Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Cashback is essentially getting paid to shop for things you'd buy anyway. Whether you're a seasoned rewards hunter or just curious about making your money work harder, this guide explores how savvy consumers are earning while spending, without changing their shopping habits. Ready to turn your everyday purchases into extra cash? Let's dive in.

What is cashback?

Cashback is a rewards program that gives you a percentage of your money back when you make purchases using eligible credit cards, debit cards, or shopping platforms. Think of it as a small rebate on what you spend, typically ranging from 1% to 5% of your purchase amount.

In recent years, cashback has increased in popularity across financial services and retail, becoming one of the most straightforward and appealing customer incentives (no guesses why).

Unlike complicated points systems or airline miles, cashback offers a simple proposition: spend money and get some of it back. Cashback transforms everyday spending into an opportunity to save, whether through your credit card statement, a bank transfer, or an app balance.

How does cashback work?

At its core, cashback operates on a simple principle: when you spend money, you earn a percentage back. This percentage - known as the cashback rate - determines how much you'll receive. For example, a 2% cashback rate means you'll get $2 back for every $100 you spend.

Here's what happens behind the scenes:

- You make a purchase with your cashback-enabled card or through a cashback platform.

- The transaction is processed and qualified against the program's terms.

- Cashback is calculated based on the purchase amount and applicable rate.

- The reward is credited to your account (either immediately or after a designated period).

Cashback rewards are typically issued as:

- Statement credits (reducing what you owe on your credit card)

- Direct deposits to your bank account

- Digital wallet credits within an app

- Gift cards or vouchers for specific retailers

Most cashback programs are funded through transaction fees that merchants pay to credit card companies (typically 2-3% of each purchase). The card issuer then shares a portion of these fees with you as cashback. For retailer programs and cashback apps, the incentive is funded through marketing budgets as they benefit from increased customer spending and loyalty.

Different types of cashback programs

Credit card cashback

Credit cards are a common way to earn cashback, generally structured in three main formats:

- Flat-rate cashback cards

These cards offer the same cashback rate on all purchases, regardless of category. For example, the Citi® Double Cash Card offers up to 2% on all purchases (1% when you buy, 1% when you pay). Note that rewards are earned as ThankYou® Points, which can be redeemed for cash back or other options.

- Tiered/category cashback cards

These offer higher cashback rates in specific categories and lower rates elsewhere. For instance, the Blue Cash Preferred® Card from American Express offers 6% back at U.S. supermarkets (up to $6,000 per year), 6% on select U.S. streaming services, 3% on transit and U.S. gas stations, and 1% on everything else.

- Rotating category cards

These cards offer higher cashback (often 5%) in categories that change each quarter, such as restaurants, gas stations, or online shopping.

For example, The Chase Freedom Flex℠ and Discover it® cash back programs require users to activate these categories each quarter, from where they can earn up to 5% cashback on purchases.

Debit card cashback

Differing from the credit card structure above, debit card cashback typically comes in two forms:

- Bank-offered cashback programs

Rewards for using your debit card for purchases. These are often tied to premium or business accounts and offer lower rates than credit cards (typically 0.5%-1%) since banks don't earn the same merchant fees that credit card companies do.

Examples include: Discover Cashback Debit offering 1% on up to $3,000 in monthly purchases; while some neobanks or fintechs offer promotional cashback for debit use, but these are often time-limited (Not at Tap).

- Cash back at checkout

This feature allows you to withdraw cash alongside your purchase at certain retailers (e.g., Walmart, Walgreens, or pharmacies), essentially getting "cash back" at the point of sale. This isn't a reward but a convenience service.

Retailer-specific programs

Many stores offer their own cashback programs:

- Store loyalty programs

These provide rebates on purchases, often tracked through a membership account. Examples include Target Circle, which offers 1% in rewards on qualifying purchases, or Kohl's Cash, which gives you $10 in store credit for every $50 spent during promotional periods.

- Receipt scanning programs

Apps like Ibotta and Checkout 51 offer cashback when users upload receipts or link loyalty cards. Offers vary by retailer and product.

Cashback websites and apps

These third-party platforms connect shoppers with retailers and share the commission they receive:

- Cashback websites

Websites like Rakuten, TopCashback, and BeFrugal offer rebates when you shop at partner retailers through their portal. These sites earn commissions from retailers for referring customers and share a portion with you.

- Browser extensions

Honey (owned by PayPal) and Capital One Shopping apply coupons and may offer cashback (called “Honey Gold” or Capital One Shopping Credits), though amounts and eligibility vary.

However, these platforms often come with caveats:

- Cashback typically pays out quarterly rather than immediately

- Minimum payout thresholds may apply (often $5-$25)

- Some offers are region-specific or limited-time

How much cashback can you earn?

Cashback earnings vary widely across programs:

Typical credit card rates range from 1% to 2% as a baseline, with category bonuses reaching 3% to 6%. Premium cards may offer higher rates but often carry annual fees.

Sign-up bonuses can significantly boost initial earnings, sometimes offering $150-$300 back after spending a certain amount in the first few months.

Cashback apps and websites typically offer higher percentages (often 2%-10%) but on a more limited selection of retailers.

Most programs include some limitations:

- Spending caps that limit cashback on certain categories (e.g., 6% on groceries up to $6,000 yearly)

- Minimum spend requirements before cashback activates

- Redemption thresholds requiring you to accumulate a minimum amount (often $20-$25) before cashing out

- Quarterly or annual payment schedules rather than immediate rewards

How much cashback can you earn with Tap?

Looking for a cashback program that gives you Cashback rewards on your your spendings and not just at specific brands or places? Tap makes it easy. By using your Tap card, you earn Cashback rewards on your spending, from groceries to fuel and even holidays.

How much can you earn? With Tap’s flexible premium tiers, cashback rewards are tailored to fit your lifestyle: earn from 0.5% up to 8% on every eligible purchase made with your Tap card. The more you spend, the more you earn—simple as that.

Pros and cons of cashback programs

Pros

- Simplicity: Cash rewards are straightforward to understand and use

- Flexibility: Unlike points or miles, cash can be used for anything

- Automatic earnings: Most programs require minimal effort beyond using the right card

- No devaluation: Unlike travel points, a dollar of cashback remains a dollar

- Immediate value: No need to save up for specific redemptions

Cons

- Potential for overspending: The promise of cashback can encourage unnecessary purchases

- Hidden costs: Cards with generous cashback may have higher annual fees or interest rates

- Category restrictions: Many programs limit higher cashback to specific merchant types

- Reward caps: Many programs limit how much you can earn in bonus categories

- Redemption delays: Some programs only pay out quarterly or when you reach certain thresholds

Is Cashback really free money?

Cashback isn't exactly "free", it's better understood as a discount on your spending. The funding comes from several sources:

Debit and Credit card cashback is funded by interchange fees paid by merchants (typically 1.5%-3.5% of each transaction). Card issuers share a portion of these fees with cardholders to encourage more spending.

Retail cashback programs are essentially marketing expenses designed to drive sales and customer loyalty.

Cashback apps and websites earn affiliate commissions from retailers and share a portion with users.

The most important caveat: cashback on credit cards only makes financial sense if you pay your balance in full each month. If you carry a balance, the interest charges (often 15%-25% APR) will quickly exceed any cashback earned.

How to choose the right cashback option

Finding the best cashback program depends on your spending patterns and preferences:

Analyse your spending habits: Review your monthly expenses to identify where you spend the most. If groceries and gas dominate your budget, a card with bonus rewards in those categories makes sense. If your spending is diverse, a flat-rate card might be better.

Consider fees vs rewards: Some cards with higher cashback rates charge annual fees. Calculate whether your typical spending will earn enough extra cashback to offset any fees.

Evaluate redemption options: Consider how and when you can access your cashback. Some programs offer automatic redemption, while others require manual redemption or have minimum thresholds.

For businesses: Business-specific cashback cards often offer higher rewards on categories like office supplies, internet services, and travel. If you're a business owner, these specialised options may provide better value than consumer cards.

Tips to maximise cashback

Strategically use multiple cards: You can use different cards for different categories based on which offers the highest rate for each spending type.

Stack rewards programs: Combine a cashback credit card with a cashback app or website for double dipping. For example, make a purchase through Rakuten using a cashback credit card.

Activate bonus categories: Many cards require quarterly activation of rotating bonus categories - set calendar reminders so you don't miss out.

Pay bills with cashback cards: Set up utilities, subscriptions, and other regular payments on your best cashback card (if there's no processing fee).

Watch for promotional offers: Many programs offer limited-time enhanced cashback rates or bonus categories.

Avoid carrying balances: Always pay your credit card bill in full to avoid interest charges that negate cashback benefits.

In conclusion

Cashback rewards offer a practical way to earn while you spend on everyday purchases. Unlike complicated reward systems, cashback provides straightforward value that anyone can understand and use.

Choose cards and apps that reward your existing spending patterns rather than changing your habits to chase rewards. Also, try maximising cashback benefits by matching the right programs to your spending habits and being disciplined about your purchasing behaviour.

Remember: the best cashback strategy is one that fits naturally into your financial life, providing rewards without encouraging overspending or complicating your finances.

Tired of complicated cashback programs tied to specific brands? Discover our simple Cashback program that rewards you when you spend with your Tap card, learn more here.

Bitcoin Crashes Below $82K in Brutal Sell-Off

After breaking through several support levels, Bitcoin is trading around $82,000, extending a punishing downtrend that has erased more than 30% of its value since October's peak at $126,000.

The cause? A perfect storm of selloffs in U.S. equity markets, which triggered a wave of risk aversion that swept through global markets. Meanwhile, the Federal Reserve's cautious stance on further rate cuts has injected fresh uncertainty into trading floors. Markets still anticipate a 0.25% cut, but with recession fears intensifying, traders are hitting the exits. Crypto found itself directly in the crosshairs of this flight to safety

The damage extended well beyond Bitcoin. Estimates show around $2 billion in crypto positions liquidated, as forced selling and evaporating liquidity accelerated the downturn across digital assets. But here's a twist for you: Bitcoin is now entering territory that has historically preceded major recoveries. Let’s dive in.

Bitcoin Is Officially Oversold… And That Matters

The Relative Strength Index (RSI) has officially moved into oversold territory for the first time in nine months, signaling extreme selling pressure. The last time BTC hit oversold levels was in February, right before a notable rebound. Oversold signals don’t guarantee an immediate reversal, but they often mark the beginning of seller exhaustion.

In the previous oversold event, BTC dropped around an additional 10% before bouncing. If that were to happen again, BTC could briefly dip toward $77,000 before bulls regain momentum. If the current selling eases earlier, a shorter-term bounce could happen sooner.

MVRV Points to Undervaluation

Another key indicator worth looking at is Bitcoin’s MVRV Ratio. This on-chain indicator reveals whether investors are collectively sitting on profits or losses. An MVRV Ratio above 1 means the average holder is in the green; below 1 signals most are underwater.

BTC’s MVRV now sits at 1.5, its lowest level in over two years. When MVRV enters a “opportunity zone”, it suggests two things:

- Many short-term holders are underwater

- Downside selling pressure is approaching exhaustion

Key Levels to Watch

If bearish pressure continues, it’s possible BTC could revisit the $80,000 level, with a deeper support level around $77,000, matching the RSI’s recent historical pattern.

But there’s also a realistic bullish scenario: reclaiming $92,000 could turn the structure decisively bullish, opening the door to the $95,000 region and beyond.

What Can We Expect From BTC This November?

Beyond the indicators, there’s a seasonal angle worth emphasizing: Bitcoin has historically shown strong end-of-year recoveries and rallies. Even during weaker macro environments, Q4 has often delivered rebounds driven by renewed risk appetite and improved liquidity flows.

Combine that with oversold technicals, undervaluation signals, and easing macro uncertainty if the Fed does follow through on cuts, and the current levels could start looking less like panic territory and more like potential opportunity.

The Takeaway

Bitcoin's slide doesn’t appear to be driven by broken fundamentals; it's the result of macro turbulence, risk-off positioning, and temporary sentiment shifts. Short-term chop may persist, but on the flip side, key indicators are flashing oversold conditions which have historically marked turning points.

Corrections are part of Bitcoin's DNA. It has survived far steeper crashes and consistently emerged more resilient. Whether the bounce starts today or after one final shake-out, the pattern is familiar: selling exhaustion plants the seeds for the next rally. Patient holders have seen this pattern many times, and more often than not, their patience has been rewarded.

.webp)

Ready to cut through traditional banking barriers and dive into the world of crypto payments? From buying falafels at your local cafe to luggage from a store in Japan, crypto payments are fast, cost-effective, and easier than you can imagine.

In this guide, we will walk you through exactly how to pay with crypto - from opening your account to making your first transaction. By the end, you'll have the confidence to make crypto payments anywhere, anytime.

Is paying with crypto legal?

Let's address the elephant in the room first. Paying with crypto is legal in most major markets, including the United States, the European Union, Canada, and the UK. However, some countries, like China and India, have restrictions on crypto transactions.

Here's the global snapshot:

- Fully legal: US, EU, UK, Canada, Australia, Singapore, Switzerland

- Restricted or banned: China, India (limited use), Russia (complex regulations)

- Grey areas: Some developing nations with evolving frameworks

Why does this matter? Operating within legal boundaries protects you from compliance issues and ensures your transactions won't be flagged or reversed. Rest assured, Tap only operates in jurisdictions where crypto payments are fully compliant.

How crypto payments work

Think of crypto payments like sending an email instead of traditional mail. With email, your message goes directly from your computer to the recipient's inbox through the internet.

Similarly, crypto payments travel directly from your cryptocurrency wallet to the merchant's wallet through a blockchain network - no banks or financial middlemen required.

Here's what happens behind the scenes:

- Your payment gets recorded on a decentralised ledger (blockchain)

- Multiple computers verify the transaction

- Once confirmed, the payment is permanent and irreversible

- The entire process typically takes minutes, not days

This system eliminates the need for banks, reduces fees, and works 24/7 globally.

Common payment methods

There are several ways to pay with crypto, each suited for different situations. Here are the two most popular:

On-chain wallet transfers involve scanning a QR code or copying a wallet address to send payments directly from your wallet to theirs. This method works well for peer-to-peer transactions and in-store payments. As a side note: Tap users can enjoy free transfers between users, anywhere in the world.

Tap’s crypto-backed debit card lets you spend your crypto anywhere Mastercard and Visa are accepted. The card automatically converts your crypto to fiat at the point of sale.

Setting up your Tap account

Here’s how to get started:

- Download the app and create your account.

- Complete the quick identity check.

Since Tap is licensed and regulated, we ask for some basic verification - just like any trusted fintech app. It only takes a few minutes. - Once you're approved, you're in.

You’ll be ready to explore the crypto world.

Order your Tap card

Tap the “Card” tab in the app (between Hub and Cash), and follow the steps to order your card. It’ll arrive in a few days, depending on where you are.

Now all you need is crypto.

Topping up your wallet is simple.

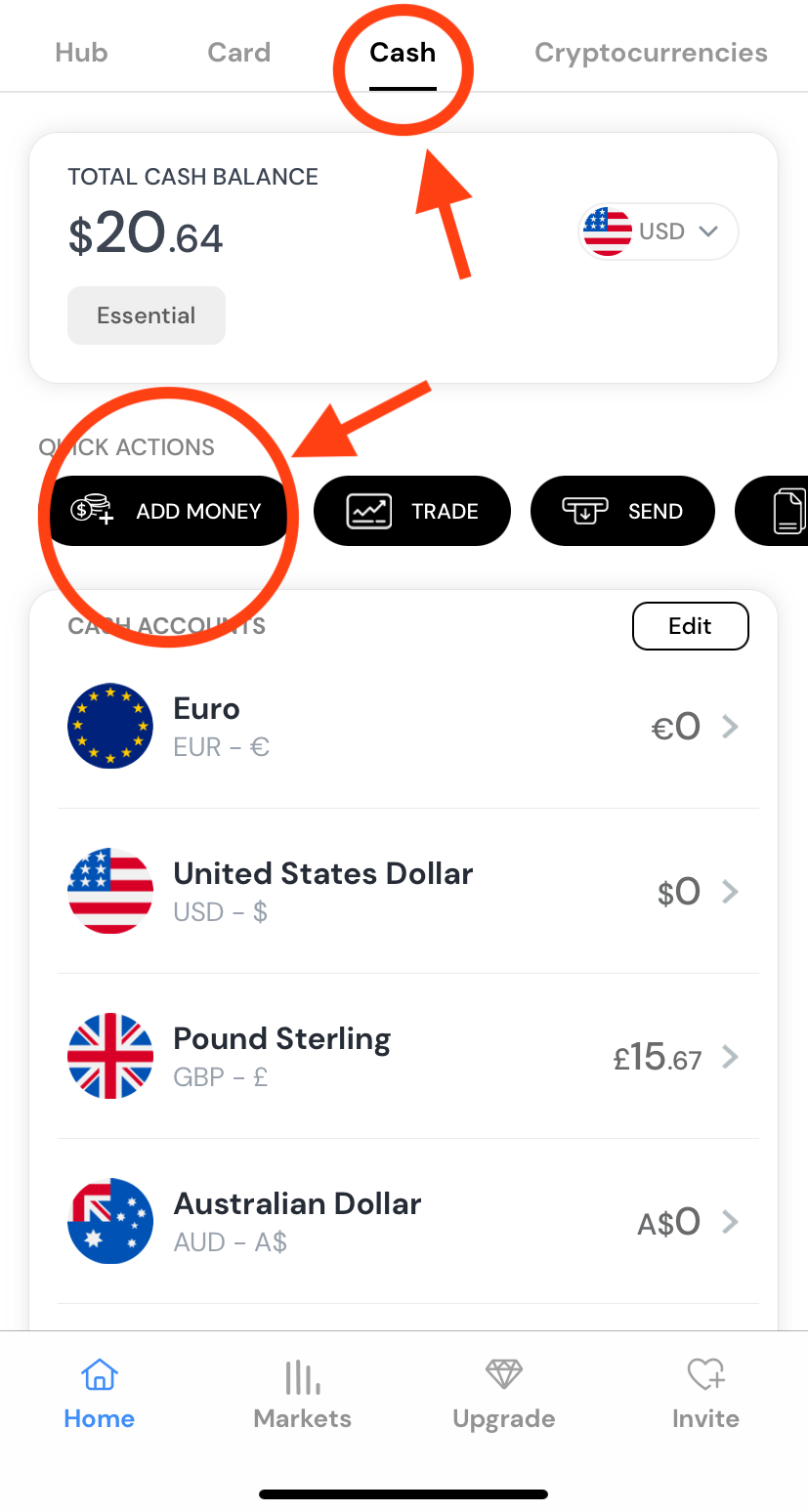

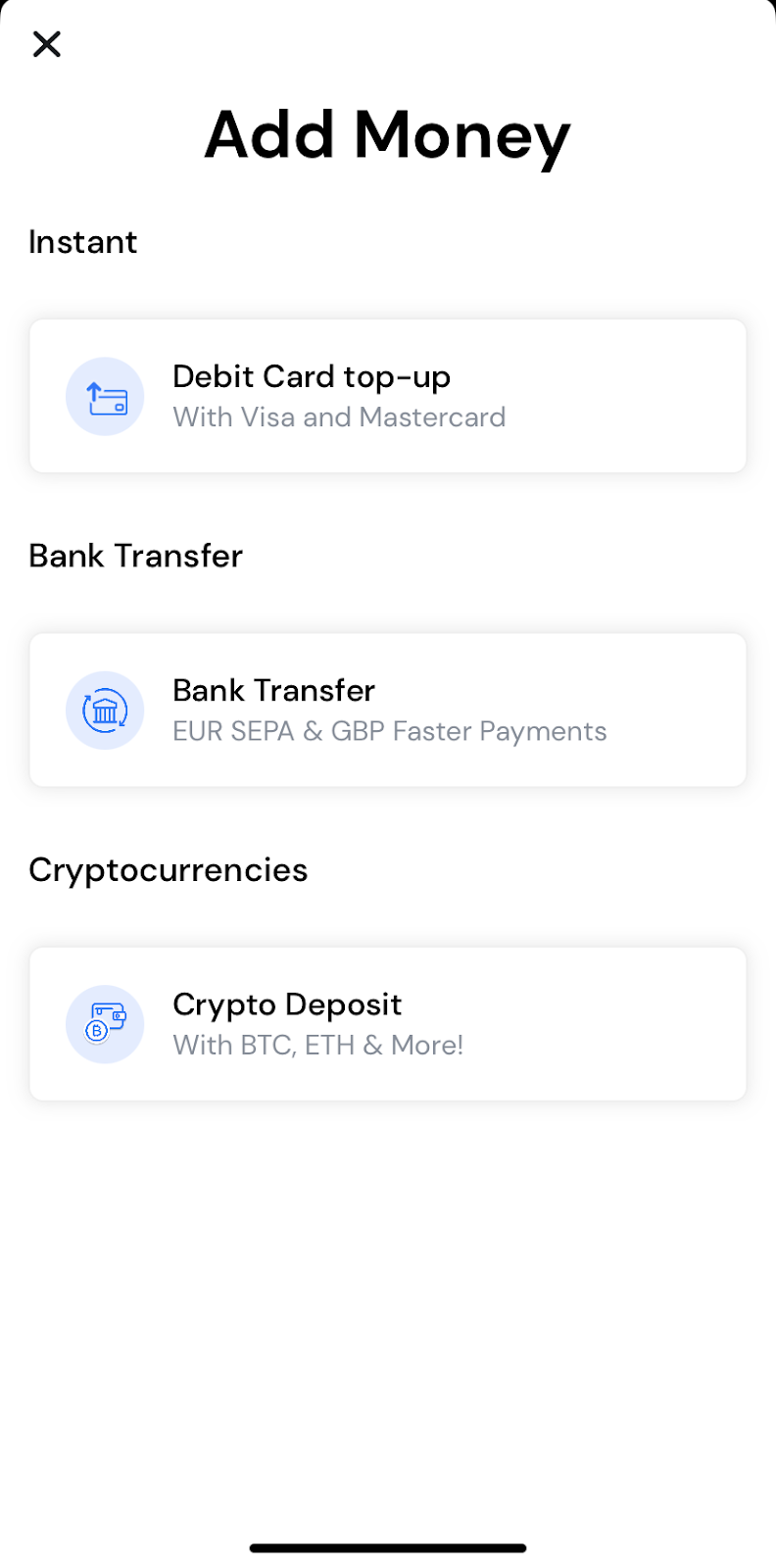

To load fiat (USD, EUR, GBP, AUD, CAD, CHF, JPY), tap “Cash” in the top menu and hit the black “Add Money” button. Choose your preferred method and follow the instructions.

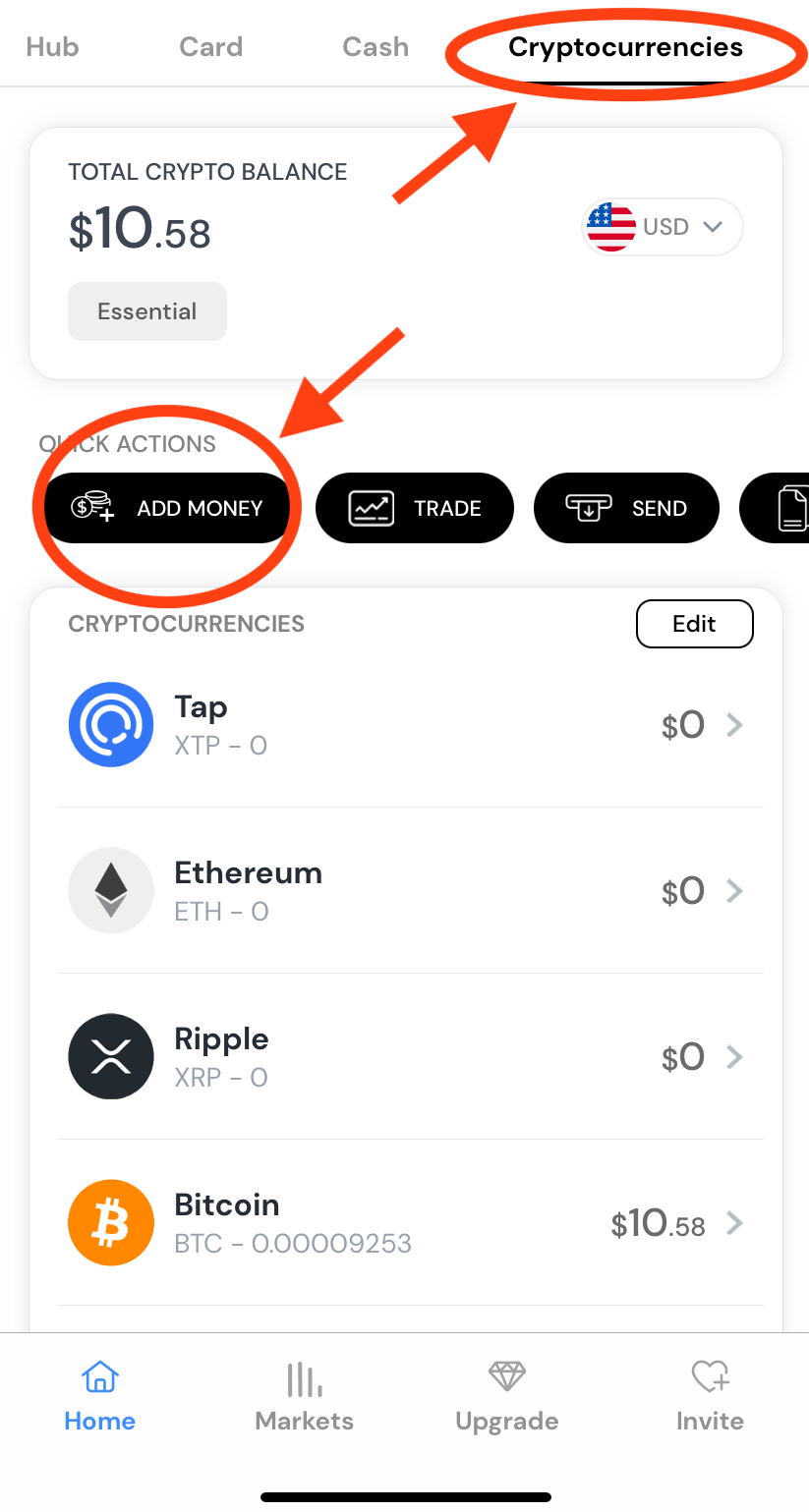

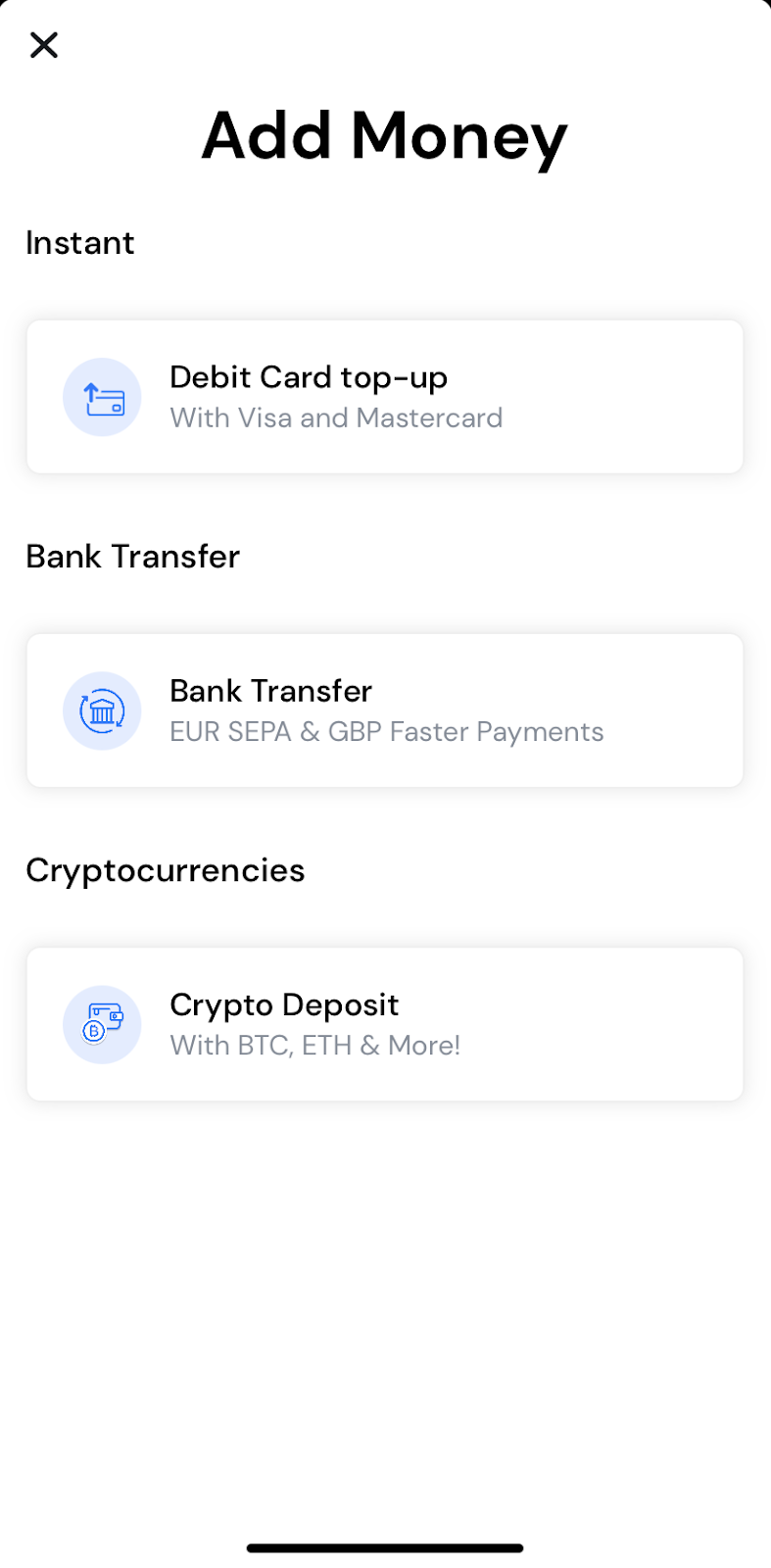

If you already have crypto, select Cryptocurrencies from the top menu, Add Money, and then the last option (Crypto Deposit). It’ll take a few minutes to clear (depending on the network).

When your card arrives, move funds to the Card section of your wallet, and you’re all set.

Step-by-step: how to make a crypto payment with Tap

Ready to make your first crypto payment? Let’s get stuck in:

Step 1: Take your Tap card out of your wallet.

Step 2: Swipe or tap at the merchant.

That’s it. Couldn’t be simpler.

Making a crypto payment through the app

If you don’t have a card or are waiting for it to arrive, here is the alternative option:

Step 1: Go to the “Cryptocurrencies” section of the app.

Step 2: Tap on “Send”.

Step 3: Choose “Crypto Withdrawal”.

Step 4: Pick the crypto you’d like to use.

Step 5: Tap the blue + New icon in the upper right corner.

Step 6: Choose “External Beneficiary” and carefully enter the wallet address.

Step 7: To complete the transfer, select the Beneficiary you just added and initiate the transfer.

Most payments are confirmed within minutes, though some networks may take longer during high-traffic periods.

Converting crypto to fiat & using crypto cards

Not every merchant accepts crypto directly, but that doesn't limit your spending power. Tap offers seamless conversion options that bridge the gap between crypto and traditional payments.

Our instant conversion feature lets you convert crypto to fiat currencies within your Tap account. Simply select the amount you want to convert, choose your target currency, and confirm the transaction. The converted funds appear in your fiat balance immediately.

The Tap Card takes this further by allowing you to spend crypto anywhere Mastercard and Visa are accepted. When you make a purchase, the card automatically converts the required amount from your crypto balance to fiat at competitive exchange rates. You can use it for online shopping, in-store purchases, or ATM withdrawals globally. Simply load the money onto your card through the app, and we’ll handle the rest.

Conversion happens in real-time, so you always get current market rates. *For real-time FX rates, click on your profile picture on the homepage and scroll down to “FX Calculator".

Fees, speeds & network choices

Understanding fees helps you make cost-effective payment decisions. There are two types of fees to consider:

Network fees go to blockchain validators who process your transaction. These vary by network and have nothing to do with Tap.

Bitcoin during peak times might cost $10-50, while networks like Polygon often cost under $0.01. Lightning Network Bitcoin payments typically cost less than a penny.

Tap fees are transparent and competitive. We charge a small percentage for conversions and premium features, but basic payments between Tap users are free.

Confirmation times depend on your chosen network:

- Lightning Network: Instant

- Ethereum: 1-5 minutes

- Bitcoin: 10-60 minutes

- Polygon: Under 1 minute

Best practice: For small, everyday purchases, use fast, low-cost networks like Lightning or Polygon. For larger transactions where security is important, Bitcoin's main network offers maximum security despite higher fees.

Security & common pitfalls

Crypto payments are irreversible, making security crucial. Here are the main risks and how to avoid them:

Wrong addresses are the top cause of lost payments. Always double-check recipient addresses and use QR codes when possible. Try to avoid typing wallet addresses manually unless necessary.

Phishing attacks trick users into entering wallet details on fake websites. Always bookmark legitimate sites and verify URLs carefully. Do not follow links from emails or text messages.

Rug pulls and scam projects promise unrealistic returns. Stick to established cryptocurrencies and verified merchants when making payments.

Tap's built-in safeguards include two-factor authentication and automated AML checks that flag suspicious transactions.

Tax & reporting considerations

Here's something many users overlook: spending crypto is a taxable event in most jurisdictions. When you use crypto to buy goods or services, you're technically selling that crypto, which may trigger capital gains tax.

How it works: If you bought Bitcoin at $30,000 and spent it when Bitcoin was $40,000, you owe tax on the $10,000 gain, even though you used it for a purchase rather than selling for cash.

Record-keeping is essential. To stay on the safe side, keep records of your transactions that include purchase dates, sale dates, amounts, and calculated gains or losses.

Regional differences matter:

- United States: IRS treats crypto spending as taxable events with capital gains implications

- European Union: VAT applies to crypto purchases, but capital gains treatment varies by country

- Other regions: Consult local tax advisors as regulations continue evolving

We recommend consulting with a crypto-savvy accountant to ensure you’re on the right side of your local tax obligations.

Why choose Tap to pay with crypto

We've built Tap specifically to solve the pain points of crypto payments. Here's what sets us apart:

Instant settlement means merchants receive payments immediately, not after blockchain confirmations. This solves the biggest barrier to crypto adoption for businesses.

Multi-chain support lets you use Bitcoin, Ethereum, stablecoins, and 60+ other cryptocurrencies through a single platform. No need to manage multiple wallets or apps.

Built-in compliance handles KYC/AML requirements automatically, so you can focus on payments rather than paperwork. We operate within regulatory frameworks.

Global reach without the complexity of international banking. Accept payments from anywhere, settle in your preferred currency, and expand your market instantly.

Ready to start paying with crypto? Download the Tap app and join the future of digital payments.

.jpg)

Need to call Ireland but not sure how to dial correctly? You're in the right place. Ireland's country code is +353, and knowing how to use it properly can save you from those awkward moments when your call doesn't go through (and your phone bill doesn't thank you either).

Whether you're calling family in Dublin, conducting business in Cork, or trying to reach that charming B&B in Galway, this guide covers everything you need to know about dialling Ireland correctly. We'll walk you through the step-by-step process, common mistakes to avoid, and even some free calling options that won't break the bank.

What is the country code for Ireland?

Ireland's country code is 353. This three-digit number is what you need to dial when calling Ireland from any other country around the world.

Country codes are part of the international telephone numbering system, designed to route calls to the correct country. Think of them as postal codes for phone calls - they tell the network exactly where your call needs to go. Ireland's 353 code has been in use since the country established its modern telecommunications system.

For reference, Ireland's ISO country codes are IE (alpha-2) and IRL (alpha-3), which you might see used in forms, websites, or official documentation.

How to call Ireland from abroad

Calling Ireland follows a simple three-step formula that works from anywhere in the world:

International Access Code → Country Code → Local Number

Here's how it breaks down:

- Dial your country's international access code (011 from the US/Canada, 00 from most European countries)

- Add Ireland's country code: 353

- Dial the local number, dropping the initial "0"

Examples in Action:

From the US to Dublin: 011 353 1 234 5678

From the UK to Cork: 00 353 21 234 5678

From Germany to Galway: 00 353 91 234 5678

The key thing to remember? Always drop that initial "0" from Irish area codes when calling from abroad. Irish numbers start with 0 when dialled domestically (like 01 for Dublin), but you skip this zero for international calls.

Ireland area codes (most common by city)

Here are the most important area codes you'll need when calling different parts of Ireland:

City/region - area code

Dublin - 01

Cork - 21

Limerick - 61

Galway - 91

Waterford - 51

Drogheda - 41

Dundalk - 42

Wexford - 53

Kilkenny - 56

Athlone - 90

Sligo - 71

Letterkenny - 74

Tralee - 66

Ennis - 65

Carlow - 59

Important note: Irish mobile numbers (starting with 08) don't use area codes. You simply dial the full mobile number after the country code.

How to call Ireland from a mobile phone

Mobile phones make international calling even simpler. Instead of remembering different international access codes, you can use the universal + symbol:

Format: +353 [area code] [local number]

Examples:

- To Dublin mobile: +353 87 123 4567

- To Cork landline: +353 21 234 5678

Most smartphones automatically recognise the + symbol when you hold down the "0" key. This method works regardless of which country you're calling from - no need to remember whether it's 011, 00, or something else.

How to call Ireland for free

Who doesn't love a good bargain? Several apps and services let you call Ireland without traditional phone charges:

Internet-based calling:

- WhatsApp: Free voice and video calls (both parties need the app)

- FaceTime: Free for Apple users calling other Apple devices

- Google Meet: Free voice and video calling

- Viber: Free app-to-app calls worldwide

Pros and cons:

Pros: Completely free (just uses your internet data), often better call quality than traditional calls Cons: Both parties need the same app and a reliable internet connection

These options work brilliantly for staying in touch with friends and family, though you might still need traditional calling for businesses or official services.

Common reasons why calls to Ireland fail

Nothing's more frustrating than a call that won't connect. Here are the usual suspects and quick fixes:

Wrong country code: Double-check you're using 353, not 533 or any other combination Incorrect area code: Check that the area code matches the city you're calling

Missing digits: Irish landlines typically have 7 digits after the area code, mobiles have 7 digits after 08

Forgot to drop the zero: Remember to skip the initial "0" when calling from abroad

No international plan: Check with your provider; some plans block international calls by default

Network issues: Try calling from a different location or wait and try again

Pro tip: If you're still having trouble, try calling an Irish directory service first to test your connection.

What time is best to call Ireland?

Ireland follows Greenwich Mean Time (GMT) in winter and Irish Standard Time (GMT+1) during daylight saving time (March to October).

For business calls: Aim for 9 AM to 5 PM Irish time, Monday through Friday

For personal calls: Consider that Irish folks often have dinner around 6-7 PM, so early evening can work well

Always use a time zone converter when scheduling important calls - there's nothing quite like waking up your Irish colleague at 3am because you miscalculated the time difference.

Emergency and service numbers in Ireland

In case you ever need them, here are Ireland's essential service numbers:

- 112 and 999: Emergency services (police, fire, ambulance)

- 116000: Missing child helpline

- 116123: Emotional support helpline

These numbers are free to call from any phone in Ireland and should only be used for genuine emergencies or crises.

Conclusion

Calling Ireland is straightforward once you know the basics: use country code 353, remember to drop the initial zero from area codes, and don't forget about free internet-based calling options. Whether you're planning a business call to Dublin or want to check in with a B&B in the countryside, following these simple steps will ensure your calls connect smoothly.

For the best experience, double-check the local time before calling and keep a time zone converter handy. With these tools in your back pocket, you'll be chatting away like a pro in no time. Sláinte to successful calls!

The 49 country code is your gateway to connecting with Germany from anywhere in the world, whether you're calling a business in Berlin, family in Munich, or that cozy hotel in Bavaria you're hoping to book.

Getting the dialling format right can save you from failed calls, unexpected charges, and the frustration of hearing that dreaded "the number you have dialled cannot be completed" message.

This guide breaks down everything you need to know about calling Germany, from basic dialling steps to troubleshooting common problems that trip up even the most experienced international callers.

What is the 49 country code?

The 49 country code is Germany's designated number in the international telephone system. When you want to call any German phone number from outside Germany, you must start your call with this two-digit code.

Country codes are part of a global system managed by the International Telecommunication Union (ITU) that ensures your call reaches the right country. Think of it as an international postal code for phone calls - without it, the global telephone network wouldn't know where to route your call. The 49 code covers all of Germany, including both landline and mobile numbers.

How to call Germany from the U.S. (or abroad)

Calling Germany follows a straightforward four-step process that works from any country:

Step-by-step dialing format:

- Dial your country's international exit code

- From the U.S./Canada: 011

- From most European countries: 00

- From many Asian countries: 00

- Dial Germany's country code: 49

- Dial the German area code (drop the leading zero)

- Berlin becomes 30 (not 030)

- Munich becomes 89 (not 089)

- Dial the local phone number

Complete examples:

Calling a Berlin landline from the U.S.: 011 49 30 12345678

Calling a Munich mobile from the UK: 00 49 171 1234567

Mobile phone shortcut: Most smartphones let you use the + symbol instead of your country's exit code. Just hold down the 0 key until + appears, then dial: +49 30 12345678

The key mistake many people make? Including that leading zero from the German area code. German numbers start with 0 when dialled domestically (like 030 for Berlin), but you must drop this zero for international calls.

Common area codes in Germany

Germany uses a logical area code system where major cities have shorter, memorable codes:

| City | Area Code | Full Domestic Format |

|---|---|---|

| Berlin | 30 | 030 |

| Munich (München) | 89 | 089 |

| Frankfurt | 69 | 069 |

| Hamburg | 40 | 040 |

| Cologne (Köln) | 221 | 0221 |

| Stuttgart | 711 | 0711 |

| Düsseldorf | 211 | 0211 |

| Dortmund | 231 | 0231 |

| Essen | 201 | 0201 |

| Bremen | 421 | 0421 |

Remember: When calling from abroad, always use the shorter version without the leading zero.

Smaller cities and towns have longer area codes, sometimes with 4 or 5 digits. The rule remains the same - drop that leading zero when calling internationally.

Calling German mobile numbers

German mobile numbers are easy to spot once you know the pattern. They typically start with these prefixes:

- 015x (various carriers)

- 016x (O2, E-Plus)

- 017x (T-Mobile, Vodafone)

How to call a German mobile:

Format: +49 [mobile prefix] [7-digit number]

Example: +49 171 1234567

Unlike landlines, mobile numbers don't use city-based area codes. The three-digit prefix (like 171) identifies the mobile carrier, and you'll always get seven digits after that.

Cost-saving tip: Many Germans use WhatsApp extensively, so if you're calling friends or family, ask if they prefer a WhatsApp call instead. It's free with a good internet connection and often has better sound quality than traditional international calls.

Why your call to Germany might not be working

Nothing's more frustrating than a call that won't connect. Here are the most common culprits and their fixes:

Common issues:

Wrong exit code: Using 00 instead of 011 from the U.S., or vice versa

- Fix: Check your country's correct international exit code

Including the leading zero: Dialling 011 49 030 instead of 011 49 30

- Fix: Always drop the first zero from German area codes

Missing country code: Trying to dial German numbers without the 49

- Fix: Never skip the country code when calling internationally

Incorrect mobile format: Treating mobile numbers like landlines

- Fix: Remember mobile numbers don't use city area codes

Network restrictions: Your carrier blocks international calls

- Fix: Contact your provider to enable international calling

Time zone confusion: Calling during German night hours

- Fix: Germany is GMT+2, be sure to check what the time is there before trying to call

Quick troubleshooting:

Try calling a German directory service first (like +49 11833) to test if your international dialling is working properly.

Alternative ways to call Germany

Traditional phone calls aren't your only option. Several modern alternatives can save you money and often provide better call quality:

Internet-based options:

WhatsApp: Extremely popular in Germany, free voice and video calls

Google Voice: Competitive international rates from the U.S.

Viber: Free app-to-app calling with good European coverage

FaceTime: Free for iPhone/Mac users calling other Apple devices

VoIP Providers:

Companies like Vonage, RingCentral, and 8x8 offer business-grade international calling with flat-rate plans that can be cost-effective for frequent callers.

Pros and cons:

Pros: Often free or very cheap, better call quality, video calling options

Cons: Requires internet connection, both parties might need the same app

What other country codes are similar to 49?

If you're travelling in German-speaking regions or neighbouring countries, these codes might come in handy:

- Austria: +43 (German-speaking)

- Switzerland: +41 (German is one of four official languages)

- France: +33 (borders Germany)

- Netherlands: +31 (Germany's northern neighbour)

- Belgium: +32 (close to the German border)

- Denmark: +45 (borders northern Germany)

Travel tip: Some mobile carriers offer European roaming packages that can be more cost-effective than international calling if you're travelling between these countries.

Conclusion

Calling Germany doesn't have to be complicated once you understand the basics. Remember the golden rule: use 49 as your country code, drop that leading zero from area codes, and don't forget your international exit code (011 from the U.S.).

And if in doubt, those internet-based calling options can be both your wallet's and your connection quality's best friend.

Guten Tag and happy calling!

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Say goodbye to low-balance stress! Auto Top-Up keeps your Tap card always ready, automatically topping up with fiat or crypto. Set it once, and you're good to go!

Read moreWhat’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.Έτοιμος για το πρώτο βήμα;

Γίνε μέρος της νέας γενιάς έξυπνων επενδυτών και όσων ξέρουν να διαχειρίζονται το χρήμα. Ξεκλείδωσε νέες δυνατότητες και ξεκίνα το δικό σου μονοπάτι προς την επιτυχία — σήμερα.

Ξεκίνα τώρα