Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

LATEST ARTICLEs

Money talks, but some currencies whisper so quietly you need a magnifying glass to hear them. In the grand theatre of global finance, not all currencies are created equal, while some strut around like peacocks (looking at you, Kuwaiti Dinar), others shuffle about with the confidence of a wet paper bag.

The Lebanese Pound (LBP) currently holds the unfortunate distinction of being the world's weakest currency in 2025, with an exchange rate so low that one U.S. dollar equals approximately 89,500 Lebanese pounds. To put this in perspective, you'd need a small suitcase to carry the equivalent of $100 in Lebanese pounds, assuming you could find enough physical notes.

Currency weakness isn't just about having a lot of zeros after the decimal point. It reflects a complex web of economic factors, including inflation rates, political stability, monetary policy decisions, and investor confidence. This guide on the world's weakest currencies in 2025, explores the economic stories behind their struggles and what it means for the countries (and the people) who use them.

Top 10 weakest currencies in the world (2025)

Here's the lineup of currencies that make your wallet feel surprisingly heavy when travelling abroad:

| Rank | Currency | Country | Approx. units per USD |

|---|---|---|---|

| 1 | Lebanese Pound (LBP) | Lebanon | 89,500-90,000 LBP |

| 2 | Iranian Rial (IRR) | Iran | 800,000-890,000 IRR |

| 3 | Vietnamese Dong (VND) | Vietnam | 25,960-26,100 VND |

| 4 | Laotian Kip (LAK) | Laos | 21,500-21,600 LAK |

| 5 | Indonesian Rupiah (IDR) | Indonesia | 15,400 IDR |

| 6 | Uzbekistani Som (UZS) | Uzbekistan | 12,700-12,800 UZS |

| 7 | Syrian Pound (SYP) | Syria | 13,000 SYP |

| 8 | Guinean Franc (GNF) | Guinea | 8,600 GNF |

| 9 | Paraguayan Guarani (PYG) | Paraguay | 7,800 PYG |

| 10 | Malagasy Ariary (MGA) | Madagascar | 4,600 MGA |

Exchange rates are approximate and fluctuate daily. Data compiled from multiple financial sources as of July 2025.

What makes a currency weak?

Before we roll our eyes at long strings of zeros, let’s get clear on what actually drives currency weakness.

Exchange rates show how much of one currency you need to buy another, usually measured against the U.S. dollar. But a low exchange rate isn’t automatically a red flag. Just like shoe sizes, bigger numbers aren’t necessarily worse, they’re just different.

The real reasons a currency weakens?

- Persistent inflation that eats away at value

- Short-term monetary policies that undermine long-term confidence

- Trade imbalances and shrinking foreign reserves

- Political instability that rattles investor trust

When investors lose faith, money moves fast, and exchange rates feel the impact. In short, weak currencies aren’t a punchline, they’re a signal of deeper economic tension.

Country spotlights - case studies behind the weakest currencies

Lebanon | A financial collapse without precedent

Lebanon’s currency crisis is a case study in how not to run an economy. As of mid-2025, the Lebanese pound trades at over 89,500 LBP per USD, making it one of the weakest currencies in the world.

The collapse stemmed from a banking sector that functioned like a state-sponsored Ponzi scheme: banks attracted deposits with sky-high interest rates, only to lend most of those funds to a debt-laden government. When confidence evaporated, the system imploded. Add in the 2019 mass protests and the devastating 2020 Beirut port explosion, and the result was economic freefall.

Today, Lebanese citizens navigate a surreal economy where ATMs limit withdrawals to tiny amounts, and many businesses have shifted to unofficial dollar pricing. A shadow economy thrives alongside the official one, proof that when trust in institutions fails, people find their own workarounds.

Iran | Sanctions, inflation, and isolation

The Iranian rial now trades at over 1,000,000 IRR per USD (yes, that's six zeros). Sanctions have cut Iran off from the global financial system, leaving its oil-rich economy unable to fully monetise its most valuable resource.

It's like owning a garage full of Ferraris with no keys to drive them. In response, Iran has attempted to bypass sanctions with crypto experiments and barter agreements, but none have stabilised the currency.

Inflation routinely exceeds 40%, and as a result Iranians have turned to gold, property, and U.S. dollars to preserve what little value they can. In a country known for its resilience, the rial’s collapse remains a stark reminder of the long-term costs of economic isolation.

Vietnam | Weak by design, not disaster

The Vietnamese dong trades at around 26,000 VND per USD, but that doesn’t signal a crisis, it actually reflects deliberate policy. Vietnam maintains a weaker currency to keep exports competitive, a strategy known as competitive devaluation.

This has helped transform Vietnam into a global manufacturing hub, attracting companies looking to diversify away from China. It's like running a permanent sale on your national output - foreign buyers love the prices, and Vietnamese factories stay busy.

The challenge lies in balance. The government works to avoid the inflation traps that have plagued other countries on this list, proving that not all weak currencies come from failure, some are tools of long-term economic strategy.

Laos | Trapped by debt and dependency

The Laotian kip now trades at around 21,800 LAK per USD, weighed down by inflation above 25% and a debt-to-GDP ratio over 125%. Much of that debt is owed to China, tied to major infrastructure projects that haven’t yet paid off economically.

Laos is a landlocked nation with limited industrial capacity and high import dependence, leaving its currency exposed whenever commodity prices shift. With little monetary wiggle room, the kip’s trajectory reflects deeper economic vulnerabilities.

Sierra Leone | A currency redefined, but still fragile

In 2022, Sierra Leone redenominated its currency, removing three zeros from the leone to simplify transactions. But even the new leone remains weak due to decades of disruption: civil war, the Ebola outbreak, COVID-19, and swings in diamond prices.

This is an economy that's faced shock after shock, and recovery is slow. The mining sector, especially diamonds, still dominates, leaving the leone vulnerable to commodity price drops.

Healthcare challenges and limited infrastructure add even more pressure, reducing productivity and increasing fiscal strain. The leone’s weakness tells the story of a country rebuilding piece by piece, with its currency reflecting both the past and the uphill path ahead.

Why some countries choose to keep their currency weak

Believe it or not, some countries actually prefer their currencies to be weaker - and for good economic reasons. It's counterintuitive, like preferring to drive in the slow lane, but the strategy can be remarkably effective.

Export competitiveness represents the primary motivation. A weaker currency makes domestic products cheaper for foreign buyers, essentially providing a permanent discount. German cars might be excellent, but if Vietnamese motorcycles cost 70% less due to currency differences, guess which ones developing countries will buy?

Countries like China famously maintained an artificially weak currency for decades, helping fuel their manufacturing boom. The strategy worked so well that other countries accused them of "currency manipulation" - the economic equivalent of being too good at a game and getting accused of cheating.

However, this approach carries significant risks. Import costs rise dramatically, making everything from oil to smartphones more expensive for domestic consumers

Long-term currency weakness can also trigger capital flight, where wealthy citisens move their money abroad. When your own citisens don't trust your currency, convincing foreigners becomes considerably more challenging.

Does a weak currency mean a weak economy?

We’ve established that a weak currency doesn't automatically signal economic disaster,sometimes it's just a reflection of different economic structures and historical circumstances.

Indonesia and Vietnam serve as the best examples of countries with numerically weak currencies but relatively strong economies. Both nations have achieved consistent growth, reduced poverty, and built increasingly diversified economies despite their currencies requiring calculators to count properly.

The key lies in purchasing power parity - what matters isn't how many zeros follow your currency symbol, but what those zeros can actually buy. A Vietnamese worker earning 10 million dong monthly isn't necessarily poor if that amount provides a comfortable living standard within the Vietnamese economy.

The real measure of economic health involves factors like employment rates, productivity growth, infrastructure development, and living standards. A country with a weak currency but growing wages, improving infrastructure, and expanding opportunities may be economically healthier than a nation with a strong currency but declining industries and rising unemployment.

What are the consequences of a weak currency?

In essence, a weak currency makes daily life more expensive, with rising prices on imports like food, fuel, and electronics. Added into the mix, Inflation erodes savings, and capital flight accelerates as people move their money into more stable currencies.

Over time, foreign currencies may replace the local one in everyday use, limiting government control. Internationally, weak currencies hurt credit ratings and investor confidence, reinforcing instability.

Final thoughts

Currency weakness is more than just numbers, it’s a signal. We’ve learnt above that it can both expose deep economic flaws or reflect deliberate strategies for growth. Lebanon and Iran highlight how instability and isolation can erode value fast, while Vietnam shows how weakness can fuel exports and development.

These disparities then shape the country’s trade, capital flows, and financial stability worldwide, causing a wider ripple effect. In a global economy, no currency moves alone; each affects the rest. And behind every weak currency are real people navigating inflation, opportunity, or uncertainty.

You know that feeling when the Fed announces a rate cut and suddenly everyone's talking about how "bullish" it is for crypto? Many people just nod along, but honestly have no clue why cheaper borrowing costs would make Bitcoin go up. Let's dig deep into this topic and share what the data shows – whether you're totally new to this stuff or already trading like a pro.

Let's Start Simple: What Are Interest Rates Anyway?

Okay, let's assume you're not an economics major here. Interest rates are basically the price of money. When you borrow money, you pay interest. When you save money, you (hopefully) earn interest. The big kahuna is the rate set by central banks like the Federal Reserve – this is the rate that affects pretty much everything else in the economy.

Here's the deal: when rates are high, borrowing money sucks because it's expensive. People spend less, businesses hold off on big investments, and suddenly that savings account looks pretty attractive. When rates are low, it's the opposite – borrowing is cheap, so people and businesses start spending and investing more aggressively.

A rate cut is just the central bank saying "Hey, we want people to spend more money and take more risks." And guess what falls into that "risky investment" bucket? Yep, crypto.

The Crypto Connection (Or: Why Bitcoin Doesn't Care About Your Savings Account)

Here's something that becomes clear when you think about it: Bitcoin doesn't pay you anything to hold it. Neither does Ethereum, Solana, or pretty much any other crypto sitting in your wallet. They're not like bonds or savings accounts that give you a steady income.

When interest rates are near zero, this isn't a big deal. But imagine government bonds are paying 5% with zero risk. Suddenly, holding volatile crypto that might crash 50% overnight doesn't look so smart, right?

So the math is pretty straightforward:

- High rates = "Why gamble on crypto when you can get guaranteed returns?"

- Low rates = "These bonds pay nothing, maybe Bitcoin looks interesting..."

This is probably the biggest reason why rate cuts get crypto people excited. When safe investments pay peanuts, risky assets start looking a lot more appealing.

How Rate Cuts Actually Push Money Into Crypto

Alright, let's get into the nitty-gritty of how this actually works. It's not just about psychology – there are real mechanisms at play here. Beyond simple psychology, several concrete mechanisms drive capital toward cryptocurrency markets when central banks ease monetary policy.

When central banks cut rates, they typically inject additional liquidity into the financial system. This expanded money supply creates excess capital that seeks higher returns, with crypto markets often benefiting from these flows.

Lower interest rates fundamentally alter investment opportunity costs. This is finance speak for "what am I giving up?" If I can only earn 0.5% in a savings account, the opportunity cost of holding Bitcoin (which pays nothing) is pretty low. But if savings accounts pay 5%, then holding Bitcoin means I'm giving up a lot of guaranteed income.

Here's something interesting: when the U.S. cuts rates, it often makes the dollar less attractive to international investors. A weaker dollar historically has been good for Bitcoin, especially since many people see it as "digital gold", a way to protect against currency debasement.

Accommodative monetary policy encourages risk-taking across markets. Traders can borrow more to make bigger bets, capital flows more easily toward crypto startups, and regular folks start FOMOing into altcoins. It's like the whole market gets a shot of adrenaline.

The COVID Case Study (AKA When Everything Went Bananas)

Want to see this in action? Look at what happened during COVID. In March 2020, everything crashed: stocks, crypto, you name it. Central banks freaked out and slashed rates to basically zero while printing money like it was going out of style.

At first, Bitcoin crashed along with everything else (down to around $3,200). But once all that stimulus money started flowing through the system, crypto went absolutely bonkers. Bitcoin went from that March low to nearly $70,000 by late 2021. That's more than a 20x return in less than two years!

Now, rate cuts alone didn't cause that rally, there was a lot going on, including institutional adoption, the whole "inflation hedge" narrative, and pure FOMO. But the massive liquidity injection definitely set the stage.

Fast forward to now, and we're starting to see rate cuts again. The Fed just cut rates for the first time in years, and everyone's wondering if we're about to see another crypto supercycle. Spoiler alert: it's complicated.

Why It's Not Always That Simple (The Plot Thickens)

The relationship between monetary policy and cryptocurrency prices isn't as straightforward as it seems. Rate cuts don't guarantee crypto rallies, and several factors can throw a wrench in this supposedly reliable connection.

Take timing, for instance. Monetary policy doesn't work like flipping a switch. The Fed cuts rates today, but that doesn't mean money suddenly floods into Bitcoin tomorrow. These effects take months to work through the financial system, creating frustrating delays between policy changes and actual market movements.

Then there's the whole expectations game. If everyone and their mother already expects a rate cut, the actual announcement might barely move markets. It's already baked into prices, as traders say. But when cuts come by surprise? That's when things get interesting, and volatile.

Inflation makes everything messier. Central banks get nervous about cutting rates when prices are already rising. And if they do cut while inflation is running hot, investors start worrying about the economy overheating. This is why smart money watches real interest rates, the actual rate minus inflation, which sometimes tells a completely different story than the headline numbers.

The Advanced Stuff (For Market Nerds)

Okay, this is where things get really interesting. If you're already trading and want to understand what moves the big money, here are the deeper dynamics that separate amateur hour from professional-grade analysis.

Real rates matter more than anything else. When rates sit at 2% but inflation runs at 4%, cash holders are losing 2% annually in purchasing power. That’s the kind of environment where Bitcoin’s ‘hard money’ narrative tends to resonate, and where institutional investors have historically shown greater interest.

The yield curve tells stories that headline rates can't. This relationship between short and long-term rates reveals market psychology. When short rates exceed long rates, the dreaded inverted curve, recession fears dominate. Rate cuts during these periods often fall flat because fear trumps greed, and nobody wants to touch risky assets regardless of how cheap money becomes.

But here's what separates the pros from everyone else: they know it's never just about rates. Credit spreads show how much extra yield risky borrowers pay compared to safe government debt. Dollar funding conditions reveal whether international markets can actually access all that cheap liquidity. And bank lending standards determine if that Fed money ever makes it past Wall Street desks into the real economy. The Fed can slash rates to zero, but if banks won't lend and credit markets freeze up, crypto won't see a dime of that stimulus.

The Dark Side (Because Nothing's Ever Perfect)

Let's be honest here, painting rate cuts as some magic crypto catalyst without acknowledging the risks would be doing everyone a disservice. Easy money creates bubbles, and when those bubbles burst, crypto typically gets damaged first and hardest.

The inflation trap is real and brutal. When rate cuts work too well and prices start spiraling upward, central banks panic and slam the brakes with aggressive rate hikes. That policy whiplash absolutely crushes speculative assets, with crypto leading the carnage every single time.

Then there's the liquidity trap – monetary policy's most frustrating failure mode. Sometimes rate cuts simply don't work. Banks refuse to lend, consumers won't borrow, and all that cheap money sits trapped in the financial system instead of flowing into markets. Japan learned this lesson painfully over decades of ineffective stimulus.

Here's an uncomfortable truth: despite all the "digital gold" rhetoric, crypto still dances to the stock market's tune most days. When rate cuts happen during genuine recessions and equities crater, Bitcoin rarely stays immune. The correlation breaks down only during very specific market conditions, not during broad-based selloffs.

Finally, there's the regulatory sword hanging over everything. Crypto rallies have this annoying habit of attracting government attention, especially when retail investors pile in and inevitably lose their shirts. That regulatory risk never disappears, it just sits there waiting for the next bubble to pop.

Strategic Approaches at Different Levels

The beauty of understanding rate cut dynamics is that you can apply this knowledge regardless of where you are in your trading journey. Here's how to think about it based on your experience level.

Starting out? Keep things dead simple. Track Fed meetings, watch inflation numbers, and brace for wild swings around major announcements. Don't get lost in the weeds trying to predict every twist and turn. Just remember that cheaper money generally makes crypto more attractive, even if the timing stays unpredictable.

Getting more serious about this game? Time to expand the toolkit. Real interest rates become your new best friend, along with the dollar index (DXY) and whatever the Fed chair actually says about future moves. Pay close attention to how crypto moves when stocks hiccup, that correlation hasn't disappeared just because Bitcoin hit some arbitrary price target.

Going full macro nerd? Now we're talking. Layer in yield curve analysis, credit spreads, and options flow data. The goal shifts from reacting to news toward positioning ahead of surprises. This means using derivatives to hedge positions and managing risk like the professionals do. At this level, it's less about being right and more about surviving when you're wrong.

The Bottom Line

So why are interest rate cuts good for crypto? Because they make safe assets less attractive, flood the system with liquidity, weaken fiat currencies, and make everyone a little more willing to take risks. For Bitcoin, that often strengthens its narrative as a store of value. For altcoins, it can fuel speculative rallies and bring more funding to interesting projects.

But here's the key insight: context is everything. Rate cuts during an economic expansion can be rocket fuel for crypto. Rate cuts during a deep recession might just keep things from getting worse. The difference comes down to liquidity conditions, market sentiment, and whether people actually believe the central bank's strategy will work.

For newcomers, the headline is simple enough: lower rates usually help crypto. For everyone else, remember that it's not just about the rate cut itself, it's about how that cut fits into the bigger macroeconomic puzzle.

The most successful traders don't just look at rate cuts in isolation. They consider the whole picture: inflation, employment, credit conditions, dollar strength, and market positioning. Because at the end of the day, markets are about human psychology as much as they are about monetary policy.

And honestly? That's what makes this whole game so fascinating, and frustrating at the same time.

Vous connaissez peut-être déjà l’achat et la vente de cryptomonnaies, mais avez-vous déjà entendu parler des airdrops ? Ces distributions gratuites de tokens sont en réalité des stratégies marketing visant à faire connaître un projet blockchain. Elles permettent de toucher une large audience et de créer de l’engagement. Explorons ensemble comment fonctionnent les airdrops et ce qu’ils peuvent réellement apporter.

Qu’est-ce qu’un airdrop crypto ?

Un airdrop crypto, c’est lorsqu’un projet distribue gratuitement ses tokens natifs à des utilisateurs — souvent pour attirer l’attention, élargir sa communauté ou encourager l’adoption. En clair : de la crypto gratuite, parfois en échange d’une petite action (suivre un compte, s’inscrire à une newsletter), parfois sans rien faire du tout.

Les tokens sont transférés dans les portefeuilles des utilisateurs existants ou potentiels. Cette technique a explosé lors du boom des ICOs en 2017, et reste encore largement utilisée. Même si ces tokens sont donnés gratuitement, leur valeur peut augmenter avec le temps — ce qui les rend parfois très intéressants pour les détenteurs.

C’est aussi une méthode pour augmenter le nombre de portefeuilles actifs (un bon indicateur pour les nouveaux projets) et favoriser la décentralisation en élargissant la détention des tokens.

Comment fonctionne un airdrop crypto ?

Les airdrops sont souvent planifiés dans la feuille de route d’un projet et se déclenchent après avoir atteint certains objectifs. Les modalités varient, mais en général, de petites quantités de tokens (souvent sur Ethereum ou une autre blockchain compatible avec les smart contracts) sont envoyées à plusieurs portefeuilles.

Certains airdrops sont entièrement gratuits, d’autres demandent de remplir quelques conditions : s’abonner à un canal Telegram, relayer un post sur X, ou simplement détenir un certain nombre de tokens.

Un airdrop bien pensé génère souvent du bouche-à-oreille autour du projet avant même sa cotation sur un exchange.

Quelle est la différence entre un ICO et un airdrop ?

Même s’ils sont tous deux liés au lancement de nouveaux projets crypto, la différence est claire :

- Un ICO (Initial Coin Offering) demande aux participants d’acheter des tokens, généralement pour lever des fonds.

- Un airdrop, lui, consiste à distribuer gratuitement des tokens, sans engagement financier.

Les ICO sont donc des moyens de financement, tandis que les airdrops sont des outils marketing.

Quels sont les différents types d’airdrops ?

Il existe plusieurs formes d’airdrops. Voici les plus courants :

Airdrops exclusifs

Réservés aux utilisateurs précoces ou aux membres actifs de la communauté, ces airdrops récompensent la fidélité. Exemple célèbre : Uniswap, qui a distribué 400 UNI à chaque portefeuille ayant interagi avec la plateforme avant une certaine date. Ces tokens de gouvernance donnaient un droit de vote sur les décisions du projet.

Airdrops “bounty”

Ces airdrops exigent une participation active : suivre des comptes, partager des contenus, inviter des amis, etc. Le projet peut demander une preuve d’engagement avant de distribuer les tokens.

Airdrops pour détenteurs (holders)

Ici, seuls les portefeuilles détenant déjà des tokens du projet sont récompensés. Le projet effectue une capture d’écran (snapshot) des soldes à un moment donné, et distribue des tokens aux portefeuilles éligibles.

Certains projets utilisent aussi des airdrops pour attirer des utilisateurs d’autres blockchains. En 2016, par exemple, Stellar (XLM) a distribué 3 milliards de XLM aux détenteurs de Bitcoin, dans l’idée d’élargir sa base d’utilisateurs.

Les risques liés aux airdrops

Comme souvent dans l’univers crypto, tout n’est pas toujours rose. Les airdrops attirent aussi des acteurs malveillants.

Exemples de scams courants :

- Vous recevez des tokens inconnus dans votre portefeuille. En les bougeant, votre portefeuille est vidé.

- Un faux projet vous incite à connecter votre wallet à une plateforme frauduleuse. Résultat : vos données privées sont récupérées.

⚠️ Un airdrop légitime ne vous demandera jamais de payer quoi que ce soit, ni de fournir votre seed phrase ou clé privée. Restez toujours vigilant et faites vos propres recherches (DYOR).

Autre point à surveiller :

Un airdrop massif peut fausser la perception de la popularité d’un projet. Si un token est envoyé à des milliers de wallets mais n’est quasiment jamais échangé, attention au miroir aux alouettes. Assurez-vous que le volume de trading réel correspond au nombre d’utilisateurs actifs.

Comprendre la valeur nette

Que vous soyez investisseur, épargnant ou que vous souhaitiez simplement mieux gérer votre budget, connaître votre valeur nette est une étape essentielle pour prendre le contrôle de votre situation financière. Cette donnée vous donne une vision claire de votre patrimoine et vous aide à prendre des décisions plus éclairées.

Contrairement au revenu, qui reflète ce que vous gagnez à un moment donné, la valeur nette donne une vue d’ensemble à long terme en tenant compte de ce que vous possédez (vos actifs) et ce que vous devez (vos dettes).

Quels éléments influencent votre valeur nette ?

Vos revenus

Le revenu regroupe vos différentes sources de gains : salaire, investissements, revenus secondaires… Plus vous gagnez, plus vous avez de potentiel pour augmenter votre patrimoine. Mais l’accumulation de richesse ne dépend pas seulement de ce que vous gagnez : elle repose aussi sur votre gestion des dépenses.

Vos actifs

Les actifs sont tout ce que vous possédez qui a de la valeur : épargne, biens immobiliers, portefeuille d’investissement, voiture… Diversifier vos actifs et miser sur ceux qui prennent de la valeur peut contribuer à faire croître votre patrimoine.

Vos dettes

Les dettes diminuent votre valeur nette. Elles incluent : prêts immobiliers, crédits à la consommation, soldes de cartes de crédit, etc. Réduire vos dettes, notamment celles avec des taux d’intérêt élevés, améliore mécaniquement votre valeur nette.

💡 Pour calculer votre valeur nette :

Valeur nette = Total des actifs – Total des dettes

Comment calculer sa valeur nette ?

Voici les étapes à suivre :

- Listez vos actifs : incluez vos comptes bancaires, biens, investissements, etc.

- Additionnez vos dettes : crédits en cours, prêts étudiants, factures impayées…

- Soustrayez vos dettes de vos actifs : le résultat est votre valeur nette.

Exemple de valeur nette positive

Prenons le cas de Sarah :

Actifs :

- Maison : 400 000 €

- Épargne : 50 000 €

- Portefeuille d’investissement : 150 000 €

- Compte retraite : 200 000 €

- Voiture : 20 000 €

→ Total : 820 000 €

Dettes :

- Crédit immobilier : 200 000 €

- Prêt étudiant : 30 000 €

→ Total : 230 000 €

👉 Valeur nette = 820 000 € – 230 000 € = 590 000 €

Exemple de valeur nette négative

Prenons maintenant le cas de Mark :

Actifs :

- Voiture : 10 000 €

- Effets personnels : 5 000 €

→ Total : 15 000 €

Dettes :

- Prêt étudiant : 50 000 €

- Crédit carte bancaire : 8 000 €

- Factures médicales : 3 000 €

→ Total : 61 000 €

👉 Valeur nette = 15 000 € – 61 000 € = –46 000 €

Pourquoi chercher à augmenter sa valeur nette ?

🔒 Sécurité financière

Un patrimoine plus solide vous protège face aux imprévus : perte d’emploi, dépenses urgentes…

🎯 Réalisation de vos objectifs

Acheter un logement, créer une entreprise, préparer votre retraite… Tous ces projets deviennent plus accessibles avec une valeur nette en croissance.

📈 Construction de patrimoine

Augmenter sa valeur nette, c’est aussi se constituer un patrimoine durable à transmettre ou à faire fructifier.

🧠 Meilleures opportunités financières

Une valeur nette élevée améliore votre capacité d’emprunt et l'accès à des produits financiers avantageux.

🛠️ Plus de liberté

Un patrimoine solide vous permet de faire des choix en fonction de vos projets, sans être freiné par des contraintes financières.

☁️ Tranquillité d’esprit

Savoir que votre situation s’améliore réduit le stress et vous aide à planifier sereinement.

Conseils pour améliorer votre valeur nette

Gérez vos revenus et dépenses

- Développez de nouvelles sources de revenus

- Maîtrisez vos dépenses

- Épargnez régulièrement

Faites croître vos actifs

- Diversifiez vos investissements

- Renseignez-vous sur les opportunités dans l'immobilier, les actions, etc.

Réduisez vos dettes

- Priorisez le remboursement des dettes à taux élevé

- Réunifiez vos crédits si nécessaire

- Respectez un plan de remboursement clair

Planifiez à long terme

- Constituez une épargne de secours

- Anticipez votre retraite

- Envisagez de vous faire accompagner par un expert

En conclusion

Comprendre et suivre votre valeur nette est essentiel pour piloter vos finances et poser des bases solides pour l’avenir. Que vous soyez en phase de démarrage ou en pleine croissance financière, ce simple indicateur peut vous guider et vous encourager à faire les bons choix.

👉 Votre valeur nette n’est pas juste un chiffre. C’est le reflet de vos progrès financiers – et un outil pour façonner l’avenir que vous souhaitez.

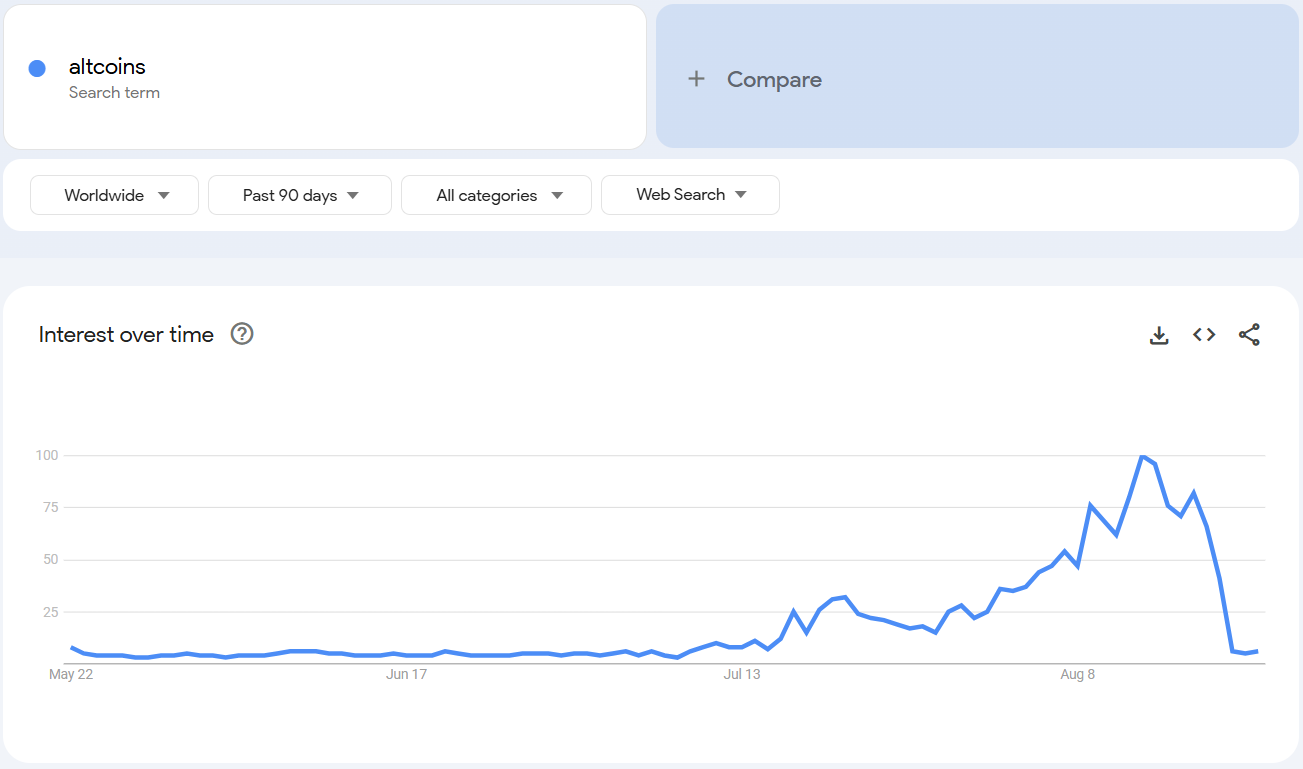

For a fleeting moment, it looked like altcoin season was finally here. Google searches for “altcoins” skyrocketed to record highs, 𝕏 was buzzing, and retail excitement seemed to return in full force. But within a week, that hype fizzled out almost as quickly as it appeared, leaving traders wondering if the long-awaited alt season was just a mirage.

A Spike That Vanished Overnight

Search interest for “altcoin” on Google Trends hit its highest score ever in early August, only to fall back to baseline levels within days. Globally, the same pattern played out, with scores dropping from 100 to just 16 in a week, mimicking a “pump and dump” pattern that you would expect from a memecoin.

Market cap data told the same story. The total value of altcoins (excluding Bitcoin and Ethereum) briefly climbed by $100 billion before giving it all back, leaving investors wondering whether the hype had any real weight behind it.

Naturally, some saw the collapse as proof that the altcoin season had ended before it really began. Others, however, like analyst Cyclop, argue the spike shows something deeper: that “altcoin” has become the mainstream term retail uses today, replacing “crypto” in 2021. In his view, this isn’t the peak. Rather, it’s just the beginning of broader interest.

Why Google Trends Doesn’t Tell the Whole Story

Relying on Google searches to measure retail demand may no longer work the way it used to. With AI tools increasingly replacing traditional search, and with concepts like “altcoins” now part of everyday investor vocabulary, Trends data might not be capturing where and how money is really flowing.

Instead, analysts point to on-chain and trading activity as better indicators of where momentum is building. And in August, that momentum was fragmented.

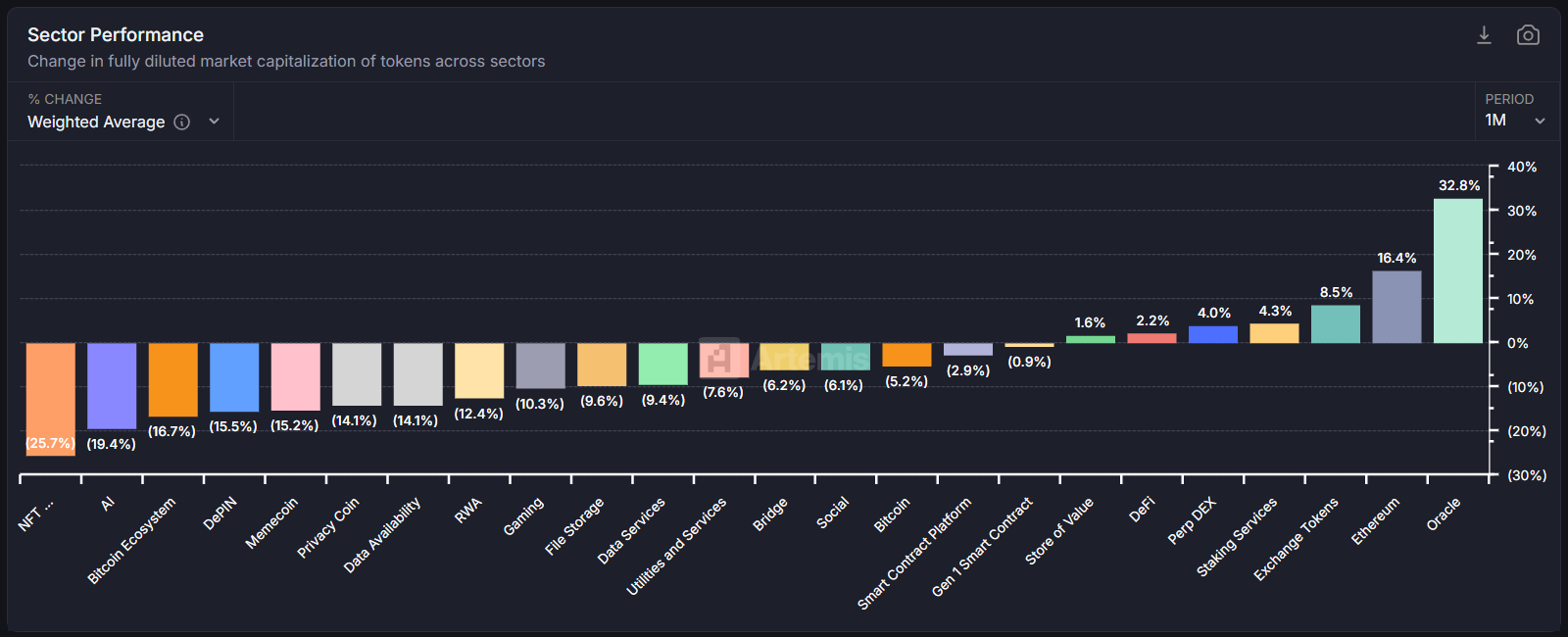

A Season of Winners and Losers

Data from Artemis showed only a few categories outperforming last month: Ethereum, exchange tokens, and oracles.

Beyond these bright spots, however, most altcoins struggled. The result? A patchwork “mini season” rather than the explosive, across-the-board surge that retail and social media had been hoping for.

Polygon’s co-founder Sandeep put it bluntly: "Retail is searching, but institutions aren't buying the narratives yet. Old altcoin seasons were driven by speculation and promises and narratives and marketing. Institutional money is smarter money. It cares about real utility and cash flows. The next "alt season" won't look like 2017 or 2021. It’ll be fewer tokens with actual usage, not just tokens with better marketing." Sandeep said.

The Road Ahead

That doesn’t mean altcoin season is dead, it probably just means it’s evolving.Coinbase has suggested that the next true wave could arrive as early as September, but that it likely won’t be a full-scale altcoin season.

Bottom line? The altcoin season isn’t gone; it’s just different. It’s maturing. And the next leg up may not belong to every token in the market, but only to the select few proving they can deliver value beyond mere speculation.

The internet has made earning money easier than ever - whether you want a side hustle for some extra cash or a full online business, the opportunities keep growing fast. From quick gigs to long-term passive income streams, there’s something for everyone.

But don’t expect to get rich overnight (and if someone promises you that, it’s more than likely a scam). With focus, patience, and smart moves, you can build real, sustainable income online.

This guide breaks down proven ways people are making money from home, some with zero upfront costs, others aimed at long-term growth. The trick? Find what fits your skills, time, and goals.

Let’s dive in!

1. Best ways to make money online quickly (low skill, high interest)

If you're new to making money online (see our beginners’ guide here) or need cash fast, these low-barrier options can help you start building income without any special skills. They won’t replace your 9-5, but they’re great for extra cash or to start building your online income game.

Paid online surveys

Surveys remain one of the easiest ways to start earning online. Companies pay for your honest opinion. No skills needed, just some spare time.

- Top platforms: Swagbucks, Branded Surveys, YouGov, Prolific

- Earnings: Typically £0.50-£3 per survey, 10-20 minutes each

- Tip: You’ll need to hit a payout threshold (usually £10-20) before withdrawing

Get paid to click, watch, or search

Earn small amounts doing simple online tasks like watching videos or using a search engine. It won’t replace a full income, but it adds up if you’re consistent.

- Try: Qmee, InboxPounds, Swagbucks

- Earnings: Pennies per task, but easy to do anytime

Micro-tasks

These quick gigs need human input, like data entry or web research.

- Platforms: Clickworker, Amazon Mechanical Turk, Lionbridge

- Pay: £2–£10 per hour, flexible hours

Test websites and apps

Give feedback on the usability and functionality of websites or apps.

- Sites: UserTesting, Userlytics, TryMyUI

- Pay: £8-£12 per 20-minute test

- Requirements: Good communication skills and reliable internet

Competitions and prize draws (comping)

Not guaranteed income, but some people win prizes worth thousands annually by entering competitions.

- Follow brands on social media for exclusive contests

- Use aggregator sites like LoquaxTM and MSE's Competition Corner

2. Medium-effort methods with reliable returns

These options require more skill or time investment but offer better earning potential and more engaging work.

Freelance writing and editing

Content demand is booming. If you can write clearly, this is a solid way to earn.

- Get started: Upwork, Intch, Freelancer

- Rates: Beginners £10-20/article; experienced £30-100+/hour

- Tip: Build a niche and portfolio gradually

Sell stock photos or videos

Monetise your photography/videography skills on platforms like Shutterstock or Adobe Stock.

Become a Virtual Assistant (VA)

Support businesses with admin tasks, social media, customer service, and more.

- Pay: £8-25/hour

- Build: Long-term client relationships for stable income

Sell handmade products

Use Etsy, Folksy, or Amazon Handmade to turn crafts into cash.

Sell digital products

High margins, no inventory. Popular items include Notion templates, Canva designs, ChatGPT prompts, and planners.

- Platforms: Gumroad, Etsy, Creative Market

3. Scalable and passive income streams

These take real effort up front, but once they’re set up, they can bring in steady income with little to no maintenance.

Dropshipping tips

Sell products online without inventory, using Shopify or WooCommerce.

- Profit margins: 3-7% after ads

- Requires skills in marketing and customer service

Print-on-demand

Design items like t-shirts or mugs are printed only when ordered.

- Platforms: Printful, Printify, Merch by Amazon, Redbubble

Start a blog or niche website

Earn through ads, affiliate links, sponsored content, and digital products.

- Takes roughly 6-18 months to grow, but can generate substantial passive income

Create and sell online courses

Share your expertise on platforms like Udemy, Teachable, Skillshare, or Coursera.

Write and publish ebooks

Self-publish on Kindle Direct Publishing or Smashwords. Good editing and marketing matter.

Launch a YouTube channel

Earn through ads, memberships, super chats, sponsorships, and affiliate marketing.

Side hustles that use your environment or possessions

Why not monetise what you already own?

- Rent property through Airbnb or Booking.com for significant income.

- Rent belongings like cars (Turo), equipment (Fat Llama), or parking spaces (JustPark).

- Sell unused items on Facebook Marketplace, eBay, or Vinted - many earn hundreds decluttering.

- Use cashback apps like Shoppix and TopCashback (or from your Tap card - up to 8% people) for purchases you're already making.

These options work especially well in urban areas and thankfully require minimal upfront investment.

What to watch out for

The internet is full of legitimate opportunities, but scams are unfortunately common. Protecting yourself is crucial.

Avoid scams, watch for:

- Promises of guaranteed big money with little effort

- Upfront payment requests for “training” or “kits”

- Pyramid or multi-level marketing schemes

Know your tax obligations. In the UK, you must report online income over £1,000 to HMRC. Keep good records and consider professional advice.

Understand platform rules. Check minimum payouts, fees, payment methods, and account policies before signing up. Always read the ts and cs.

Tips for success when earning online

Unlock your online earning power with these 5 no-fluff strategies:

- Use a separate email for online earning to stay organised and secure

- Track your earnings and time with a spreadsheet for insights and taxes

- Focus on higher-paying platforms and build skills accordingly

- Start small, then scale what works best for you

- Learn digital skills (SEO, copywriting, design, social media) via free online tutorials

Final thoughts

Making money online gives you freedom, but it also takes effort and patience. There’s no magic formula - some people thrive blogging, others with surveys or micro-tasks. Start small, learn, and expand gradually.

And lastly, watch out for scams, keep good records, and keep adding value. If you’ve made it this far, we believe you’re ready to take control of your online income journey!

TAP'S NEWS AND UPDATES

What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.What’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Say goodbye to low-balance stress! Auto Top-Up keeps your Tap card always ready, automatically topping up with fiat or crypto. Set it once, and you're good to go!

Read moreWhat’s a Rich Text element?

What’s a Rich Text element?The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.Static and dynamic content editing

Static and dynamic content editingA rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!

A rich text element can be used with static or dynamic content. For static content, just drop it into any page and begin editing. For dynamic content, add a rich text field to any collection and then connect a rich text element to that field in the settings panel. Voila!How to customize formatting for each rich text

How to customize formatting for each rich textHeadings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.

Headings, paragraphs, blockquotes, figures, images, and figure captions can all be styled after a class is added to the rich text element using the "When inside of" nested selector system.BOOSTEZ VOS FINANCES

Prêt à passer à l’action ? Rejoignez celles et ceux qui prennent une longueur d’avance. Débloquez de nouvelles opportunités et commencez à façonner votre avenir financier.

Commencer