Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

After a volatile October that saw one of the sharpest two-day liquidations of the year, the crypto market is trying to regain its footing, but conviction remains divided. Bitcoin has stabilized near key support levels, while altcoins fight against selling pressure. With macro, policy, and on-chain factors all in play, the debate between the bull and bear camps is as alive as ever. Let’s unpack the forces shaping both sides of the ledger.

The Bear Case

When Good News Don’t Move Prices

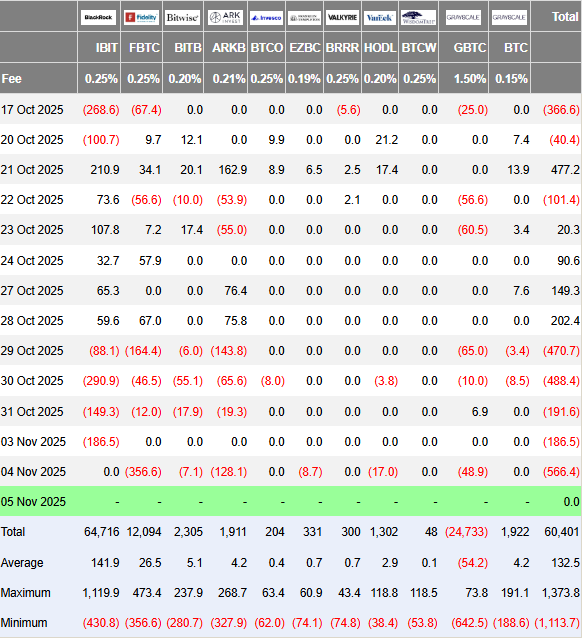

Despite encouraging ETF data and easing rate expectations, crypto failed to rally in late October, a classic warning sign of risk fatigue. According to Farside Investors, U.S. spot Bitcoin ETFs saw outflows of $470 million, $488 million, and $191 million between October 29 and 31, signaling that short-term traders were taking profits or stepping aside after “Uptober” fizzled out.

The AI Narrative

Macro sentiment still casts a long shadow. The tech-heavy equity rally, driven by AI infrastructure and chip stocks, has stirred debate about overvaluation. Nvidia’s brief breach of a $5 trillion valuation in late October triggered flashbacks of the dot-com era. If AI equities begin to deflate, crypto could feel the wealth effect unwind, as liquidity shifts from speculative assets to safer havens.

The 10/10 Crash Aftershock

The October 10 downturn marked one of the largest single-day liquidations in recent memory. Analysts note that this event left traders hunting for “dead entities” and potential hidden losses, injecting caution across the market. Even with recovery underway, scars from that drop remain fresh.

Post-Halving Cycle Timing

Bitcoin’s halving on April 20, 2024 (block 840,000) reset expectations, but it also reignited the age-old question: where are we in the cycle? Historically, the strongest rallies have occurred before or shortly after the halving, not a full year later. Some analysts now argue that the current consolidation could represent a late-cycle phase rather than the start of a new one.

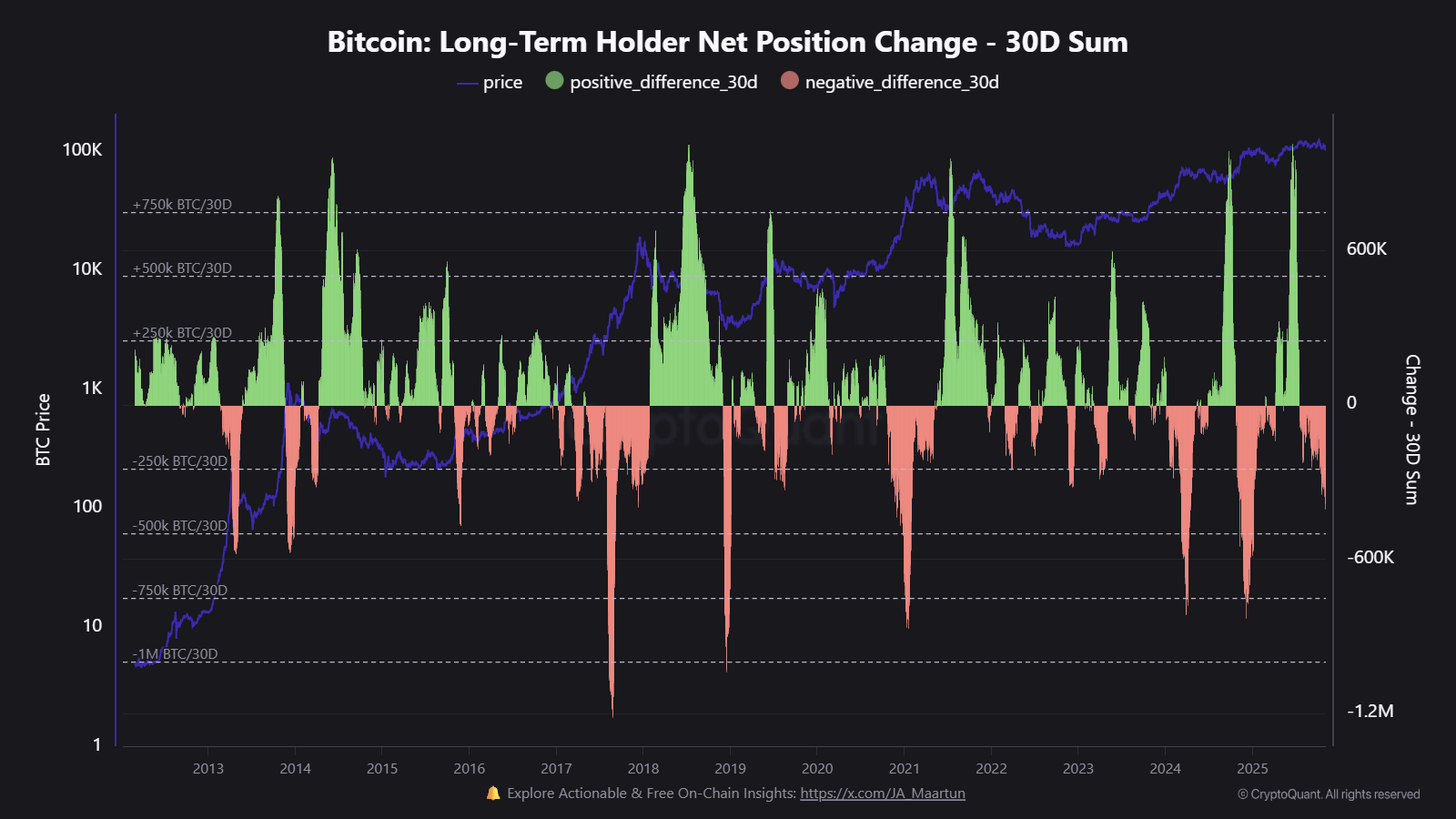

Dormant Wallets Awakening

On-chain data from CryptoQuant shows that long-term holders have increased net distribution since mid-October, with tens of thousands of BTC re-entering circulation. Several Satoshi-era wallets have also moved funds, not necessarily bearish in isolation, but enough to add pressure and short-term supply.

The Bull Case

No Signs of Euphoria

Market positioning remains far from overheated. The Crypto Fear & Greed Index currently sits in the 20s, and has been recently hovering between “Fear” and “Neutral.” That’s a far cry from the exuberant 80s to 90s readings that often precede blow-off tops. In practical terms, this suggests there’s still room for sentiment to improve before the market becomes dangerously crowded.

Liquidity Is Turning

Central banks are easing. The European Central Bank has already paused, the Bank of England has begun cutting, and the U.S. Federal Reserve is expected to follow suit with at least one more rate cut by year-end. According to the CME FedWatch Tool, the odds of a 0.25% cut currently stand above 70%. Historically, easing cycles have correlated strongly with renewed crypto uptrends, as lower yields push investors back into risk assets.

Institutional Adoption Keeps Compounding

Spot ETFs remain the biggest driver of credibility and inflows this year. Despite short-term outflows, global crypto investment products reached $921 million as recently as last week. That steady institutional presence gives crypto markets deeper liquidity and a stronger foundation than in previous cycles, where retail speculation dominated.

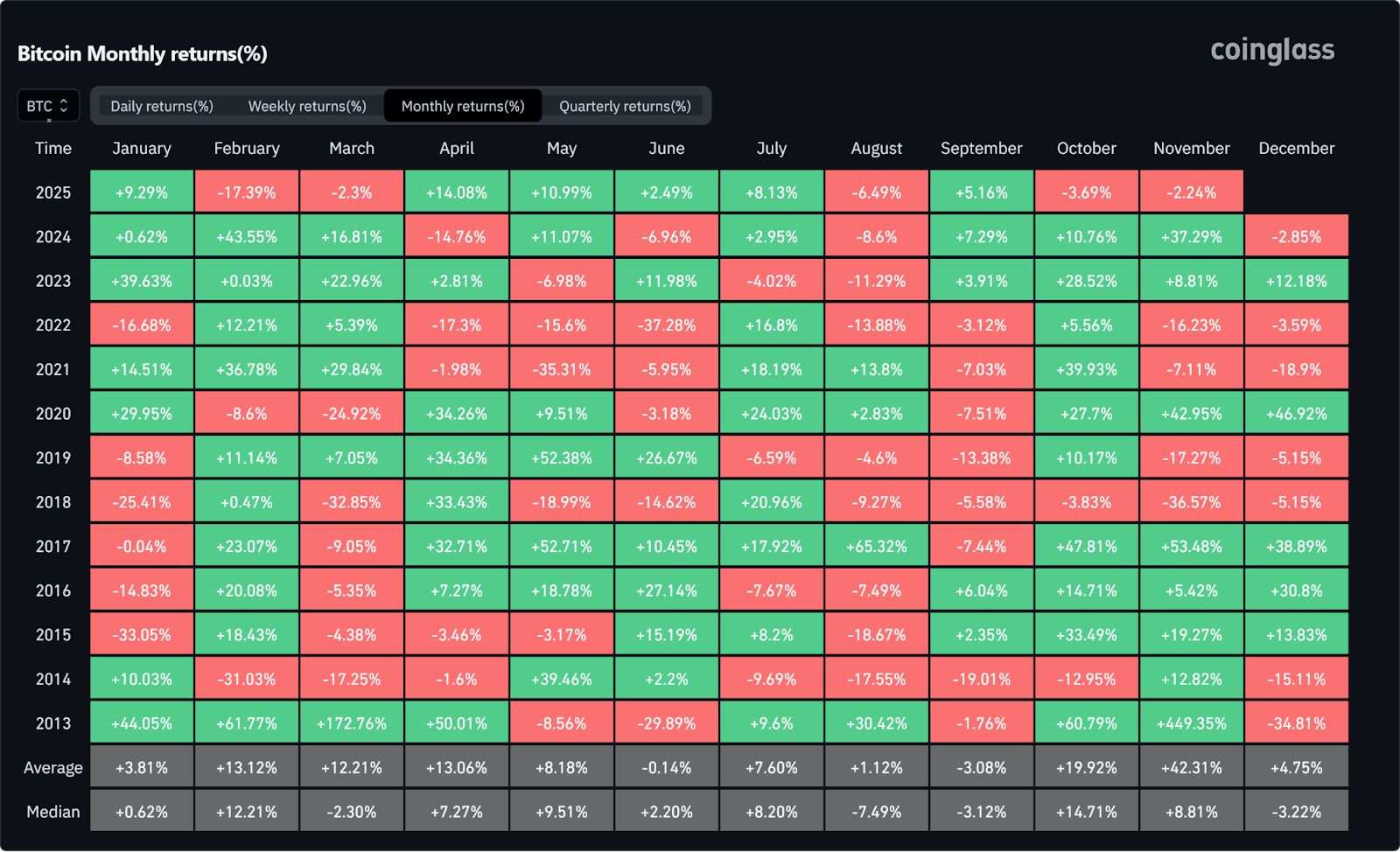

The Seasonal Edge

Seasonality adds another bullish data point. Since 2013, Q4 has consistently been Bitcoin’s strongest quarter on average. With November historically delivering above-average performance, many traders see the current consolidation not as a ceiling, but as a potential setup, particularly if macro data softens and ETF inflows resume.

Improving Global Sentiment

Finally, the U.S.–China trade thaw is a quiet but important catalyst. China has agreed to pause 24% tariffs on U.S. goods, marking the most significant de-escalation yet. For global risk assets, that’s a relief valve, potentially restoring confidence in emerging markets and crypto alike.

Final Verdict

Crypto’s tug-of-war between optimism and caution is far from over. The bull camp points to liquidity, policy progress, and institutional growth as evidence of a maturing ecosystem. The bears, on the other hand, warn that cycle timing, macro fragility, and old-wallet selling could cap any short-term rally.

Currently, the most realistic view lies somewhere in between these two extremes. After October's flash crash sent shockwaves through the market, a period of recalibration has taken hold. Whenever the next significant high arrives, the current environment may be best described not as peak fear or euphoria, but as consolidation.

When Satoshi Nakamoto created Bitcoin, he designed it in such a way that should the value increase dramatically, there would still be an inclusive decimal value for the masses. Satoshis could one day be how we buy a cup of coffee anywhere in the world, using the same currency from Britain to Japan.

How Many Satoshis Are in One Bitcoin?

Often shortened to SAT, Satoshi is the smallest unit of Bitcoin, the world’s first and most popular cryptocurrency. Just like the U.S. dollar divides into cents, Bitcoin divides into Satoshis, but on a much finer scale. One Bitcoin equals 100,000,000 Satoshis (0.00000001 BTC).

This structure ensures that Bitcoin remains usable for everyday financial transactions, even as its market value rises. Whether someone is investing a few dollars or buying a cup of coffee, the Bitcoin network allows precise division and ownership down to a single Satoshi, making the digital currency accessible to everyone.

Why Satoshis Matter

Bitcoin’s price often exceeds tens of thousands of U.S. dollars, creating a psychological barrier for newcomers who assume they must buy an entire coin. Satoshis remove that barrier by enabling fractional ownership.

This level of accessibility supports financial inclusion, allowing individuals from all backgrounds (including those in developing markets) to participate in the cryptocurrency economy.

From micropayments to online services, Satoshis make purchasing small products, tipping creators possible, etc. As adoption grows, the ability to transact in Satoshis could become a standard part of personal finance and global economic development.

How to Convert Satoshis

Because 1 BTC = 100,000,000 SATs, converting between the two is very simple math:

Satoshis = Bitcoin × 100,000,000

Bitcoin = Satoshis ÷ 100,000,000

For instance, if Bitcoin trades at $60,000, then:

- 1 SAT = $0.0006

- 10,000 SATs = $6

- 100,000 SATs = $60

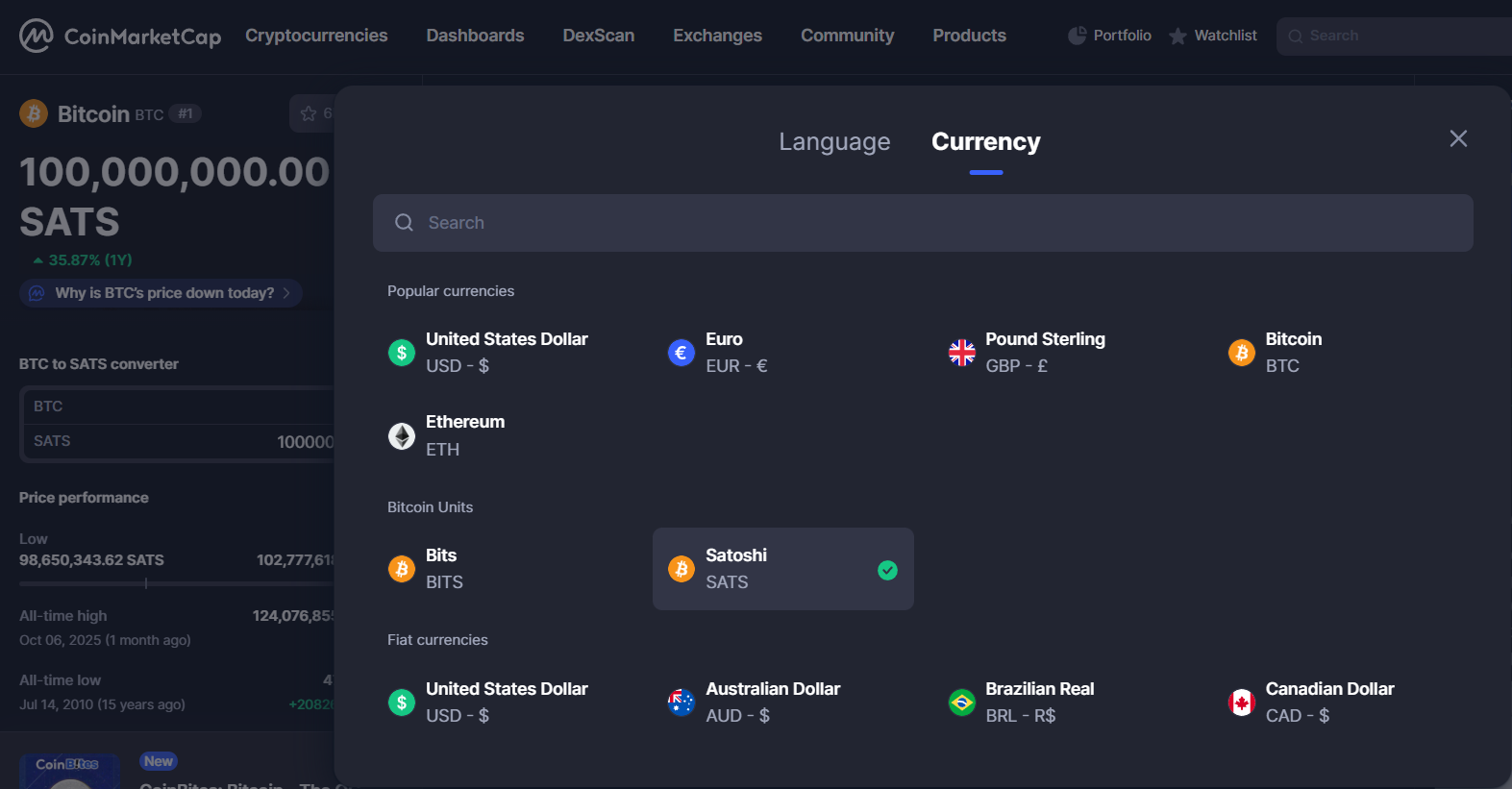

To simplify conversions, users can access Satoshi calculators or adjust display preferences within their cryptocurrency wallet or favorite platform. Many platforms also allow price displays in SATs to improve user experience and accuracy.

For instance, on CoinMarketCap, you can change the default currency to SATs by selecting the currency drop down option in the top right-hand corner. Select the Satoshi option under Bitcoin units. This will then display all values as Satoshis.

The History Behind the Name

The name “Satoshi” honors Satoshi Nakamoto, the mysterious programmer who invented Bitcoin and published its white paper in 2008.

The term was first proposed in 2010 on the BitcoinTalk forum by a user named Ribuck, who suggested defining a smaller Bitcoin unit for microtransactions. The community endorsed it, and “Satoshi” became the standard reference for Bitcoin’s smallest fraction.

This naming not only pays tribute to Bitcoin’s anonymous creator but also reflects the peer-to-peer and community-driven nature of the blockchain project.

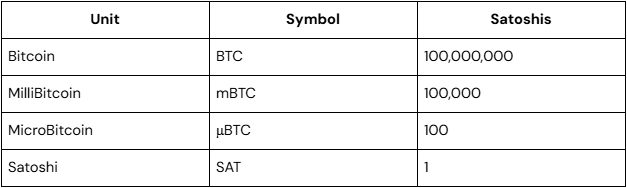

Bitcoin Unit Hierarchy Explained

Bitcoin can be divided into several measurement units, which make it easier to display or calculate different values depending on trade size or market purpose:

Users can choose their preferred unit in most cryptocurrency wallets or mobile apps, which helps reduce confusion when managing balances. This hierarchical structure is part of Bitcoin’s software design, ensuring precision, scalability, and transparency across every financial service or exchange that integrates it.

Real-World Applications of Satoshis

The use of Satoshis extends far beyond calculations. They play a vital role in everyday transactions and digital finance. Examples include:

- Micropayments. Paying for an article, video, or song online using fractions of Bitcoin.

- Remittances. Sending money across borders with minimal fees and no intermediary banks.

- Retail payments. Buying coffee, subscriptions, or services priced in SATs.

- Mining rewards. Bitcoin miners earn Satoshis as rewards for validating blocks on the blockchain.

- Lightning Network transactions. Enables instant, low-cost peer-to-peer payments denominated in milli- or micro-Satoshis.

These use cases show us how cryptocurrency adoption supports faster, cheaper, and more inclusive financial transactions, which helps bridge gaps between traditional fiat money and the digital economy. Satoshis make it easier to represent these small, day-to-day amounts.

Satoshis vs Other Cryptocurrency Units

Other blockchains have their own smallest units. For example, Ethereum uses the Wei, where 1 ETH = 1,000,000,000,000,000,000 Wei (18 decimal places). While Ethereum’s extreme divisibility helps with DeFi and smart contract operations, Bitcoin’s 8-decimal precision balances usability and simplicity. The Satoshi system keeps values easy to calculate, supports market liquidity, and provides enough granularity for future adoption.

This approach makes Bitcoin user-friendly, maintaining accuracy and precision in every financial transaction without overwhelming users with excessive mathematical complexity.

Considerations

Despite its simplicity, using the Satoshi unit can bring some hurdles too:

- Many newcomers are unfamiliar with terms like “Satoshi” or how to interpret BTC in fractional units.

- Since Bitcoin’s price fluctuates, the value of a Satoshi changes constantly, affecting everyday purchasing power.

- Not all wallets and exchanges display Satoshis by default, creating potential confusion for the end user.

- While some companies and fintech platforms already support SAT-based payments, widespread retail exposure is still limited.

Overcoming these hurdles will require better user experience design, educational content, and standardized software development practices across the industry.

The Future of Satoshis

As Bitcoin adoption expands, Satoshis may play an even bigger role in daily finance. With the Lightning Network, users can already transact in milli-satoshis, enabling high-speed, low-cost microtransactions far below one SAT.

In the long term, Bitcoin’s fractional-reserve capabilities and tokenization could make it a backbone for financial services, virtual payments, and cross-border trade. For emerging economies, Satoshis could represent economic empowerment, offering a stable, global currency that anyone around the world can use.

In short, Satoshis are not just a mathematical fraction. They are the mathematical foundation of a global peer-to-peer financial system that continues to evolve.

Key Takeaways

- 1 Satoshi = 0.00000001 Bitcoin

- Enables fractional ownership and global accessibility

- Named after Satoshi Nakamoto, Bitcoin’s anonymous creator

- Used for microtransactions, payments, and mining rewards

- Essential for the future of financial inclusion and digital payments

Getting Started: How to Buy and Use Satoshis

You can acquire the exact amount of Satoshis you're looking for through the Tap app, making it easy to begin your journey into the exciting world of Bitcoin.

You’ve probably heard whispers about the "whales" swimming in the crypto seas. But these aren’t your typical marine mammals. They’re the ultra-wealthy folks and organizations holding massive amounts of digital currency.

What Exactly is a Crypto Whale?

So, what makes someone a crypto whale? There’s no hard-and-fast rule, but it generally comes down to owning a huge chunk of a coin’s total supply. If we’re talking over 10% of the available coins for a particular cryptocurrency, then that’s an ocean-sized wallet!

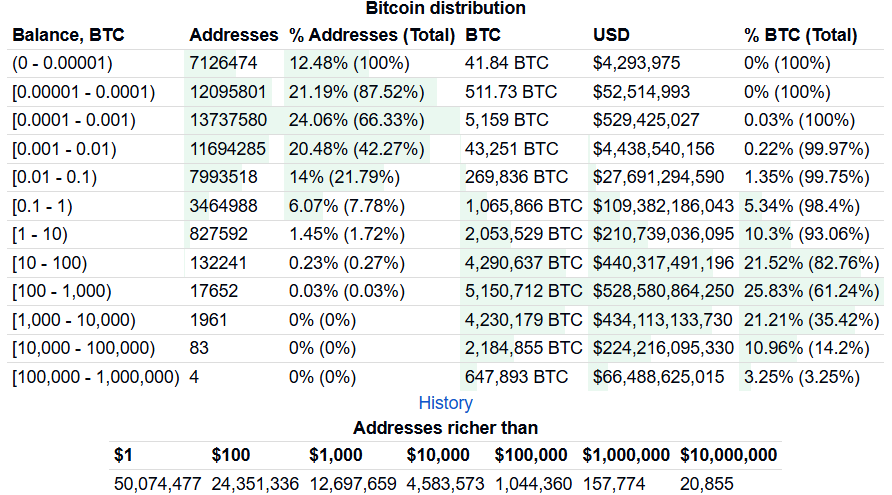

Take Bitcoin, for example. In October 2025, the wealthiest addresses controlled over 14% of all Bitcoin in existence. From Satoshi Nakamoto himself to MicroStrategy. Now that’s some serious whale power!

Bitcoin isn’t the only one with its share of whales. Dogecoin, the beloved meme coin, had a pretty wild concentration too. In 2025, just 3 addresses held over 32% of its total supply. Even Vitalik Buterin, the mastermind behind Ethereum, is considered an Ether whale thanks to his massive stake in the coin he created.

How Much Money Makes You a Crypto Whale?

The exact percentage threshold varies by cryptocurrency, but Bitcoin probably offers the clearest benchmark. Analysts typically define a Bitcoin whale as anyone holding over 1,000 BTC, worth around $100 million USD at recent 2025 market prices.

What About Other Assets?

- Whales usually hold 10,000 ETH or more.

- Generally, 500,000 SOL or more.

These thresholds aren’t clear-cut, and they shift as market value, liquidity, and overall supply and demand evolve. In simple terms, whales are the elite of the cryptocurrency market, capable of moving markets with a single transaction.

How Whales Make Waves

With that kind of buying power, whales can really make waves in the crypto marketplace. If a whale decides to sell off a giant chunk of their holdings, it creates a tidal wave of downward pressure on prices due to the sheer volume and lack of liquidity. Other crypto enthusiasts are always on the lookout for signs of an impending "whale dump," closely monitoring exchange inflows to spot potential dangers.

Here’s the twist, though – whales keeping their coins locked away actually reduces trading liquidity in the market since there are fewer coins actively circulating. Their massive idle fortunes are like icebergs weighing down the crypto ocean.

Tracking Whale Movements

Not every whale transaction is a sell-off. These giants could simply be migrating to new wallets, switching exchanges, or making monster-sized purchases. But you can bet experienced crypto folks keep a keen eye on those huge whale wallets, carefully tracking any ripples they make to navigate the ever-shifting tides of the market.

Whale Alert is a popular service that tracks these large transactions and reports them, often on Twitter. Whenever a whale makes a big move, it’s usually publicized quickly, giving everyone a heads-up on potential market changes.

Below is an example from Twitter from Whale Alert:

The Human Side of Whales

Behind these massive holdings are real people and organizations. Some whales are early adopters who bought into Bitcoin or other cryptocurrencies when they were cheap. Others are companies that have invested heavily in the belief that cryptocurrencies will continue to grow in value. For instance, Ethereum’s founder, Vitalik Buterin, is the biggest Ethereum whale because he holds a significant amount of the cryptocurrency he created.

How Whales Affect Crypto's Price

Price volatility can be increased by whales, particularly when they move a significant amount of one cryptocurrency in one go. For example, when an owner tries to sell their BTC for fiat currency, the lack of liquidity and enormous transaction size create downward pressure on Bitcoin's price. When whales sell, other investors become extremely vigilant, looking for hints of whether the whale is "dumping" their crypto (and whether they should do the same).

The exchange inflow mean, also known as the average amount of a certain cryptocurrency deposited into exchanges, is one of the most common indicators crypto investors look for. If the mean transaction volume rises above 2.0, it implies that whales are likely to start dumping if there are a large number of them using the exchange. This can be viewed by regular crypto traders as a time to act before losing any potential profit.

How Whales Affect Liquidity

When it comes to learning about whales and liquidity, one must remember that while whales are generally considered neutral elements in the industry, when a large number of whales hold a particular cryptocurrency, instead of using it, this reduces the liquidity in the market due to there being fewer coins available.

What Crypto Whales Mean to Investors

In terms of the relationship between whales and investors, one must remember that there are various situations in which a person may transfer their cryptocurrency holdings. It's worth mentioning that moving one's assets doesn't always indicate that you're selling them; they might be switching wallets or exchanges, or making a major purchase.

Occasionally, whales may sell portions of their holdings in discrete transactions over a longer period to avoid drawing attention to themselves or generating market anomalies that send the price up or down unpredictably. This is why investors keep an eye on known whale addresses to check for the number of transactions and value. This is not necessarily a task that newbie investors need to actively be involved with, however, understanding the terms and how whale accounts can affect the market is recommended.

Why Whales Matter

Whether you love them or hate them, whales are a formidable force in the crypto world, shaping its dynamics in profound ways. These giants, whether they’re creators, collectors, or traders, have a tremendous impact across the digital waters. When they make a move, it can trigger monumental swells that ripple through the entire market.

By understanding whale activity, anyone involved in cryptocurrency can better navigate these choppy waters. Staying informed about whale movements helps both newbies and seasoned traders make smarter decisions and stay afloat in this ever-changing space. Keep an eye on these behemoths; their actions can significantly influence your crypto journey.

While tracking whale activity can offer valuable insights into the cryptocurrency market, it's important to complement this knowledge with expert advice. Consulting with a financial advisor can help you navigate the complexities of investing and ensure your strategies align with your personal financial goals and risk tolerance.

In recent years, cryptocurrency, and therefore cryptocurrency exchanges, have firmly established themselves in the global financial market. As they become increasingly popular, many concerns have been raised over the regulation of these entities, and how they are preventing illicit monetary activity from taking place.

In an attempt to crack down on funds being illegally moved, exchanges are required to implement KYC (Know Your Customer) and AML (anti-money laundering) policies. Regulatory bodies are working to build legal frameworks for the industry, in an attempt to fight crime conducted using blockchain technology.

The biggest challenge for these regulatory bodies is to find a solution that doesn't hamper the innovative qualities of cryptocurrencies.

In the UK there is the Financial Conduct Authority, a financial regulatory body that operates outside of the UK government. In 2020, the FCA required every company participating in any crypto activity in the sector to comply with its Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 policy (the 'MLR's). This obligation requires crypto service providers to complete the necessary registration and infrastructural requirements.

What is AML in crypto?

AML stands for anti-money laundering and involves protocols that ensure that every transaction can be tied to an identity, thus providing greater transparency. This ensures that if any suspicious activity is flagged, the origins and/or destination of the funds can be confirmed on the platform.

Due to the anonymous, or more accurately pseudonymous, nature of cryptocurrencies, many believe that it provides an easy opportunity for ill actors to engage in money laundering. Money laundering is the act of changing large amounts of illicit income into a legitimate avenue, the money is "laundered" so as to appear clean.

While cryptocurrencies seemingly provide a perfect platform for money laundering due to the lack of central authority or third parties, AML processes are implemented on exchanges to stop this activity in its tracks.

What are the risks hindering AML practices?

The first risk that challenges AML practices is privacy coins, cryptocurrencies designed to conceal transactions and the relevant information attached to them. Platforms like Monero offer users the opportunity to send funds with no record of the transaction taking place.

The data associated with the transactions like the sender, receiver and amount sent are encrypted and often broken up when stored on the blockchain to ensure they are untraceable.

The second risk is coin join platforms that mix cryptocurrency transactions, hiding the origin and destination of the funds. These platforms essentially provide a service that can make ordinary cryptocurrencies anonymous.

While cryptocurrencies have their benefits, there are a number of challenges they pose to regulatory bodies, AML and CFT (Combating the Financing of Terrorism) intentions:

- The anonymity they can provide

- Opportunity for gaps when transacting cross-border transactions

- Absence of one central authority to ensure compliance

- The limited scope of identity verification processes

Differentiating between illicit activity and investors just wanting to safeguard their investments is a tricky business. Bad actors might make use of paper wallets to hide funds and keep them secret, while an investor might make use of a paper wallet in order to protect their funds against theft.

AML in crypto exchanges

Despite the challenges it faces, AML has proven to be valuable in cracking down on illegal activity conducted on crypto exchanges.

In July, $1.45 billion worth of illegal cross-border crypto transactions were traced back to 33 individuals on the South Korean exchange, Bithump. The platform quickly banned all foreign transactions, requiring a mobile KYC verification, and increased the KYC requirements so as to align with the country's AML regulations.

Bitcoin ATMs, a notorious option for mixing funds, have come together to form the Cryptocurrency Compliance Cooperative (CCC). This operation calls for cash-based cryptocurrency services, financial institutions, and regulators to participate in building universal compliance factors.

Does AML help or hinder the crypto market?

While AML tends to go against the decentralized nature of cryptocurrencies, the crypto community actively welcomes these regulatory efforts as it drives more trust and interest in the market on top of innovation and adoption. For example, an institution or retail investor is more likely to invest in a regulated asset than in a lawless, anything-goes market.

Anyone that has been watching the markets closely for the last several months will have noticed a definite chill in the air (not to mention a decline in their money). As the bears become more prominent, weak hands are losing faith and exiting the market. Why are we talking about a cryptocurrency winter now? Before we firmly declare this to be a crypto winter, let's explore the recent dips of the digital asset market and what previous crypto winters have detailed.

What is a cryptocurrency winter?

A cryptocurrency winter is a term used in the crypto market to describe a long term bear market. A bear market is classified as a declining market where shares have fallen below 20%. Investors typically call it a crypto winter when the markets have struggled to reclaim highs previously witnessed (usually right before the winter set in). Does that mean cryptocurrency investors should take out their snow shoes? Metaphorically, yes. And by snow shoes we mean thick skin and strong hands.

The recent market climate (five month period).

Since reaching its most recent all-time high, Bitcoin has dropped over 40%. After reaching highs of $68,789.63 in November 2021, Bitcoin has gone through a red-tainted slump reaching lows of $33,710 in late January and since recovering to just under the $40,000 mark.

Ethereum, the second-biggest cryptocurrency, has experienced a similar fate, dropping from highs of $4,891 in November 2021 to lows of $2,211 in late January. Ethereum has since corrected to the $2,800 region as it generates interest in its move to a Proof-of-Stake consensus.

It's no secret that the stock markets have suffered a similar fate in recent months, with seemingly only gold remaining unscathed. Experts have suggested in various articles that the uncertainty in global politics is playing a considerable role in the decline of various markets and businesses.

Buterin confirms a crypto winter

As touched on above, the current ongoing war between Russia & Ukraine has played a large role in driving investors' uncertainty as prices bounce through the highly volatile period. While we've seen an increase in trading volume, there have also been strong price swings.

This paired with the declining prices has led to a downfall in companies and traders entering the market, further fuelling the problem. This has become known in the industry as a crypto winter.

Ethereum founder, Vitalik Buterin, recently confirmed the case, although he also highlighted the positives, particularly for those on the development side. He pointed out that crypto winters offer a period of rejuvenation for the industry, allowing unsustainable projects to fall away.

"They welcome the bear market because when there are these long periods of prices moving up by huge amounts as it does - it does obviously make a lot of people happy - but it does also tend to invite a lot of very short-term speculative attention."

He added that it encompasses a "time when a lot of those applications fall away and you can see which projects are actually long-term sustainable, like both in their models and in their teams and their people." If one factors the development side of things in, we can bank on the industry coming out stronger after this period.

Unwrapping the previous crypto winter

The last crypto winter we experienced took place in 2018 after the highs of December 2017 (when Bitcoin almost reached $20,000). This bear market continued until mid-2019 before it started showing signs of recovery. It wasn't until Bitcoin defied the odds in 2020 and overcame the pandemic that it soared to higher heights, almost triple that of the previous all-time high.

While losing 40% of its value this season sounds rough, the previous crypto winter saw losses of 84%. As cryptocurrencies further emerge themselves into the mainstream financial markets, many believe it is only a matter of time before the prices enter the green again. Time also tends to play a regulator role when it comes to changing crypto seasons.

Bitcoin's four year cycle theory

There is a growing belief in the industry that Bitcoin has a definitive four-year cycle of prices rising and falling. This aligns with the halving mechanism which takes effect every 210,000 blocks, or roughly every four years.

The halving, the last of which took place in May 2020, halves the rewards given to miners for verifying transactions and effectively halves the number of new coins entering circulation. History has shown that a bull run succeeds these events, roughly twelve to eighteen months later.

Surviving the chill

While many can agree that the crypto winter is upon us, there is no saying how long it might last, or how low it may go. Analysts suggest that traders use the time to sharpen their investment strategies and implement plans of action that keep risk to a minimum. As blockchain and cryptocurrencies have already passed a significant milestone in their adoption, there is no stopping it now. For any traders concerned over the crypto winter, fear not. It will pass.

Tap is a regulated DLT company in Gibraltar, we are also agents of Transact Payments Limited who and as a regulated Electronic Money Institution (EMI) Transact Payments are required by law to “safeguard” customer monies received under its E-Money or Payment Services permissions.

What is safeguarding?

Under the requirements of the Gibraltar E-Money Regulations 2020 and Payment Services Regulations 2020 Transact Payments must;

· Segregate all client monies from our own funds.

· Deposit customer funds with a Credit Institution (Bank) with permission to hold client funds.

That Credit Institution must designate (name) the account to show that it is an account which is held for the purpose of segregating and safeguarding the funds or assets in accordance with regulations.

No person other than the payment institution may have any interest in or right over any funds or assets placed in safeguarding accounts.

What does this mean?

All Customer funds are entirely separate from operational funds and held within an authorised credit institution separate from Tap and Transact Payments.

During the course of normal business, Tap and or Transact Payments have rights to use those funds to settle transactions as authorised / instructed by the customer, including redemption to the customer.

Should Tap or Transact Payments experience an insolvency event those segregated safeguarded funds cannot be used for any other purposes.

Is safeguarding limited?

No. 100% of customer balances are safeguarded. There is no limit to the amount that you would receive should an event occur that required the return of your funds.

Reporting.

Transact Payments regulatory reporting requires regular reporting on Transact Payments regulatory capital, own funds calculations and outstanding e-money balances.

Both Tap and Transact Team are committed to open and transparent engagement with our customers. If you have any further question or queries, please do not hesitate to contact us.

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Say goodbye to low-balance stress! Auto Top-Up keeps your Tap card always ready, automatically topping up with fiat or crypto. Set it once, and you're good to go!

Read moreWhat’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.BOOSTEZ VOS FINANCES

Prêt à passer à l’action ? Rejoignez celles et ceux qui prennent une longueur d’avance. Débloquez de nouvelles opportunités et commencez à façonner votre avenir financier.

Commencer