Learning the friendly way

Dive into our resources, guides, and articles for all things money-related. Grow your financial confidence with our experts curated tips and articles for both experienced and new investors.

Latest posts

Wrapped Bitcoin (WBTC): the Future of Bitcoin… or Just Another Crypto Fad?

Despite radically reshaping the world’s financial landscape, the first ever cryptocurrency has limitations when interacting with newer blockchains. For example, Ethereum. Wrapped Bitcoin (WBTC) solves this limitation by allowing Bitcoin to function on the Ethereum network, enabling access to decentralized finance (DeFi) services.

WBTC is an ERC-20 token that represents Bitcoin 1:1 on the Ethereum blockchain, combining Bitcoin’s value with Ethereum’s smart contract power, and opening new opportunities for BTC holders in decentralized finance (DeFi). Unlike Bitcoin variants aiming to improve its technology, WBTC extends Bitcoin's utility without replacing it.

Join us in this deep dive on how WBTC works, its benefits, risks, and how it connects Bitcoin to the broader DeFi ecosystem.

Unlocking Bitcoin’s Power on Ethereum

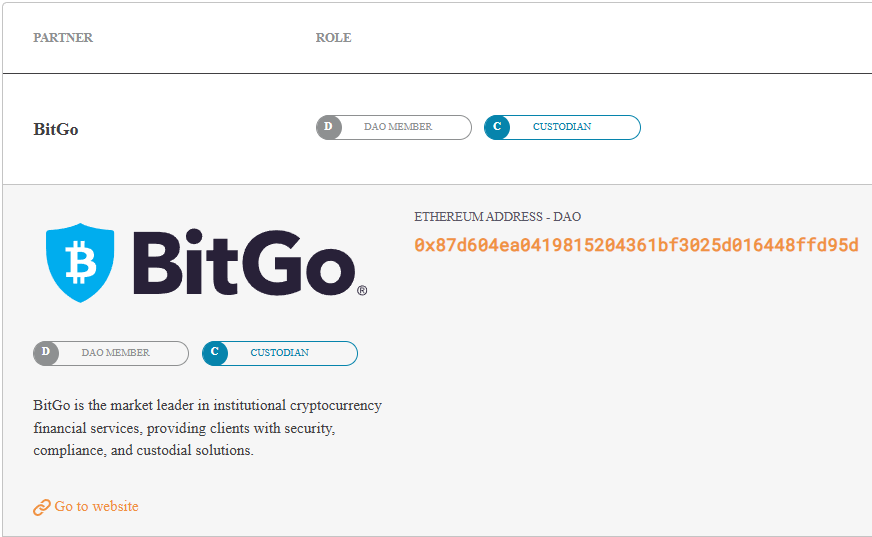

Launched in January 2019, approximately 10 years after Bitcoin's initial release, WBTC was created as a collaborative effort between BitGo, Kyber Network, and Ren (formerly Republic Protocol), along with other major players in the DeFi space including MakerDAO, Dharma, and Set Protocol.

As an ERC-20 token, WBTC adheres to Ethereum's token standard, making it compatible with the entire Ethereum ecosystem, including its smart contracts, decentralized applications, and wallets.

In structure, WBTC bears similarities to stablecoins like USDC or USDT, which are backed by reserve assets. However, while stablecoins aim to maintain a stable value (usually pegged to a fiat currency like the US dollar), WBTC's value fluctuates with Bitcoin's market price.

Each WBTC token is backed by an equivalent amount of Bitcoin (BTC) held in reserve by a custodian, maintaining a strict 1:1 ratio, meaning 1 WBTC is always equivalent to 1 BTC in value.

Wrapped Bitcoin is now under the control of a Decentralized Autonomous Organization (DAO) called the WBTC DAO. This organization oversees the protocol, ensuring the integrity of the wrapping process and maintaining transparency in the system. Unlike Bitcoin's fully decentralized nature, WBTC relies on certain trusted entities to maintain the backing of the tokens, which creates an interesting balance between utility and trustworthiness.

WBTC belongs to a broader category of financial instruments known as "wrapped tokens." These are cryptocurrencies that are enclosed or "wrapped" in a digital vault and represented as another token on a different blockchain. While WBTC represents Bitcoin on Ethereum, there are other wrapped tokens in the cryptocurrency space, including Wrapped Ether (WETH) which, somewhat paradoxically, is a wrapped version of Ethereum's native token on its own blockchain that conforms more strictly to the ERC-20 standard.

Why Does Wrapped Bitcoin Exist?

Wrapped Bitcoin (WBTC) was created to bridge the gap between Bitcoin and newer blockchain platforms like Ethereum.

1. Bitcoin's limited smart contract functionality

Bitcoin prioritizes security over programmability, making it unsuitable for complex decentralized apps. In contrast, Ethereum supports smart contracts that power a wide range of automated financial services.

2. Access to DeFi for Bitcoin holders

Ethereum's DeFi ecosystem offers lending, trading, and yield farming, but Bitcoin holders couldn't participate without converting their BTC. WBTC solves this, letting them use Bitcoin's value within Ethereum-based applications.

3. Unlocking Bitcoin's liquidity

Bitcoin's vast market capitalization holds significant untapped liquidity. WBTC brings this capital into Ethereum's DeFi network, benefiting both Bitcoin holders and the broader ecosystem.

4. Faster, more flexible Bitcoin transactions

While Bitcoin transactions can be slow and costly, WBTC uses Ethereum's network for quicker, cheaper trades-ideal for active traders and DeFi users.

In short, WBTC enhances Bitcoin's utility without altering its core protocol, connecting it to the evolving world of decentralized finance.

How Does Wrapped Bitcoin Work? The Nuts and Bolts

Wrapped Bitcoin (WBTC) bridges Bitcoin and Ethereum through a secure, transparent process involving key participants and smart contracts.

1. Wrapping and unwrapping process:

Wrapping (BTC → WBTC): Users send Bitcoin to a custodian, who secures it and mints an equivalent amount of WBTC on Ethereum, sending it to the user's Ethereum wallet.

Unwrapping (WBTC → BTC): Users burn WBTC, prompting the custodian to release the equivalent Bitcoin back to their Bitcoin wallet.

This 1:1 pegging ensures WBTC is fully backed by Bitcoin reserves.

2. Key participants:

Custodians (e.g., BitGo): Hold and safeguard the Bitcoin backing WBTC.

Merchants: Authorized to request minting or burning of WBTC.

Users: Individuals or entities using WBTC in Ethereum's DeFi ecosystem.

WBTC DAO Members: Stakeholders who govern protocol decisions.

3. Transparency and verification:

Proof of reserves: Publicly verifiable Bitcoin addresses back every WBTC in circulation.

On-chain verification: Minting and burning are recorded on both blockchains.

Regular attestations: Independent checks confirm reserve accuracy.

4. Technical implementation:

WBTC is built as an ERC-20 token, Ethereum’s standard for fungible tokens. All ERC-20 tokens follow the same set of rules, which makes them interchangeable, easy to trade, and instantly compatible with most Ethereum wallets and DeFi apps.

This makes WBTC easily transferable, compatible with wallets, and usable in DeFi apps like lending platforms, decentralized exchanges, and yield farming protocols. It gives Bitcoin the same programmability and utility as Ethereum-native assets.

Showdown: Wrapped Bitcoin (WBTC) vs. Bitcoin (BTC)

Although WBTC and BTC share the same value, their use cases differ. Bitcoin is designed for security, immutability, and censorship resistance. WBTC, on the other hand, thrives in Ethereum’s ecosystem where smart contracts enable lending, borrowing, and trading.

For storing wealth long-term, Bitcoin remains the go-to. For generating yield or accessing DeFi, WBTC is the practical choice. Different uses for different needs.

How Wrapped Bitcoin Boosts Your Crypto

1. DeFi accessibility:

WBTC lets users leverage Bitcoin in DeFi platforms for:

Lending & borrowing: Use WBTC as collateral on platforms like Aave or Compound to earn interest or borrow assets.

Yield farming: Provide WBTC liquidity for rewards, often surpassing Bitcoin's passive holding returns.

Liquidity provision: Earn trading fees by adding WBTC to pools on exchanges like Uniswap.

Synthetic assets: Mint assets pegged to traditional markets using WBTC as collateral.

2. Enhanced liquidity:

WBTC boosts capital efficiency across Ethereum by:

Expanding DeFi liquidity: Unlocking Bitcoin's market value to strengthen liquidity pools.

Reducing slippage: Deeper markets enable smoother trades.

Providing stable collateral: Bitcoin-backed assets offer trusted options for DeFi protocols.

3. Transaction advantages:

Compared to Bitcoin, WBTC transactions on Ethereum benefit from:

Faster confirmations: Ethereum's ~12-second block times outpace Bitcoin's 10-minute average.

Predictable fees: Ethereum's fee structure can be more cost-effective in certain conditions.

Smart contract integration: WBTC supports complex transactions Bitcoin's network can't handle.

4. Broader utility:

Beyond DeFi, WBTC enhances user options by:

Accessing smart contracts: Participate in advanced applications without selling Bitcoin.

Composability: Use WBTC across multiple protocols simultaneously.

Simplified management: Store WBTC alongside other Ethereum assets in common wallets.

Gaming & NFTs: Spend WBTC in blockchain games or NFT marketplaces.

While WBTC offers significant opportunities, it comes with trade-offs regarding decentralization and security, as covered in the next section.

Navigating Wrapped Bitcoin: Risks and Challenges

Custodial risks

While WBTC brings Bitcoin into DeFi, it introduces centralization as well. WBTC depends on BitGo as the sole custodian to hold the backing Bitcoin, creating a central point of failure. Users must trust these custodians to safeguard funds, process redemptions, and comply with regulations that could freeze assets or restrict conversions.

Smart contract risks

WBTC relies on Ethereum smart contracts, which, despite audits, can still have vulnerabilities or coding flaws. It's also affected by Ethereum network issues like congestion, high gas fees, and risks from interacting with DeFi platforms.

Price and market risks

WBTC tracks Bitcoin's price and shares its volatility. In turbulent markets, it may trade slightly above or below Bitcoin's value. Large conversions can strain liquidity, making big trades harder without impacting price.

Operational challenges

Managing WBTC involves both Bitcoin and Ethereum blockchains, which can be complex for newcomers. High Ethereum gas fees and slow WBTC-to-Bitcoin conversions (especially for large transactions) are additional hurdles.

Alternatives with less trust required

Some users prefer fully decentralized options like native Bitcoin, though it lacks smart contract functionality. Other wrapped Bitcoin solutions use different technologies to reduce reliance on custodians.

Wrapping Up WBTC

WBTC represents a shift in the cryptocurrency space, bridging the gap between Bitcoin's unparalleled network security and store-of-value properties with Ethereum's programmability and vibrant DeFi landscape. Since its launch in 2019, WBTC has grown from a novel concept to a cornerstone of cross-chain interoperability, enabling countless new use cases for Bitcoin holders.

For users, WBTC allows exposure to Bitcoin while engaging with decentralized finance (DeFi) on Ethereum and other platforms, enabling participation in both without choosing between them. While for DeFi, Bitcoin's liquidity has fostered growth, stability and asset diversity. WBTC has also paved the way for other wrapped assets, making the crypto ecosystem more interconnected and efficient.

As blockchain technology evolves, solutions like WBTC will address limitations while retaining core utility. Its success shows how cryptocurrency innovation can build upon existing strengths without replacing them.

Other Wrapped Bitcoin alternatives

While WBTC is the most widely used Bitcoin representation on Ethereum, several alternatives have emerged, each with different approaches to the bridge between Bitcoin and other blockchains:

- renBTC

- tBTC

- sBTC (Synthetic BTC)

- HBTC

- pBTC

How Can I Buy Wrapped Bitcoin (WBTC)?

If you’re looking to bring Bitcoin into the world of Ethereum, Wrapped Bitcoin (WBTC) is the gateway you might be looking for. Through the Tap app, users can easily add WBTC to their portfolios, opening up access to Ethereum’s thriving DeFi ecosystem. Getting started is simple: just download the app, create an account, and start trading WBTC in minutes.

Learn what net worth means and how it's calculated. Gain insights into managing personal finances and building wealth, and empower your financial journey.

Whether you’re a strong investor or just starting out, understanding your net worth is a crucial step toward gaining control over your financial health. Knowing what net worth entails and how to calculate it provides valuable insights that empower you to make informed choices and build a stronger financial future.

In this article, we will explore the concept of net worth, discuss the factors that influence it, guide you through the calculation process, and provide practical examples to enhance your understanding.

Understanding net worth

Net worth is a comprehensive financial metric that reflects your financial standing. It represents the difference between your assets and liabilities, giving you a holistic view of your wealth.

Unlike income, which represents your earnings over a specific period, net worth offers a long-term perspective by considering both what you own and what you owe. Understanding what net worth means allows you to evaluate your financial progress, set realistic goals, and make informed decisions about your financial well-being.

Factors affecting your net worth

There are several factors that need to be considered when calculating your net worth:

Income

Your income plays a significant role in determining your net worth. It includes earnings from various sources such as salaries, investments, and side businesses. The higher your income, the more potential you have to accumulate wealth.

However, it's important to remember that sustainable wealth is not solely dependent on income but also on effective management of expenses.

Assets

Assets are valuable resources that contribute to your net worth. They can include investments, savings, real estate properties, and personal possessions. By acquiring appreciating assets and diversifying your portfolio, you can increase your net worth over time. Understanding the value and potential growth of your assets is crucial for making informed financial decisions.

Liabilities and Debts

When liabilities exceed assets, on the other hand, this decreases your net worth. Liabilities and debt encompass mortgages, loans, credit card balances, and any outstanding payments. Minimizing liabilities and managing debts effectively is vital for improving your net worth.

By reducing high-interest debts and maintaining a healthy debt-to-income ratio, you can positively impact your overall financial health. A healthy debt-to-income ratio is considered to be at or below 43%, meaning that you are spending at or less than 43% of your income on debt payments.

How to calculate net worth

Whether your goal is to improve your net worth or aspire to be one of the high-net-worth individuals in your country, calculating your net worth is an integral step to achieving these. To calculate your net worth, you will need to:

- Write a list of all your assets and their estimated values.

- Summarize your liabilities, including outstanding debts and obligations.

- Subtract your total liabilities from your total assets to determine your net worth.

By regularly updating and monitoring your net worth statement, you can track your progress and identify areas for improvement.

Example of a positive net worth calculation

To illustrate what it looks like to calculate a positive average net worth, see this example below:

Step 1: Write a list of all your assets and their estimated values

Assets

Home: The current market value of Sarah's primary residence is $400,000.

Savings: Sarah has $50,000 in her savings account.

Investment portfolio: Sarah's investments, including stocks and bonds, are valued at $150,000.

Retirement account: Sarah has a 401(k) retirement account with a balance of $200,000.

Vehicle: Sarah owns a car, which is valued at $20,000.

Step 2: Summarize your liabilities, including outstanding debts and obligations

Liabilities

Mortgage: Sarah still owes $200,000 on her mortgage.

Student loan: Sarah has a remaining balance of $30,000 on her student loan.

Step 3: Subtract your total liabilities from your total assets to determine your net worth

Total Assets

$400,000 (Home) + $50,000 (Savings) + $150,000 (Investment Portfolio) + $20,000 (Vehicle) = $620,000

Total Liabilities

$200,000 (Mortgage) + $30,000 (Student Loan) = $230,000

Net Worth

Total Assets - Total Liabilities = $620,000 - $230,000 = $390,000

Based on these calculations, Sarah's net worth is $390,000. This positive average net worth indicates that her total assets exceed her total liabilities, representing her wealth and financial standing. It showcases her financial progress and the value of her accumulated assets.

Example of a negative net worth calculation

To illustrate what it looks like to calculate a negative net worth, see this example below:

Step 1: Write a list of all your assets and their estimated values

Assets

Car: Mark owns a car valued at $10,000.

Personal possessions: Mark has various personal possessions valued at approximately $5,000.

Step 2: Summarize your liabilities, including outstanding debts and obligations

Liabilities

Student loan: Mark has a student loan debt with an outstanding balance of $50,000.

Credit card debt: Mark has accumulated credit card debt totaling $8,000.

Medical expenses: Mark has unpaid medical bills amounting to $3,000.

Step 3: Subtract your total liabilities from your total assets to determine your net worth

Total Assets

$10,000 (Car) + $5,000 (Personal Possessions) = $15,000

Total Liabilities

$50,000 (Student Loan) + $8,000 (Credit Card Debt) + $3,000 (Medical Expenses) = $61,000

Net Worth

Total Assets - Total Liabilities = $15,000 - $61,000 = -$46,000

This reveals that Mark's net worth is -$46,000, illustrating a negative value. This negative net worth indicates that Mark's total liabilities exceed the value of his assets, serving as a clear indicator that Mark's financial obligations outweigh his accumulated wealth. This sheds light on his ongoing financial challenges and the extent of his financial struggles.

6 reasons why it’s beneficial to grow your net worth

Financial security

Increasing your net worth provides a foundation of financial security. As your net worth grows, you have a greater buffer against unexpected expenses, job loss, or economic downturns. It offers a safety net to navigate through challenging times and helps you maintain stability in your financial life.

Achieve financial goals

A higher net worth enables you to achieve your financial goals and aspirations. Whether it's buying a home, starting a business, funding education, or retiring comfortably, a growing net worth provides the necessary resources and financial freedom to pursue your dreams.

Build wealth

Net worth is a measure of your wealth accumulation over time. By actively growing your net worth, you increase your overall wealth and improve your financial position. It allows you to build a stronger foundation for yourself and potentially leave a legacy for future generations.

Tap into better financial opportunities

A higher net worth opens doors to better financial opportunities. It improves your borrowing capacity, allowing you to secure favourable loan terms and interest rates when needed. Additionally, a strong net worth can attract investment opportunities and partnerships that can further boost your wealth.

Have greater flexibility and choices

Increasing your net worth provides you with more flexibility and choices in life. It affords you the freedom to make decisions based on what aligns with your long-term goals and values, rather than being constrained by financial limitations. A growing net worth expands your options and empowers you to take calculated risks or make life-changing decisions with confidence.

Peace of mind

Knowing that your net worth is growing can bring peace of mind. It reduces financial stress and anxiety, allowing you to focus on other aspects of your life. A positive net worth provides a sense of control over your financial well-being and offers peace of mind that you are on the right track towards a secure financial future.

Tips for increasing your net worth

Building and growing your net worth requires proactive steps and strategic planning. Consider the following tips as a guideline for building your net worth in a sustainable way.

Manage income and expenses

- Increase your earning potential through career development or additional income streams.

- Practice sensible spending habits and reduce unnecessary expenses.

- Allocate a portion of your income towards savings and investments.

Grow assets and investments

- Diversify your investment portfolio to mitigate risks and maximize returns.

- Seek professional advice to identify opportunities for growth in real estate, stocks, or other assets.

- Regularly review and adjust your investment strategy based on market conditions.

Reduce debts and liabilities

- Prioritize paying off high-interest debts to minimize interest charges.

- Consolidate debts and explore refinancing options to potentially lower interest rates.

- Develop a realistic debt repayment plan and stick to it.

Long-term financial planning considerations

- Establish an emergency fund to handle unexpected expenses.

- Plan for retirement by contributing to retirement accounts and exploring other retirement investment options.

- Consider contacting a financial advisor or planner for personalized guidance and expertise.

In conclusion

Understanding net worth is a fundamental step toward taking charge of your financial future. By comprehending the factors that influence net worth, calculating it accurately, and implementing practical strategies, you can enhance your financial health and build a more secure tomorrow.

Empower yourself with knowledge, embrace proactive financial habits, and make informed choices that align with your long-term goals. Your net worth is not just a number but a tool that can transform your financial well-being.