Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

A pesar de la transformación radical del panorama financiero mundial, la primera criptomoneda de la historia tiene limitaciones a la hora de interactuar con las cadenas de bloques más nuevas. Wrapped Bitcoin (WBTC) soluciona esta limitación al permitir que Bitcoin funcione en la red Ethereum, lo que permite el acceso a finanzas descentralizadas (DeFi).

WBTC es un token ERC-20 que representa a Bitcoin 1:1 en la cadena de bloques Ethereum, que combina el valor de Bitcoin con el poder de los contratos inteligentes de Ethereum y abre nuevas oportunidades para los titulares de BTC en las finanzas descentralizadas (DeFi). A diferencia de otros proyectos que buscan modificar Bitcoin, WBTC amplía su utilidad sin reemplazarlo.

A continuación, analizamos en profundidad cómo funciona WBTC, sus beneficios, riesgos y su papel como puente entre Bitcoin y el ecosistema DeFi.

Liberando el poder de Bitcoin en Ethereum

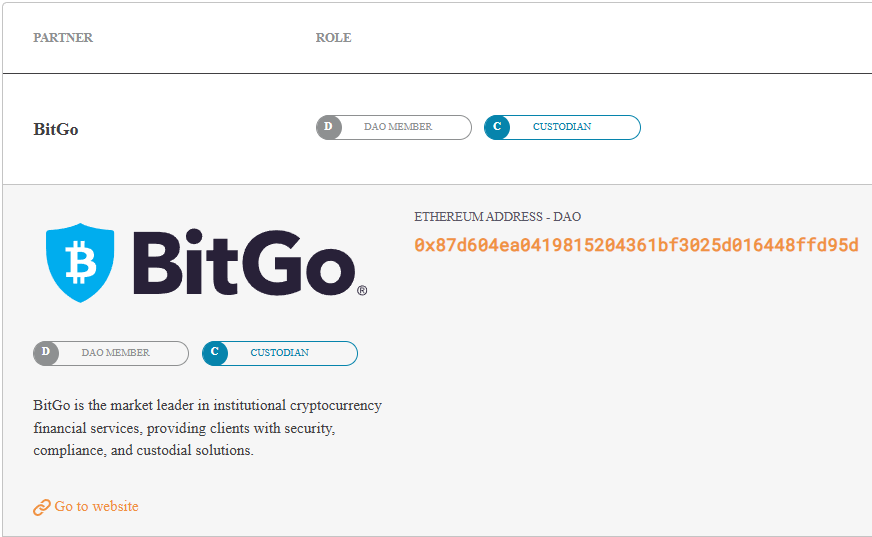

Lanzado en enero de 2019, aproximadamente 10 años después del lanzamiento inicial de Bitcoin, WBTC se creó como un esfuerzo de colaboración entre BitGo, Kyber Network y Ren (anteriormente Republic Protocol), junto con otros actores importantes en el espacio DeFi, como MakerDAO, Dharma y Set Protocol.

Como token ERC-20, WBTC se adhiere al estándar de tokens de Ethereum, lo que lo hace compatible con todo el ecosistema de Ethereum, incluidos sus contratos inteligentes, aplicaciones descentralizadas y carteras.

En su estructura, WBTC es similar a stablecoins como USDC o USDT, ya que está respaldado por reservas. Sin embargo, mientras las stablecoins buscan mantener un valor estable, WBTC fluctúa según el precio de mercado de Bitcoin.

Cada WBTC está respaldado por una cantidad equivalente de BTC custodiada por una entidad autorizada, manteniendo una estricta relación 1:1: 1 WBTC siempre equivale a 1 BTC en valor.

Actualmente, Wrapped Bitcoin está gestionado por una organización autónoma descentralizada llamada WBTC DAO, que supervisa el protocolo, garantiza la integridad del proceso de “wrapping” y mantiene la transparencia del sistema. A diferencia de la naturaleza totalmente descentralizada de Bitcoin, WBTC depende de entidades de confianza, lo que crea un equilibrio entre utilidad y custodia.

WBTC forma parte de una categoría más amplia conocida como “wrapped tokens”, activos que representan criptomonedas en otras blockchains. Un ejemplo adicional es Wrapped Ether (WETH), una versión de ETH adaptada al estándar ERC-20.

¿Por qué existe Wrapped Bitcoin?

WBTC se creó para cerrar la brecha entre Bitcoin y blockchains más avanzadas como Ethereum.

1. Funcionalidad limitada de smart contracts en Bitcoin

Bitcoin prioriza la seguridad frente a la programabilidad, lo que limita su uso en aplicaciones complejas. Ethereum, en cambio, permite smart contracts avanzados.

2. Acceso a DeFi para holders de Bitcoin

El ecosistema DeFi de Ethereum ofrece préstamos, trading y yield farming. Antes de WBTC, los holders de BTC no podían participar sin vender sus bitcoins.

3. Desbloqueo de la liquidez de Bitcoin

Bitcoin concentra una enorme capitalización de mercado. WBTC introduce esta liquidez en DeFi, beneficiando a todo el ecosistema.

4. Transacciones más rápidas y flexibles

Las operaciones con WBTC en Ethereum suelen ser más rápidas y versátiles que las transacciones nativas de Bitcoin.

En resumen, WBTC amplía la utilidad de Bitcoin sin modificar su protocolo base.

¿Cómo funciona Wrapped Bitcoin?

WBTC conecta Bitcoin y Ethereum mediante un proceso transparente y seguro:

1. Proceso de wrapping y unwrapping

Wrapping (BTC → WBTC): el usuario envía BTC a un custodio, que los bloquea y acuña la cantidad equivalente de WBTC en Ethereum.

Unwrapping (WBTC → BTC): el usuario quema WBTC y recibe los BTC correspondientes.

2. Participantes clave

- Custodios (como BitGo): mantienen los BTC en reserva.

- Merchants: autorizados para acuñar o quemar WBTC.

- Usuarios: utilizan WBTC en DeFi.

- WBTC DAO: gobierna el protocolo.

3. Transparencia

- Prueba pública de reservas.

- Registros on-chain de acuñación y quema.

- Auditorías y verificaciones periódicas.

4. Implementación técnica

WBTC sigue el estándar ERC-20, lo que facilita su uso en wallets, exchanges descentralizados y plataformas DeFi como Aave, Compound o Uniswap.

WBTC vs Bitcoin (BTC)

Aunque ambos comparten el mismo valor, sus usos son distintos. Bitcoin destaca como reserva de valor y red resistente a la censura. WBTC, en cambio, brilla en el ecosistema Ethereum, donde permite préstamos, trading y generación de rendimiento.

Cómo Wrapped Bitcoin impulsa tus criptomonedas

1. Acceso a DeFi:

WBTC permite a los usuarios aprovechar Bitcoin en las plataformas DeFi para:

Préstamos y préstamos: Usa WBTC como garantía en plataformas como Aave o Compound para ganar intereses o pedir prestado activos.

Cultivo de rendimiento: Proporcione liquidez al WBTC para obtener recompensas, que a menudo superan los retornos de tenencia pasiva de Bitcoin.

Provisión de liquidez: Gane comisiones de negociación añadiendo WBTC a los grupos de bolsas como Uniswap.

Activos sintéticos: Activos de la Casa de la Moneda vinculados a los mercados tradicionales utilizando WBTC como garantía.

2. Mejora de la liquidez:

WBTC aumenta la eficiencia del capital en Ethereum al:

Expansión de la liquidez de DeFi: Desbloquear el valor de mercado de Bitcoin para fortalecer los fondos de liquidez.

Reducir el deslizamiento: Los mercados más profundos permiten operaciones más fluidas.

Proporcionar garantías estables: Los activos respaldados por Bitcoin ofrecen opciones confiables para los protocolos DeFi.

3. Ventajas de la transacción:

En comparación con Bitcoin, las transacciones de WBTC en Ethereum se benefician de:

Confirmaciones más rápidas: Los tiempos de bloqueo de aproximadamente 12 segundos de Ethereum superan el promedio de 10 minutos de Bitcoin.

Tarifas predecibles: La estructura de tarifas de Ethereum puede ser más rentable en determinadas condiciones.

Integración de contratos inteligentes: WBTC admite transacciones complejas que la red de Bitcoin no puede gestionar.

4. Utilidad más amplia:

Más allá de DeFi, WBTC mejora las opciones de usuario al:

Acceso a contratos inteligentes: Participa en aplicaciones avanzadas sin vender Bitcoin.

Composibilidad: Utilice WBTC en varios protocolos simultáneamente.

Administración simplificada: Almacene WBTC junto con otros activos de Ethereum en carteras comunes.

Juegos y NFT: Gasta WBTC en juegos de cadenas de bloques o mercados de NFT.

Si bien el WBTC ofrece oportunidades importantes, conlleva ventajas y desventajas en relación con la descentralización y la seguridad, como se explica en la siguiente sección.

Riesgos y desafíos de WBTC

Riesgos de custodia

Si bien WBTC lleva Bitcoin a DeFi, también introduce la centralización. WBTC depende de BitGo como el único custodio para mantener el Bitcoin de respaldo, creando un punto central de fracaso. Los usuarios deben confiar en estos custodios para proteger los fondos, procesar los reembolsos y cumplir con las normativas que podrían congelar los activos o restringir las conversiones.

Riesgos de los contratos inteligentes

WBTC se basa en los contratos inteligentes de Ethereum, que, a pesar de las auditorías, aún pueden tener vulnerabilidades o fallas de codificación. También se ve afectado por problemas de red de Ethereum, como la congestión, las altas tarifas de gas y los riesgos derivados de la interacción con las plataformas DeFi.

Riesgos de precio y mercado

WBTC rastrea el precio de Bitcoin y comparte su volatilidad. En mercados turbulentos, puede cotizar ligeramente por encima o por debajo del valor de Bitcoin. Las grandes conversiones pueden afectar la liquidez y dificultar las grandes operaciones sin afectar al precio.

Desafíos operativos

La gestión de WBTC implica cadenas de bloques de Bitcoin y Ethereum, lo que puede resultar complejo para los recién llegados. Las altas tarifas de gas de Ethereum y las lentas conversiones de WBTC a Bitcoin (especialmente en el caso de grandes transacciones) son obstáculos adicionales.

Se requieren alternativas con menos confianza

Algunos usuarios prefieren opciones totalmente descentralizadas como el Bitcoin nativo, aunque carece de la funcionalidad de contrato inteligente. Otras soluciones empaquetadas de Bitcoin utilizan diferentes tecnologías para reducir la dependencia de los custodios.

En resumen

El WBTC representa un cambio en el espacio de las criptomonedas, ya que cierra la brecha entre la incomparable seguridad de red y las propiedades de almacenamiento de valor de Bitcoin con la programabilidad y el vibrante panorama de DeFi de Ethereum. Desde su lanzamiento en 2019, el WBTC ha pasado de ser un concepto novedoso a convertirse en la piedra angular de la interoperabilidad entre cadenas, lo que ha permitido a los poseedores de bitcoins innumerables casos de uso nuevos.

Para los usuarios, WBTC permite la exposición a Bitcoin mientras interactúan con las finanzas descentralizadas (DeFi) en Ethereum y otras plataformas, lo que permite la participación en ambas sin tener que elegir entre ellas. Mientras que para DeFi, la liquidez de Bitcoin ha fomentado el crecimiento, la estabilidad y la diversidad de activos. El WBTC también ha allanado el camino para otros activos empaquetados, haciendo que el ecosistema criptográfico esté más interconectado y sea más eficiente.

A medida que la tecnología blockchain evolucione, soluciones como WBTC abordarán las limitaciones y, al mismo tiempo, conservarán la utilidad principal. Su éxito demuestra cómo la innovación en criptomonedas puede aprovechar las fortalezas existentes sin reemplazarlas.

Otras alternativas a Wrapped Bitcoin

Si bien WBTC es la representación de Bitcoin más utilizada en Ethereum, han surgido varias alternativas, cada una con diferentes enfoques para el puente entre Bitcoin y otras cadenas de bloques:

- renBTC

- tBTC

- sBTC (BTC sintético)

- HBTC

- pBTC

¿Cómo puedo comprar Wrapped Bitcoin (WBTC)?

Si está buscando llevar Bitcoin al mundo de Ethereum, Wrapped Bitcoin (WBTC) es la puerta de entrada que podría estar buscando. A través de la app, los usuarios pueden añadir fácilmente WBTC a sus carteras, lo que abre el acceso al próspero ecosistema DeFi de Ethereum.

En la economía digital actual, centrada en lo digital desde el primer momento, las empresas de todos los sectores buscan soluciones financieras innovadoras que les permitan ganar eficiencia, mejorar la experiencia del cliente y abrir nuevas fuentes de ingresos. Una de las estrategias más eficaces es la implementación de tarjetas de crédito de marca compartida, que han demostrado aumentar de forma significativa la fidelidad y el gasto de los clientes.

De hecho, el 75 % de los consumidores con estabilidad financiera prefieren las tarjetas co-branded por sus recompensas y beneficios, lo que refleja una clara alineación entre este tipo de programas y las expectativas del mercado.

Al colaborar con entidades financieras para ofrecer tarjetas de marca compartida, las empresas pueden crear soluciones de pago adaptadas a sus clientes y reforzar la lealtad hacia la marca. Este enfoque transforma la infraestructura de pagos, que deja de ser una simple necesidad operativa para convertirse en un activo estratégico que impulsa el crecimiento.

Como ejemplo, se estima que el mercado de tarjetas de crédito co-branded crecerá de 13,41 mil millones en 2023 a 25,72 mil millones en 2030, con una tasa de crecimiento anual compuesta del 9,74 %.

Ya sea que operes en retail, SaaS o manufactura, un programa de tarjetas diseñado a medida puede ser la clave para transformar la relación con tus clientes y escalar tu negocio de forma más eficiente.

¿Qué es la gestión de programas de tarjetas?

La gestión de programas de tarjetas abarca todo el proceso de diseño, implementación y optimización de soluciones de tarjetas de pago adaptadas a una empresa. Desde tarjetas corporativas para gastos internos hasta tarjetas de marca que fortalecen la fidelidad del cliente, estos programas ofrecen una versatilidad que beneficia a prácticamente cualquier organización que busque modernizar sus operaciones financieras.

En un entorno de mercado cada vez más complejo, las empresas que cuentan con herramientas financieras flexibles obtienen una ventaja competitiva clara. Un programa de tarjetas bien diseñado no solo procesa pagos, sino que genera datos valiosos, reduce la carga administrativa y crea oportunidades para una relación más profunda con empleados y clientes.

Por qué es importante

En esencia, la gestión de programas de tarjetas implica supervisar todos los aspectos del ecosistema de tarjetas, desde la emisión y distribución hasta el procesamiento de transacciones, los informes y el cumplimiento normativo. Las plataformas modernas permiten crear soluciones de pago personalizadas manteniendo visibilidad y control.

Esto es clave porque los métodos de pago tradicionales suelen generar fricciones que frenan el crecimiento. Procesos manuales, poca visibilidad de los gastos y sistemas rígidos consumen recursos y limitan la innovación. Un programa de tarjetas bien gestionado resuelve estos problemas mediante automatización, mayor seguridad y flexibilidad operativa.

Beneficios clave para empresas de todos los sectores

Operaciones más eficientes

Los programas de tarjetas reducen de forma notable la carga administrativa al automatizar el control de gastos, simplificar la conciliación y eliminar procesos en papel. Esta eficiencia se traduce en ahorro de costes y permite que los equipos se centren en iniciativas estratégicas.

Mejor experiencia del cliente

En los programas orientados al cliente, los beneficios se reflejan directamente en la experiencia. Las tarjetas de marca refuerzan la fidelidad y la emisión instantánea responde a las expectativas actuales de inmediatez. Sectores como la hostelería o la salud ya utilizan estos programas para diferenciar sus servicios.

Información basada en datos

Uno de los beneficios menos valorados es la cantidad de datos que genera un programa de tarjetas moderno. Cada transacción aporta información que ayuda a entender patrones de gasto, optimizar procesos y apoyar la toma de decisiones. Este valor crece a medida que el programa escala.

Escalabilidad y flexibilidad

A medida que la empresa crece, el programa de tarjetas puede evolucionar con ella. Ya sea al entrar en nuevos mercados o lanzar nuevas líneas de producto, un programa bien diseñado se adapta sin necesidad de rehacer todo el sistema.

Proceso de implementación simplificado

Poner en marcha un programa de tarjetas no tiene por qué ser complejo. Normalmente, el proceso sigue estos pasos:

Evaluación y definición de la estrategia: analizar el ecosistema de pagos actual y establecer objetivos claros.

Selección de la plataforma e integración: elegir una solución alineada con los requisitos técnicos y los objetivos del negocio, e integrarla con los sistemas existentes.

Lanzamiento y optimización: desplegar el programa con la formación adecuada y ajustarlo de forma continua según los datos y el feedback de los usuarios.

Impacto en el mundo real

En distintos sectores, las empresas utilizan la gestión de programas de tarjetas para resolver retos concretos:

Las empresas de retail implementan emisión digital instantánea para captar oportunidades de venta.

Los proveedores de salud utilizan tarjetas especializadas para simplificar ayudas financieras a pacientes.

Las empresas manufactureras despliegan tarjetas corporativas con controles de gasto personalizados para optimizar compras.

El denominador común es claro: todas usan la gestión de programas de tarjetas como una herramienta estratégica, no solo como un método de pago.

Cómo puede ayudarte Tap

Gestionar un programa de tarjetas con éxito requiere experiencia y el socio tecnológico adecuado. La plataforma integral de Tap combina tecnología avanzada con conocimiento sectorial para ayudar a las empresas a diseñar, implementar y optimizar programas de tarjetas que generan resultados medibles.

Nuestra solución aborda retos habituales como el cumplimiento normativo, la seguridad y las integraciones técnicas, permitiéndote centrarte en los beneficios estratégicos en lugar de en la complejidad operativa.

¿Listo para explorar cómo la gestión de programas de tarjetas puede transformar tus operaciones y apoyar el crecimiento de tu negocio? Conecta con el equipo de especialistas de Tap y descubre el potencial de un programa de tarjetas diseñado a medida para tu organización.

Estructura del artículo: Gestión de programas de tarjetas

Tono y enfoque

Tono: profesional, informativo y con autoridad.

Perspectiva: enfoque experto que educa a las empresas sobre cómo lanzar y gestionar un programa de tarjetas con éxito.

Encabezados y estructura prioritarios

1. Introducción

Qué es la gestión de programas de tarjetas.

Por qué las empresas necesitan una gestión eficaz.

Visión general de los principales actores: emisores, redes, procesadores, entre otros.

2. Cómo funciona la gestión de programas de tarjetas

Componentes clave: emisión, procesamiento, cumplimiento y gestión de riesgos.

El papel del gestor del programa, interno o externo.

Relación entre bancos emisores, redes y gestores de programa.

3. Elementos clave de un programa de tarjetas exitoso

Diseño del programa: tipos de tarjetas, selección de red y branding.

Emisión y gestión de cuentas: patrocinio BIN, configuración y onboarding.

Cumplimiento y gestión de riesgos: KYC, AML, PCI DSS y prevención del fraude.

Procesamiento y liquidación de transacciones: flujo de fondos.

Experiencia y soporte al cliente.

4. Programas autogestionados vs. gestionados por socios

Ventajas y retos de la gestión interna.

Cuándo tiene sentido externalizar.

Cómo los gestores externos aportan valor.

5. Aspectos clave antes del lanzamiento

Objetivos de negocio y modelo de ingresos.

Requisitos regulatorios y de seguridad.

Consideraciones de tiempo de salida al mercado.

6. Tendencias y futuro de la gestión de programas de tarjetas

Finanzas embebidas y BaaS.

Detección de fraude y gestión de riesgos con IA.

Open banking y soluciones basadas en APIs.

7. Conclusión y próximos pasos

Resumen de los puntos clave.

Cómo empezar con un programa de tarjetas.

Contacto con un experto en gestión de programas.

Internet ha hecho que ganar dinero sea más fácil que nunca. Tanto si buscas un ingreso extra como si quieres crear un negocio online completo, las oportunidades siguen creciendo a gran velocidad. Desde pequeños trabajos rápidos hasta fuentes de ingresos pasivos a largo plazo, hay opciones para todo tipo de perfiles.

Eso sí, no esperes hacerte rico de la noche a la mañana (y si alguien te promete eso, probablemente sea una estafa). Con enfoque, paciencia y decisiones inteligentes, es posible construir ingresos reales y sostenibles en internet.

Esta guía reúne formas contrastadas con las que muchas personas ya están ganando dinero desde casa: algunas sin coste inicial y otras pensadas para el crecimiento a largo plazo. La clave está en encontrar lo que encaje con tus habilidades, tu tiempo y tus objetivos.

¡Vamos a ello!

1. Mejores formas de ganar dinero online rápidamente (baja cualificación, alta demanda)

Si eres nuevo ganando dinero online (venuestra guía aquí) o necesitas efectivo rápido, estas opciones con baja barrera de entrada pueden ayudarte a empezar sin necesidad de habilidades especiales. No sustituirán a un trabajo a jornada completa, pero son útiles para ingresos extra o como primer paso.

Encuestas online remuneradas

- Siguen siendo una de las formas más sencillas de empezar a ganar dinero online

- Las empresas pagan por tu opinión honesta

- Plataformas destacadas: Swagbucks, Branded Surveys, YouGov, Prolific

- Ganancias: normalmente entre 0,50 £ y 3 £ por encuesta (10–20 minutos)

- Consejo: suele haber un mínimo de retirada (normalmente entre 10 £ y 20 £)

Cobrar por hacer clic, ver vídeos o buscar

- Gana pequeñas cantidades realizando tareas simples como ver vídeos o usar un buscador

- No sustituye un salario, pero suma si eres constante

- Plataformas: Qmee, InboxPounds, Swagbucks

- Ganancias: céntimos por tarea, pero disponibles en cualquier momento

Microtareas

- Pequeños trabajos que requieren intervención humana, como introducción de datos o investigación web

- Plataformas: Clickworker, Amazon Mechanical Turk, Lionbridge

- Pago: entre 2 £ y 10 £ por hora, con horarios flexibles

Probar sitios web y apps

- Da feedback sobre la usabilidad y el funcionamiento de webs o aplicaciones

- Plataformas: UserTesting, Userlytics, TryMyUI

- Pago: entre 8 £ y 12 £ por test de unos 20 minutos

- Requisitos: buena comunicación y conexión a internet estable

Concursos y sorteos

- No es un ingreso garantizado, pero algunas personas ganan premios valorados en miles al año

- Sigue marcas en redes sociales para concursos exclusivos

- Usa agregadores como LoquaxTM o Competition Corner de MSE

2. Métodos de esfuerzo medio con retornos fiables

Estas opciones requieren más tiempo o habilidades, pero ofrecen mayor potencial de ingresos y trabajos más interesantes.

Redacción y edición freelance

La demanda de contenido no deja de crecer. Si escribes con claridad, es una opción sólida.

- Plataformas: Upwork, Intch, Freelancer

- Tarifas: principiantes 10–20 £ por artículo; perfiles con experiencia 30–100 £ o más por hora

- Consejo: crea un nicho y un portafolio poco a poco

Vender fotos o vídeos de stock

Monetiza tus habilidades de fotografía o vídeo en plataformas como Shutterstock o Adobe Stock.

Convertirte en asistente virtual (VA)

Apoya a empresas con tareas administrativas, redes sociales, atención al cliente y más.

- Pago: entre 8 £ y 25 £ por hora

- Ventaja: relaciones a largo plazo para ingresos estables

Vender productos hechos a mano

Utiliza Etsy, Folksy o Amazon Handmade para convertir tus creaciones en ingresos.

Vender productos digitales

Altos márgenes y sin inventario físico.

- Productos habituales: plantillas de Notion, diseños de Canva, prompts de ChatGPT, planners

- Plataformas: Gumroad, Etsy, Creative Market

3. Fuentes de ingresos escalables y pasivos

Requieren esfuerzo inicial, pero una vez en marcha pueden generar ingresos constantes con poco mantenimiento.

Dropshipping

Vende productos online sin gestionar inventario, usando Shopify o WooCommerce.

- Márgenes: 3–7 % tras publicidad

- Requiere conocimientos de marketing y atención al cliente

Print-on-demand

Diseños de camisetas, tazas u otros productos que solo se imprimen cuando se venden.

- Plataformas: Printful, Printify, Merch by Amazon, Redbubble

Crear un blog o web de nicho

Genera ingresos con anuncios, enlaces de afiliados, contenido patrocinado y productos digitales.

- Suele tardar entre 6 y 18 meses en despegar, pero puede convertirse en un ingreso pasivo relevante

Crear y vender cursos online

Comparte tu experiencia en plataformas como Udemy, Teachable, Skillshare o Coursera.

Escribir y publicar ebooks

Autoedítalos en Kindle Direct Publishing o Smashwords. La edición y el marketing son clave.

Crear un canal de YouTube

Gana dinero con anuncios, membresías, super chats, patrocinios y afiliación.

Side hustles usando tu entorno o tus pertenencias

¿Por qué no monetizar lo que ya tienes?

- Alquila propiedades en Airbnb o Booking.com para ingresos significativos

- Alquila objetos como coches (Turo), equipos (Fat Llama) o plazas de aparcamiento (JustPark)

- Vende artículos que no uses en Facebook Marketplace, eBay o Vinted

- Usa apps de cashback como Shoppix y TopCashback (o tu tarjeta Tap, con hasta un 8 %) en compras habituales

Estas opciones funcionan especialmente bien en zonas urbanas y requieren poca inversión inicial.

En qué debes tener cuidado

Internet está lleno de oportunidades reales, pero también de estafas. Protegerte es fundamental.

- Desconfía de promesas de grandes ganancias garantizadas con poco esfuerzo

- Evita pagos por adelantado para “formaciones” o “kits”

- Huye de esquemas piramidales o de marketing multinivel

Ten en cuenta tus obligaciones fiscales. En el Reino Unido, los ingresos online superiores a 1.000 £ deben declararse a HMRC. Lleva un buen registro y considera asesoramiento profesional.

Revisa siempre las normas de cada plataforma: mínimos de retirada, comisiones, métodos de pago y políticas de cuenta. Lee siempre los términos y condiciones.

Consejos para tener éxito ganando dinero online

- Usa un email separado para organizar y proteger tus actividades online

- Registra ingresos y tiempo en una hoja de cálculo para análisis e impuestos

- Prioriza plataformas mejor pagadas y desarrolla habilidades en consecuencia

- Empieza poco a poco y escala lo que mejor funcione

- Aprende habilidades digitales (SEO, copywriting, diseño, redes sociales) con tutoriales gratuitos

Reflexión final

Ganar dinero online ofrece libertad, pero también exige esfuerzo y paciencia. No existe una fórmula mágica: algunas personas destacan con blogs, otras con encuestas o microtareas. Empieza poco a poco, aprende y crece de forma progresiva.

Y, por último, mantente alerta ante estafas, lleva un buen control y sigue aportando valor. Si has llegado hasta aquí, creemos que estás listo para tomar el control de tu camino hacia los ingresos online.

Ankr es uno de los actores clave que respaldan el rápido crecimiento de Web3, ofreciendo herramientas que ayudan a desarrolladores, empresas y usuarios cotidianos a interactuar con múltiples blockchains de forma rápida y fiable. Desde alojamiento de nodos hasta staking, APIs y soluciones blockchain de nivel empresarial, Ankr busca facilitar el uso de las redes descentralizadas y apoyar la evolución de las monedas digitales, la tecnología financiera y las finanzas descentralizadas (DeFi).

¿Qué es Ankr (ANKR)?

Ankr es un proveedor descentralizado de infraestructura Web3 que ofrece a desarrolladores y usuarios un acceso rápido y seguro a redes blockchain. En lugar de funcionar como una blockchain independiente, Ankr actúa como una capa intermedia que conecta aplicaciones, sistemas de staking y empresas con el ecosistema cripto en general.

A través de su conjunto de endpoints RPC, APIs, servicios de nodos y herramientas de staking, Ankr reduce la complejidad de interactuar con redes Proof of Stake (PoS). Los desarrolladores pueden lanzar aplicaciones sin gestionar hardware, sincronizar nodos o preocuparse por la congestión de la red. Al mismo tiempo, los usuarios se benefician de opciones de staking simplificadas, tokens de liquid staking y un acceso cómodo a oportunidades DeFi.

Ankr se lanzó originalmente como una Red de Computación en la Nube Distribuida, diseñada para aprovechar recursos informáticos inactivos en todo el mundo. Este enfoque desafió a los proveedores de nube centralizados tradicionales e introdujo un modelo basado en la descentralización, la eficiencia de recursos y la confianza. Con el tiempo, la plataforma evolucionó para ofrecer una amplia gama de servicios blockchain, ganando relevancia en sectores interesados en la tokenización, los activos digitales y la infraestructura financiera de nueva generación.

¿Quién creó la plataforma Ankr?

Ankr fue fundada en 2017 por Chandler Song, Ryan Fang y Stanley Wu. Song y Fang fueron compañeros de universidad en UC Berkeley, mientras que Wu supervisó a Song durante su etapa en Amazon Web Services. Sus conversaciones sobre computación descentralizada y Proof of Useful Work dieron lugar a la creación de Ankr.

El equipo atrajo rápidamente la atención de grandes inversores. Las preventas y ventas públicas de tokens recaudaron más de 37 millones de dólares en total, financiando el desarrollo inicial. También recibieron apoyo de firmas de inversión destacadas como Pantera Capital y NEO Global Capital (NGC). Actualmente, Song es el CEO, Fang el COO y Wu el CTO, guiando la misión de Ankr de construir una infraestructura Web3 fiable y escalable.

¿Cómo funciona el protocolo Ankr?

Ankr ofrece herramientas especializadas para desarrolladores, stakers y empresas. Sus principales funcionalidades se dividen en cuatro categorías:

Servicios de infraestructura de nodos

Gracias a la infraestructura descentralizada de Ankr, plataformas DeFi, proyectos NFT, juegos blockchain y DApps pueden acceder a las blockchains de forma más rápida, escalable y rentable. Al estar alojadas en nodos de alto rendimiento distribuidos globalmente, las aplicaciones disfrutan de un rendimiento óptimo.

Configurar un nodo blockchain requiere conocimientos técnicos, tiempo y esfuerzo. Ankr simplifica este proceso lanzando nodos accesibles de forma remota, permitiendo a usuarios de cualquier nivel participar en la validación de redes PoS. Además, la plataforma supervisa el rendimiento para evitar penalizaciones por inactividad o fallos.

Acceso instantáneo a APIs y RPC para desarrolladores

Los desarrolladores que lanzan contratos inteligentes y DApps necesitan APIs específicas, lo que suele implicar ejecutar y sincronizar nodos. Ankr resuelve este problema ofreciendo acceso instantáneo a APIs y RPC, garantizando un acceso ininterrumpido a los datos de la blockchain y una mejor experiencia de usuario.

Herramientas blockchain personalizadas para empresas

Para empresas que necesitan soluciones optimizadas para múltiples redes, Ankr ofrece un modelo de Infraestructura Web3 como Servicio. A través de una plataforma de monitorización intuitiva, las empresas pueden utilizar APIs y servicios RPC para operar de forma más eficiente y económica.

Liquid staking

Ankr ofrece staking en múltiples cadenas, proporcionando tokens que representan los fondos depositados. Estos tokens pueden utilizarse para trading o actividades DeFi como préstamos, yield farming o liquidity mining, maximizando el potencial de ingresos.

Por ejemplo, en lugar de bloquear 32 ETH en Ethereum 2.0, los usuarios pueden hacer staking de solo 0,5 ETH mediante Ankr, recibiendo tokens como aETHb o aETHc, que ofrecen liquidez sobre los activos en staking.

¿Por qué es importante Ankr en el ecosistema Web3?

Ankr mejora la accesibilidad, eficiencia y descentralización de las blockchains. Soporta redes clave como Ethereum, Polygon y Polkadot, ayudando a reducir costes, mejorar el rendimiento y acelerar el desarrollo.

Algunas razones por las que los usuarios eligen Ankr:

- Infraestructura fiable y distribuida globalmente

- Acceso más rápido a blockchains

- Herramientas que reducen la fricción técnica

- Soluciones empresariales rentables

- Respaldo de inversores reconocidos

- Flexibilidad adicional mediante liquid staking

Su importancia va más allá de las criptomonedas, alineándose con tendencias como la descentralización, la interoperabilidad y la transformación digital global.

¿Qué es el token ANKR?

ANKR es la criptomoneda nativa que impulsa el ecosistema Ankr. Funciona como token ERC-20 y BEP-20, con un suministro máximo de 10.000 millones de tokens. No es solo un activo negociable, sino la moneda funcional que hace posible la red.

ANKR se utiliza para pagar servicios como alojamiento de nodos, acceso a APIs y soluciones empresariales. Los stakers y colaboradores lo reciben como recompensa, y los holders pueden participar en la gobernanza votando decisiones clave. Además, actúa como incentivo para mantener la seguridad y descentralización de la red.

A medida que la adopción blockchain crece en sectores como fintech, finanzas globales, videojuegos o identidad digital, criptomonedas de infraestructura como ANKR se vuelven cada vez más esenciales.

¿Qué aporta valor a ANKR?

El valor de ANKR está ligado a la demanda de los servicios de Ankr, su capacidad de innovación y la sostenibilidad de su modelo de negocio. Factores como la adopción de Web3, las condiciones del mercado, la regulación y el sentimiento inversor influyen en su precio, como ocurre con cualquier criptomoneda.

Conclusión

Ankr se sitúa en el núcleo de la infraestructura Web3, impulsando desde el despliegue de nodos hasta el staking, las soluciones empresariales y el desarrollo de aplicaciones descentralizadas. Al simplificar el acceso a decenas de redes y mejorar el rendimiento mediante nodos distribuidos globalmente, Ankr facilita una interacción más eficiente con la tecnología blockchain. Es un proyecto fundamental a seguir dentro del ecosistema Web3.

Dónde conseguir ANKR

ANKR ocupa una posición única en el mundo cripto. Puede atraerte por su infraestructura multichain, por sus soluciones de liquid staking o por su papel clave en el crecimiento de Web3. Si quieres explorar ANKR, puedes encontrarlo en la app junto a decenas de otros tokens.

Así que estás en la treintena y empiezas desde cero en lo que respecta a tus finanzas. Tranquilo: no estás solo y la buena noticia es que nunca es tarde para tomar el control y encaminarte hacia el éxito financiero. Enhorabuena por dar el primer paso.

En este artículo te acompañamos con una guía paso a paso, consejos prácticos y un enfoque claro para que tomes decisiones informadas y recorras tu camino financiero con ilusión. No es ciencia espacial, lo prometemos.

Paso 1: Evalúa tu situación financiera actual

Entender dónde estás hoy es el primer paso para construir una base sólida. Analiza tus ingresos, gastos y deudas. Anótalos o pásalos a una hoja de cálculo. Identifica dónde puedes ajustar para liberar dinero y fija objetivos claros a corto y largo plazo. ¿Comprar una casa en 5 años? ¿Viajar para ver a un amigo en Hong Kong? Escríbelos: los objetivos motivan.

Paso 2: Construye una base sólida

Crea un presupuesto y controla tus gastos

La noticia menos emocionante: el presupuesto es esencial. No se trata de eliminar lo que te gusta, sino de entender cómo fluye tu dinero y ahorrar sin sacrificar tu bienestar. Usa herramientas o apps si las hojas de cálculo te intimidan.

Ahorra de forma eficaz

Ahorrar es la piedra angular para crear patrimonio. Empieza reservando un porcentaje mensual para emergencias e inversiones futuras. Automatiza el ahorro y considera cuentas remuneradas. Aprovecha también beneficios “gratuitos” como puntos o compensaciones laborales.

Gestiona tus deudas y mejora tu score crediticio

Haz una lista de tus deudas y prioriza las de mayor interés. Paga a tiempo y evita abrir nuevas líneas de crédito. Tomar el control hoy es un regalo para tu yo del futuro.

Paso 3: Genera ingresos adicionales

Ganar más suele significar avanzar más rápido. Un pequeño side hustle puede marcar la diferencia.

Explora trabajos extra

Convierte tus intereses en ingresos: trabajos a tiempo parcial o proyectos puntuales pueden reforzar tu ahorro.

Monetiza tus habilidades como freelance

Plataformas como Upwork o Fiverr permiten ofrecer tus talentos y generar ingresos extra mientras creces profesionalmente.

Invierte en tu crecimiento personal

Aprender nuevas habilidades, obtener certificaciones o hacer cursos aumenta tu empleabilidad y tu potencial de ingresos. Invertir en ti es una de las mejores decisiones.

Paso 4: Invierte para el futuro

Entiende lo básico

Empieza poco a poco. Aprende sobre acciones, bonos, fondos y el equilibrio entre riesgo y rentabilidad. Si lo necesitas, busca asesoramiento profesional.

Opciones para principiantes

Fondos indexados de bajo coste o ETFs suelen ser accesibles y adecuados para empezar. Evita promesas de dinero rápido y alinea tus inversiones con tus objetivos y tolerancia al riesgo.

Diversificación y gestión del riesgo

No pongas todos los huevos en la misma cesta. Diversifica, revisa tu cartera periódicamente y ajústala cuando sea necesario.

Paso 5: Supera los retos financieros

Afronta imprevistos

Los gastos inesperados pasan. Un fondo de emergencia amortigua el impacto y te ayuda a priorizar necesidades frente a deseos.

Mantén expectativas realistas

Construir patrimonio lleva tiempo. Celebra pequeños logros y recuerda por qué empezaste.

Busca apoyo profesional

Un asesor financiero puede ayudarte con decisiones complejas y estrategias adaptadas a tus objetivos.

Paso 6: Construcción de riqueza a largo plazo

Define objetivos a largo plazo

Compra de vivienda, jubilación cómoda o emprender: traduce tus sueños en hitos alcanzables y revisa el plan con el tiempo.

Planifica la jubilación

Cuanto antes empieces, mejor. Aprovecha el interés compuesto, planes de empresa y ventajas fiscales cuando sea posible.

Revisa y ajusta tu plan

La vida cambia y tu plan financiero también debe hacerlo. Revisa presupuesto, inversiones y objetivos con regularidad.

Reflexión final

Empezar desde 0 € en tus 30 puede parecer difícil, pero con la mentalidad adecuada y pasos prácticos es totalmente alcanzable. Presupuestar, ahorrar, generar ingresos extra e invertir con cabeza te permitirá construir una base sólida para una seguridad financiera duradera. No es un paseo, pero tampoco es ciencia espacial. Cada paso cuenta y te acerca a un futuro financiero mejor.

No cabe duda de que la innovación tecnológica ha acelerado el ritmo del sector financiero, impulsando una transformación constante entre las marcas que quieren mantenerse a la vanguardia. Como en cualquier industria dinámica, surgen tendencias a medida que las empresas luchan por seguir siendo relevantes. Una de ellas es el auge de las tarjetas white-label y de las compañías que facilitan su emisión.

El proceso de emisión de tarjetas white-label se ha consolidado como una solución potente dentro del ecosistema fintech, al ofrecer experiencias de pago personalizadas que se adaptan a las necesidades tanto de las empresas como de los clientes. En este artículo exploramos qué son las tarjetas white-label, sus ventajas, aplicaciones y por qué se han convertido en una opción tan popular para entidades financieras y compañías fintech.

Entendiendo las tarjetas white-label

Las tarjetas white-label, también conocidas como tarjetas de marca privada, permiten que una empresa ofrezca a sus clientes tarjetas de crédito o débito personalizadas emitidas por una entidad financiera o fintech de confianza, manteniendo la identidad de marca del negocio.

Este enfoque permite incorporar logotipo y branding propios, otorgando control sobre la identidad de la tarjeta sin la carga de diseñar o desarrollar un programa desde cero.

Al asociarse con una entidad financiera o fintech consolidada, las empresas ahorran tiempo, esfuerzo y recursos, aprovechando soluciones de pago listas para usar en lugar de afrontar procesos complejos y costosos de licencias con redes como Mastercard o Visa.

El giro hacia soluciones de pago personalizadas

Los sistemas bancarios tradicionales suelen percibirse como lentos a la hora de adoptar innovación. A medida que crece la demanda de experiencias de pago personalizadas, las empresas aprovechan la oportunidad de adaptarse a clientes que buscan soluciones a medida y tarjetas de marca privada.

Los consumidores valoran cada vez más las soluciones alineadas con sus preferencias y con las marcas en las que confían. Este cambio de comportamiento ha impulsado las tarjetas white-label, permitiendo a las empresas adaptar productos de pago a las necesidades de sus clientes.

Proveedores externos ofrecen ahora soluciones de pago simplificadas, asumiendo los procesos de acreditación y cumplimiento, para que las empresas puedan lanzar tarjetas sin largos y costosos procesos de onboarding.

Las tarjetas co-brandeadas de marca privada pueden incluir recompensas, puntos extra y descuentos exclusivos en comercios y plataformas online. Además, existen tarjetas virtuales que permiten pagos online o el uso de servicios como Apple Pay, funcionando como una cuenta bancaria.

Ventajas de las tarjetas de marca privada

Para las empresas

Las tarjetas white-label ofrecen una alternativa rentable frente a desarrollar un programa interno. Aportan flexibilidad y escalabilidad, adecuadas tanto para startups como para empresas consolidadas. Desde el punto de vista de marca, incrementan la visibilidad, refuerzan la identidad y fomentan la fidelización mediante diseños personalizables y programas de recompensas.

Para los consumidores

Aportan comodidad y seguridad, integrándose en ecosistemas de pago existentes. Permiten transacciones seguras y el acceso a ventajas como puntos de fidelidad, descuentos exclusivos y control de gastos, con una experiencia de pago fluida y personalizada.

Seguridad y cumplimiento normativo

La seguridad y el cumplimiento regulatorio son esenciales. Las entidades que ofrecen programas white-label implementan medidas robustas para proteger los datos y prevenir el fraude, cumpliendo estándares como PCI DSS y normativas de protección de datos para garantizar la tranquilidad de los usuarios.

Ejemplos de marcas con tarjetas de marca privada

Square

En 2019, Square lanzó la Square Card junto a Marqeta, permitiendo a sus vendedores acceder a fondos de forma inmediata y reforzando su propuesta de valor.

Shopify

Shopify utilizó los servicios de emisión de Stripe para crear la Shopify Balance Card, facilitando a más de un millón de comercios el acceso instantáneo a sus ingresos. La adopción fue rápida y muy positiva.

Beneficios observados en los casos de uso

- Rapidez de lanzamiento al mercado.

- Reducción de costes frente a infraestructuras propias.

- Mayor engagement y retención de clientes.

- Nuevas fuentes de ingresos mediante servicios añadidos.

Consideraciones antes de implementar

La implantación requiere planificación: definir funcionalidades, integrar sistemas, formar equipos y garantizar una experiencia de usuario fluida. Los resultados no están garantizados y dependen de una ejecución adecuada y de una colaboración estrecha con el emisor.

Tendencias futuras e innovación

La demanda de servicios financieros, los avances tecnológicos (APIs, seguridad) y una regulación más favorable seguirán impulsando esta tendencia. El principal reto será la competencia creciente, que exigirá diferenciación mediante innovación, personalización y alianzas sólidas.

La solución white-label de Tap

Tap ofrece un servicio ágil de emisión de tarjetas para empresas, con tarjetas Mastercard de marca privada a menor coste y en menos tiempo. En 2023, Tap proporcionó a Bitfinex una solución de tarjeta prepago white-label, creando una nueva fuente de ingresos y una experiencia de pago diferenciada.

Conclusión

La emisión de tarjetas white-label está transformando el panorama de pagos al ofrecer soluciones personalizadas, rápidas y eficientes. Aporta ventajas claras, aunque requiere una implementación cuidadosa y una gestión sólida de la seguridad y el cumplimiento. Con una demanda en crecimiento y avances tecnológicos constantes, las tarjetas de marca privada jugarán un papel clave en el futuro de las finanzas, habilitando experiencias de pago flexibles y a medida para empresas y usuarios.

TAP'S NEWS AND UPDATES

Redo att ta första steget?

Gå med i nästa generations smarta investerare och pengaanvändare. Lås upp nya möjligheter och börja din resa mot ekonomisk frihet redan idag.

Kom igång