock liquidity, and drive capital toward speculative plays, creating tailwinds that can supercharge momentum in well positioned altcoins.

That said, the Fed could also surprise with restraint, and even another “standard” 25-basis-point cut may be viewed as lukewarm. In such scenarios, the dollar may strengthen and risk assets could wobble. Traders and investors should therefore approach the market with discipline, track the macro context, and be prepared for either direction.

NEWS AND UPDATES

After a brutal October sell-off, crypto just staged one of its most dramatic comebacks yet. Here's what the market's resilience signals for what comes next.

The crypto market just pulled off one of its boldest recoveries in recent memory. What began as a violent sell-off on October 10 has given way to a surprisingly strong rebound. In this piece, we’ll dig into “The Great Recovery” of the crypto market, how Bitcoin’s resilience particularly stands out in this comeback, and what to expect next…

The Crash That Shook It All

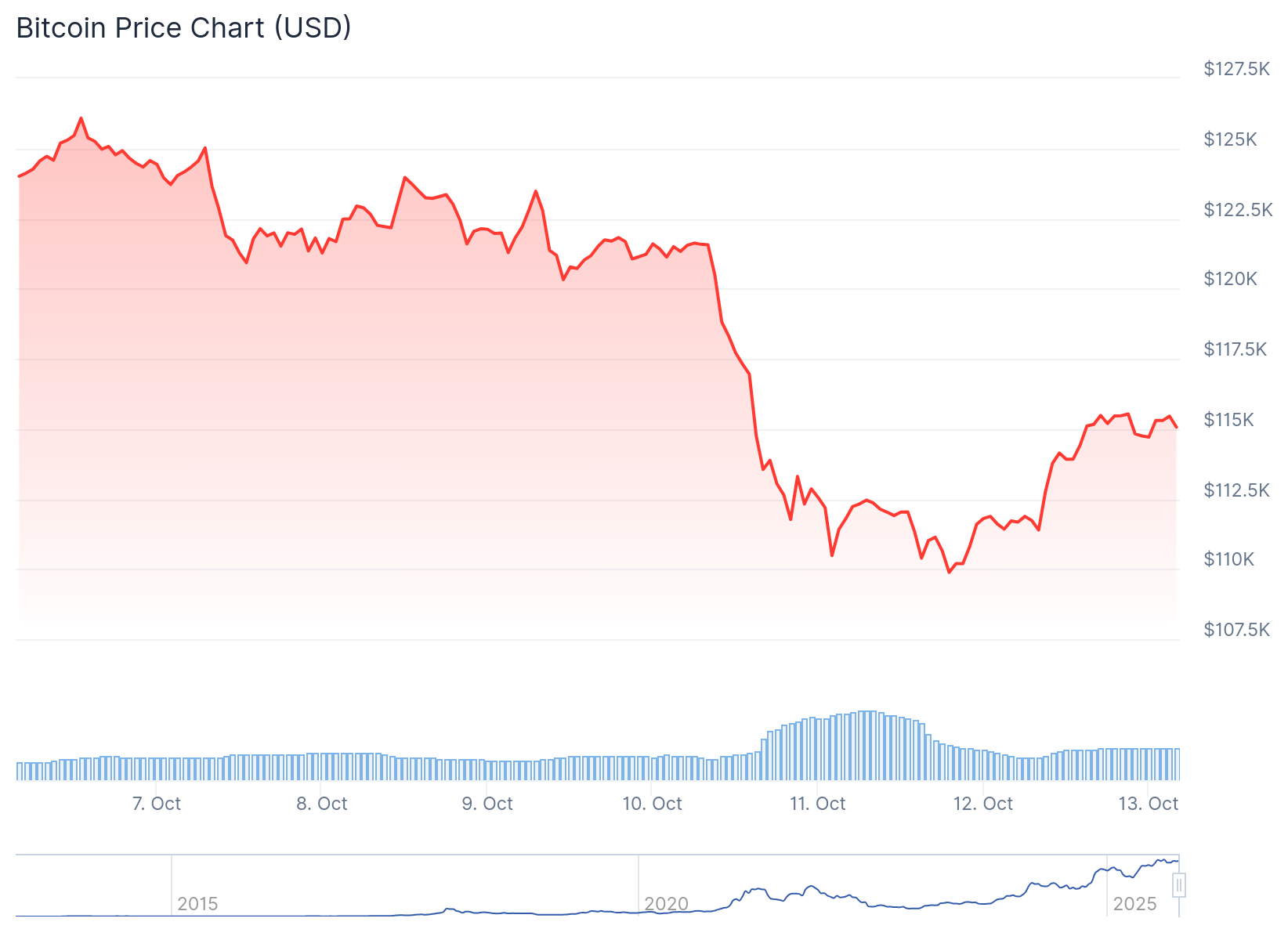

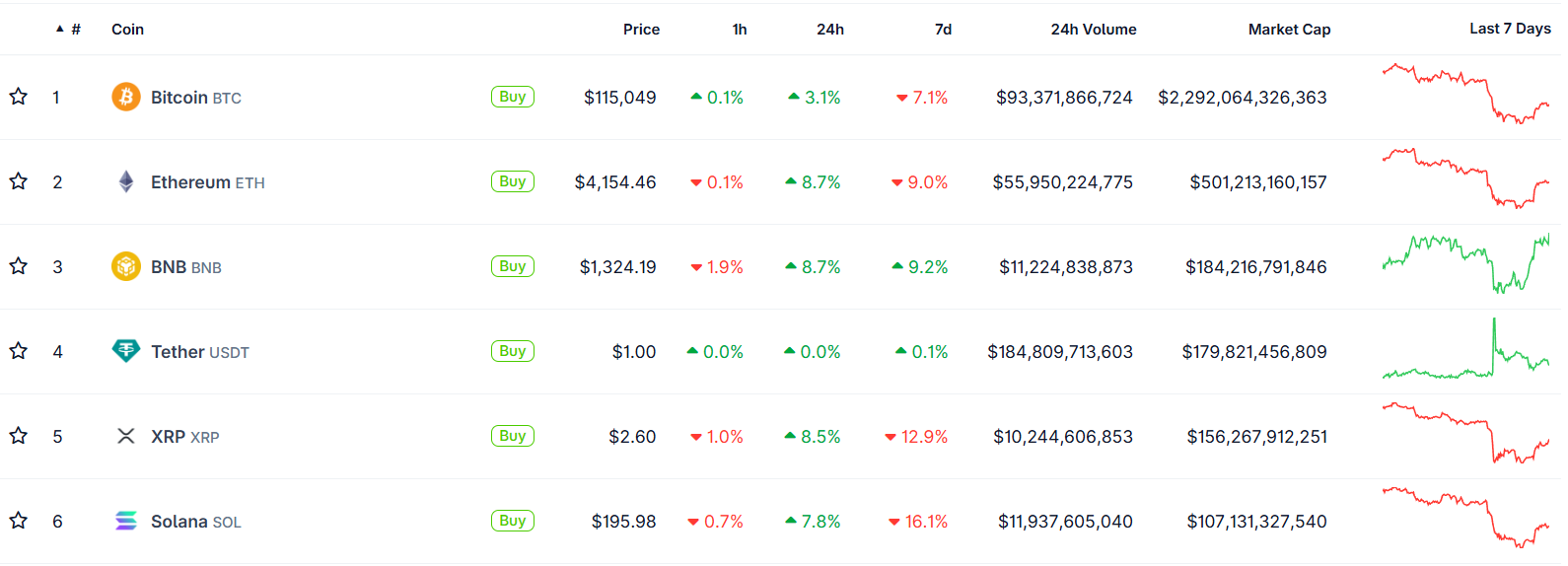

On October 10, markets were rattled across the board. Bitcoin fell from around $122,000 down to near $109,000 in a matter of hours. Ethereum dropped into the $3,600 to $3,700 range. The sudden collapse triggered massive liquidations, nearly $19 billion across assets, with $16.7B in long positions wiped out.

That kind of forced selling, often magnified by leverage and thin liquidity, created a sharp vacuum. Some call it a “flash crash”; an overreaction to geopolitical news, margin stress, and cascading liquidations.

What’s remarkable, however, is how quickly the market recovered.

The Great Recovery: Scope and Speed

Within days, many major cryptocurrencies recouped large parts of their losses. Bitcoin climbed back above $115,000, and Ethereum surged more than 8%, reclaiming the $4,100 level and beyond. Altcoins like Cardano and Dogecoin led some of the strongest rebounds.

One narrative gaining traction is that this crash was not a structural breakdown but a “relief rally”, a market reset after overleveraged participants were squeezed out of positions. Analysts highlight that sell pressure has eased, sentiment is stabilizing, and capital is re-entering the market, all signs that the broader uptrend may still be intact.

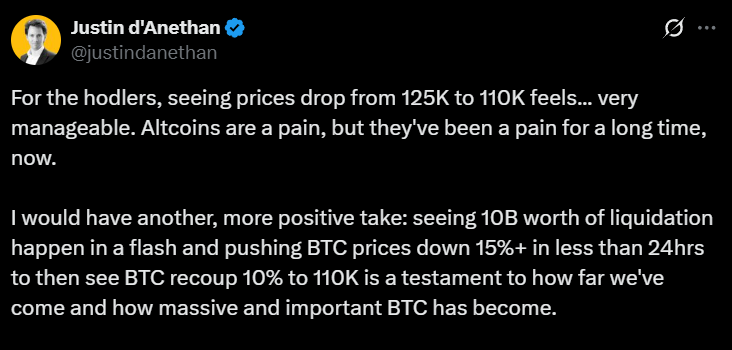

“What we just saw was a massive emotional reset,” Head of Partnerships at Arctic Digital Justin d’Anethan said.

“I would have another, more positive take: seeing 10B worth of liquidation happen in a flash and pushing BTC prices down 15%+ in less than 24hrs to then see BTC recoup 10% to 110K is a testament to how far we've come and how massive and important BTC has become,” he posted on 𝕏.

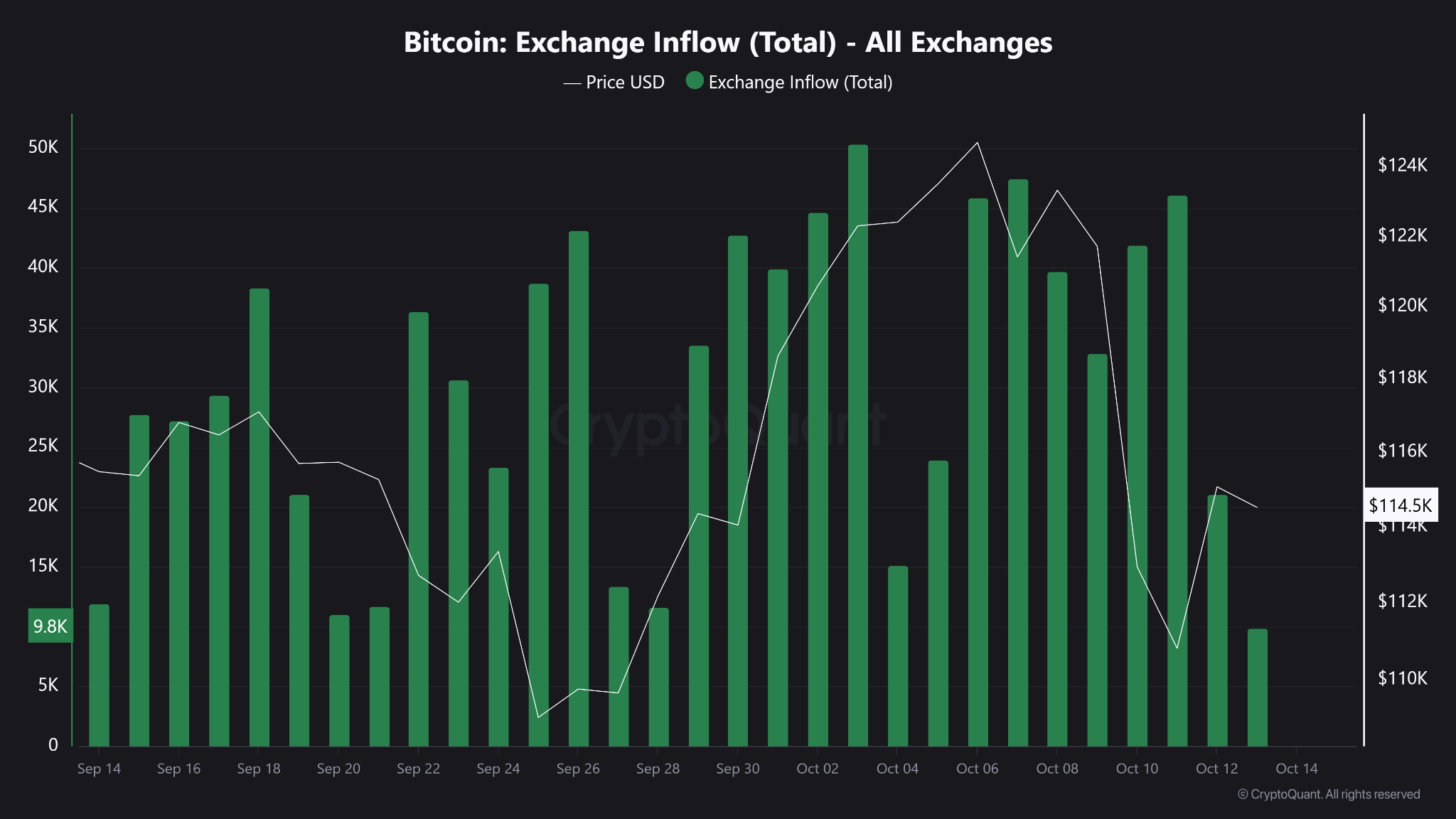

Moreover, an important datapoint stands out. Exchange inflows to BTC have shrunk, signaling that fewer holders are moving coins to exchanges for sale. This signals that fewer investors are transferring their Bitcoin from personal wallets to exchanges, which is a common precursor to selling. In layman terms, coins are being held rather than prepared for trade.

Bitcoin’s Backbone: Resilience Under Pressure

Bitcoin’s ability to rebound after extreme volatility has long been one of its defining traits. Friday’s drop admittedly sent shockwaves through the market, triggering billions in liquidations and exposing the fragility of leveraged trading.

Yet, as history has shown, such sharp pullbacks are far from new for the world’s largest cryptocurrency. In its short history, Bitcoin has endured dozens of drawdowns exceeding 10% in a single day (from the infamous “COVID crash” of 2020 to the FTX collapse in 2022) only to recover and set new highs months later.

This latest event, while painful, highlights a maturing market structure. Since the approval of spot Bitcoin ETFs in early 2024, institutional involvement has deepened, creating greater liquidity buffers and stronger institutional confidence. Even as billions in leveraged positions were wiped out, Bitcoin has held firm around the $110,000 zone, a level that has since acted as psychological support.

What to Watch Next

The key question now is whether this rebound marks a short-term relief rally or the start of a renewed uptrend. Analysts are closely watching derivatives funding rates, on-chain flows, and ETF inflows for clues. A sustained increase in ETF demand could provide a steady bid under the market, offsetting the effects of future liquidation cascades. Meanwhile, Bitcoin’s ability to hold above $110,000 (an area of heavy trading volume) may serve as confirmation that investor confidence remains intact.

As the market digests the events of October 10, one lesson stands out. Bitcoin’s recovery isn’t just a matter of luck, it’s a reflection of underlying market structure that can absorb shocks. It is built on a growing base of long-term holders, institutional adoption, and a financial system increasingly intertwined with digital assets. Corrections, however dramatic, are not signs of weakness; they are reminders of a maturing market that is striding towards equilibrium.

Bottom Line

The crash on October 10 was brutal, there’s no denying that. It was one of the deepest and fastest in recent memory. But the recovery has been equally sharp. Rather than exposing faults, the rebound has underscored the market’s adaptability and Bitcoin’s central role.

The market consensus is seemingly leaning towards a reset; not a reversal. The shakeout purged excess leverage, and the comeback underlined demand. If Bitcoin can maintain that strength, and the broader market keeps its footing in the coming days, this could mark a turning point rather than a cave-in.

What's driving the crypto market this week? Get fast, clear updates on the top coins, market trends, and regulation news.

Welcome to Tap’s weekly crypto market recap.

Here are the biggest stories from last week (8 - 14 July).

💥 Bitcoin breaks new ATH

Bitcoin officially hit above $122,000 marking its first record since May and pushing total 2025 gains to around +20% YTD. The rally was driven by heavy inflows into U.S. spot ETFs, over $218m into BTC and $211m into ETH in a single day, while nearly all top 100 coins turned green.

📌 Trump Media files for “Crypto Blue‑Chip ETF”

Trump Media & Technology Group has submitted an S‑1 to the SEC for a new “Crypto Blue Chip ETF” focused primarily on BTC (70%), ETH (15%), SOL (8%), XRP (5%), and CRO (2%), marking its third crypto ETF push this year.

A major political/media player launching a multi-asset crypto fund signals growing mainstream and institutional acceptance, and sparks fresh conflict-of-interest questions. We’ll keep you updated.

🌍 Pakistan launches CBDC pilot & virtual‑asset regulation

The State Bank of Pakistan has initiated a pilot for a central bank digital currency and is finalising virtual-asset laws, with Binance CEO CZ advising government efforts. With inflation at just 3.2% and rising foreign reserves (~$14.5b), Pakistan is embracing fintech ahead of emerging-market peers like India.

🛫 Emirates Airline to accept crypto payments

Dubai’s Emirates signed a preliminary partnership with Crypto.com to enable crypto payments starting in 2026, deepening the Gulf’s commitment to crypto-friendly infrastructure.

*Not to take away from the adoption excitement, but you can book Emirates flights with your Tap card, using whichever crypto you like.

🏛️ U.S. declares next week “Crypto Week”

House Republicans have designated 14-18 July as “Crypto Week,” aiming for votes on GENIUS (stablecoin oversight), CLARITY (jurisdiction clarity), and Anti‑CBDC bills. The idea is that these bills could reshape how U.S. defines crypto regulation and limit federal CBDC initiatives under Trump-aligned priorities.

Stay tuned for next week’s instalment, delivered on Monday mornings.

Explore key catalysts driving the modern money revolution. Learn about digital currencies, fintech innovation, and the future of finance.

The financial world is undergoing a significant transformation, largely driven by Millennials and Gen Z. These digital-native generations are embracing cryptocurrencies at an unprecedented rate, challenging traditional financial systems and catalysing a shift toward new forms of digital finance, redefining how we perceive and interact with money.

This movement is not just a fleeting trend but a fundamental change that is redefining how we perceive and interact with money.

Digital Natives Leading the Way

Growing up in the digital age, Millennials (born 1981-1996) and Gen Z (born 1997-2012) are inherently comfortable with technology. This familiarity extends to their financial behaviours, with a noticeable inclination toward adopting innovative solutions like cryptocurrencies and blockchain technology.

According to the Grayscale Investments and Harris Poll Report which studied Americans, 44% agree that “crypto and blockchain technology are the future of finance.” Looking more closely at the demographics, Millenials and Gen Z’s expressed the highest levels of enthusiasm, underscoring the pivotal role younger generations play in driving cryptocurrency adoption.

Desire for Financial Empowerment and Inclusion

Economic challenges such as the 2008 financial crisis and the impacts of the COVID-19 pandemic have shaped these generations' perspectives on traditional finance. There's a growing scepticism toward conventional financial institutions and a desire for greater control over personal finances.

The Grayscale-Harris Poll found that 23% of those surveyed believe that cryptocurrencies are a long-term investment, up from 19% the previous year. The report also found that 41% of participants are currently paying more attention to Bitcoin and other crypto assets because of geopolitical tensions, inflation, and a weakening US dollar (up from 34%).

This sentiment fuels engagement with cryptocurrencies as viable investment assets and tools for financial empowerment.

Influence on Market Dynamics

The collective financial influence of Millennials and Gen Z is significant. Their active participation in cryptocurrency markets contributes to increased liquidity and shapes market trends. Social media platforms like Reddit, Twitter, and TikTok have become pivotal in disseminating information and investment strategies among these generations.

The rise of cryptocurrencies like Dogecoin and Shiba Inu demonstrates how younger investors leverage online communities to impact financial markets2. This phenomenon shows their ability to mobilise and drive market movements, challenging traditional investment paradigms.

Embracing Innovation and Technological Advancement

Cryptocurrencies represent more than just investment opportunities; they embody technological innovation that resonates with Millennials and Gen Z. Blockchain technology and digital assets are areas where these generations are not only users but also contributors.

A 2021 survey by Pew Research Center indicated that 31% of Americans aged 18-29 have invested in, traded, or used cryptocurrency, compared to just 8% of those aged 50-64. This significant disparity highlights the generational embrace of digital assets and the technologies underpinning them.

Impact on Traditional Financial Institutions

The shift toward cryptocurrencies is prompting traditional financial institutions to adapt. Banks, investment firms, and payment platforms are increasingly integrating crypto services to meet the evolving demands of younger clients.

Companies like PayPal and Square have expanded their cryptocurrency offerings, allowing users to buy, hold, and sell cryptocurrencies directly from their platforms. These developments signify the financial industry's recognition of the growing importance of cryptocurrencies.

Challenges and Considerations

While enthusiasm is high, challenges such as regulatory uncertainties, security concerns, and market volatility remain. However, Millennials and Gen Z appear willing to navigate these risks, drawn by the potential rewards and alignment with their values of innovation and financial autonomy.

In summary

Millennials and Gen Z are redefining the financial landscape, with their embrace of cryptocurrencies serving as a catalyst for broader change. This isn't just about alternative investments; it's a shift in how younger generations view financial systems and their place within them. Their drive for autonomy, transparency, and technological integration is pushing traditional institutions to innovate rapidly.

This generational influence extends beyond personal finance, potentially reshaping global economic structures. For industry players, from established banks to fintech startups, adapting to these changing preferences isn't just advantageous—it's essential for long-term viability.

As cryptocurrencies and blockchain technology mature, we're likely to see further transformations in how society interacts with money. Those who can navigate this evolving landscape, balancing innovation with stability, will be well-positioned for the future of finance. It's a complex shift, but one that offers exciting possibilities for a more inclusive and technologically advanced financial ecosystem. The financial world is changing, and it's the young guns who are calling the shots.

Unveiling the future of money: Explore the game-changing Central Bank Digital Currencies and their potential impact on finance.

Since the debut of Bitcoin in 2009, central banks have been living in fear of the disruptive technology that is cryptocurrency. Distributed ledger technology has revolutionized the digital world and has continued to challenge the corruption of central bank morals.

Financial institutions can’t beat or control cryptocurrency, so they are joining them in creating digital currencies. Governments have now been embracing digital currencies in the form of CBDCs, otherwise known as central bank digital currencies.

Central bank digital currencies are digital tokens, similar to cryptocurrency, issued by a central bank. They are pegged to the value of that country's fiat currency, acting as a digital currency version of the national currency. CBDCs are created and regulated by a country's central bank and monetary authorities.

A central bank digital currency is generally created for a sense of financial inclusion and to improve the application of monetary and fiscal policy. Central banks adopting currency in digital form presents great benefits for the federal reserve system as well as citizens, but there are some cons lurking behind the central bank digital currency facade.

Types of central bank digital currencies

While the concept of a central bank digital currency is quite easy to understand, there are layers to central bank money in its digital form. Before we take a deep dive into the possibilities presented by the central banks and their digital money, we will break down the different types of central bank digital currencies.

Wholesale CBDCs

Wholesale central bank digital currencies are targeted at financial institutions, whereby reserve balances are held within a central bank. This integration assists the financial system and institutions in improving payment systems and security payment efficiency.

This is much simpler than rolling out a central bank digital currency to the whole country but provides support for large businesses when they want to transfer money. These digital payments would also act as a digital ledger and aid in the avoidance of money laundering.

Retail CBDCs

A retail central bank digital currency refers to government-backed digital assets used between businesses and customers. This type of central bank digital currency is aimed at traditional currency, acting as a digital version of physical currency. These digital assets would allow retail payment systems, direct P2P CBDC transactions, as well as international settlements among businesses. It would be similar to having a bank account, where you could digitally transfer money through commercial banks, except the currency would be in the form of a digital yuan or euro, rather than the federal reserve of currency held by central banks.

Pros and cons of a central bank digital currency (CBDC)

Central banks are looking for ways to keep their money in the country, as opposed to it being spent on buying cryptocurrencies, thus losing it to a global market. As digital currencies become more popular, each central bank must decide whether they want to fight it or profit from the potential. Regardless of adoption, central banks creating their own digital currencies comes with benefits and disadvantages to users that you need to know.

Pros of central bank digital currency (CBDC)

- Cross border payments

- Track money laundering activity

- Secure international monetary fund

- Reduces risk of commercial bank collapse

- Cheaper

- More secure

- Promotes financial inclusion

Cons of central bank digital currency (CDBC)

- Central banks have complete control

- No anonymity of digital currency transfers

- Cybersecurity issues

- Price reliant on fiat currency equivalent

- Physical money may be eliminated

- Ban of distributed ledger technology and cryptocurrency

Central bank digital currency conclusion

Central bank money in an electronic form has been a big debate in the blockchain technology space, with so many countries considering the possibility. The European Central Bank, as well as other central banks, have been considering the possibility of central bank digital currencies as a means of improving the financial system. The Chinese government is in the midst of testing out their e-CNY, which some are calling the digital yuan. They have seen great success so far, but only after completely banning Bitcoin trading.

There is a lot of good that can come from CBDCs, but the benefits are mostly for the federal reserve system and central banks. Bank-account holders and citizens may have their privacy compromised and their investment options limited if the world adopts CBDCs.

It's important to remember that central bank digital currencies are not cryptocurrencies. They do not compete with cryptocurrencies and the benefits of blockchain technology. Their limited use cases can only be applied when reinforced by a financial system authority. Only time will tell if CBDCs will succeed, but right now you can appreciate the advantages brought to you by crypto.

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Let us dive into it for you.

What is the "Travel Rule"?

You might have heard of the "Travel Rule" before, but do you know what it actually mean? Well, let me break it down for you. The Travel Rule, also known as FATF Recommendation 16, is a set of measures aimed at combating money laundering and terrorism financing through financial transactions.

So, why is it called the Travel Rule? It's because the personal data of the transacting parties "travels" with the transfers, making it easier for authorities to monitor and regulate these transactions. See, now it all makes sense!

The Travel Rule applies to financial institutions engaged in virtual asset transfers and crypto companies, collectively referred to as virtual asset service providers (VASPs). These VASPs have to obtain and share "required and accurate originator information and required beneficiary information" with counterparty VASPs or financial institutions during or before the transaction.

To make things more practical, the FATF recommends that countries adopt a de minimis threshold of 1,000 USD/EUR for virtual asset transfers. This means that transactions below this threshold would have fewer requirements compared to those exceeding it.

For transfers of Virtual Assets falling below the de minimis threshold, Virtual Asset Service Providers (VASPs) are required to gather:

- The identities of the sender (originator) and receiver (beneficiary).

- Either the wallet address associated with each transaction involving Virtual Assets (VAs) or a unique reference number assigned to the transaction.

- Verification of this gathered data is not obligatory, unless any suspicious circumstances concerning money laundering or terrorism financing arise. In such instances, it becomes essential to verify customer information.

Conversely, for transfers surpassing the de minimis threshold, VASPs are obligated to collect more extensive particulars, encompassing:

- Full name of the sender (originator).

- The account number employed by the sender (originator) for processing the transaction, such as a wallet address.

- The physical (geographical) address of the sender (originator), national identity number, a customer identification number that uniquely distinguishes the sender to the ordering institution, or details like date and place of birth.

- Name of the receiver (beneficiary).

- Account number of the receiver (beneficiary) utilized for transaction processing, similar to a wallet address.

By following these guidelines, virtual asset service providers can contribute to a safer and more transparent virtual asset ecosystem while complying with international regulations on anti-money laundering and countering the financing of terrorism. It's all about ensuring the integrity of financial transactions and safeguarding against illicit activities.

Implementation of the Travel Rule in the United Kingdom

A notable shift is anticipated in the United Kingdom's oversight of the virtual asset sector, commencing September 1, 2023.

This seminal development comes in the form of the Travel Rule, which falls under Part 7A of the Money Laundering Regulations 2017. Designed to combat money laundering and terrorist financing within the virtual asset industry, this new regulation expands the information-sharing requirements for wire transfers to encompass virtual asset transfers.

The HM Treasury of the UK has meticulously customized the provisions of the revised Wire Transfer Regulations to cater to the unique demands of the virtual asset sector. This underscores the government's unwavering commitment to fostering a secure and transparent financial ecosystem. Concurrently, it signals their resolve to enable the virtual asset industry to flourish.

The Travel Rule itself originates from the updated version of the Financial Action Task Force's recommendation on information-sharing requirements for wire transfers. By extending these recommendations to cover virtual asset transfers, the UK aspires to significantly mitigate the risk of illicit activities within the sector.

Undoubtedly, the Travel Rule heralds a landmark stride forward in regulating the virtual asset industry in the UK. By extending the ambit of information-sharing requirements and fortifying oversight over virtual asset firms

Implementation of the Travel Rule in the European Union

Prepare yourself, as a new regulation called the Travel Rule is set to be introduced in the world of virtual assets within the European Union. Effective from December 30, 2024, this rule will take effect precisely 18 months after the initial enforcement of the Transfer of Funds Regulation.

Let's delve into the details of the Travel Rule. When it comes to information requirements, there will be no distinction made between cross-border transfers and transfers within the EU. The revised Transfer of Funds regulation recognizes all virtual asset transfers as cross-border, acknowledging the borderless nature and global reach of such transactions and services.

Now, let's discuss compliance obligations. To ensure adherence to these regulations, European Crypto Asset Service Providers (CASPs) must comply with certain measures. For transactions exceeding 1,000 EUR with self-hosted wallets, CASPs are obligated to collect crucial originator and beneficiary information. Additionally, CASPs are required to fulfill additional wallet verification obligations.

The implementation of these measures within the European Union aims to enhance transparency and mitigate potential risks associated with virtual asset transfers. For individuals involved in this domain, it is of utmost importance to stay informed and adhere to these new guidelines in order to ensure compliance.

What does the travel rules means to me as user?

As a user in the virtual asset industry, the implementation of the Travel Rule brings some significant changes that are designed to enhance the security and transparency of financial transactions. This means that when you engage in virtual asset transfers, certain personal information will now be shared between the involved parties. While this might sound intrusive at first, it plays a crucial role in combating fraud, money laundering, and terrorist financing.

The Travel Rule aims to create a safer environment for individuals like you by reducing the risks associated with illicit activities. This means that you can have greater confidence in the legitimacy of the virtual asset transactions you engage in. The regulation aims to weed out illicit activities and promote a level playing field for legitimate users. This fosters trust and confidence among users, attracting more participants and further driving the growth and development of the industry.

However, it's important to note that complying with this rule may require you to provide additional information to virtual asset service providers. Your privacy and the protection of your personal data remain paramount, and service providers are bound by strict regulations to ensure the security of your information.

In summary, the Travel Rule is a positive development for digital asset users like yourself, as it contributes to a more secure and trustworthy virtual asset industry.

Unlocking Compliance and Seamless Experiences: Tap's Proactive Approach to Upcoming Regulations

Tap is fully committed to upholding regulatory compliance, while also prioritizing a seamless and enjoyable customer experience. In order to achieve this delicate balance, Tap has proactively sought out partnerships with trusted solution providers and is actively engaged in industry working groups. By collaborating with experts in the field, Tap ensures it remains on the cutting edge of best practices and innovative solutions.

These efforts not only demonstrate Tap's dedication to compliance, but also contribute to creating a secure and transparent environment for its users. By staying ahead of the curve, Tap can foster trust and confidence in the cryptocurrency ecosystem, reassuring customers that their financial transactions are safe and protected.

But Tap's commitment to compliance doesn't mean sacrificing user experience. On the contrary, Tap understands the importance of providing a seamless journey for its customers. This means that while regulatory requirements may be changing, Tap is working diligently to ensure that users can continue to enjoy a smooth and hassle-free experience.

By combining a proactive approach to compliance with a determination to maintain user satisfaction, Tap is setting itself apart as a trusted leader in the financial technology industry. So rest assured, as Tap evolves in response to new regulations, your experience as a customer will remain top-notch and worry-free.

LATEST ARTICLE

Private label cards are branded payment solutions that enable businesses to offer customized rewards, incentives, and financing options to their customers and employees. These cards serve as powerful tools for driving customer loyalty, improving cash flow management, and gaining valuable spending insights. In this article, we'll guide you through the concept of private label cards, their key benefits for businesses, and delve into how they work.

What are private label cards?

Private label cards are branded payment cards issued by businesses to their customers or employees, allowing them to make purchases or access funds within a specific ecosystem or network. Unlike traditional debit or credit cards issued by a bank, private label cards are a product tailored to the branding and specific needs of the issuing company.

These cards differ from traditional cards in several ways. Firstly, they are not tied to a specific financial institution but rather to the company's brand and loyalty program. Secondly, they often offer unique rewards and incentives tailored to the business's products or services. Additionally, private label cards provide businesses with valuable customer data and insights, enabling targeted marketing efforts and personalized experiences.

Private label cards and fintechs

In recent years, fintech platforms have revolutionized the issuance and management of private label cards. These technology-driven companies act as program managers, handling the end-to-end process of card issuance, transaction processing, and compliance adherence.

By partnering with fintech platforms like Tap, businesses can efficiently launch and manage their private label card programs, leveraging advanced technologies, scalability, and industry expertise without the need for extensive in-house resources.

How private label cards benefit businesses

Private label cards empower businesses to strengthen customer relationships, optimize financial operations, and gain a competitive edge through tailored rewards, data-driven insights, and robust security measures. Let’s explore some of these concepts below:

Drive business

Private label cards offer businesses a range of benefits that can drive customer loyalty, enhance brand recognition, and streamline operations. By offering customizable rewards and loyalty programs tailored to their products or services, businesses can incentivize customers to make repeat purchases while simultaneously collecting data on customer preferences, fostering long-term relationships and brand advocacy.

Cash flow management

Private label cards provide businesses with a valuable tool for cash flow management. By encouraging customers to use their branded cards, companies can receive payments more quickly, improving their working capital and financial flexibility.

Collect data and analytics

One of the key advantages of private label cards is the wealth of data and analytics they provide. Businesses can gain insights into customer spending patterns, preferences, and behaviours, enabling data-driven decision-making and targeted marketing strategies.

Security benefits

Additionally, private label card programs prioritize security and fraud prevention measures. Fintech platforms offering these solutions employ advanced technologies and protocols to safeguard customer information and transactions, providing businesses and their customers with peace of mind.

The differences between private label and co-branded cards

Private label cards are issued by a single retailer or business, bearing their branding and tailored rewards program. Co-branded cards, however, involve a partnership between a merchant and a major card network (Visa, Mastercard), carrying dual branding.

In general, private label cards offer more customization and control for the merchant but may have limited acceptance outside their network. They can also drive stronger loyalty but require more resources to manage.

Co-branded cards, on the other hand, have wider acceptance but less flexibility in terms of rewards/benefits. As they leverage an existing card network's infrastructure, they offer less differentiation.

The choice depends on the merchant's goals; private label are beneficial for deeper customization and loyalty while co-branded cards off wider acceptance and shared resources with a card network partner.

How private label cards work

Private label cards are issued through a collaborative process involving businesses and fintech platforms. Businesses define the card program's features, branding, and reward structure, while fintech platforms handle the technical and operational aspects. As program managers, fintech companies then oversee card issuance, transaction processing, and data management, leveraging their expertise and scalable technologies.

The importance of compliance and adherence to regulatory requirements cannot be underestimated or overlooked when looking at the issuance of private label cards. Fintech platforms need to ensure that card programs comply with industry standards, data privacy laws, and anti-fraud measures, providing businesses with a secure and reliable payment solution.

Regular audits and risk assessments are conducted to maintain compliance and mitigate potential risks. Businesses must always do their research before engaging in private label card issuance with a fintech platform.

Examples of use cases

Private label cards can offer a range of use cases across various industries. See several examples below:

Retail and e-commerce

In the retail and e-commerce sectors, they serve as powerful loyalty tools, incentivizing customers with tailored rewards and exclusive offers. Businesses can leverage these cards to drive repeat purchases and foster brand loyalty. An example would be the Amazon Store Card.

Corporate expense management

Corporate organizations utilize private label cards for streamlined expense management, enabling employees to make authorized purchases while providing detailed spending data for analysis and budgeting purposes.

These cards also facilitate employee incentive and recognition programs, rewarding high-performers with customized benefits and privileges. An example of this would be a company card issued to employees to use for company expenses.

Specific purposes

Additionally, private label cards can be issued as prepaid cards for specific purposes, such as payroll disbursements, gift cards, or restricted-use cards for controlled spending. This versatility allows businesses to tailor card programs to their unique needs, ensuring efficient fund management and targeted usage.

An example of this could be a corporate-branded preloaded gift card for promotional purposes allowing holders to buy something in-store using the card.

How to create a private label card for your business

With Tap, you can seamlessly integrate private label card programs into your operations. Tap streamlines the entire card issuance and management process, allowing companies to leverage off their advanced technologies and industry expertise.

By partnering with Tap, you gain access to a scalable and flexible solution, enabling you to launch and adapt card programs efficiently, tailored to your company’s specific needs. Tap's platform offers robust features, real-time analytics, and end-to-end support, empowering every businesses to deliver tailored payment experiences while ensuring compliance and security.

With Tap, you have the power to not only launch and adapt your card programs efficiently but also to customise the fees charged to your users. Our approach is entirely flexible, allowing you to set charges that align with your clientele's needs. Our platform offers unparalleled freedom, allowing you to tailor your card programs precisely to your company's needs and goals.

Conclusion

In summary, private label cards empower businesses with a versatile payment solution that promotes customer loyalty, optimizes operations, and delivers valuable data insights. Whether for retail, corporate, or specific use cases, private label cards offer a competitive edge through tailored rewards, data-driven strategies, and enhanced customer experiences - paving the way for business growth.

Please contact xxx for further information on setting up your private label card.

Did you know that there are five different ways we express our love through money? Below we break down the original five love languages and then explain how these can be integrated into a financial setting. Knowledge is power, after all.

The original five love languages

The original five love languages were first introduced by Dr. Gary Chapman in his book "The 5 Love Languages: The Secret to Love that Lasts" offering insight into how we convey our love and how we hope to receive it. The five love languages are:

Words of affirmation

Expressing love and appreciation through verbal or written compliments, praise, and kind words.

Quality time

Showing love by giving undivided attention and spending meaningful quality time together.

Receiving gifts

Demonstrating love through thoughtful and meaningful gifts, usually involves around both giving and receiving gifts.

Acts of service

Expressing love by performing acts of kindness and service for the other person.

Physical touch

Showing affection and love through physical touch, such as hugs, kisses, and holding hands.

These love languages help individuals understand how they prefer to give and receive love. The book also states that recognizing and speaking each other's love languages can strengthen relationships.

What are the financial love languages?

Taking the original pillars, we’ve created five money love languages to give you an idea of how you financially show up in relationships (family, love or otherwise). Whether you share a flat with your brother, a business with a friend, or a joint account with a partner, everyone will be able to relate to these financial love languages. Afterall, managing money in a positive light is the cornerstone of any healthy relationship.

The five financial love languages

There’s value in being attuned to your own patterns, and to those of the ones you love. By recognising your partner's money love language you might get a better objective of how to create more harmony in the relationship by understanding what drives them to spend money. Without further adieu, let’s get into the five money love languages.

Open communication

While there are few topics less pleasant to talk about than money, having open and honest communication when it comes to the benjamins is not only valuable but essential. Having the skill, or having honed the skill should we say, to speak about financial matters with a loved one is an accolade, and for some, the most natural money love language. These chats will likely make you feel empowered and more connected to those around you, making it easier to be on the same page.

Acts of service: money edition

While the original acts of service encompass doing things that make the lives of those you love a little easier, in this context acts of service relate to money-related tasks such as taxes or budgeting. Having someone do your taxes as an act of love might be a bit ambitious, so let’s look at alternatives. It could be organising the holiday budget or creating an action plan to get your friend out of debt, or simply fixing something for you in order to save you money.

Love in savings

While it doesn’t sound like the sexiest option, planning for the future and having financial security is an invaluable act of love. Whether through investments, retirement plans, or even an emergency fund, what doesn’t say “I love you” if not “let’s make a financial decision to grow old together.” Some people's love language is expressing affection through providing, so why not let them put their planning skills and diligence to the test and shower you with their love? It might even help you reach your financial goals that much faster.

Experiencing something together

This person’s money love language is expressing their fondness through experiences and quality time, spending money on taking a trip, going on an exciting date night, or simply a new adventure. Through investing in time and experiences, you are quite simply saying I value spending time with you more than I value monetary gains.

The art of gifting

The last money love language we have for you today centers around gift-giving. Are you someone who likes to shower friends with presents, or love to spoil your significant other with something wonderful? Then this one’s for you. While this shouldn’t ever involve draining your bank account, pouring your love (and money) into an appropriate gift is a great way to show affection. Remember, it’s often the thought that counts rather than the price tag.

Which is your money love language?

Which of these do you most resonate with? Sometimes by identifying these intrinsic needs, we are able to better understand not only ourselves but our expectations of others. Whatever your financial love language might be, be sure to pour the greatest amount of love into your own finances and steadily work toward reaching your financial goals.

Before Bitcoin was launched in 2009, Satoshi Nakamoto designed the cryptocurrency to have a maximum supply of 21 million coins. As part of the greater plan, the number of new Bitcoin that enter circulation decreases at regular intervals, thus maintaining the total supply. These intervals are known as halvings, and affect everything from market value to investing strategies to potential profitability. Let's get into it.

What is the Bitcoin halving?

Roughly every 4 years, or every 210,000 blocks that are mined, the network undergoes a halving where the block reward for miners is reduced by 50%. This reward is earned by verifying transactions and adding a new block to the blockchain.

The halvings process decreases the rate at which new Bitcoins enter circulation, gradually depleting the remaining supply until the final satoshi is mined, expected to be around 2140. After that, miners will solely rely on transaction fees as an incentive to validate blocks.

The most recent Bitcoin network halving took place in April 2024, when the mining reward was reduced from 6.25 BTC to 3.125 BTC.

Why does the halving occur?

The Bitcoin halving is pre-programmed into Bitcoin's core code and is not something that can be changed - it's set in stone. Designed to control and slow down the release of new Bitcoins over time results in fewer and fewer Bitcoin being minted after each halving event.

This limited supply is a key part of what gives the digital currency its deflationary nature and potential for increasing value. As the supply is capped at 21 million, the dwindling new supply hitting the market reinforces Bitcoin's artificial scarcity.

Previous Bitcoin halvings

Below we look at previous halvings and how these affected the price of Bitcoin. Historically, 12 - 18 months after halvings, Bitcoin has reached a record high. While this is not the rule of thumb, it has certainly been witnessed.

2009 - Bitcoin launches

Date: 3 January 2009

Block reward: 50 BTC

2012 - Bitcoin’s first halving

Date: 28 November 2012

Block: 210,000

Block reward: 25 BTC

Price before halving (November 2012): Around $12

Next all-time high after halving: $1,156 (November 2013)

2016 - Bitcoin’s second halving

Date: 9 July 2016

Block: 420,000

Block reward: 12.5 BTC

Price before halving (July 2016): Around $650

Next all-time high after halving: $19,891 (December 2017)

2020 - Bitcoin’s third halving

Date: 11 May 2020

Block: 630,000

Block reward: 6.25 BTC

Price before halving (May 2020): Around $8,800

Next all-time high after halving: $69,000 (November 2021)

2024 - Bitcoin’s fourth halving

Date: 19 April 2024

Block: 840,000

Block reward: 3.125 BTC

Price before halving (April 2024): Around $65,000

At the time of writing, next all-time high after halving: $99,655.50 (November 2024)

Taking a look at the future dates, the next halving is expected to take place in 2028, when the block reward will be reduced to 1.5625 BTC. Thereafter, in 2032 and 2036. This will continue until all Bitcoins have been mined, which is expected to be in 2140.

Potential impacts of the recent halving

The next Bitcoin halving event is expected to have several potential impacts on the cryptocurrency. First and foremost, it will reduce the supply of new Bitcoins entering circulation by 50%, substantially decreasing its inflation rate. This scheduled supply rate reduction enhances Bitcoin's hardcoded scarcity which could lead to increased demand if investors view reduced supply as more desirable. Higher demand coupled with tightened supply could potentially drive up Bitcoin's price.

However, the halving will also cut block rewards for miners by 50%, which could force some smaller mining operations to shut down if their expenses outweigh newly reduced revenues. This may result in mining becoming less decentralised as larger entities with greater economies of scale are able to continue operating profitably. This could lead to further consolidation of the mining hashrate among a smaller number of big players.

Regardless of price movement, the most recent halving holds significance for Bitcoin's disinflationary issuance schedule, which will continue until the final Bitcoin is mined around 2140. This systematically shrinking supply reinforces Bitcoin's key value proposition as a deflationary asset, with absolute scarcity built into its design. Understanding this info highlights why some investors see Bitcoin's scarcity as a central role in its potential long-term value.

How will the rest of the crypto market be impacted?

We can confirm that Bitcoin's halving creates a ripple effect across the entire cryptocurrency market. While it directly impacts Bitcoin, it can also cause broader market shifts affecting many altcoins as investors start adjusting their portfolios during this time, which can lead to increased volatility and capital moving between digital assets.

Established cryptocurrencies like Ethereum often respond to Bitcoin's market changes, though their reactions aren’t always predictable. Smaller, less-known coins may face even greater uncertainty. Because crypto markets are so interconnected, even indirect effects from the halving can create big waves, making it a key event that influences the entire ecosystem.

Should I invest during a Bitcoin halving?

Sure, navigating Bitcoin halving speculation can feel like walking through a maze. Investors often debate the best timing - before, during, or after the event - but there's really no universal playbook.

The cryptocurrency market moves in mysterious ways, influenced by countless global factors, and past halvings have shown dramatically different market behaviors, making predictions challenging. While some see these events as potential opportunities, others view them with caution.

The key is understanding that no single strategy guarantees success. Individual research, a clear view of personal risk tolerance, and a broad understanding of market dynamics are essential for anyone considering involvement in this volatile landscape.

The bottom line

The Bitcoin halving is a highly significant event worth learning about as it enforces the cryptocurrency's hardcoded disinflationary monetary policy. While past halvings have led to powerful bull markets and substantial price appreciation, as illustrated above, it's important to understand that future price movements remain unpredictable and cannot be relied on.

Bitcoin's value is influenced by a complex array of factors beyond just supply dynamics, including adoption rates, regulatory developments, and overall market sentiment. Though artificially constrained supply can increase scarcity, demand is ultimately the driving force behind long-term valuations.

Hey there, Community! ✨

We've got some exciting news to share, and it's all about making your life a little bit easier and a whole lot clearer. We're thrilled to announce our partnership with TapiX – and before you wonder what this is all about, let me break it down into plain English, just for you.

No More Guessing Games 🎲

Ever looked at your transaction history and thought, "Where on earth did I spend that money?" We've all been there, scratching our heads, trying to decipher cryptic names or puzzling out just which coffee shop that was.

Here's where TapiX comes in – and why we're so excited about it. TapiX turns those confusing codes and names into information you can actually understand. We're talking real names of stores, complete with local language and all the details to make it click instantly. Yes, that means no more guessing games!

A Picture Speaks a Thousand Words 📷

But why stop at names? When you look at your transactions, you can now see actual logos and images – making it even easier to spot at a glance where you've been shopping. It's like turning your transaction history into a colourful gallery of your spending habits.

Pinpoint Shopping Locations📍

Ever got a charge from a store and wondered, "When did I go there?”. Now, you won't just see the name; you'll get the exact location. We're talking street address, city, even zip codes – perfect for those "Aha!" moments.

Extra Details at Your Fingertips 🫰

And there's more. Want to revisit a store but can't remember the name? You can now access additional details like website links, opening hours, and more for the store and companies that support it. It's like having a little assistant tucked away in your transaction history.

Why This Matters to You 👀

We believe managing your money should be as straightforward as shopping. That's why we partnered with TapiX – to transform your transaction list from a boring spreadsheet into a clear, understandable, and even helpful part of your daily life.

Here's what it boils down to: less time puzzling out your past spends and more time enjoying your present. Whether you're a budgeting pro or just trying to keep track of where your money's going, we think you'll love this new feature.

It's All About You 💙

At Tap, everything we do is aimed at giving you a better experience. We listen, we care, and we act on what you need. This partnership? It's all about making your financial life clearer and simpler.

We're here to help you make sense of your spending, save time, and maybe even discover some new favourite spots along the way. And this is just the beginning – we're always looking for ways to improve your experience.

So go ahead, take a look at your updated transaction history, and see the difference for yourself.

Here's to clearer, simpler, and more enjoyable finances.

Warmly,

The Tap Team.

Tap, announces a temporary suspension of XTP locking/fees payment for all its users, reflecting a steadfast commitment to regulatory compliance and global collaboration.

In alignment with our regulatory-first vision, Tap announce the temporarily suspending XTP locking and fee payment in XTP. This strategic move reflects our dedication to regulatory compliance in every aspect of our operations.

At Tap, we prioritize responsibility alongside innovation. This temporary suspension underscores our commitment to regulatory compliance and our ability to effectively serve all our users in the United Kingdom, aligning with the new FCA regulations set in place.

In accordance with the Financial Conduct Authority's (FCA) financial promotion rule, we regret to inform our UK residents that the utilization of XTP for locking or payment is temporarily suspended. The FCA has classified the use of digital assets for obtaining discounts as a financial incentive, thus preventing its extension to any UK resident.

The temporary suspension of services in the UK has necessitated a pause in functionality across our entire platform due to its unified nature. Nevertheless, our team remains unwavering in our commitment to restoring Locking/Paying Fees in XTP for our global community.

While this transition may present temporary challenges, it also represents an opportunity for growth and collective progress.

We extend our heartfelt appreciation to our users for their unwavering support and patience as we navigate through this transition. Rest assured, Tap remains steadfastly committed to delivering an unparalleled digital asset experience that is compliant, secure, seamless, and transformative for users worldwide.

TAP Partners with Notabene to Implement Innovative Solutions Ensuring Adherence to Cryptocurrencies’ Travel Rule

Tap is proud to announce its new partnership with Notabene, in a concerted and strategic response to strengthen its compliance operations, by utilizing the market-leading solutions to ensure ongoing compliance with the Travel Rule for cryptocurrencies. Embracing the ever-evolving regulatory landscape, this partnership underscores TAP's dedication to ensuring consumer trust and guaranteeing pre-transaction regulatory compliance requirements at all times.

Tap has always taken pride in its regulatory-first approach, emphasizing the importance of consumer trust and operational transparency. Tap's decision to partner with Notabene is grounded in a multitude of strategic rationales. Notabene's all-encompassing SafeTransact platform, renowned for its excellence in identifying and mitigating high-risk activity before it occurs, provides compliance teams with the tools to make data-driven choices and enhances operational efficiency by seamlessly integrating the Travel Rule into compliance processes.

Notabene's notable offering includes its SafeGateway solution, which facilitates VASP-to-VASP interaction across protocols. This positions them as strong contenders in the cryptocurrency compliance solutions sector. This underscores why TAP views this partnership as a positive step toward maintaining a competitive edge in the fintech compliance landscape.

Comment from Kriya Patel, CEO of Tap

“I am delighted to be able to announce our strategic partnership with Notabene and I look forward to growing the relationship together whilst navigating through to meeting and maintaining our current and future regulatory requirements in our industry.

The partnership with Notabene was a natural one. They share the same values as Tap by focusing on customer-driven product needs, whilst allowing us to maintain a regulated and security-first approach.”

Comment from Pelle Braendgaard, CEO of Notabene

"We are pleased to collaborate with Tap, their commitment to compliance and customer trust aligns seamlessly with our mission. Together, we can advance the industry while ensuring the highest standards of security and transparency."

Kickstart your financial journey

Ready to take the first step? Join forward-thinking traders and savvy money users. Unlock new possibilities and start your path to success today.

Get started