Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Have you ever sent an invoice and then spent the next week chasing your payment? Or worse… have you ever lost crypto by sending it to the wrong address!? If you have, well, you’re not the only one. And that’s exactly what Request has come to fix.

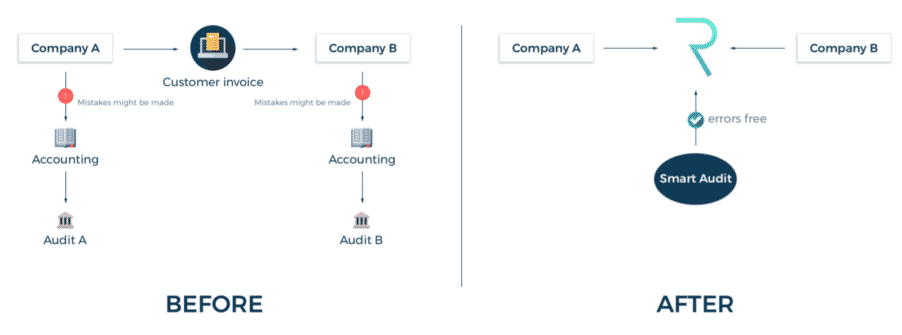

Traditional systems for the most part still rely on an awkward mix of middlemen, manual data entry, and accounting software that belongs in a different era. On top of all that, human error will always be a factor. Request (REQ) aims to cut through these inefficiencies by offering a blockchain solution for creating, tracking, and settling payments.

Whether you're just dipping your toes into crypto or you're already swimming in the deep end of Web3 finance, Request stands out for more than one reason. So, let’s dive in and find out!

How Request Actually Works (Without Jargon)

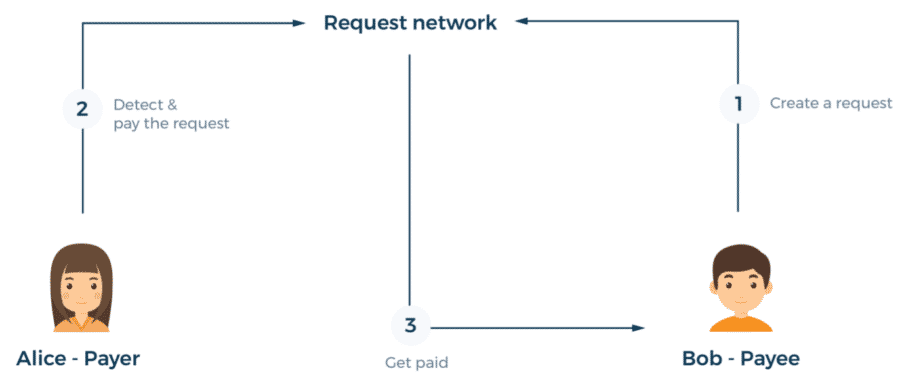

At its core, Request Network allows someone to issue a secure, immutable payment request through blockchain technology. Think of it this way: instead of manually sending funds to a wallet address (which carries the very real risk of one mistyped character sending your money into the digital void), the payee generates an invoice through a smart contract. The payer then approves it with a single transaction. Simple, clean, and significantly less prone to expensive mistakes.

This model reduces common payment errors, improves recordkeeping for everyone involved, and creates what financial people love to call "a single source of truth." Because all payment data lives on-chain, financial histories become independently verifiable without needing to trust third-party payment processors or wade through conflicting records.

It goes without saying, your accountant’s job gets significantly simpler. Payment requests, transaction amounts, due dates, tax information, and complete audit trails can all exist within the same blockchain-based system.

Why Businesses Are Building on Request

Request has become something of an unsung hero in the Web3 infrastructure world. Many blockchain organizations (from DeFi protocols to gaming studios) have adopted it because it addresses challenges that traditional payment systems simply weren't designed to handle.

Here’s what makes it special:

- Reliable audit trails. Every single request is timestamped, immutable, and independently verifiable, an accountant's dream, really.

- Built-in compliance capabilities. Request's architecture naturally supports detailed tax reporting and regulatory workflows, which matters considerably more than it sounds.

- Easy integration options. Businesses can connect Request to existing platforms like WooCommerce through tools such as WooReq, or leverage Request Finance for more sophisticated requirements.

- True scalability. The network handles recurring payments, batch transactions, and multi-chain activity across more than 25 different blockchains without breaking a sweat.

This combination of automation, transparency, and flexibility has made Request valuable for all sorts of teams, no matter the size.

Understanding the REQ Token

While Request Network focuses on simplifying payment infrastructure, the REQ token functions as the operational backbone that keeps everything running smoothly. Rather than serving as the primary transaction currency (i.e., using it to buy a delicious cup of coffee) it works behind the scenes to power the network's various operations.

Every time someone creates or processes a payment request, associated network fees are paid in REQ. These fees are then automatically converted into whichever blockchain currency is needed at that moment (such as ETH for Ethereum network gas fees), allowing Request to operate seamlessly across multiple blockchain ecosystems. Importantly, a portion of the REQ used in these transactions gets burned (or in layman terms, permanently removed from circulation) which creates a natural deflationary pressure over time.

REQ also plays a meaningful role in network governance. Token holders can participate in decisions about protocol upgrades and development priorities. This ensures the network grows through community consensus rather than through centralized decision-making. Moreover, small REQ-based micro-fees help prevent spam and malicious activity by making excessive request creation economically impractical for bad actors.

The token's economic design emphasizes long-term sustainability. With a total supply capped at 1 billion tokens and a relatively decentralized distribution model, the ecosystem sidesteps many of the concentration risks that plague other projects. This structure reduces the likelihood of sudden large-scale token dumps and supports a more stable, resilient market over time.

Why Request Matters in the Crypto Ecosystem

As blockchain technology and the crypto industry as a whole continue to mature, infrastructure projects like Request are becoming increasingly critical to the ecosystem's practical utility. They're not trying to reinvent money itself; they're focused on making financial processes demonstrably smarter.

Who Benefits From Request?

- Major DeFi organizations including Aave, Fantom, and Maker use Request to manage complex multi-token accounting across their operations.

- Traditional enterprises have adopted Request for streamlined tax reporting and regulatory compliance, particularly those operating across multiple jurisdictions.

- Developers rely on Request's API to automate everything from routine payroll processing to recurring subscription billing, eliminating manual intervention.

- Web3 projects leverage Request Finance to manage payments in dozens of different digital assets simultaneously, avoiding the headache of manual conversion and tracking.

The network has also collaborated with Aleo for confidential payroll solutions that maintain compliance while protecting employee financial privacy.

Moreover, Request gained significant mainstream attention in 2021 when The Sandbox (one of the largest NFT gaming platforms) picked Request for its payment infrastructure. This partnership not only drove increased token activity but, more importantly, validated Request as a tool with genuine utility.

Bottom Line

Request shows us what financial infrastructure could be in the Web3 era. It’s transparent, automated, and built for a fast, digital economy. It bridges blockchain's reliability with real-world needs, proving that decentralization is as relevant as it has ever been.

Where to Get REQ

Are you excited about what Request brings to the table? You can get the REQ token directly on the Tap app and start exploring the future of digital payments and invoicing today.

Wanting to stake ETH but don't have the full 32 ETH required? Enter Rocket Pool – the game-changing protocol that's making Ethereum staking accessible to everyone.

Founded in 2016 and launched on mainnet in October 2021, Rocket Pool breaks down the barriers to Ethereum staking by allowing anyone to participate with as little as 0.01 ETH. Or, if you want to run a node, you'll need 8 ETH (plus some RPL as collateral) instead of the standard 32 ETH.

In this guide, we break down everything you need to know about the protocol, including its two key tokens:

- RPL: The governance token that also serves as insurance for the protocol

- rETH: A liquid token that represents your staked ETH and automatically grows in value as rewards accumulate

By democratising access to staking, Rocket Pool stays true to Ethereum's vision of decentralisation while making it possible for anyone to earn rewards from securing the network, with no massive ETH holdings required!

How Rocket Pool works

Rocket Pool's design has three main components that work together to facilitate decentralised ETH staking: smart contracts, smart node network and minipools.

The Smart Contracts Backbone

At the foundation of Rocket Pool lies a sophisticated set of smart contracts that govern all protocol operations. These contracts manage:

- Deposit pools where regular users stake their ETH

- The creation and management of minipools (validator nodes)

- The minting and burning of rETH tokens

- The staking and distribution of RPL rewards

- Protocol governance mechanisms

The smart contracts ensure that all operations happen in a trustless manner, removing the need for intermediaries and preserving the decentralised ethos of Ethereum. They incorporate various security measures, including extensive testing and multiple independent audits to safeguard user funds.

Key smart contracts include the Deposit Pool, Minipool Factory, and Token contracts. When users deposit ETH, the smart contracts either match them with node operators to create validators or mint rETH representing their stake and accumulated rewards.

Smart Node Network and Minipools explained

Rocket Pool's network consists of independent node operators running the Rocket Pool Smart Node software. This software interacts with the protocol's smart contracts and manages validator duties on the Ethereum network.

Node operators in Rocket Pool contribute 8 ETH (rather than the full 32 ETH required for solo staking), which is matched with 24 ETH from the protocol's deposit pool to form a standard 32 ETH validator. This validator unit is called a "minipool."

The process works as follows:

- A node operator installs and configures the Smart Node software

- They deposit 8 ETH and a minimum of 10% worth of ETH in RPL tokens as collateral

- The protocol matches this with 24 ETH from regular stakers

- A minipool (validator) is created and begins participating in Ethereum consensus

- When the validator earns rewards, they are split proportionally between the node operator and the deposit pool

This system creates a symbiotic relationship between those who want to stake without running infrastructure (regular stakers) and those willing to operate nodes but don't have the full 32 ETH requirement (node operators).

The minipool design is particularly innovative because it allows for fractional validator ownership while maintaining security through RPL collateral requirements. If a node operator behaves maliciously or negligently, their RPL collateral can be slashed, protecting regular stakers from potential losses.

Understanding RPL and rETH

As mentioned earlier, Rocket Pool's ecosystem revolves around two main tokens, each serving specific functions within the protocol.

What is RPL used for?

RPL (Rocket Pool Protocol Token) is the native utility and governance token of the Rocket Pool protocol, designed to align the interests of node operators with the long-term success of the protocol. Unlike rETH, which represents staked ETH, this ERC-20 token serves several specific functions:

- Node operator collateral: Node operators must stake a minimum of 10% of their ETH value in RPL tokens as security against wrongdoing. This collateral can be slashed if the node operator behaves maliciously, protecting the protocol and its users.

- Insurance mechanism: The RPL staked by node operators creates a protocol-wide insurance fund that helps secure user deposits and maintain trust in the system.

- Additional rewards: Node operators can stake up to 150% of their ETH value in RPL to receive proportional RPL rewards, incentivising greater security deposits and alignment with protocol success.

- Governance: RPL token holders have voting rights on protocol upgrades, parameter changes, and other governance decisions through the Rocket Pool DAO.

What is rETH and how does it work?

rETH is Rocket Pool's liquid staking token that represents staked ETH plus accumulated rewards. These automatically increase in value relative to ETH through a changing exchange rate rather than requiring separate reward claims.

How to stake ETH with Rocket Pool (step-by-step)

Staking ETH with Rocket Pool as a regular user (not a node operator) is straightforward and accessible to anyone with an Ethereum wallet. Here's a guide to getting started:

Option 1: Using the Rocket Pool dApp

- Connect your wallet: Visit the Rocket Pool website and navigate to the staking interface. Connect your Ethereum wallet (MetaMask, WalletConnect, etc.).

- Determine your stake amount: Decide how much ETH you want to stake (minimum 0.01 ETH).

- Approve the transaction: After reviewing the details, confirm the transaction in your wallet. This will swap your ETH for rETH at the current exchange rate.

- Receive rETH: Once the transaction is confirmed, you'll receive rETH in your wallet, representing your staked ETH plus future rewards.

Option 2: Using decentralised exchanges

- Access a DEX: Open a decentralised exchange that supports rETH/ETH pairs (Uniswap, SushiSwap, Balancer, etc.).

- Execute the swap: Trade your ETH for rETH through the exchange interface.

- Store your rETH: Keep your rETH in your wallet or utilise it in compatible DeFi protocols.

Monitoring your stake

Once you hold rETH, your rewards accumulate automatically through the increasing exchange rate between rETH and ETH. To monitor your rewards:

- Check the current rETH/ETH exchange rate on the Rocket Pool website or through blockchain explorers.

- Calculate the difference between the current value of your rETH holdings and your initial investment.

Remember that you don't need to claim rewards separately - they're built into the increasing value of your rETH tokens. When you eventually want to unstake, you can simply swap your rETH back to ETH through the Rocket Pool interface or a decentralised exchange.

How to become a Rocket Pool node operator

For those with technical expertise and a desire to become more actively involved in Ethereum's consensus mechanism, becoming a Rocket Pool node operator offers an opportunity to run validators with reduced capital requirements while earning additional rewards.

Prerequisites:

- 8 ETH for each minipool (validator) you wish to create

- At least 10% of your ETH value in RPL tokens as collateral (for maximum rewards, up to 150%)

- A computer or server that meets the minimum requirements:

- 4+ CPU cores

- 8+ GB RAM

- 100+ GB SSD storage

- Stable internet connection

- Basic command line knowledge

- Understanding of Ethereum staking principles

Step-by-step process:

- Set up your hardware and operating system: Either use a dedicated machine or a cloud service provider. Most node operators use Linux-based systems.

- Install Ethereum clients: Set up an execution client (Geth, Nethermind, etc.) and a consensus client (Prysm, Lighthouse, etc.).

- Install Rocket Pool Smart Node software: Follow the detailed instructions on the Rocket Pool documentation site to install the node software.

- Configure your node: Set up network settings, client preferences, and MEV-boost options if desired.

- Deposit ETH and RPL: Use the node software to deposit your 8 ETH and the required RPL collateral.

- Create your minipool: Once your deposits are confirmed, create a minipool which will be matched with 24 ETH from the deposit pool.

- Monitor and maintain your node: Keep your system updated, monitor performance, and participate in protocol governance if desired.

The future of Rocket Pool

As Ethereum continues to evolve, Rocket Pool is positioning itself for sustained growth and adaptation. In coming years, several key developments and trends will likely shape its trajectory.

Protocol upgrades:

The Rocket Pool development team has outlined an ambitious roadmap with several major upgrades:

- Saturn upgrade series: A comprehensive set of improvements focusing on scalability, capital efficiency, and user experience. The Saturn upgrade is a multi-phase initiative, with Saturn 0 completed and further phases underway.

- Distributed Validator Technology (DVT): Implementation of validator key distribution across multiple operators, enhancing security and reducing single points of failure.

- Greater MEV optimisation: Advanced strategies for maximising Maximal Extractable Value for stakers while maintaining ethical standards.

- Cross-chain expansion: Potential expansion to other proof-of-stake networks or layer-2 solutions that require validation services.

Scaling with Ethereum:

As Ethereum implements its scaling roadmap, Rocket Pool will adapt to support:

- Danksharding and proto-danksharding implementations

- Increasing validator requirements as Ethereum grows

- Adjustments to staking economics as Ethereum's monetary policy evolves

- Supporting specialised validation roles that might emerge in Ethereum's future

Market position and growth:

While Rocket Pool currently holds a smaller market share than some competitors, its emphasis on decentralisation potentially positions it well for sustainable growth. Here are key aspects worth keeping an eye on:

- Increasing regulatory scrutiny may favour more decentralised staking solutions

- Growing community awareness of centralisation risks could drive users toward Rocket Pool

- The protocol's conservative approach to security and upgrades builds long-term trust

How to buy Rocket Pool (RPL)

If you’re looking to accumulate RPL, you can do so securely and easily through the Tap app. Simply download the app, create an account and complete the identity verification process. Once verified, you can buy RPL with a wide range of supported cryptocurrencies or fiat currencies (through debit card or bank transfer). Ready to dive into the world of staking, or just go along for the ride? Tap’s ready for you.

Numeraire är ett banbrytande projekt som kombinerar dataanalys, AI och blockchain för att skapa vad som beskrivs som världens första AI-drivna och crowdsourcade hedgefond. Det grundades i oktober 2015 av Richard Craib, en sydafrikansk teknolog, och representerar ett helt nytt sätt att närma sig finansmarknaderna.

I stället för att förlita sig på traditionella analytiker, låter Numerai tusentals data scientists världen över tävla om att bygga de mest träffsäkra maskininlärningsmodellerna för börsprognoser – modeller som sedan styr hedgefondens faktiska investeringsbeslut.

TL;DR

AI-styrd hedgefond:

Numeraire (NMR) är en Ethereum-baserad token som används i Numerai – en hedgefond baserad i San Francisco som fattar beslut med hjälp av AI, utan mänskliga känslor.

Data science-tävling:

Numerai anordnar världens tuffaste datatävling, där deltagare belönas med NMR-tokens för modeller som förbättrar fondens resultat. Mer än 200 000 USD delas ut varje månad.

Crowdsourcade prognoser:

Deltagare använder Numerais krypterade data för att skapa maskininlärningsmodeller och skicka in sina prognoser, som sedan utvärderas och belönas.

Staking-mekanism:

För att delta måste användare hålla och satsa NMR-tokens – både för att visa förtroende för sina modeller och för att få tillgång till olika funktioner i ekosystemet.

Hur fungerar Numeraire?

Numerai använder ett unikt system där hedgefondens strategi formas av en global datatävling. Så här går det till:

- Numerai släpper anonymiserad, krypterad finansiell data varje vecka.

- Data scientists laddar ner datan och bygger modeller som förutspår hur aktier kommer prestera.

- Prognoserna skickas in och utvärderas utifrån hur väl de stämmer med marknadsutfallet.

För att delta på riktigt måste deltagare satsa (stakea) NMR-tokens på sina inskickade modeller. Går det bra? Då får de mer NMR. Går det dåligt? Då förloras en del av insatsen. Den här mekanismen uppmuntrar till kvalitet framför kvantitet – du måste tro på dina egna modeller.

Till skillnad från många andra projekt använder Numerai inte en enskild vinnande modell. Istället kombineras de mest framgångsrika bidragen till en större “meta-modell” som fonden baserar sina investeringar på. Det gör systemet mer motståndskraftigt än om man bara litade på en enda förutsägelse.

Vem skapade Numeraire?

Richard Craib grundade Numerai 2015. Han studerade matematik och ekonomi vid University of Cape Town och senare på University of California, Berkeley. Innan Numerai arbetade han inom globala aktiemarknader, bland annat på Prudential (M&G).

Craib ville bygga en ny typ av hedgefond – en som drivs av kollektiv intelligens, transparenta incitament och teknik, snarare än traditionella analytiker. Numerai har sedan dess vuxit till att attrahera några av världens skarpaste data scientists.

Vad är NMR?

NMR är den inbyggda tokenen i Numerai-ekosystemet och används för flera viktiga funktioner:

- Tävlingar: Deltagare måste satsa NMR för att delta i tävlingarna och tjäna belöningar.

- Styrning: Tokeninnehavare kan delta i beslut kring plattformens framtid och förändringar.

- Incitament: Den staking-baserade modellen säkerställer att deltagarna bidrar med seriösa modeller.

- Belöningar: Numerai delar ut över 200 000 USD i NMR varje månad till framgångsrika modeller.

Tokenen är en ERC-20-token och fungerar smidigt inom hela Ethereum- och DeFi-ekosystemet.

Hur kan jag köpa och sälja NMR?

Du kan enkelt köpa, sälja och hantera NMR direkt i Tap-appen, tillsammans med dina övriga kryptotillgångar. Appen erbjuder ett enkelt gränssnitt och säker förvaring, vilket gör det lätt att komma igång.

Värt att nämna är att NMR:s utveckling är nära kopplad till Numerais hedgefonds framgång och tillväxten av dess globala nätverk av data scientists.

Polkastarter represents one of the leading decentralised launchpad platforms in the blockchain ecosystem, focused on empowering early-stage crypto projects to raise funds and launch tokens. First launched in December 2020, it has established itself as a prominent player in the Initial DEX Offering (IDO) space, providing a secure and efficient environment for project launches.

The platform has facilitated the launch of over 100 projects, demonstrating its significant impact on the crypto funding landscape. Polkastarter also features a dedicated marketing team, including video production and design, providing support beyond just the technical infrastructure.

TLDR

Multi-chain launchpad: Polkastarter is a decentralised platform that enables crypto projects to conduct token sales and fundraising campaigns across multiple blockchain networks.

Fixed-price swaps: The platform's main offering is its fixed-swap smart contract, which allows projects to easily launch liquidity pools that execute orders at a fixed price, rather than using traditional AMM models.

Cross-chain support: Polkastarter currently supports Ethereum, BNB Chain, Polygon, Celo, and Avalanche, providing flexibility for projects across different ecosystems.

Native token (POLS): POLS serves as the platform's utility token, providing access to IDO participation, governance rights, and various platform benefits.

What is Polkastarter (POLS)?

Polkastarter is a decentralised launchpad platform designed to democratise access to early-stage crypto investments through Initial DEX Offerings (IDOs). The platform serves as a bridge between innovative blockchain projects seeking funding and investors looking for early access to promising tokens.

The platform's core innovation lies in its fixed-swap mechanism, which provides predictable pricing for token sales rather than the variable pricing models used by automated market makers. This approach offers greater transparency and certainty for both projects and investors during token launch events.

Beyond the launchpad functionality, Polkastarter runs an internal incubation and advisory program, bringing together experience and lessons learned from 100+ project launches to nurture and grow Web3 projects, helping to ensure that projects launched on the platform receive proper guidance and support.

The platform takes security seriously by carefully reviewing each project before allowing it to launch. This screening process helps ensure that only legitimate, high-quality projects reach investors, protecting users from scams and poorly developed tokens.

Who created Polkastarter?

Polkastarter was founded in 2020 by Daniel Stockhaus, Tiago Martins, and Miguel Leite. The founding team brought together diverse expertise in business development, technology, and product management to address the growing need for reliable fundraising infrastructure in the decentralised finance space.

Daniel Stockhaus serves as CEO and Co-founder, leading the platform's strategic direction and business development efforts. Under his leadership, the platform has grown from a startup concept to one of the most recognised launchpad platforms in the crypto industry.

The founding team recognised the challenges faced by early-stage crypto projects in accessing capital and the difficulties investors encountered in finding legitimate investment opportunities. Their solution was to create a platform that could serve both sides of this equation while maintaining high standards for security and project quality.

How does Polkastarter work?

Launchpad mechanism

To participate in token launches, users need to hold POLS tokens, with different amounts unlocking various access levels. The more POLS you hold, the better your chances of getting into popular launches and the more you can invest.

Projects set fixed prices for their tokens rather than using changing market prices. This means investors know exactly what they're paying and how many tokens they'll get before they invest.

Multi-chain infrastructure

Polkastarter works across several different blockchains, so projects can pick the one that best fits their needs. Some chains have lower fees, others are faster, and some have different user communities.

Project curation and support

As mentioned above, before any project can launch on Polkastarter, it goes through a thorough review process. The team checks the technology, verifies who's behind the project, and evaluates whether the business makes sense.

Projects also get help with marketing, strategy advice, and technical support to give them the best chance of success both during their launch and afterwards.

What Is POLS?

POLS is the native utility token of the Polkastarter ecosystem, serving a range of functions within the ecosystem:

- Tier access: Users must hold and stake POLS tokens to access different participation tiers in IDO launches, with higher holdings providing better benefits and guaranteed allocations.

- Governance rights: POLS holders can participate in platform governance decisions, voting on proposals that affect the platform's future development and policies.

- Staking rewards: Token holders can stake their POLS to earn rewards while maintaining their tier status for IDO participation.

- Platform fees: POLS can be used to pay for various platform services and may provide discounts on transaction fees.

How can I buy and sell POLS?

POLS tokens are available on Tap, allowing verified users to easily buy, sell, and trade the token. Before investing in POLS, we encourage you to consider how useful the token is on the Polkastarter platform and how much the launchpad space is growing. The token’s value depends largely on the platform’s success and how widely IDO fundraising is adopted.

Livepeer är ett decentraliserat nätverk för videostreaming, med målet att göra videoinnehåll mer tillgängligt och prisvärt för alla. Projektet lanserades 2017 och var det första fullt decentraliserade live-videoprotokollet – ett alternativ till traditionella, centraliserade streamingtjänster som YouTube och Twitch.

Plattformen fungerar genom att koppla samman innehållsskapare med datoroperatörer som tillhandahåller datorkraft. Denna peer-to-peer-modell kan minska kostnaderna för videobehandling med upp till 50–90 % jämfört med molnbaserade lösningar, samtidigt som kvaliteten bibehålls.

TL;DR

Decentraliserad videoinfrastruktur:

Livepeer bygger ett nätverk där AI-bearbetning och videotranskodning kan utföras av oberoende noder i stället för dyra serverhallar.

Kostnadseffektiv streaming:

Tack vare sin decentraliserade marknadsplats kan Livepeer erbjuda konkurrenskraftiga priser och tillförlitliga tjänster till utvecklare och plattformar.

Ethereum-baserat protokoll:

Byggt på Ethereum ger det utvecklare frihet att skapa videolösningar utanför storföretagens kontroll.

LPT-tokenen:

Livepeers inbyggda token används för staking och styrning av nätverket, inte som direkt betalningsmedel.

Hur fungerar Livepeer?

När någon vill streama video använder de normalt stora serverhallar för att bearbeta innehållet. Livepeer gör det istället möjligt att distribuera jobbet över ett globalt nätverk av datorer – så kallade orchestrators – som hjälper till att transkoda video till olika kvaliteter (t.ex. 1080p, 720p, 480p). Det gör att videor fungerar oavsett enhet eller internetuppkoppling.

Det här gynnar både innehållsskapare, tittare och datoroperatörer:

- Skapare betalar mindre för högkvalitativ streaming

- Operatörer tjänar pengar genom att bidra med datorkraft

- Tittare får samma upplevelse som på traditionella plattformar

För utvecklare innebär det ett billigt, flexibelt och decentraliserat alternativ till att själva bygga upp videoinfrastruktur.

Vem ligger bakom Livepeer?

Livepeer grundades 2017 av Doug Petkanics (CEO) och Eric Tang (CTO) – två mjukvaruutvecklare med lång erfarenhet av startupvärlden. Doug har tidigare varit med och grundat Wildcard och studerat vid University of Pennsylvania, medan Eric är teknisk visionär med fokus på hur blockchain kan effektivisera streaming.

De såg hur videoinnehåll blev allt dyrare att distribuera, samtidigt som några få stora aktörer kontrollerade större delen av infrastrukturen. Livepeer föddes ur idén att göra streaming mer öppet och decentraliserat – utan att tumma på kvalitet eller prestanda.

Transkodningsnätverket

Grunden i Livepeer är dess videotranskodningsnätverk. Varje gång en video ska streamas behöver den konverteras till flera olika format för att fungera på olika enheter och nätverk. Det är det här jobbet som Livepeer distribuerar över tusentals datorer världen över.

Operatörerna tävlar om att erbjuda bästa möjliga tjänst till lägsta pris, vilket skapar ett naturligt effektivt system där kvalitet och kostnad balanseras.

Säkerhet och staking

För att få utföra arbete i nätverket måste operatörerna stakea LPT-tokens. Det fungerar som en säkerhetsinsats – om de fuskar eller levererar dålig service riskerar de att förlora sina tokens. Det här håller kvaliteten hög.

Andra användare kan också välja att delegera sina LPT till operatörer de litar på, och i gengäld få en andel av belöningarna, utan att själva behöva köra någon hårdvara.

Ekonomiska incitament

Livepeer fungerar som en öppen marknadsplats för videobearbetning. De operatörer som erbjuder bäst kombination av pris, tillförlitlighet och kvalitet får jobben. Själva betalningarna sker i ETH eller andra kryptovalutor, medan LPT används för staking, governance och belöningar.

Vad är LPT?

LPT är Livepeers native token och används inte främst som betalmedel utan för att:

- Säkra nätverket: Operatörer måste stakea LPT för att få jobba i nätverket

- Styra protokollet: Tokeninnehavare kan rösta om viktiga beslut och uppgraderingar

- Få belöningar: Genom delegation kan du få en del av intäkterna från operatörer

- Utföra arbete: LPT representerar rätten att bidra till nätverket och tjäna på videobearbetning

Tokenen följer en inflationsmodell där nya LPT skapas som belöning – men värdet balanseras av användning och nätverkets tillväxt.

Hur köper och säljer man LPT?

Nyfiken på att utforska LPT? Du kan enkelt köpa, sälja, handla och lagra Livepeer-tokenen direkt i Tap-appen – tillsammans med dina andra digitala tillgångar.

Eftersom LPT:s värde är kopplat till hur mycket Livepeers infrastruktur används, påverkas efterfrågan av hur många utvecklare och innehållsskapare som väljer att bygga på plattformen.

Harvest Finance is a decentralised yield farming protocol that automates the process of earning maximum returns on crypto investments. Launched in 2020 on the Ethereum blockchain, it functions as a yield aggregator that automatically moves users' funds between different DeFi protocols to capture the highest available yields. It now operates on additional blockchains such as Binance Smart Chain and Polygon.

The platform was designed to solve one of the biggest challenges in DeFi yield farming: the time and expertise needed to constantly monitor and switch between different protocols to maximise returns. Instead of users having to do this manually, Harvest Finance does it automatically, making yield farming accessible to everyone.

TLDR

Automated yield farming: Harvest Finance is a DeFi protocol that automatically farms the highest yields available from various DeFi protocols and pools, optimising returns using advanced farming techniques.

Yield aggregator: Harvest Finance serves as a yield aggregator where assets are deposited into strategic vaults to maximise their yield.

Vault system: Users deposit their crypto assets into specialised vaults, receiving fTokens in return that represent their share of the vault and accumulated rewards.

Native token (FARM): FARM is the governance token that allows holders to vote on protocol parameters and share in farming revenue. FARM token holders can vote on proposals for the operational treasury and may receive a fee from Harvest operations

What is Harvest Finance (FARM)?

Harvest Finance simplifies the complex world of yield farming by creating an automated system that does the hard work for users. When you deposit your crypto into a Harvest vault, the protocol automatically deploys your funds to various DeFi platforms that offer the best returns at any given time.

Think of it like having a professional fund manager for your crypto, but instead of a human making decisions, smart contracts automatically move your money to wherever it can earn the most. The protocol automatically farms the highest yield by moving funds between farming pools on your behalf, eliminating the need for users to constantly research and switch between different platforms.

The platform supports various types of assets including stablecoins, popular cryptocurrencies, and liquidity pool tokens. When you deposit assets, you receive fTokens (like fUSDC for USDC deposits) that represent your share of the vault and track your earnings over time.

Harvest Finance's goal is to make yield farming more accessible by automating the process and optimising the potential returns using the latest farming techniques, bringing sophisticated DeFi strategies to everyday users.

Who created Harvest Finance?

The founders of Harvest Finance remain anonymous, which was common for many DeFi projects launched in 2020. The team is completely anonymous, though the project succeeded in attracting a relatively sizable community and has been involved in the community by doling out grants.

Despite the anonymous nature of the founding team, Harvest Finance has built a strong reputation in the DeFi community through its transparent operations and community involvement. The token was distributed via fair launch with no token sales to investors, demonstrating the team's commitment to decentralised principles.

The project launched during the height of the 2020 DeFi summer when yield farming became extremely popular, and the anonymous team capitalised on the growing demand for automated yield optimisation tools.

How does Harvest Finance work?

Vault Strategy System

The platform operates through a system of specialised vaults, each designed for different types of assets and risk profiles. When you deposit crypto into a vault, you receive fTokens that represent your share of that vault's total holdings.

The magic happens behind the scenes, where the protocol's strategies automatically deploy your funds to various DeFi protocols like Compound, Curve, Uniswap, and others based on where they can earn the highest yields. The system constantly monitors yield opportunities and automatically rebalances to maximise returns.

Automated Yield Optimisation

Harvest Finance's protocol design automatically farms the highest available yields and distributes the profits to users in the pool. This means users don't need to understand the complexities of different DeFi protocols or spend time managing their positions.

The protocol uses sophisticated algorithms to determine the best allocation of funds across different yield farming opportunities, taking into account factors like APY rates, smart contract risks, and gas costs for rebalancing.

Profit Sharing Model

When the automated strategies generate profits, these are shared among all users in the vault proportional to their deposits. A portion of the profits is also distributed to FARM token holders who stake their tokens in profit-sharing pools, creating an additional incentive layer for the community.

What is FARM?

FARM serves as the governance and profit-sharing token of the Harvest Finance ecosystem:

- Governance Rights: Holders can vote on protocol parameters and propose or veto the introduction of new Vaults, giving the community control over the platform's direction.

- Profit Sharing: FARM, when deposited in Profit Sharing pools, becomes a means of participating in farming revenue, allowing token holders to earn a share of the protocol's success.

- Protocol Incentives: Harvest at launch required a native crypto so as to be able to incentivise yield farmers, and allow Harvest to stake other platforms and collect rewards in return.

- Community Participation: The token creates alignment between users and the protocol's long-term success, as both benefit from higher yields and more efficient farming strategies.

FARM operates as an ERC-20 token on Ethereum, making it compatible with the broader DeFi ecosystem and easily tradeable on decentralised exchanges. While FARM is originally an ERC-20 token, it also exists on other blockchain platforms such as Polygon and Binance Smart Chain, expanding to multiple blockchains to offer yield farming opportunities across different ecosystems

How can I buy and sell FARM?

For those looking to participate in automated yield farming, FARM tokens are readily available through the Tap app. You can purchase, sell, and store FARM tokens securely while managing them alongside your broader crypto portfolio.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Redo att ta första steget?

Gå med i nästa generations smarta investerare och pengaanvändare. Lås upp nya möjligheter och börja din resa mot ekonomisk frihet redan idag.

Kom igång