Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

.webp)

Så, du har säkert hört talas om ChatGPT vid det här laget

Det är den där AI-assistenten som dyker upp i nästan alla samtal om produktivitet och teknik. Och ärligt talat? Den lever verkligen upp till hypen.

Tänk dig att ha en riktigt smart kompis tillgänglig dygnet runt. Oavsett om du behöver hjälp med ett jobbprojekt, vill formulera det perfekta mejlet eller undrar över något mitt i natten.

Men här är något jag önskar att någon hade sagt till mig från början. Alla ChatGPT-planer är inte likadana. Skillnaden mellan gratisversionen och de betalda nivåerna är ganska stor. Det är som att jämföra en vän som ibland är upptagen med en assistent som alltid är redo att fokusera helt på det du behöver hjälp med.

Oavsett om du är student med tajt budget eller ett proffs med höga krav är det värt att förstå skillnaderna. Här är allt du behöver veta.

Prisplaner för ChatGPT under 2025

| Plan | Monthly Cost | Annual Cost | Best For |

|---|---|---|---|

| Free | $0 | $0 | Casual users, testing |

| Plus | $20 | $20 | Individual professionals |

| Team | $30/user | $25/user | Small teams, startups |

| Pro | $200/user | $200/user | Power users, researchers |

| Enterprise | ~$60+/user | Custom pricing | Large organisations |

🟢 ChatGPT Free

Pris: 0 kronor

Funktioner:

- Tillgång till GPT-4o mini

- Begränsad tillgång till GPT-4o

- Standard röstläge

- Filuppladdningar

- Bildgenerering

- Webbsökning

- Avancerad dataanalys

Passar dig som:

Vill testa ChatGPT utan att binda dig. Det är som en provkörning där du får uppleva kraften i AI men med vissa begränsningar.

🔵 ChatGPT Plus

Pris: 20 dollar per månad

Funktioner:

- Upp till 80 meddelanden per 3 timmar

- Prioriterad tillgång till GPT-4o

- Snabbare svar

- Avancerat röstläge

- Tidig tillgång till nya funktioner

- Möjlighet att skapa egna GPTs

Passar dig som:

Använder AI regelbundet. Du kanske är frilansare, student eller yrkesverksam och behöver pålitlig tillgång till en effektiv arbetskamrat.

🧑🤝🧑 ChatGPT Team

Pris: 30 dollar per användare och månad, eller 25 med årsabonnemang

Funktioner:

- Allt som ingår i Plus

- Stöd för samarbete mellan flera användare

- Arbetsytor med sekretesskydd

- Adminpanel och användaröversikt

- Skräddarsydda GPTs för teamet

Passar dig som:

Jobbar i ett mindre team och vill använda AI på ett effektivt och säkert sätt. Ni får en gemensam AI-upplevelse med koll på datan.

🧠 ChatGPT Pro

Pris: 200 dollar per användare och månad

Funktioner:

- Obegränsad tillgång till GPT-4o

- Avancerad AI-förmåga för komplexa uppgifter

- Tillgång till högpresterande resurser

- Inkluderar allt från tidigare planer

Passar dig som:

Jobbar djupt med AI. Du kanske forskar, utvecklar eller analyserar och behöver maximal prestanda utan avbrott.

🏢 ChatGPT Enterprise

Pris: Cirka 60 dollar per användare och månad. Kräver minst 150 användare och 12 månaders avtal

Funktioner:

- Sekretess- och säkerhetsfunktioner på företagsnivå

- Integration med interna källor som Google Drive, GitHub och Dropbox

- Anpassad driftsättning

- Avancerade kontroller för åtkomst och dataskydd

- Dedikerad support

Passar dig som:

Driver en större organisation och vill integrera AI i hela verksamheten. Fokus ligger på trygghet, skalbarhet och anpassning.

Så väljer du rätt ChatGPT-plan

Det är som att välja mobilabonnemang. Du vill ha det som passar dina behov utan att betala för mer än du använder.

🎓 För studenter

Tips: Börja med gratisplanen. Uppgradera till Plus om du ofta når gränserna. Den hjälper dig med plugg, uppsatser och research utan att påverka budgeten.

💼 För frilansare och enmansföretagare

Tips: Välj ChatGPT Plus. Det är din digitala assistent. Perfekt för att spara tid och öka effektiviteten.

👨💻 För utvecklare

Tips: Välj Plus om du kodar ibland. Går du djupare och bygger med AI bör du överväga Pro.

👥 För team och startups

Tips: Välj Team-planen. Den är anpassad för samarbete, sekretess och kontroll.

🏦 För större företag

Tips: Enterprise är rätt val om AI ska integreras i arbetsflöden, interna verktyg och affärsprocesser.

Viktigt att känna till om dolda kostnader

💬 API-prissättning

Om du bygger egna appar med GPT tillkommer kostnader baserat på tokenförbrukning. Serveroptimering och kringkostnader kan göra det dyrare än väntat.

📉 Användningsbegränsningar

Även betalda planer har gränser. Gratisanvändare har lägre tillgång, Plus är generösare men inte obegränsad.

🛑 Funktioner släpps olika snabbt

Vissa funktioner blir tillgängliga först för Plus och Pro. Använder du gratisplanen kan du behöva vänta.

📁 Begränsningar för filuppladdning

Det finns storleksgränser och bearbetningsrestriktioner som kan påverka om du jobbar med tunga dokument eller datamängder.

Alternativ till ChatGPT, finns det något bättre?

Här är några konkurrenter som också erbjuder kraftfulla AI-upplevelser:

TjänstPrisStyrkorBäst förClaude AIGratis och 20 dollar ProBra på analys och resonemangLånga, komplexa texterPerplexity AIGratis och 20 dollar ProWebbsökning med källorResearch och aktuell informationDeepSeek20 till 50 dollar i månadenBra prestanda till lägre kostnadBudgetmedvetna användareGoogle GeminiGratis eller 20 dollar PremiumIntegrerat med Googles ekosystemAnvändare av Googles verktyg

Alla dessa har sina egna styrkor. ChatGPT är allround, enkel att använda och kraftfull. Men beroende på hur du arbetar kan något av alternativen passa dig bättre.

Är ChatGPT värt priset år 2025?

Det beror helt på hur mycket du använder det.

Om du bara använder AI då och då räcker gratisplanen långt. Om du jobbar med innehåll, analys eller kommunikation på daglig basis är Plus värt investeringen. För team och företag är de mer avancerade planerna logiska val när AI blir en del av arbetsrutinerna.

Det bästa är att du inte behöver bestämma dig på en gång. Testa gratisversionerna av ChatGPT, Claude eller Perplexity. Välj den som passar din stil och dina behov bäst.

Vi befinner oss fortfarande i AI-teknikens tidiga dagar. Men det är tydligt att verktyg som ChatGPT kommer att bli lika vardagliga som e-post eller molntjänster. Frågan är inte om du ska använda AI, utan vilken lösning som passar dig just nu.

Slippage is a natural part of trading that happens when there’s a difference between the price you expect to pay for an asset and the price you actually get. It’s common across all markets, from crypto to forex, stocks, and commodities, and it reflects the gap between your order request and the execution price.

Understanding how slippage works helps investors manage expectations, avoid unnecessary losses, and choose smarter trading strategies. In this guide, we’ll explore what causes slippage, how to calculate it, and how to minimize its impact in real trading scenarios.

What Is Slippage In Trading?

Slippage is when an investor opens a trade but between creating the trade and executing the trade; the price changes due to price movements in the greater market. This can often be a costly problem in the financial sector and particularly when trading digital currencies on crypto exchanges.

How Does Slippage Occur?

The two main causes of slippage are volatility and liquidity, outlined in more information below.

Volatility is when the price changes rapidly, as is common in cryptocurrency markets, and as a result the price changes between the time of creating the buy or sell order and the time of execution.

Liquidity concerns on the other hand are when the coin you are trading is not traded very often and the range between the lowest ask and the highest bid is wide. This can cause sudden and dramatic price changes, resulting in slippage. Fewer people trading an asset results in fewer asking prices, resulting in less favourable prices.

This is common among altcoins with low volume and liquidity. While slippage can occur in forex and stock markets too, it is much more prevalent in crypto markets, particularly on decentralized exchanges (DEXs).

There are two types of slippages:

Positive Slippage

Positive slippage is when a trader creates a buy order and the executed price is lower than the price initially expected. This will result in the trader getting a better rate. The same is true for a sell order that experiences a higher price point at trade execution, resulting in more favourable value for the trader. Positive slippage banks profits.

Negative Slippage

Negative slippage is when the trader loses out on the trade, with the price of the buy order higher than expected at the time of execution. The opposite is true for sell orders, meaning that the execution price is lower at the time of execution, similarly resulting in losses for the trader..

How To Calculate Slippage

Slippage can be calculated in two ways, either in dollar amount or percentage. Although to work out the percentage, you will first need the dollar amount. This is calculated by subtracting the price you expected to pay from the price you actually paid. This amount will indicate if you incurred a positive or negative slippage.

Most exchanges express this amount in percentages. This is calculated by dividing the dollar amount of slippage by the difference between the price you expected to get and the limit price. Then multiply that by 100.

Slippage Example in Practice

Imagine you plan to buy 1 BTC for $50,000, but by the time your market order executes, the price has risen to $50,250. You’ve experienced negative slippage of $250.

Now imagine you place a limit order at $50,000, and the order executes at $49,900, that’s positive slippage, meaning you paid less than expected.

To calculate slippage:

Slippage amount = Executed Price − Expected Price

Slippage percentage = (Slippage ÷ Expected Price Difference) × 100

For example, if your expected buy was £50,000 and you paid £50,250, slippage = £250 (0.5%).

This simple math helps traders evaluate execution quality and whether slippage is within acceptable limits.

Slippage Across Different Markets

Crypto Markets:

Crypto markets operate 24/7 and can swing several percent in seconds. On decentralised exchanges (DEXs) like Uniswap, prices depend on liquidity pools; so if liquidity is low, large trades can move the price dramatically. Tokens with small trading volumes, like new altcoins, are particularly prone to high slippage.

Forex Markets:

In the foreign exchange market, slippage often occurs during news releases (e.g., interest rate decisions). Liquidity is usually high, but during volatile moments, even major pairs like GBP/USD can slip several pips.

Stock Markets:

Stock slippage tends to appear at market open or close, when volatility spikes. During major events (earnings reports, Fed meetings) even large-cap shares can gap before orders fill.

Across all asset classes, slippage is most noticeable during low liquidity or high volatility, two conditions traders should always monitor.

How To Avoid Slippage

While one can't eradicate slippage entirely, there are several measures one can take to better manage slippage, as regularly falling victim to negative slippages can result in losing a lot of money.

Create limit orders:

Instead of creating market orders, traders can instead create limit orders as these types of trades don't settle for unfavourable prices. Market orders are designed to execute a trade service as quickly as possible at the current available price.

Set a slippage percentage:

Traders can create a slippage percentage that eliminates trades happening outside of the predetermined range. This can range from 0.1% to 5%, however, if the slippage percentage is too low this could lead to the trade not being executed and the trader missing out on large drops/jumps.

Understand the coin's volatility:

When in doubt, get educated. Learn about the coin's volatility as well as the volatility on the trading platform you are using. Understanding more about previous patterns can assist in making more informed decisions on when to open and close a position, and avoiding negative slippages.

Bottom Line

Slippage is inevitable but manageable. Whether you’re trading crypto, forex, or equities, some gap between expected and actual execution is normal. The goal isn’t to eliminate slippage, but to understand it, anticipate it, and minimize unnecessary exposure.

By combining timing awareness and education, traders can protect profits and execute more confidently, even in fast-moving markets.

.png)

Oavsett om du är en trogen datoranvändare eller föredrar mobilen, finns det tillfällen då du snabbt behöver skriva det brittiska pundtecknet (£) i ett mejl, dokument eller meddelande. I den här guiden visar vi hur du enkelt lägger till symbolen – oavsett om du använder Mac, PC eller smartphone.

Men först: om du vill skicka brittiska pund internationellt, erbjuder Tap – en reglerad och användarvänlig fintechplattform – snabba, smidiga överföringar med låga avgifter och konkurrenskraftiga växlingskurser. Överför pengar globalt eller gratis mellan Tap-användare, direkt i appen.

Var kommer pundtecknet ifrån?

Det brittiska pundet, symboliserat med £, har en över 1 200 år lång historia. Ursprungligen användes det som viktmått för silver i det anglosaxiska England och blev officiell valuta år 1694 under kung William III.

Pundet fick global betydelse genom det brittiska imperiets expansion, och trots historiska utmaningar – som valutadevalvering 1967 och Brexit – förblir det en stark och inflytelserik valuta.

Enligt Bank of England härstammar symbolen från bokstaven L, första bokstaven i det latinska ordet libra, som betyder "pund". Den horisontella linjen i symbolen tros ha tillkommit på 1600-talet och finns dokumenterad på ett checkexemplar från 1660.

I brittisk skrivstil placeras pundtecknet före summan – exempelvis: £10.

🎭 Kul fakta: År 1970 lanserades en ny £20-sedel med William Shakespeare, vilket lade grunden till traditionen att pryda sedlar med historiskt betydelsefulla personer.

Så skriver du £ i ett dokument

Låt oss nu gå igenom hur du faktiskt skriver pundtecknet (£) på olika enheter – oavsett om du använder Mac, PC eller mobil.

För Mac-användare

Använder du Mac? Här är det enklaste sättet:

- Håll in Option (⌥) (eller Alt) och tryck samtidigt på 3.

På vissa tangentbord kan det fungera med Shift + 3, beroende på layouten.

För Windows-användare

På en Windows-dator:

- Håll in Shift och tryck på 3 (överst på tangentbordet). På vissa tangentbord finns pundsymbolen tryckt ovanför siffran – som en visuell påminnelse.

💡 Värt att notera: Amerikanska tangentbord har oftast inte £ som standard. I så fall kan du alltid kopiera symbolen härifrån: £

För dig med smartphone eller surfplatta

På mobilen (både iOS och Android) är det ännu enklare:

- Öppna tangentbordet i meddelandet eller appen du skriver i.

- Växla till symbol- eller siffertangentbordet.

- Leta efter £, eller håll in dollartecknet ($) för att få upp fler valmöjligheter.

Inget tangentbord? Inga problem

Skriver du i Word eller Google Docs utan tillgång till tangentbord? Så här gör du:

I Microsoft Word:

- Gå till Infoga > Symbol.

- Leta upp £ i listan och klicka för att infoga.

I Google Docs:

- Gå till Infoga > Specialtecken.

- Välj Symboler > Valuta och klicka på £.

Klart!

Nu vet du hur du snabbt och enkelt skriver pundtecknet (£) – oavsett vilken enhet du använder. Spara gärna den här guiden till nästa gång du behöver lägga till symbolen i ett mejl, dokument eller meddelande.

Du kanske redan har testat att köpa och sälja kryptovalutor – men har du koll på airdrops? En airdrop är en marknadsföringsstrategi som används för att skapa uppmärksamhet och bygga upp ett starkare nätverk kring ett kryptoprojekt.

I den här guiden går vi igenom vad airdrops är, hur de fungerar och varför de har blivit ett populärt sätt att engagera communityn – ofta med riktiga tokenbelöningar.

Vad är en krypto-airdrop?

En krypto-airdrop innebär att ett projekt delar ut sina egna tokens gratis till användare. Målet? Att skapa hype, öka spridningen av sina tokens och locka nya användare – ofta i ett tidigt skede innan projektet listas på en börs.

I vissa fall krävs det små insatser, som att följa projektets sociala medier eller gå med i en Telegram-kanal. I andra fall får man tokenbelöningen utan att behöva göra något alls.

Airdrops blev särskilt populära under ICO-boomen 2017 och används fortfarande idag. Och även om tokenen ges bort gratis, kan dess värde öka med tiden – vilket gör airdrops potentiellt intressanta för användare.

När projekten delar ut tokens ökar också decentraliseringen, vilket ofta ses som ett positivt tecken på att projektet är community-drivet.

Hur fungerar en krypto-airdrop?

En airdrop finns ofta med i ett projekts roadmap och startar när vissa kriterier är uppfyllda. Det kan handla om att uppnå ett antal användare, genomföra en marknadskampanj eller lansera en viss funktion.

Tokens delas vanligtvis ut i små mängder till många olika plånböcker. Dessa tokens bygger ofta på blockkedjor som Ethereum eller andra smarta kontraktsplattformar.

För att kvalificera sig kan man behöva:

- Hålla ett visst antal tokens i sin plånbok

- Gå med i en community

- Utföra enkla marknadsföringsuppgifter (t.ex. gilla ett inlägg)

En lyckad airdrop leder ofta till att användare själva sprider ordet och skapar intresse kring projektet.

Airdrop vs ICO – vad är skillnaden?

Både airdrops och ICO:er handlar om nya kryptoprojekt, men det finns en tydlig skillnad:

- Airdrop: Tokens delas ut gratis som en form av marknadsföring.

- ICO (Initial Coin Offering): Tokens säljs till användare till ett fast pris – som ett sätt att samla in kapital.

Man kan säga att ICO är ett crowdfunding-verktyg, medan airdrops är ett marknadsföringsgrepp.

Vilka typer av airdrops finns?

Det finns olika typer av airdrops – här är de tre vanligaste:

🎯 Exklusiva airdrops

Riktade mot aktiva medlemmar eller early adopters. Tokens skickas endast till utvalda plånböcker.

Exempel: Uniswap skickade 400 UNI till varje användare som använt plattformen innan ett visst datum.

🪙 Bounty airdrops

Användare måste utföra uppgifter, t.ex. gilla inlägg, dela tweets eller tagga vänner. Vissa projekt ber om bevis innan distribution.

🔒 Holder airdrops

Belöningar till befintliga innehavare av projektets token. Projekten tar en "snapshot" av alla plånböcker och skickar belöningar till dem som uppfyller kriterierna.

Exempel: 2016 airdroppade Stellar 3 miljarder XLM till Bitcoin-innehavare för att locka användare till sin plattform.

Finns det risker med airdrops?

Ja – precis som allt annat i krypto finns det risker att känna till:

- Bedrägliga projekt kan skicka tokens till din plånbok – men när du försöker använda dem kan plånboken bli tömd.

- Phishing-sajter kan efterlikna riktiga projekt och be dig ansluta din plånbok – och i värsta fall stjäla dina tillgångar.

- Ingen legitim airdrop kommer någonsin kräva din seed phrase eller att du skickar pengar för att "låsa upp" en token.

En annan nackdel är att distributionen kan ge falska intryck. Tusentals tokens i tusentals plånböcker kan få ett projekt att se större ut än det egentligen är.

👉 Tips: Kontrollera alltid att projektet har verklig handelsvolym – inte bara många innehavare.

Picture this: You're scrolling through DeFi platforms, and suddenly you see two different projects. One screams "12% APR!" while another boasts "12% APY!" Your brain probably thinks, "Same, right?"

Wrong. Very wrong.

When it comes to comparing interest rates, APR and APY might look like twins… but they’re not. Far from it. The difference between them can determine whether you grow your savings or overpay on a loan. In this guide, we’ll break down what APR and APY really mean, how they work in banking, lending, and crypto, and how understanding them can help you make smarter financial decisions.

Key Takeaways

- APR (Annual Percentage Rate) shows the yearly cost of borrowing, including interest and certain fees.

- APY (Annual Percentage Yield) reflects your total yearly return, factoring in compounding.

- For borrowers, lower APR = lower total cost. For savers, higher APY = higher returns.

- In crypto and DeFi, compounding frequency can turn modest APRs into much higher APYs.

APY vs APR: The Essential Difference

At a glance, APR tells you how much interest you’ll pay (or earn) over a year, without compounding. APY, on the other hand, includes compounding, the process where interest earns more interest over time.

When comparing financial products, whether a credit card, savings account, or staking pool, this distinction matters. For borrowers, APR reveals the true cost of debt, while for investors, APY highlights the power of compound growth.

TL;DR. APR is about cost, APY is about growth. Knowing which one applies helps you choose between competing offers with confidence.

What Is APR (Annual Percentage Rate)?

APR represents the yearly interest rate charged to borrow money, or the rate you earn before compounding if you lend it. It includes interest and certain fees, helping you understand the total cost of credit.

APR is widely used in credit cards, personal loans, mortgages, and auto financing. For example, if your credit card has an 18% APR, you’ll pay 18% interest on any carried balance. Fixed-rate loans maintain the same APR, while variable-rate loans fluctuate with market conditions and Federal Reserve changes.

Example: Borrow $10,000 at 10% APR for one year. You’ll owe $1,000 in interest. Simple and transparent, without compounding surprises.

What Is APY (Annual Percentage Yield)?

APY measures how much your money grows over a year, including compounding. It reflects how often your interest is added to your balance (daily, monthly, or annually) which then generates more interest.

This is the standard metric for savings accounts, money market accounts, and certificates of deposit (CDs). Banks and digital financial platforms often advertise APY because it paints a more complete picture of earning potential.

Example: Deposit $10,000 in an account with a 5% APY, compounded monthly. After one year, your balance grows to $10,511, slightly higher than a flat 5% APR return.

The more frequent the compounding, the greater the growth, especially important in DeFi protocols that compound every few minutes.

APR vs APY in Different Financial Products

Credit Cards and Loans (APR)

When borrowing, APR helps you understand the true borrowing cost. For instance, if a mortgage advertises a 6.5% APR, that includes both the interest and certain closing costs.

Car loans, student loans, and credit cards use APR to keep comparisons straightforward across lenders. The key? Lower APR = less expensive borrowing.

Savings and Investment Accounts (APY Focus)

If your goal is wealth building, APY is your guide. A high-yield savings account with 4.5% APY grows faster than one with 4% because compounding quietly amplifies returns.

For certificates of deposit (CDs) or fixed deposits, APY helps you compare the real impact of compounding frequency.

Cryptocurrency and DeFi (Both APR and APY)

In crypto lending, staking, or yield farming, both metrics appear and can be easily confused.

- APR shows base rewards (without compounding).

- APY assumes you’re constantly reinvesting.

Example: A DeFi pool may show 100% APR, but with daily compounding, it becomes 171% APY. The key is understanding how often you can claim rewards and whether gas fees make compounding worthwhile.

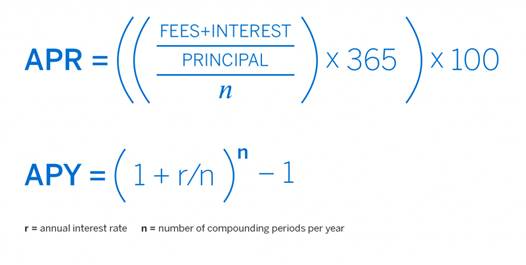

How to Calculate APR vs APY

To compare offers correctly, you can calculate one from the other:

Example: 12% APR compounded monthly

APY = (1 + 0.12/12)^12 - 1 = 12.68%

Compounding more frequently increases APY slightly each time.

Which Should You Focus On?

- If you’re borrowing, prioritize APR. It reflects the total cost of debt.

- If you’re saving or investing, look at APY. It shows how compounding boosts earnings.

- In crypto, check both. APR tells you the base reward, APY reveals potential if you reinvest.

When comparing offers, always read the fine print; frequency, fees, and conditions can shift the real value dramatically.

Common Misconceptions and Pro Tips

Myth: “APY is always better.”

Reality: Only if compounding happens, or if you reinvest earnings.

Myth: “APR ignores compounding, so it’s useless.”

Reality: APR helps borrowers compare costs clearly.

Pro Tip: Use online APR-to-APY calculators for quick comparisons. They’re free and eliminate guesswork.

The Bottom Line

APR and APY aren't just different ways of saying the same thing, they represent two different approaches to measuring returns.

When you see APR, you're looking at simple interest calculated over a year. When you see APY, you're seeing what happens when earnings get reinvested and compound over time. Both are valid measurements, just showing different scenarios.

This distinction becomes more noticeable with higher interest rates. A 50% APR becomes closer to 65% when compounded daily. The higher the base rate, the bigger the difference between these two numbers becomes.

Understanding which one you're looking at helps you compare options accurately. APR gives you the base rate, while APY shows the potential with compounding factored in.

Once you get the hang of spotting the difference, those financial offers suddenly make a lot more sense. No more squinting at numbers wondering why similar-sounding deals seem to work out so differently. It's like finally understanding why some recipe measurements are in cups and others in ounces - same concept, different scales, and knowing which is which makes all the difference.

Yield farming is a method to generate more crypto with your crypto holdings. The process involves you lending your digital assets to others by means of the power of computer programs known as smart contracts.

Cryptocurrency holders have the option of leaving their assets idle in a wallet or binding them into a smart contract to assist with liquidity. Yield farming allows you to benefit and gain rewards from your cryptocurrency without spending any more of it. Sounds quite easy, right?

Well, hold on because it isn't that straightforward and we are just getting started.

Yield farmers employ highly advanced tactics in order to improve returns.

They constantly move their cryptocurrencies among a variety of lending markets in order to optimize their returns. After a quick Google search, you would wonder why there isn't more content surrounding strategies and why these yield farmers are so tight-lipped about the greatest yield farming procedures.

Well, the answer is quite simple: the more people are informed about a strategy, the less effective it becomes. Yield farming is the lawless territory of Decentralized Finance (DeFi), where farmers compete for the opportunity to grow the highest-yield crops.

As of November 2021, there is $269 billion in crypto assets locked in DeFi, gaining an impressive almost 27% in value compared to the previous month of October.

The DeFi yield farming rise shows that the excitement in the crypto market has extended far beyond community- and culture-based meme tokens and planted itself in the centre of the hype. What exactly does it take to be a yield farmer?

What kinds of yields can you anticipate? Where do you start If you're considering becoming a yield farmer? Here, we'll guide you through everything you need to know.

What is Yield Farming?

Also referred to as liquidity farming, yield farming is a method for generating profits using your cryptocurrency holdings instead of leaving them idle in an account on a crypto website. In a nutshell, it involves bidding cryptocurrency assets into platforms that offer lending and borrowing services and earning a reward for it.

Yield farming is similar to bank loans or bonds in that you must pay back the money with interest when the loan is due. Yield farming works the same way, but this time, the banks are replaced in this scenario by crypto holders like yourself in a decentralized environment. Yield farming is a form of cryptocurrency investment in which "idle cryptocurrencies" that would have otherwise been held on an exchange or hot wallet are utilized to provide liquidity in DeFi protocols in exchange for a return.

Yield farming is not possible without liquidity pools or liquidity farming. But, what is a liquidity pool? It's basically a smart contract that contains funds. Liquidity pools are working with users called liquidity providers (LP) that add funds to liquidity pools. Find more information about liquidity pools, liquidity providers, and the automated market maker model below.

How Does Yield Farming Work?

Liquidity pools (smart contracts filled with cash) are used by yield farming platforms to offer trustless methods for crypto investors to make passive revenue by loaning out their funds or crypto using smart contracts.

Similar to how people create bonds to pay off a house and then pay the bank interest for the loan, users can tap into a decentralized loan pool to pay for the bonds.

Yield farming is a type of investment that involves the use of a liquidity provider and a liquidity pool in order to run a DeFi market.

- A liquidity provider is a person or company who puts money into a smart contract.

- The liquidity pool is a smart contract filled with cash.

Liquidity providers (LPs), also known as market makers, are in charge of staking funds in liquidity pools enabling sellers and purchasers to transact conveniently by executing a buyer-seller agreement utilizing smart contracts. LPs earn a reward for providing liquidity to the pool. Yield farming is based on liquidity providers and liquidity pools, which are the foundations of yield farming. These work by staking or lending crypto assets on DeFi protocols to earn incentives, interest or additional cryptocurrency. It's similar to how venture capital firms invest in high-yield equities, which is the practice of investing in equities that offer better long term results.

Yield farmers will frequently shuffle their money between diverse protocols in search of high yields. For this reason, DeFi platforms may also use other economic incentives to entice more capital onto their platform as higher liquidity tends to attract more liquidity. The method of distribution of the rewards will be determined by the specific implementation of the protocol. By yield farming law, the liquidity providers get compensated for the amount of liquidity they contribute to the pool.

How Are Yield Farming Returns Calculated?

Estimated yield returns are calculated on an annualized model. This estimates the returns that you could expect throughout a year. The primary difference between them is that annual percentage rates (APR) don't consider compound interest, while annual percentage yield (APY) does. Compounding is the process of reinvesting current profits to achieve greater results (i.e. returns). Most calculation models are simply estimates. It is difficult to accurately calculate returns on yield farming because it is a dynamic market and the rewards can fluctuate rapidly leading to a drop in profitability. The market is quite volatile and risky for both borrowers and lenders.

Before Getting Started, Understand The Risks Of Yield Farming

Despite the obvious potential benefits, yield farming has its challenges. Yield farming isn't easy. The most successful yield farming techniques are quite complex, recommended only to advanced users or experts who have done their research.

Here are the different risks:

Smart contract

Smart contracts are computerized agreements that automatically implement the terms of the agreement between parties and predefined rules. Smart contracts remove intermediaries, are less expensive to operate and are a safer way to conduct transactions. However, they are vulnerable to attack vectors and bugs in the code.

Liquidation risks

DeFi platforms, like traditional finance platforms, use customer deposits to create liquidity in their markets. However, if the collateral's value falls below the loan's price, you would be liquidated. Collateral is subject to volatility, and debt positions are vulnerable to under-collateralization in market fluctuations.

If you borrow XX collateralized by YY a rise in the value of XX would force the loan to be liquidated since the collateral YY value would be inferior to the value of the XX loan.

DeFi Rug Pulls

In most cases, rug pulls are obvious exit scams that are intended to entice investors with a well-manufactured promising project in order to attract investors.

A crypto rug pull happens when developers create a token paired with a valuable cryptocurrency. When funds flow into the project and the price rises, developers then seize as much liquidity they can get their hands on resulting in losses for the investors left in.

Impermanent loss

Impermanent loss happens when a liquidity provider deposits their crypto into a liquidity pool and the price changes within a few days. The amount of money lost as a result of that change is what is called an impermanent loss. This situation is counter-intuitive yet crucial for liquidity providers to comprehend.

Exercise Caution When Getting Into Yield Farming

If you have no prior knowledge of the cryptocurrency world, entering into the yield farming production may be a hazardous endeavour. You might lose everything you've put into the project. Yield farming is a fast-paced and volatile industry. If you want to venture into yield farming, make sure you don't put more money in than you can afford, there's a reason why the United Kingdom has recently implemented serious crypto regulations.

What The Future Holds For Yield Farming

We hope that after reading this article you will have a much deeper understanding of yield farming and that it answered some of your burning questions.

In summary, yield farming uses investors' funds to create liquidity in the market in exchange for returns. It has significant potential for growth, but it's not without its faults.

What else might the decentralized financial revolution have in store for us? It's difficult to anticipate what future applications may emerge based on these present components. However, trustless liquidity protocols and other DeFi technologies are driving finance, cryptoeconomics, and computer science forward.

Certainly, DeFi money markets have the ability to contribute to the development of a more open and inclusive financial system that is accessible to everyone with an Internet connection.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Redo att ta första steget?

Gå med i nästa generations smarta investerare och pengaanvändare. Lås upp nya möjligheter och börja din resa mot ekonomisk frihet redan idag.

Kom igång