Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

In our interconnected global economy, currency symbols are everywhere, whether you're planning international travel, running an e-commerce business, formatting financial documents, or simply trying to understand pricing on a foreign website. Knowing how to recognise and use currency symbols correctly is essential.

The long and the short of it is that currency symbols are shorthand notations that represent different monetary units around the world.

Unlike ISO currency codes (like USD or EUR), these symbols provide a quick visual reference that transcends language barriers. From the familiar dollar sign ($) to the Indian rupee symbol (₹), each symbol tells a story of economic identity and cultural significance.

Understanding currency symbols becomes particularly important when dealing with international transactions, creating multilingual websites, formatting invoices, or developing financial applications. They're not just academic knowledge - they're practical tools for anyone engaged in global commerce or travel.

What is a currency symbol?

A currency symbol is a graphical representation used to illustrate a specific monetary unit. These symbols serve as universal shorthand, allowing people to quickly identify and work with different currencies without needing to spell out the full currency name or remember complex three-letter codes.

For example, the dollar sign ($) immediately signals US dollars, while the euro symbol (€) represents the European Union's currency. The British pound uses (£), and the Japanese yen employs (¥). Each symbol has been carefully designed to be distinctive and memorable.

It's important to distinguish currency symbols from ISO currency codes. While the symbol for US dollars is $, the ISO code is USD. The symbol for euros is €, but the ISO code is EUR. Symbols are visual and compact, while codes are standardised three-letter abbreviations used primarily in financial systems and international banking.

Currency symbol placement rules (before or after the number?)

The placement of currency symbols relative to numbers varies significantly across countries and cultures, following local conventions rather than universal rules.

In most English-speaking countries, the symbol appears before the number: $100, £50, or A$75 for Australian dollars. However, many European countries place the symbol after the number: 100€ in France, or 50₽ in Russia.

Some currencies have unique formatting conventions. In Cape Verde, you might see 20$00, where the dollar sign appears before the decimal portion. Similarly, some Latin American countries write $20.00 or $20,00 depending on their decimal separator conventions.

When working with international documents or websites, always research the local convention for the specific country and currency you're dealing with. This attention to detail demonstrates cultural awareness and professionalism in global business communications.

Complete list of world currency symbols by region

Europe

| Country | Currency Name | Symbol | ISO Code |

|---|---|---|---|

| European Union | Euro | € | EUR |

| United Kingdom | British Pound | £ | GBP |

| Switzerland | Swiss Franc | CHF | CHF |

| Russia | Russian Ruble | ₽ | RUB |

| Poland | Polish Zloty | zł | PLN |

| Czech Republic | Czech Koruna | Kč | CZK |

| Denmark | Danish Krone | kr | DKK |

| Sweden | Swedish Krona | kr | SEK |

| Norway | Norwegian Krone | kr | NOK |

The Americas

| Country | Currency Name | Symbol | ISO Code |

|---|---|---|---|

| United States | US Dollar | $ | USD |

| Canada | Canadian Dollar | C$ | CAD |

| Mexico | Mexican Peso | $ | MXN |

| Brazil | Brazilian Real | R$ | BRL |

| Argentina | Argentine Peso | $ | ARS |

| Chile | Chilean Peso | $ | CLP |

| Colombia | Colombian Peso | $ | COP |

| Peru | Peruvian Sol | S/ | PEN |

Asia & Pacific

| Country | Currency Name | Symbol | ISO Code |

|---|---|---|---|

| Japan | Japanese Yen | ¥ | JPY |

| China | Chinese Yuan | ¥ | CNY |

| India | Indian Rupee | ₹ | INR |

| South Korea | South Korean Won | ₩ | KRW |

| Australia | Australian Dollar | A$ | AUD |

| New Zealand | New Zealand Dollar | NZ$ | NZD |

| Thailand | Thai Baht | ฿ | THB |

| Philippines | Philippine Peso | ₱ | PHP |

| Indonesia | Indonesian Rupiah | Rp | IDR |

Middle East

| Country | Currency Name | Symbol | ISO Code |

|---|---|---|---|

| Israel | Israeli Shekel | ₪ | ILS |

| Saudi Arabia | Saudi Riyal | ر.س | SAR |

| UAE | UAE Dirham | د.إ | AED |

| Turkey | Turkish Lira | ₺ | TRY |

| Iran | Iranian Rial | ﷼ | IRR |

Africa

| Country | Currency Name | Symbol | ISO Code |

|---|---|---|---|

| South Africa | South African Rand | R | ZAR |

| Nigeria | Nigerian Naira | ₦ | NGN |

| Ghana | Ghanaian Cedi | ₵ | GHS |

| Kenya | Kenyan Shilling | KSh | KES |

| Egypt | Egyptian Pound | £ | EGP |

Cryptocurrencies

| Currency | Symbol | Common Abbreviation | ISO Code |

|---|---|---|---|

| Bitcoin | ₿ | BTC | ZAR |

| Ethereum | Ξ | ETH | NGN |

| Litecoin | Ł | LTC | GHS |

How to type currency symbols on your keyboard

Windows Shortcuts

- Dollar ($): Shift + 4

- Euro (€): Alt + 0128

- British Pound (£): Alt + 0163

- Japanese Yen (¥): Alt + 0165

- Cent (¢): Alt + 0162

Mac Shortcuts

- Dollar ($): Shift + 4

- Euro (€): Option + Shift + 2

- British Pound (£): Option + 3

- Japanese Yen (¥): Option + Y

- Cent (¢): Option + 4

Additional Methods

For symbols not available through keyboard shortcuts, you can use Unicode codes, copy from character maps, or use online symbol generators. Some fonts may not support all currency symbols, so consider using web-safe fonts like Arial or Times New Roman if your specific font isn’t supportive.

Currency symbols in documents and spreadsheets

Microsoft Word

Navigate to Insert > Symbols to access the complete symbol library. You can also use Alt codes or set up custom keyboard shortcuts for frequently used symbols.

Microsoft Excel

Use Format Cells > Currency to automatically apply currency formatting. Excel recognises most major currency symbols and can format numbers accordingly.

Google Docs

Go to Insert > Special Characters, then search for "currency" to find available symbols. You can also bookmark frequently used symbols for quick access.

Google Sheets

Use Format > Number > Currency to apply currency formatting. Google Sheets automatically detects your location and suggests appropriate currency symbols.

Most traded and recognised currency symbols

The most globally recognised and traded currency symbols include:

- US Dollar ($) - The world's primary reserve currency, used in international trade and forex markets

- Euro (€) - The second most traded currency, representing 19 European Union countries

- British Pound (£) - One of the oldest currencies still in use, significant in global finance

- Japanese Yen (¥ or JP¥) - Major Asian currency and key player in international markets

- Chinese Yuan (¥ or CN¥) - Rapidly growing importance in global trade and reserves

- Indian Rupee (₹) - Representing one of the world's largest economies

Closing summary

Understanding currency symbols is more than academic knowledge - it's a practical skill that enhances your ability to navigate our global economy. Whether you're travelling abroad, conducting international business, or simply trying to understand pricing on a foreign website, knowing how to recognise and properly use currency symbols will have you one step ahead.

_%20(1).webp)

VeChain represents a unique approach to blockchain technology, positioning itself as an enterprise-focused platform that bridges the gap between traditional business operations and decentralised innovation.

Unlike cryptocurrencies designed primarily for financial transactions, VeChain operates with a dual-token model specifically engineered to solve real-world business challenges, particularly in supply chain transparency and process improvement.

The platform's primary mission centers on bringing trust, transparency, and efficiency to complex business networks. From tracking luxury goods through global supply chains to verifying pharmaceutical authenticity, VeChain has expanded beyond its initial scope to encompass Web3 applications, Internet of Things (IoT) integration, and sustainability initiatives.

This practical focus has attracted both enterprise adopters seeking operational improvements and investors interested in blockchain technology with demonstrated real-world utility.

What is VeChain (VET)?

VeChain's journey began in 2015 under the leadership of Sunny Lu, former Chief Information Officer of Louis Vuitton China, who founded the project through his company Bitse. This background in luxury retail operations provided crucial insights into the authentication and supply chain challenges that would later define VeChain's core value proposition.

The platform's mission extends beyond simple crypto functionality to address fundamental business needs for transparency, trust, and operational efficiency. VeChain achieves this through a comprehensive ecosystem that encompasses supply chain tracking applications, decentralised apps (dapps), IoT device integration, and sustainability-focused projects.

Central to VeChain's architecture is its innovative two-token system. VET serves as the primary value transfer token and represents the investment asset within the ecosystem, while VTHO (VeThor) functions as the operational fuel for transaction processing.

This separation allows businesses to predict and control transaction costs while providing token holders with potential value appreciation through VET ownership.

How does VeChain work?

VeChain operates on the VeChainThor blockchain, which uses a Proof of Authority (PoA) consensus mechanism (also referred to as Proof of Authenticity within the VeChain ecosystem). This PoA model relies on 101 Authority Masternodes selected via identity verification and KYC, allowing fast, low-energy, enterprise-suitable consensus. This approach prioritises transaction speed, energy efficiency, and predictable performance over complete decentralisation.

In 2021, PoA was upgraded to PoA 2.0 (SURFACE) to enhance scalability, security, throughput, and energy efficiency.

How does it work? Authority Masternodes validate transactions and maintain network security, while Economic Nodes and X-nodes provide additional network support and earn rewards based on their VET holdings and node status.

VeChain’s architecture offers clear benefits for businesses:

- Transactions are fast and use very little energy.

- Costs are predictable and low.

- The network performs reliably, even during heavy usage.

These features make VeChain a strong choice for companies that need efficient, dependable, and cost-effective blockchain solutions.

Key features & technology stack

VeChain combines traditional business systems with blockchain technology using several core components. Notably, smart chips, RFID tags, and IoT sensors collect real-time data from physical products and processes. This information is then recorded directly on the blockchain, creating permanent, tamper-proof records.

The platform also offers a full set of tools for developers and businesses. These include smart contracts, data integration APIs, and easy-to-use interfaces for non-technical users, creating space for everything from simple tracking apps to complex, multi-party business solutions.

Governance is then managed through a structured model that balances efficiency and stakeholder input.

Essentially, the VeChain Foundation sets the overall strategy, while authority node operators help make key network decisions. This approach keeps transaction costs predictable, ensures strong performance, and allows the network to adapt to changing business needs.

Real-world use cases & partnerships

VeChain is used across many industries, showing its flexibility and real-world value.

In pharmaceuticals, companies track medicines from the factory to the pharmacy. This helps ensure authenticity and stops counterfeit drugs from entering the market.

In food production, VeChain gives consumers full traceability - from farm to store shelf - so they can see exactly where their food comes from.

The automotive industry uses VeChain for digital maintenance records and fraud prevention. Partners like Renault and BMW have built systems to log vehicle history, repairs, and ownership transfers on the blockchain. This creates transparent, trustworthy records that help manufacturers, buyers, and sellers while cutting down on fraud in used car sales.

Corporate partnerships have boosted VeChain’s global reach. PwC includes it in their blockchain advisory services, while Walmart China uses it to let shoppers scan products with their phones and confirm origin and safety information.

VeChain has even moved into sports and entertainment - for example, partnering with the UFC to authenticate gloves via NFT technology.

In the public and sustainability sectors, governments and organisations use VeChain to track carbon credits, verify renewable energy certificates, and manage environmental compliance data.

VeChain's tokenomics explained

As touched on earlier, VeChain uses a unique two-token system to separate value storage from transaction costs.

- VET is the main token with a fixed supply. It’s used for transferring value, running smart contracts, and as an investment asset. People who hold VET can take part in network governance and earn VTHO over time.

- VTHO is the “fuel” for transactions, like gas fees on other blockchains.

The key difference with VeChain’s model is predictability: VTHO is generated at a fixed rate from VET holdings, so businesses can budget for blockchain costs without worrying about token price swings.

This setup is designed to benefit everyone in the ecosystem:

- Developers and businesses get stable, predictable costs.

- Investors have potential for value growth through VET.

- The network stays secure and incentivised for participation.

VeChain price history & market performance

VeChain’s price history has been shaped by both the ups and downs of the wider crypto market and key moments in its own growth.

Firstly, the native coin started out as VEN tokens, then switched to VET in 2018 with the launch of the VeChainThor mainnet, a big technical step that also set up its current token model.

During the 2021 crypto bull run, VET hit its all-time high as interest in enterprise blockchain and supply chain solutions surged. Like most cryptocurrencies, it later saw sharp drops during market pullbacks.

Also, like most cryptocurrencies, VET’s price has often reacted to news of new partnerships, enterprise adoption, and developments in the blockchain industry. Regulatory discussions around crypto and blockchain in different countries have also played a role.

Today, VeChain is seen as one of the more established blockchain platforms with real-world enterprise adoption, though its market cap is still smaller than bigger general-purpose players like Ethereum and Solana.

How to Buy VeChain (VET)

VET can be bought through platforms that support crypto trading. The process is similar to buying any other digital asset (just ensure that the platform supports VET directly).

First, create an account on a platform that offers VET, then complete the required identity verification, which usually involves providing proof of identity and address. Once verified, add funds using a bank transfer, card payment, or another supported method.

From there, find the VET trading option and place your order. If you’re making a larger purchase, you might consider buying in smaller amounts over time to reduce the impact of price swings.

For long-term storage, VeChain-compatible wallets allow you to manage both VET and VTHO, and some also track VTHO generation. Hardware wallets can provide an extra layer of security.

How to use VeChain

For businesses:

VeChain can be used for things like product verification, protecting data integrity, and connecting IoT devices. It offers APIs and tools so companies can build blockchain solutions without needing deep cryptocurrency knowledge.

For everyday users:

People can interact with VeChain through apps built on the platform, such as NFT marketplaces, supply chain trackers, and sustainability tools. Many of these apps are designed to be easy to use, even for those new to blockchain.

For developers:

VeChainThor supports familiar programming languages and frameworks, with detailed documentation, tools, and a test network for building and testing apps.

For token holders:

Owning VET lets you earn VTHO, join governance discussions, and contribute to network operations by running economic nodes.

Advantages & criticisms of VeChain

VeChain’s strengths lie in its real-world use, enterprise adoption, and operational efficiency. The platform focuses on practical business solutions, leading to partnerships with established companies and measurable results. Its low transaction costs and predictable fees make it appealing for businesses that need to handle large volumes of transactions.

VeChain also emphasises sustainability, supporting corporate goals around environmental responsibility. Its energy-efficient consensus system and applications for carbon tracking and renewable energy verification help achieve these aims.

However, there are some criticisms and risks. VeChain’s Proof of Authority system relies on pre-approved authority nodes, which some say goes against blockchain’s decentralisation principles and could create points of control or failure.

Market volatility is another concern. While the two-token system stabilises operational costs, fluctuations in VET’s price can still affect the ecosystem’s economics.

Finally, VeChain faces competition. Many other blockchain platforms are targeting enterprise use cases, and general-purpose blockchains are increasingly adding enterprise-focused features.

Did you know some chart patterns boast success rates of over 80% when spotted and used correctly? While the market often feels chaotic, decades of historical data reveal that price movements tend to repeat in recognisable ways.

For many investors and traders, these patterns are seen as the market’s “body language,” offering clues about shifts in momentum and sentiment. Every move on a stock chart reflects what investors are thinking and doing, and once you learn to “read” those signals, the idea is that you can spot whether a stock is likely to keep running or flip directions.

The real power isn’t in predicting the future (nobody can do that). It’s about stacking the odds in your favour. Patterns help you zero in on higher-probability setups, fine-tune your entries and exits, and manage risk more effectively, meaning smarter trades and fewer costly mistakes.

In this guide, we’ll break down several reliable patterns and show you which timeframes matter.

The best timeframes for chart pattern analysis

Before diving into specific patterns, you need to understand that timeframe selection dramatically impacts pattern reliability. The same asset can show completely different patterns depending on whether you're looking at 15-minute, daily, or weekly charts.

For instance, take Bitcoin below: the very same moment in time can look completely different on a daily chart versus a monthly chart.

Source: TradingView | 1 day vs 1 month trading charts

Daily charts

For most investors, daily charts often hit the sweet spot because they balance short-term noise with more reliable signals. Patterns that take weeks or months to form on daily charts tend to be more trustworthy because they reflect genuine shifts in market sentiment rather than momentary blips.

4-hour charts

If you’re swing trading (holding positions for days or weeks) 4-hour charts are likely going to be your best friend. They capture medium-term trends and provide more opportunities than daily charts, while still being reliable enough for professional traders to use when sharpening their entries and exits.

15-minute charts

Then there are 15-minute charts, the playground of active traders. They can be exciting, but here’s the catch: shorter timeframes often mean more false signals. You might spot plenty of patterns, but their accuracy drops fast. Only use these if you can stay glued to the screen and stick to strict risk controls.

Many traders chose to blend their timeframes in a layered strategy. Starting with daily charts to lock onto the bigger trend, then zooming into shorter ones to pinpoint their entry.

The 5 most well-known chart patterns for timing

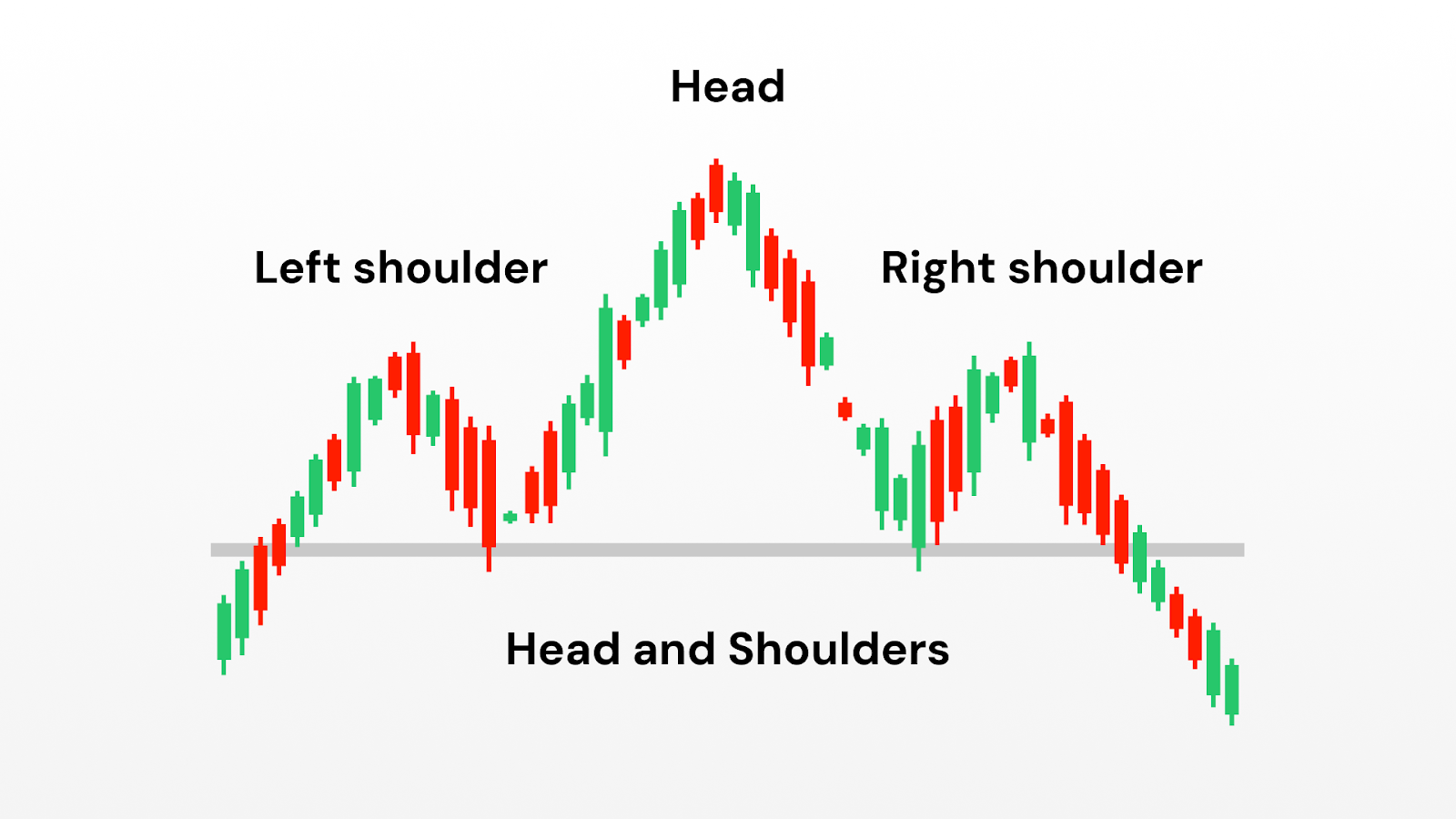

1. Head and Shoulders

The Head and Shoulders formation is one of the most widely studied and discussed reversal patterns in technical analysis. It’s often described as the market’s way of “topping out,” suggesting that an uptrend may be running out of steam.

Structure of the pattern

- The left shoulder: An initial rally creates a peak, followed by a decline.

- The head: A stronger rally pushes prices to a higher peak than before, but the move is not sustained.

- The right shoulder: A final attempt to rise falls short of the head’s height, showing reduced momentum.

- The neckline: A line connecting the two low points between the shoulders and the head, often used as a reference for when the pattern is considered “complete.”

When this sequence appears, many analysts view it as a sign that bullish pressure is fading and that selling interest is beginning to dominate.

Why it matters

The head and shoulders pattern is so closely followed because it reflects a psychological shift:

- The first rally shows enthusiasm.

- The higher peak shows overextension but also reveals strong optimism.

- The final, weaker rally shows that buyers no longer have the same conviction. This shift from strength to weakness is why the pattern is often considered a reliable reversal signal.

Variations

Inverse Head and Shoulders: The opposite version, often seen at market bottoms, where the formation suggests a shift from selling pressure to renewed buying interest.

Complex Head and Shoulders: In some markets, extra shoulders may form, reflecting prolonged tug-of-war before momentum reverses.

Caveats

Despite its reputation, the head and shoulders is not foolproof. False signals are common, particularly in thinly traded assets or during periods of high volatility.

Many traders treat it as a useful warning sign rather than a guarantee, and they often combine it with other forms of analysis (such as trend strength, support and resistance zones, or macro factors) to build confidence in their interpretation.

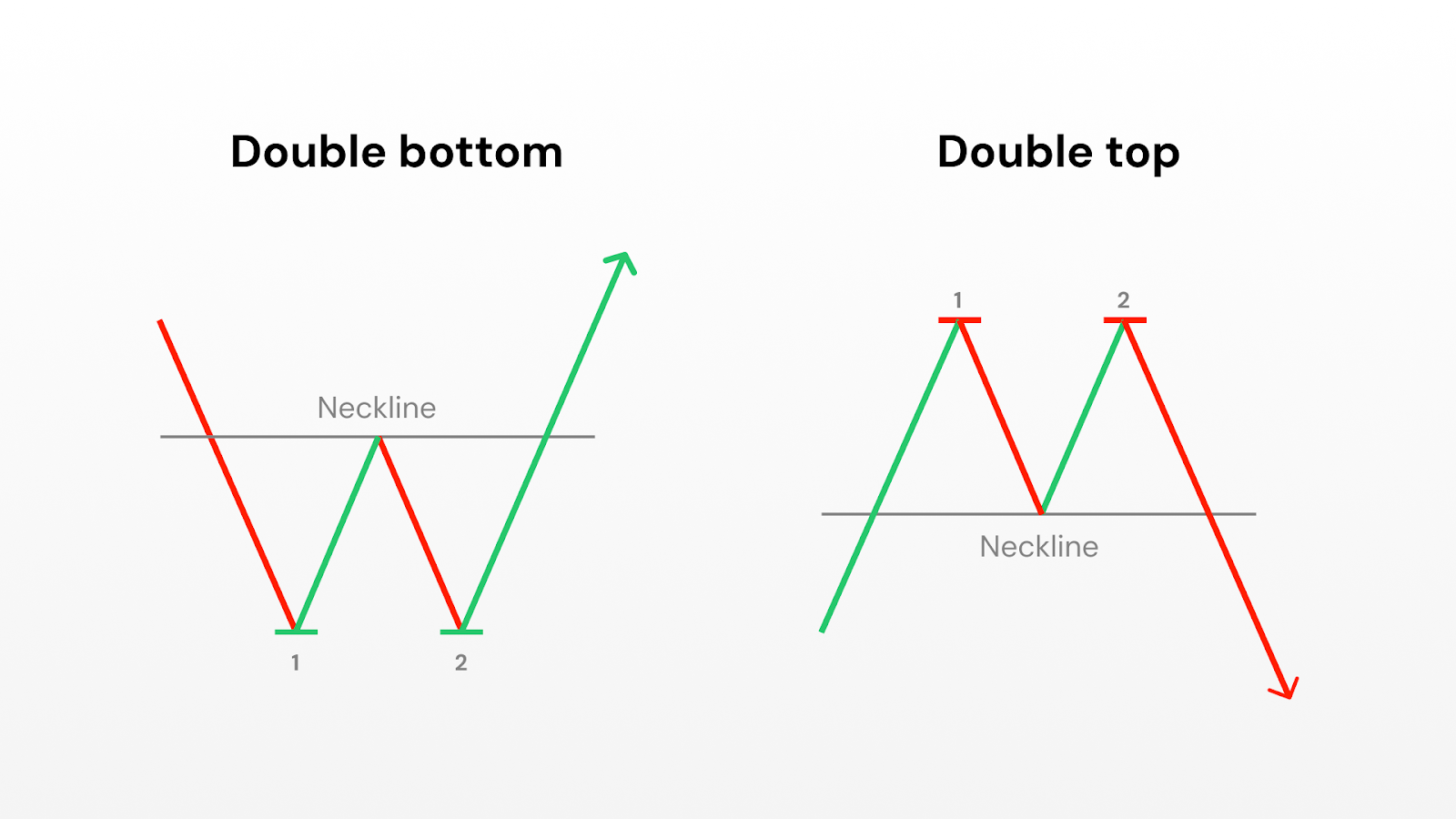

2. Double Bottom/Top

Double Bottoms (bullish) and Double Tops (bearish) are among the simplest and most recognisable reversal patterns in technical analysis.

They occur when the price tests the same level twice and fails to break through, creating what looks like a “W” (double bottom) or an “M” (double top) on the chart.

Analysts often interpret these formations as signals that a prevailing trend may be losing strength.

Structure of the pattern

- Double Bottom:

- The first trough forms after a decline, followed by a rebound.

- A second trough appears at or near the same price level as the first, showing that sellers were unable to push prices much lower.

- The interim peak between the two troughs creates a resistance line that observers often watch as a reference point.

- Double Top:

- The first peak forms after an advance, followed by a pullback.

- A second peak occurs at or near the same level as the first but fails to exceed it, showing reduced buying strength.

- The interim valley between the two peaks creates a support line that analysts watch for signs of confirmation.

Why it matters

Double tops and bottoms are considered significant because they capture a classic battle between buyers and sellers. The first test establishes an important price level, while the second test highlights the inability of the market to push through that level a second time. This repetition signals a potential turning point:

- In double bottoms, the failure to break support is often interpreted as a sign of strengthening demand.

- In double tops, the failure to break resistance is seen as evidence of weakening demand.

Variations

Broad or Narrow Spacing: The distance between the two peaks or troughs can vary. Wider spacing often indicates a more meaningful shift in sentiment.

Multiple Tests: Sometimes prices test the same support or resistance level more than twice before a trend change occurs, creating what some analysts call “triple tops” or “triple bottoms.”

Caveats

Like all technical formations, double tops and bottoms are not guarantees. False signals are common, especially in highly volatile markets where short-term noise can mimic the shape of a pattern without any true shift in momentum.

Analysts often combine this pattern with other tools, such as volume trends, broader market direction, or momentum indicators.

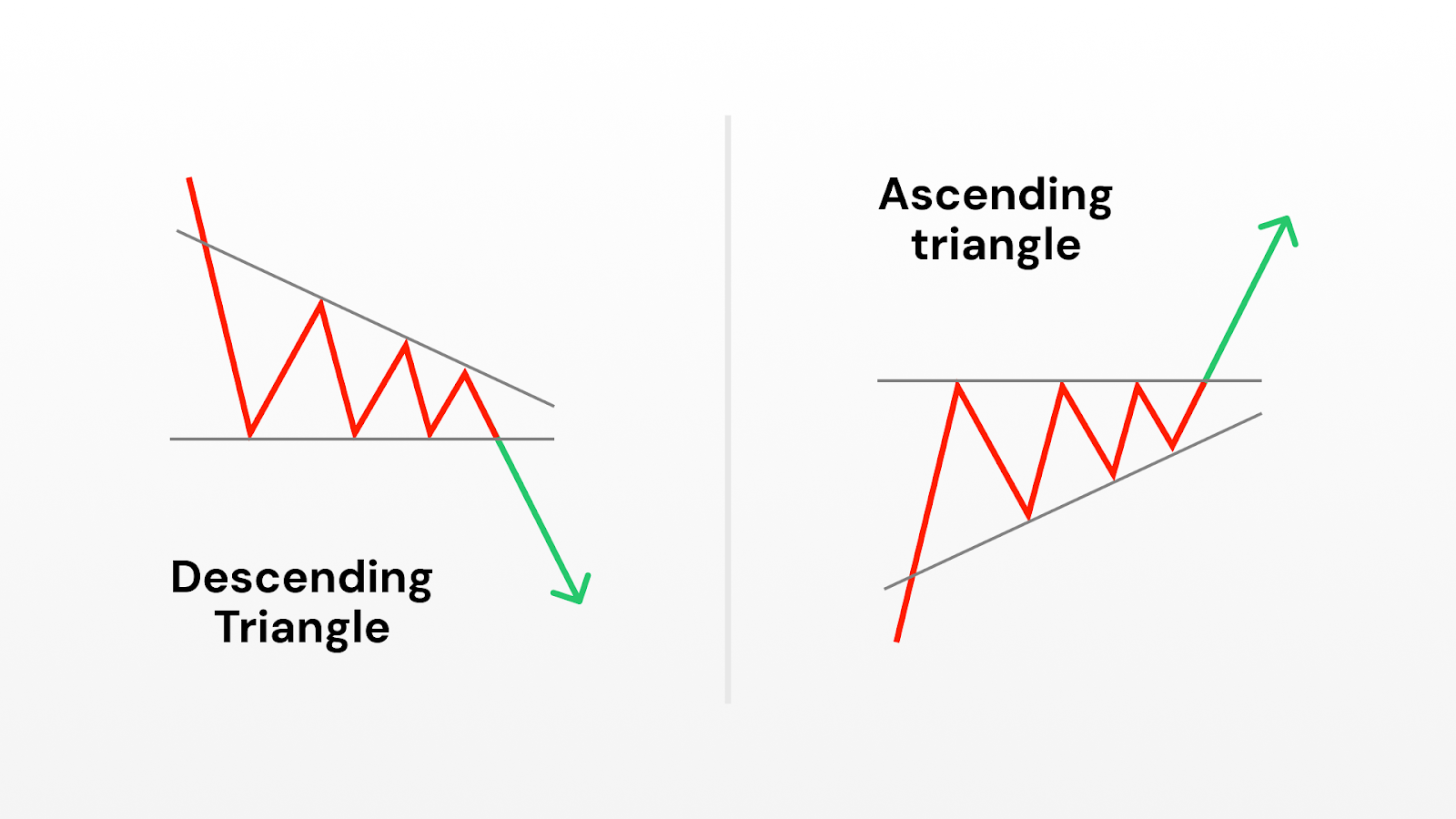

3. Ascending and Descending Triangles

Triangles are continuation patterns that appear when prices start moving in a narrower range. This usually signals a pause in the market before the existing trend continues. The two most common types are Ascending Triangles (often seen as bullish) and Descending Triangles (often seen as bearish).

Structure of the pattern

- Ascending Triangle: Price makes a series of higher lows while repeatedly testing the same horizontal resistance. This shows that buyers are becoming more aggressive, steadily bidding prices higher, while sellers defend a key level.

- Descending Triangle: Price makes a series of lower highs while testing a horizontal support. This suggests that sellers are increasingly dominant, though buyers continue to defend a price floor.

- The breakout level: The horizontal line of support (in descending) or resistance (in ascending) is the critical feature analysts watch, as it represents the point where supply or demand may finally give way.

Why it matters

Triangles reflect consolidation: a period where the market pauses, often as traders wait for new information or a decisive shift in sentiment.

- In ascending triangles, the sequence of higher lows highlights persistent demand, hinting at underlying bullish pressure.

- In descending triangles, lower highs point to mounting selling pressure, often seen as bearish.

Variations

Symmetrical Triangles: Unlike ascending or descending, both highs and lows converge toward a point. These are sometimes called “bilateral” patterns, as they can break in either direction.

Time to completion: Many studies suggest that triangle patterns typically resolve before prices reach the tip of the triangle; if not, the pattern may lose significance.

Caveats

While widely followed, triangles are not predictive in isolation. Breakouts can and do fail, particularly in choppy or news-driven markets. Analysts often seek confirmation through trading volume or other trend indicators before treating the pattern as meaningful.

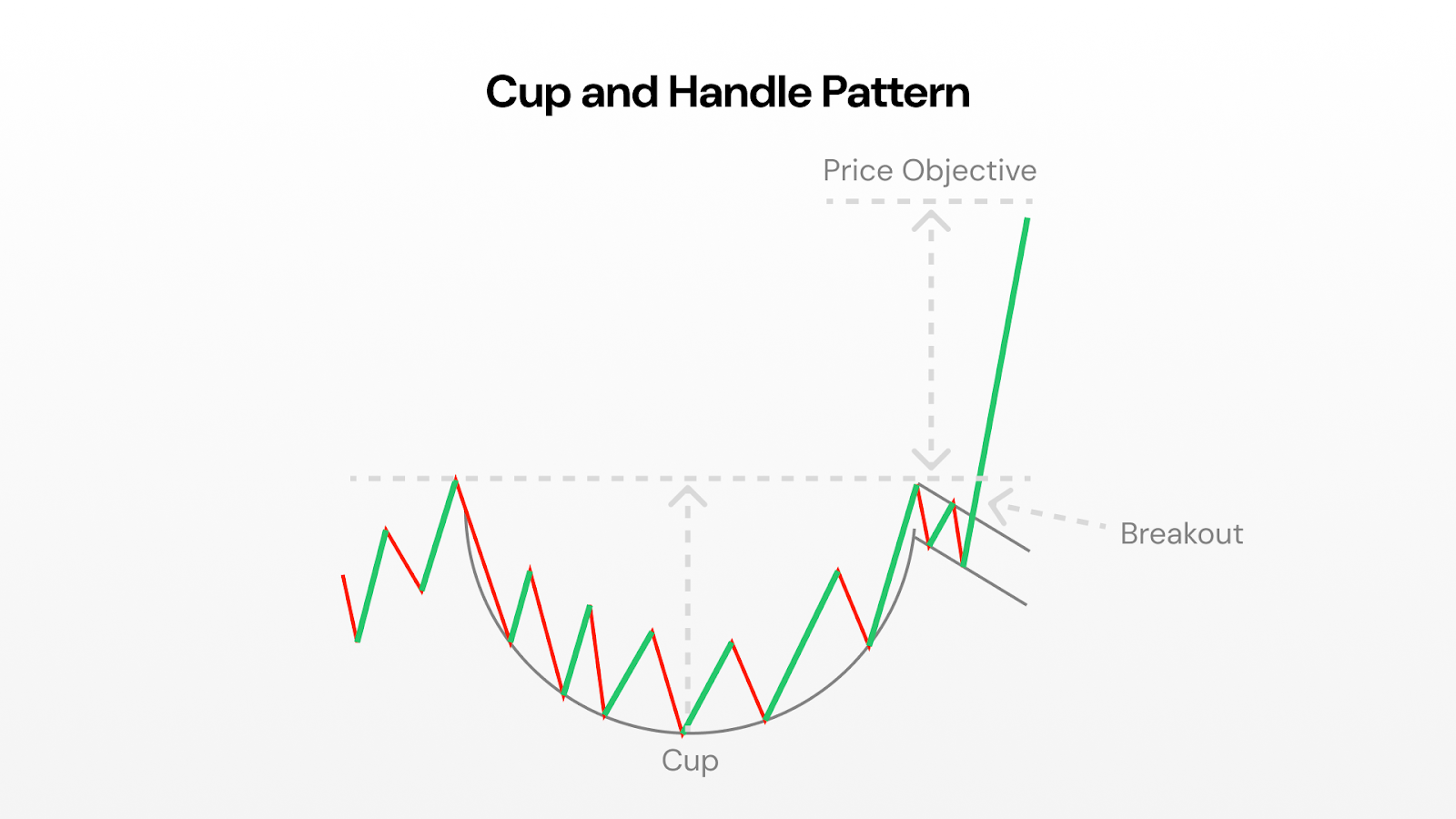

4. Cup and Handle

The Cup and Handle is a long-term bullish pattern named for its resemblance to a teacup. It is frequently studied in equity markets and is often associated with extended uptrends when it completes successfully.

Structure of the pattern

- The Cup: Prices decline gradually, bottom out, and then recover in a rounded, U-shaped curve. The depth of the cup reflects the extent of the pullback before sentiment recovers.

- The Handle: After the cup completes, prices typically consolidate sideways or drift slightly downward in a shorter, shallower formation. This pause is seen as a “shakeout” of weaker hands before a new advance.

- The Breakout Level: The top of the cup, where prices previously peaked before declining, becomes a reference level for confirmation.

Why it matters

The Cup and Handle is often interpreted as evidence of a market shaking off selling pressure and regaining strength. The extended base (the cup) suggests long-term accumulation, while the smaller handle shows short-term hesitation before renewed buying. This blend of consolidation and recovery is why the pattern is often associated with continuation of an uptrend.

Variations

Deep vs. shallow cups: Shallow cups are generally considered stronger, as they indicate lighter selling pressure. Very deep cups can signal weaker underlying demand.

No handle: Occasionally, prices break out directly after forming the cup without creating a handle. Some analysts treat these as valid, while others consider the handle an essential feature.

Caveats

Because cup and handle formations often take weeks or months to develop, they can be subjective. False signals are common if the “handle” drifts too low or if volume patterns don’t align with expectations. As with other patterns, context (i.e. broader market trends and sector strength) is critical.

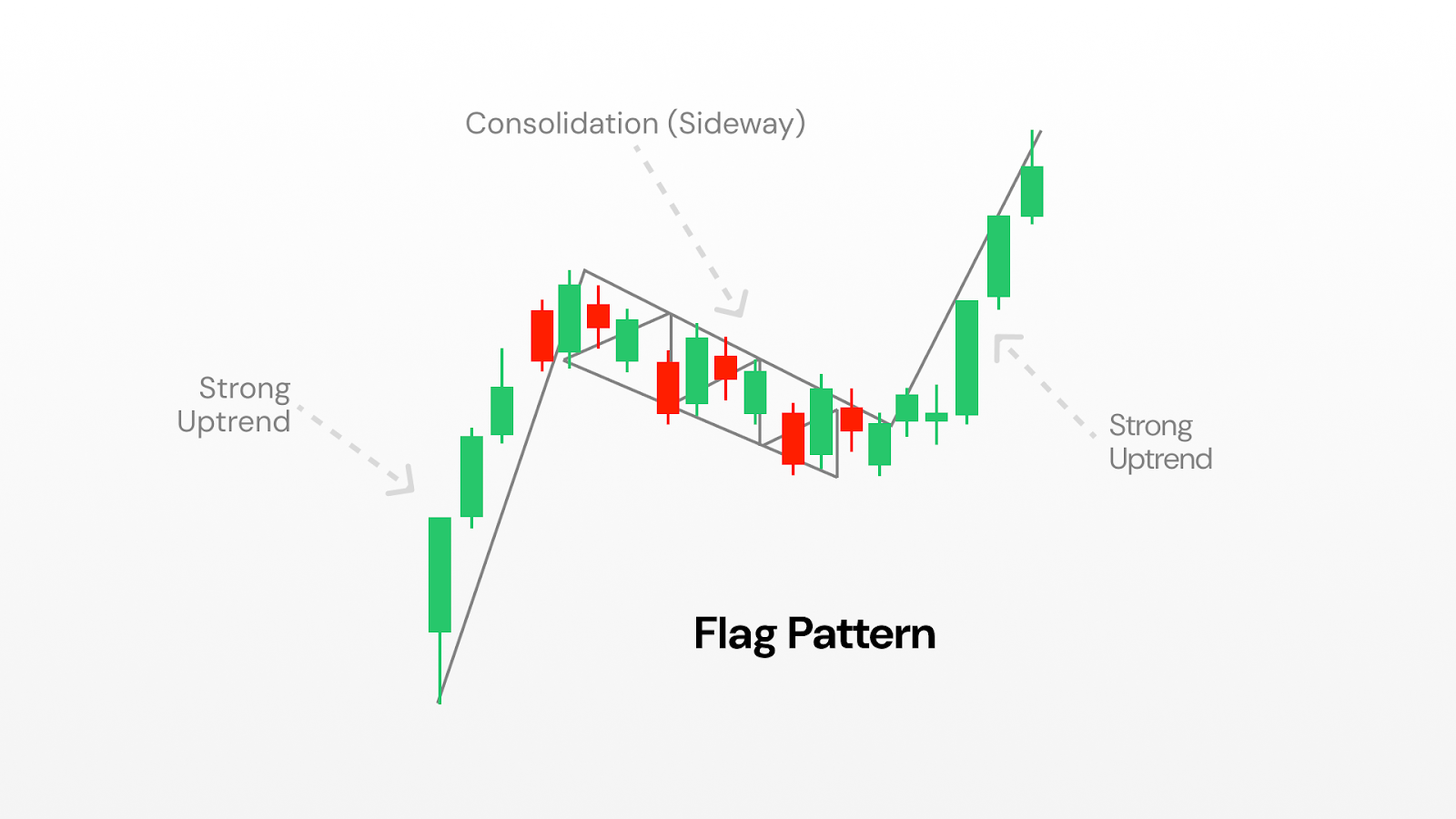

5. Flag Patterns

Flag patterns are short-term continuation formations that occur after sharp price movements, known as “flagpoles.” They are named for their resemblance to a flag on a pole: a rapid advance or decline, followed by a small rectangular consolidation sloping against the trend.

Structure of the pattern

- The Flagpole: A sudden, strong move in one direction, often accompanied by high trading volume.

- The Flag: A brief consolidation where prices move sideways or slightly against the prevailing trend, usually within parallel lines that slope modestly.

- Resolution: If the pattern holds, the prevailing trend resumes after the consolidation.

Why it matters

Flags capture the rhythm of momentum markets. The flagpole reflects urgency, often from institutional buying or selling, while the flag represents a pause where the market digests the move. This pause is considered healthy in a trend, as it can prevent overextension.

Variations

Bullish vs. Bearish Flags: Bullish flags slope downward after an upward flagpole, while bearish flags slope upward after a downward pole.

Pennants: A related pattern where consolidation takes the form of a small symmetrical triangle rather than a rectangle.

Caveats

Flags are short-term patterns, often lasting only a few sessions to a few weeks. Because they form quickly, they are prone to producing false signals, especially in volatile markets. Analysts stress the importance of volume dynamics and overall market context before giving weight to a flag formation.

Pattern categories: continuations vs reversals

Not all patterns tell the same story. Some hint that the market is just taking a breather before carrying on, while others warn that momentum is running out and a reversal could be around the corner.

Continuation patterns - think triangles, flags, and pennants - pop up roughly 70% of the time when a market is trending. They usually mean the pause is temporary and the trend is about to resume.

Reversal patterns - like head and shoulders or double tops and bottoms - are less common but pack more punch. When they appear, they often mark a major turning point.

Then there are bilateral patterns such as symmetrical triangles. These are trickier because they can break either way. They tend to shine in volatile, uncertain markets where direction isn’t obvious.

The secret is context. Continuation patterns work best when the trend is already strong, while reversal patterns are most powerful after a long, extended move. Match the pattern to the bigger picture, and you’ll read the market with far more accuracy.

How traders often approach chart patterns

Spotting a pattern is just the start. To trade them successfully, you need a clear set of rules for when to act, how much to risk, and when to walk away. These rules will be specific to your personal needs, and should be discussed with a financial advisor if you’re unsure.

Confirm your entry. Analysts generally stress the importance of waiting for confirmation (like a breakout or changes in volume) before treating a pattern as complete. Set alerts at key levels so you don’t waste hours glued to charts.

Protect yourself with stop-losses. Most traders place their stop just beyond the pattern’s critical level. For breakouts, that means just below the breakout point; for reversals, just beyond the highest high or lowest low.

Set realistic profit targets. The measured move gives you a solid first target. Many traders take partial profits there (say half the position) and let the rest ride with a trailing stop, locking in gains while leaving room for more upside.

Size your positions wisely. Risk management is often discussed in terms of position sizing. For example, some traders limit risk on a single trade to just a small percentage (e.g. 2-3%) of their account, so that several losses don’t cause major damage.

Respect the clock. Patterns don’t work forever. If the move hasn’t unfolded within the expected window (usually 2-3 weeks on daily charts), it’s often best to exit, even if your stop hasn’t been triggered.

Do chart patterns really work?

Chart patterns aren’t crystal balls, but they can give you a genuine statistical edge when used properly. Studies show that well-formed patterns on highly liquid stocks deliver success rates between 60-85%, far better than pure chance.

That said, no pattern is bulletproof. Around a quarter to nearly half of them will fail. This is why risk management and position sizing aren’t optional; they’re your safety net. You need to be able to take several hits without blowing up your account.

Patterns also don’t exist in a vacuum. They’re much more reliable when they line up with the bigger picture - things like the overall market trend, sector strength, or even key fundamentals. A bullish setup in a weak sector or during a bear market has the odds stacked against it.

And remember: context is everything. Chart patterns work best in “normal” market conditions. In periods of extreme volatility, major news events, or panic-driven trading, emotions often override technical signals.

Level up: advanced pattern techniques

Once you’re comfortable spotting the basics, a few advanced techniques can take your timing to the next level.

Watch the volume. Real breakouts usually come with a surge, at least 50% above recent average volume. Volume should also “fit the story”: tapering off during consolidation, then expanding sharply when the breakout hits.

Use multi-timeframe confluence. When the same pattern shows up on both daily and weekly charts, or when shorter-term setups align with longer-term trends, your odds of success might climb.

Validate with support and resistance. The strongest patterns often form at levels the market has respected before. Multiple past tests of support or resistance add weight to the signal and help filter out false moves.

And always remember: chart patterns aren’t fortune tellers. They’re tools to tilt the odds in your favour, not guarantees of profit. Combine them with sound risk management, diversification, and realistic expectations. With practice and discipline, pattern recognition can become a powerful part of your trading toolkit.

Let's get one thing straight: most "make money while you sleep" crypto promises are complete nonsense. The internet overflows with schemes promising $10,000 monthly returns that usually end with empty wallets and regret.

But you actually can earn passive income with crypto in 2025. The keyword here is "can," not "will automatically" or "guaranteed to". The difference lies in having realistic expectations. We're talking 3-12% annual returns through legitimate methods, not the 300% fairy tales that flood social media.

Thankfully, the crypto passive income landscape has matured since 2021's wild west era. Those 20,000% APY farms that vanished overnight? They're mostly gone (though some still lurk if you fancy yourself some financial Russian roulette). Today's opportunities are more modest but actually sustainable.

This guide covers seven common methods for earning crypto passive income. You'll find beginner-friendly options yielding 3-8% annually, plus riskier strategies that could hit 15-50% if you know what you're doing. We'll also cover the less exciting but crucial stuff: taxes, risks, and how to avoid losing everything to market volatility.

If you want get-rich-quick schemes, look elsewhere. But if you're interested in building a legitimate income stream while participating in the future of finance, let's explore what's actually possible in 2025.

Let the record state that this is educational only and should not be considered financial, investment, or tax advice. Crypto yields are variable and can result in loss of principal. Verify availability, legality, and rates in your jurisdiction before participating.

Understanding crypto passive income

Before diving into specific methods, let's clarify what we mean by "passive income" in crypto. Traditional passive income might be rental properties or dividend stocks - you invest money, then collect regular payments without active work. Crypto passive income works similarly, but with a digital twist and significantly more volatility.

The fundamental difference? Traditional investments might fluctuate 5-10% annually. Your crypto holdings can swing 50% in a week. This means your "passive" income can be passive in name only if you're constantly checking prices and panicking over market moves.

Here's the reality: crypto passive income exists on a risk spectrum. On the safer end, you have crypto savings accounts offering 2-8% APY - similar to high-yield savings but with crypto.

On the riskier end, there's yield farming, where you might earn 50-200% returns, but you could also lose everything to smart contract bugs or market crashes.

All in all, the crypto passive income market has grown substantially. By 2025, over $150 billion is locked in various DeFi protocols, and some major institutions now offer crypto earning products. This legitimacy doesn't eliminate risk, but it does mean you're not dealing with fly-by-night operations (mostly).

Why do people choose crypto for passive income? Beyond potentially higher returns, it offers 24/7 market access, global opportunities, and the ability to start with small amounts. Plus, there's something satisfying about earning yield on assets you believe will appreciate long-term.

Top 7 common methods used by market participants to earn crypto passive income

Low-complexity options (recommended for beginners)

1. Crypto savings accounts

Think of these as high-yield savings accounts, but for crypto. You deposit your coins in custodial yield products from compliant exchanges (availability varies by jurisdiction), and they lend them out or use them productively, and you earn interest.

How it works: Platforms take your deposits and lend them to institutional borrowers or use them in DeFi strategies. You earn a percentage of the profits.

Realistic returns: Expect 2-8% APY depending on the cryptocurrency and platform. Bitcoin typically offers lower rates (2-4%), while stablecoins might yield 4-8%. Each platform’s APYs will vary, ensure you read all the Ts and Cs.

Getting started: Most platforms require simple KYC verification. Deposit your crypto, choose your earning product, and start accumulating interest daily or weekly.

The catch: Your funds aren't FDIC insured like traditional banks. Platform risk is real (remember Celsius and BlockFi's 2022 collapses). Only deposit what you can afford to lose, and research platform stability before committing any amounts.

2. Staking

Staking is like earning dividends for helping secure a blockchain network. Instead of energy-intensive mining, Proof-of-Stake networks rely on validators who "stake" their coins as collateral to process transactions and secure the network.

Popular staking options:

- Ethereum (ETH): typically around 2-4%

- Solana (SOL): commonly 6-8% effective rate over time (depends on inflation & stake)

- Cardano (ADA): typically around 3-5%

- Polkadot (DOT): unbonding is 28 days; rewards vary (often high-single to low-double digits).

*for accurate, real-time staking rewards, see here.

Two approaches exist: Direct staking requires technical knowledge and sometimes significant minimum amounts. Delegated staking through platforms is simpler but typically offers slightly lower returns due to fees.

Important considerations: Many staking arrangements have lock-up periods, so factor in liquidity needs before committing funds.

Getting started: For beginners, exchange-based staking offers the easiest entry. More advanced users can stake directly through wallets or run their own validators for maximum returns.

Medium-complexity methods

3. Crypto lending

Crypto lending involves loaning your crypto to borrowers in exchange for interest payments. It's more hands-on than savings accounts but potentially more profitable.

Platform lending: Services like Aave, Compound, and Kava allow you to supply liquidity to lending pools. Borrowers pay interest, which gets distributed to lenders minus platform fees.

Expected returns: Highly variable based on demand. Stablecoin lending might yield 5-15% APY, while volatile assets can range from 2-25% depending on market conditions.

Risks to consider: Smart contract vulnerabilities, platform hacks, and borrower defaults can impact returns. The 2022 DeFi winter showed that high yields don't always last.

4. Liquidity pools and providing liquidity

Decentralised exchanges (DEXs) like Uniswap and PancakeSwap need liquidity to function. By providing paired assets to liquidity pools, you earn a share of trading fees.

How it works: You deposit equal values of two cryptocurrencies (like ETH and USDC) into a pool. Traders pay fees to swap between these assets, and you earn a portion based on your pool share.

Earning potential: Returns vary widely based on trading volume and fees. Popular pairs might yield 5-30% APY, but this fluctuates with market activity.

Impermanent loss: The biggest risk unique to liquidity provision. If one asset's price changes significantly relative to its pair, you might end up with less value than if you'd simply held the original assets.

It's "impermanent" because prices could return to original ratios, but it becomes permanent if you withdraw during unfavourable price relationships.

Higher-complexity methods (for experienced DeFi users)

5. Yield farming

Yield farming is DeFi's high-stakes game. You move funds between different protocols, chasing the highest returns through complex strategies involving multiple platforms and tokens.

The appeal: Returns can have a wide range - advertised headline APYs can occasionally exceed 50% for short periods, but are highly unstable and often decay quickly.

The reality: Most high-yield farms are unsustainable. They often rely on token rewards that lose value quickly, or they're simply Ponzi-like schemes waiting to collapse.

Who should try this: Only experienced DeFi users who understand smart contract risks, token economics, and can afford total losses. Consider this speculation, not passive income.

6. Dividend-paying tokens

Some crypto projects share profits with token holders, similar to stock dividends.

Examples include:

- KuCoin Token (KCS): pays a bonus from trading fees to eligible holders (terms/eligibility apply)

- NEO: generates GAS for on-chain usage

- VeChain (VET): Produces VTHO tokens for network usage

Returns: Highly variable and dependent on platform success. KCS might yield 2-6% annually in fee sharing, while others provide minimal returns.

7. Masternodes

Masternodes are specialised servers that perform network functions beyond basic transaction processing. They require significant upfront investment but can provide steady returns.

Requirements: Most masternodes need substantial token holdings - often $10,000-$100,000+ worth. You also need technical knowledge to maintain server uptime and security.

For example, Dash requires 1,000 DASH collateral while realised ROI varies with network conditions.

Barriers to entry: High costs, technical requirements, and ongoing maintenance make masternodes unsuitable for most passive income seekers.

Reality check: how much can you actually earn?

Let's crunch some hypothetical numbers based on current market conditions:

Potential $1,000 investment scenarios:

- Crypto savings account (5% APY): $50 annual income

- ETH staking (3.2% APY): $32 annual income

- Stablecoin lending (8% APY): $80 annual income

Potential $10,000 investment scenarios:

- Diversified approach (mix of staking/lending): $400-800 annual income

- Higher-risk DeFi strategies: $1,000-2,000 annual income (with significant loss potential)

Potential $100,000 investment scenarios:

- Conservative crypto portfolio: $4,000-8,000 annual income

- Aggressive yield farming: $10,000-20,000 annual income (extremely high risk)

Compare this to traditional passive income: a 4% dividend stock portfolio on $100,000 yields $4,000 annually. Crypto can potentially beat this, but with much higher volatility and risk.

The volatility factor: Your $10,000 crypto investment might earn $800 in interest, but if the underlying assets drop 30%, you've still lost $2,200 overall. This is why many successful crypto passive income earners focus on stablecoins and accept that they're speculating on both yield and price appreciation.

Tax implications you ought to know

Crypto passive income isn't a tax-free lunch. Most tax authorities treat crypto earnings as regular income, taxed at your ordinary income rate.

Key tax considerations:

- Staking rewards are taxable when received, based on fair market value

- Lending interest counts as ordinary income

- DeFi yields are also taxable, even if paid in obscure tokens

Record-keeping is crucial. Track every reward, airdrop, and interest payment with dates and values. Many platforms provide tax reports, but you're ultimately responsible for accuracy.

International complexity: Tax treatment varies by country. Some nations offer crypto-friendly policies, while others impose heavy taxes or outright bans. Research local regulations or consult professionals for significant amounts.

When to worry: If you're earning more than a few hundred dollars annually in crypto passive income, consider professional tax help. The penalties for getting crypto taxes wrong can be severe.

Risks and how to alleviate them

Crypto passive income isn't just about earning, it's about not losing everything to avoidable risks.

Platform risk: Centralised platforms can fail, get hacked, or freeze withdrawals. Celsius and FTX's collapses wiped out billions in customer funds.

Mitigation: diversify across platforms, research financial health, and never invest more than you can afford to lose.

Smart contract vulnerabilities: DeFi protocols run on code, and code has bugs. Multi-million dollar hacks happen regularly.

Mitigation: stick to audited, established protocols and understand that "decentralised" doesn't mean "safe."

Market volatility: Crypto's wild price swings can eliminate passive income gains quickly.

Mitigation: consider stablecoins for pure yield plays, or accept volatility as part of the crypto investment thesis.

Regulatory risks: Governments can ban or heavily regulate crypto activities overnight.

Mitigation: stay informed about regulatory developments and be prepared to exit positions quickly.

Practical risk management:

- Start small while learning

- Never invest emergency funds

- Diversify across methods and platforms

- Keep detailed records

- Stay informed about protocol changes and risks

Getting started: your first steps

Ready to dip your toes in crypto passive income? Here's a sensible approach:

Start with education: Understand the basics of crypto, wallets, and the specific methods that interest you. Rushing in with poor knowledge is the fastest way to lose money.

Begin conservatively: Try crypto savings accounts or exchange-based staking with small amounts. These offer lower returns but also lower complexity and risk.

Portfolio allocation: Financial advisors often suggest no more than 5-10% of investable assets in crypto, and passive income strategies should be a subset of that. Don't bet the farm.

Platform selection criteria: Look for established companies with good reputations, proper licensing, insurance if available, and transparent fee structures. Avoid platforms promising unrealistic returns.

Security basics: Use hardware wallets for significant amounts, enable two-factor authentication, and never share private keys. The decentralised nature of crypto means lost funds are often gone forever.

Conclusion

Earning passive income with cryptocurrency in 2025 is definitely possible, but it requires realistic expectations and careful risk management. The days of guaranteed 20% returns are over, but legitimate opportunities exist for those willing to do their homework.

The sweet spot for most people lies in conservative strategies: crypto savings accounts, established staking, and perhaps some stablecoin lending. These won't make you rich overnight, but they can provide steady returns while you learn the ecosystem.

Remember that "passive" income in crypto often requires more attention than traditional investments. Stay informed, start small, and never invest money you can't afford to lose. The future of finance is evolving rapidly - earning while you learn might be the smartest approach of all.

.webp)

As Solana cements its place as one of the fastest-growing blockchains, the demand for powerful, reliable node infrastructure is skyrocketing. Running your own Solana node isn’t just about plugging into the network; it’s about unlocking earning potential, owning your data, and stepping behind the curtain to see how the ecosystem really works.

Whether you're a developer building apps or an investor looking to participate in network security, this guide will walk you through everything you need to know about setting up and running a Solana node.

Understanding Solana Nodes: types and benefits

What is a Solana Node?

A Solana node is a computer that participates in the Solana blockchain network by storing data, validating transactions, and maintaining network consensus. Think of it as your personal gateway to the Solana ecosystem that gives you direct, unfiltered access to blockchain data.

Validator vs RPC Nodes

Let’s first break down the difference between these two node options. What works best for you usually comes down to your interests, technical background, and what you want to get out of it.

Validator Nodes actively participate in consensus by voting on transactions and producing blocks. They require significant hardware resources and a stake of SOL tokens. Validators earn rewards for their participation but also face potential penalties (slashing) for malicious behaviour.

RPC Nodes serve data to apps and users without participating in consensus. They're easier to run, don't require staking, and are perfect for developers who need reliable blockchain data access for their apps.

Benefits of running a Solana Node

Running your own node offers the following advantages:

- Earning potential: Validators can earn up to 5-8% APY on staked SOL, while RPC nodes can in some case generate revenue through API access fees

- Network independence: No reliance on third-party providers that might have downtime or rate limits

- Data sovereignty: Complete control over your blockchain data access and privacy

- Learning opportunity: Deep understanding of blockchain infrastructure and Solana's architecture

- Network contribution: Help decentralise and secure the Solana network

Hardware requirements and costs

Getting the hardware right is obviously incredibly important for node performance. Before we get into that, let’s first introduce you to Agave.

Essentially, Agave is a validator client for Solana, providing the backbone of validator and RPC node software in the Solana ecosystem. Initially forked from Solana Labs, it now enables independent, optimised deployment and is central to the multi-client future of Solana.

If you’re thinking about running a validator or RPC node on Solana, Agave is the client you’ll most likely use (recommended by Solana).

In short: if you care about your node staying healthy, fast, and compliant with the Solana network as it evolves, you will likely use Agave.

Minimum vs recommended specifications

Here are the official Agave requirements:

CPU:

- Validator: 2.8GHz base clock or faster, 12 cores/24 threads minimum

- RPC Node: 16 cores/32 threads or more

- AMD Gen 3+ or Intel Ice Lake+ required

- AVX2 instruction support mandatory (AVX512f helpful)

- SHA extensions instruction support

RAM:

- Validator: 256GB minimum

- RPC Node: 512GB minimum (1TB recommended for full account indexes)

- ECC memory strongly suggested

Storage: PCIe Gen3 x4 NVMe SSD or better required for each:

- Accounts: 1TB+ with high TBW rating

- Ledger: 1TB+ with high TBW rating

- Snapshots: 500GB+ with high TBW rating

- OS: 500GB+ (SATA acceptable)

- Not recommended to store accounts and ledger on the same disk

Network: 1Gbps symmetric minimum, 10Gbps preferred for mainnet

Operating system: Ubuntu 24.04 (20.04 support ended May 2025)

Hosting options for Solana Validators

Validators don't necessarily need to be "hosted" by third-party providers - you have several options:

1. Self-hosted (own hardware)

- Buy and run your own server at home or in a private data centre.

- Pros: Full control, no recurring hosting fees.

- Cons: Requires enterprise-grade internet (1-10 Gbps), reliable power, security, and 24/7 monitoring.

2. Colocation hosting

- Place your hardware in a professional data centre.

- They provide: Power, cooling, internet, and physical security.

- You handle: Hardware upkeep, software, and monitoring.

- Cost: $100–$500/month + hardware.

3. Dedicated server hosting

- Rent servers from providers (Hostkey, Cherry Servers etc.).

- They provide: Hardware + data center services

- You handle: Validator setup and monitoring.

- Cost: €349–$1,800+/month (depending on service and location)

4. Cloud hosting (not recommended)

- AWS, GCP, and Azure are possible but discouraged for mainnet due to performance issues and higher operational complexity.

Official Solana documentation warns: "Running an Agave node in the cloud requires significantly greater operational expertise" and "Do not expect to find sympathetic voices should you choose this route."

Prerequisites and preparation

Before diving into the setup, ensure you have:

SOL requirements: For validators, you'll need a minimum stake (currently around 1 SOL for vote account rent, plus your desired stake amount). RPC nodes don't require staking.

Technical skills: Basic command-line experience, understanding of Linux systems, and familiarity with SSH connections.

Security setup: Strong passwords, SSH key pairs, and a plan for securing your validator keys.

Network planning: Ensure your internet connection meets bandwidth requirements and has minimal downtime.

Your step-by-step Solana Node setup guide

Phase 1: Local machine preparation

Step 1: Install Solana CLI on your personal computer

- Open terminal on your local machine (not the server)

- Download and run the Solana CLI installer from the official release page

- Verify installation by running the version command to confirm successful setup

Step 2: Create essential keypairs

- Generate validator identity keypair and save as validator-keypair.json

- Create vote account keypair (validators only) and save as vote-account-keypair.json

- Generate authorised withdrawer keypair and save as authorised-withdrawer-keypair.json

CRITICAL SECURITY: The authorised-withdrawer keypair controls your validator's funds. Store it securely offline using a hardware wallet, multisig, etc. Never store this file on your validator server.

Step 3: Configure CLI and create Vote Account (validators only)

- Set your CLI to use the appropriate network (testnet for learning, mainnet for production)

- Set the validator keypair as your default CLI keypair

- Fund the validator keypair with sufficient SOL for vote account creation and ongoing fees

- Create the vote account on the network using the three keypairs

Step 4: Secure the withdrawer key

- Backup the authorised-withdrawer-keypair.json to multiple secure locations

- Remove the withdrawer keypair from your local machine after backup

- Verify you can access your backups before proceeding

Phase 2: Server hardware setup

Step 5: Provision your server

- Set up a server meeting the hardware requirements (dedicated public IP essential)

- Install Ubuntu 24.04 on the system

- Ensure all drives are properly connected and recognised

Step 6: Initial server configuration

- Connect to your server via SSH

- Update all system packages to latest versions

- Install essential build tools and development packages

Step 7: Create dedicated user account

- Create a new user account (typically named "sol" or "solana") for running the validator

- Add the new user to the sudo group for administrative access

- Configure passwordless sudo for convenience (optional but recommended)

Step 8: Storage configuration

- Identify and format your NVMe drives for accounts, ledger, and snapshots

- Create mount points for each drive: /mnt/accounts, /mnt/ledger, /mnt/snapshots

- Mount the drives and set proper ownership to your validator user

- Configure automatic mounting in /etc/fstab to persist after reboots

Phase 3: System optimisation

Step 9: Network and firewall setup

- Configure UFW firewall to allow SSH (port 22) and Solana ports (8000-10000)

- Enable the firewall and verify rules are active

- Ensure your server has a dedicated public IP (NAT not recommended)

Step 10: Critical system tuning

- Create sysctl configuration file to optimise UDP buffers and memory mapping

- Set maximum open file descriptors and memory lock limits

- Configure systemd service limits for file handles and memory locking

- Create security limits configuration for the validator user

Step 11: Apply system changes

- Reload sysctl settings to apply network optimisations

- Restart systemd daemon to recognise new service limits

- Log out and log back in to activate user-level limit changes

Phase 4: Software installation

Step 12: Install Agave Validator Software

- Switch to your validator user account

- Download and install the Solana CLI and Agave validator binary

- Add the Solana binary path to your user's PATH environment

- Verify installation by checking version numbers

Step 13: Transfer keypairs to server

- Securely copy validator-keypair.json and vote-account-keypair.json to the server

- Set proper file permissions (read-only for validator user)

- Never transfer the authorised-withdrawer-keypair.json to the server

Step 14: Create validator startup script

- Create a bin directory in your validator user's home folder

- Write a startup script (validator.sh) with all necessary command flags

- Include paths to keypairs, mount points, network entrypoints, and optimisation flags

- Make the script executable and test it manually first

Phase 5: Service configuration and testing

Step 15: Test manual startup

- Run the validator startup script manually to verify it works

- Monitor the initial startup process and log output

- Check for any immediate errors or configuration issues

- Stop the manual process once confirmed working

Step 16: Create system service

- Create a systemd service file for automatic startup and management

- Configure the service to run as your validator user

- Set up automatic restart policies and logging configuration

- Enable the service for automatic startup on boot

Step 17: Verification and monitoring

- Start the validator service and monitor initial synchronisation

- Verify your validator appears in the gossip network

- For validators: confirm your vote account is visible in the validator list

- Set up log monitoring and performance tracking tools

Step 18: Final checks and go-live

- Verify all system resources are performing adequately

- Confirm network connectivity and peer connections

- For validators: ensure sufficient SOL balance for ongoing vote fees

- Set up monitoring alerts for downtime, performance issues, or errors

Phase 6: Ongoing operations

Step 19: Implement monitoring

- Set up Agave Watchtower or similar monitoring tools on a separate machine

- Configure alerts for validator downtime, performance degradation, or sync issues

- Implement automated restart procedures for common failure scenarios

Step 20: Establish maintenance procedures

- Create regular update procedures for Agave software releases

- Implement log rotation to manage disk space

- Set up backup procedures for configuration and keypairs (except withdrawer)

- Document troubleshooting steps for common issues

Profitability and economics

Earning potential

Validator Rewards: Current estimates suggest 5-8% APY on staked SOL, though this varies based on network conditions and your validator's performance.

RPC Revenue: Can generate income through API access fees, though this requires building a customer base.

Running a validator isn't without risks:

- Slashing: Poor performance can result in stake penalties

- Hardware costs: Equipment failures require immediate replacement

- Market volatility: SOL price fluctuations affect reward values

Break-even analysis

According to online forums, some operators claim to have broken even after 12-18 months, depending on initial hardware investment, operational efficiency, SOL price stability, and network reward rates.

Maintenance and best practices

Regular maintenance ensures optimal performance:

Updates: Keep Solana software current with network upgrades

Monitoring: Set up alerts for downtime, performance issues, or network problems

Backups: Regularly backup validator keys and configuration files

Performance tuning: Monitor CPU, RAM, and network usage to optimise settings

Conclusion and next steps

Running a Solana node can be rewarding both technically and financially in some cases, but it requires significant commitment and resources.

Be sure to consider your technical expertise, available capital, and long-term goals when deciding between self-hosting and alternative solutions.

For additional resources, consult the official Solana documentation and join the validator community on Discord for ongoing support and updates.

You know that feeling when the Fed announces a rate cut and suddenly everyone's talking about how "bullish" it is for crypto? Many people just nod along, but honestly have no clue why cheaper borrowing costs would make Bitcoin go up. Let's dig deep into this topic and share what the data shows – whether you're totally new to this stuff or already trading like a pro.

Let's Start Simple: What Are Interest Rates Anyway?

Okay, let's assume you're not an economics major here. Interest rates are basically the price of money. When you borrow money, you pay interest. When you save money, you (hopefully) earn interest. The big kahuna is the rate set by central banks like the Federal Reserve – this is the rate that affects pretty much everything else in the economy.

Here's the deal: when rates are high, borrowing money sucks because it's expensive. People spend less, businesses hold off on big investments, and suddenly that savings account looks pretty attractive. When rates are low, it's the opposite – borrowing is cheap, so people and businesses start spending and investing more aggressively.

A rate cut is just the central bank saying "Hey, we want people to spend more money and take more risks." And guess what falls into that "risky investment" bucket? Yep, crypto.

The Crypto Connection (Or: Why Bitcoin Doesn't Care About Your Savings Account)

Here's something that becomes clear when you think about it: Bitcoin doesn't pay you anything to hold it. Neither does Ethereum, Solana, or pretty much any other crypto sitting in your wallet. They're not like bonds or savings accounts that give you a steady income.

When interest rates are near zero, this isn't a big deal. But imagine government bonds are paying 5% with zero risk. Suddenly, holding volatile crypto that might crash 50% overnight doesn't look so smart, right?

So the math is pretty straightforward:

- High rates = "Why gamble on crypto when you can get guaranteed returns?"

- Low rates = "These bonds pay nothing, maybe Bitcoin looks interesting..."

This is probably the biggest reason why rate cuts get crypto people excited. When safe investments pay peanuts, risky assets start looking a lot more appealing.

How Rate Cuts Actually Push Money Into Crypto

Alright, let's get into the nitty-gritty of how this actually works. It's not just about psychology – there are real mechanisms at play here. Beyond simple psychology, several concrete mechanisms drive capital toward cryptocurrency markets when central banks ease monetary policy.

When central banks cut rates, they typically inject additional liquidity into the financial system. This expanded money supply creates excess capital that seeks higher returns, with crypto markets often benefiting from these flows.

Lower interest rates fundamentally alter investment opportunity costs. This is finance speak for "what am I giving up?" If I can only earn 0.5% in a savings account, the opportunity cost of holding Bitcoin (which pays nothing) is pretty low. But if savings accounts pay 5%, then holding Bitcoin means I'm giving up a lot of guaranteed income.

Here's something interesting: when the U.S. cuts rates, it often makes the dollar less attractive to international investors. A weaker dollar historically has been good for Bitcoin, especially since many people see it as "digital gold", a way to protect against currency debasement.

Accommodative monetary policy encourages risk-taking across markets. Traders can borrow more to make bigger bets, capital flows more easily toward crypto startups, and regular folks start FOMOing into altcoins. It's like the whole market gets a shot of adrenaline.

The COVID Case Study (AKA When Everything Went Bananas)

Want to see this in action? Look at what happened during COVID. In March 2020, everything crashed: stocks, crypto, you name it. Central banks freaked out and slashed rates to basically zero while printing money like it was going out of style.

At first, Bitcoin crashed along with everything else (down to around $3,200). But once all that stimulus money started flowing through the system, crypto went absolutely bonkers. Bitcoin went from that March low to nearly $70,000 by late 2021. That's more than a 20x return in less than two years!

Now, rate cuts alone didn't cause that rally, there was a lot going on, including institutional adoption, the whole "inflation hedge" narrative, and pure FOMO. But the massive liquidity injection definitely set the stage.

Fast forward to now, and we're starting to see rate cuts again. The Fed just cut rates for the first time in years, and everyone's wondering if we're about to see another crypto supercycle. Spoiler alert: it's complicated.

Why It's Not Always That Simple (The Plot Thickens)

The relationship between monetary policy and cryptocurrency prices isn't as straightforward as it seems. Rate cuts don't guarantee crypto rallies, and several factors can throw a wrench in this supposedly reliable connection.

Take timing, for instance. Monetary policy doesn't work like flipping a switch. The Fed cuts rates today, but that doesn't mean money suddenly floods into Bitcoin tomorrow. These effects take months to work through the financial system, creating frustrating delays between policy changes and actual market movements.

Then there's the whole expectations game. If everyone and their mother already expects a rate cut, the actual announcement might barely move markets. It's already baked into prices, as traders say. But when cuts come by surprise? That's when things get interesting, and volatile.

Inflation makes everything messier. Central banks get nervous about cutting rates when prices are already rising. And if they do cut while inflation is running hot, investors start worrying about the economy overheating. This is why smart money watches real interest rates, the actual rate minus inflation, which sometimes tells a completely different story than the headline numbers.

The Advanced Stuff (For Market Nerds)

Okay, this is where things get really interesting. If you're already trading and want to understand what moves the big money, here are the deeper dynamics that separate amateur hour from professional-grade analysis.

Real rates matter more than anything else. When rates sit at 2% but inflation runs at 4%, cash holders are losing 2% annually in purchasing power. That’s the kind of environment where Bitcoin’s ‘hard money’ narrative tends to resonate, and where institutional investors have historically shown greater interest.

The yield curve tells stories that headline rates can't. This relationship between short and long-term rates reveals market psychology. When short rates exceed long rates, the dreaded inverted curve, recession fears dominate. Rate cuts during these periods often fall flat because fear trumps greed, and nobody wants to touch risky assets regardless of how cheap money becomes.

But here's what separates the pros from everyone else: they know it's never just about rates. Credit spreads show how much extra yield risky borrowers pay compared to safe government debt. Dollar funding conditions reveal whether international markets can actually access all that cheap liquidity. And bank lending standards determine if that Fed money ever makes it past Wall Street desks into the real economy. The Fed can slash rates to zero, but if banks won't lend and credit markets freeze up, crypto won't see a dime of that stimulus.

The Dark Side (Because Nothing's Ever Perfect)

Let's be honest here, painting rate cuts as some magic crypto catalyst without acknowledging the risks would be doing everyone a disservice. Easy money creates bubbles, and when those bubbles burst, crypto typically gets damaged first and hardest.

The inflation trap is real and brutal. When rate cuts work too well and prices start spiraling upward, central banks panic and slam the brakes with aggressive rate hikes. That policy whiplash absolutely crushes speculative assets, with crypto leading the carnage every single time.

Then there's the liquidity trap – monetary policy's most frustrating failure mode. Sometimes rate cuts simply don't work. Banks refuse to lend, consumers won't borrow, and all that cheap money sits trapped in the financial system instead of flowing into markets. Japan learned this lesson painfully over decades of ineffective stimulus.

Here's an uncomfortable truth: despite all the "digital gold" rhetoric, crypto still dances to the stock market's tune most days. When rate cuts happen during genuine recessions and equities crater, Bitcoin rarely stays immune. The correlation breaks down only during very specific market conditions, not during broad-based selloffs.

Finally, there's the regulatory sword hanging over everything. Crypto rallies have this annoying habit of attracting government attention, especially when retail investors pile in and inevitably lose their shirts. That regulatory risk never disappears, it just sits there waiting for the next bubble to pop.

Strategic Approaches at Different Levels

The beauty of understanding rate cut dynamics is that you can apply this knowledge regardless of where you are in your trading journey. Here's how to think about it based on your experience level.

Starting out? Keep things dead simple. Track Fed meetings, watch inflation numbers, and brace for wild swings around major announcements. Don't get lost in the weeds trying to predict every twist and turn. Just remember that cheaper money generally makes crypto more attractive, even if the timing stays unpredictable.

Getting more serious about this game? Time to expand the toolkit. Real interest rates become your new best friend, along with the dollar index (DXY) and whatever the Fed chair actually says about future moves. Pay close attention to how crypto moves when stocks hiccup, that correlation hasn't disappeared just because Bitcoin hit some arbitrary price target.

Going full macro nerd? Now we're talking. Layer in yield curve analysis, credit spreads, and options flow data. The goal shifts from reacting to news toward positioning ahead of surprises. This means using derivatives to hedge positions and managing risk like the professionals do. At this level, it's less about being right and more about surviving when you're wrong.

The Bottom Line

So why are interest rate cuts good for crypto? Because they make safe assets less attractive, flood the system with liquidity, weaken fiat currencies, and make everyone a little more willing to take risks. For Bitcoin, that often strengthens its narrative as a store of value. For altcoins, it can fuel speculative rallies and bring more funding to interesting projects.

But here's the key insight: context is everything. Rate cuts during an economic expansion can be rocket fuel for crypto. Rate cuts during a deep recession might just keep things from getting worse. The difference comes down to liquidity conditions, market sentiment, and whether people actually believe the central bank's strategy will work.

For newcomers, the headline is simple enough: lower rates usually help crypto. For everyone else, remember that it's not just about the rate cut itself, it's about how that cut fits into the bigger macroeconomic puzzle.

The most successful traders don't just look at rate cuts in isolation. They consider the whole picture: inflation, employment, credit conditions, dollar strength, and market positioning. Because at the end of the day, markets are about human psychology as much as they are about monetary policy.

And honestly? That's what makes this whole game so fascinating, and frustrating at the same time.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing